We examine Treasury market valuation and look for indicators that could help us time the next peak in yields. We also update the forecasts from our Treasury yield model.

UK inflation surprised to the downside in December. Headline inflation retreated below estimates to 2.5% y/y from an eight-month high of 2.6% in November. Core inflation also decreased below estimates, printing 3.2% vs. 3.5% in…

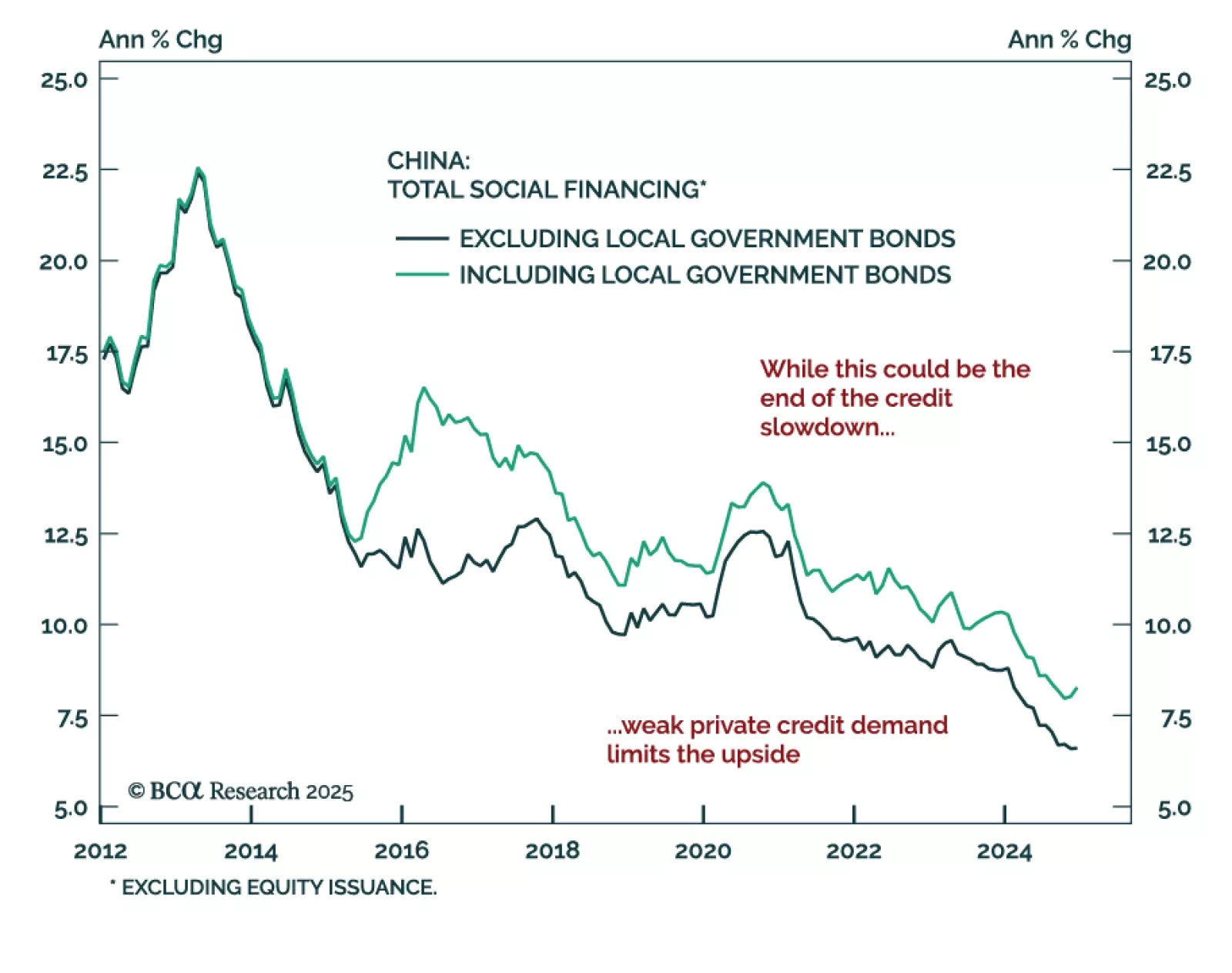

China’s monetary and credit data was relatively strong. New yuan loans increased more than expected, as did aggregate financing. M2 met estimates at 7.3% y/y. As was the case for trade in December, seasonality plays a big role…

