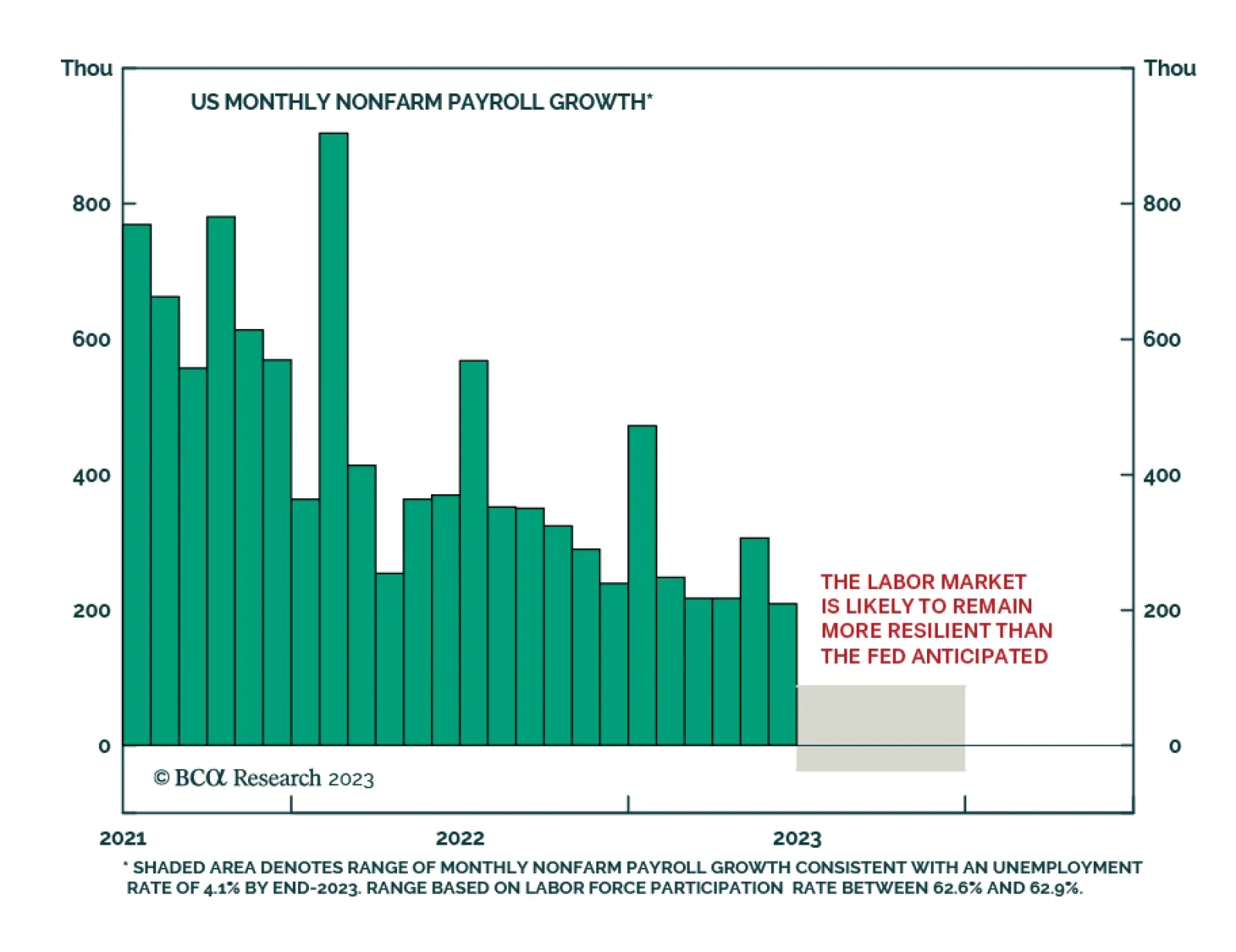

The July FOMC meeting proceeded pretty much as expected. The Fed hiked by 25 basis points, bringing the target range for the funds rate up to 5.25%-5.50%. The forward rate guidance included in the post-meeting statement was also…

