Please note that yesterday we published Special Report on Egypt recommending buying domestic bonds while hedging currency risk. Today we are enclosing analysis on Hungary, Poland and Colombia. I will present our latest thoughts on the…

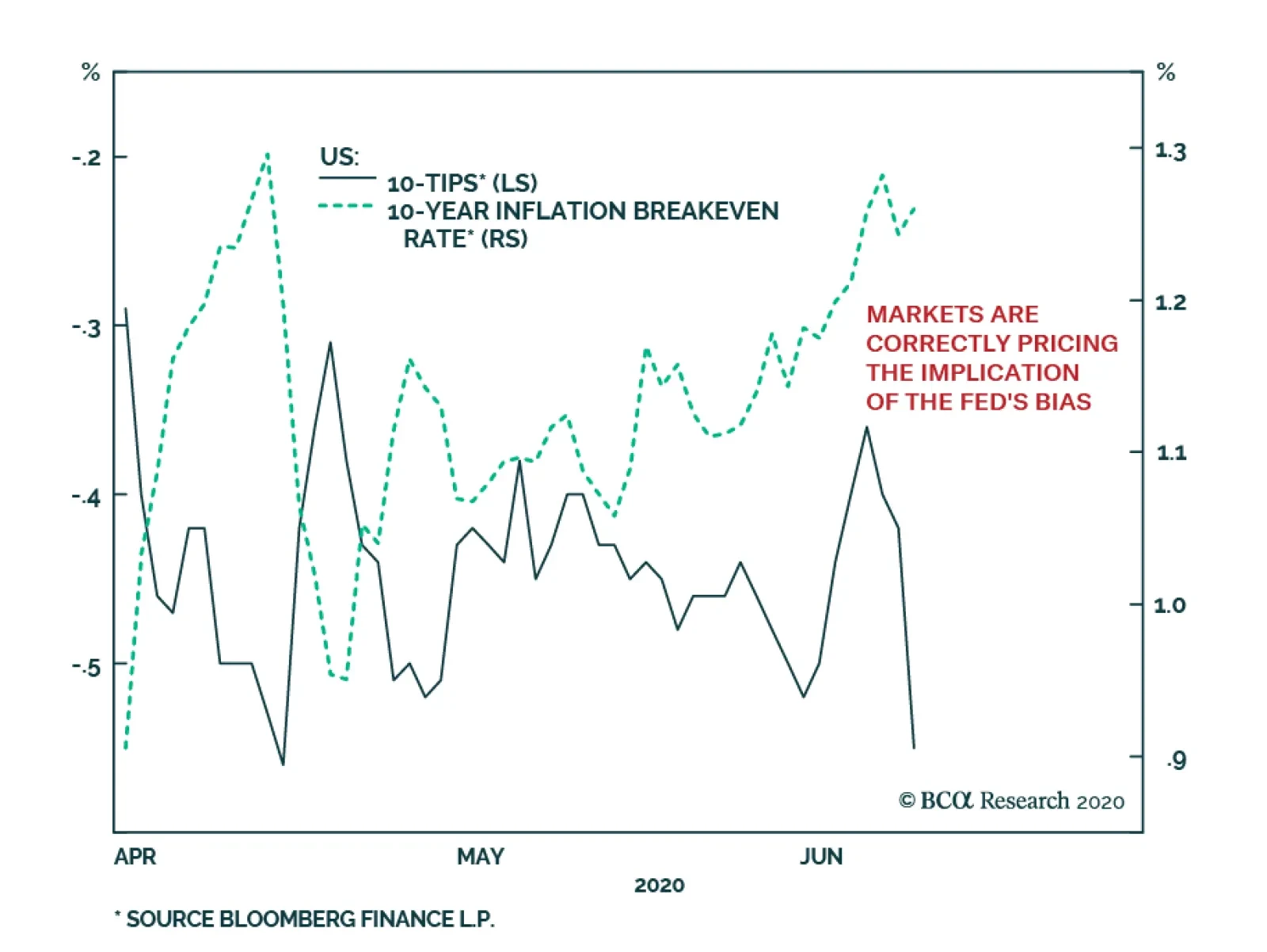

Yesterday, the Federal Reserve indicated it expects not to increase interest rates until at least the end of 2022 and its remains committed to its asset purchase program. In other words, the fed will continue to provide ample…

