Inspired by a client’s questions, we examine the rationale behind the implementation of the trailing stop governing our near-term asset allocation recommendations.

According to BCA Research’s Emerging Markets Strategy service, the gap that has formed between the S&P 500 price and its operating profit margins, as well as the divergence between the S&P 500 Forward P/E ratio and…

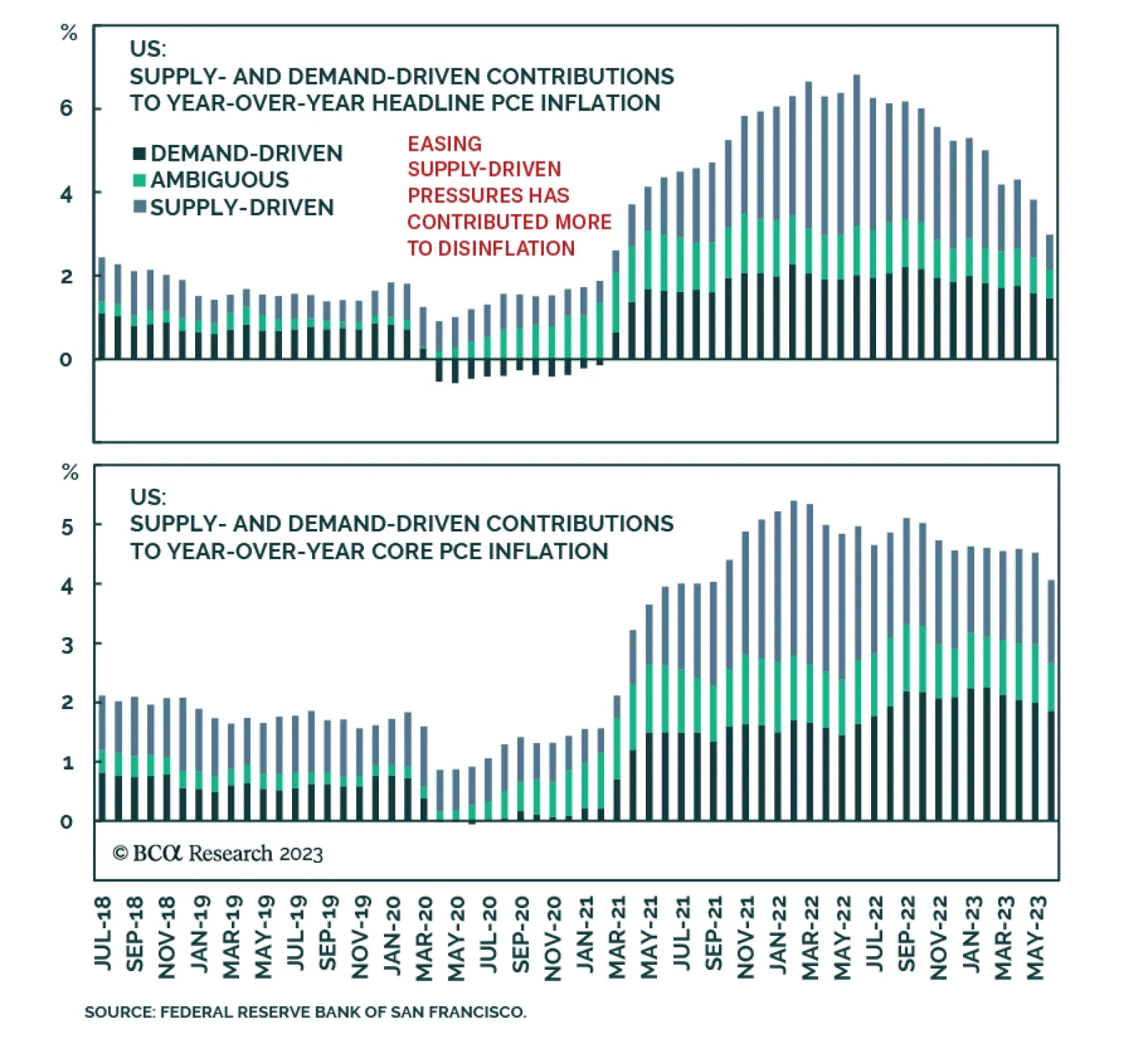

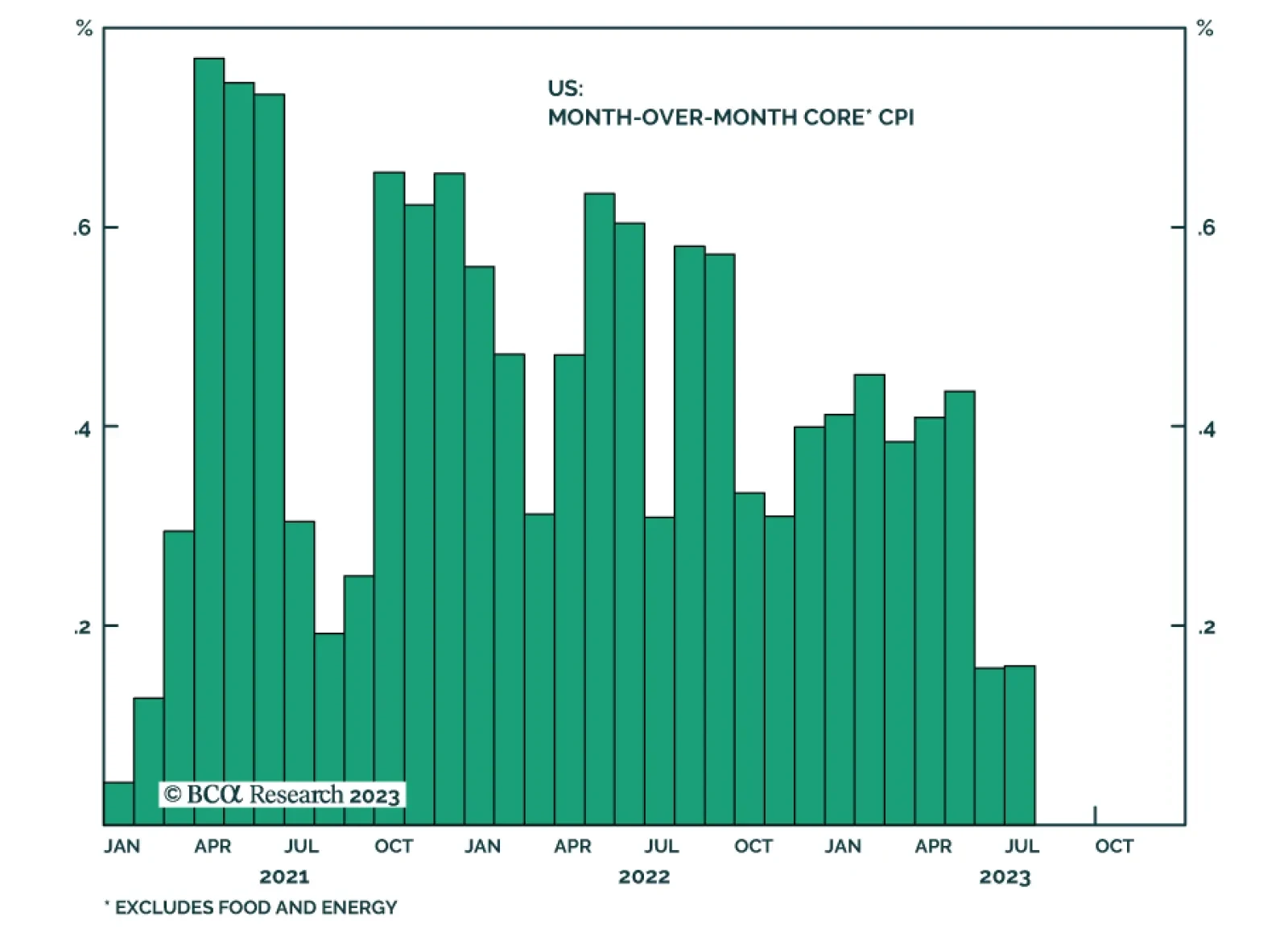

While the July US CPI release provided a positive signal that the disinflationary trend remains intact, a key question going forward is how much more scope is there for this process to run. One way to answer this question is by…

