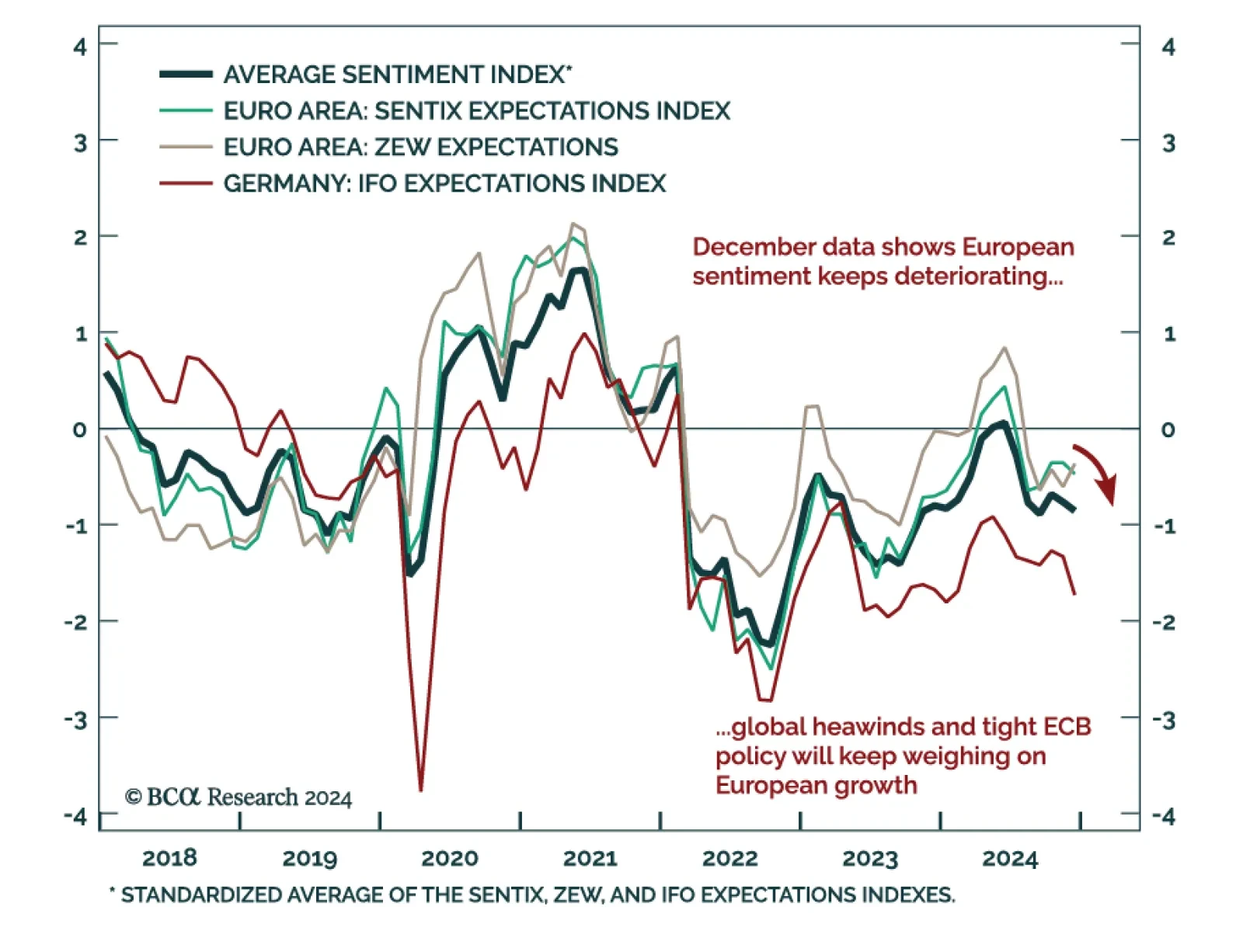

European sentiment data was mixed. The December Ifo Business Climate index for Germany missed estimates and was down 1 point to 84.7 from November. The decrease came from its expectations component, which fell to 84.4 from 87.2.…

