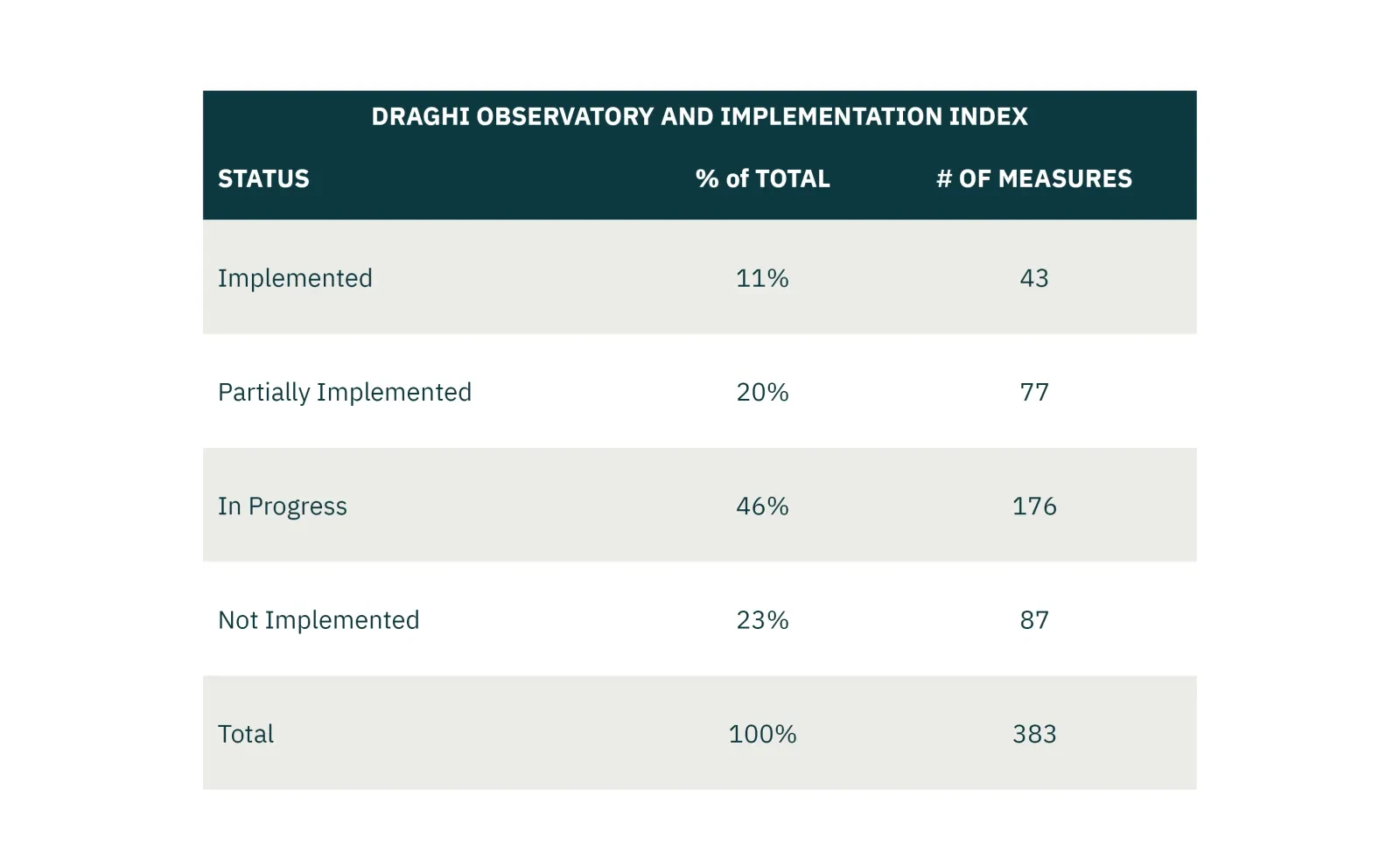

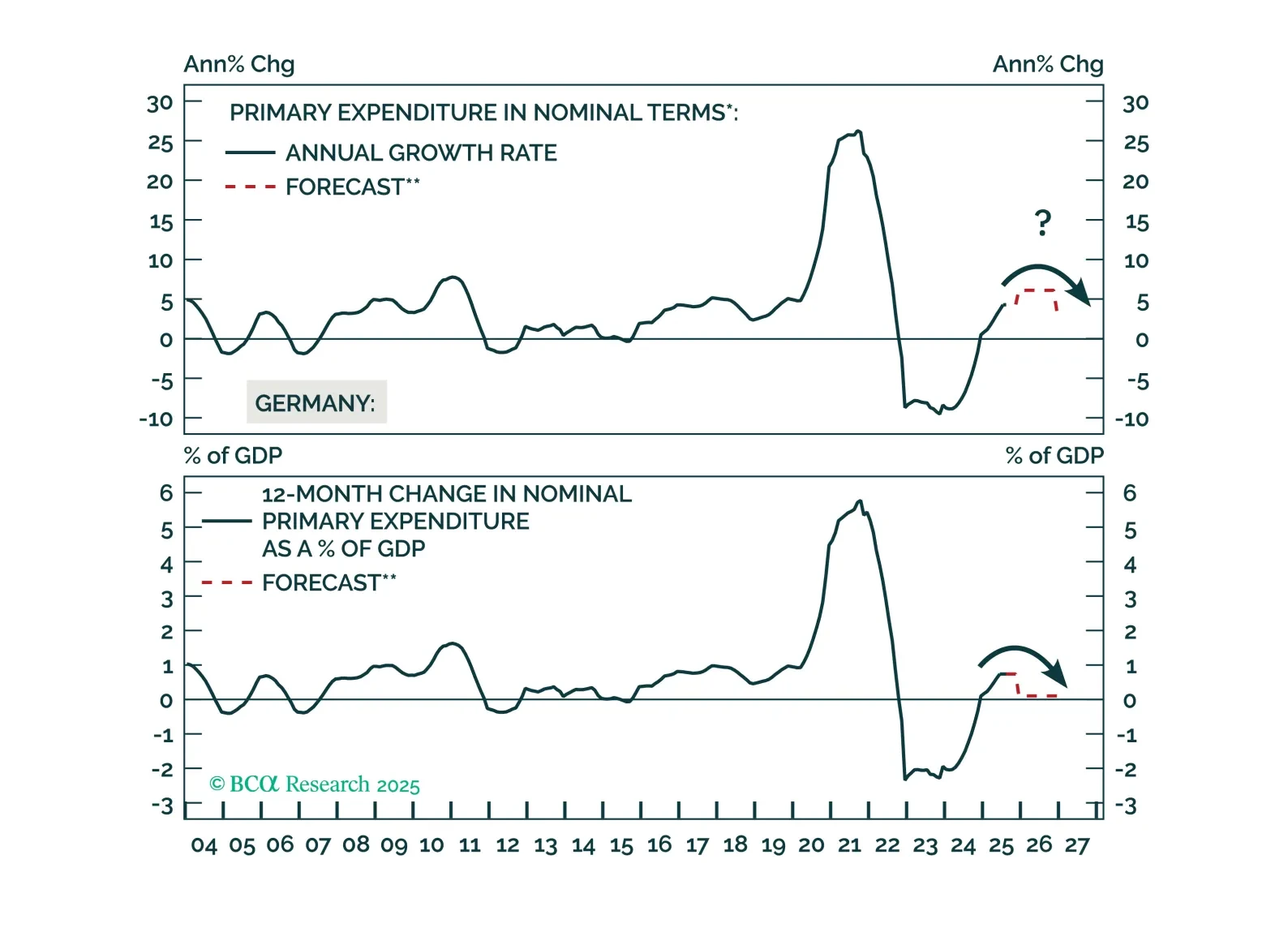

One year in, the EU is progressing slowly in implementing Mario Draghi's recommendations to restore Europe’s competitiveness. The lack of progress is due more to the various pushbacks from European capitals and the lack of proper…

