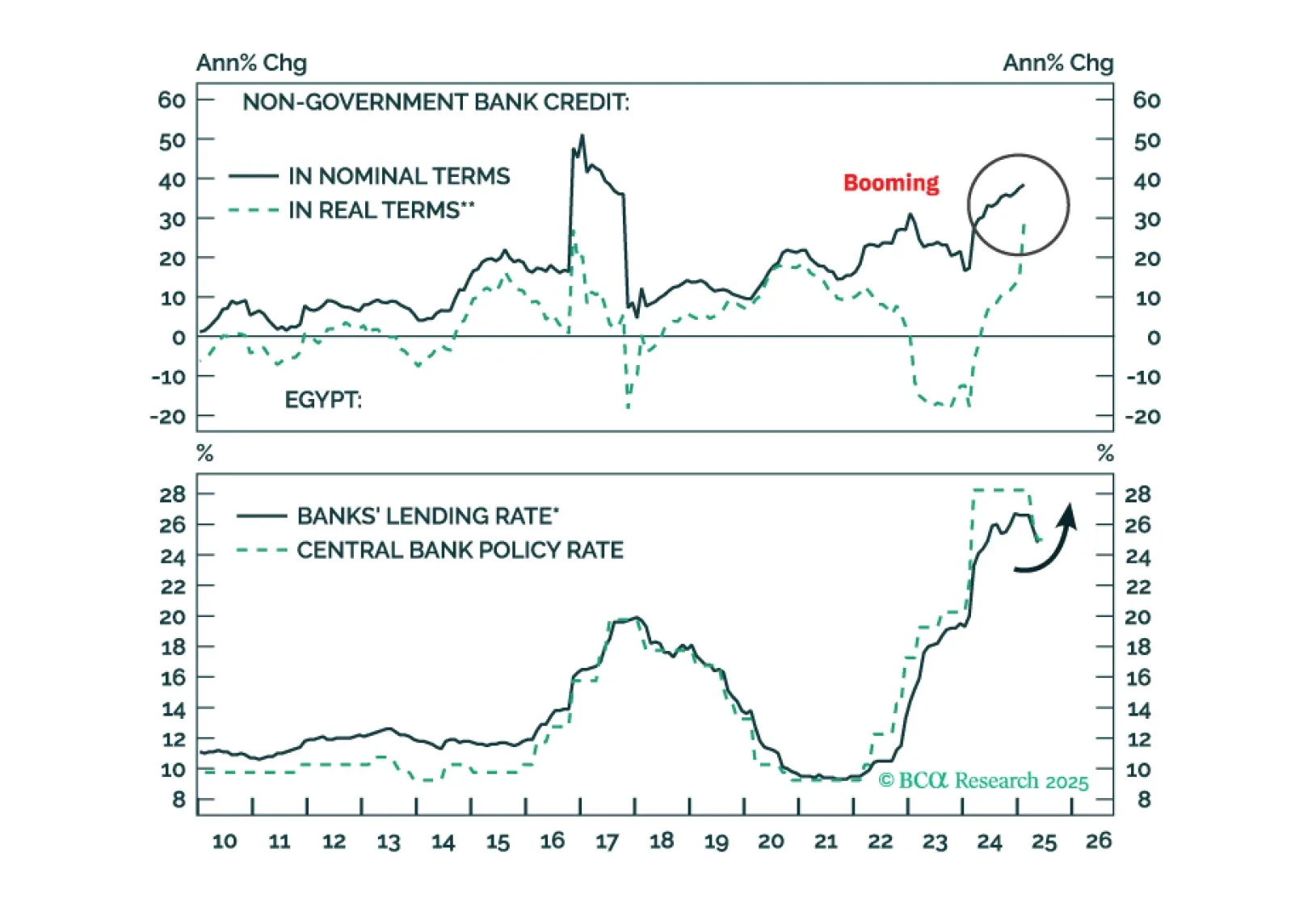

Downward pressure on the pound will rise in the coming months. Inflation will go up, so will bond yields. It’s time to book profits on Egyptian domestic bonds.

