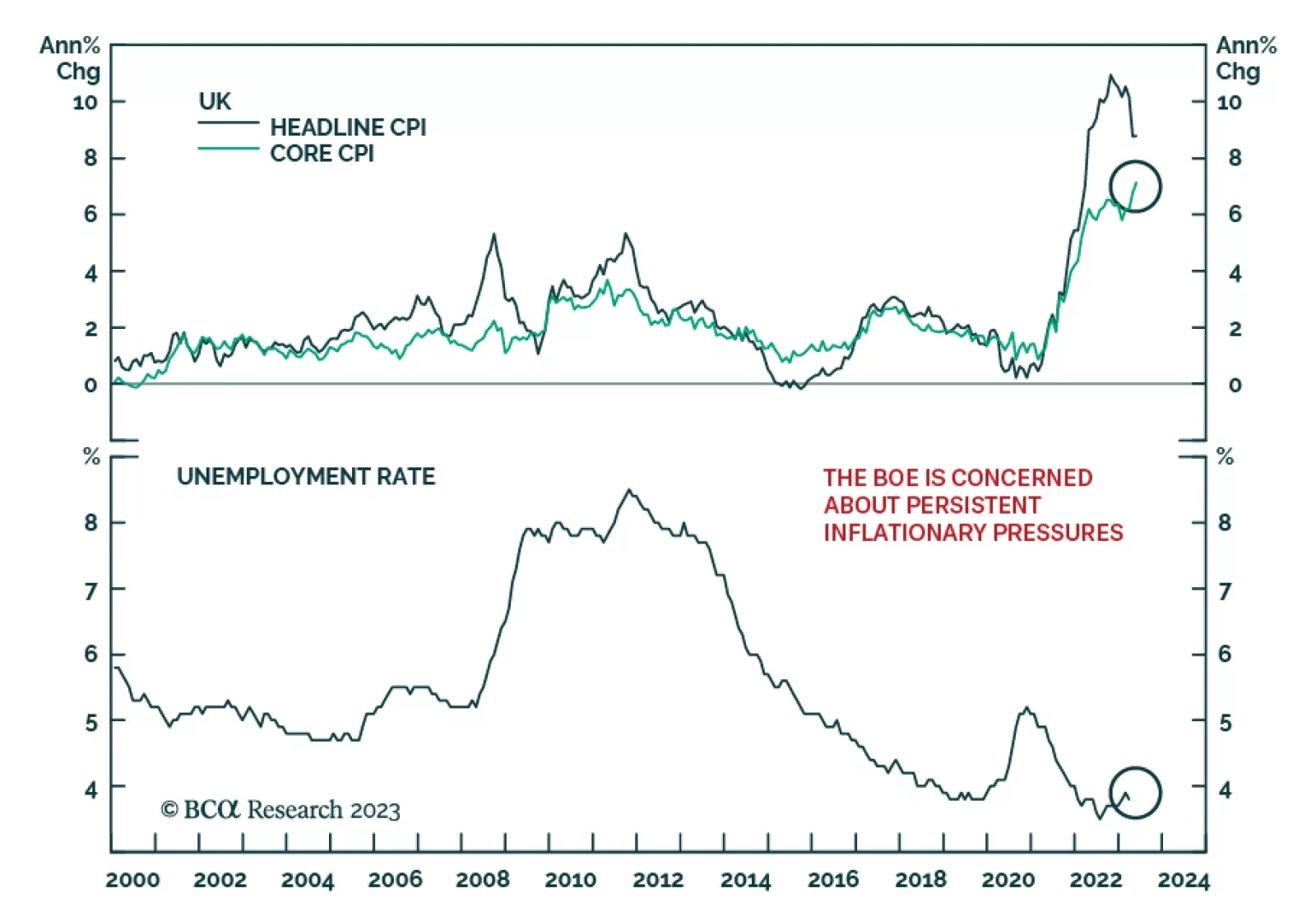

The market does not grasp the implied depths of recessions that will be needed to prevent inflation expectations from un-anchoring. Among the major economies, the most vulnerable to a deep recession is the UK. We explain why, and…