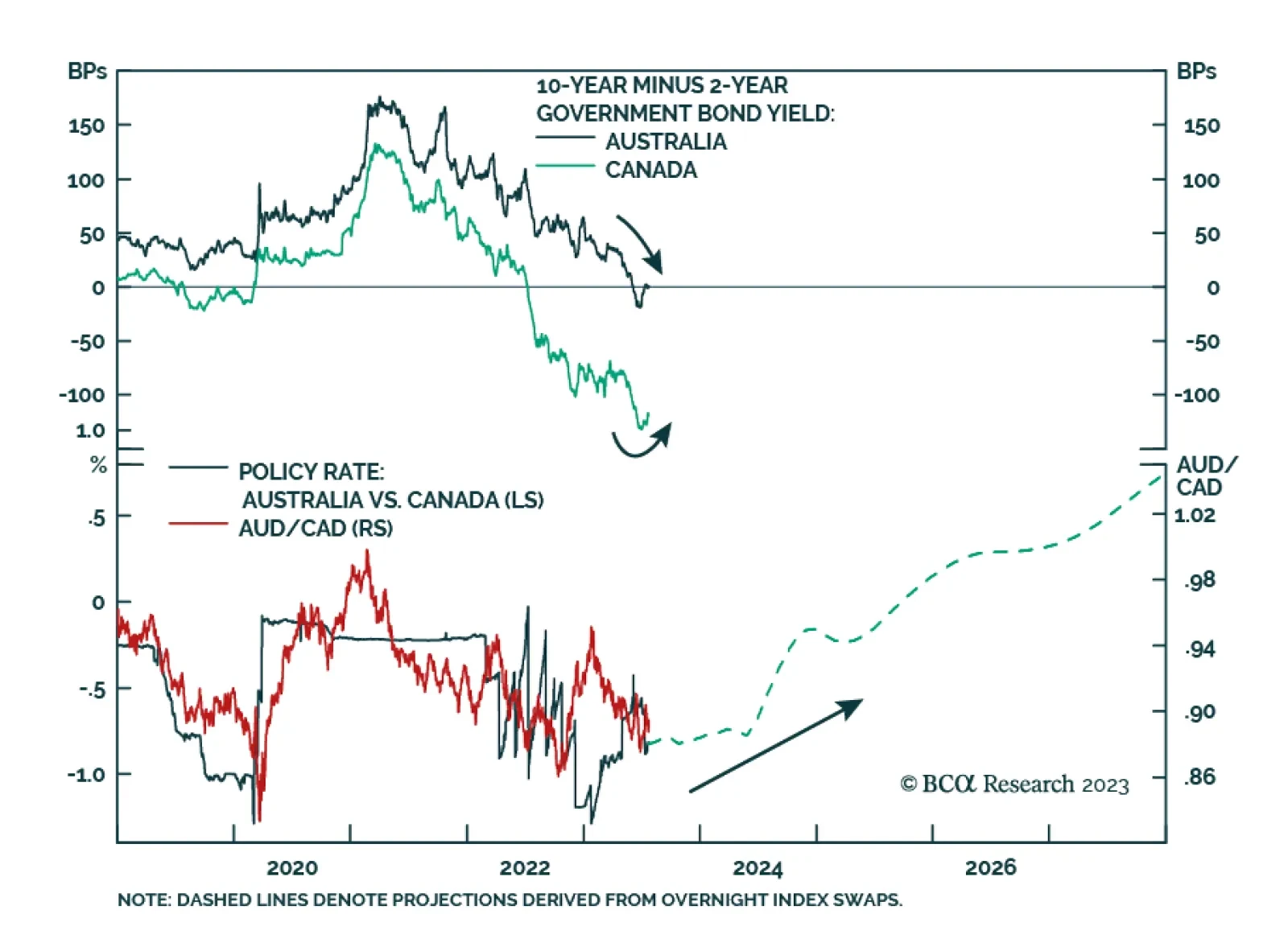

Australia’s June monthly CPI release shows inflationary pressures continue to moderate. Headline CPI inflation receded to 5.4% y/y -- in line with expectations – following a downwardly revised 5.5% y/y in May. To the…

A brief recap of the July FOMC meeting and its investment implications.