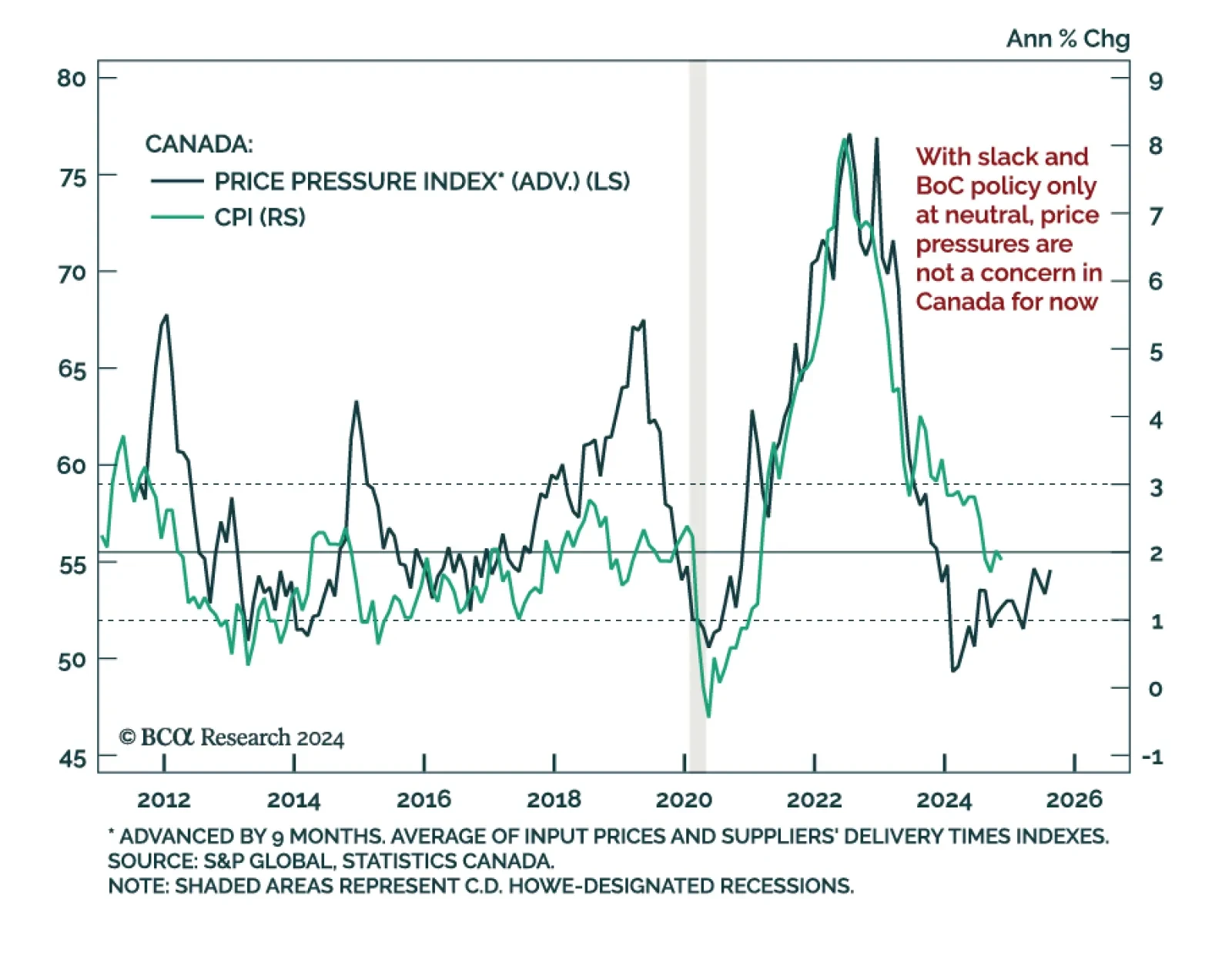

The November Canadian CPI was slightly below estimates, declining to 1.9% y/y from 2.0%, below the BoC’s 2% target but within the 1%-to-3% range. The BoC’s favored core measures, median and trim, were flat at 2.6% and…

