Highlights The recent backup in bond yields could cause stocks to fall further in the near term. However, history suggests that as long as yields remain low in absolute terms, as they are now, equities will recover. Market angst that…

Dear client, In addition to this week’s abbreviated report, we are also sending you a Special Report on currency hedging, authored by my colleague Xiaoli Tang. Xiaoli’s previous work mapped out a dynamic hedging strategy for…

Dear Client From March 18 I will be writing under a new product title, the BCA Research Counterpoint. The aim of the Counterpoint is to generate a high volume of investment opportunities that are unconnected to the business cycle and run…

Highlights The Senate will pass the $1.9 trillion American Rescue Plan largely as it stands. Markets will now turn to Biden’s second major reconciliation bill for FY2022 – the one with tax hikes. Democrats will go forward…

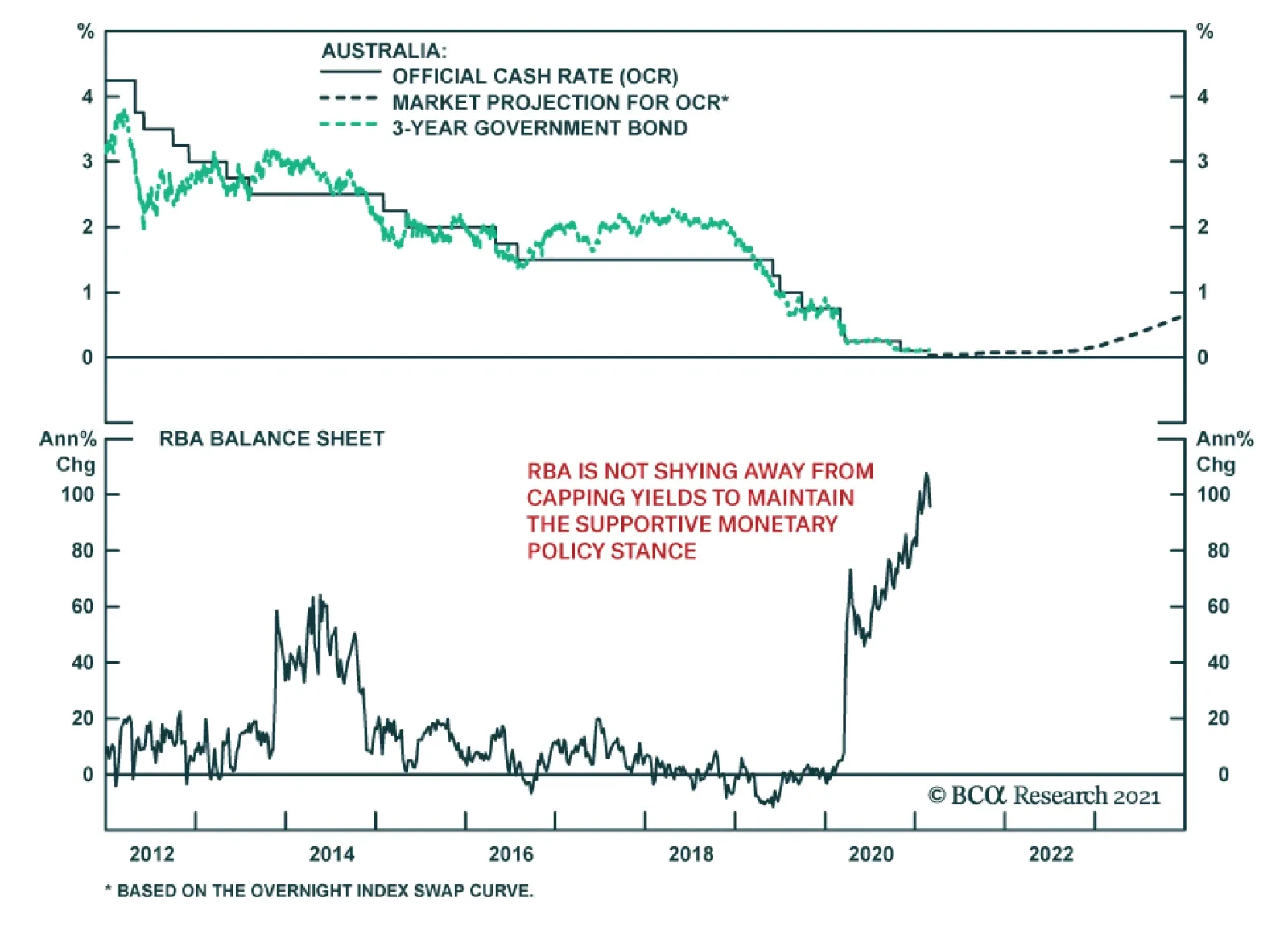

As expected, the Reserve Bank of Australia kept policy unchanged at its Tuesday meeting, maintaining the 10-basis point targets for the cash rate and the yield on the 3-year government bond. The RBA reiterated its commitment…