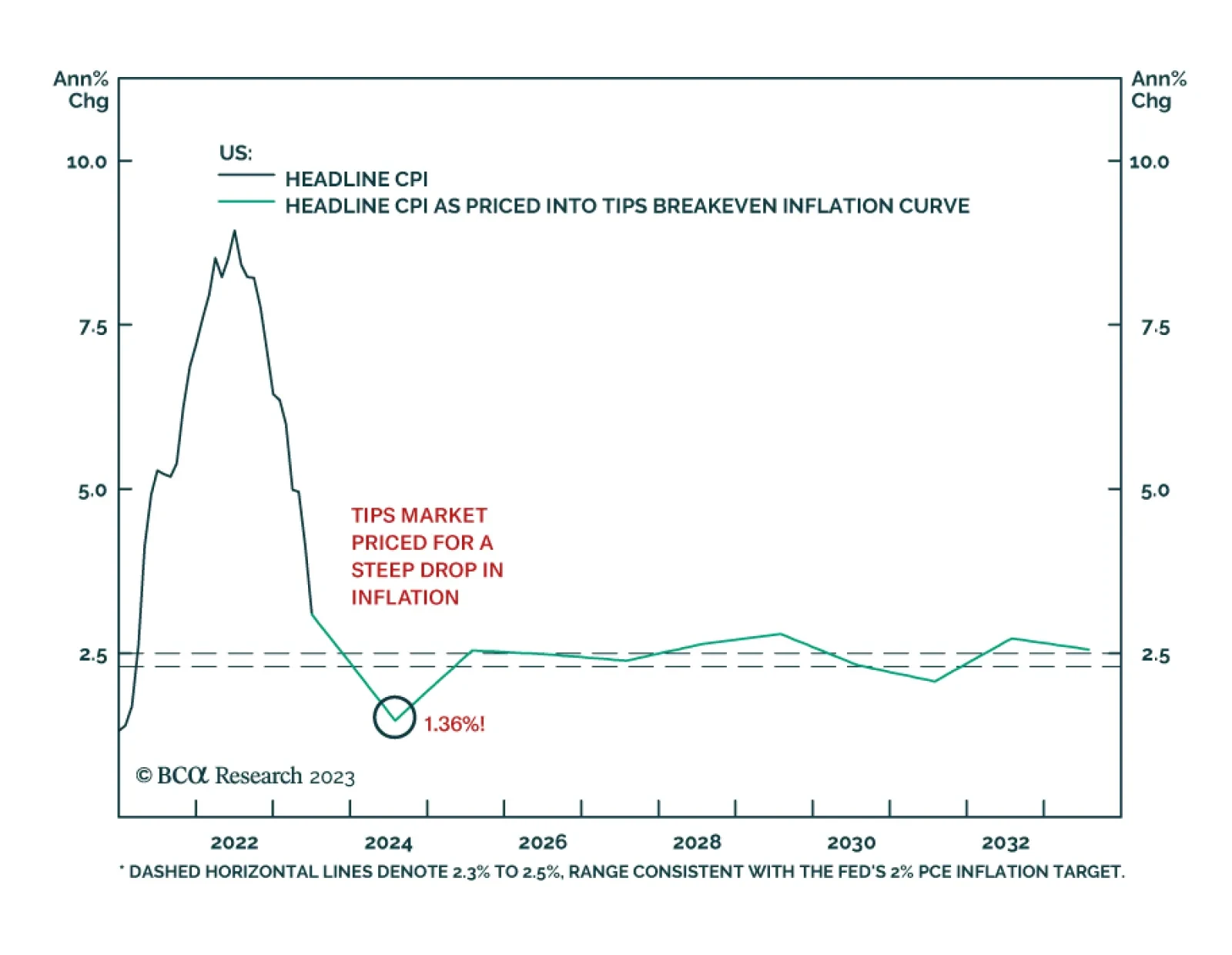

According to BCA Research’s US Bond Strategy service, inflation will fall during the next 12 months, but not by as much as markets expect. Investors should take advantage of this valuation opportunity by entering 2-year/10-…