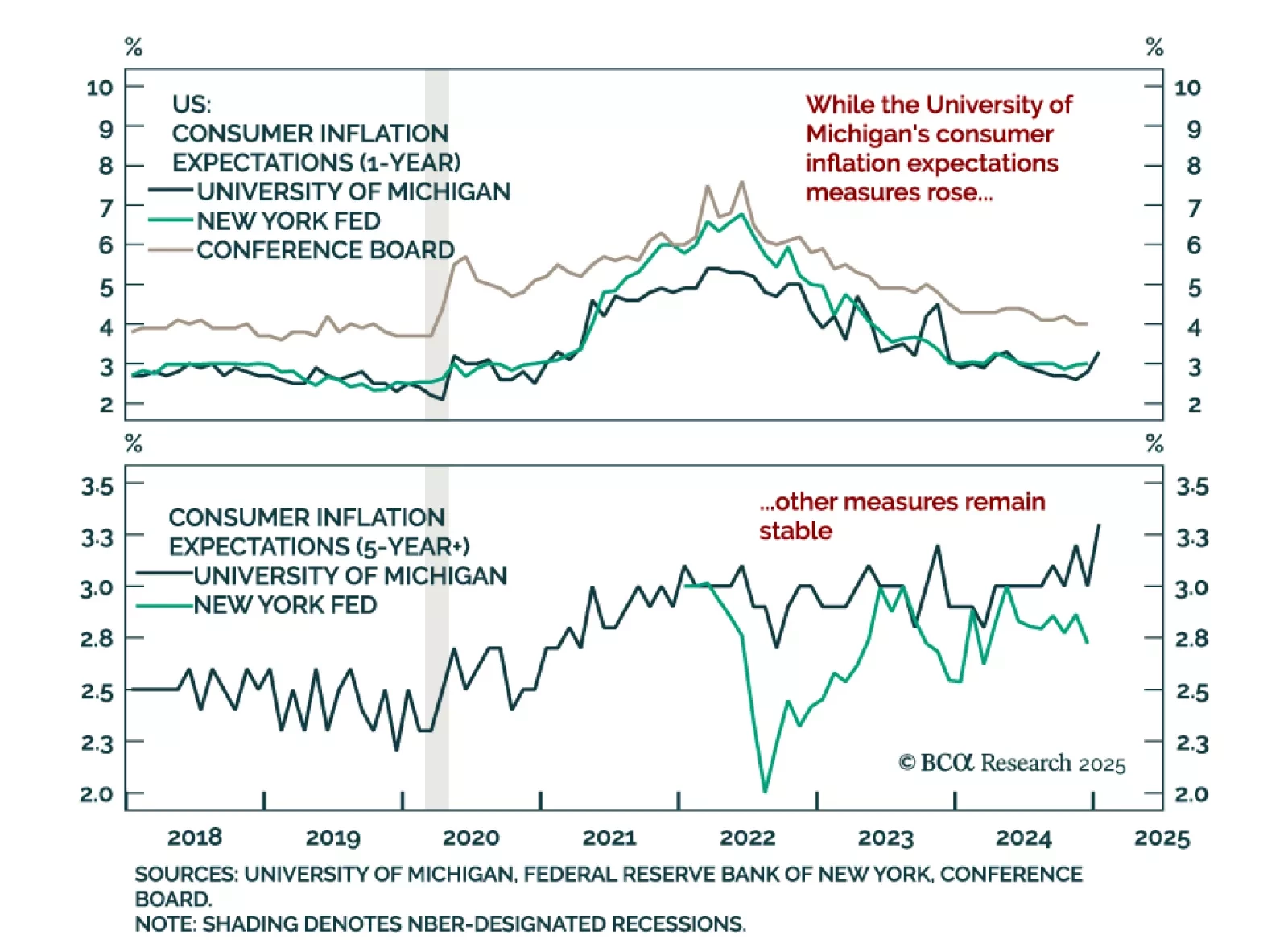

The preliminary January University of Michigan Consumer Sentiment Index missed estimates on Friday, driven by a cooling of consumer expectations. Worryingly, both the 1-year and 5-to-10 year inflation expectations ticked up to 3.3%…

