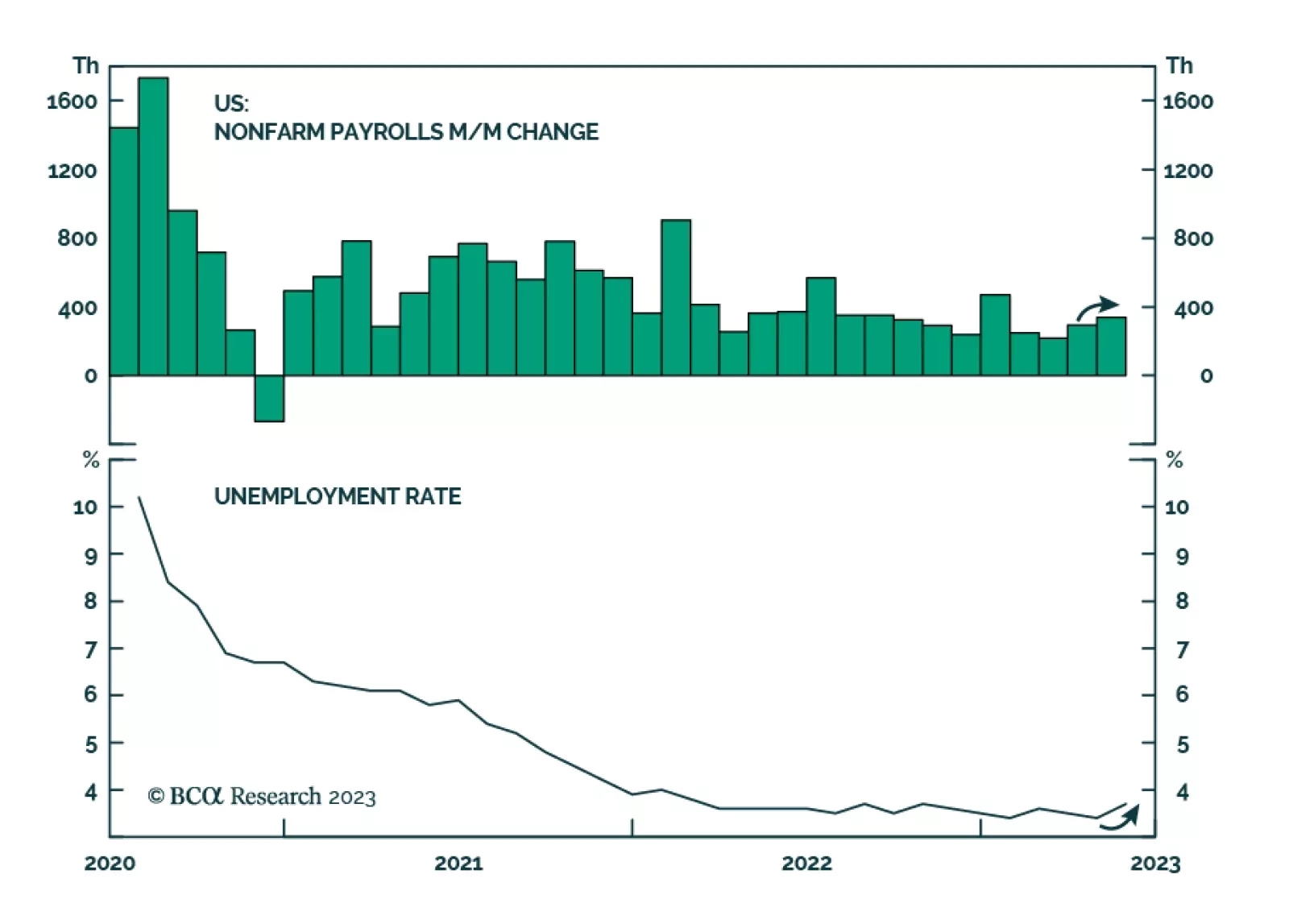

On the surface, Friday’s nonfarm payrolls report delivered a strong positive surprise. Establishment survey results reveal that employment increased by 339 thousand in May – above both the upwardly revised 294…

In this short weekly report, we review some of our favorite FX trades.

The Fed is still on track for a June pause, even after May’s strong nonfarm payroll print.

