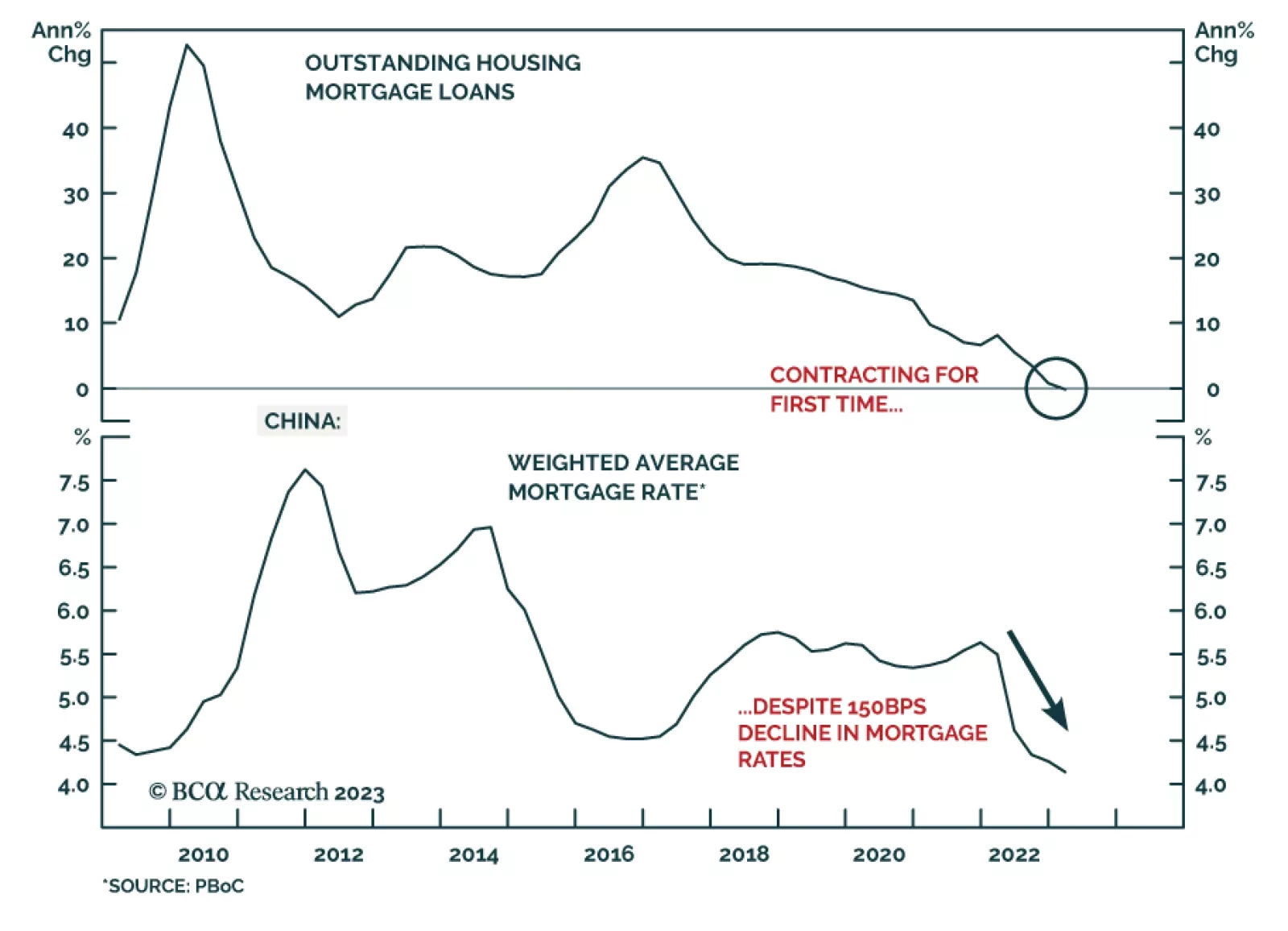

In a recently published report, our China Investment Strategy team revisited the issue of a liquidity trap in China. A liquidity trap is a condition that occurs when lower borrowing costs are unable to boost credit demand and…

