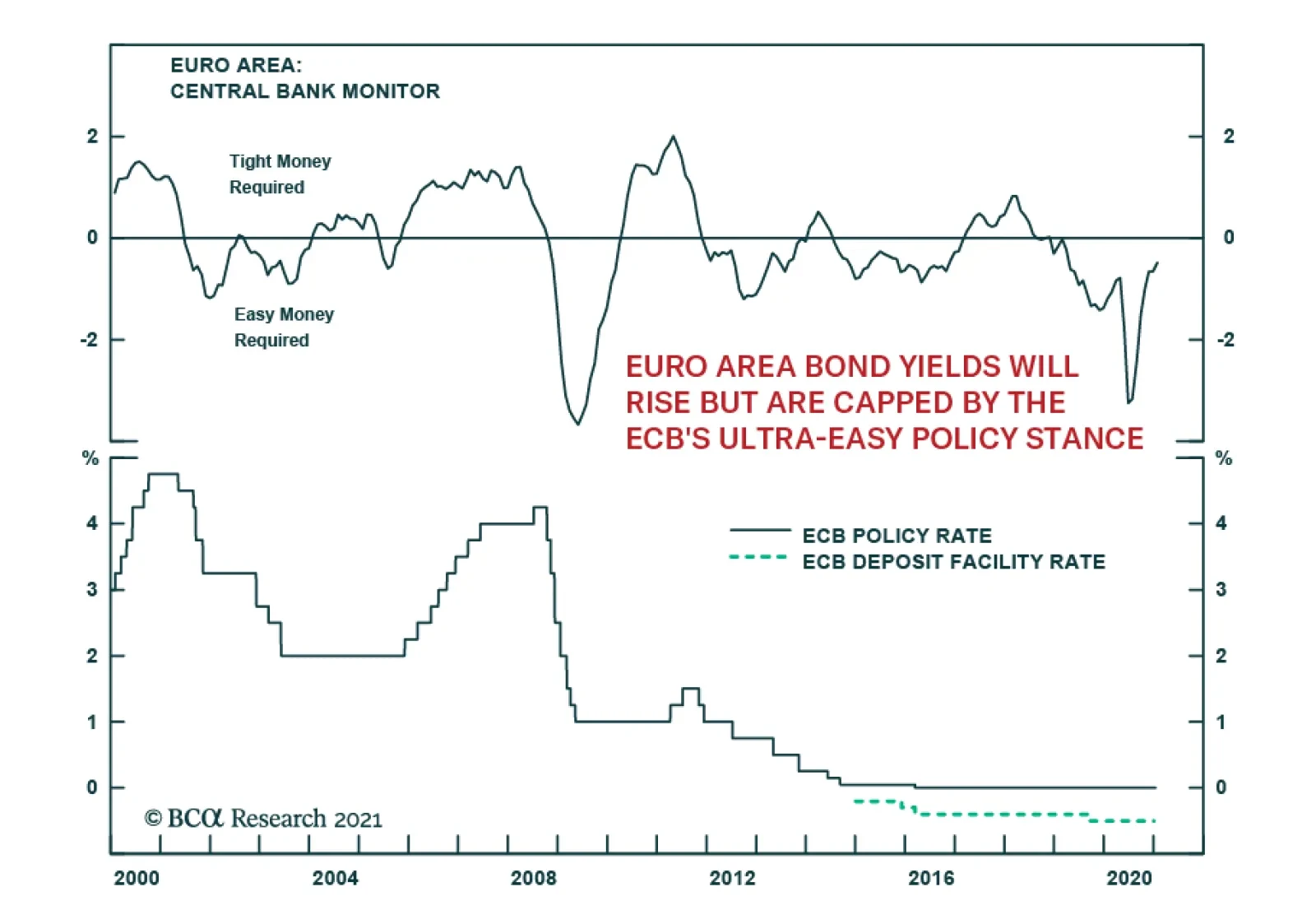

As expected, the European Central Bank did not make any changes to its policy at its first monetary policy meeting of the year yesterday. The benchmark deposit rate was maintained at -0.5% and the quota for bond purchases under…

The forthcoming third round of enormous US fiscal stimulus will likely mark a structural regime shift in global financial markets. Over the past 25 years, the chief concern of US and, hence, global financial markets, has been economic…

Highlights Inflation: Additional fiscal stimulus will lead to higher inflation in the goods sector, where bottlenecks are already forming. But stronger services inflation is required (particularly in shelter) before broad price…

Highlights Even though bonds have cheapened relative to stocks, the equity risk premium remains elevated. The end of the pandemic and supportive fiscal and monetary policies should buoy economic activity in the second half of the year…

Highlights Rising commodity prices and a weaker dollar will lead to higher inflation at the consumer level beginning this year. In the real economy, tighter commodity fundamentals – restrained supply growth, increasing demand,…

Highlights Structural reform is coming to the US in the wake of the riotous 2020 election cycle. Extreme levels of political polarization will subside, albeit remaining relatively elevated. This will smooth the way to a more proactive…

Highlights The incidents of state-owned enterprise (SOE) bond defaults late last year reflected deteriorating corporate balance sheets and exposed local governments’ weakening fiscal positions. Both were preexisting conditions…

Highlights US Reflation: The Georgia senate victories for the Democratic Party have returned the bond-bearish “Blue Sweep” scenarios to the forefront. More fiscal stimulus and an easy Fed will extend the policy-driven…

Highlights Rates: The Democratic sweep of the election has caused the uptrend in bond yields to accelerate and has benefited our recommended rates positions (below-benchmark duration, nominal and real curve steepeners, inflation curve…

Highlights A blue wave will likely supercharge the dollar’s downtrend in 2021. The key beneficiaries of this decline will be the much undervalued Scandinavian currencies, as well as those of commodity-producing countries. The…