In this report, we follow up on the upgrade to our US duration stance from last week with a review of our rates views and government bond allocations outside the US. We conclude that while we now find US Treasuries to be more…

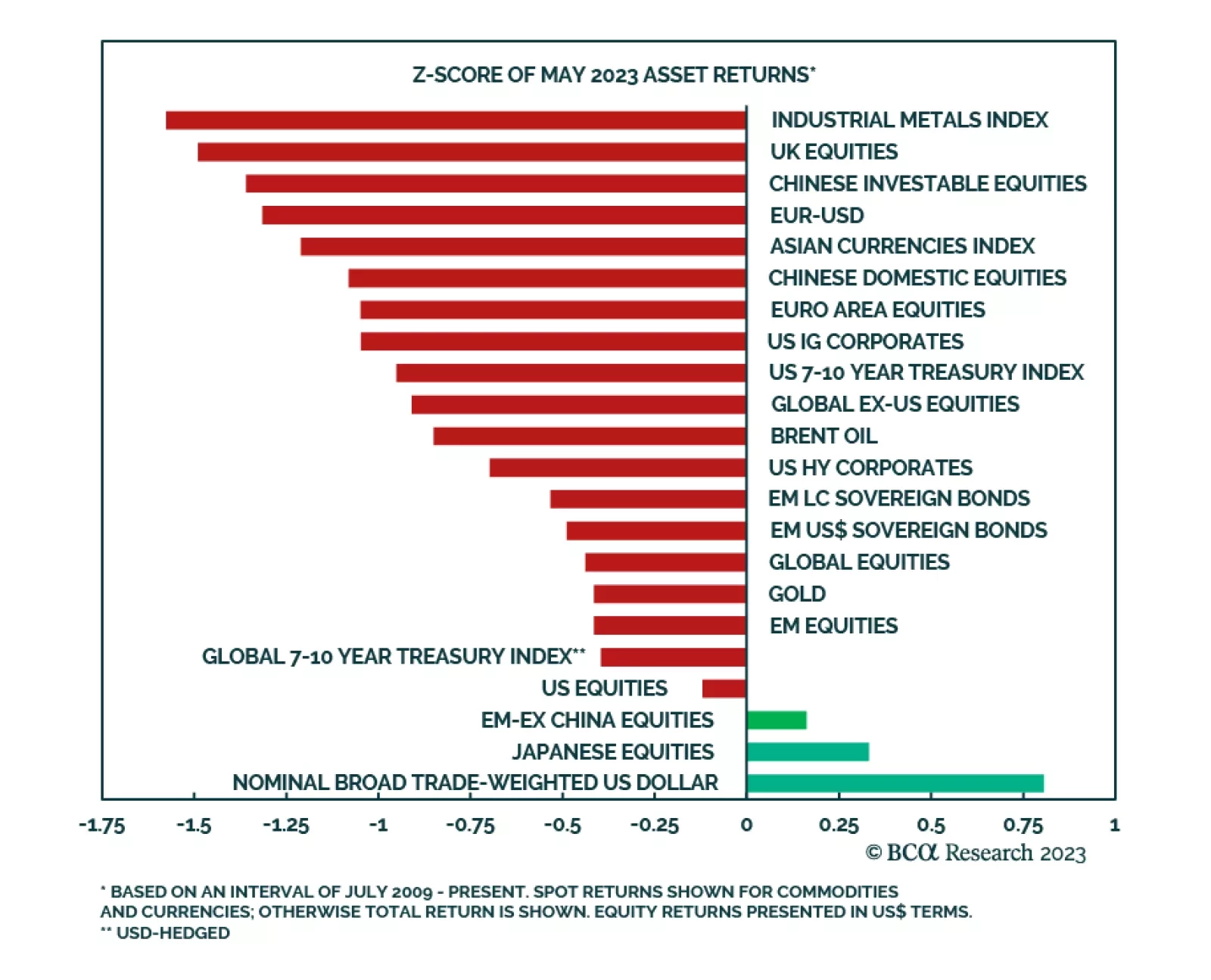

Global financial markets relapsed in May. After a relatively strong start to Q2, most of the major financial assets we track generated below average returns last month. A shift in investor expectations for the path of the Fed…