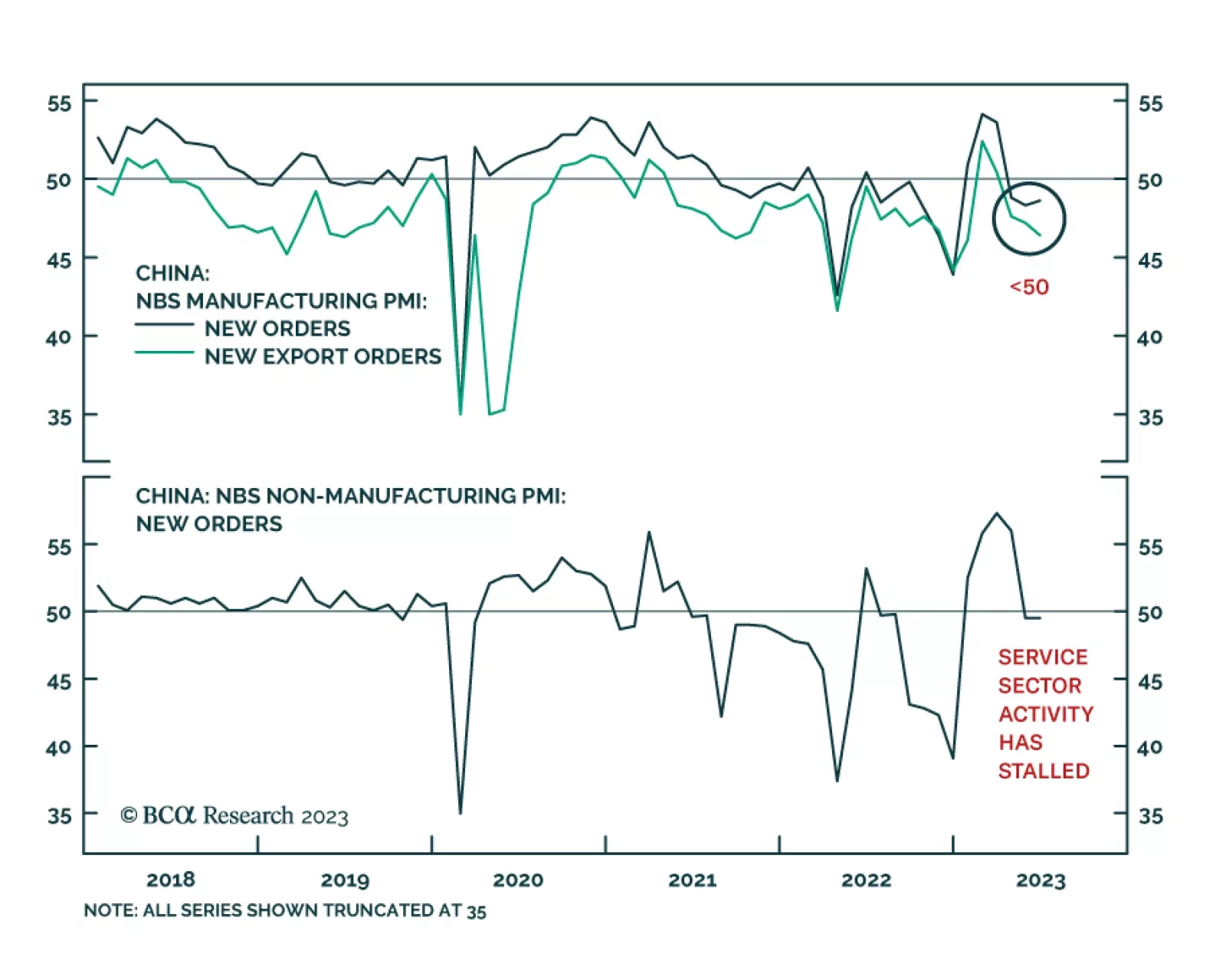

The June NBS PMI data revealed that growth conditions have deteriorated on the margin. The new orders and exports for overall manufacturing as well as for services have not improved and remain below 50. In addition, the import…

A look at how US bond yields responded to yesterday’s strong economic data and this morning’s soft inflation print.

