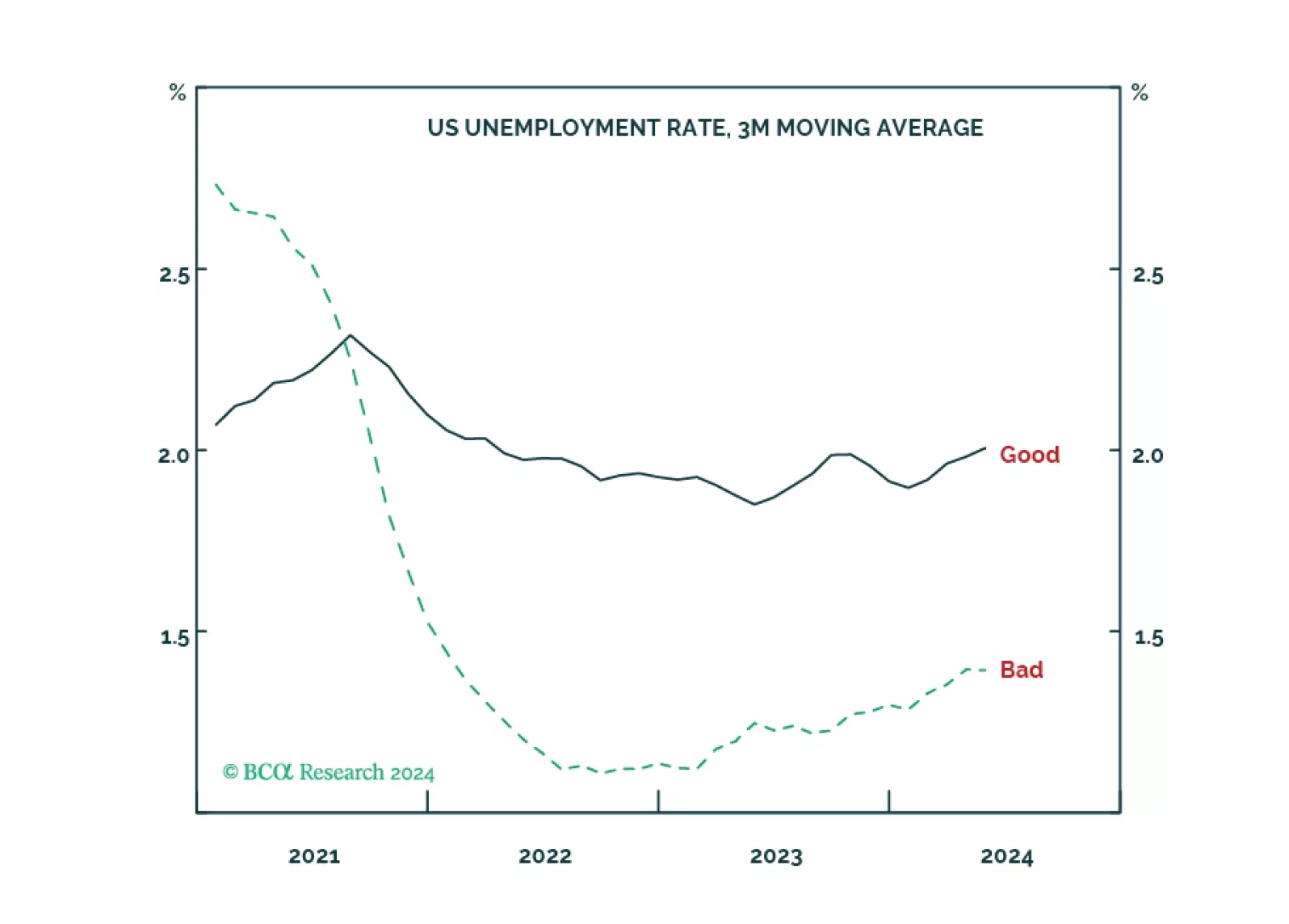

We explain how to distinguish between ‘good’, ‘bad’ and ‘ugly’ unemployment, why bad unemployment is a much better gauge of the jobs market than headline unemployment, and what this means for the tactical positioning in bonds and…