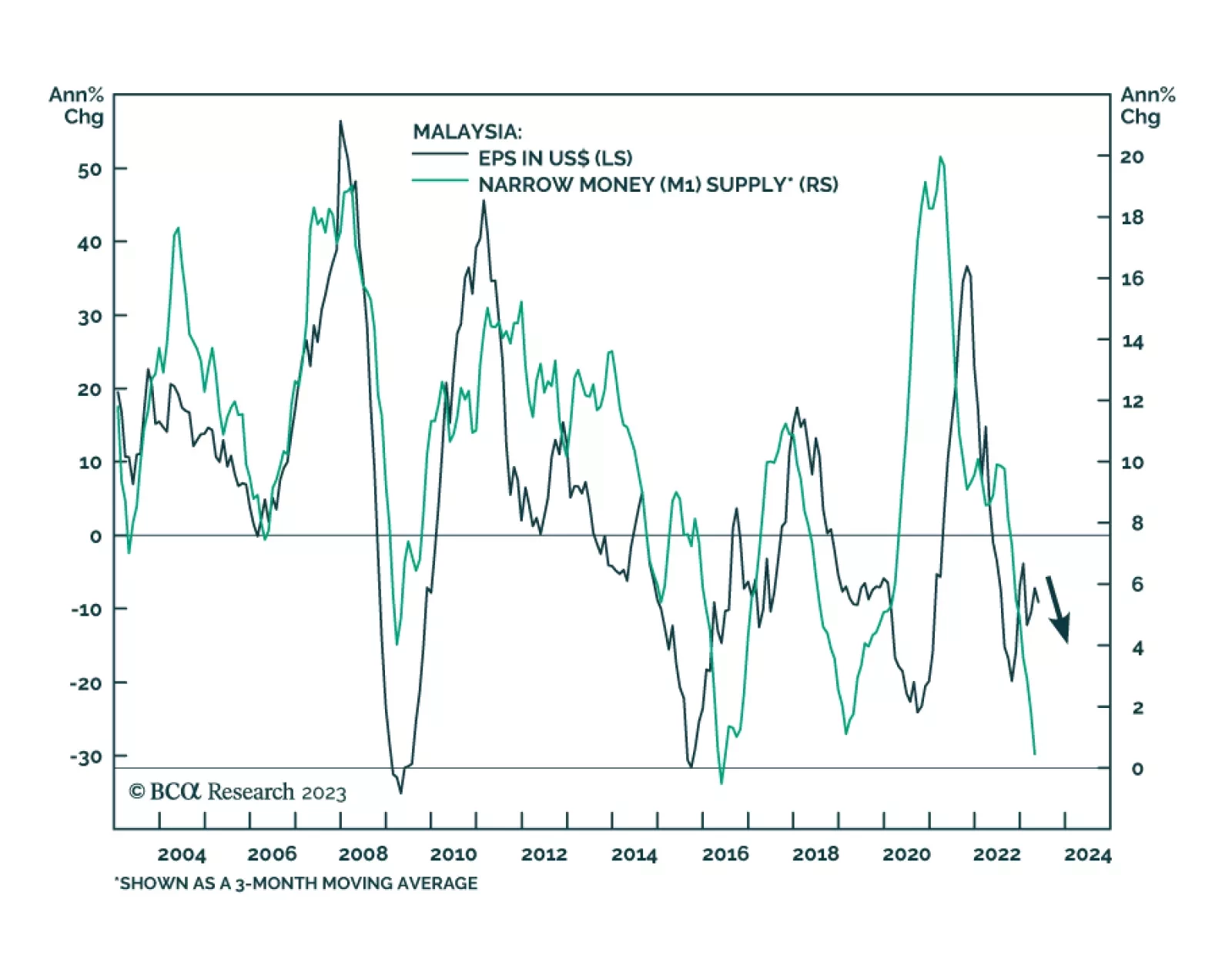

In a recent report, our Emerging Markets Strategy team posited that the bear market in Malaysian stocks will be prolonged. Disinflationary forces have taken hold of the Malaysian economy: money supply has plunged, bond yields…