Highlights Rising Global Yields: The increased turbulence in global bond markets is part of the adjustment process to a more positive outlook for global economic growth. Rising real yields are now the main driver of nominal yield…

Highlights Chart 1Back To Fair Value February was a terrible month for the bond market. In fact, the Bloomberg Barclays Treasury Master Index returned -1.8%, its worst month since November 2016. The 5-year/5-year forward…

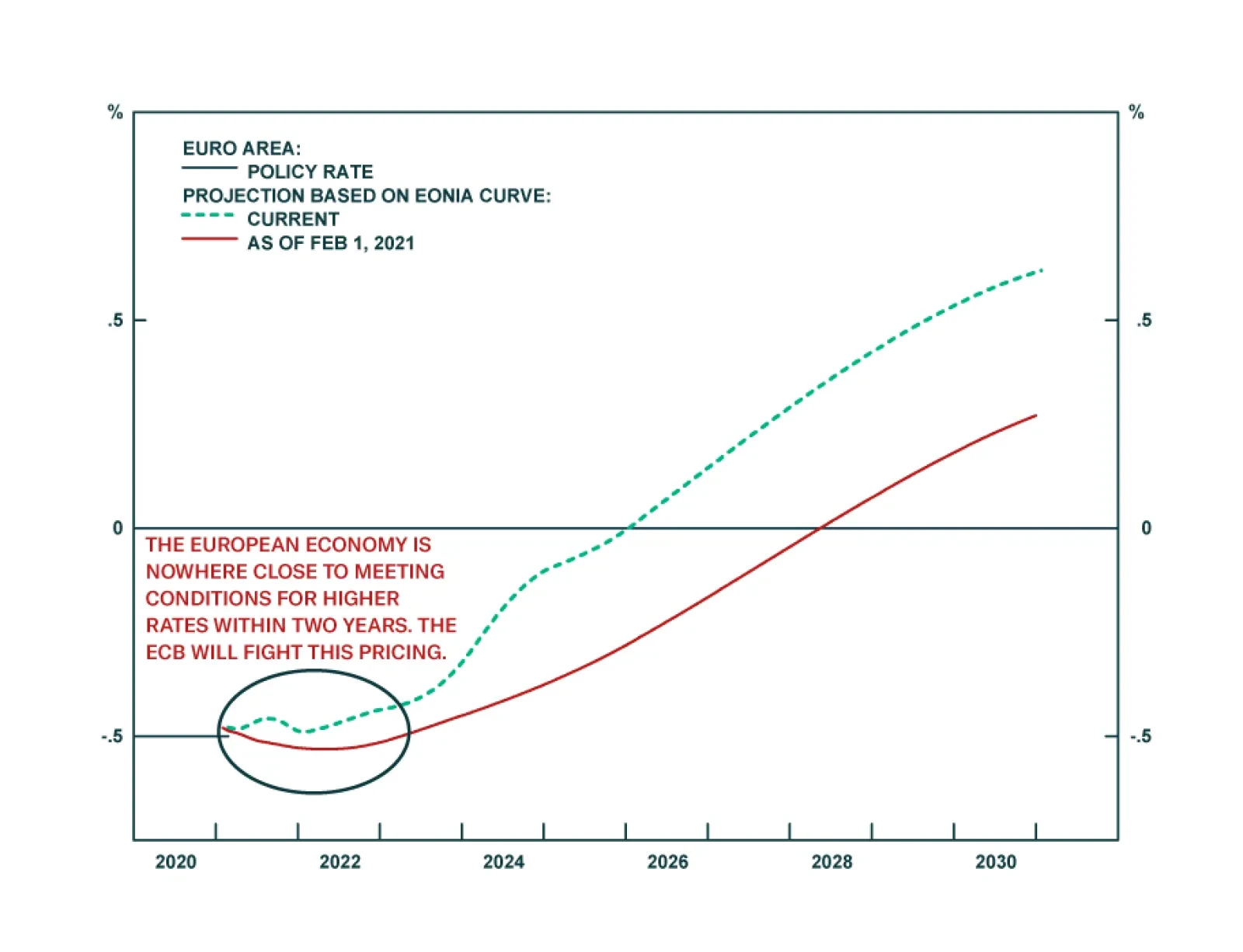

Central banks are becoming uncomfortable with the recent global yield moves. For example, many prominent members of the European Central Bank Governing Council are already suggesting that the ECB could increase the size of its…

Dear Client, In addition to this week’s abbreviated report, we are sending you a Special Report on Bitcoin. I don’t recommend you buy it. Best regards, Peter Berezin Highlights Real government bond yields have…