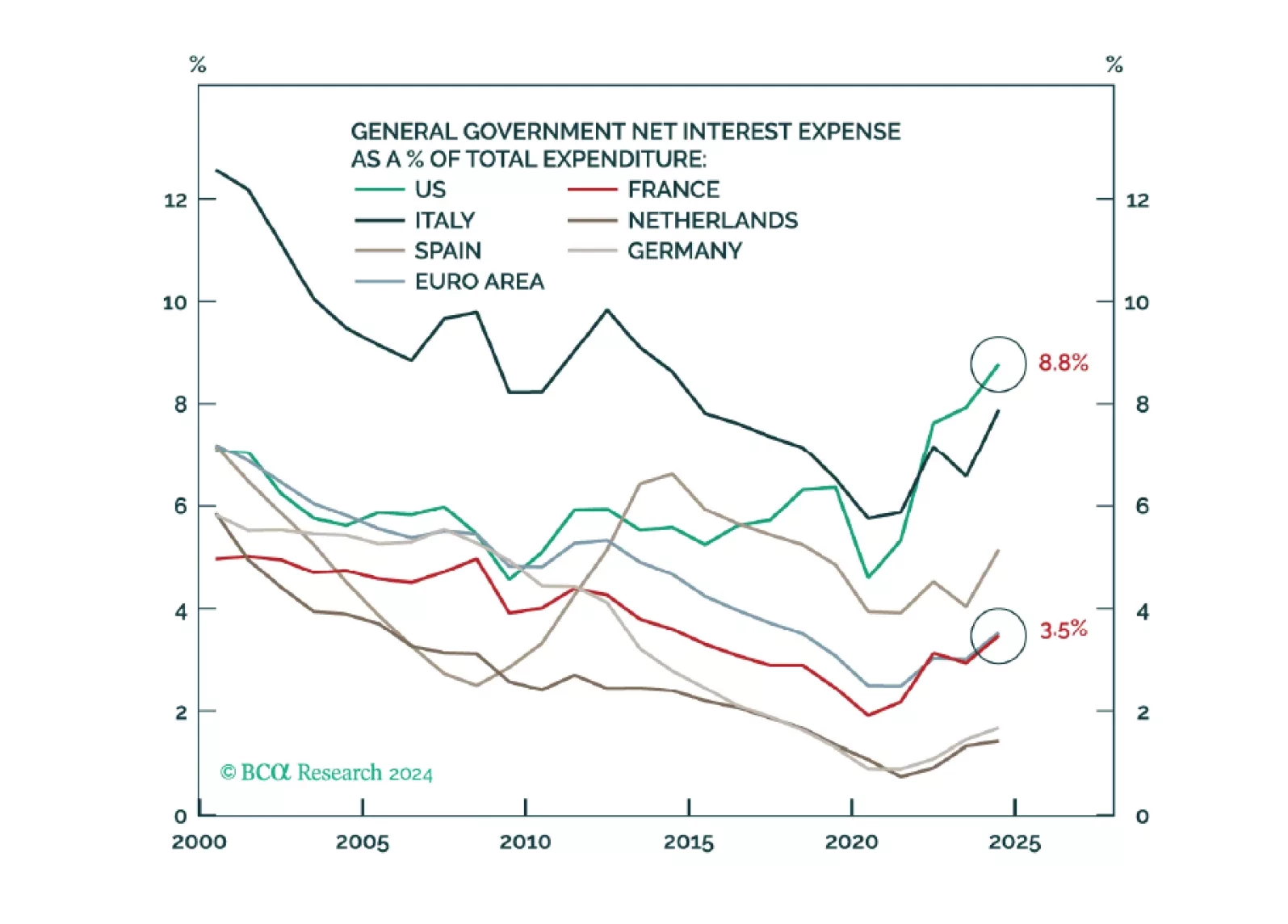

In our Volume I – The Alpha Report – we posit that the French bond market reaction is a mere amuse bouche for what is coming to the US. All year, we have warned investors that US politics could induce a bond market riot. This moment…

Our Portfolio Allocation Summary for July 2024.

