Expectations for oil demand growth through 2023-24 are way too optimistic. Until these expectations fall to -0.5-1 percent, the oil price has further downside. Plus: collapsed complexity confirms that AI is in a mania, while basic…

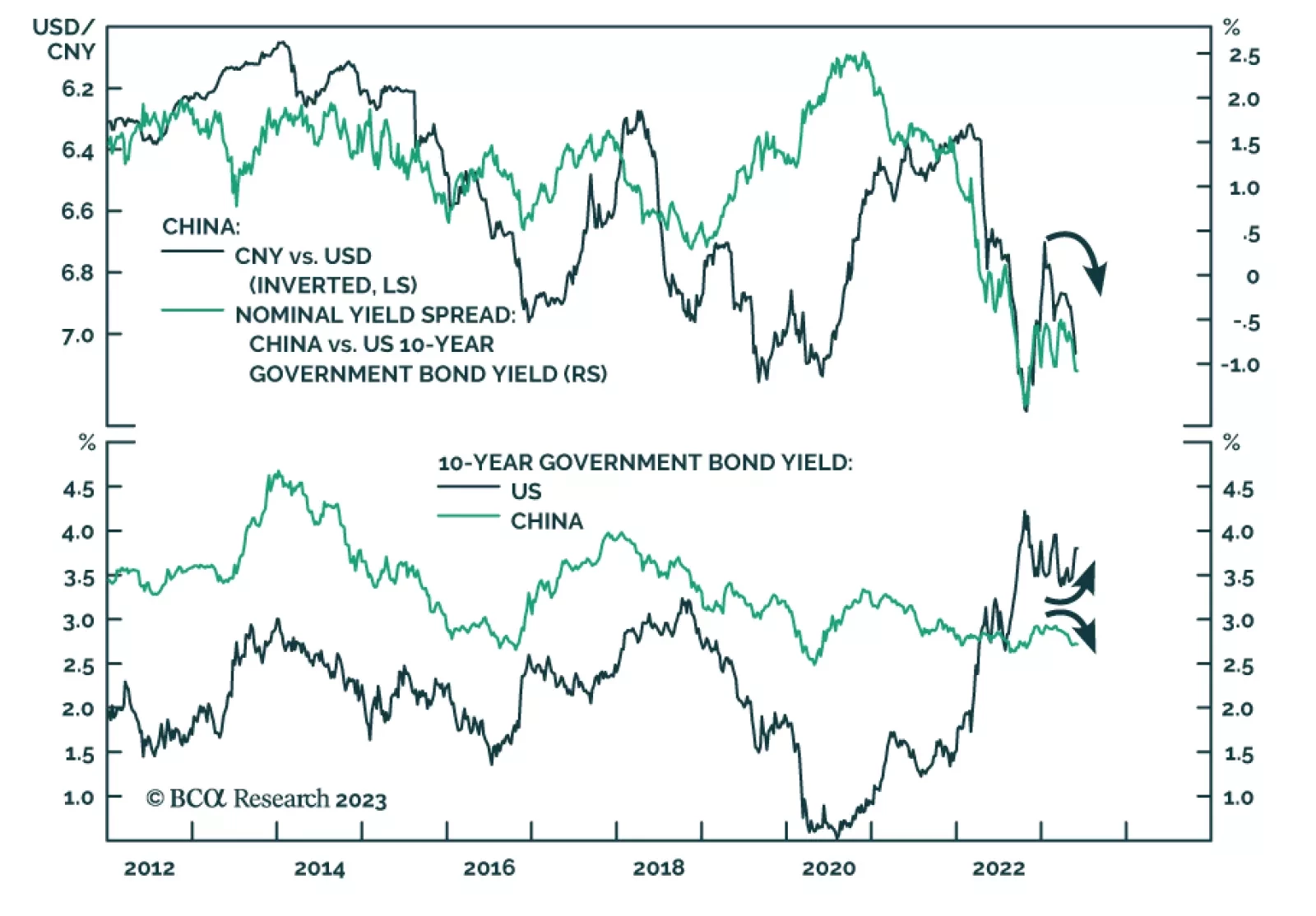

The Chinese currency has underperformed most of its emerging market peers so far this year, depreciating by 2.5% vis-à-vis the US dollar. RMB weakness is consistent with the signal from other Chinese risk assets including…

