Highlights US market risks stem from both the lack of fiscal stimulus before the new president assumes office in late January. Risk-off moves in US financial markets will weigh on EM. China’s stimulus has peaked and the country…

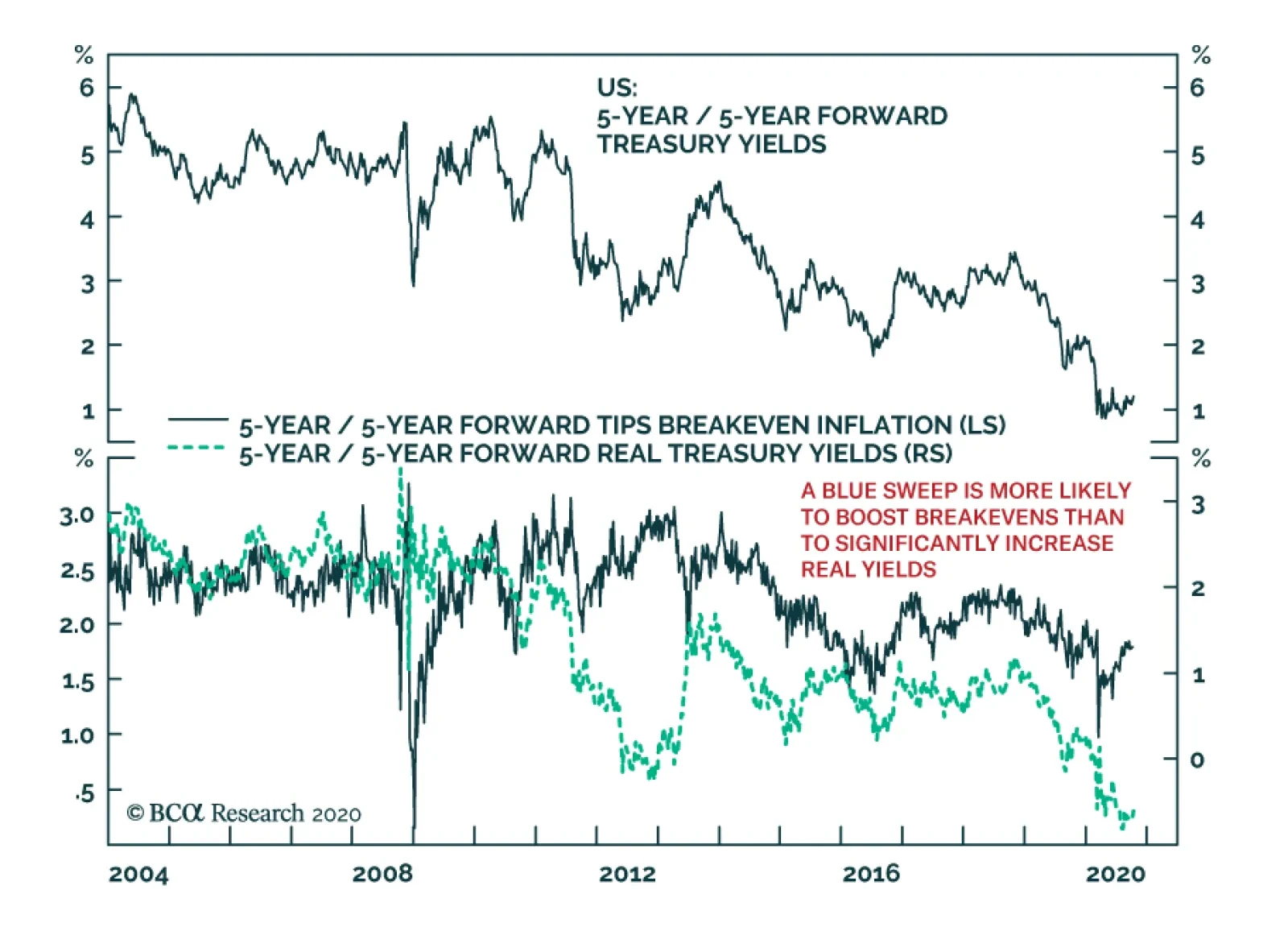

In the Tuesday morning session of our BCA Research Annual investment Conference, Professor Larry Summers mentioned that the disconnect between stock prices and economic activity was a consequence of Secular Stagnation. Secular…