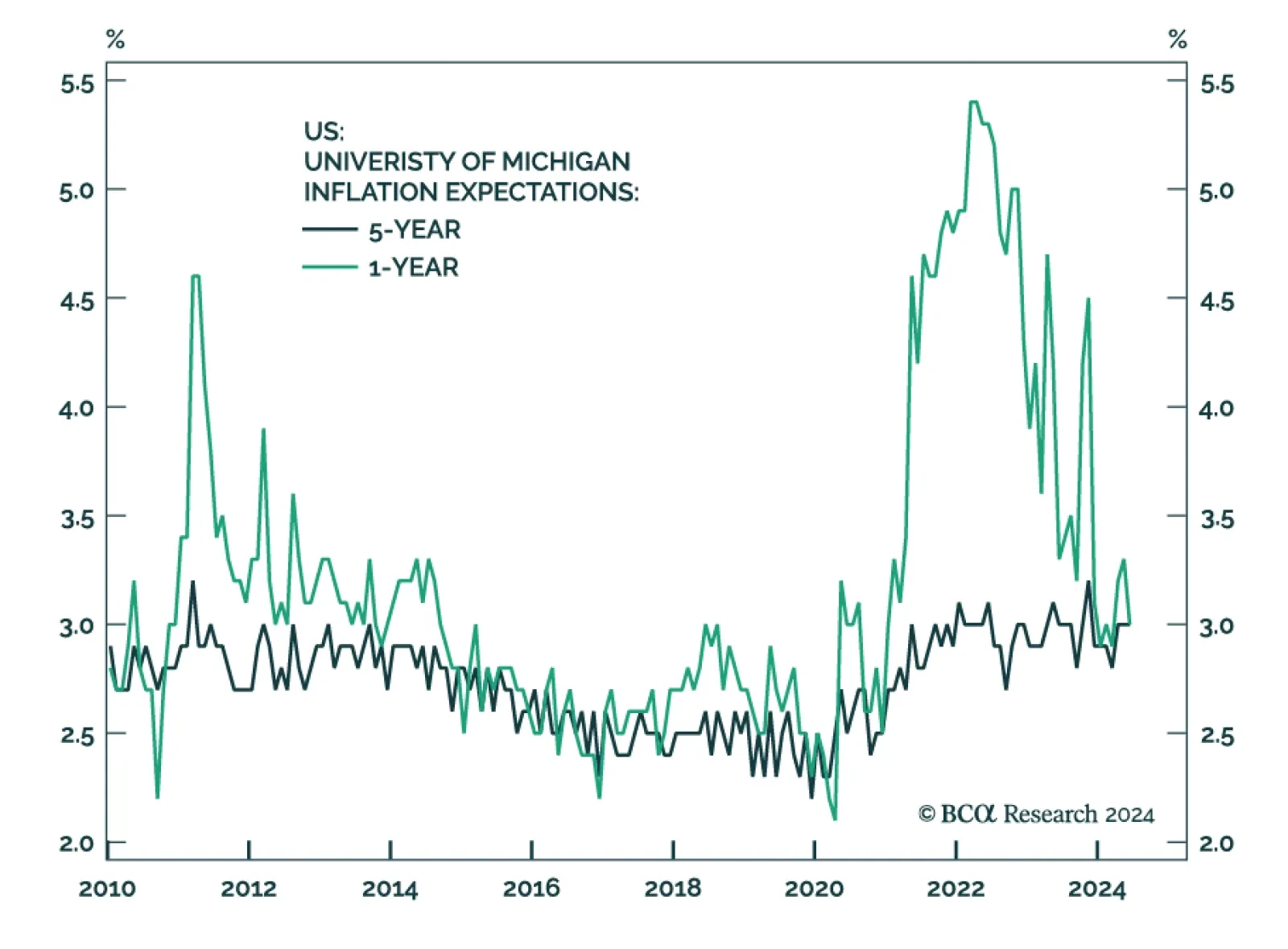

The University of Michigan survey of consumers was released on Friday. The sentiment measure increased from 65.6 to 68.2, beating consensus estimates of 66. Current conditions as well as expectations also increased, going from 62…