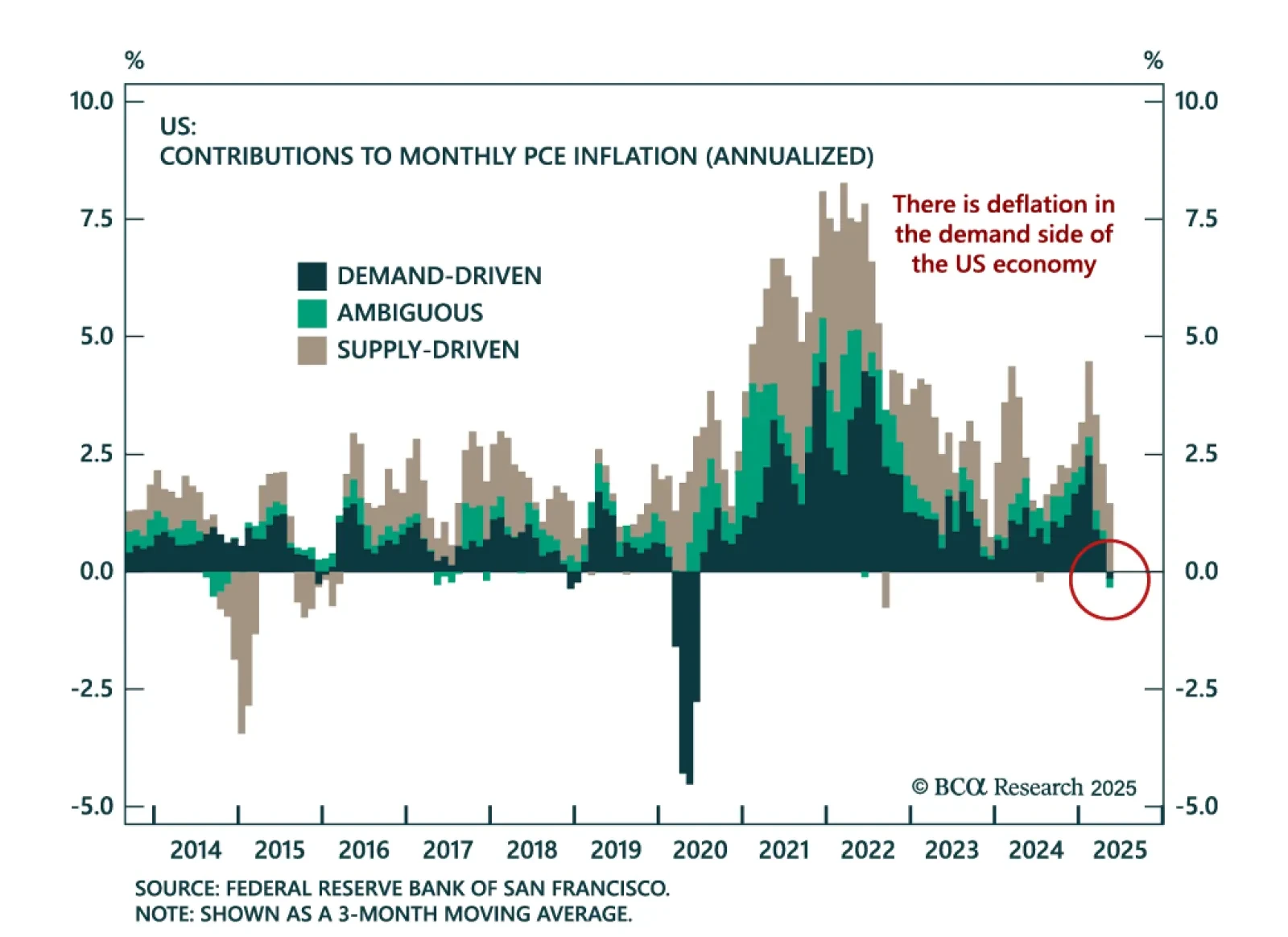

Our Global Asset Allocation strategists expect lower interest rates to revive a sluggish US economy, prompting upgrades to duration and equities. Although not in recession, the US is enduring one of the weakest non-recessionary years…