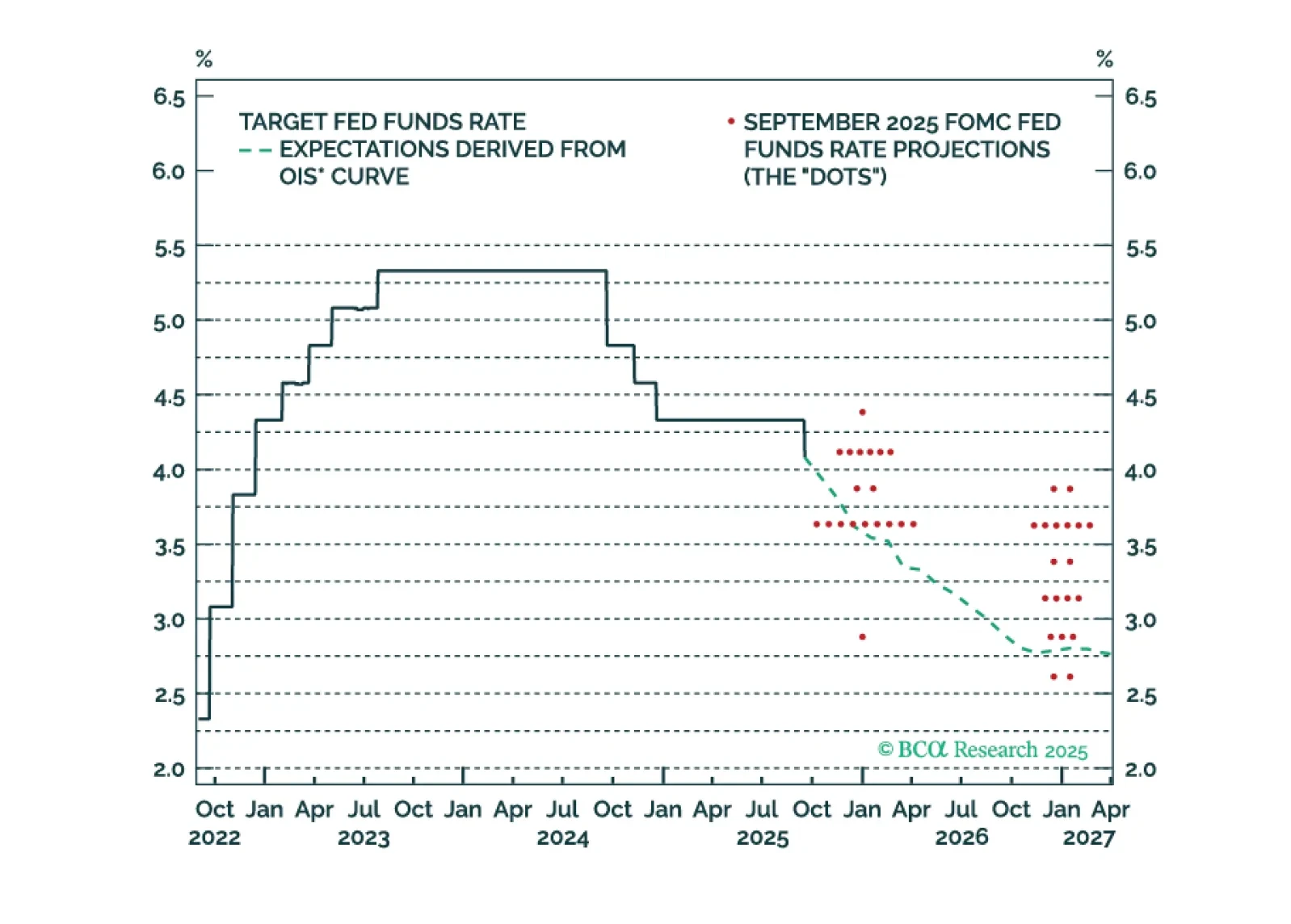

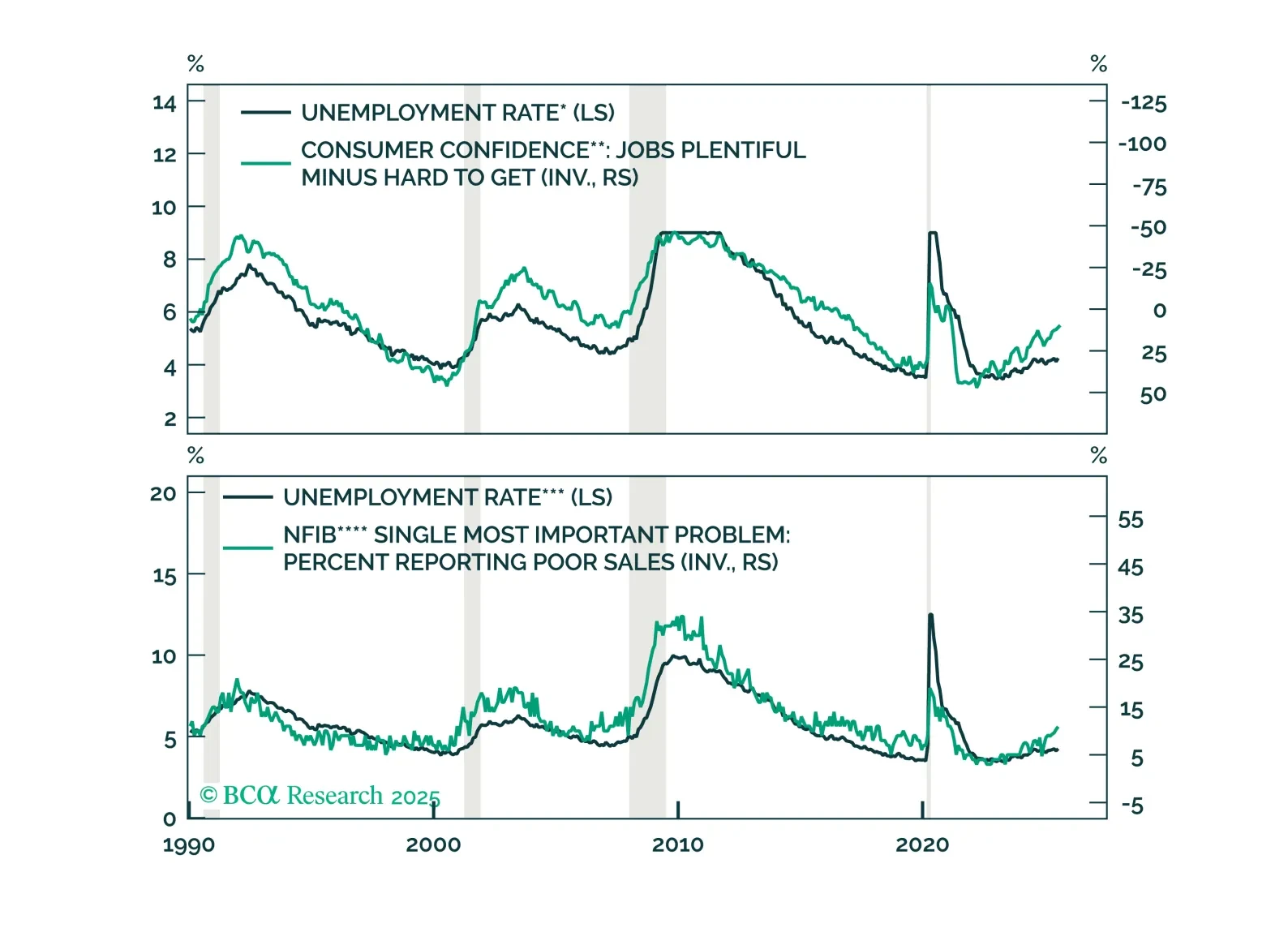

Median Fed unemployment rate projections are overly optimistic. The Fed will end up cutting more in 2026 than it currently anticipates.

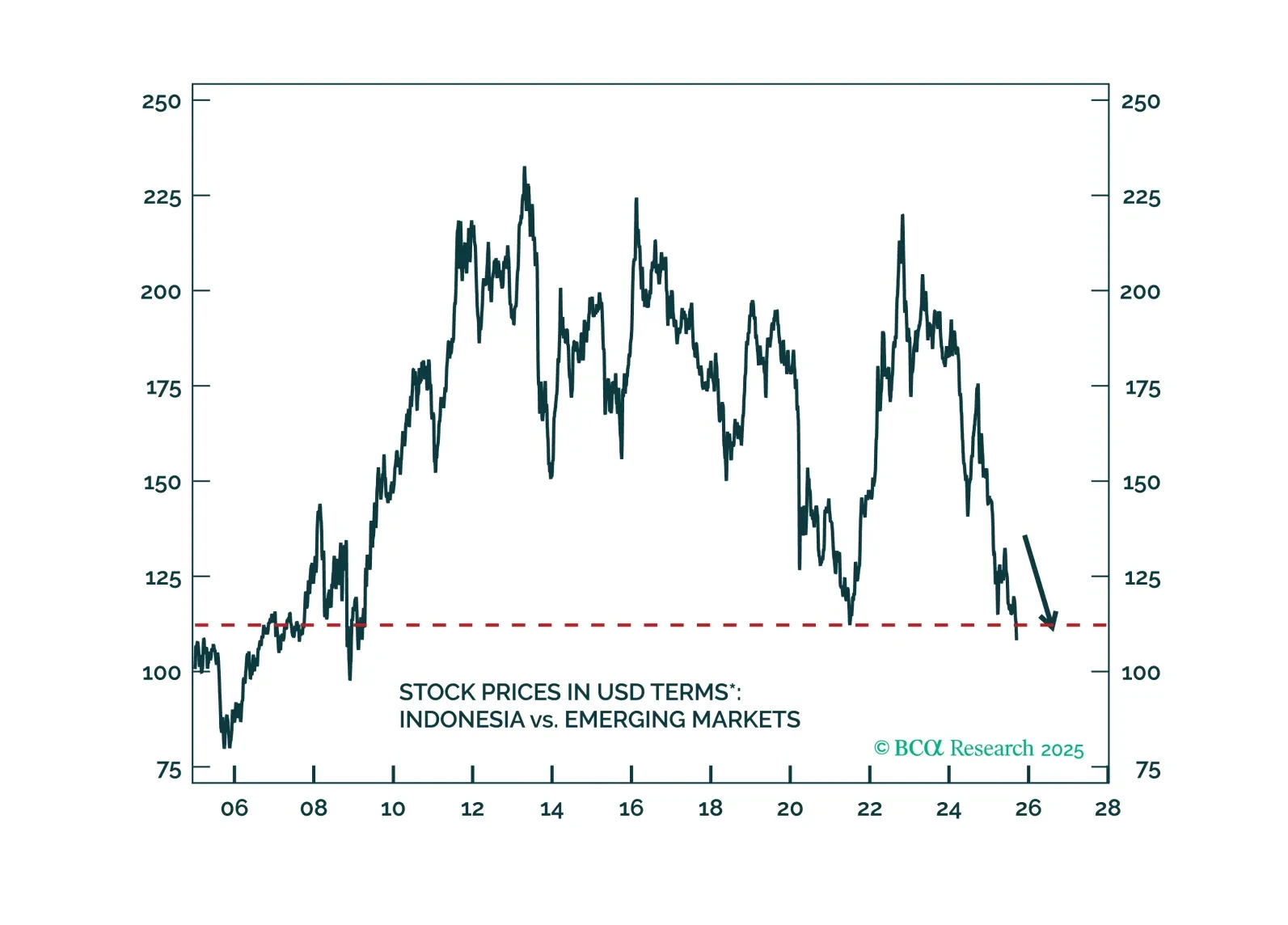

Indonesia’s policy easing will boost domestic demand, but fuel inflation. Current account deficit will widen, and the rupiah will weaken. Stay short the rupiah and go underweight Indonesian stocks, domestic bonds, and sovereign…