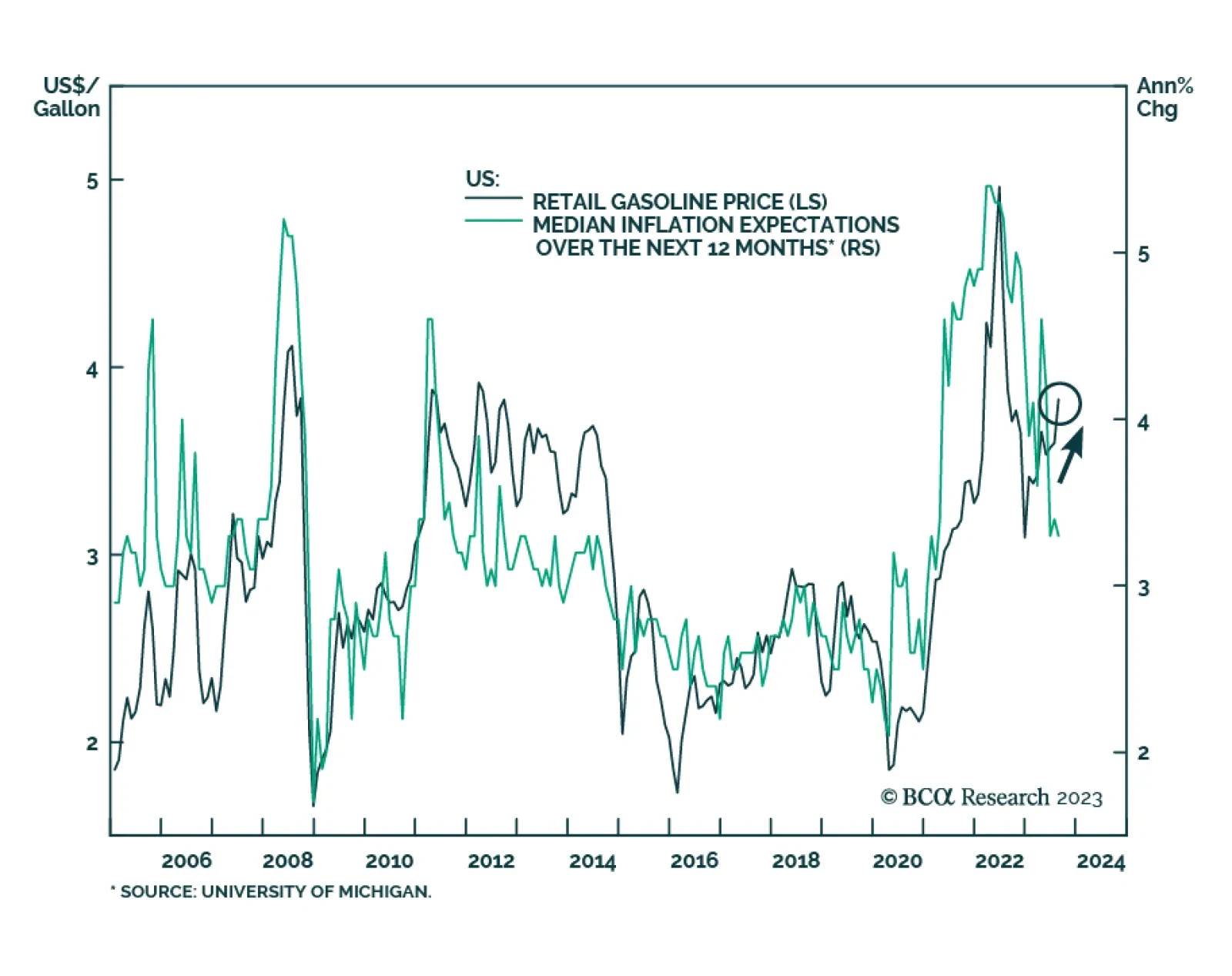

The preliminary release of the University of Michigan’s Consumer Sentiment survey shows US households’ 1-year ahead inflation expectations unexpectedly ticked down from 3.4% to 3.3% in August, surprising consensus…

Numerous divergences have opened up between global risk assets and global business cycle variables. These gaps are unsustainable, and odds are that the recoupling will occur to the downside with risk assets selling off.