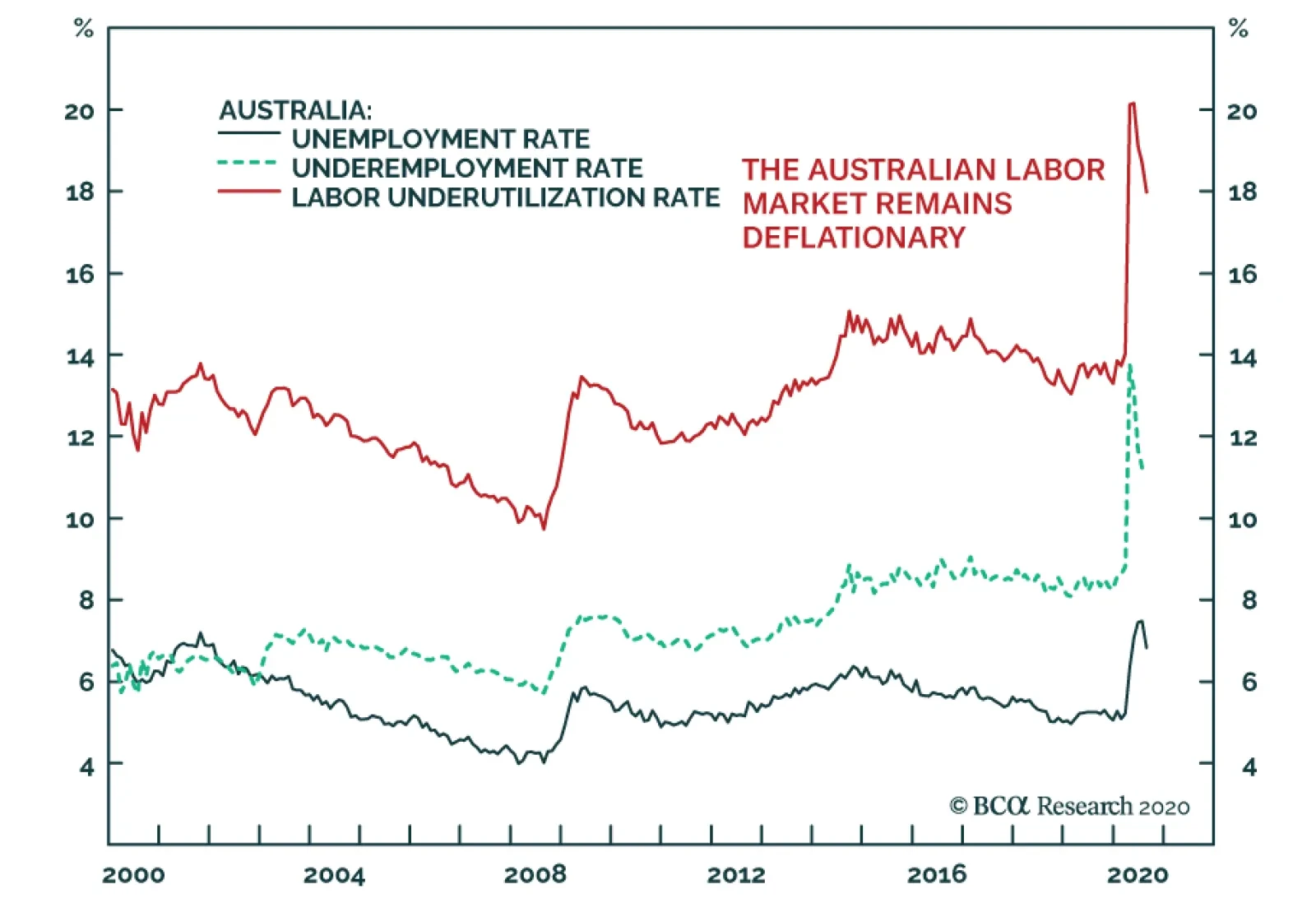

Yesterday was a big day for Australian policymakers, with announcements from both the fiscal and monetary authorities. In aggregate, they delivered a mixed bag. The Reserve Bank of Australia remains as committed as ever to policy…

Highlights The first presidential debate does not change our subjective judgment on Trump’s odds of victory (35%), but our quantitative election model is flagging a major risk to this view. The V-shaped economic recovery is…

Dear Client, We are sending you our Quarterly Strategy Outlook today, where we outline our thoughts on the macro landscape and the direction of financial markets for the rest of the year and beyond. We will also be hosting a webcast…

