Recommended Allocation Chart 1Only Internet Stocks Have Kept On Rising It has been a very strange bull market. Although global equities are up 52% since their bottom on March 23rd, the rally has been limited largely to…

Highlights US-China relations in 2020 consist of a gentleman’s agreement to keep the Phase One trade deal in place and aggressive maneuvering in every other policy area. Stimulus is unlikely to be curtailed in the US or China…

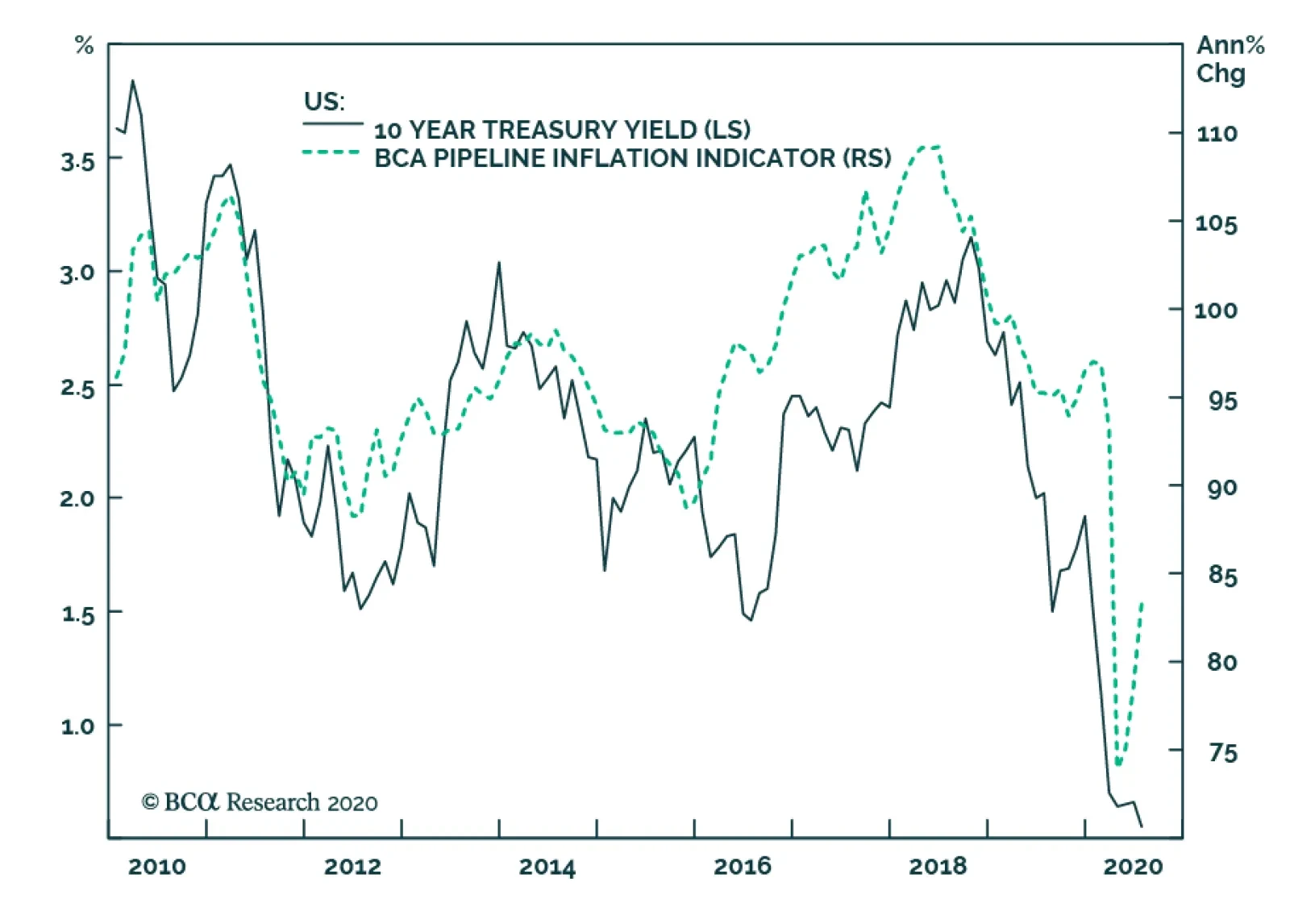

Federal Reserve Chair Jerome Powell’s long-awaited policy speech outlining the Fed’s goal of reviving US labor markets and targeting an average inflation rate of 2% over the long term was cheered on by US equity…

