Is there a lot of cash on the sidelines ready to be deployed? Would the US recession not be bearish for the US dollar and help EM like it did in the early 2000s? Why can the US investment playbook of the past 15-25 years not be used…

Eventually South Africa will do its macro rebalancing the least painful way: via adjustments in nominal variables such as prices and currency, rather than in real variables such as jobs and incomes. That entails a much weaker rand in…

Tight monetary policy will suppress copper capex. Loose fiscal policy, which is lavishing stimulus on energy and defense firms, will stoke copper demand. Constrained copper supply and turbo-charged demand will feed into headline…

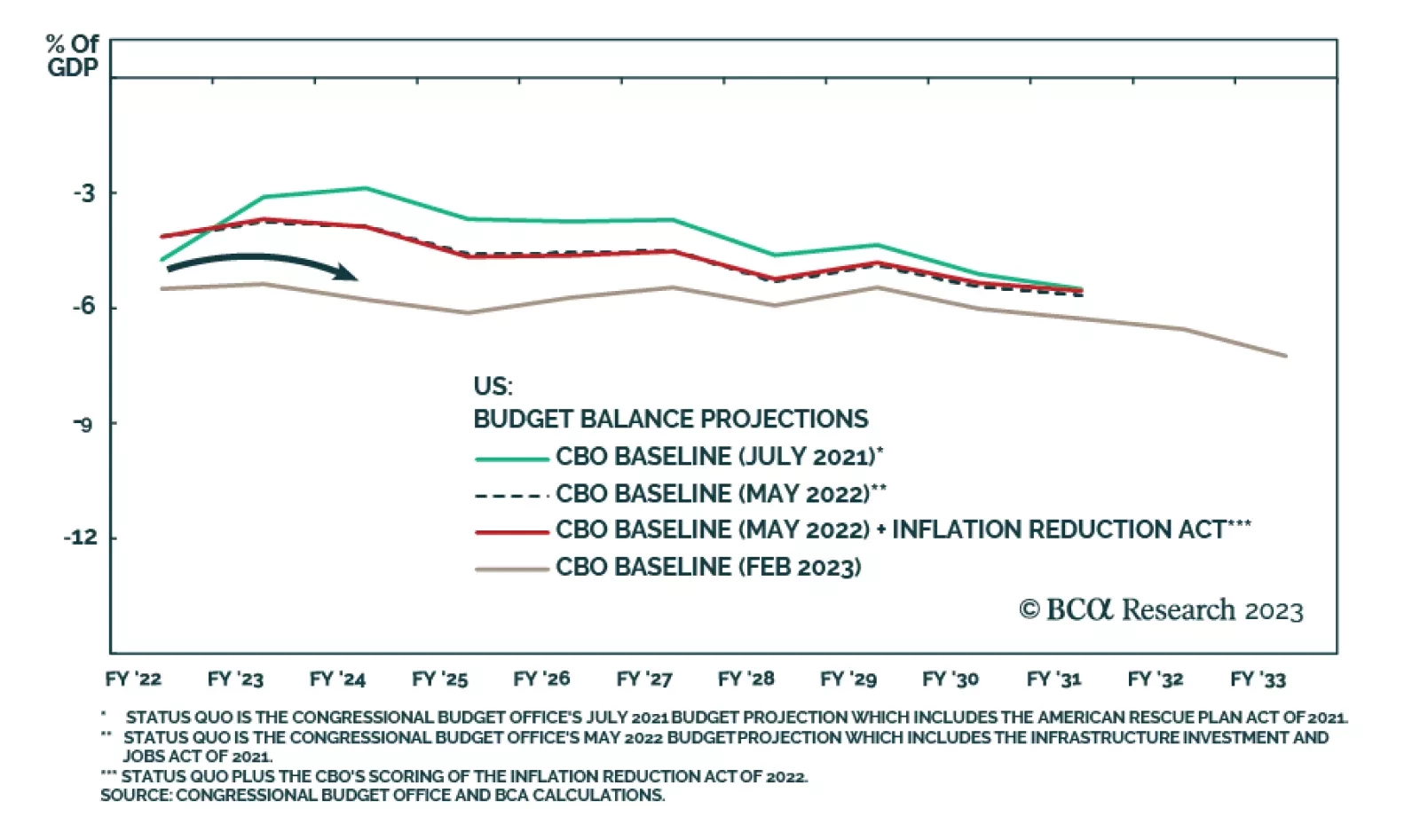

According to BCA Research’s US Political Strategy service, congressional gridlock is a bigger problem now that financial instability has emerged. The two political parties are evenly divided in Congress and public…

Bullish equity sentiment may persist in the second quarter on the Fed’s pause, but tight monetary policy, financial instability, elevated recession odds, extreme US polarization and policy uncertainty, and still-high geopolitical…

This week we present our Portfolio Allocation Summary for April 2023.

High rates have hurt real estate and, now, banks. The next shoes to drop: Loan growth, profits, and employment. Stay defensive. Recession is probable, but risk assets have not priced it in.

Is the European banking system hiding nasty surprises? How will the recent stress affect European growth and the ECB’s policy outlook?

We think the banking turmoil set off by Silicon Valley Bank’s failure will prove to be less than it’s been cracked up to be and that it will not derail the near-term equity we expect.

Colombian assets are inexpensive, but they are cheap for a reason. The economy is entering a growth recession while inflation will remain sticky and above target. Further, President Gustavo Petro’s policies will lead to lower…