Highlights Portfolio Strategy We recommend investors participate in the equity market rotation during the ongoing correction and position portfolios for next year’s bull market resumption by preferring unloved and undervalued…

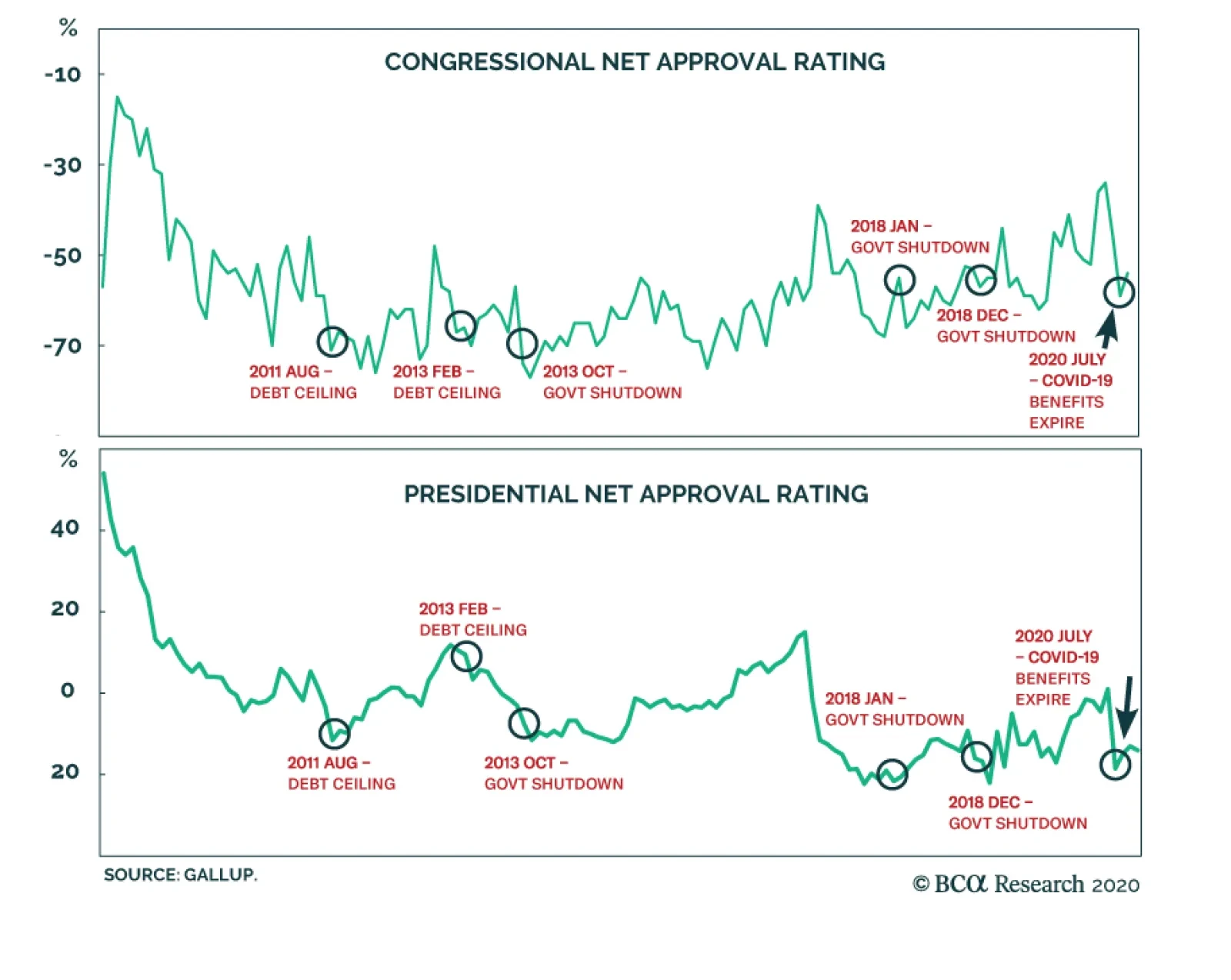

BCA Research's Geopolitical Strategy service concludes that financial markets face more downside until Senate Republicans capitulate to Pelosi’s demand of a bill around $2-$2.5 trillion. We think they will, but that is…

