Jay Powell won’t be removed as Fed Chair before the expiry of his term next May, but we will learn the identity of his replacement this year, setting up a potentially awkward “shadow Fed Chair” situation.

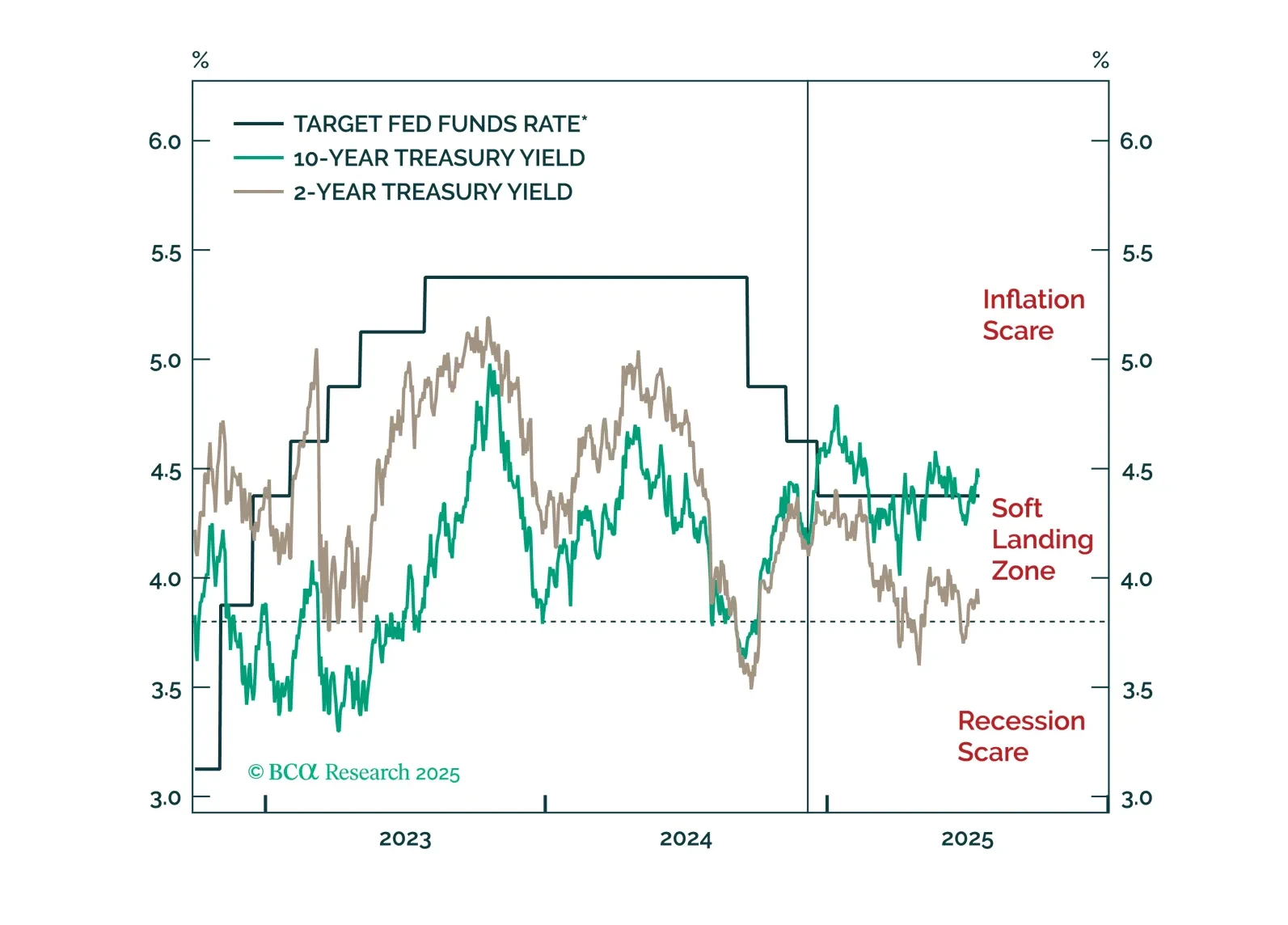

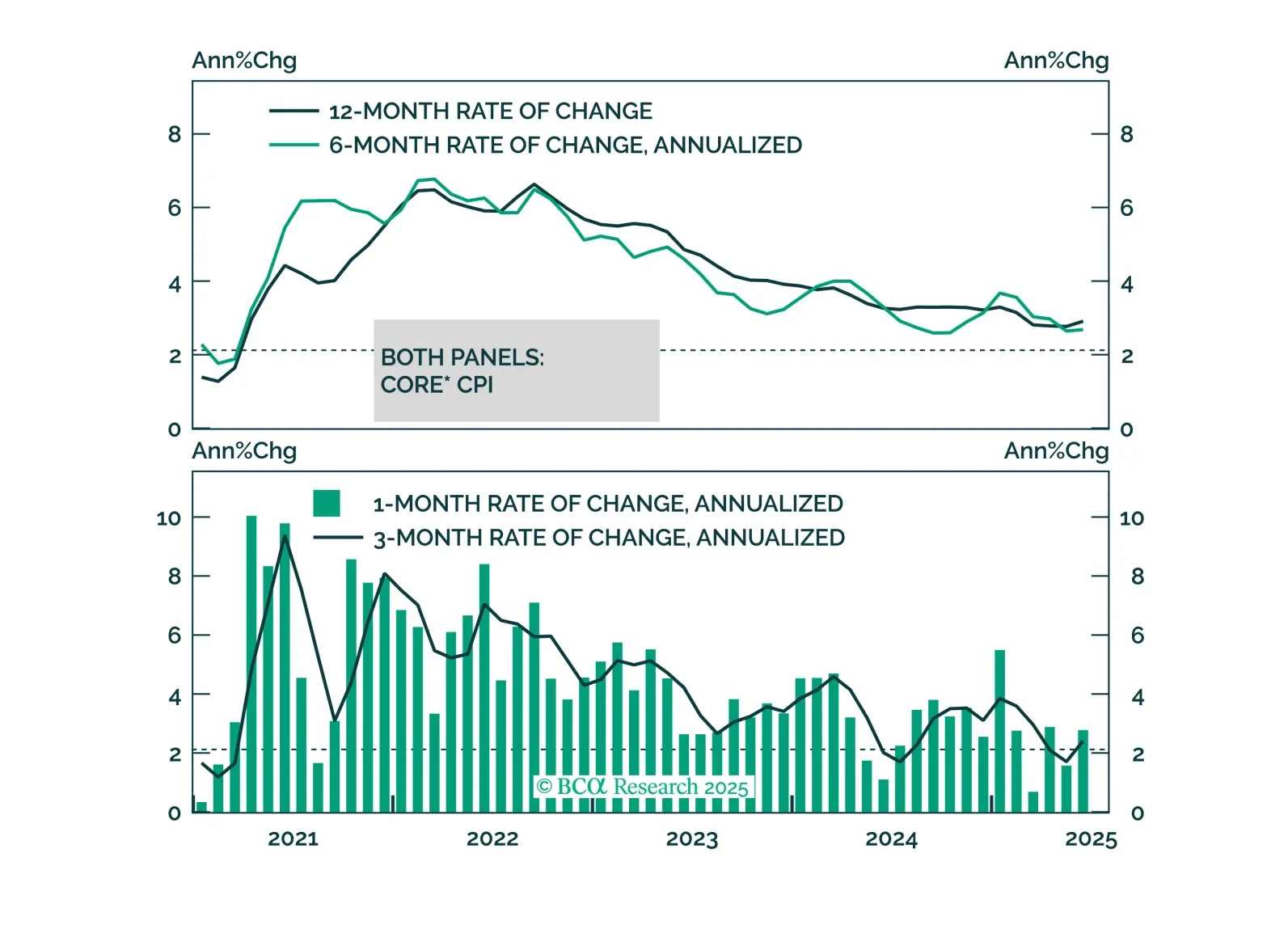

We discuss the implications of this morning’s CPI report and the relative attractiveness of 2/5 Treasury curve steepeners.