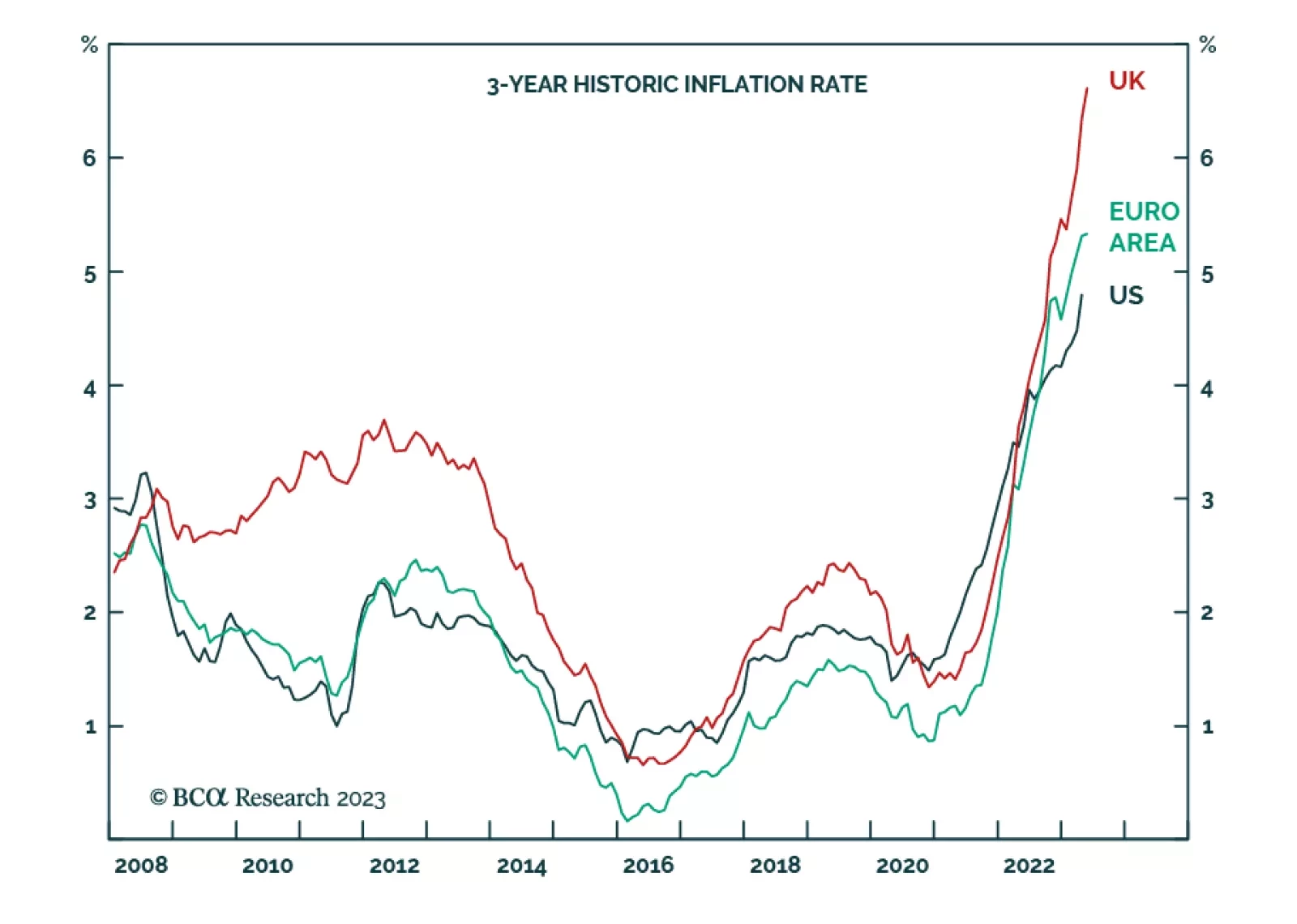

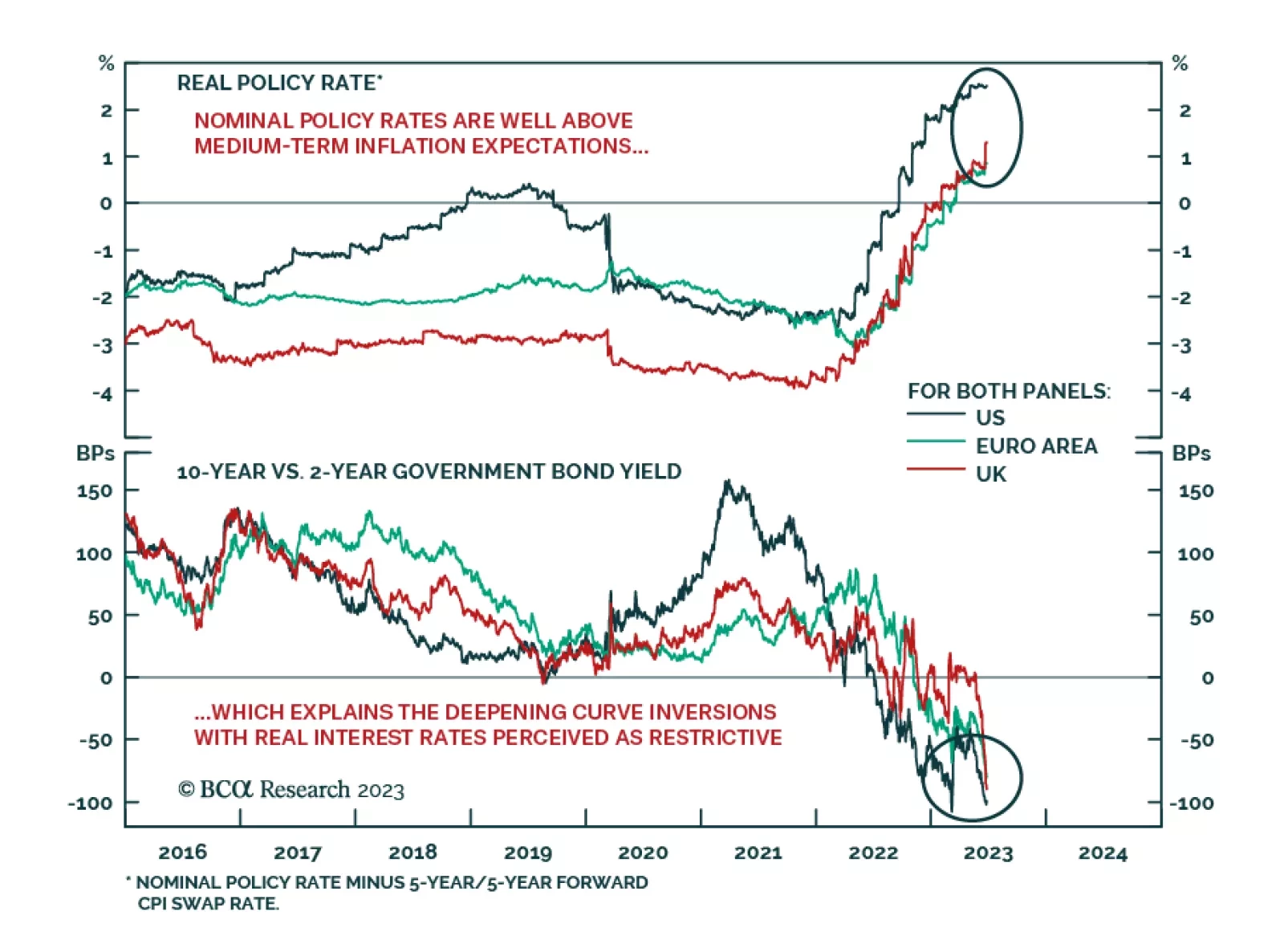

Our Counterpoint service argues that it is not enough that inflation stabilizes at 3 percent for inflation expectations to be anchored and central banks must make inflation undershoot 2 percent for some time to prevent a repeat…