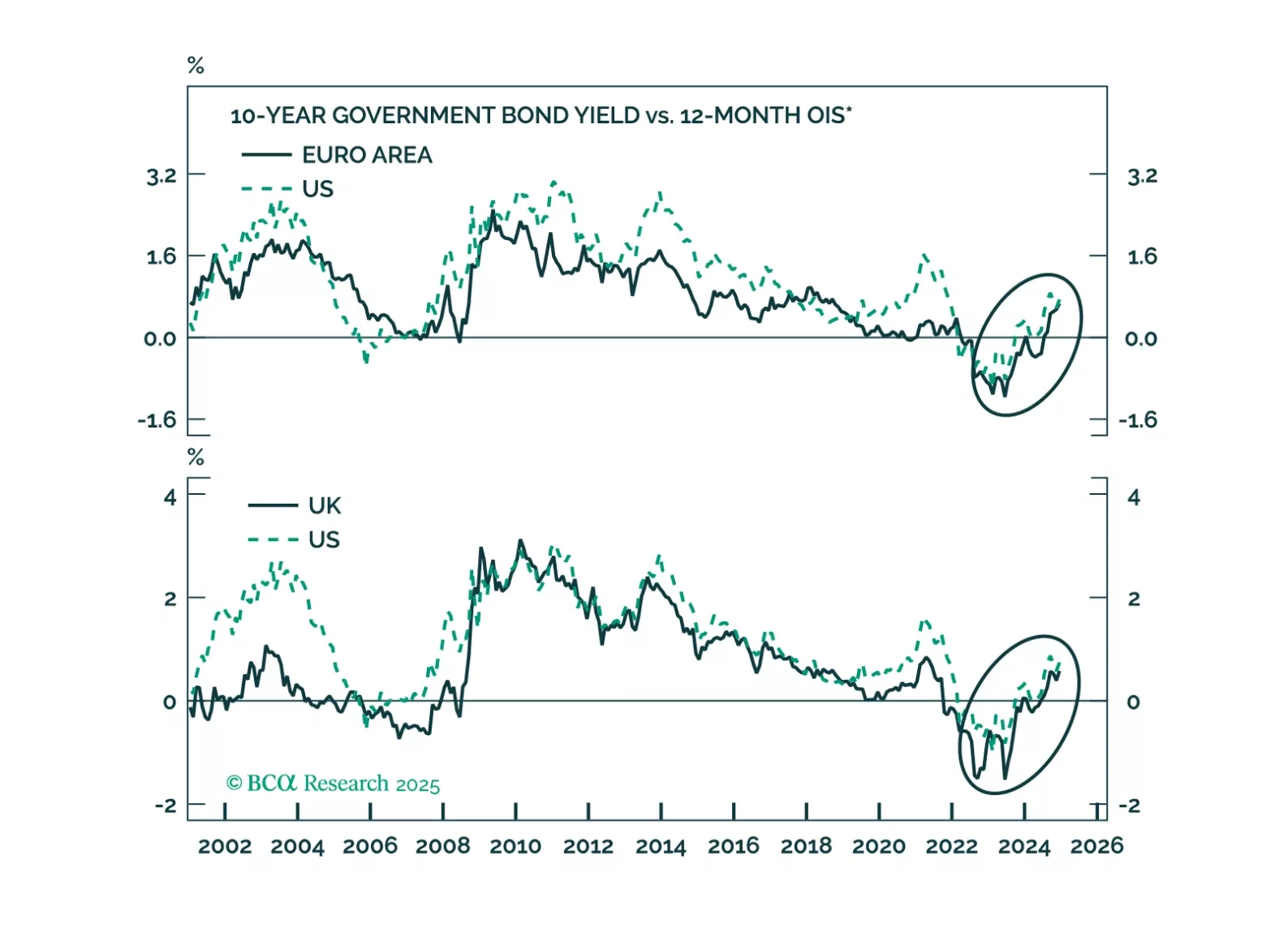

UK and German bonds are victims of the global bond market riots. Will European yields continue to move higher and will the euro and the pound find a floor anytime soon?