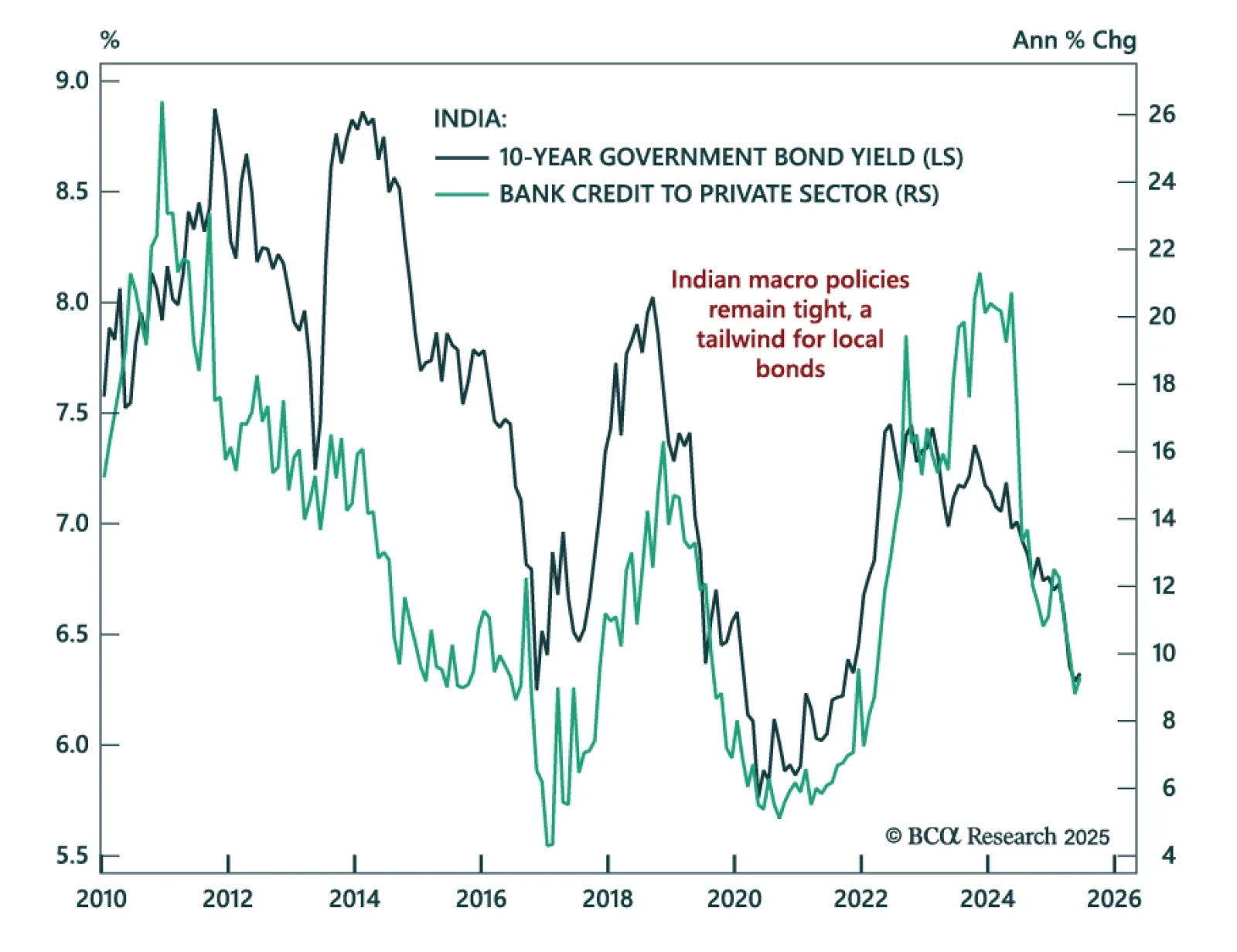

With inflation at a six-year low and restrictive policy weighing on growth, our EM strategists remain long Indian bonds and underweight equities. Headline CPI fell to 2.1% y/y, largely driven by lower food prices, bringing inflation…

We will abandon our recession call if US economic data show clear signs of stabilization over the summer months. For now, that has not happened. Maintain a modest underweight to stocks but look to get more defensive if MacroQuant’s…

Our Portfolio Allocation Summary for July 2025.