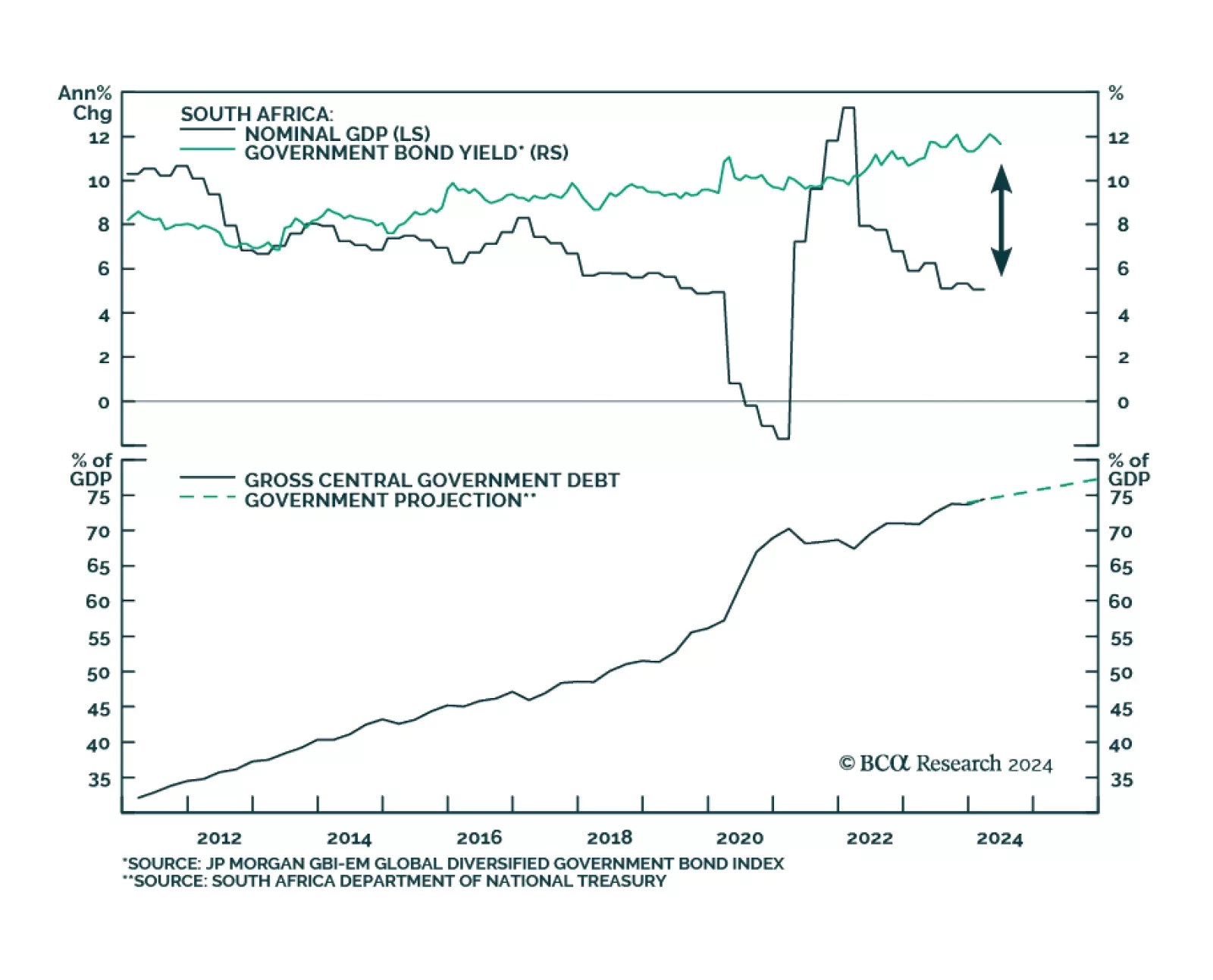

In a recent report, BCA Research’s Emerging Markets Strategy team recommended upgrading South African assets. The team argued that the new national unity government has an opportunity to ease the restrictive policies and…