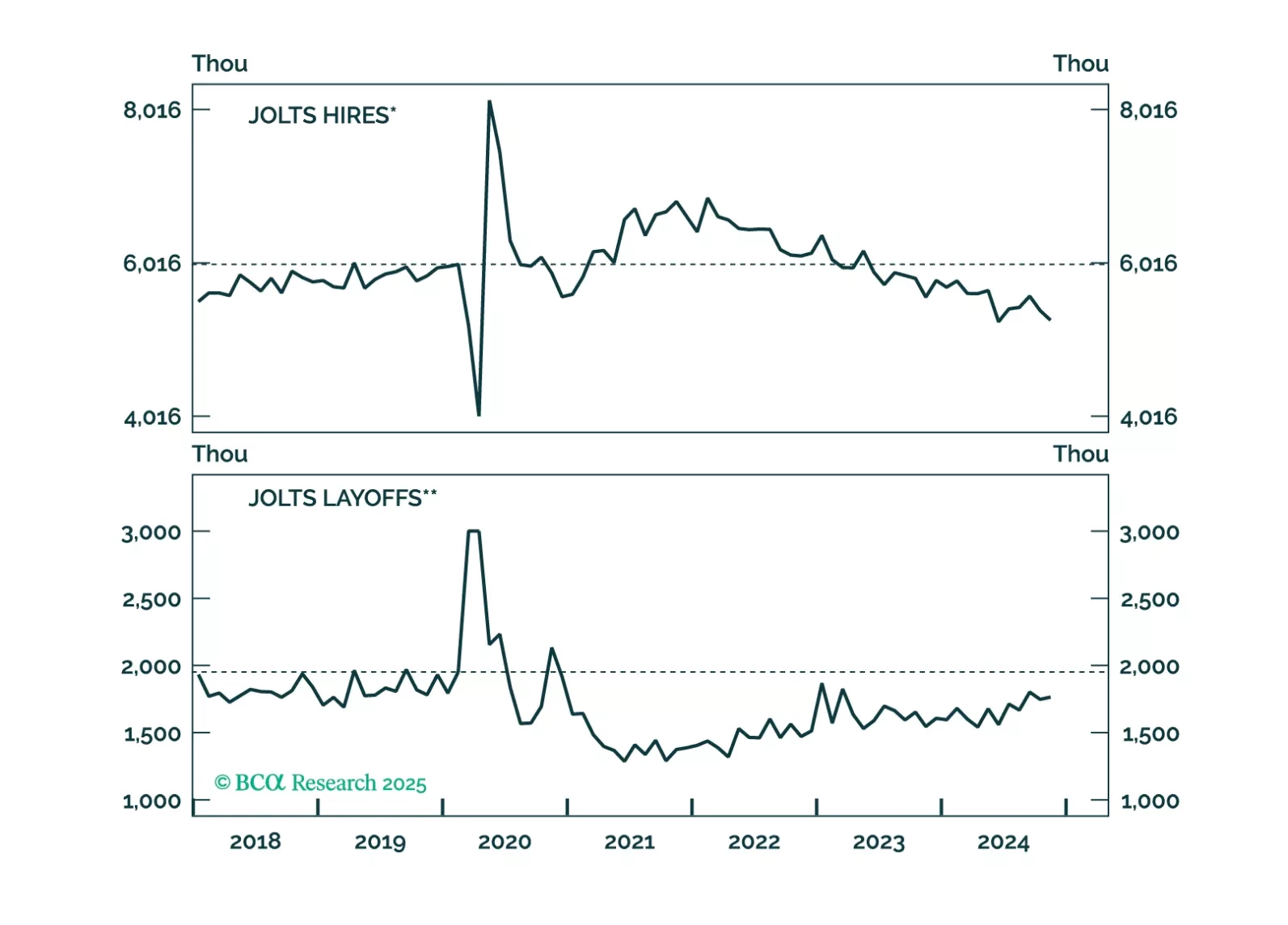

Thoughts on the increase in bond yields and this morning’s employment data.

