This week’s report examines three potential catalysts that could push Treasury yields meaningfully higher within the next few months. We also consider the rebuild of the Treasury’s cash holdings and its implications for the Fed’s…

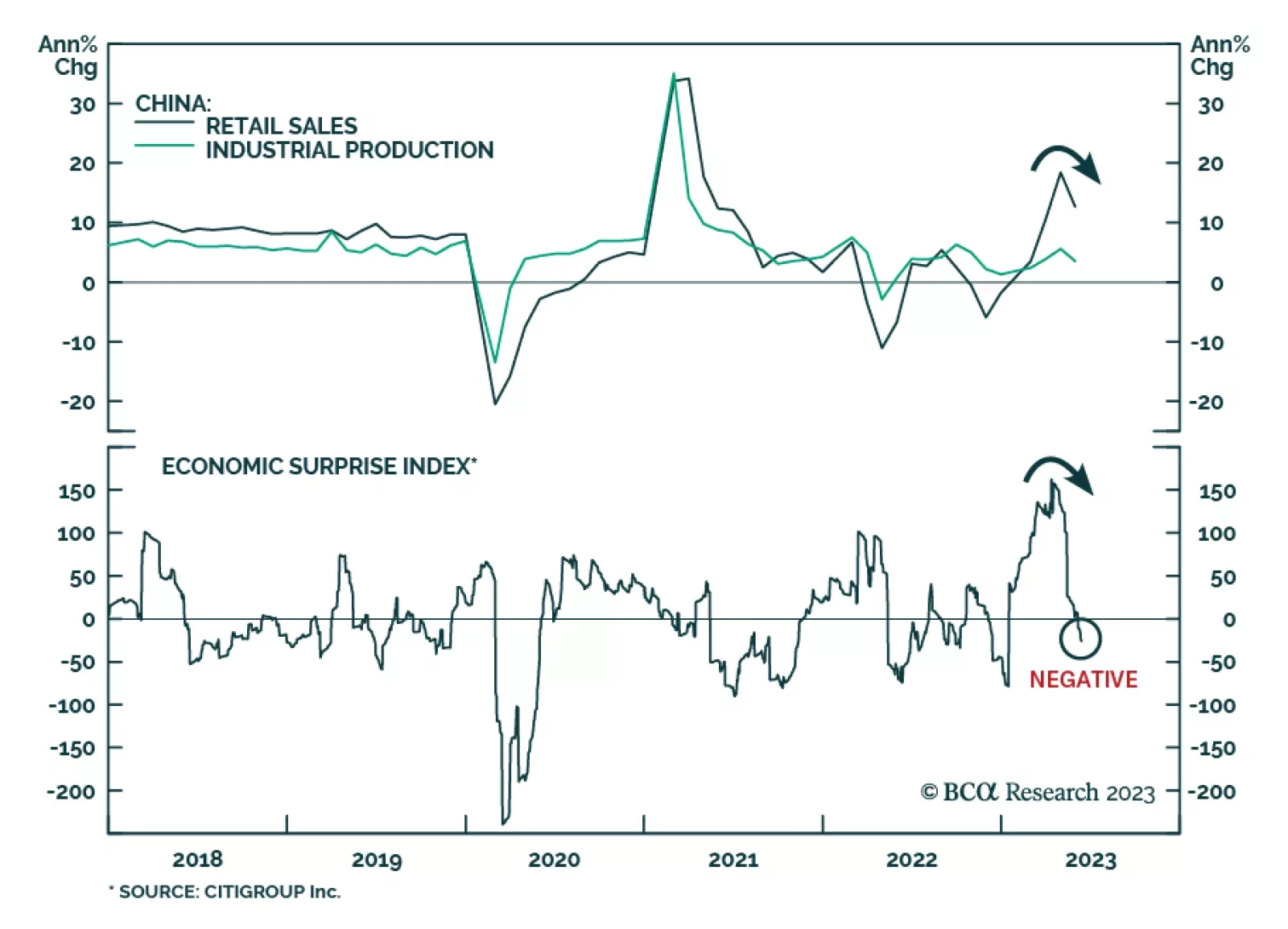

China is facing a risk of deflation. Marginal interest rate cuts and targeted stimulus will be insufficient to boost China’s growth given the current deflationary mindset and the danger is that the economy may be entering a liquidity…