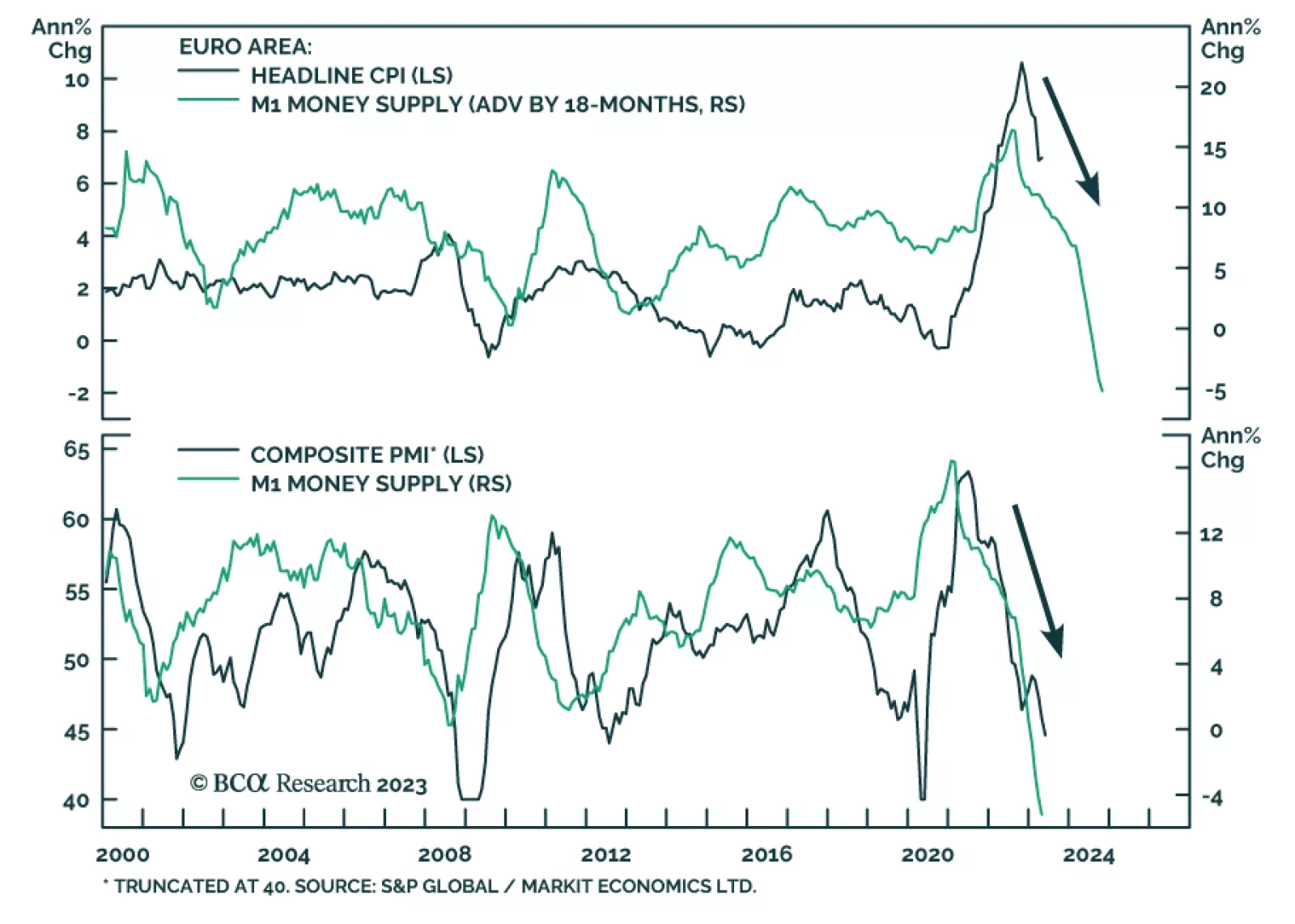

The latest Eurozone data releases show the impact of the ECB’s aggressive monetary tightening cycle. The contraction in M1 money supply – which includes currency in circulation and overnight deposits –…