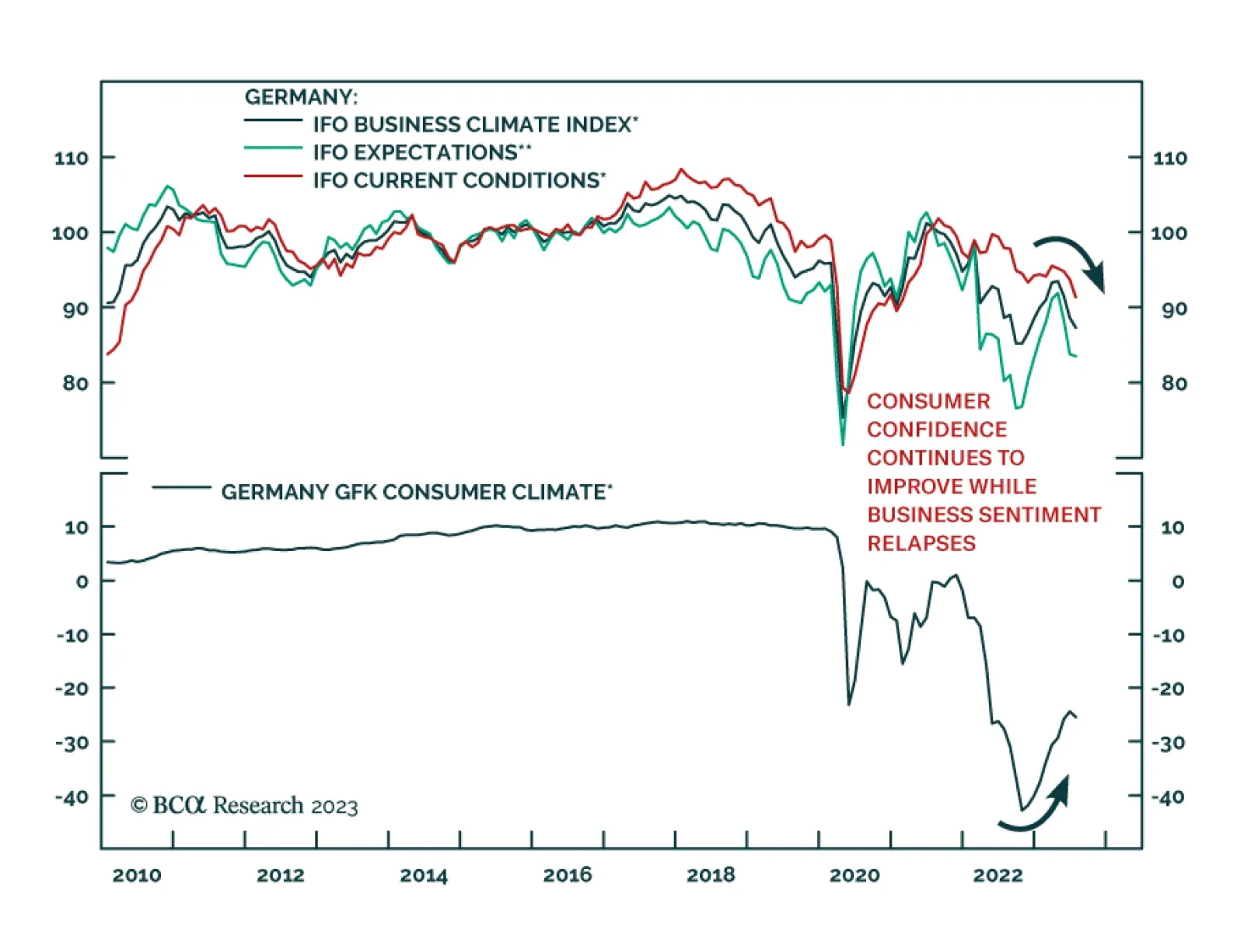

Tuesday’s German IFO survey corroborates the downbeat message from Monday’s flash PMI estimate highlighting weak economic conditions. The headline Business Climate Index dropped 1.3 points to 87.3 in July –…