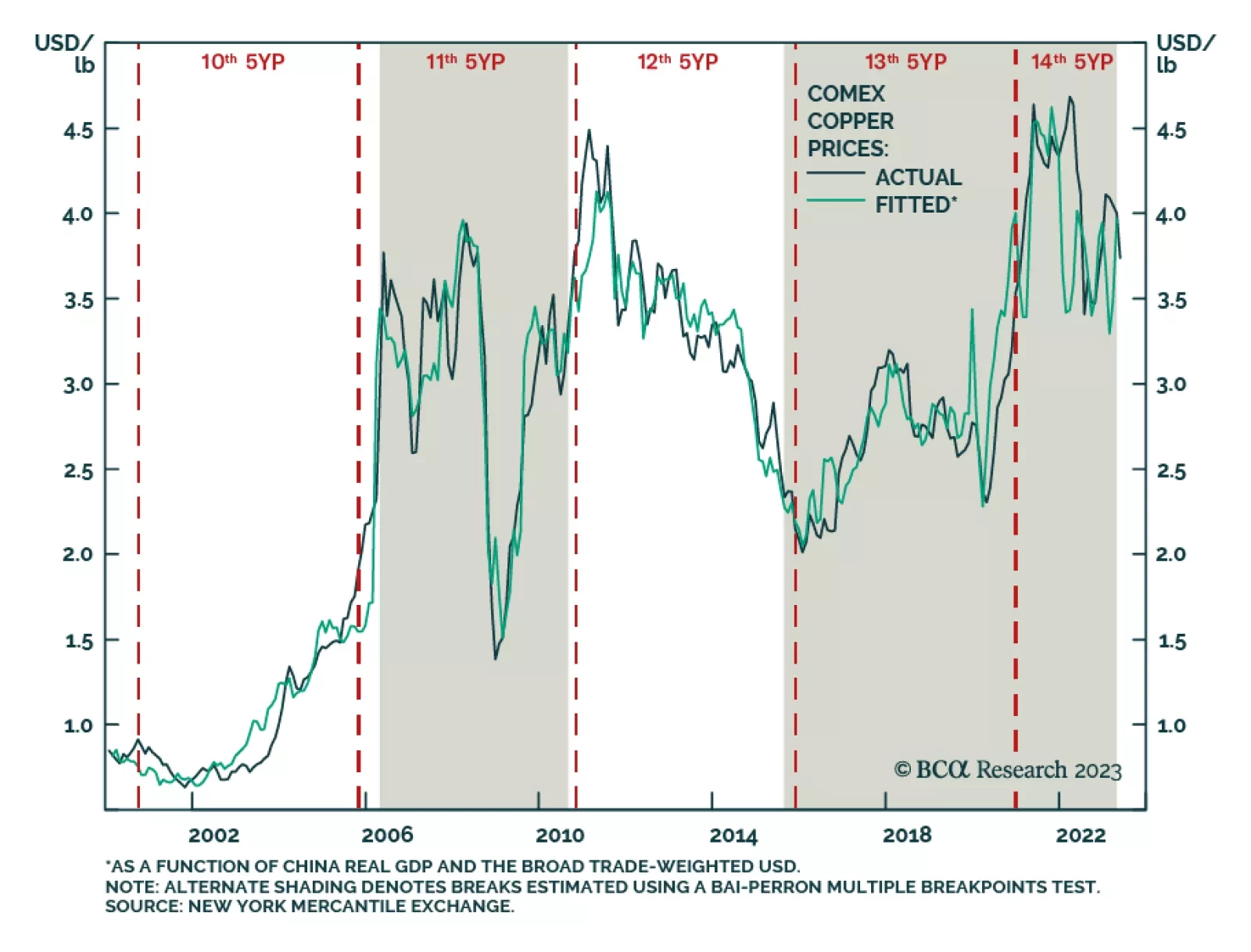

Our colleagues in BCA's Commodity & Energy Strategy (CES) service expect the Chinese Communist Party (CCP) to announce a new round of policy stimulus to re-boot the economy, in an effort to escape a prolonged liquidity…

Symptoms of a liquidity trap for Chinese households are appearing. Our proprietary indicators for the marginal propensity to spend among households and enterprises continue falling. There has been a paradigm shift in Beijing’s…