Highlights Rising Bond Yields: Global risk assets are discounting a V-shaped economic recovery. With economic data starting to revive as more economies emerge from virus-related shutdowns, bond yields are showing signs of following…

Highlights If policymakers can neutralize default pressures arising from the lockdowns, the lasting impacts of this recession may not be so bad: As Jay Powell put it on 60 Minutes several weeks ago, policymakers just have to keep…

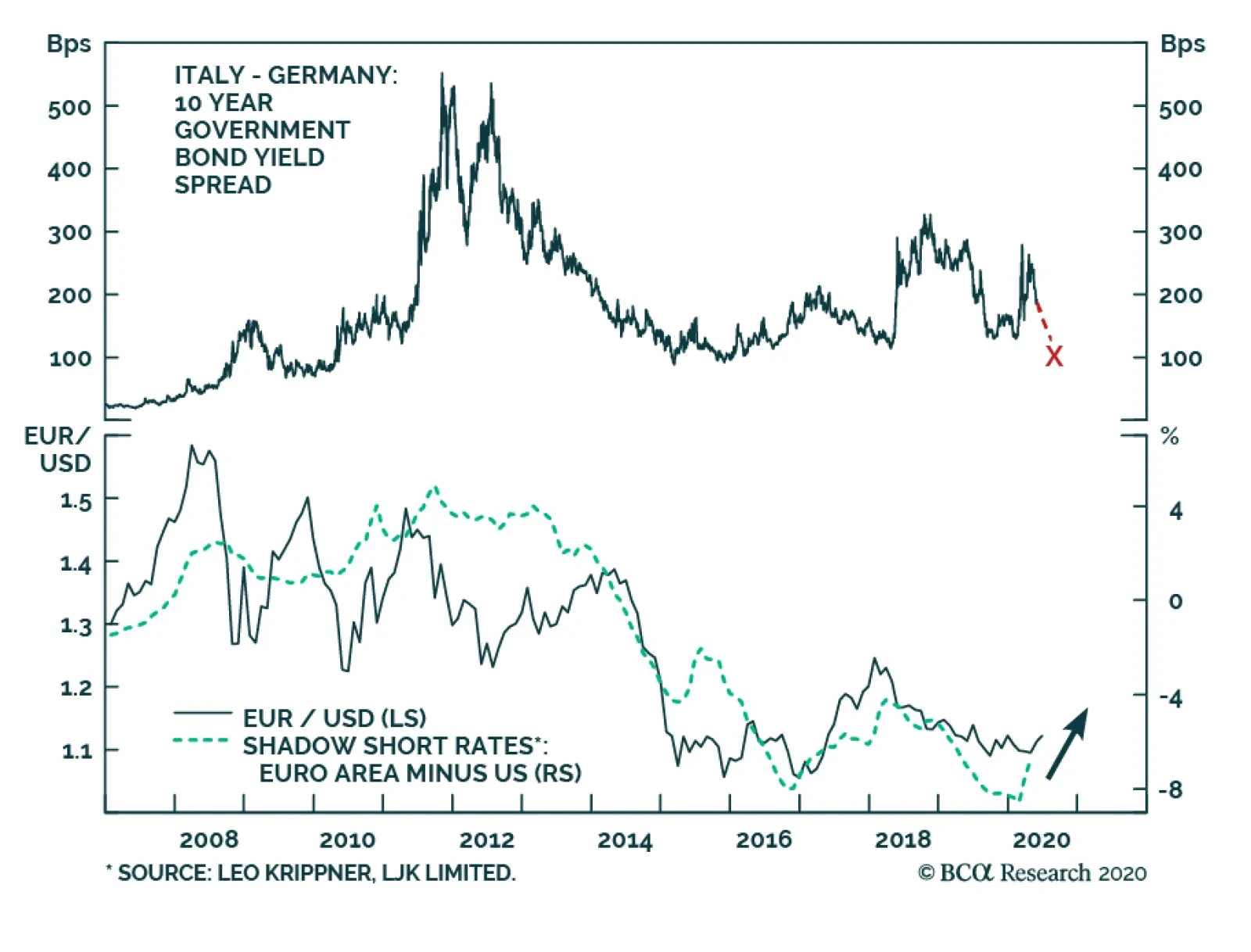

Yesterday, the ECB pleasantly surprised market participants by announcing an additional EUR600 billion of purchases and extending the program to at least June 2021. Investors expected only a further EUR500 billion in buying.…