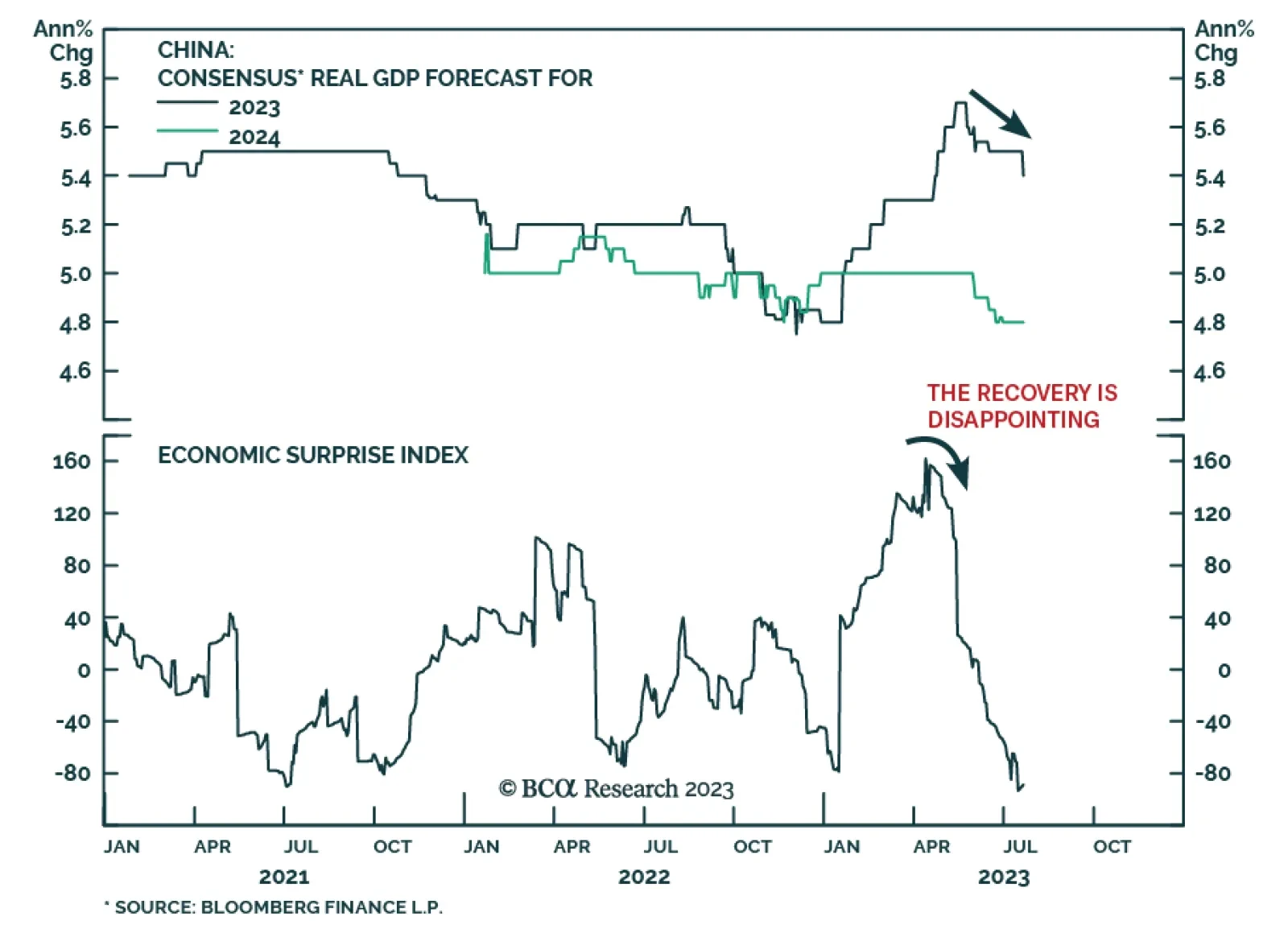

Stay cautious on Chinese stocks. Equity investors should use any rebound in onshore stock prices to downgrade A-shares from overweight to neutral within global and EM equity portfolios. Remain underweight Chinese investable/offshore…

