The US Citi Economic Surprise Index has recently dipped below zero, indicating that US economic data releases have been disappointing expectations. Most notably, the ISM Services PMI started contracting in April against…

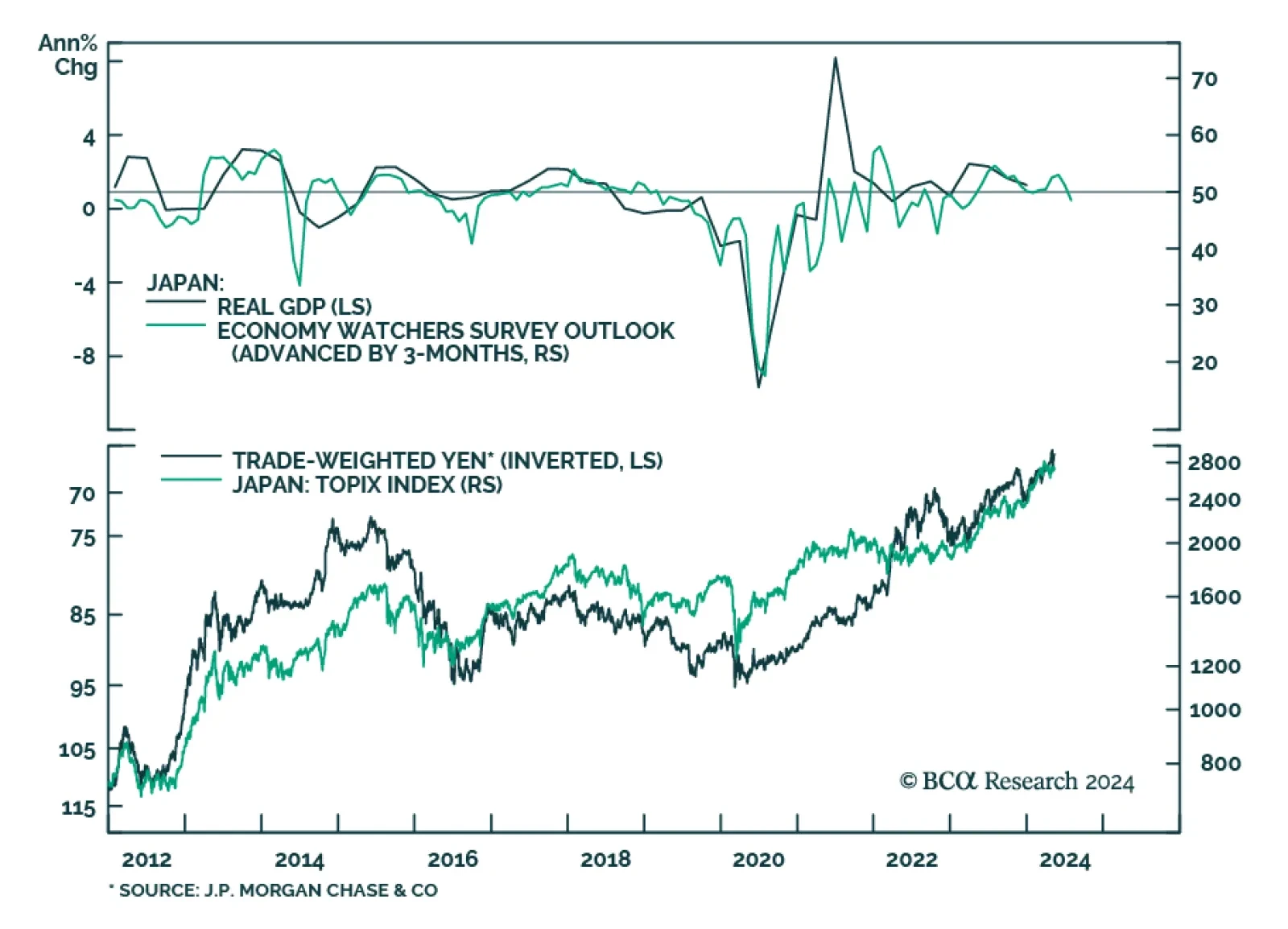

The Bank of Japan’s Economy Watchers Survey – a gauge of sentiment among business owners – disappointed in April. The Current Conditions and the Outlook indices deteriorated from 49.8 to 47.4 (20-month low) and…