We first highlighted that investors were turning a blind eye to (geo)political risks on June 8, and failure to pass a new fiscal package before the election will continue to weigh on the economy and on stocks risking a further 10% drawdown…

Highlights Senate Republicans would be suicidal not to agree to a fiscal relief bill before the election. Democrats are still offering a $2.2 trillion package. Grassroots Republican voters will forgive Republicans for blowing out the…

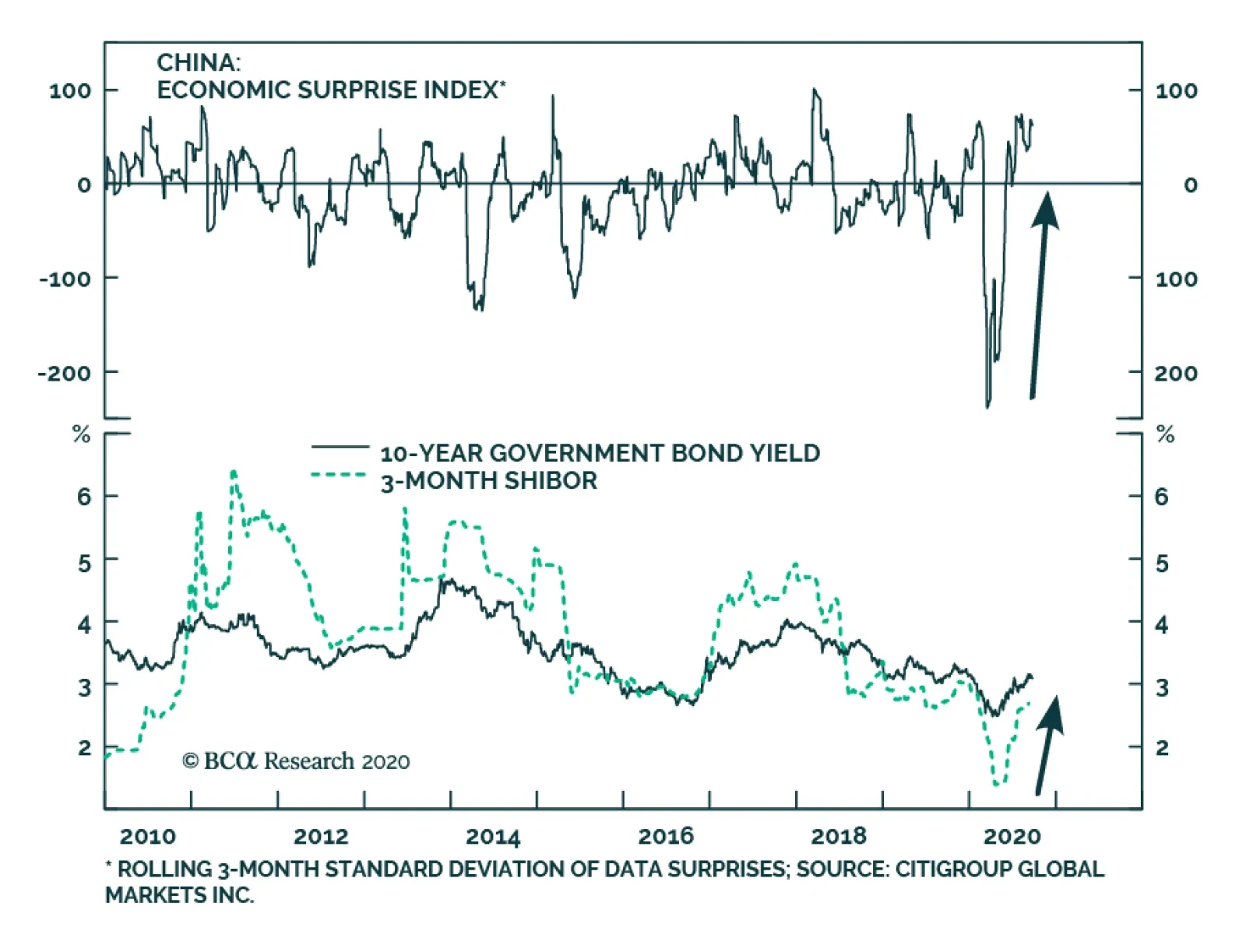

BCA Research's China Investment Strategy service analysis concludes that the extremely accommodative phase of monetary conditions has ended. Authorities will begin tightening policy by the middle of next year. The rising…