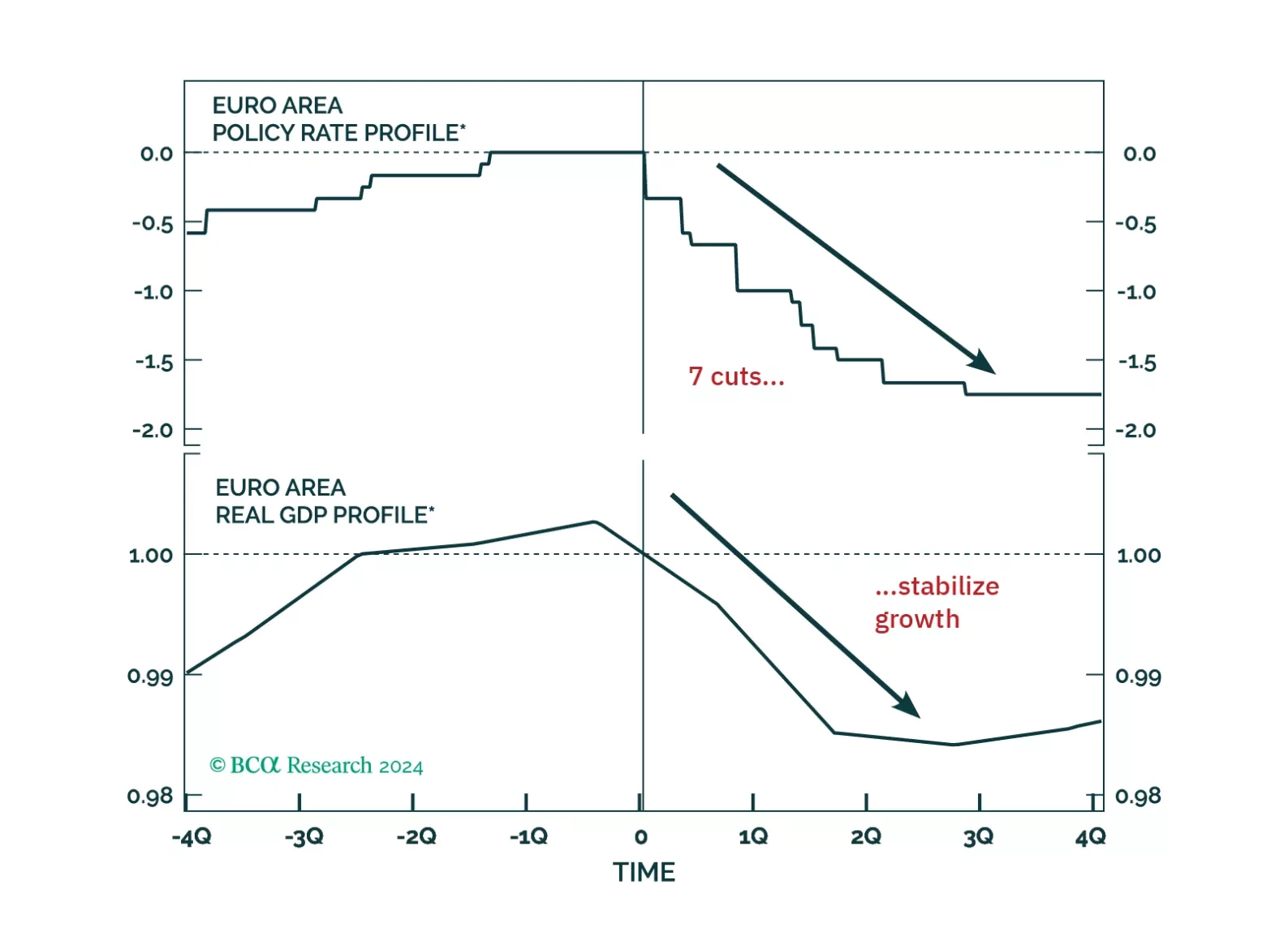

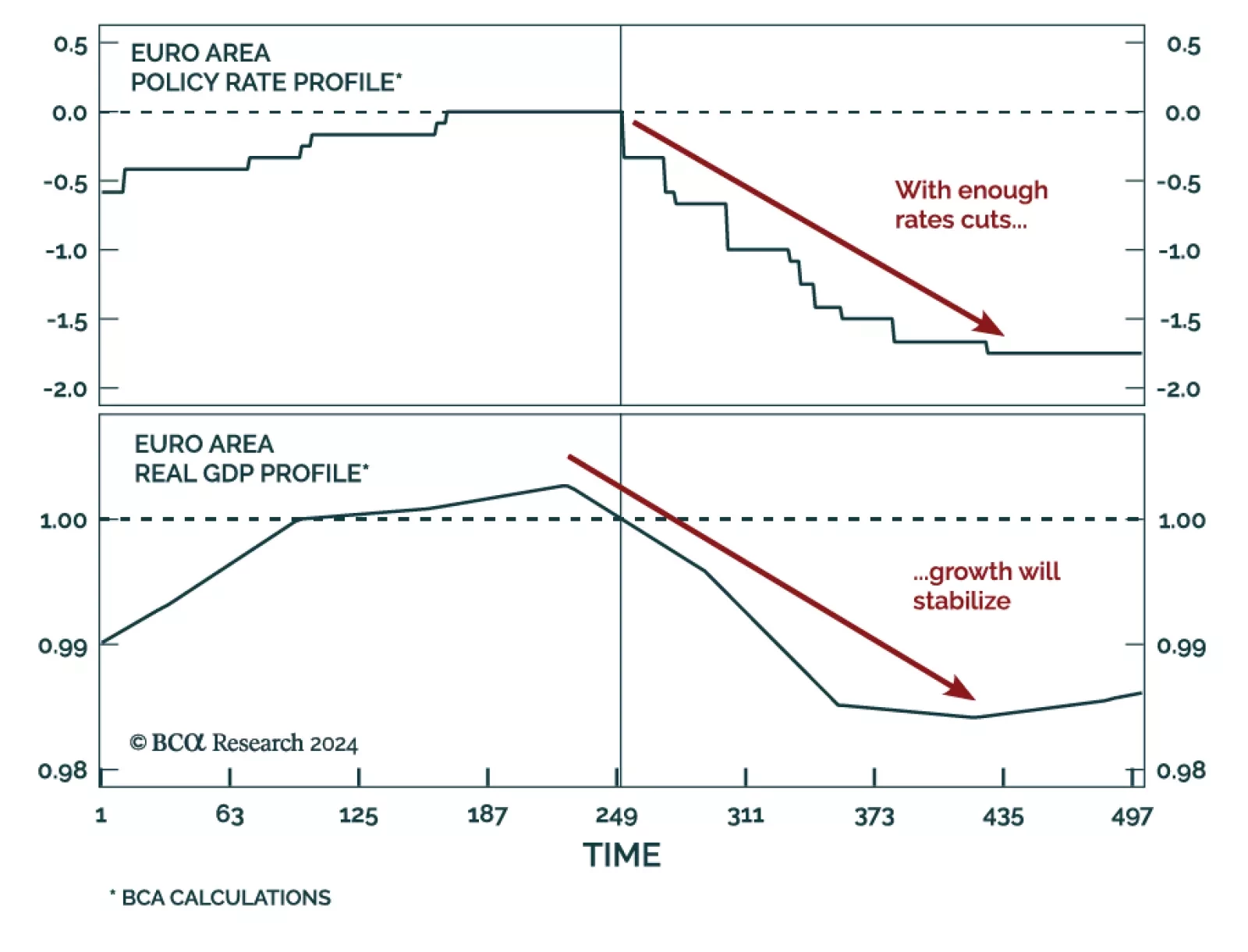

Our European Investment Strategy team published their annual outlook, outlining five key themes that will shape Europe’s economy and markets in 2025. Europe will enter a mild recession in H1 2025, but growth is…