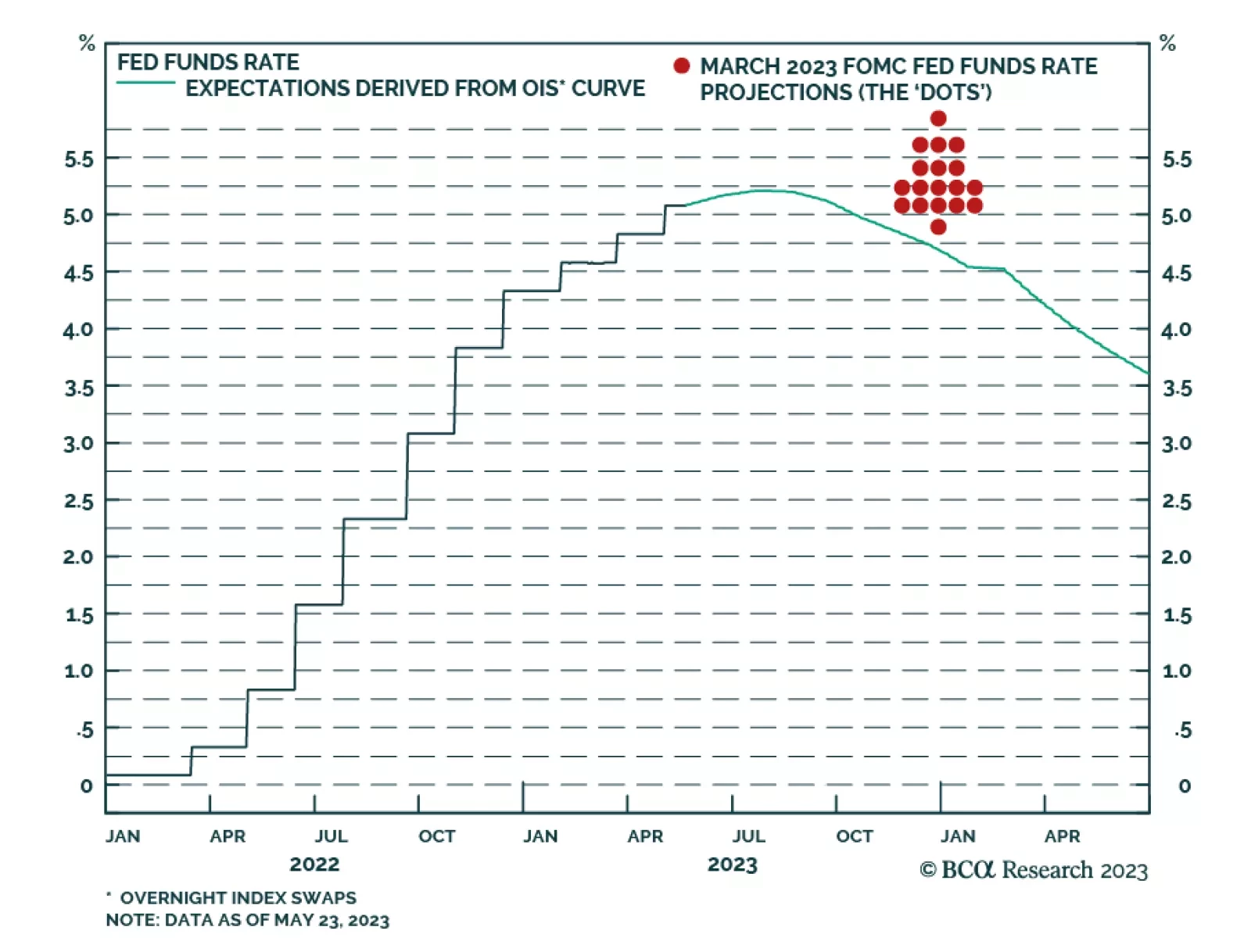

Market pricing of Fed rate expectations has moved closer in line with our US bond strategists’ expectations. According to the CME FedWatch tool, Fed funds futures are pricing in a 40% chance that the fed funds rate will be…

President Erdogan and the Justice and Development Party emerged as the winner of the Turkish general election which was concluded yesterday. This victory means that their expansive policies of the past decade will continue, and…

The Reserve Bank of New Zealand hiked rates this week to 5.5%. There are many reasons to expect that to be the last rate hike for this cycle – a development that is positive for New Zealand bonds but bearish for the New Zealand…