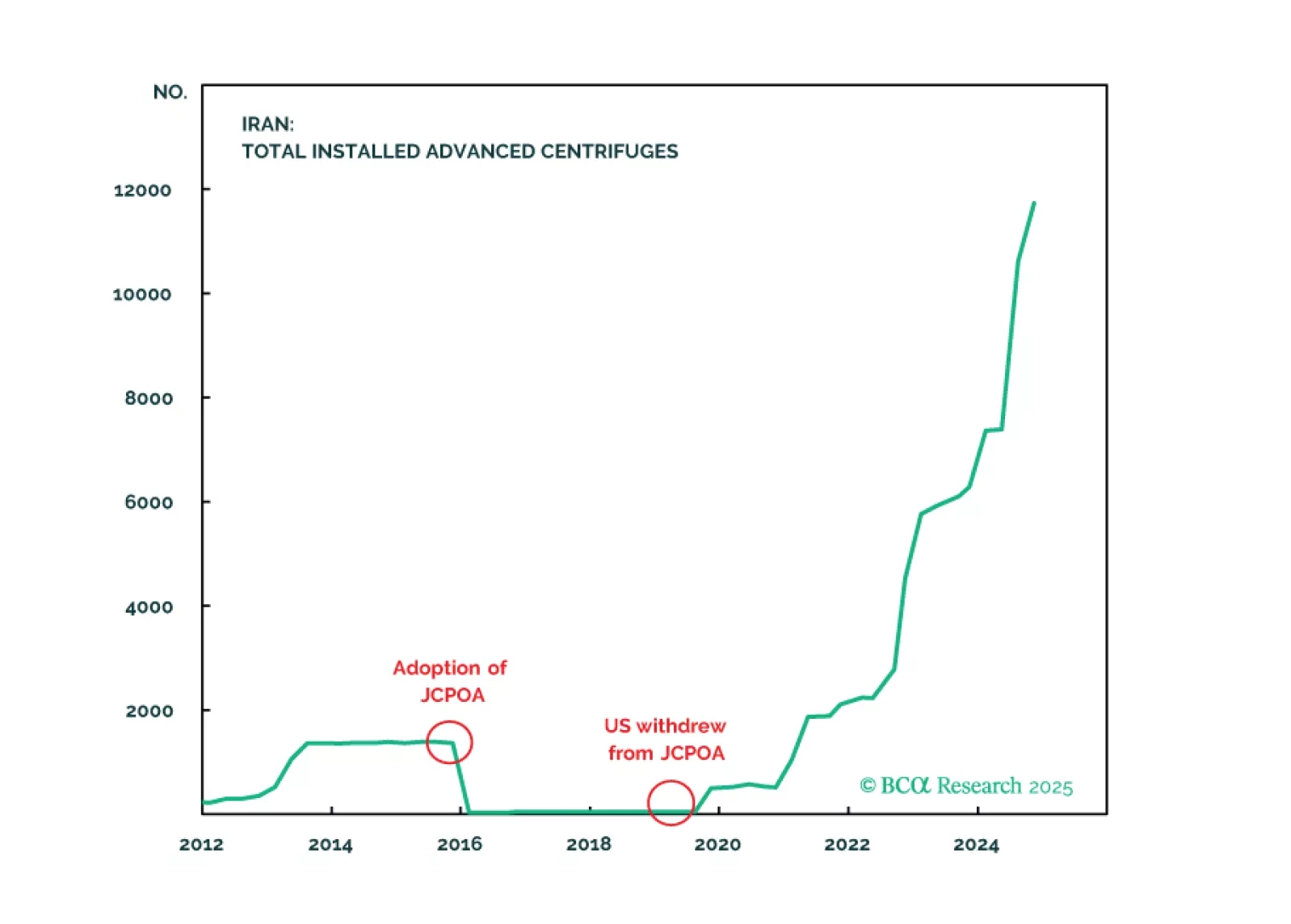

Every year we highlight five low-odds scenarios that would have a major impact on global financial markets if they happened. This year we contemplate a total reversal of Chinese policy, a US-Iran nuclear deal, a breakdown of NATO, US…