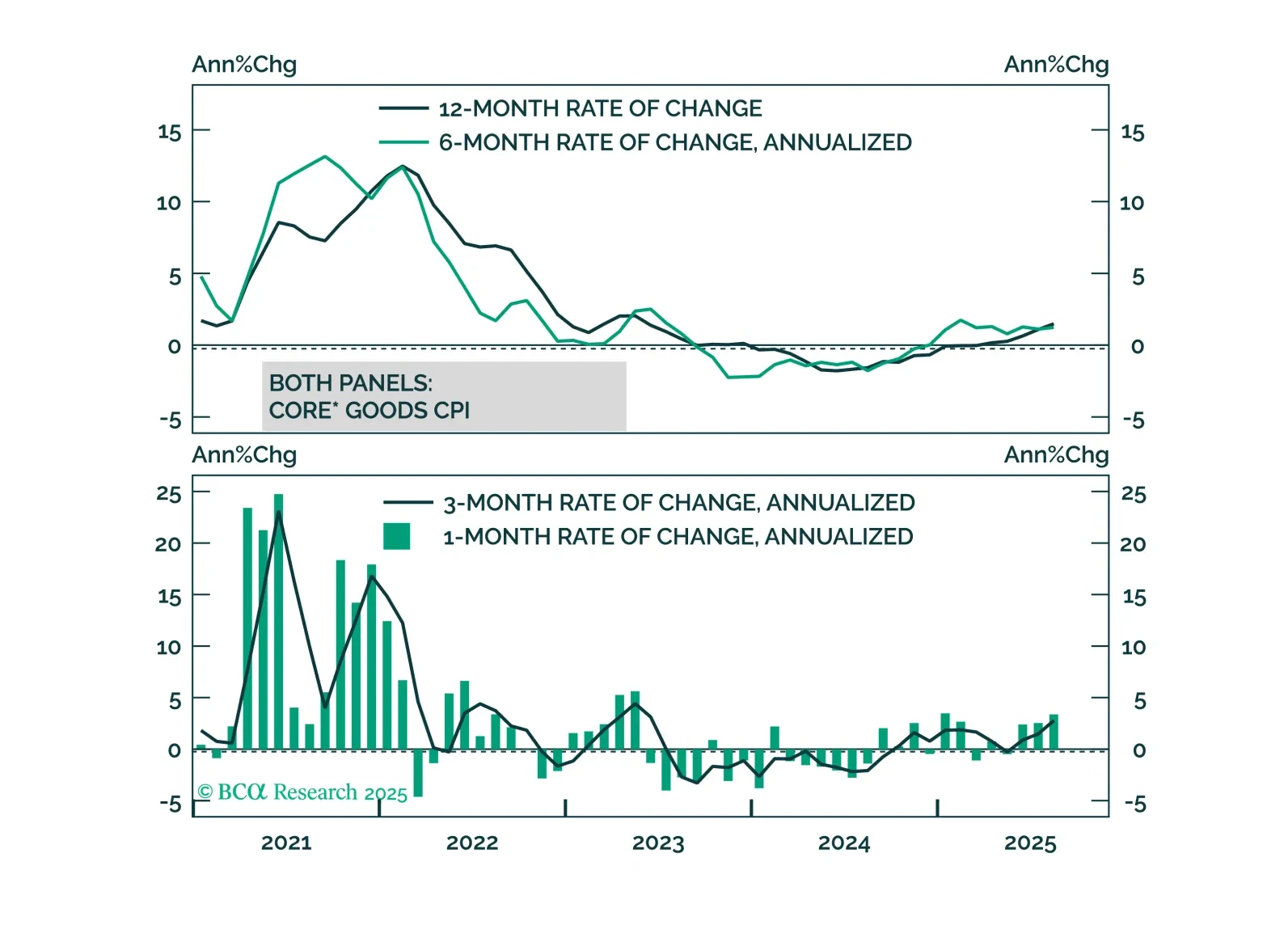

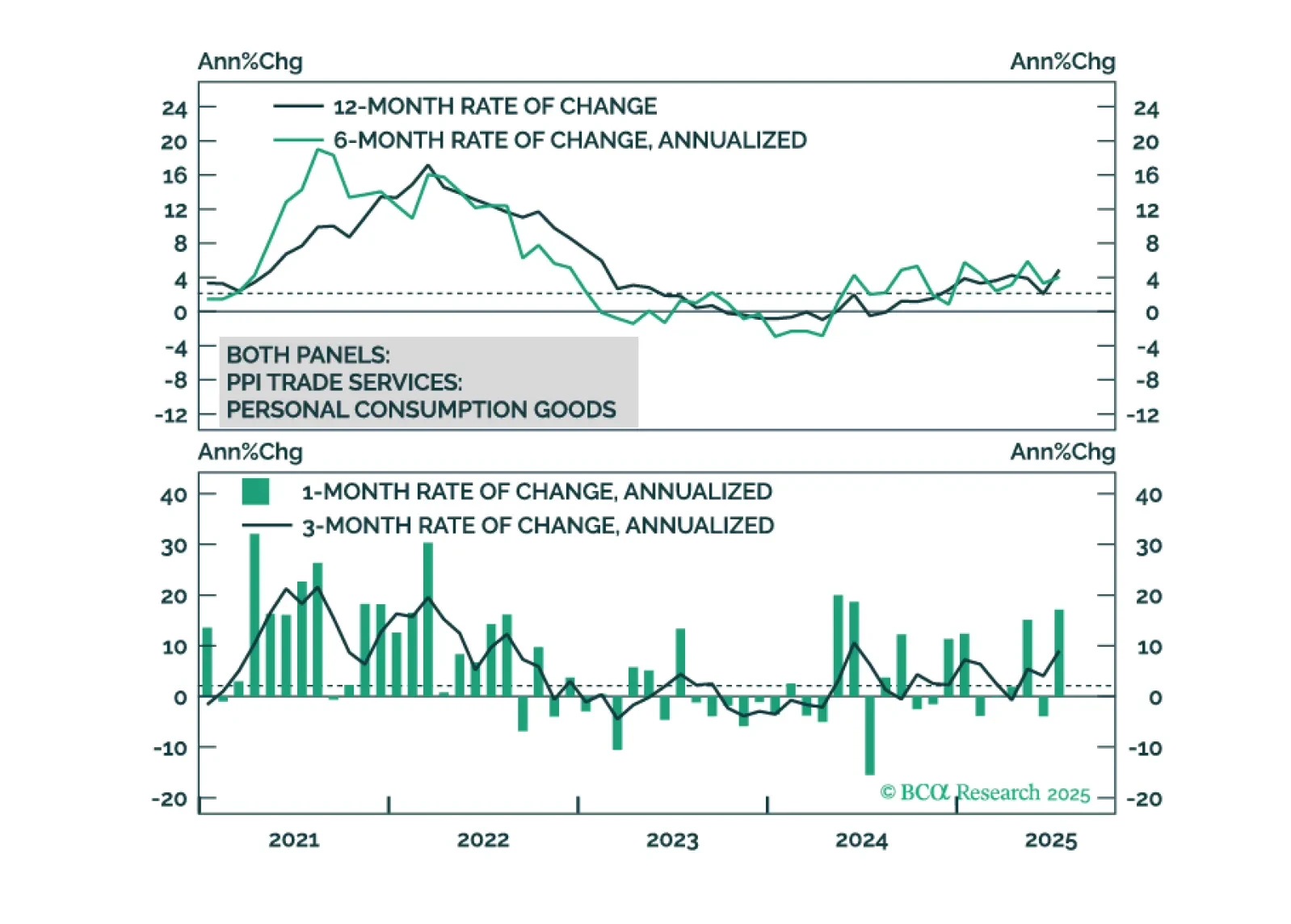

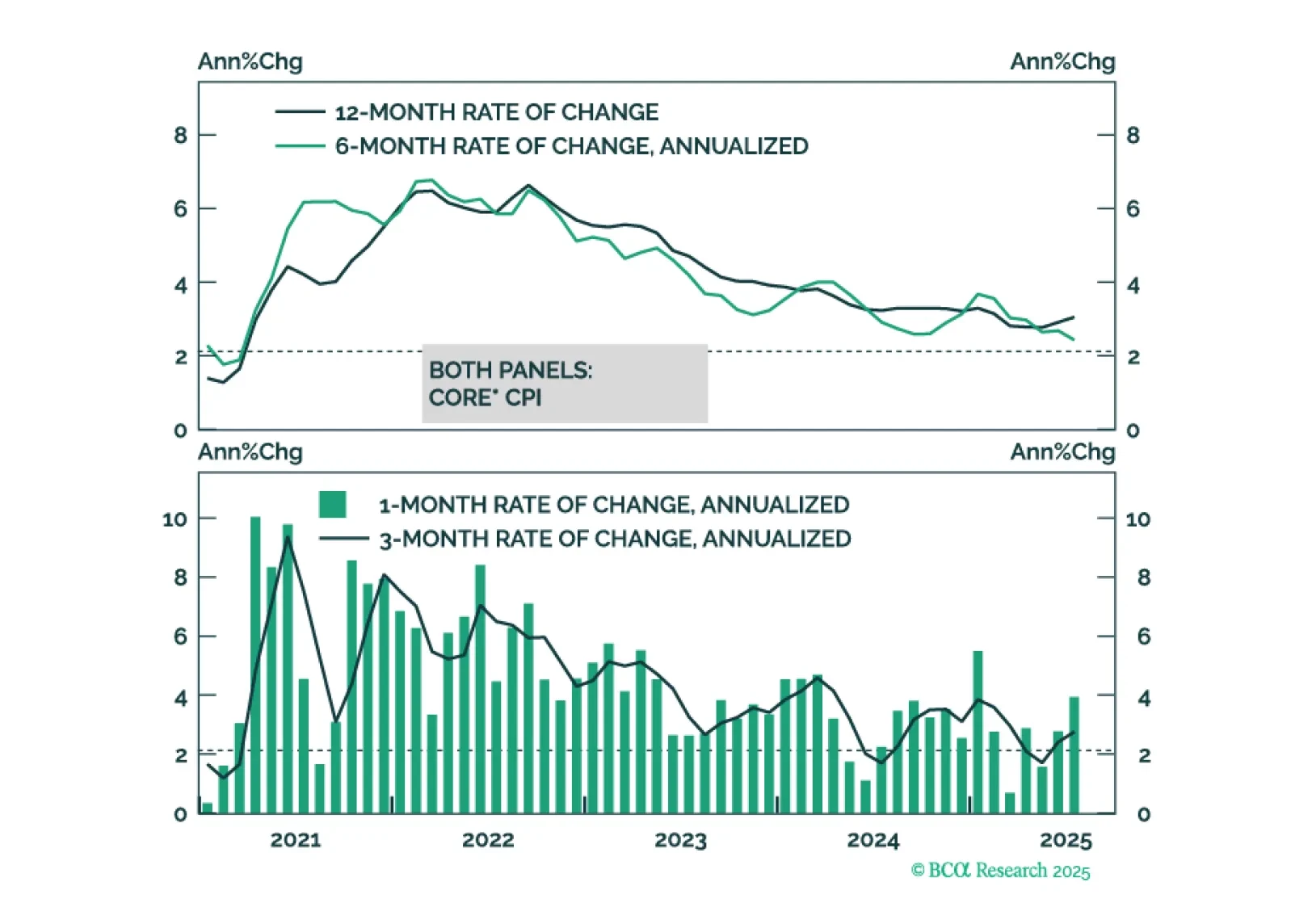

High US inflation is being driven by tariffs, not domestic inflationary pressure. This argues for Fed easing and a bull-steepening of the Treasury curve.

Core Europe’s industrial sector will relapse in the coming months due to US tariffs and a strong euro. Investors can play the imminent deflationary shock by being long Central European bonds. They should, however, hedge the…