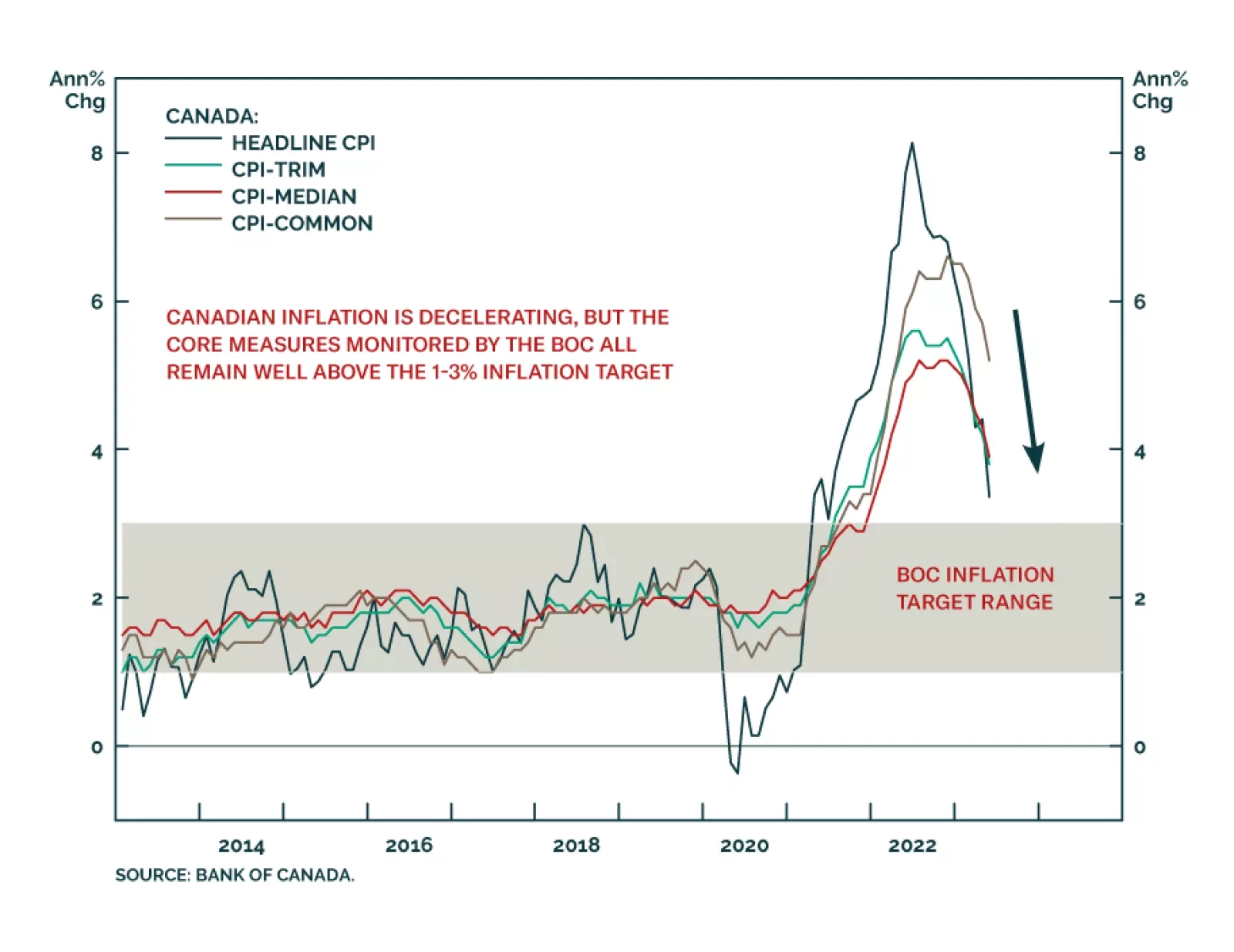

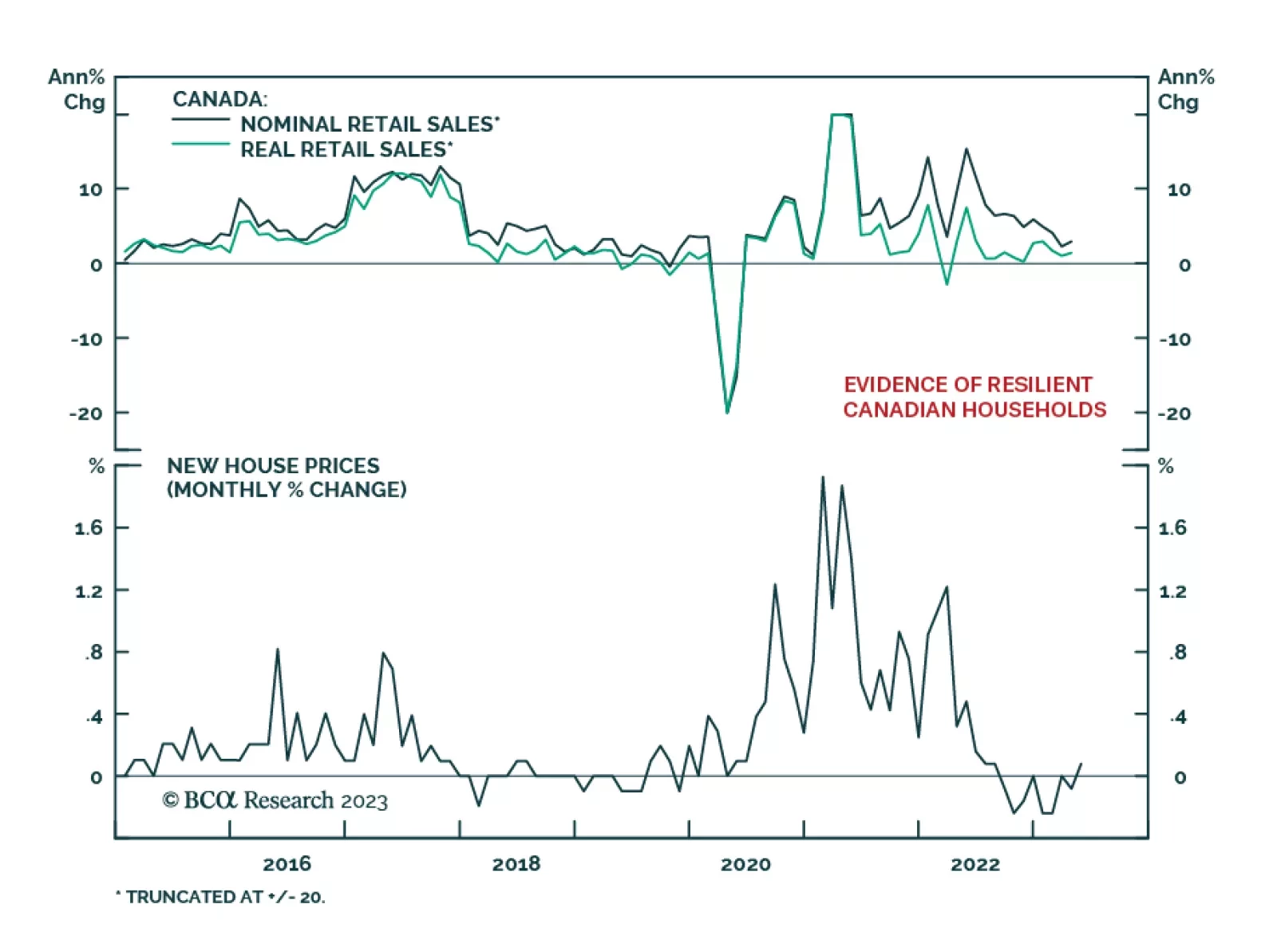

Canadian inflation slowed in May, slowing to 3.4% on a year-over-year basis from 4.4% in April. This matched market expectations, with the monthly increase of 0.4% (versus 0.7% in April), slightly lower than the 0.5% consensus…

Assuming yesterday’s policy rate hike is a sign that Turkey is finally veering towards orthodox economic policies; should investors rush in?