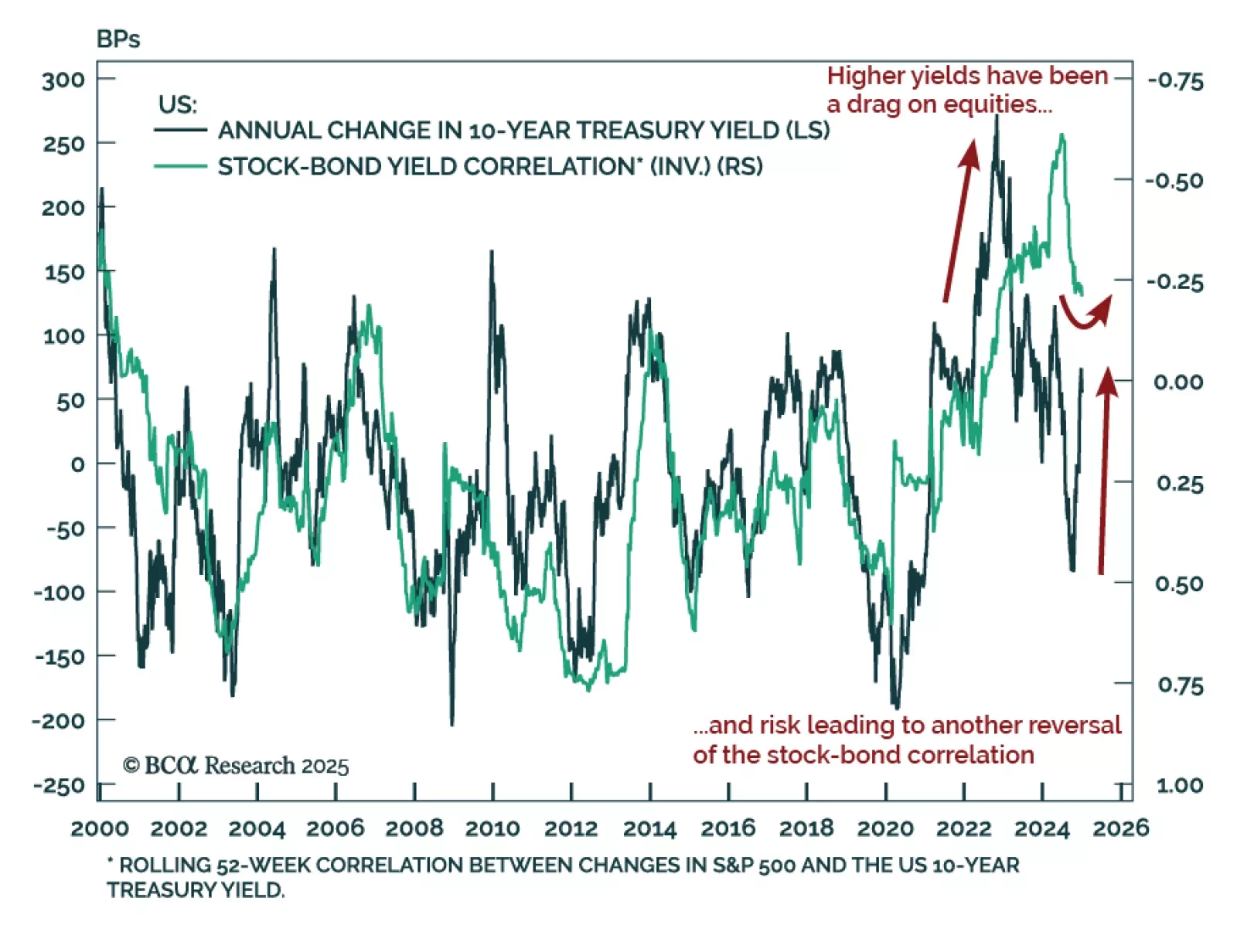

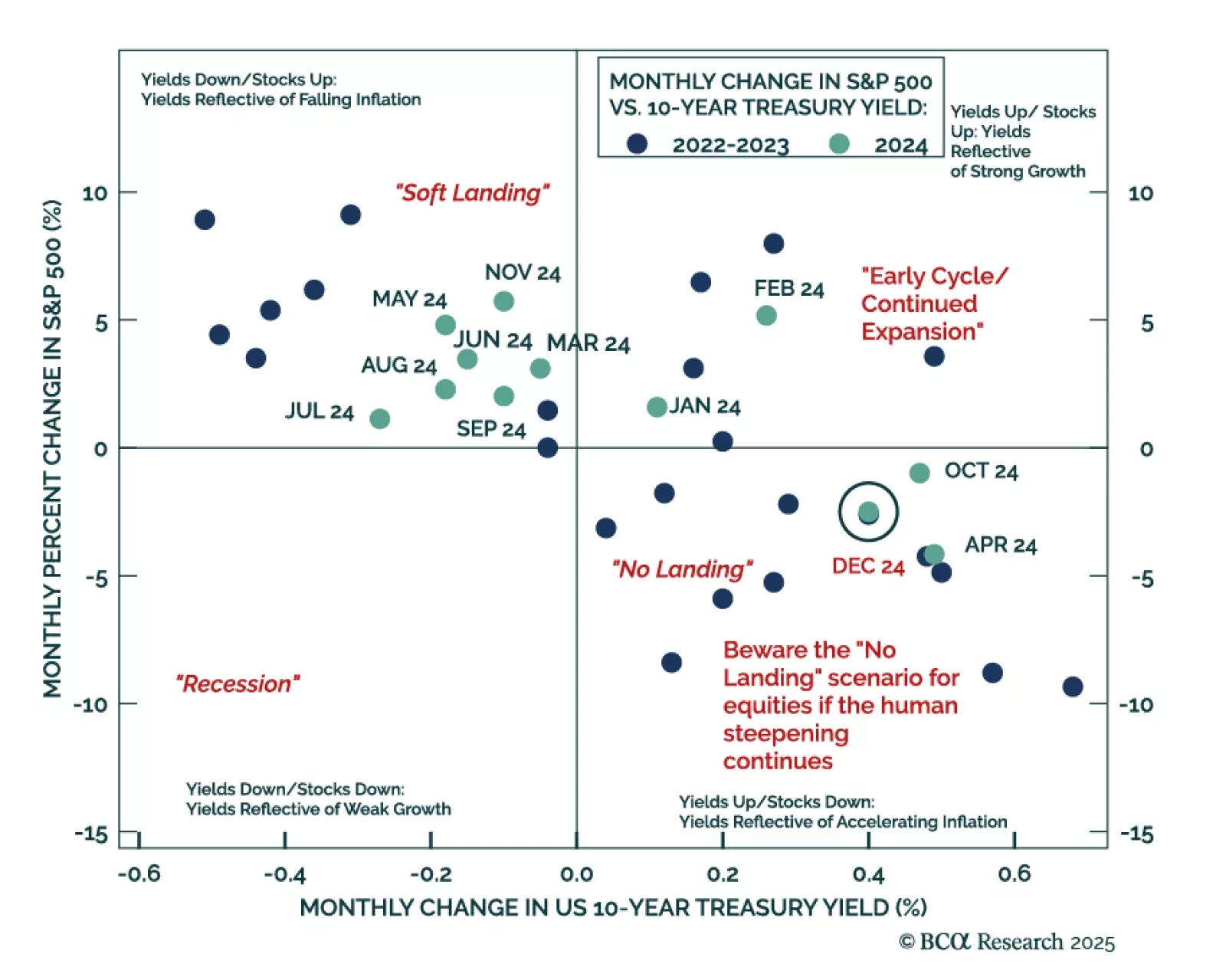

The post-COVID inflation impacted the most important cross-asset relationship: the stock-bond correlation. Higher inflation expectations pushed yields higher, leading to a correction in bond and stock prices. As price pressures…