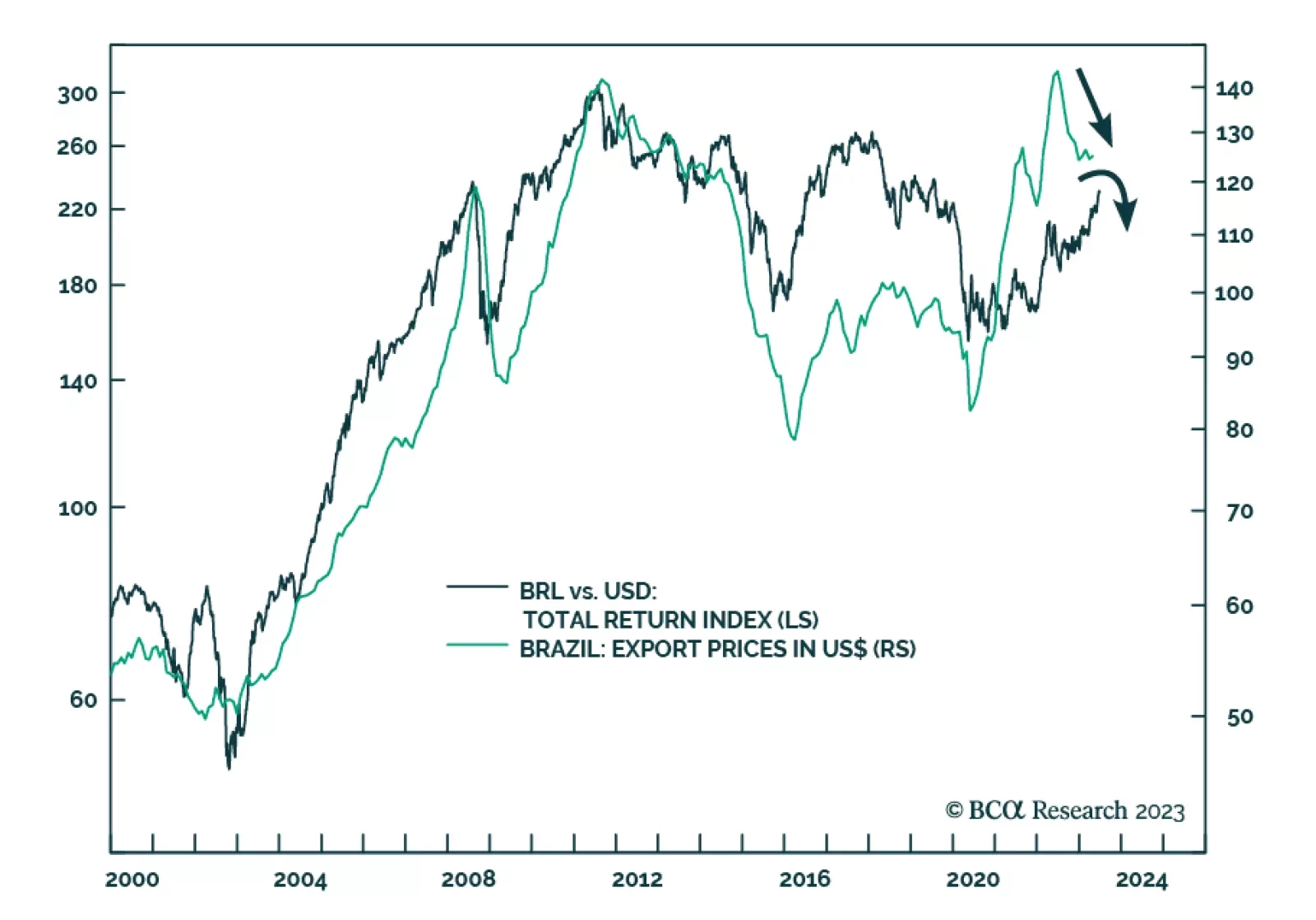

Since the Brazilian Central Bank (BCB) released its latest monetary policy minutes on June 27th, the Brazilian real has depreciated for three days in a row. Will the BRL resume its strengthening trajectory, or is the currency set…