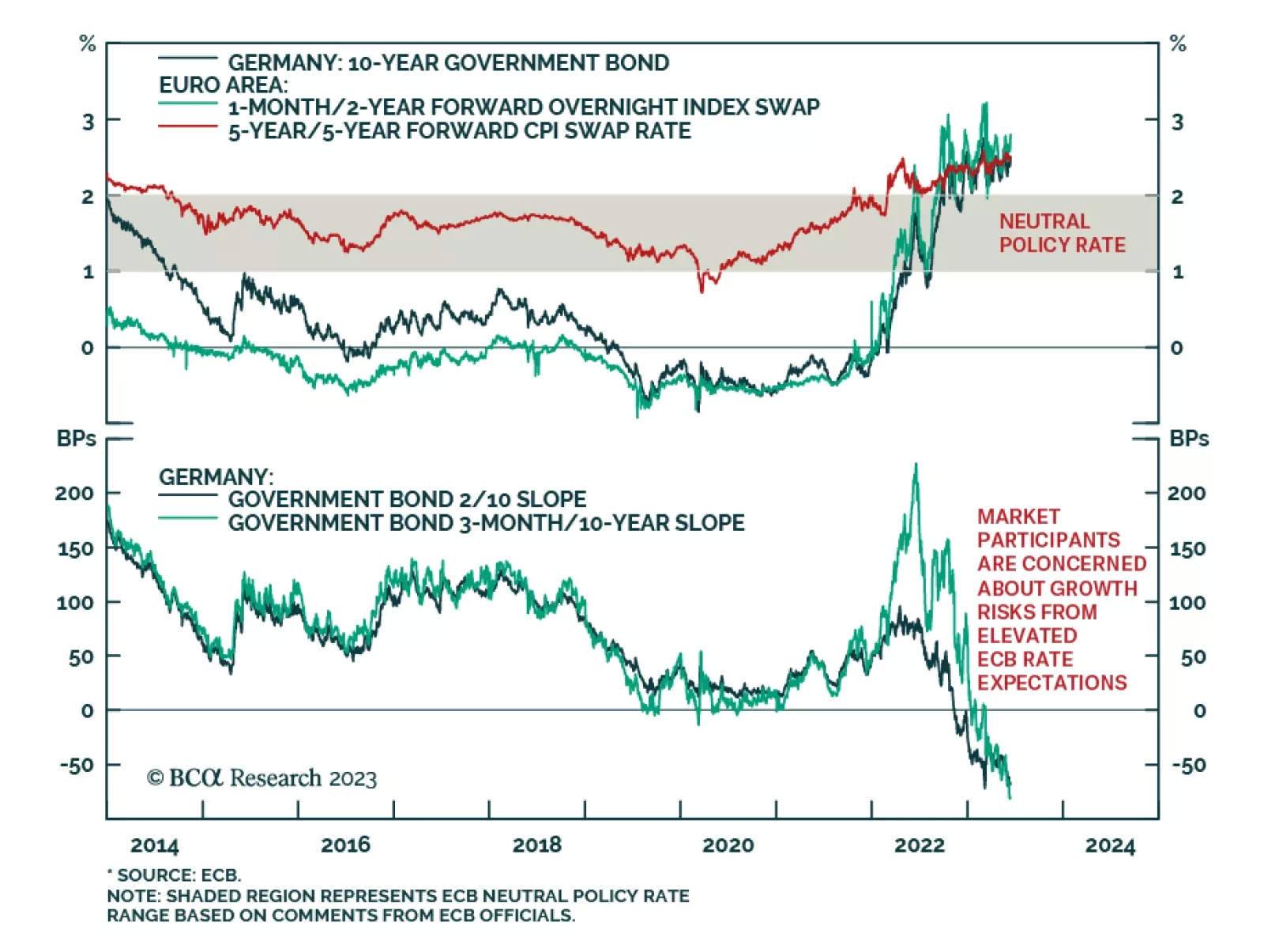

In this Insight, we discuss the currency and bond market implications of last week’s ECB and Bank of Japan policy meetings. The conclusion: the ECB is on a path to an overly hawkish policy mistake, while the Bank of Japan’s dovish…