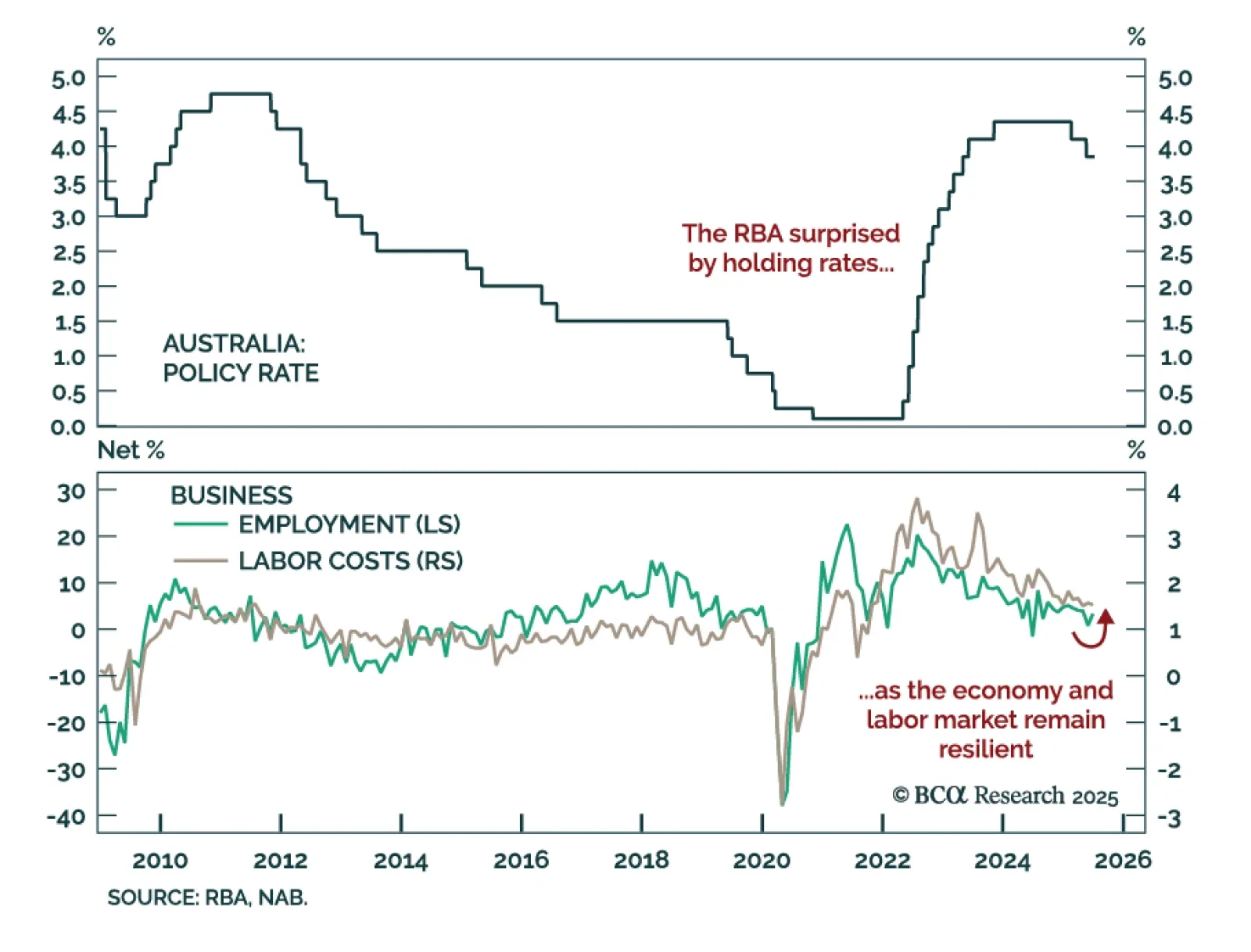

The RBA’s surprise hold reinforces a slower easing path, warranting an underweight on Australian bonds. Markets had priced in a 25 bps cut, but the central bank opted to keep rates at 3.85%. Governor Bullock characterized the…