Highlights Risks assets have entered a FOMO-driven mania phase that could last for a few more weeks. Markets are ignoring the particularities of this recession and are treating the post-lockdown activity snapback as a V-shaped…

Highlights The Chinese economy continues to recover, albeit less quickly than the first two months following a re-opening of the economy. The demand side of the Chinese economic recovery in May marginally outpaced the supply side,…

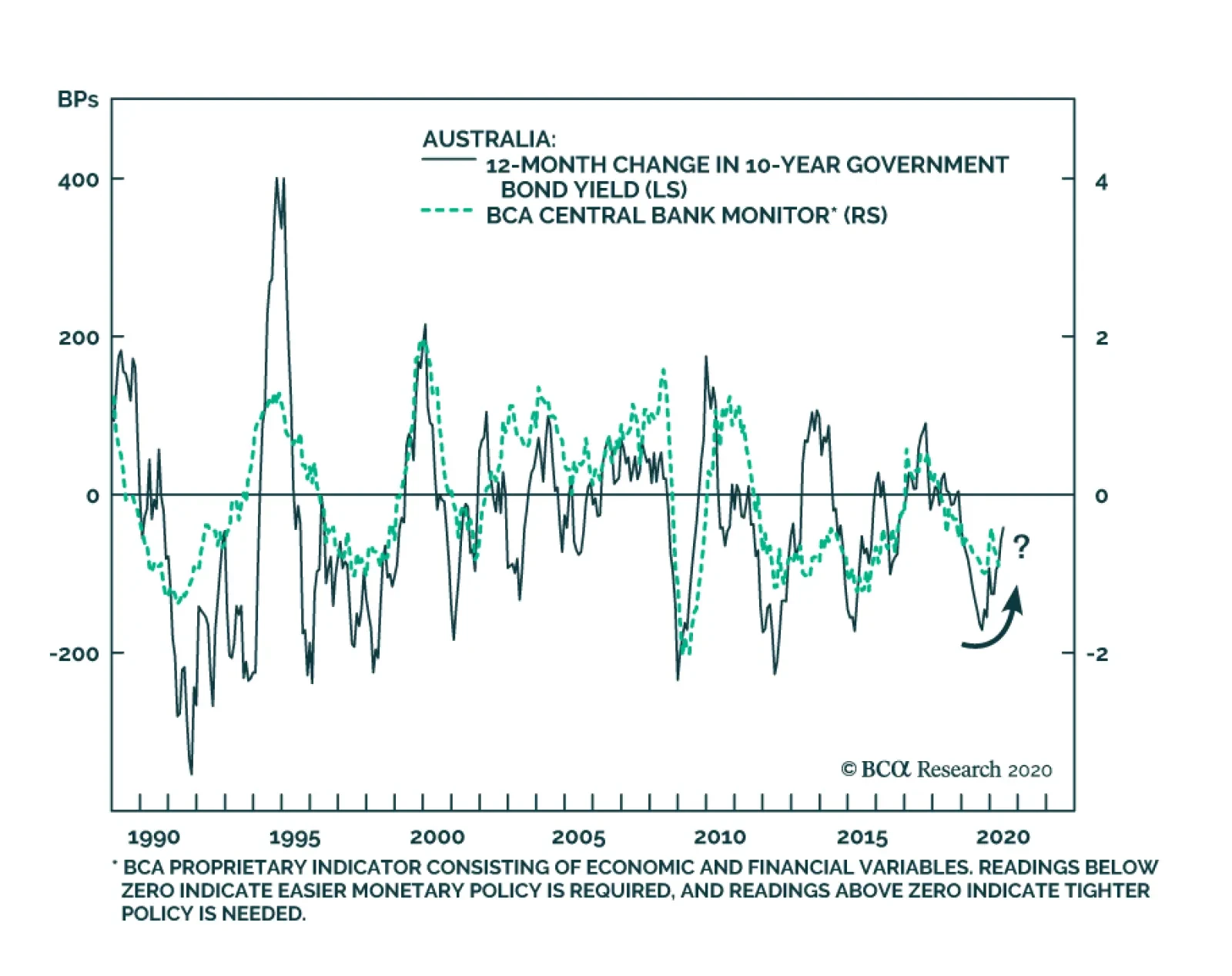

BCA Research's Global Fixed Income Strategy service's Reserve Bank of Australia (RBA) monitor may be turning the corner after Australia delivered 125bps of stimulus since June 2019. The Australian unemployment gap has…