The CCP is poised to roll out a re-boot of China’s economy that will focus on its comparative advantage in the processing of base metals – particularly copper – and the export of metals-intensive products like EVs. The re-boot will…

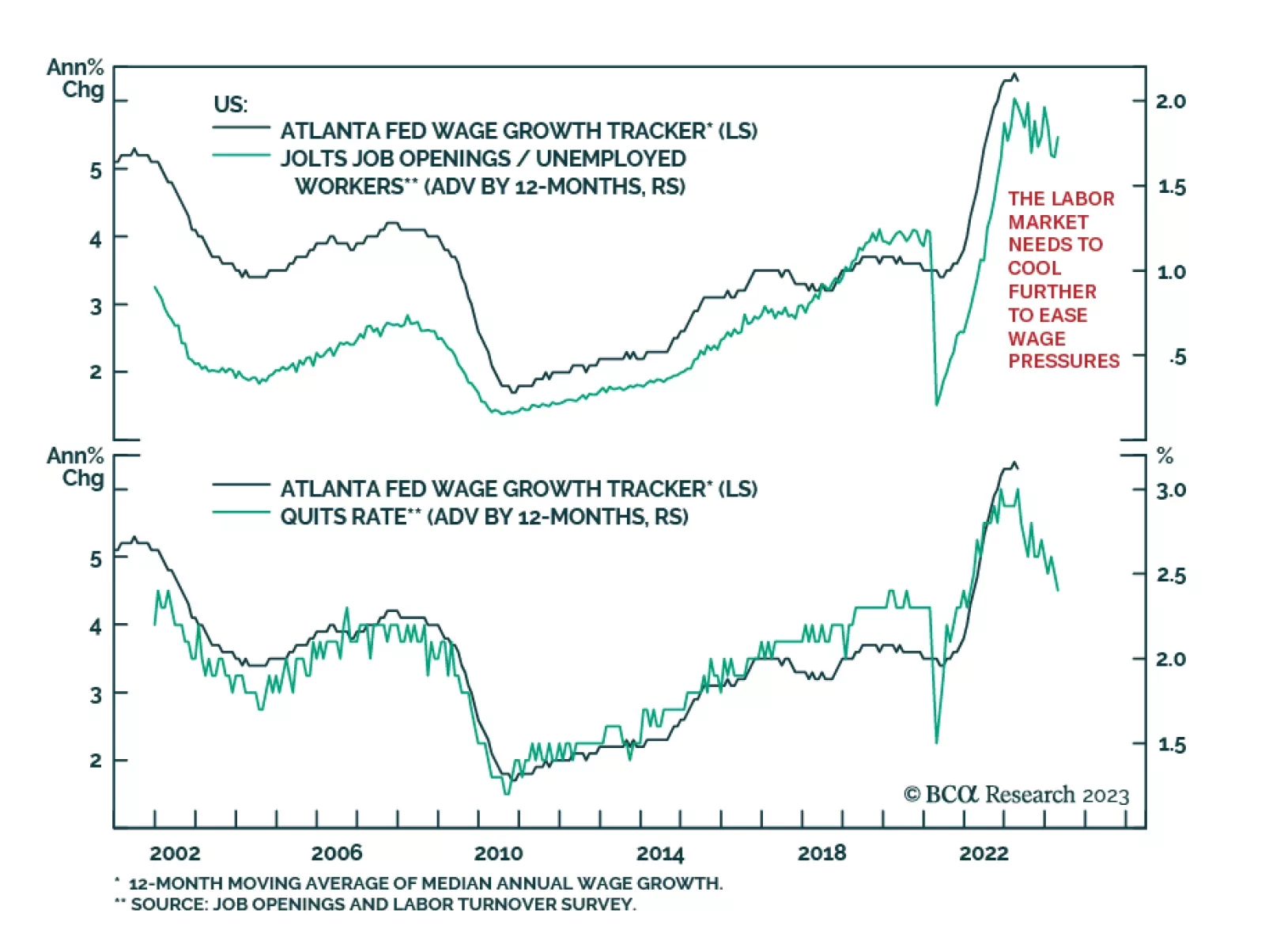

The JOLTS survey for April shows job openings unexpectedly rising from an upwardly revised 9.7 million to 10.1 million – above expectations of a decline to 9.4 million. The job openings rate inched up to 6.1% from 5.9%…