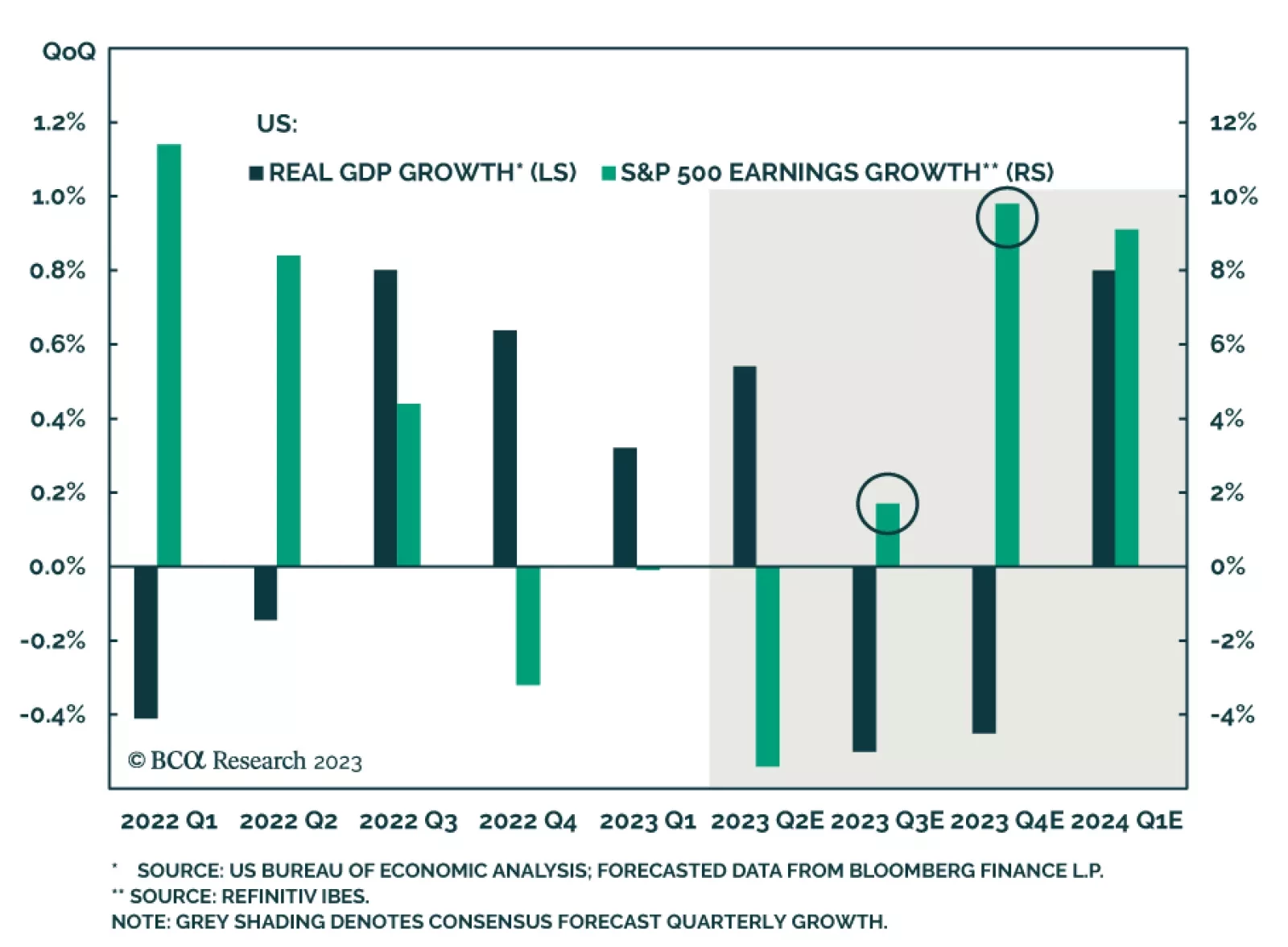

US bond investors should increase portfolio duration from “at benchmark” to “above benchmark” on a cyclical (6-12 month) investment horizon. We also recommend exiting Treasury curve flatteners and closing short positions in the…

Despite a few Federal Reserve policymakers having recently advocated for a higher funds rate, a broad survey of all recent Fed commentary and the minutes from the May FOMC meeting suggests that the Fed is more likely to keep…

The debt ceiling game’s endpoint will avoid default only if it implies economic pain. For the Republicans, the best strategy is not to lift the debt ceiling unless the Democrats cut spending a lot, or unless the economy starts to…

Investors should expect high volatility and a selloff in US stocks over the short run due to the higher-than-usual risk of technical default. Investors should seek shelter in defensive sectors and large cap stocks. Long-dated…