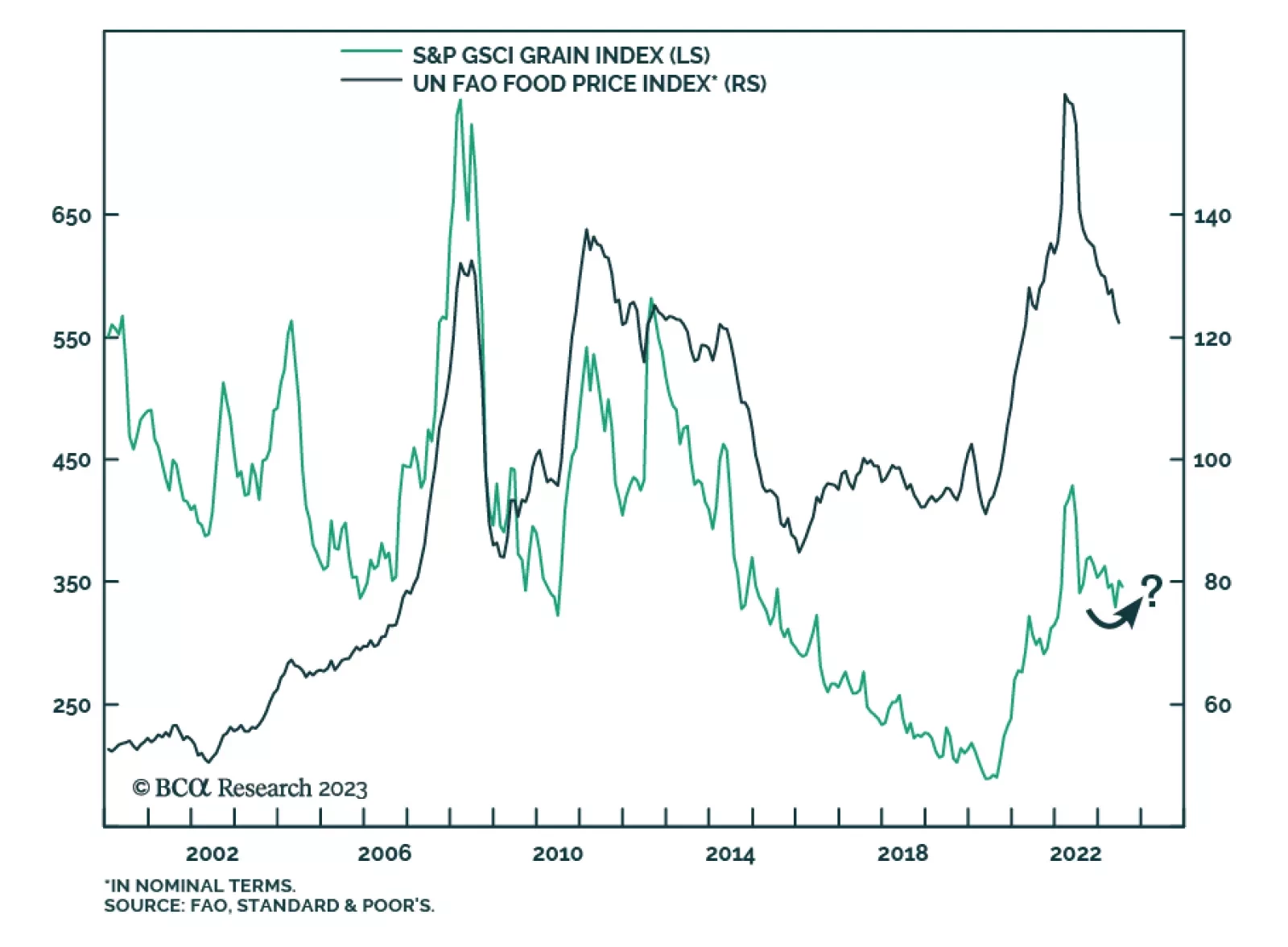

Wheat and corn prices have surged by 16% and 11%, respectively since Russia refused to renew the Black Sea Grain Initiative after it expired on July 17. The deal, which was negotiated with Turkey and the UN, allowed shipments of…

China’s Politburo meeting delivered a disappointing signal about Beijing’s willingness to deliver meaningful stimulus. Although policymakers pledged support for domestic demand, consumer sentiment, and risk prevention…

The snap election which took place on Sunday resulted in a political deadlock in Spain. No single party has won enough seats to form a government. More importantly, both the left-wing bloc and the right-bloc fell short of the 176-…

This week we preview the July FOMC meeting, provide an update on the Fed’s balance sheet and recommend a new TIPS trade.