The Bank of England surprised markets with a larger-than-anticipated 50bps rate hike on Thursday, raising its policy rate to 5% versus expectations of 4.75%. Seven of the nine MPC members voted in favor of the rate increase.…

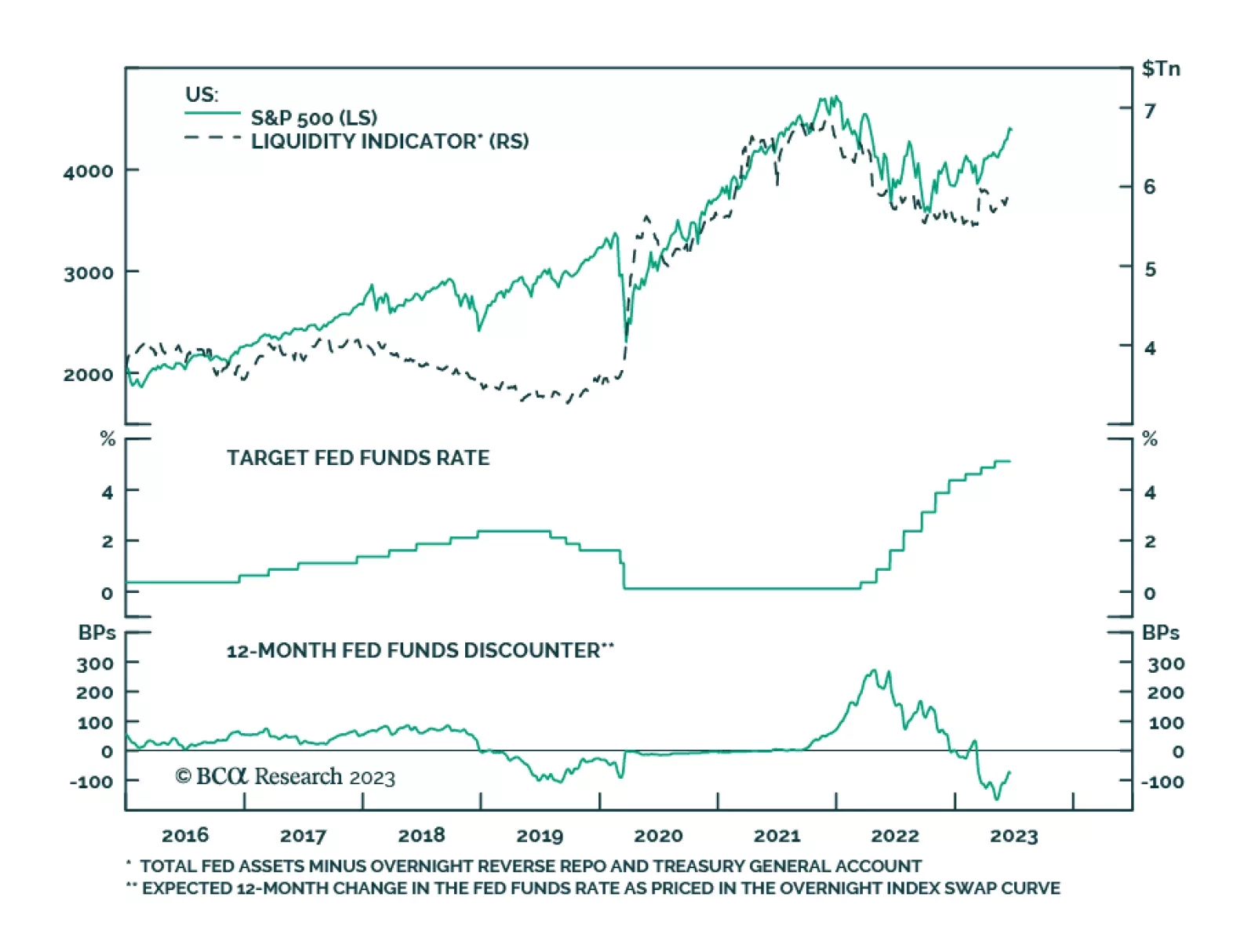

According to BCA Research’s US Bond Strategy service, when the Fed’s interest rate and balance sheet policies are sending opposite signals, listen to interest rates. There seems to be some worry among investors…

Recent economic data reveal that Canadian household conditions remain resilient. Retail sales surprised to the upside in April. The 1.1% m/m increase follows two consecutive monthly declines and beat expectations of a 0.4% m/m…