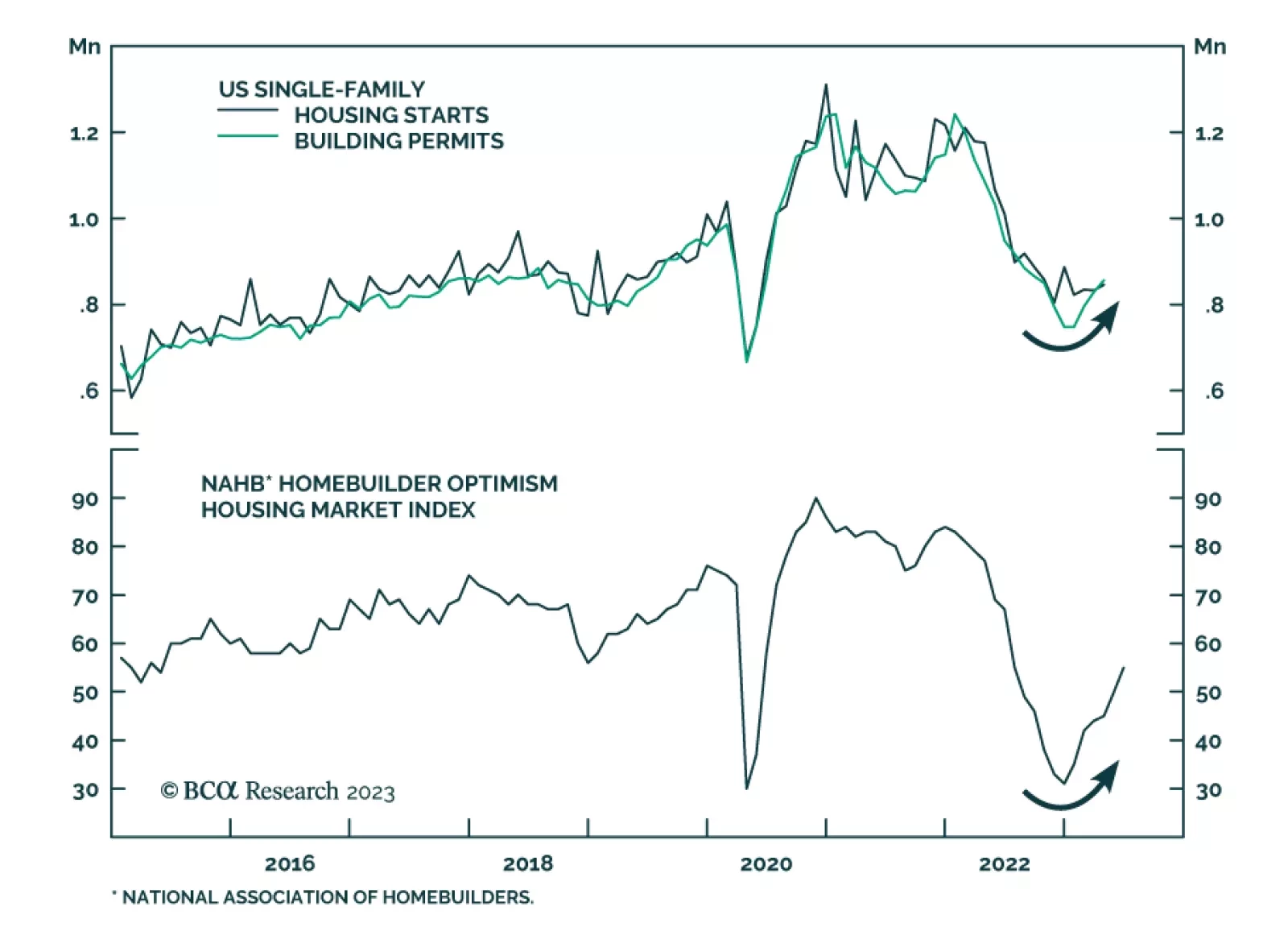

US Homebuilder confidence surprised to the upside on Monday, with the NAHB’s Housing Market Index jumping from 50 to 55 in June – beating expectations of 51. This marks the first time in 11 months that the index rises…

In this Insight, we discuss the currency and bond market implications of last week’s ECB and Bank of Japan policy meetings. The conclusion: the ECB is on a path to an overly hawkish policy mistake, while the Bank of Japan’s dovish…