The US economy is not in recession, but is suffering from a post-pandemic stimulus hangover. The cure: lower interest rates. We expect the Fed to start lowering rates, which will benefit both equities and bonds. We upgrade stocks to…

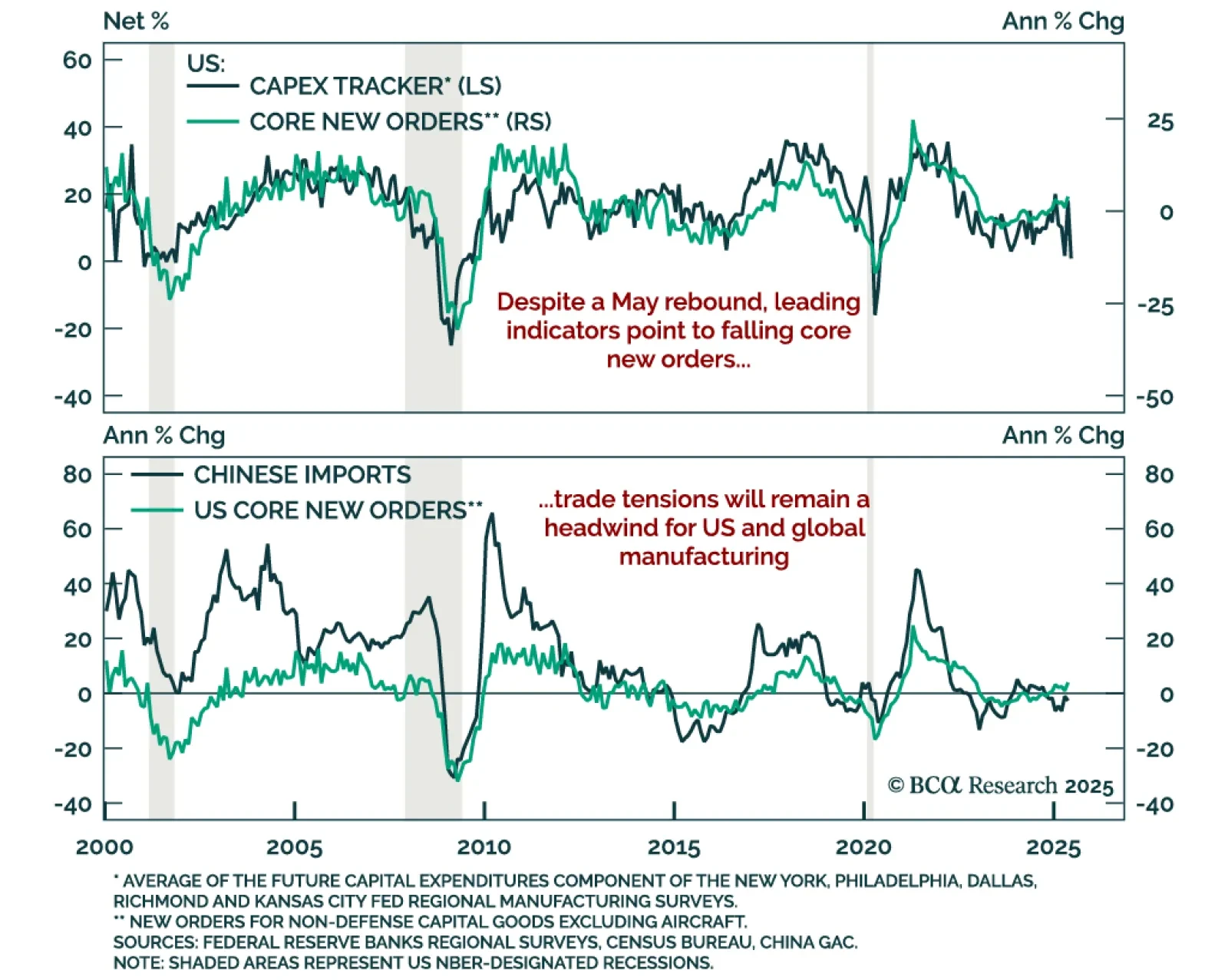

Regional Fed surveys confirm sluggish US manufacturing and tame inflation, supporting long duration positioning outside the US. The June Dallas Fed Manufacturing survey missed expectations, rising to -12.7 from -15.3, still deep in…