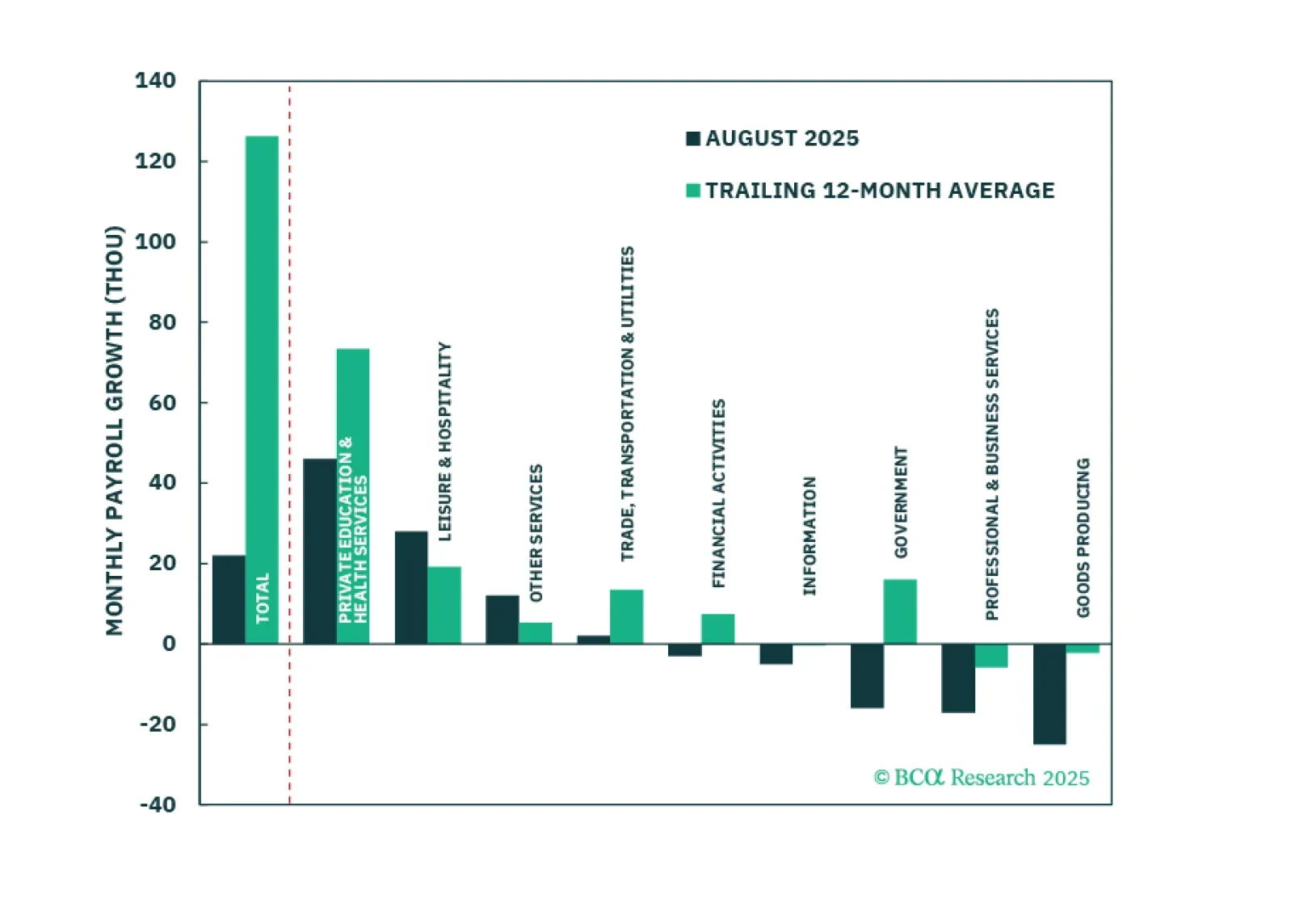

The August employment report showed a modest increase in labor market slack, enough to cement a 25-basis-point rate cut this month.

Our Portfolio Allocation Summary for September 2025.

The cost of tariffs is falling on the US consumer, not foreign exporters or US firms.