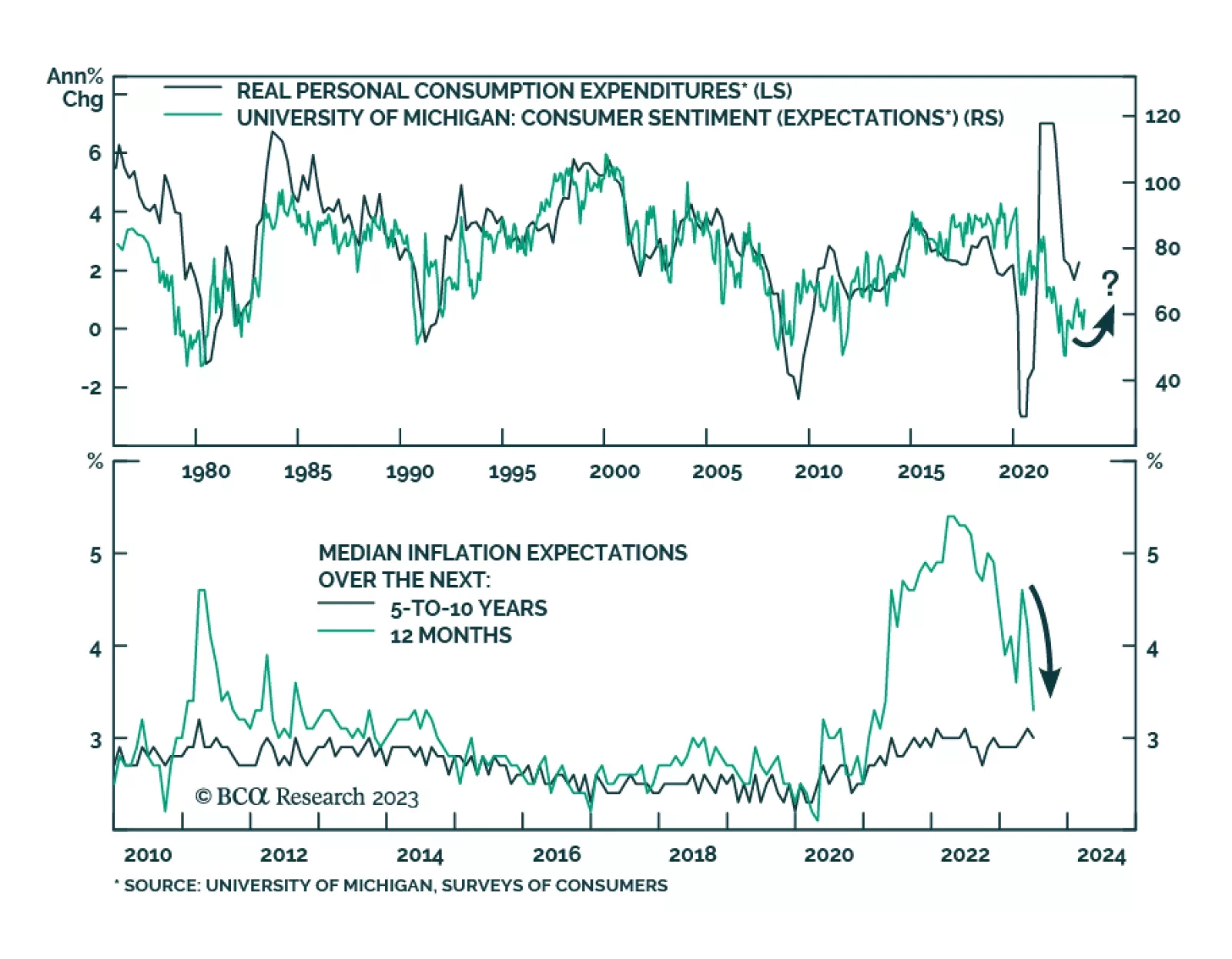

Preliminary results of the University of Michigan Consumer Sentiment survey sent a positive signal about household morale in June. The Sentiment index rose by a greater-than-anticipated 4.7 points to 63.9 on the back of…