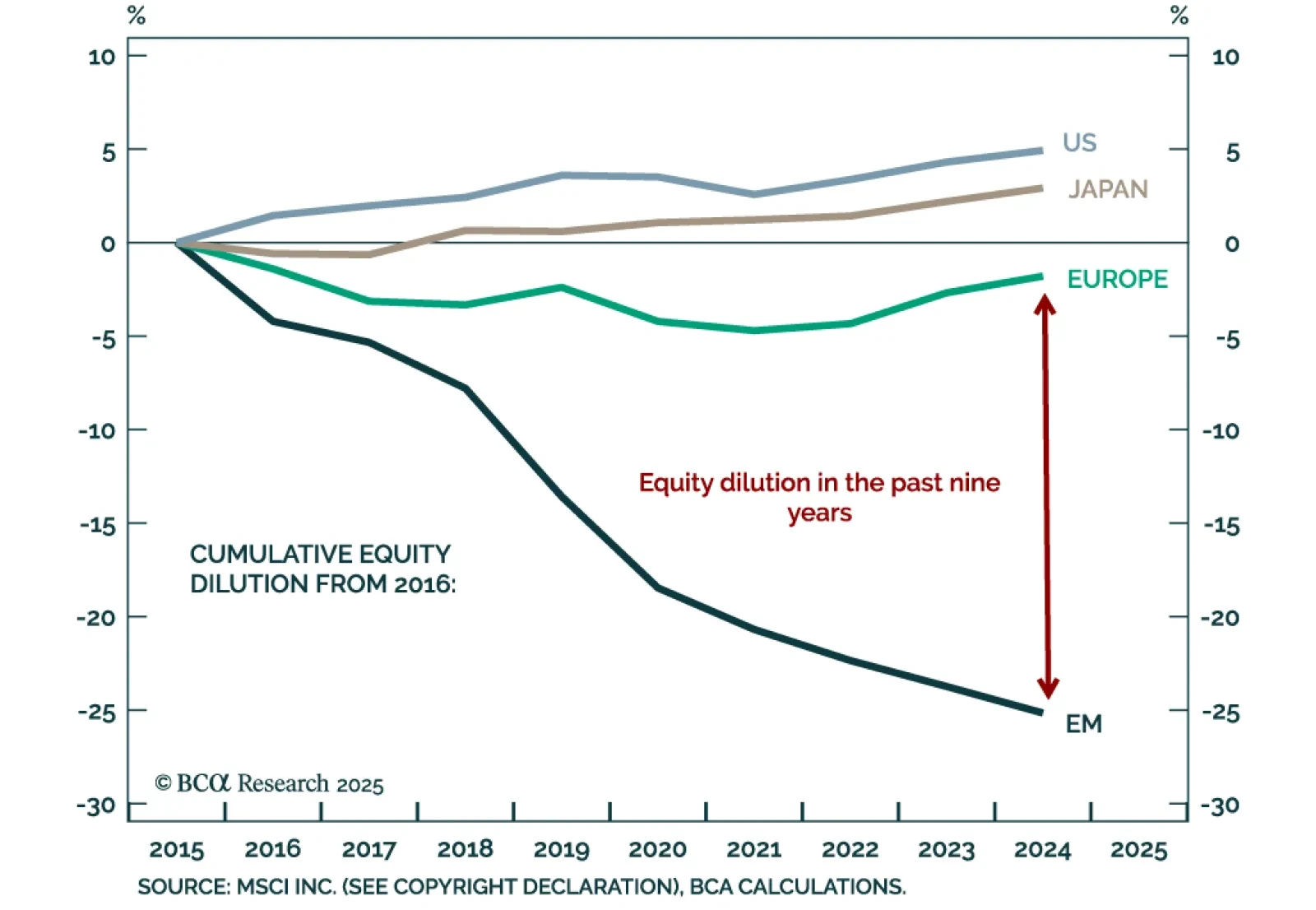

Our Emerging Markets strategists highlight that systematic equity dilution has meaningfully eroded EM shareholder returns, explaining the long-term disconnect between profit growth and EPS. Over the past 18 years, EM companies have…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