This morning’s CPI report marginally tips the scales in favor of a September rate cut.

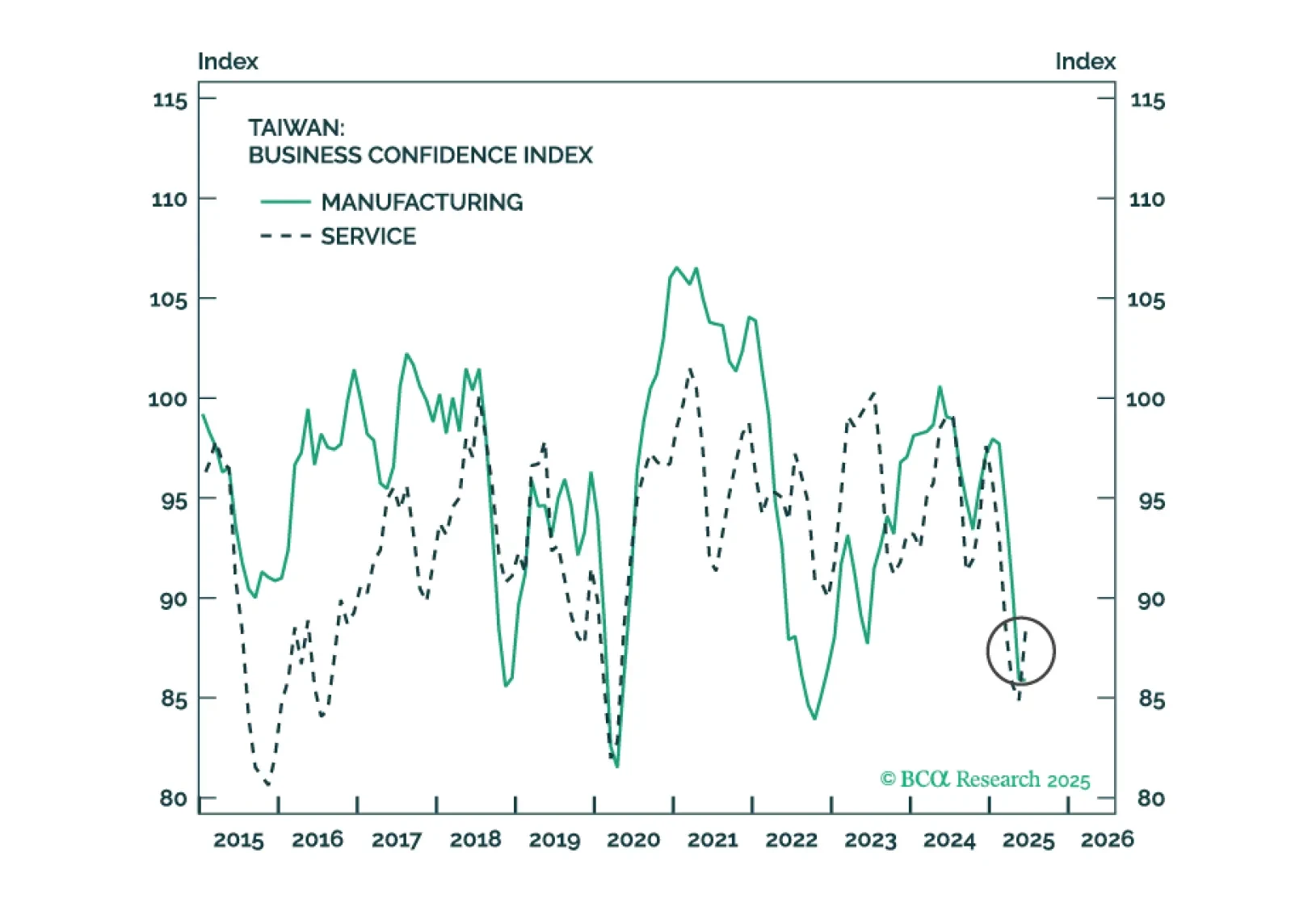

Taiwan’s failed recall election reduces 12-month geopolitical risk for Taiwanese and Chinese equities on the margin. We are reviewing our long European industrials / short Chinese industrials trade.