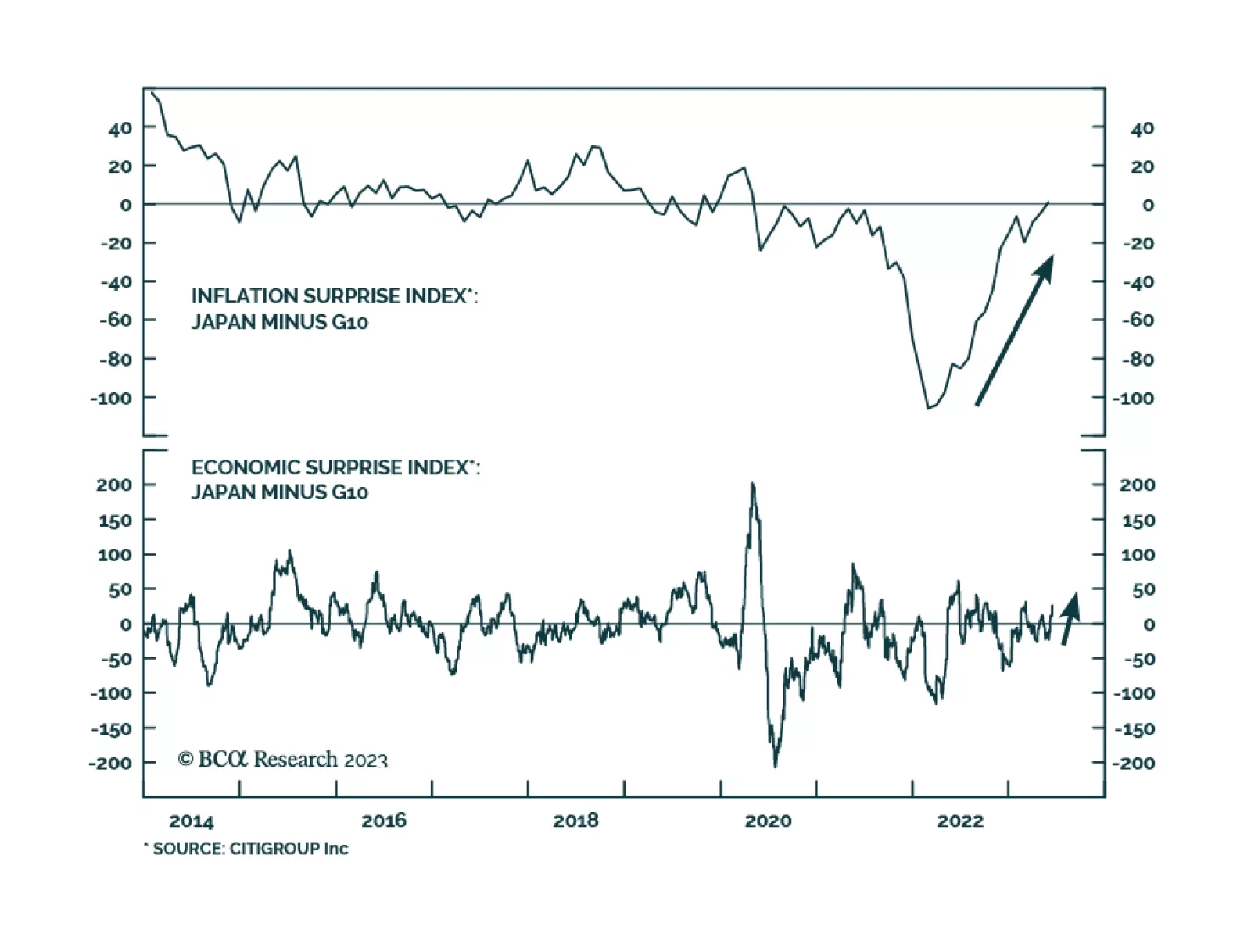

The Japanese yen was the worst performing major currency on Friday. The weakness followed news that the BoJ kept its policy rate untouched at -0.1% – as widely expected – and did not make any changes to its yield…

As expected, the European Central Bank (ECB) delivered a 25bps rate hike on Thursday, raising the policy rate to 3.5% — the highest since August 2001. Moreover, the central bank maintained a hawkish bias, signaling…

China’s economic data releases for May fell below consensus estimates. The 7.2% y/y contraction in property investment in the first five months of the year was worse than the expected 6.7% decline. The deceleration in…

This Strategy Insight discusses the bond market and currency implications of the Fed’s “hawkish pause”.