In Section I, we note that the global growth outlook has modestly deteriorated over the past month, despite an improving 12-month outlook for Chinese domestic demand in response to the imminent end of the nation’s “dynamic zero-COVID…

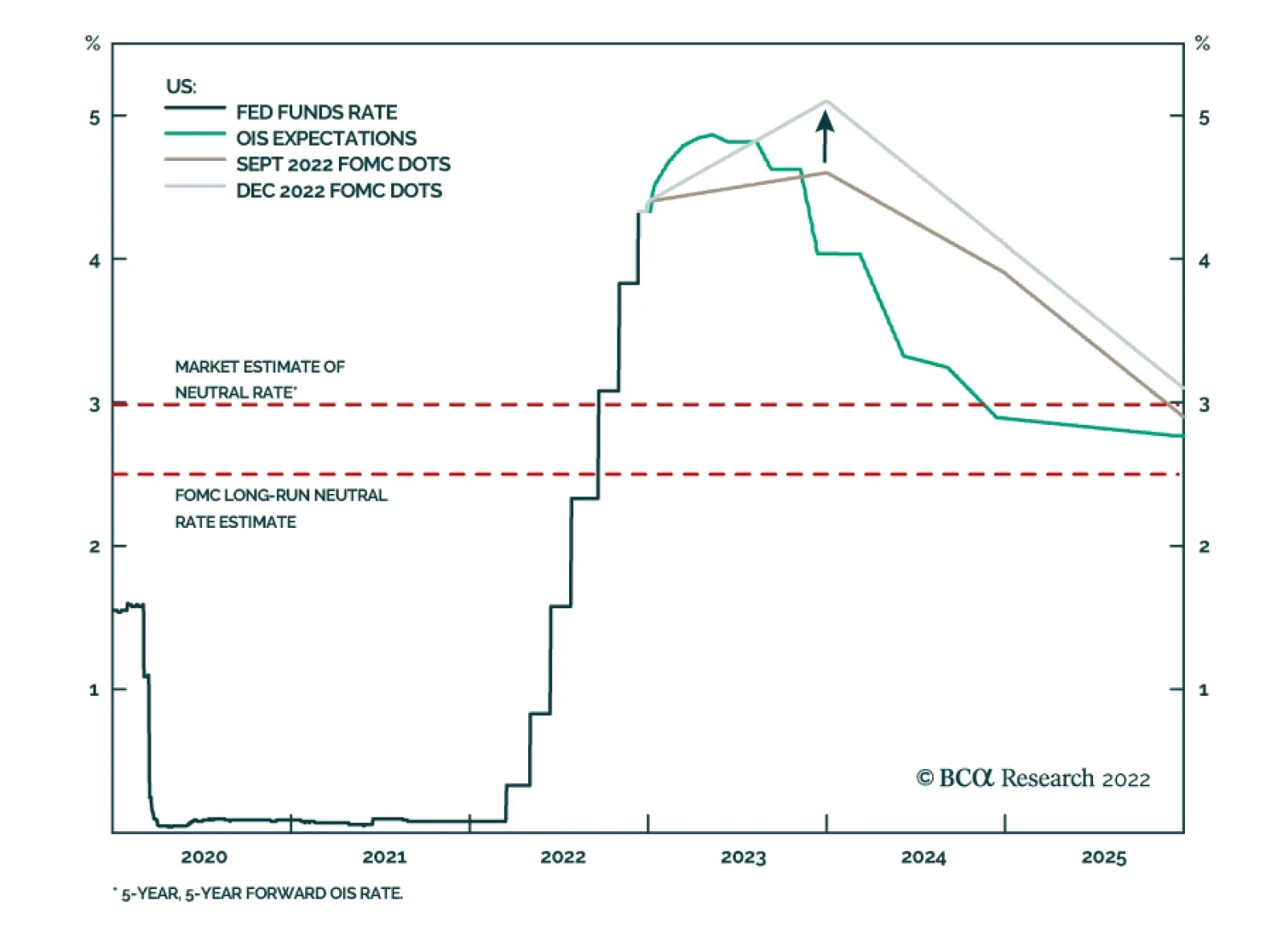

In this, our final report of a tumultuous year, we summarize our policy outlook for the “Big 4” central banks – the Fed, the ECB, the Bank of England (BoE) and the BoJ – and the associated bond market implications for 2023.

Investors were heartened by the November CPI report, but the Fed said not so fast. Although it snuffed out the latest mini-rally, ongoing disinflation will set the stage for another one early next year.

As expected, the Fed slowed the pace of rate hikes at its Wednesday meeting, opting to lift interest rates by 50bps following four consecutive 75bp increases. The statement was unchanged, with the Fed reiterating that it “…

Prefer government bonds over stocks, defensive sectors over cyclicals, and large caps over small caps. Favor North America over other markets. Favor emerging markets like Southeast Asia and Latin America over Greater China, Turkey,…