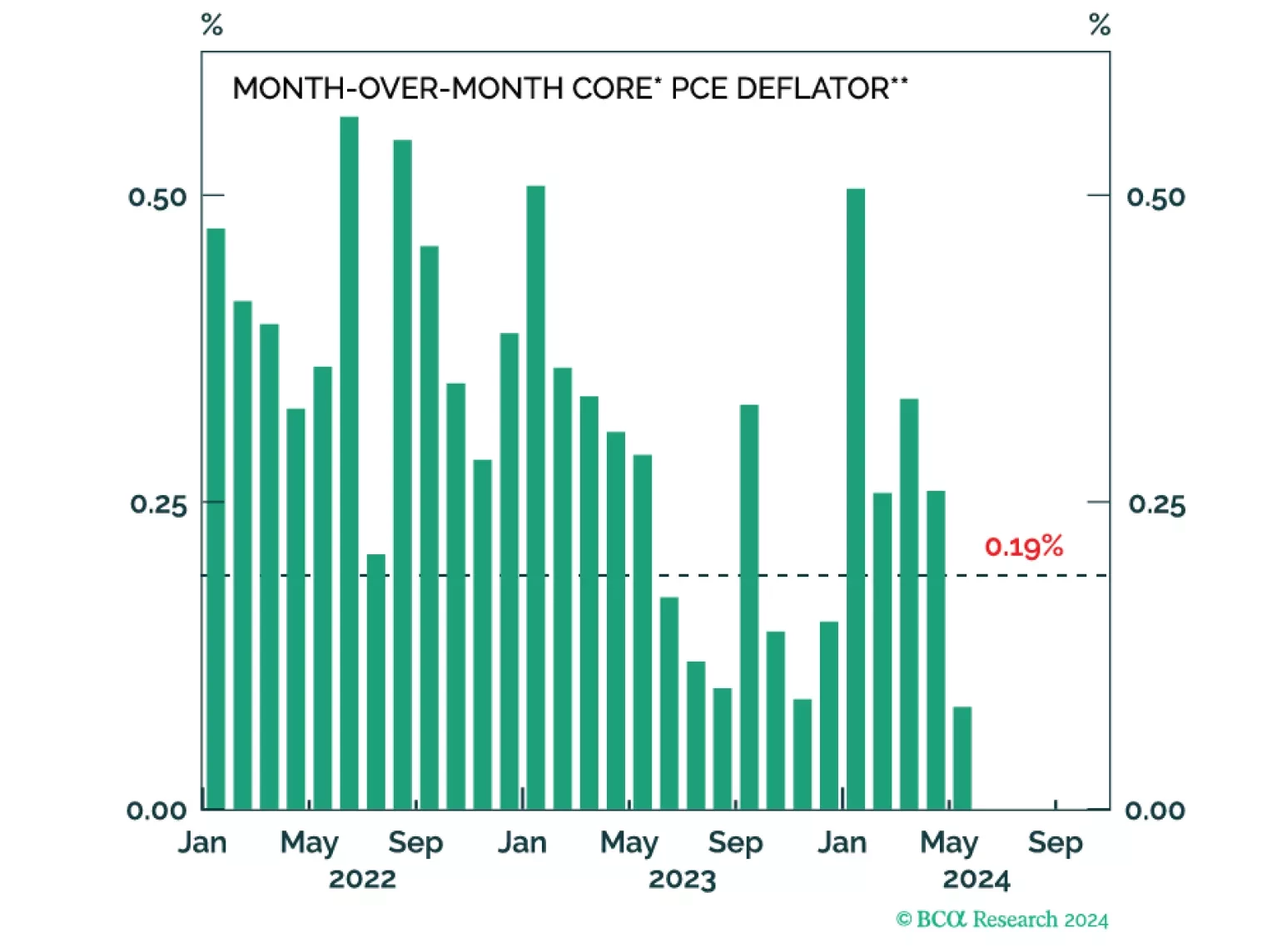

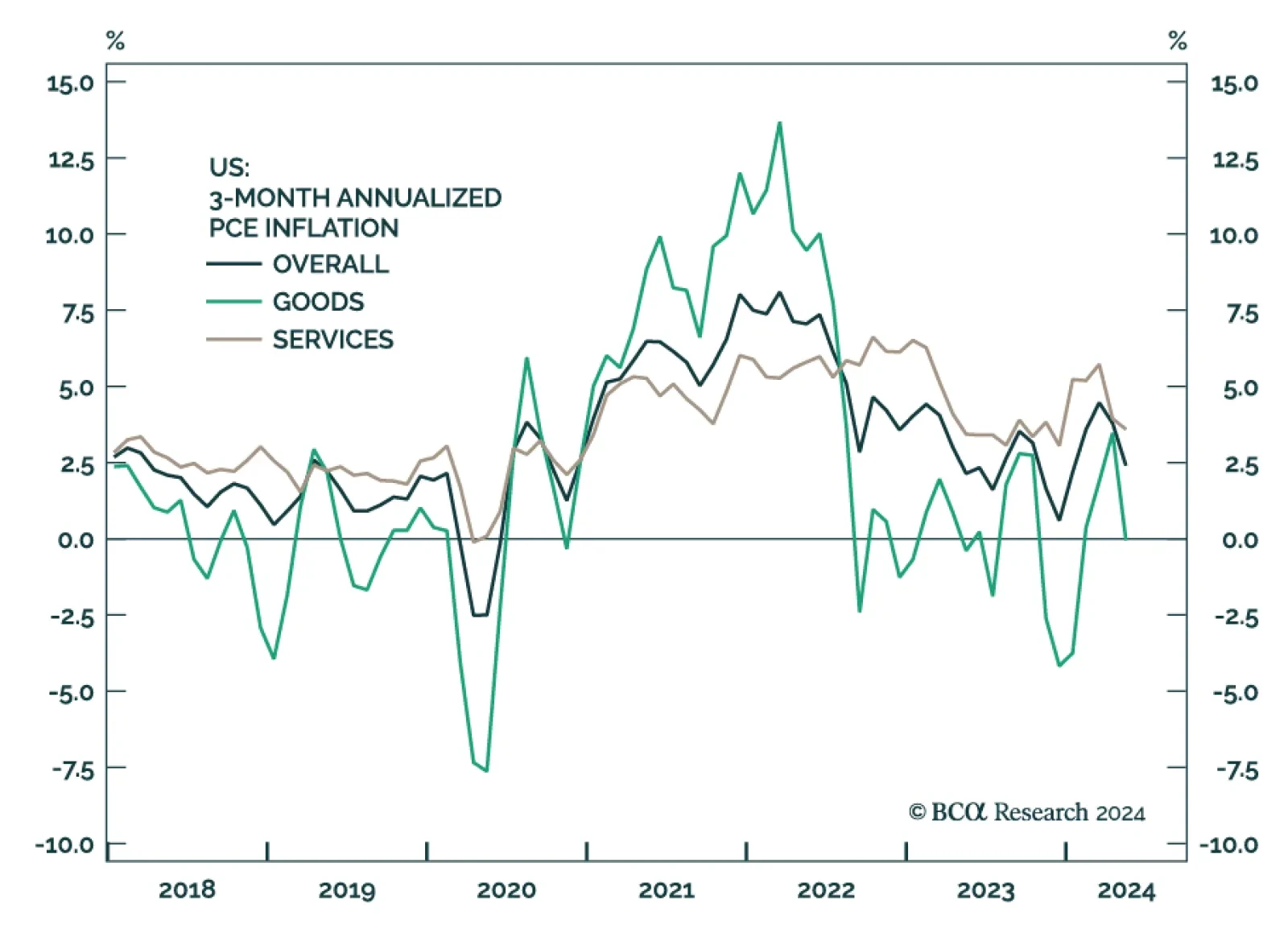

The US personal income and outlays report was released on Friday. Personal income grew by 0.5% versus 0.3% the previous month, beating consensus estimates. Real personal spending growth also increased, coming in at 0.3%…

