Highlights Global Duration: Markets are correctly interpreting the $1.9 trillion US fiscal stimulus package as a factor justifying higher global growth expectations and bond yields. Maintain a below-benchmark stance on overall global…

Highlights With the vaccination campaign in full gear and plenty of fiscal support in the pipeline, investors have swung from worrying that the US economy will grow too slowly to worrying that it will grow too fast. Thanks to the…

Highlights The Biden administration’s early actions suggest it will be hawkish on China as expected – and the giant Microsoft hack merely confirms the difficulty of reducing strategic tensions. US-China talks are set to…

Please note that we will be presenting a webcast on Thursday March 11 at 10:00 AM EST for the Americas and EMEA regions and on March 12 at 9:00 HKT/12:00 AEDT for APAC clients. We will be discussing macro themes and investment strategies…

Highlights The US has largely passed a “stress test” of its political system. Rule of law is intact. The US dollar and treasuries may fall further due to cyclical and macro developments but not due to a structural loss of…

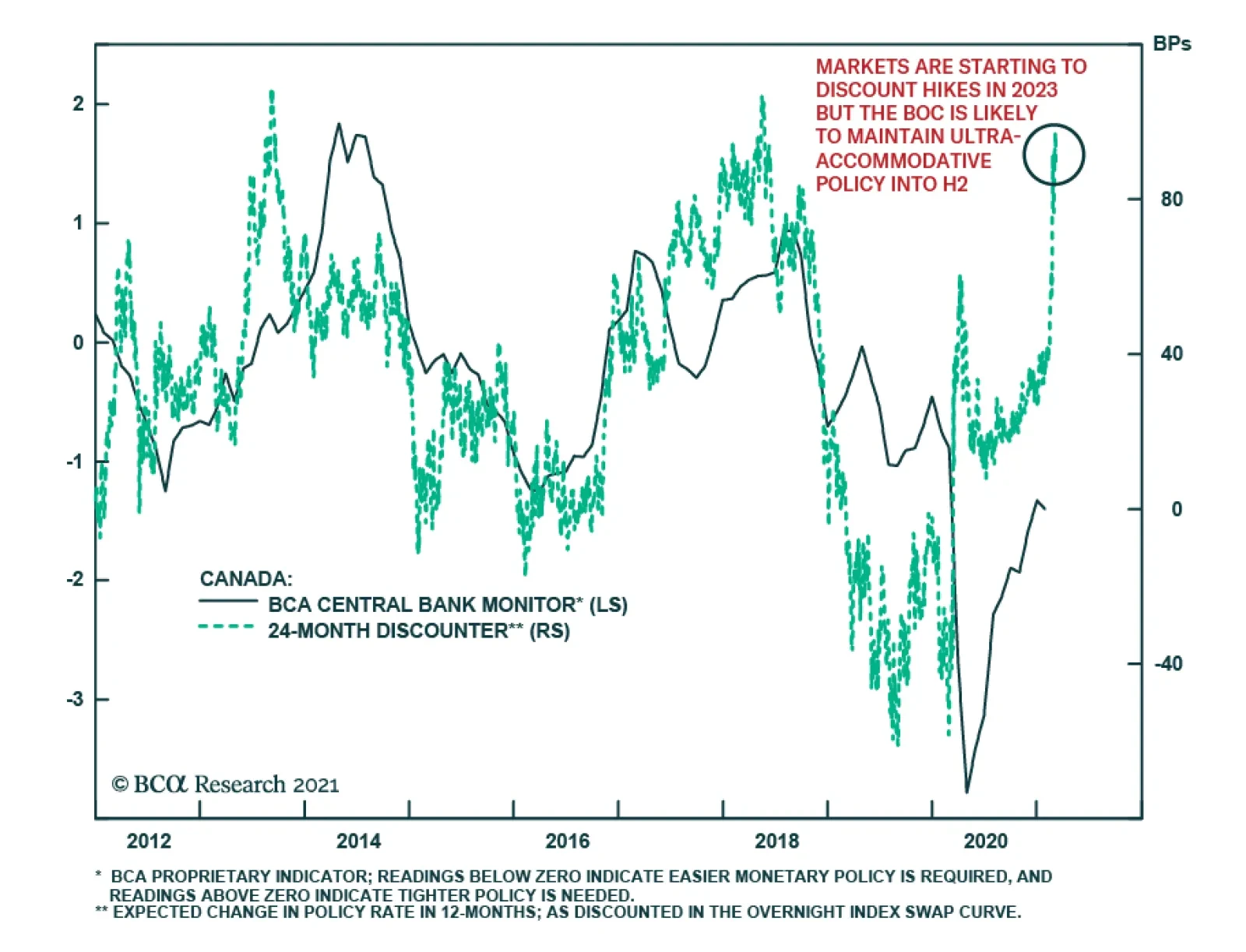

The Bank of Canada did not adjust policy at its Wednesday meeting. The overnight rate was held at 0.25% and the current pace of government bond purchases was maintained at a minimum CAD4 billion/week. Canadian bond markets…

Highlights China’s economic recovery is in a later stage than the US. A rebound in US Treasury yields is unlikely to trigger upward pressure on government bond yields in China. Imported inflation through mounting commodity and…

Highlights Duration: Only 2 of the 5 items on our Checklist For Increasing Portfolio Duration have been checked. We will heed this message and stick with below-benchmark portfolio duration for the time being. We will have an…