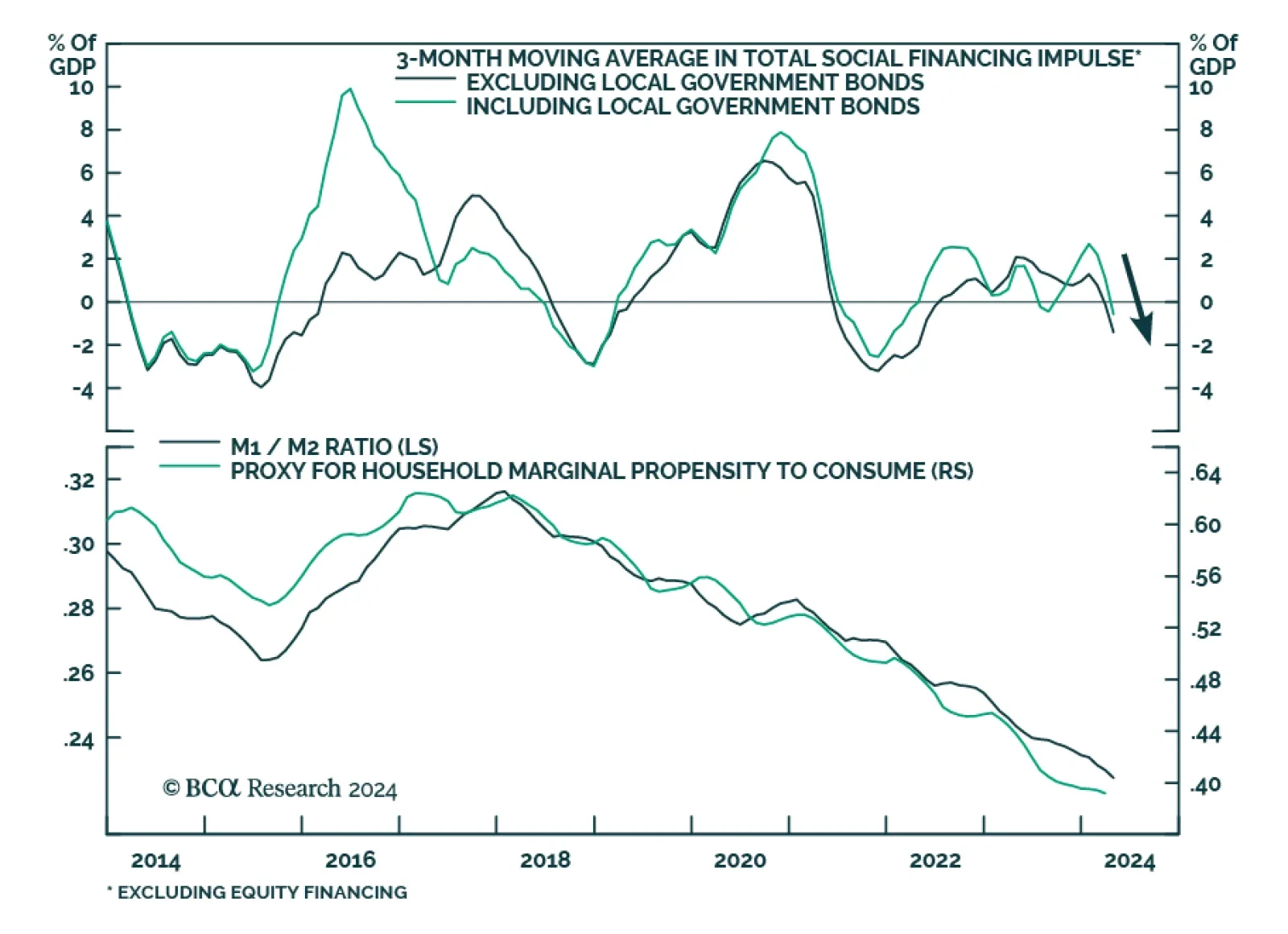

Chinese aggregate financing, a broad measure of credit, declined on a YTD basis, from CNY 12.9tr to CNY 12.7tr in April, disappointing expectations that it would grow to CNY 13.9tr. Moreover, new loan growth missed expectations (…