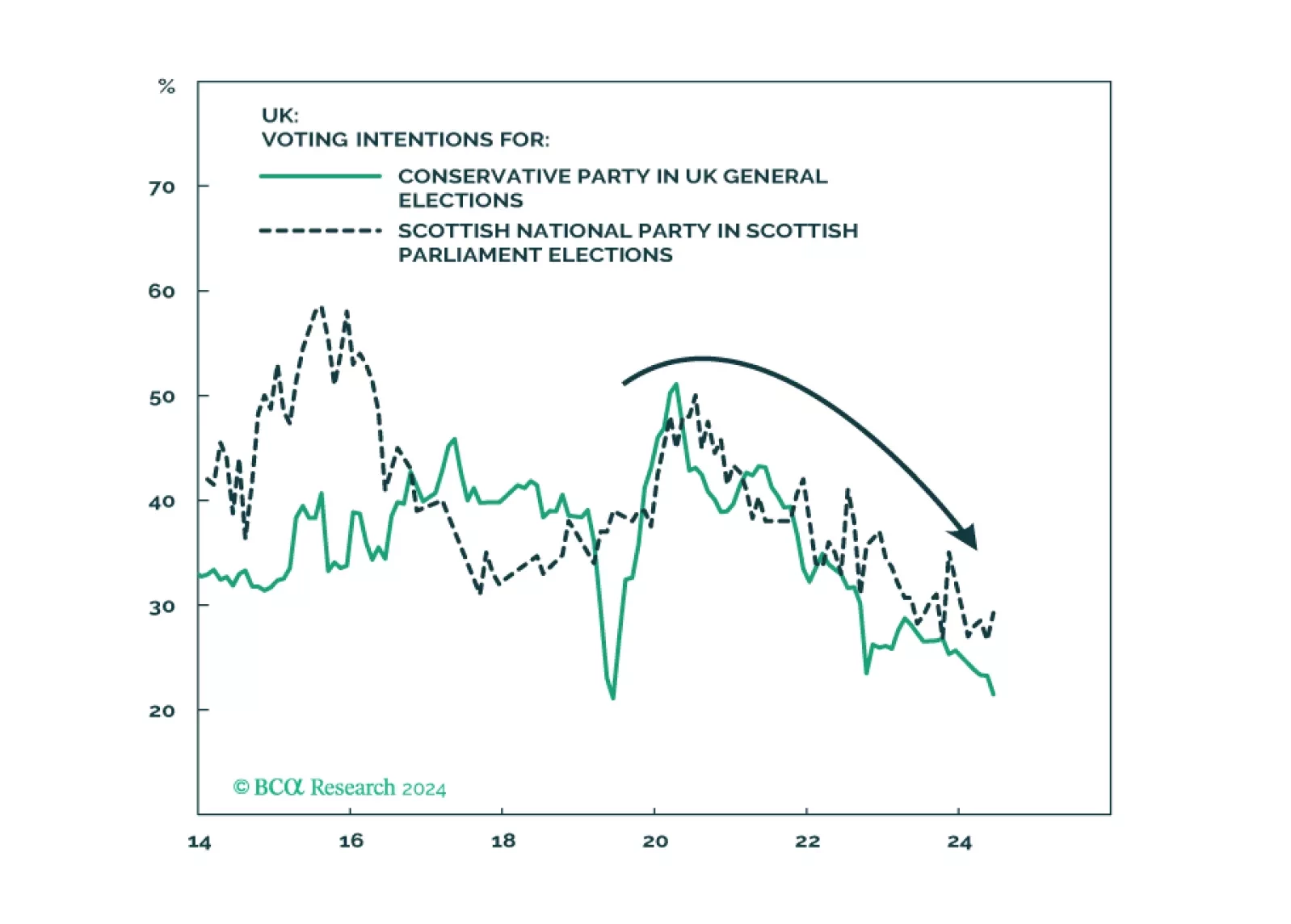

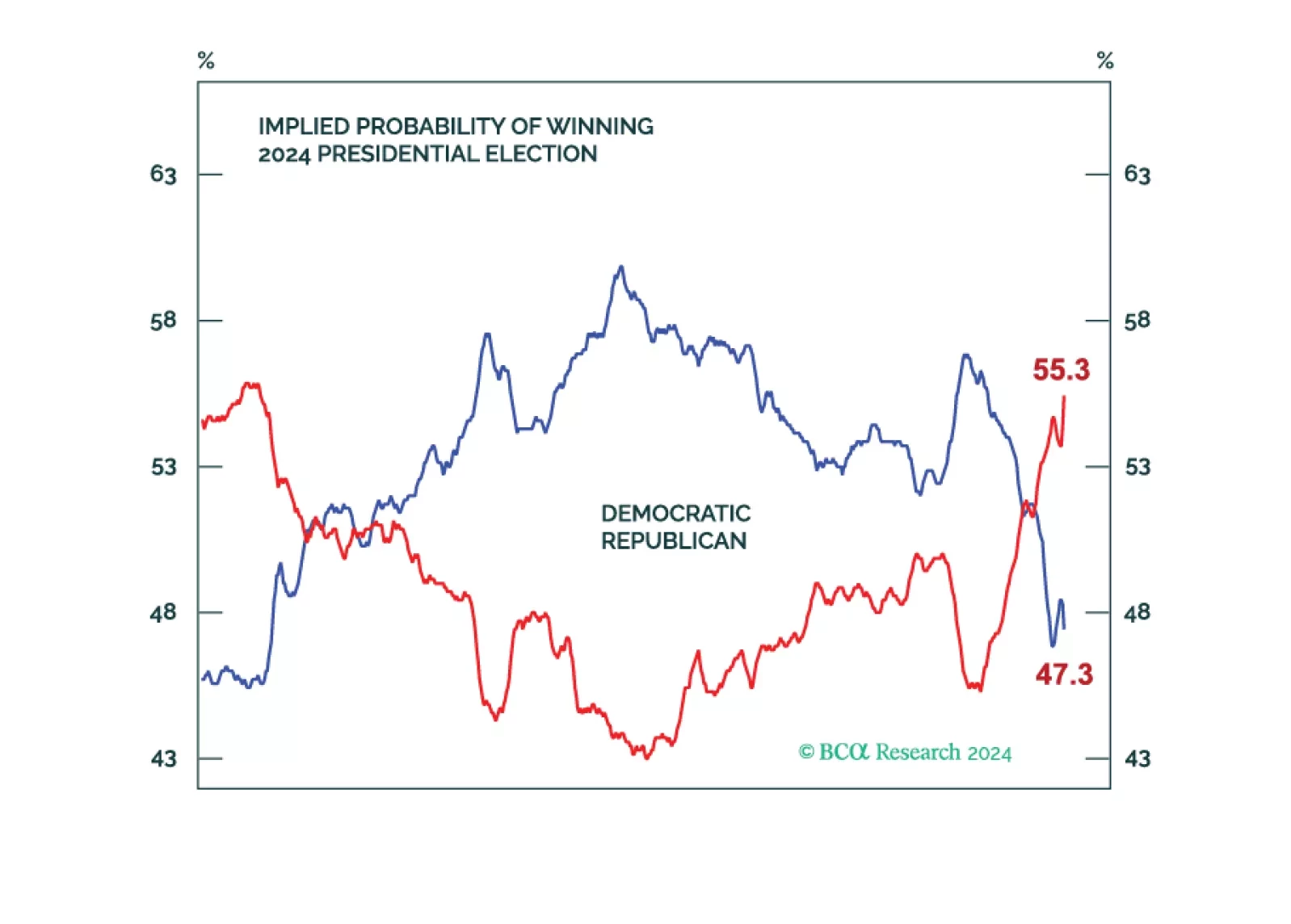

The bond market should sell off and drag stocks down on higher odds of a single-party sweep, policy uncertainty, unorthodox Trump presidency, aggressive tariffs, large tax cuts, large budget deficits, labor shortages, a fired Fed…