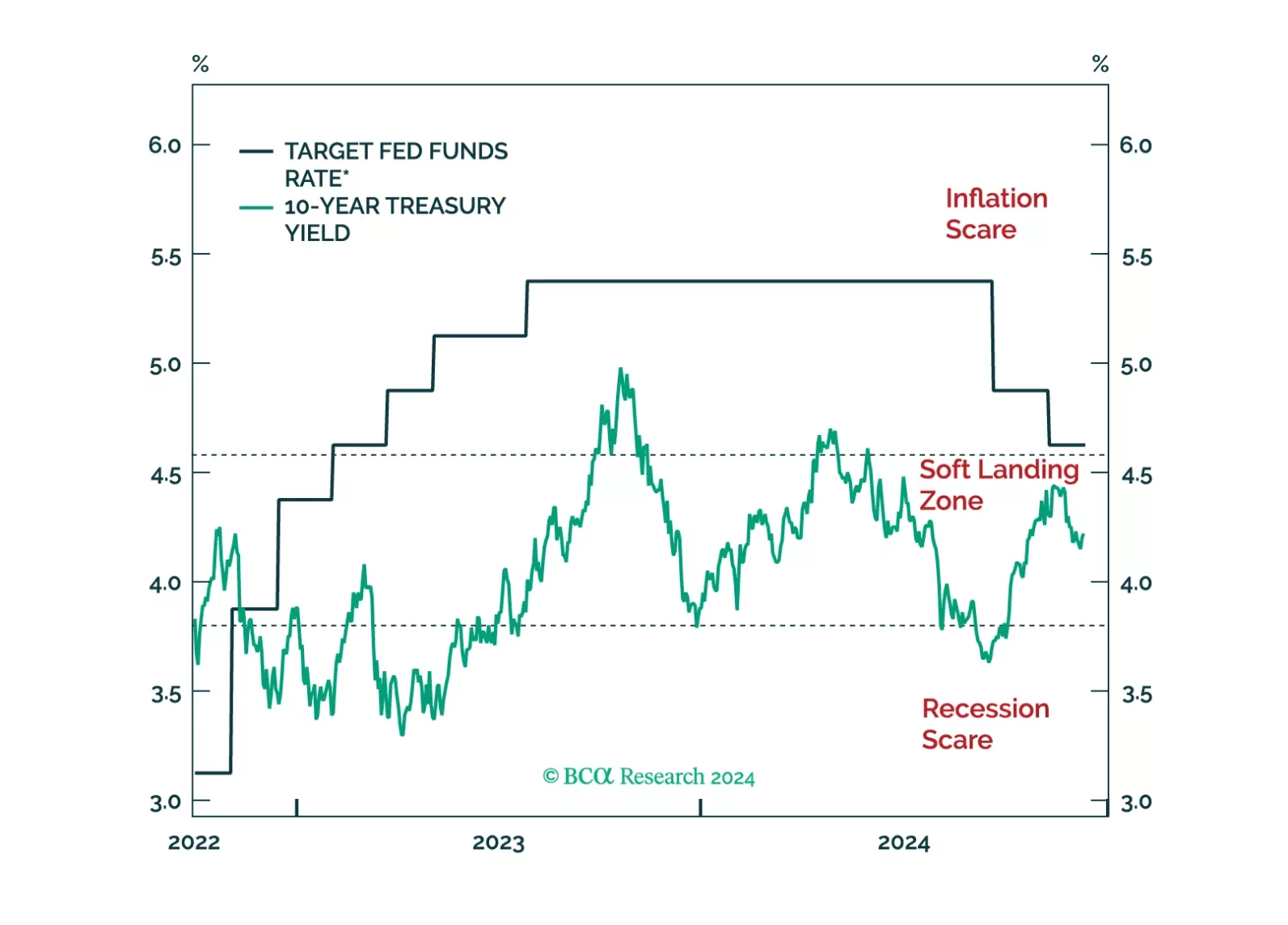

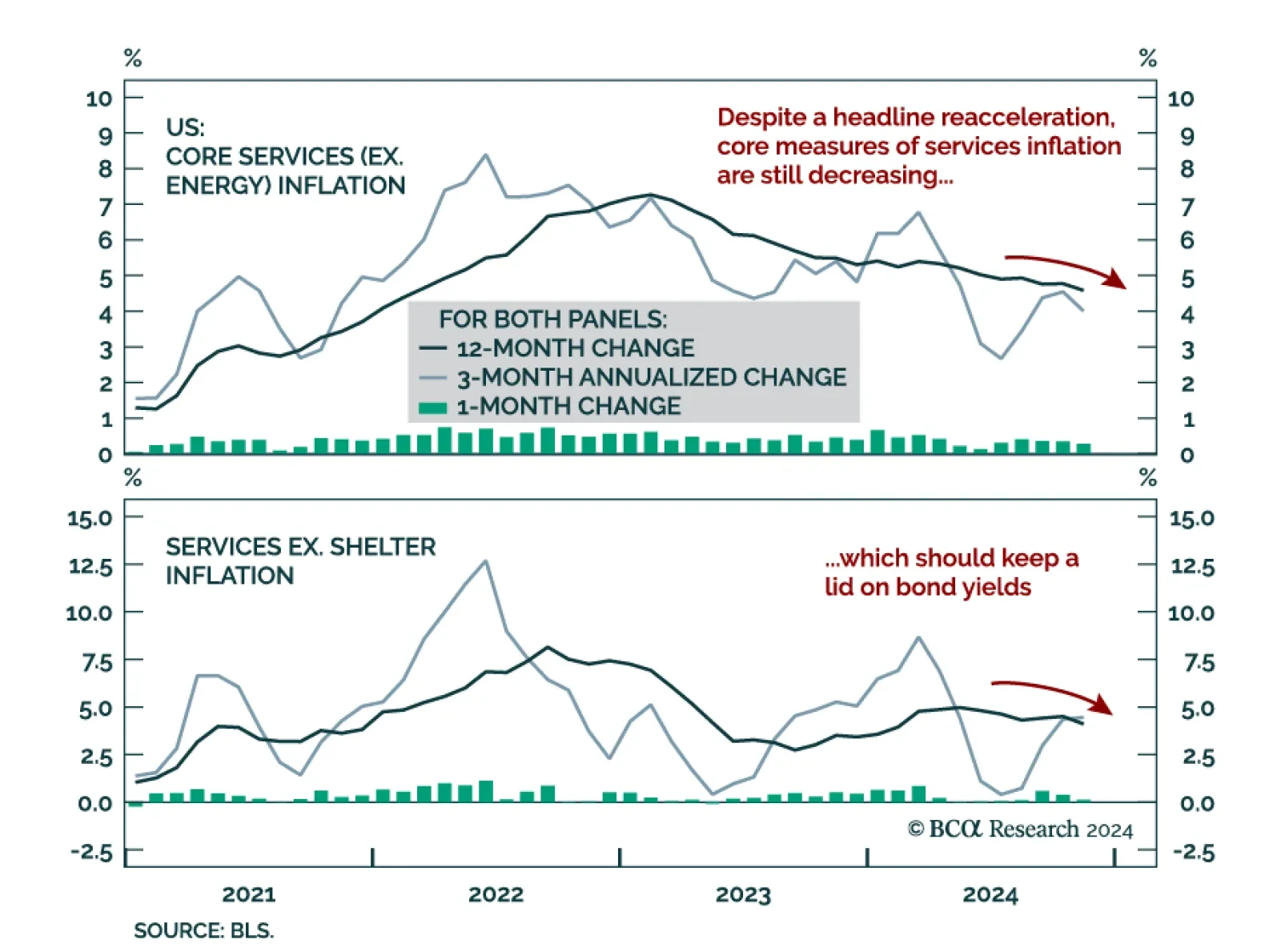

The November CPI came in line with expectations, accelerating to 0.3% m/m (2.7% y/y) from 0.2% (2.6% y/y) in October. Core also printed at 0.3% m/m, the same as October and remaining at 3.3% y/y. The acceleration was mainly…