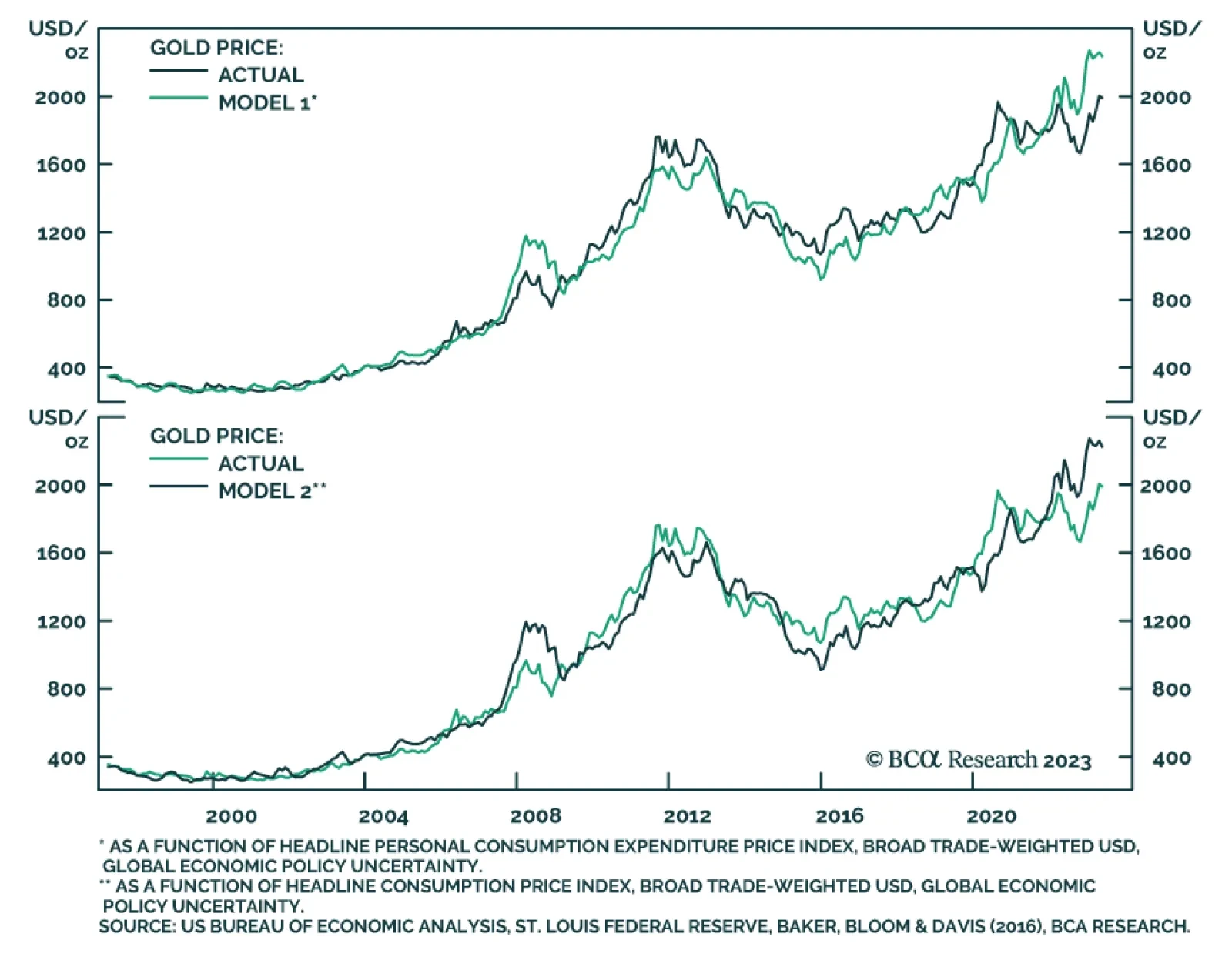

According to BCA Research’s Commodity & Energy Strategy service, gold’s appeal as a safe haven and store of value will increase as fiscal dominance overtakes monetary dominance at the Fed. Fitch’s…