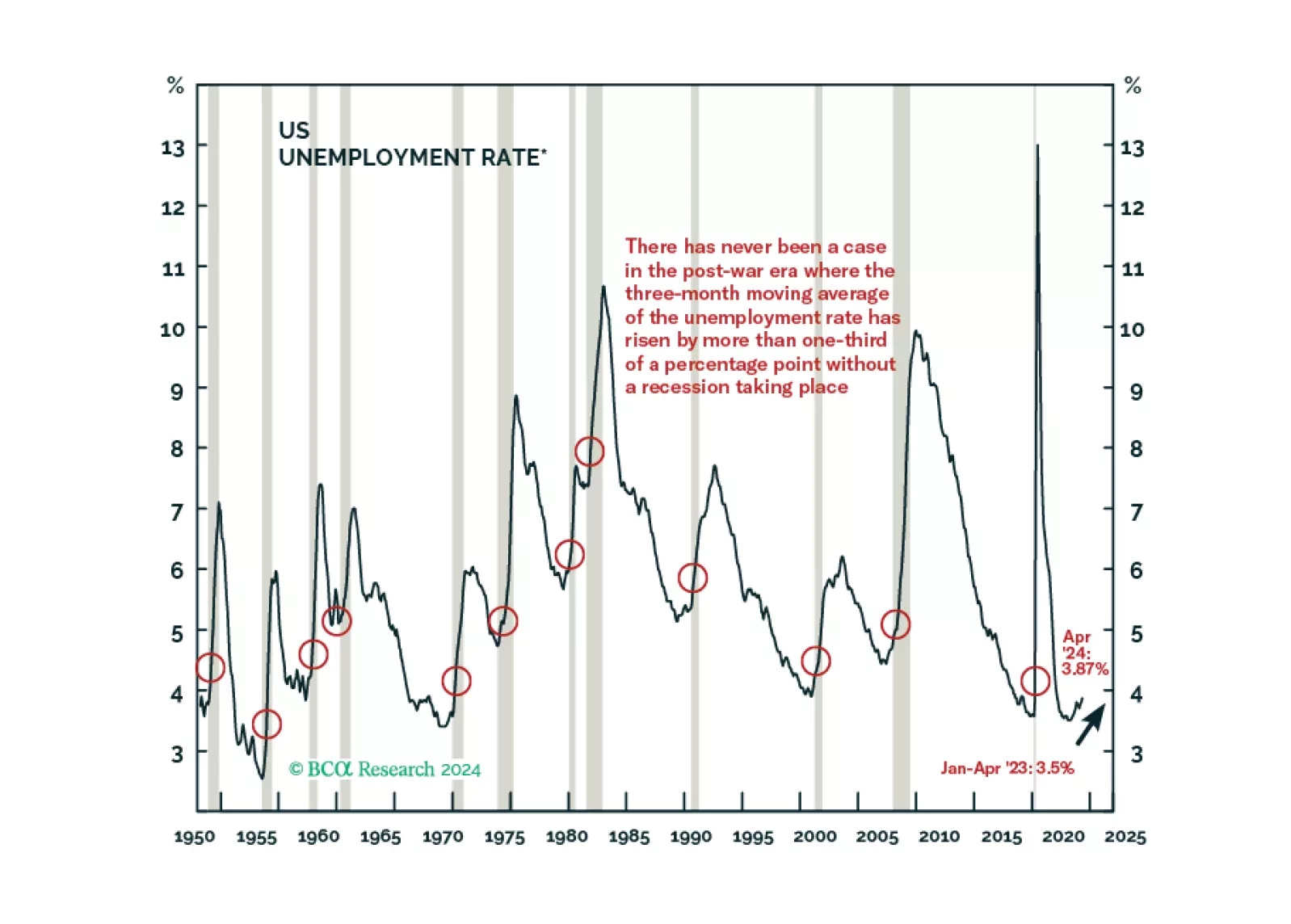

We marked the first X on our Equity Downgrade Checklist and the latest JOLTS, Employment Situation and SLOOS releases brought us closer to ticking some others. We remain tactically neutral on equities but expect that we will…