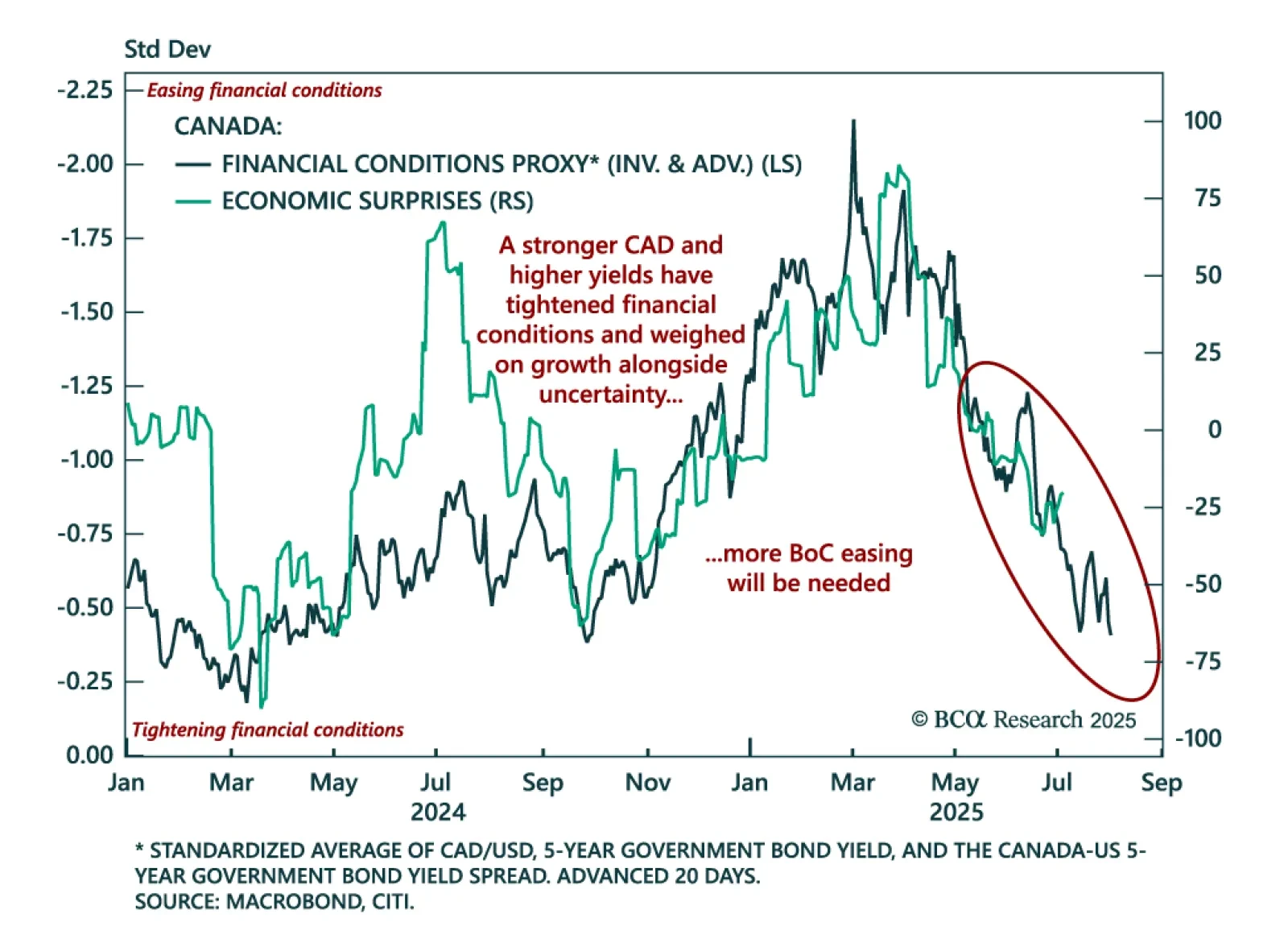

Canada’s stronger currency and tightening financial conditions point to further BoC easing and support long Canadian bond positions. The CAD has appreciated this year alongside the global push to diversify away from USD assets, which…

Our Geopolitical strategists warn that structural and cyclical risks remain elevated despite a fading threat of acute shocks, and recommend booking profits ahead of tariffs and weaker data. President Trump is passing his signature…

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…