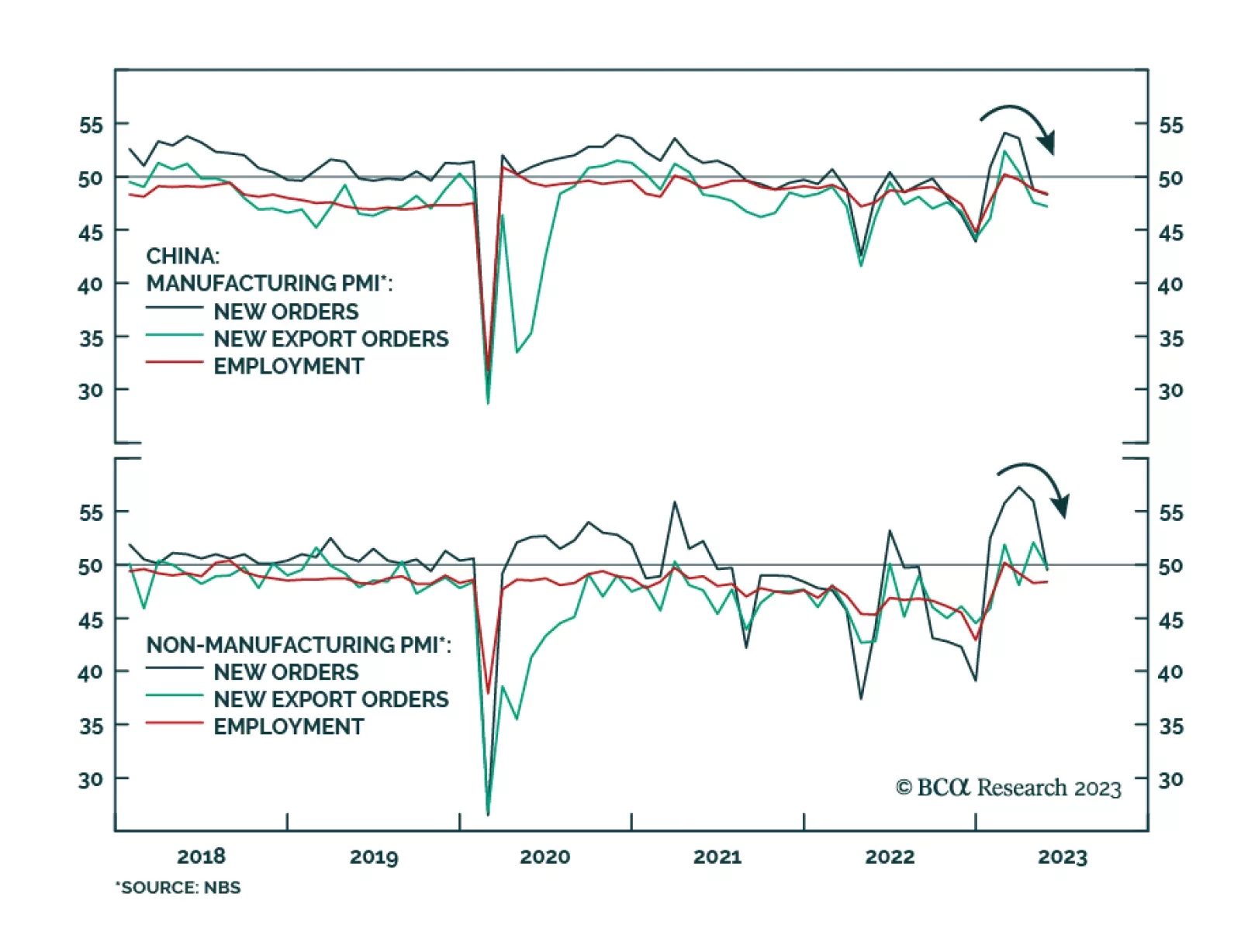

Chinese economic data releases continue to disappoint. Wednesday’s NBS PMI release showed the composite PMI dropped from 54.4 to 52.9 in May – the lowest since January. Importantly, the Manufacturing PMI unexpectedly…