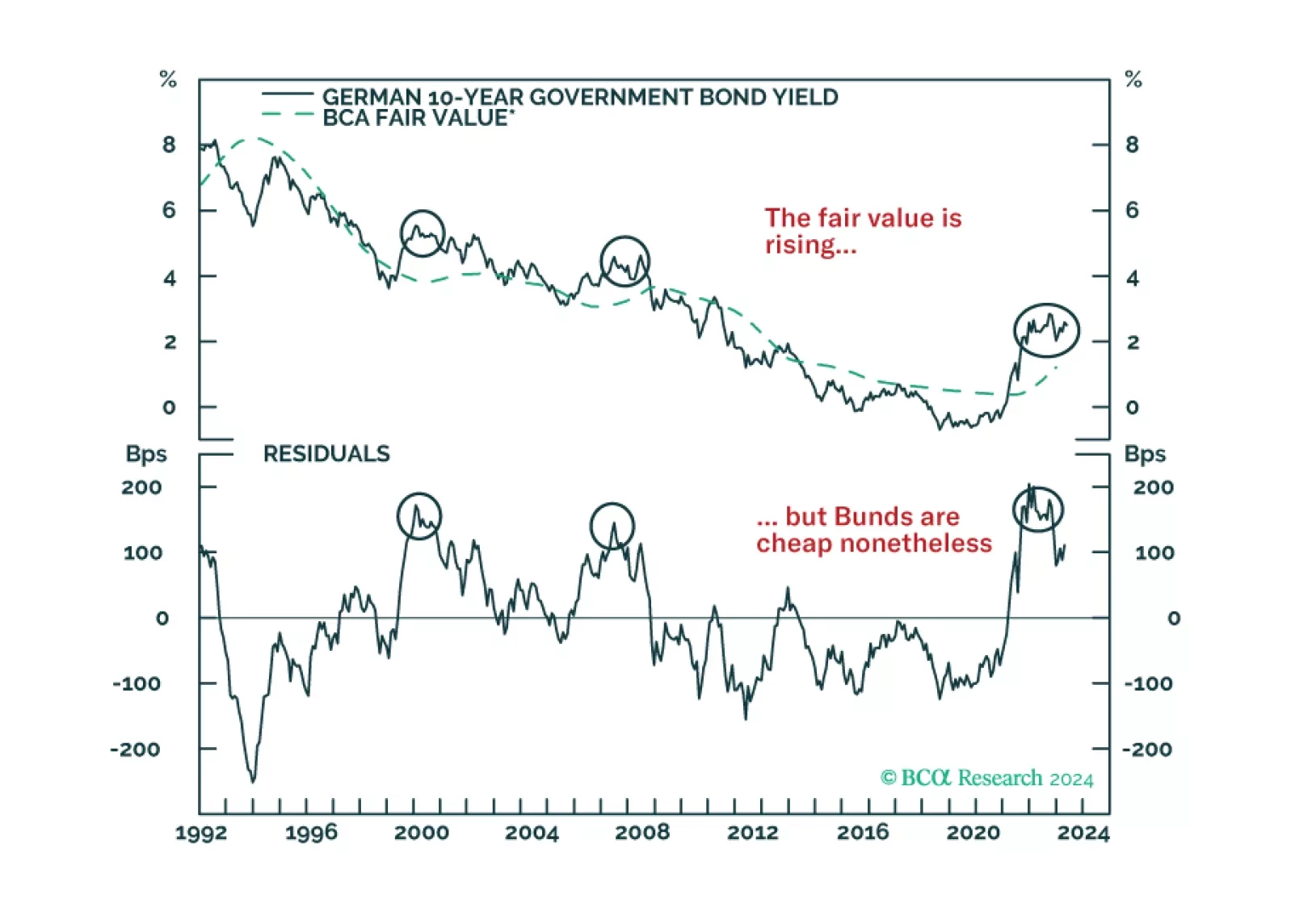

German Bunds have cheapened considerably, and the ECB is about to start cutting rates. Does this combination guarantee immediate profits from buying these bonds?