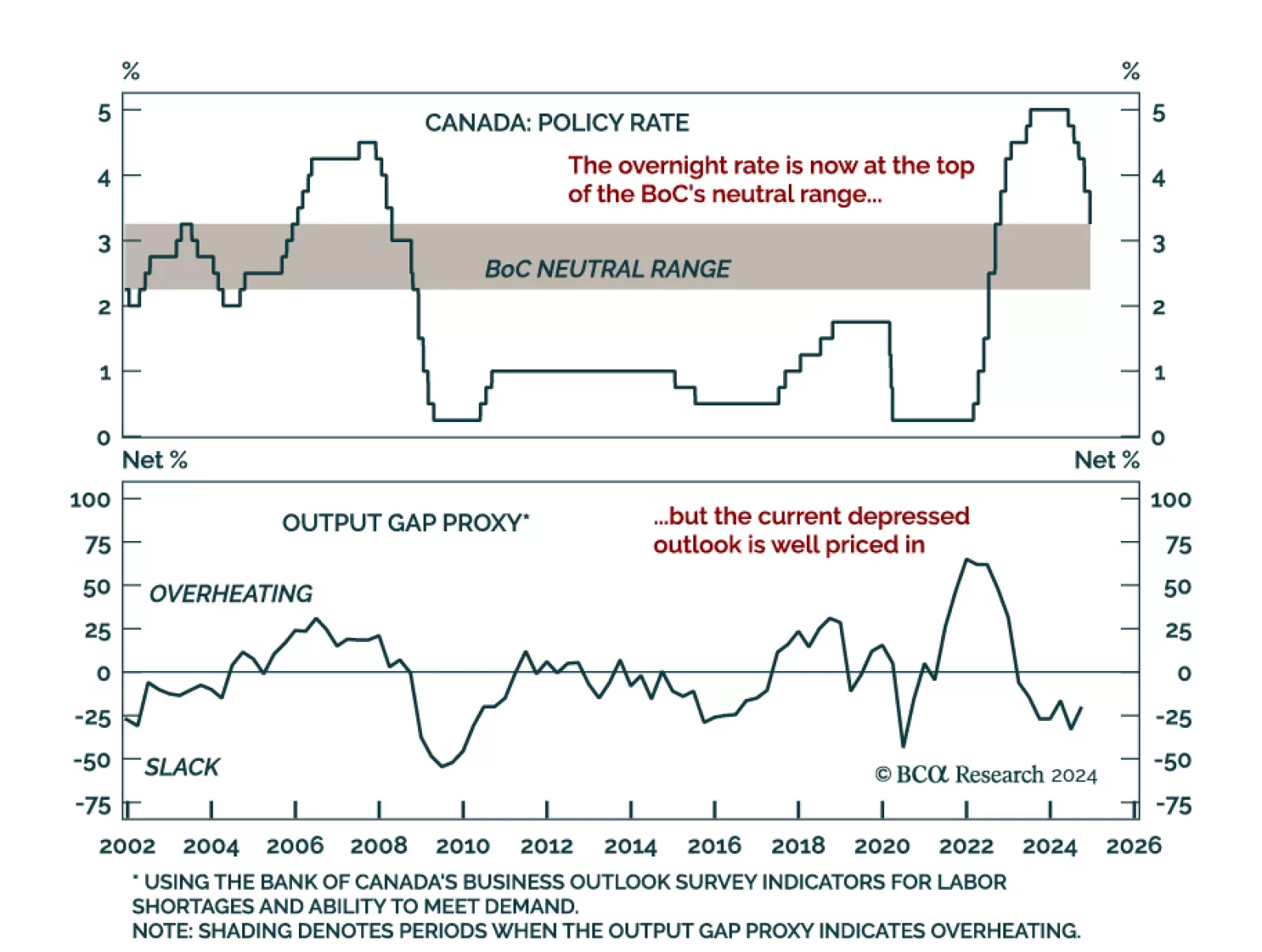

The Bank of Canada cut the overnight rate by 50 bps to 3.25%, a move predicted by economists and roughly priced in. The consecutive supersized cut brings the policy rate in the upper end of the 2.25%-to-3.25% range the BoC…