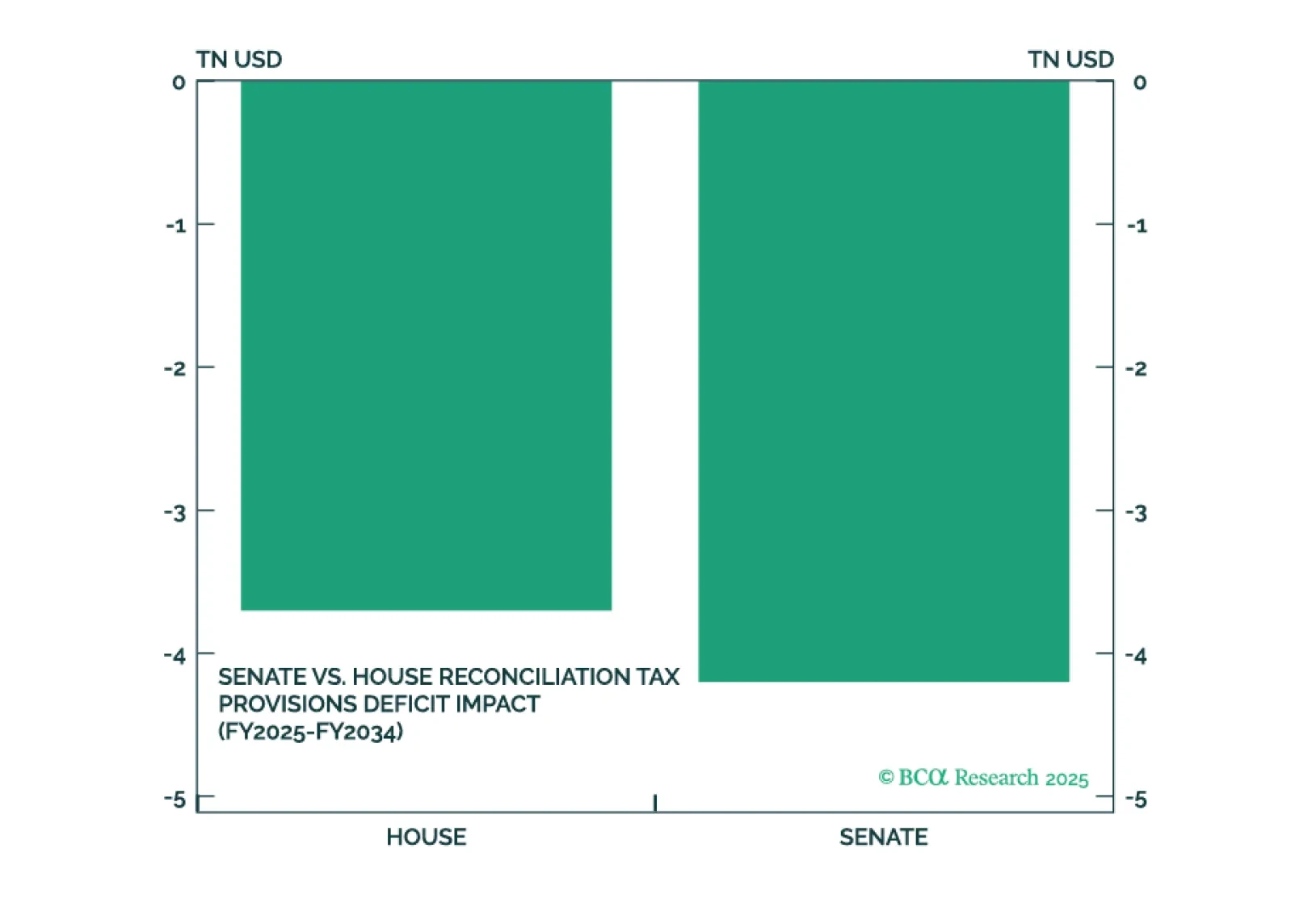

President Trump’s big beautiful bill will pass but faces near-term hurdles and will not tighten the government’s belt. It will combine with renewed tariff implementation to generate near-term risk for both the bond and stock market.…