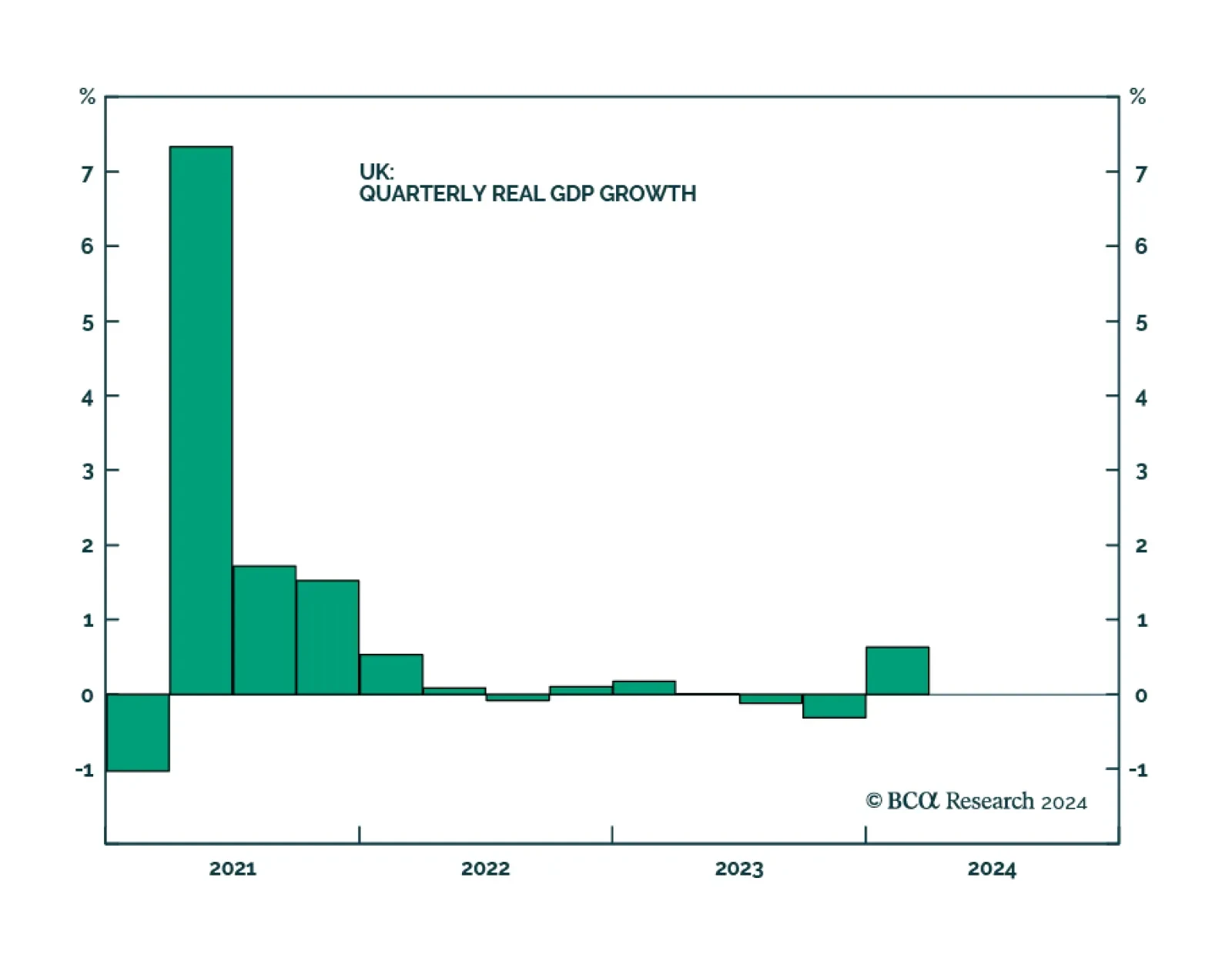

Preliminary GDP estimates suggest that the UK economy started growing again in Q1, thus exiting a technical recession in the past two quarters. Q1 growth came in at 0.6%, improving from a 0.3% contraction last quarter,…

