Have global equity markets reached a riot point? Is the Fed going on hold a sufficient condition for stocks to stage a cyclical rally? If not, what would be needed to produce such a rally? Does the Fed’s recent balance sheet…

Systematically important central banks continue to compound policy errors, which will feed higher headline inflation. Hiking interest rates to induce labor-market slack – i.e., higher unemployment – to bring down core inflation will…

This week’s report looks at the banking crisis within the context of shrinking dollar liquidity and implication for FX markets.

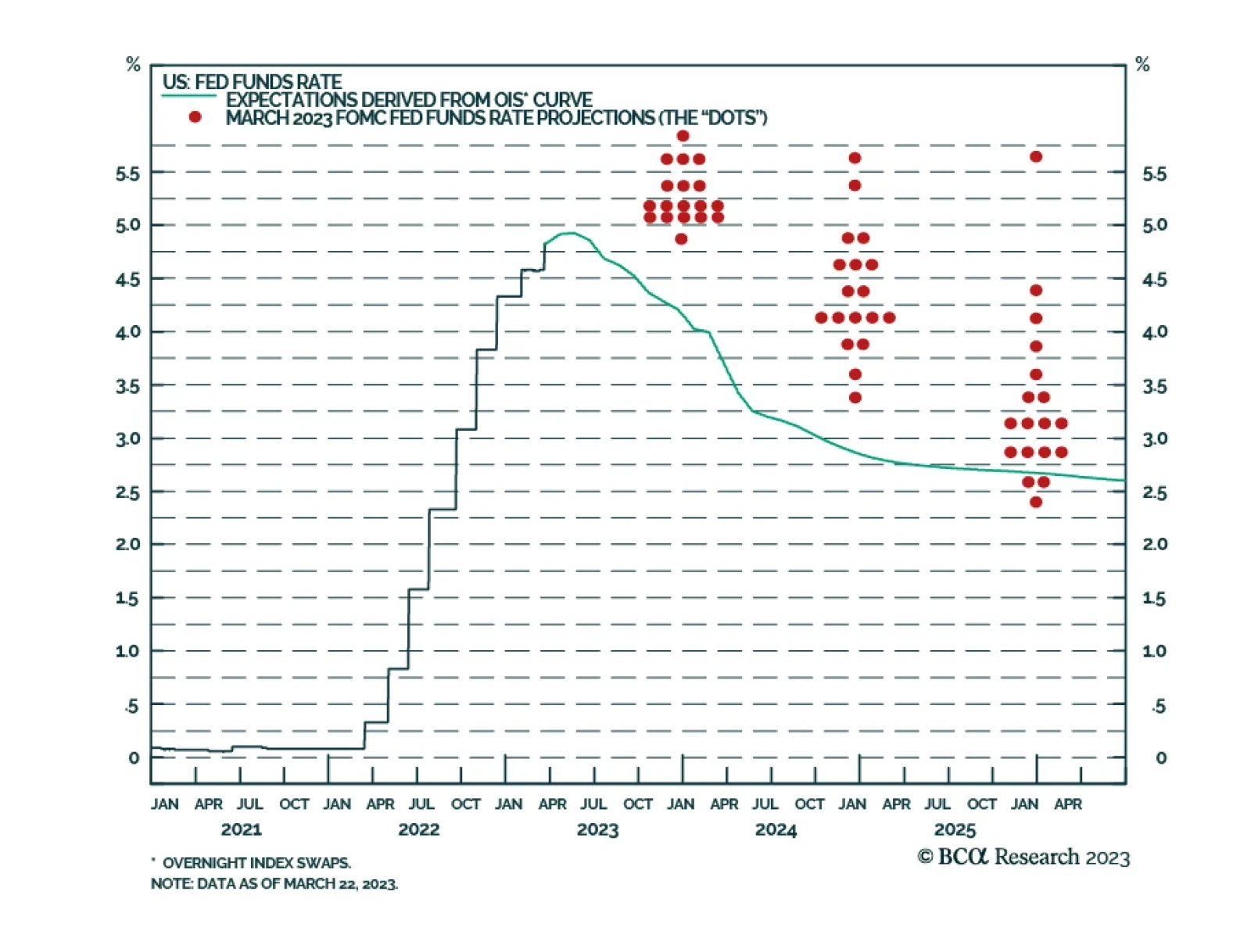

The Fed hiked rates by 25 basis points on Wednesday and made some important changes to its official forward interest rate guidance. Modifications to the policy statement signal that the Fed’s tightening cycle is close to…

The banking crisis has hit European shores and engulfed CS; is this all bad news for Europe or have the odds of a policy mistake declined?

Depending on market volatility during the next few trading days, the Fed will either lift rates by 25 bps next week or pause its tightening cycle. Either way, the Fed’s hiking cycle is close to its peak but rate cuts won’t be coming…

The odds of achieving a goldilocks scenario in the US where inflation drops amidst robust growth are low. If US bank woes do not escalate, the Fed will continue hiking amid a contraction in US corporate profits and global trade. The…

Bank failures are another ‘canary in the coal mine’ warning that a US recession is imminent, yet stocks, bonds, and the oil price are still a long way from fully pricing it.