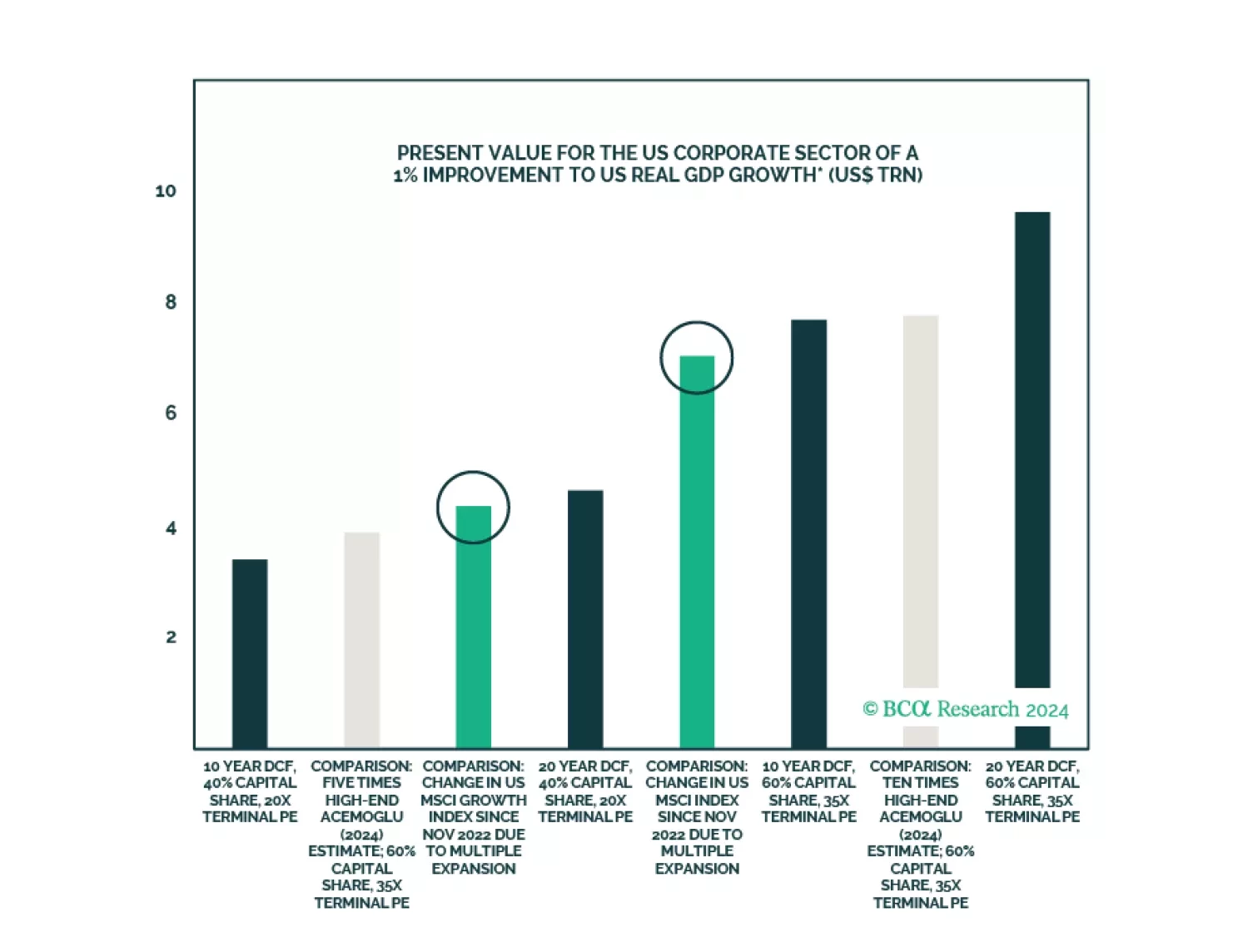

In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…