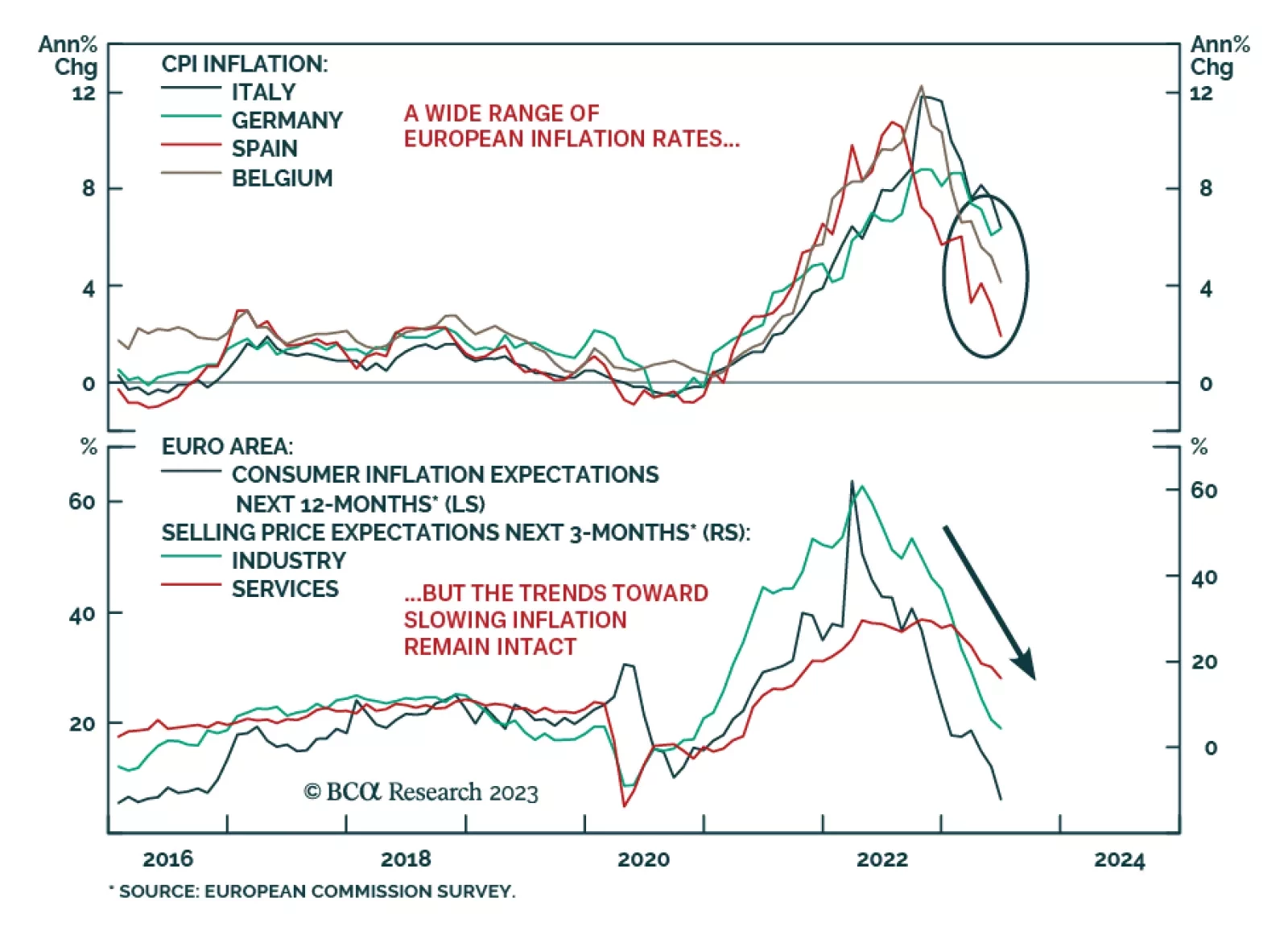

The preliminary inflation prints for June in the major euro area economies highlight a growing divergence in inflation outcomes. There was good news: headline CPI inflation in Italy fell to 6.7% in June from 8.0% in May, while…

The combination of a global manufacturing recession and tight/tightening policy is raising a red flag for global non-TMT stocks. In China, households are entering a liquidity trap, and deflationary pressures are heightening.…