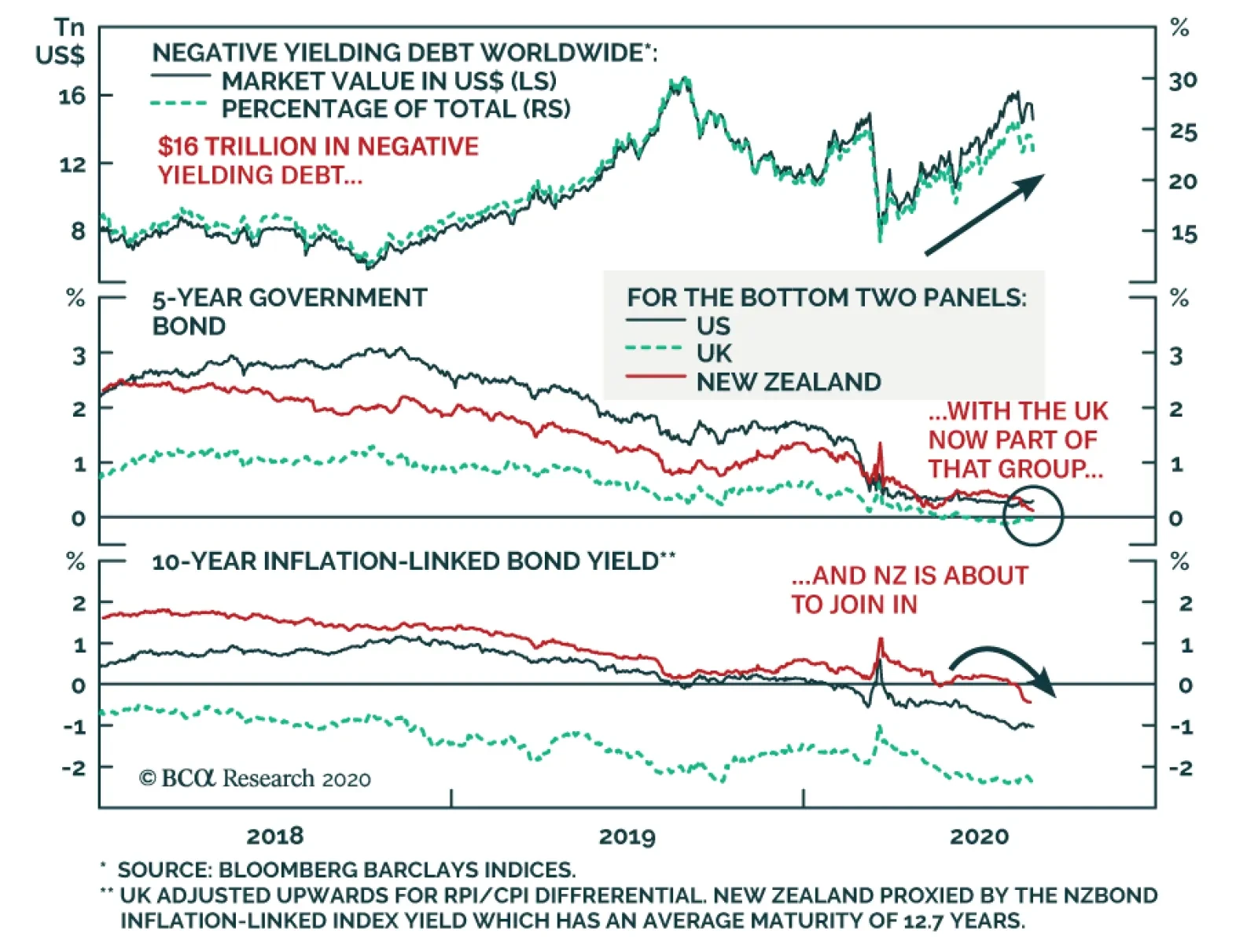

Highlights Negative Rates: The persistence of the COVID-19 pandemic is intensifying pressure on policymakers in many countries to provide more stimulus. The odds that a new central bank will join the negative policy interest rate club…

Dear clients, China Investment Strategy will take a summer break next week. We will resume our publication on September 9th. Best regards, Jing Sima, China Strategist Highlights The threat of US sanctions has sparked fears…