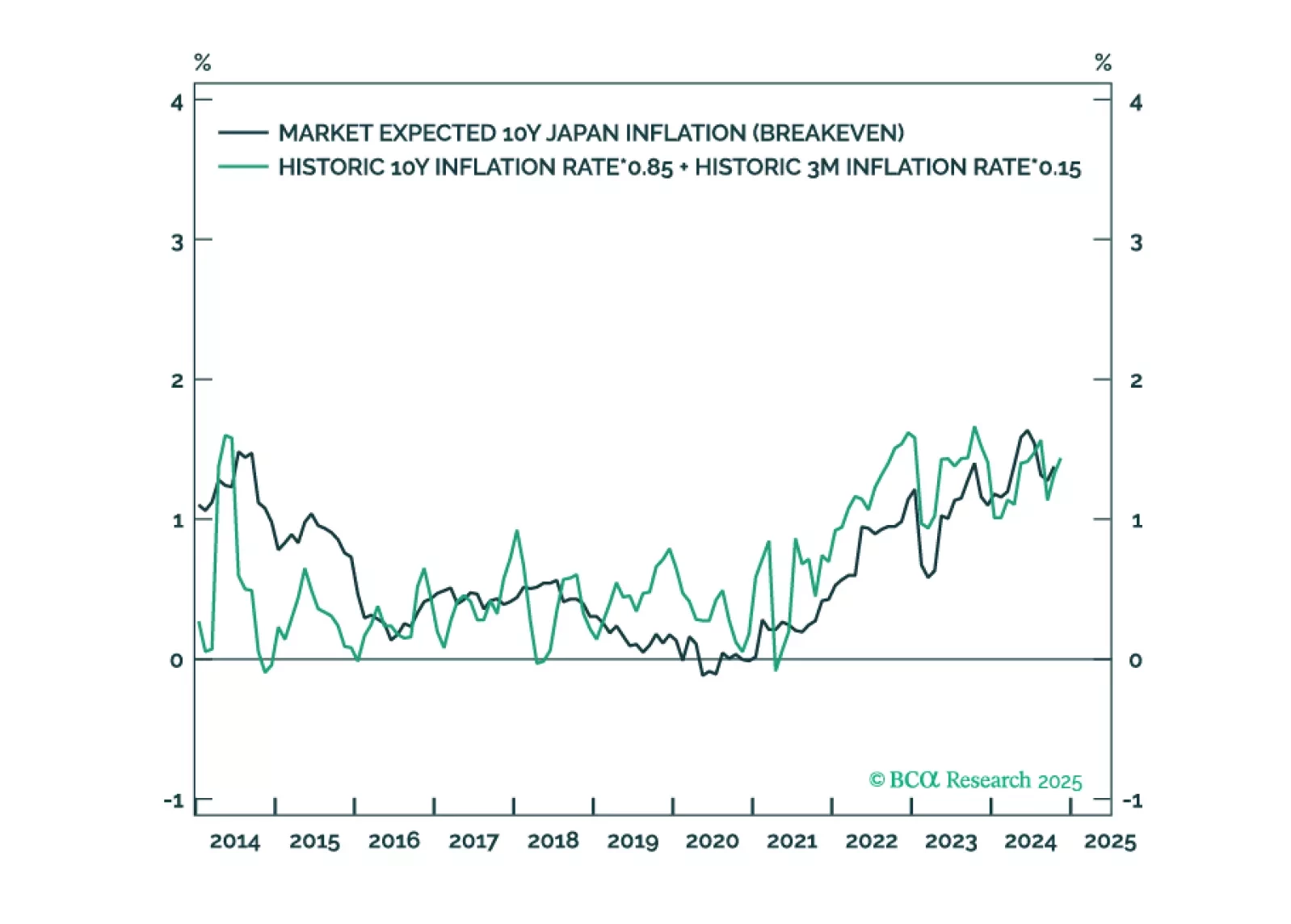

In most developed economies, rising inflation expectations will lift them further above the 2 percent target, limiting the scope for further interest rate cuts. But in Japan, rising inflation expectations will lift them up to the BoJ…

Our GeoMacro strategists published their Alpha Report, outlining their view that President Trump will have to pare back his fiscal ambitions to avoid a bond market riot. The long end of the US bond market continues to sell off,…