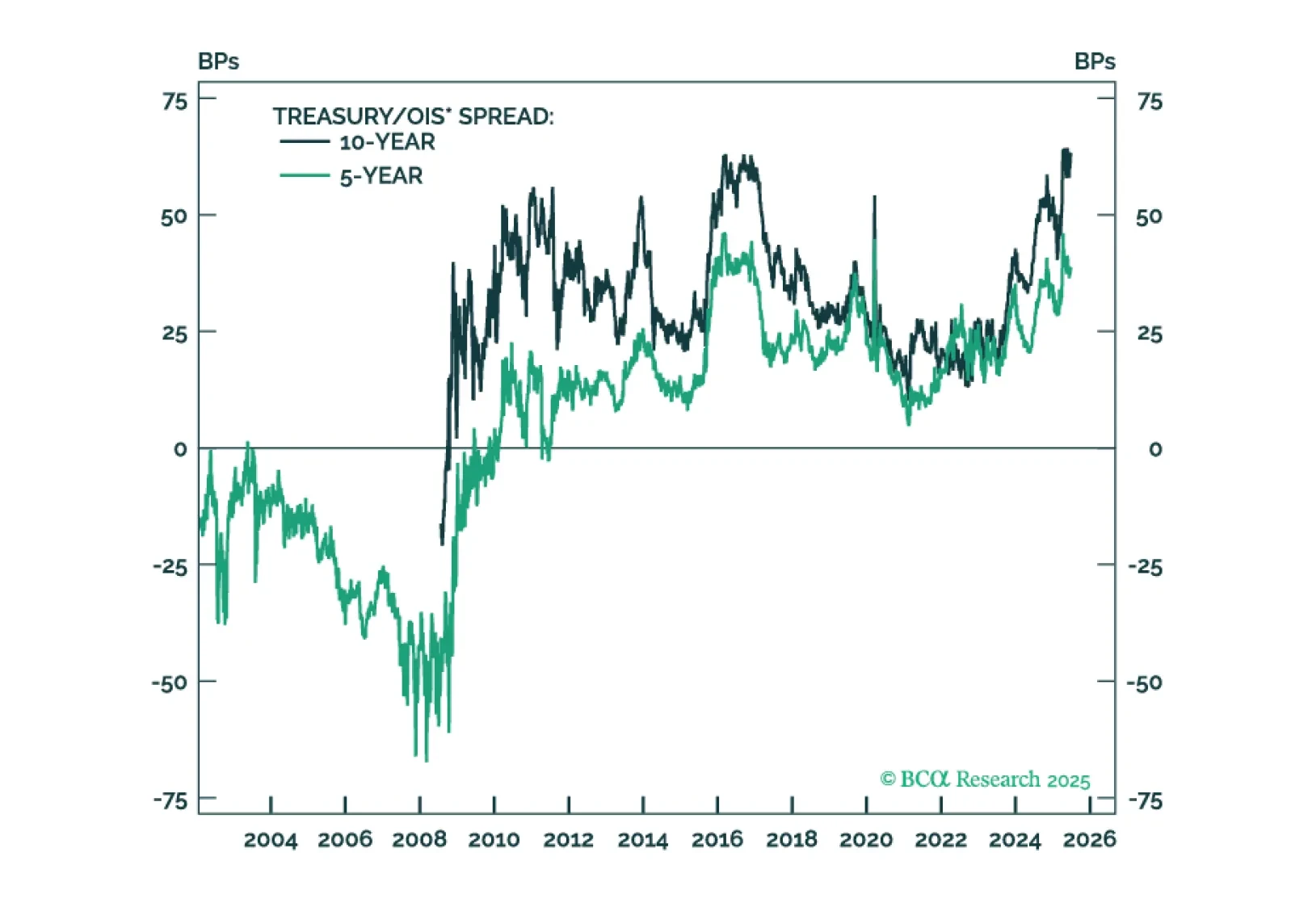

Headline strength in US capital goods orders is unlikely to last, reinforcing our defensive stance and preference for steepeners. New orders for core capital goods (nondefense ex-aircraft) rose 1.7% m/m in May, beating expectations…