Has the yield curve lost its ability to “predict” recessions? The widely-followed 2-year/10-year US Treasury curve now sits at -100bps, but it has been inverted since April 2022. Investors have seemingly been on…

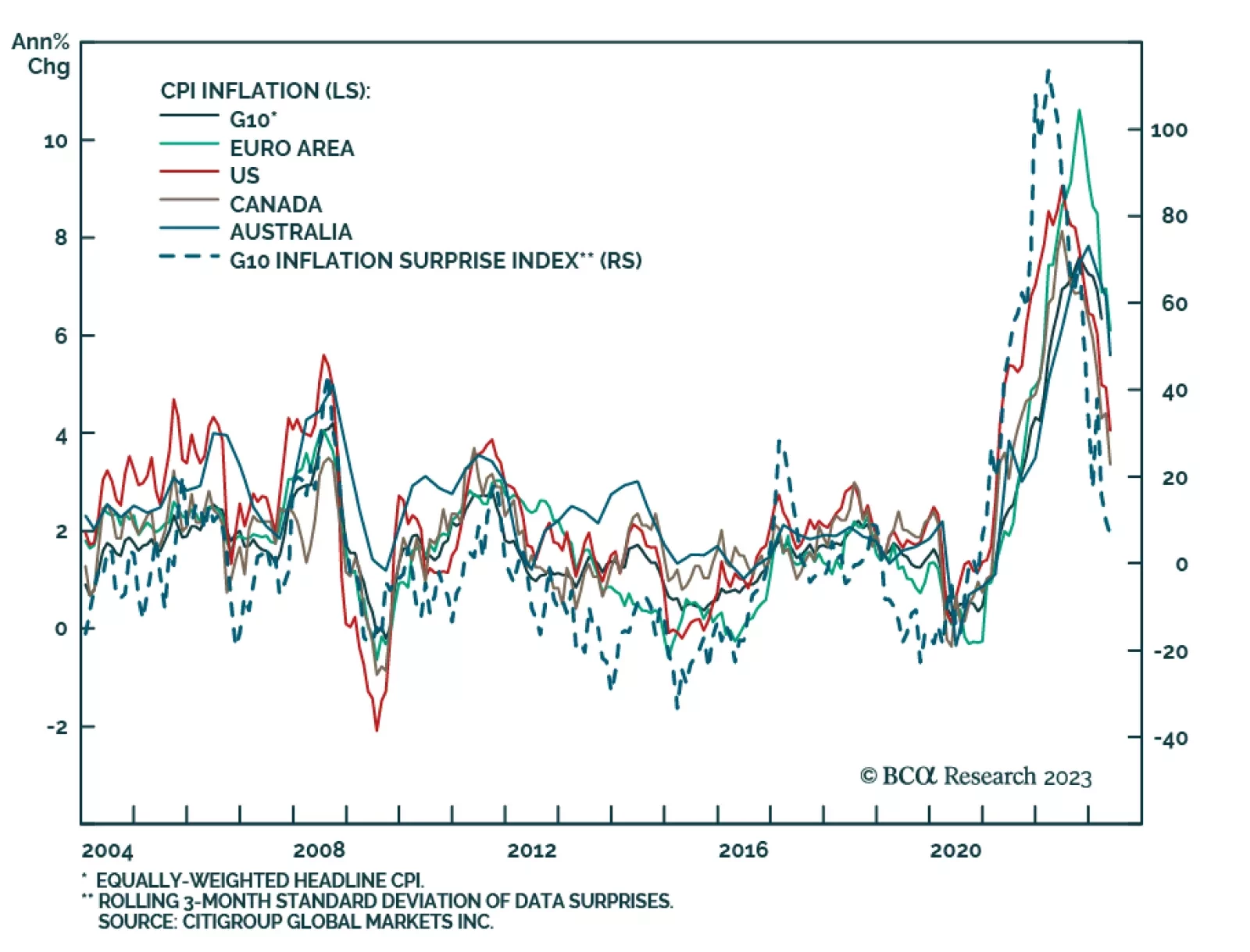

There have been big downside surprises to inflation over the last few weeks. Today, the May monthly print of Australian inflation (covers 67% of all items), came in at 5.6%, versus 6.8% the previous month. This followed a…