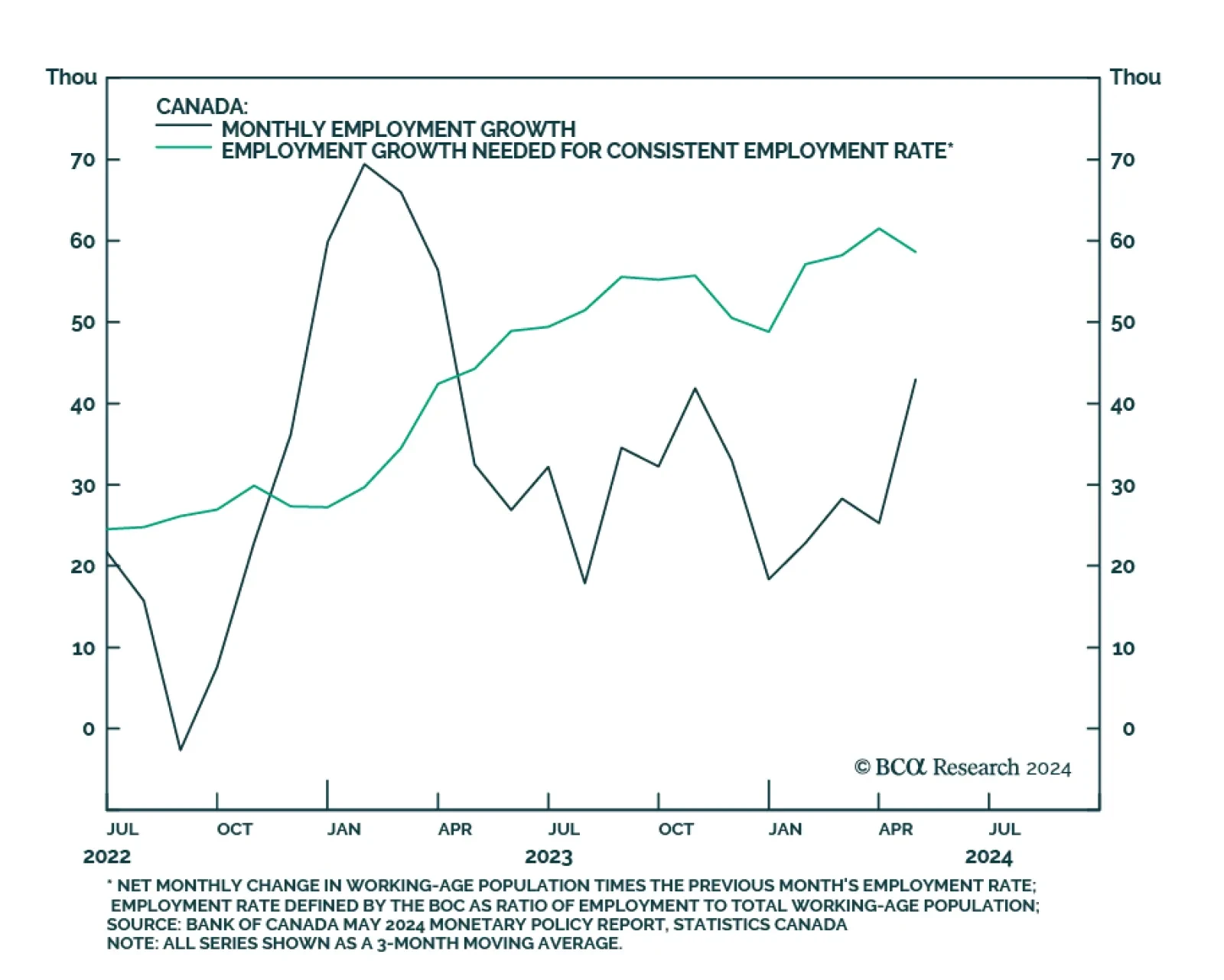

The Canadian economy added 90.4 thousand jobs in April, up from a new loss of 2.2 thousand jobs in March. The April reading beat expectations of a more moderate increase of 20 thousand. The services sector entirely explains April…