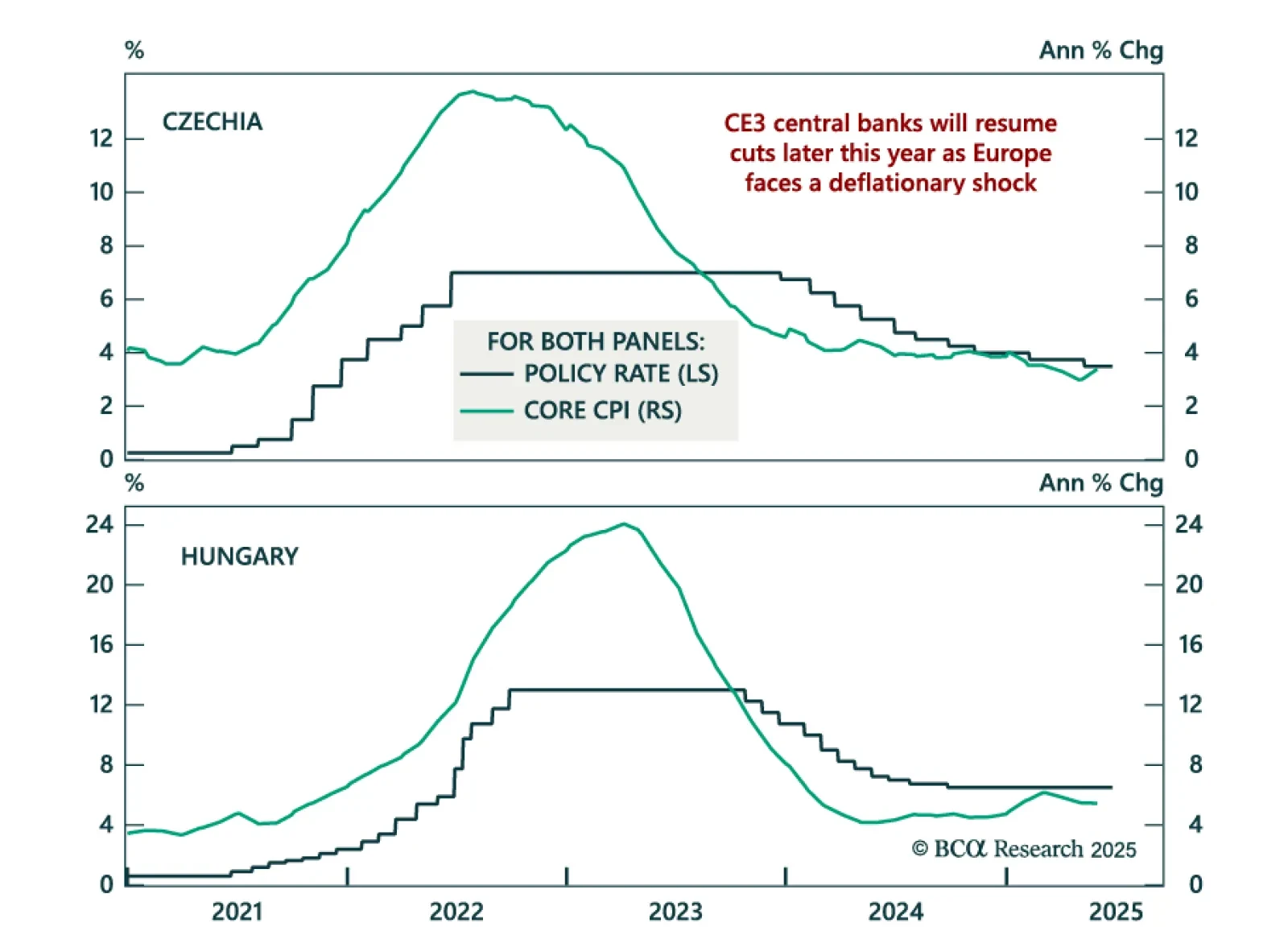

Deflationary pressures and weak core Europe growth support CE3 bond longs as rate cuts loom. The Czech and Hungarian central banks held rates steady at 3.5% and 6.5% this week, following Poland’s earlier decision to keep rates…