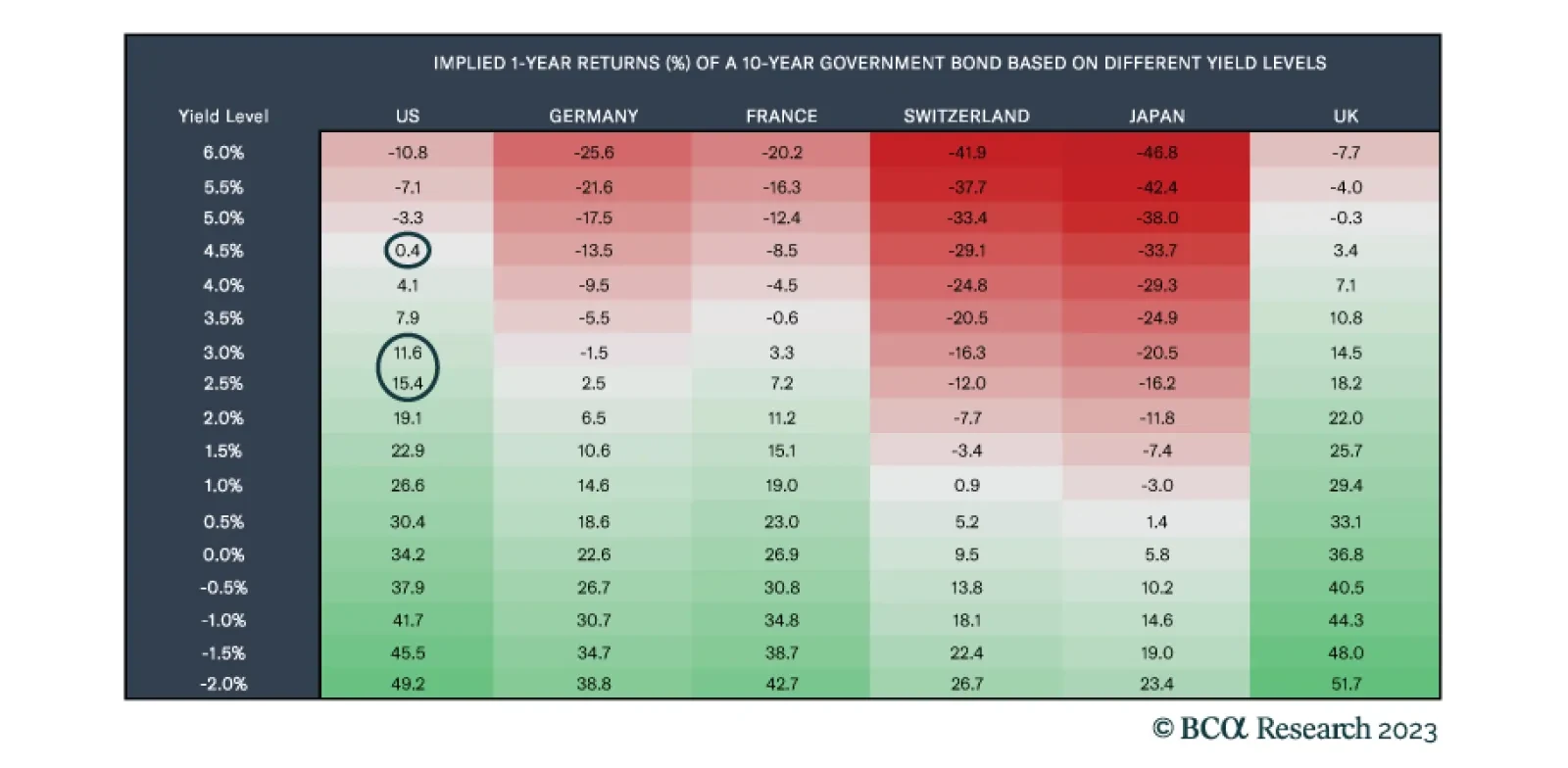

The rise in bond yields over the past few weeks has made some investors wonder whether US Treasurys and other government bonds really are a good hedge against recession. Could there be an environment in which the economy goes…