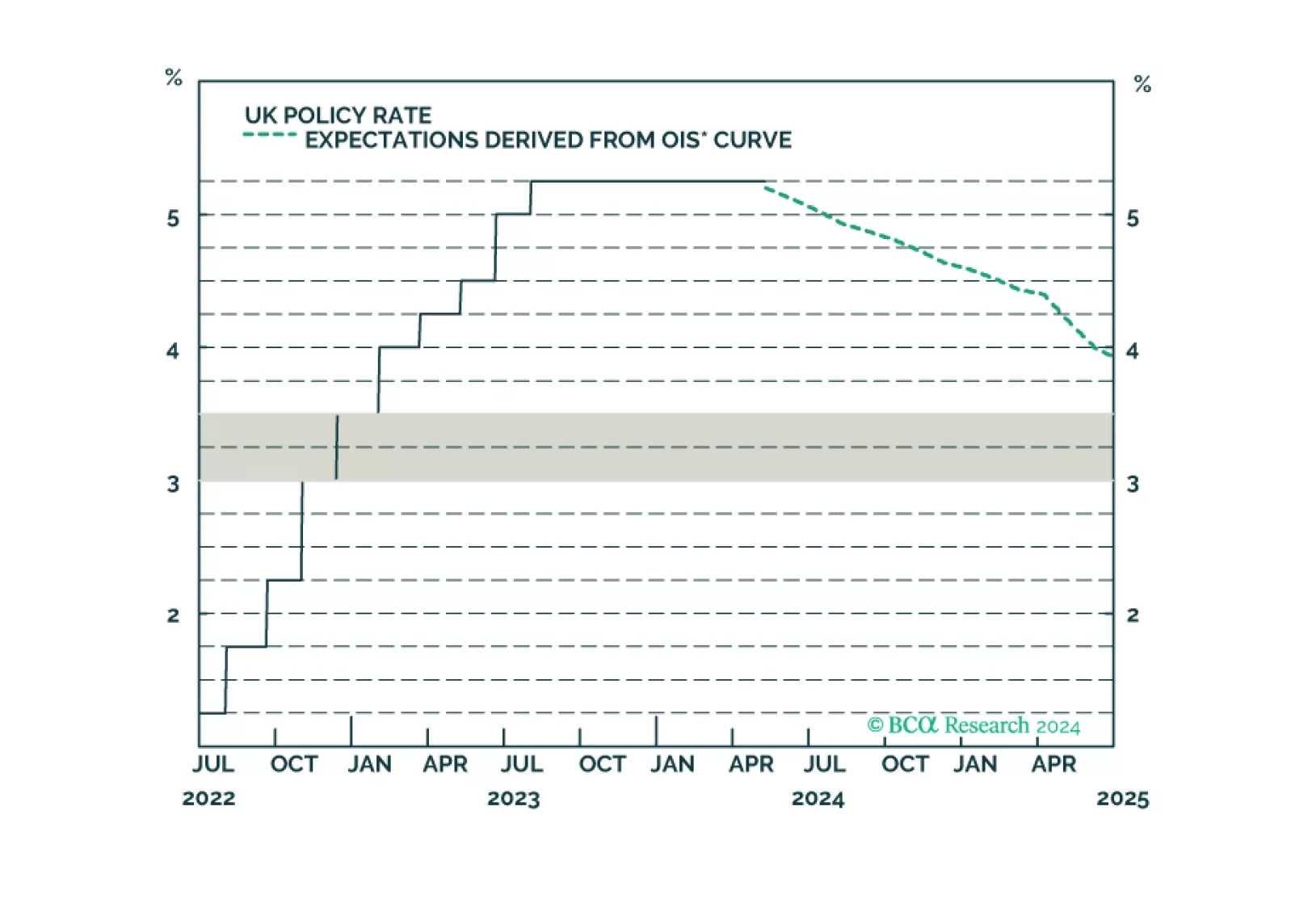

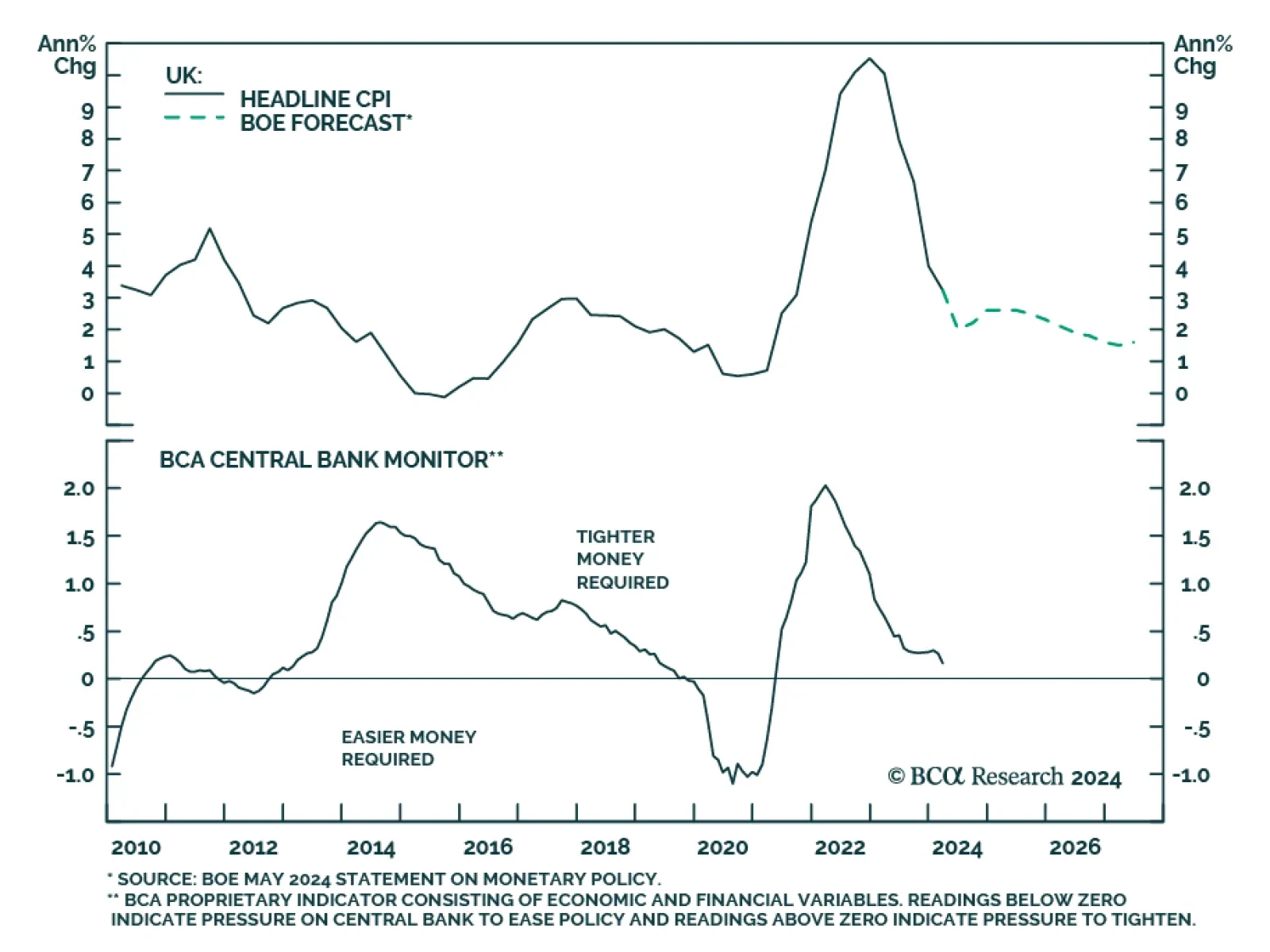

In a widely expected move, the Bank of England (BoE) maintained its policy rate at 5.25% in May. Nevertheless, two Committee Members voted in favor of cutting rates, one more than was anticipated. The tone of the report was…

An update to our views on UK rates and currency following today’s Bank of England meeting.