Highlights GameStop & Bond Yields: The reflationary conditions that helped create a backdrop highly conducive to the wild stock market speculation on display last week – namely, aggressive monetary and fiscal policy stimulus…

Highlights The dollar bounce has further to run. The DXY index could touch 94 before working off oversold conditions. In this environment, yen long positions also provide an attractive hedge. Meanwhile, Japan has stepped back into…

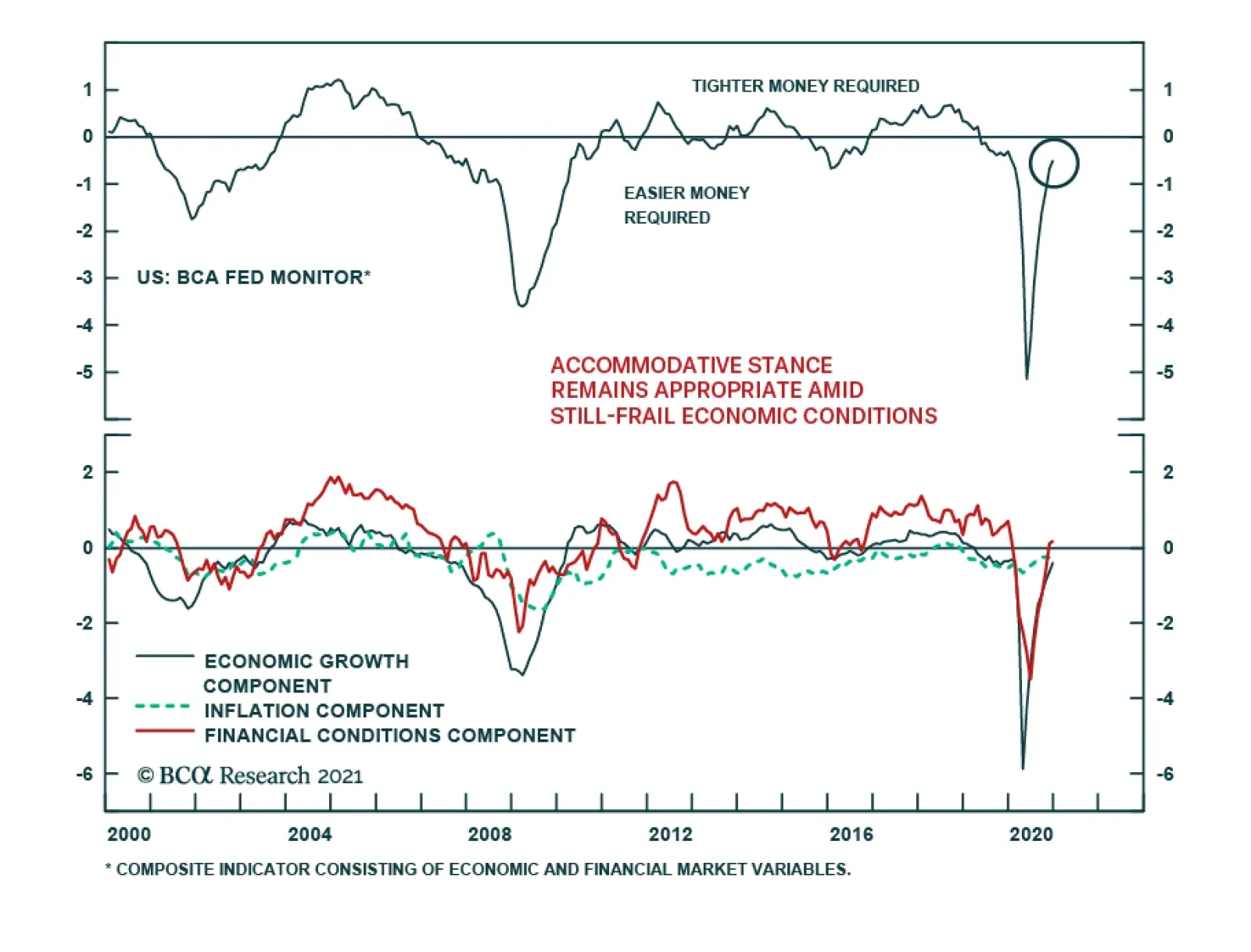

Chairman Jerome Powell maintained the dovish message at the FOMC’s first meeting of the year, emphasizing the dominant need to continue resuscitating the still-frail economy, even in the face of risks from inflationary…

Highlights The enormous size of US stimulus and overflow of liquidity is creating a thrill akin to riding a tiger. Remarkably, this kind of jubilation is very similar to what EM experienced in 2009-10. That was followed by a lost…

Highlights Increased fiscal assistance in the US and other advanced economies will support economic activity until the practice of social distancing durably ends later this year. The US is not yet vaccinating at a pace that is…

Highlights Biden’s initial political capital is moderate-to-strong according to our Political Capital Matrix. He will pass his American Rescue Plan and one or two budget reconciliation bills over the next 18 months. Investors…

Highlights A positive backdrop still supports a cyclical bull market in Chinese stocks, but the upside in prices could be quickly exhausted. Investors may be overlooking emerging negative signs in China’s onshore equity market.…

Highlights Global Yields: The fall in global bond yields over the past two weeks represents a corrective pullback from an overly rapid rise in inflation expectations, especially in the US. The underlying reflationary themes that drove…

Highlights Our baseline view is that inflation will increase only modestly over the next few years before accelerating in the middle of the decade. Nevertheless, the risks are skewed towards an earlier and sharper increase in inflation…