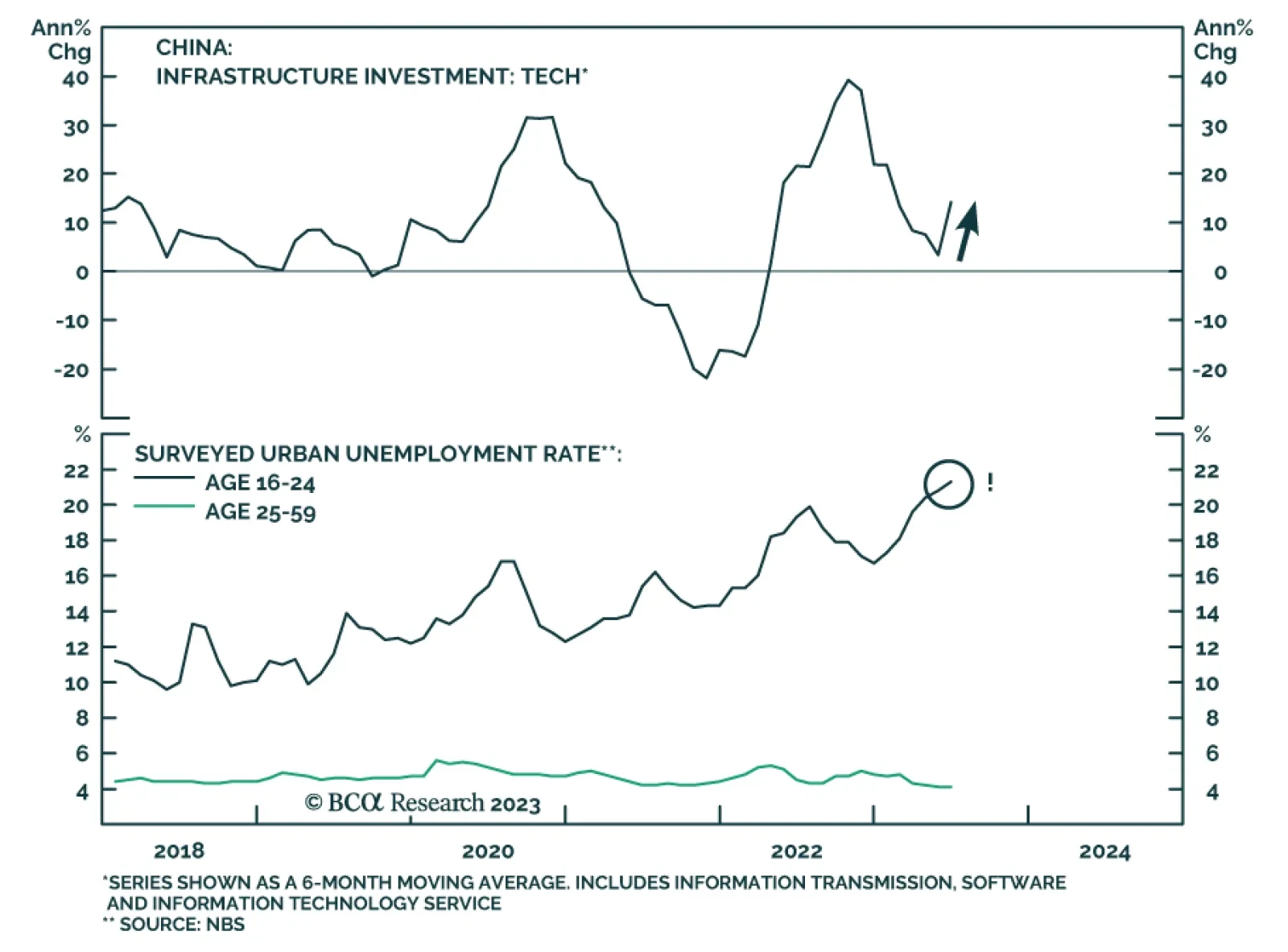

On Wednesday, President Joe Biden announced that a new ban on some US investment into China’s quantum computing, advanced chips and artificial intelligence sectors will come into force next year. This latest escalation is…

As expected, the US CPI release shows the monthly headline and core inflation gauges were both unchanged at 0.2% m/m in July. Notably, annualized monthly core inflation fell below 2% for the second consecutive month. Similarly,…

Some thoughts on this morning’s inflation number and implications for Treasury yields and TIPS.