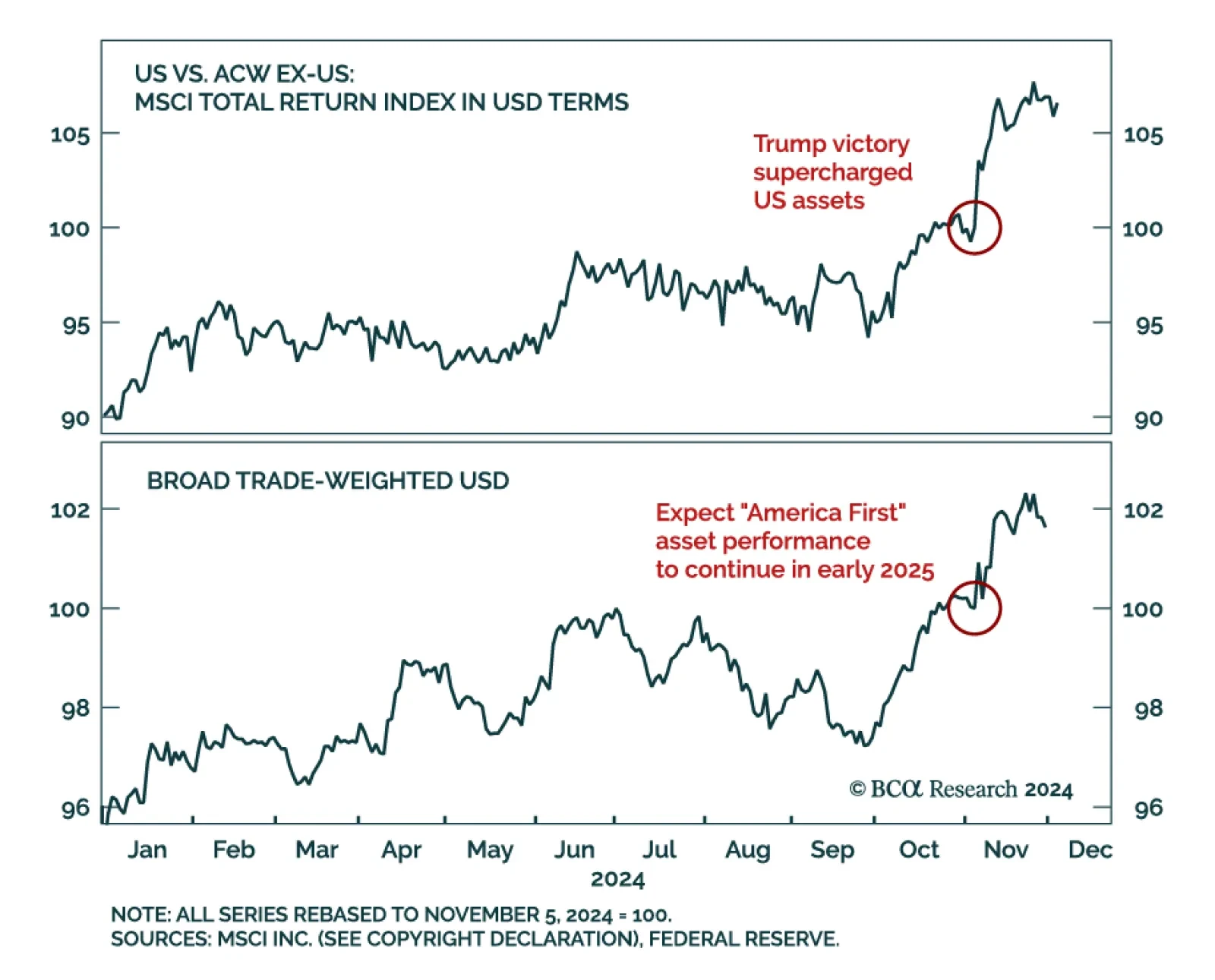

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…

Four years after the pandemic, it feels like there has not been enough self-reflection of that fascinating period in history. One lesson for the world of finance continues to go ignored.

Our GeoMacro Strategy service published their 2025 outlook, and they see three peaks shaping the year: Peak fiscal, peak-deglobalization, and peak geopolitical risk. In 2024, our colleagues’ bullish economic outlook…