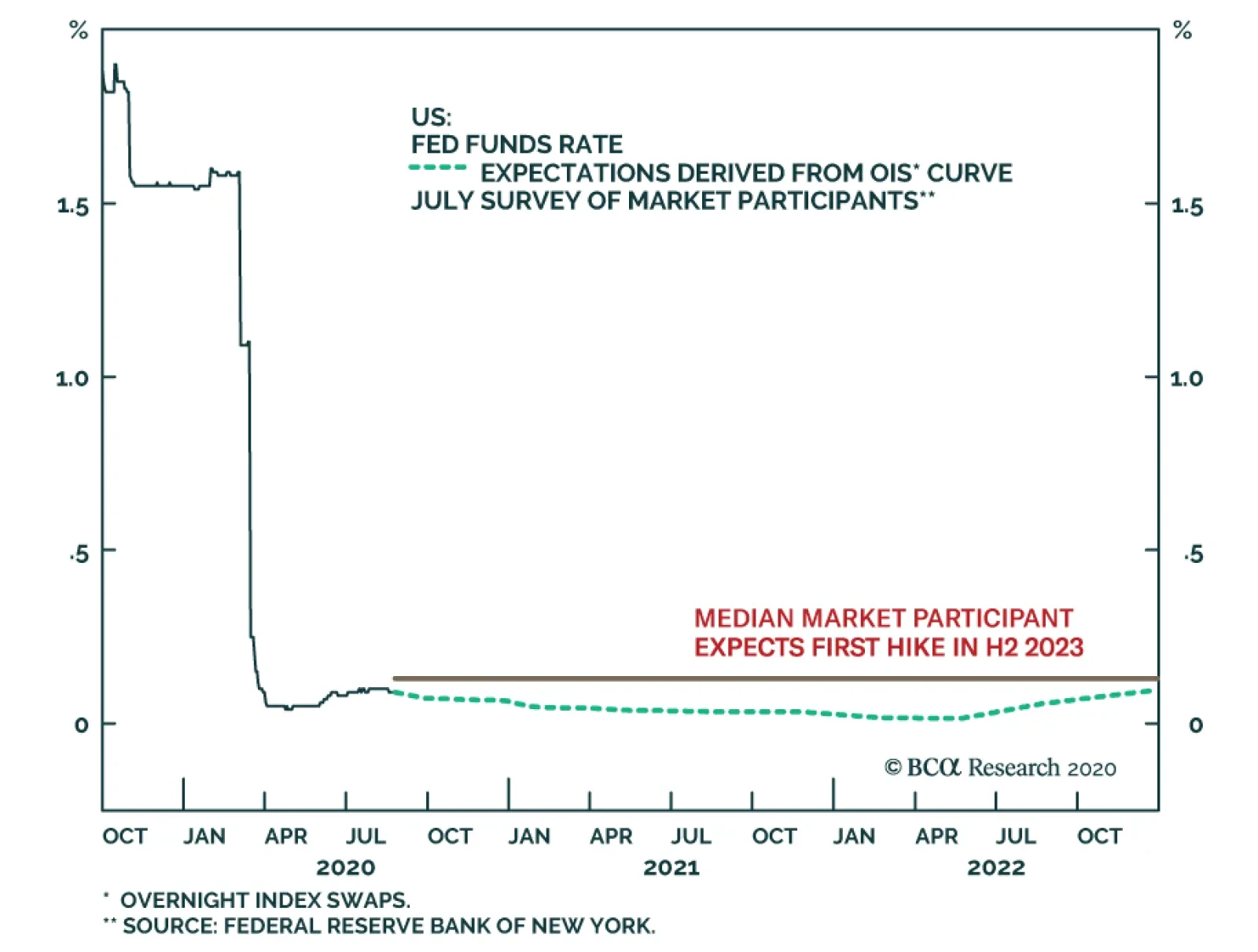

The bar for Fed Chairman Jerome Powell to deliver an incrementally dovish surprise in his remarks later today is high, given that markets already expect the Fed funds rate to stay pinned at zero until late 2023, the end of the…

BCA Research's Global Fixed Income Strategy service argues that the persistence of the COVID-19 pandemic intensifies pressure on policymakers around the world to provide more economic stimulus. The odds that more central…