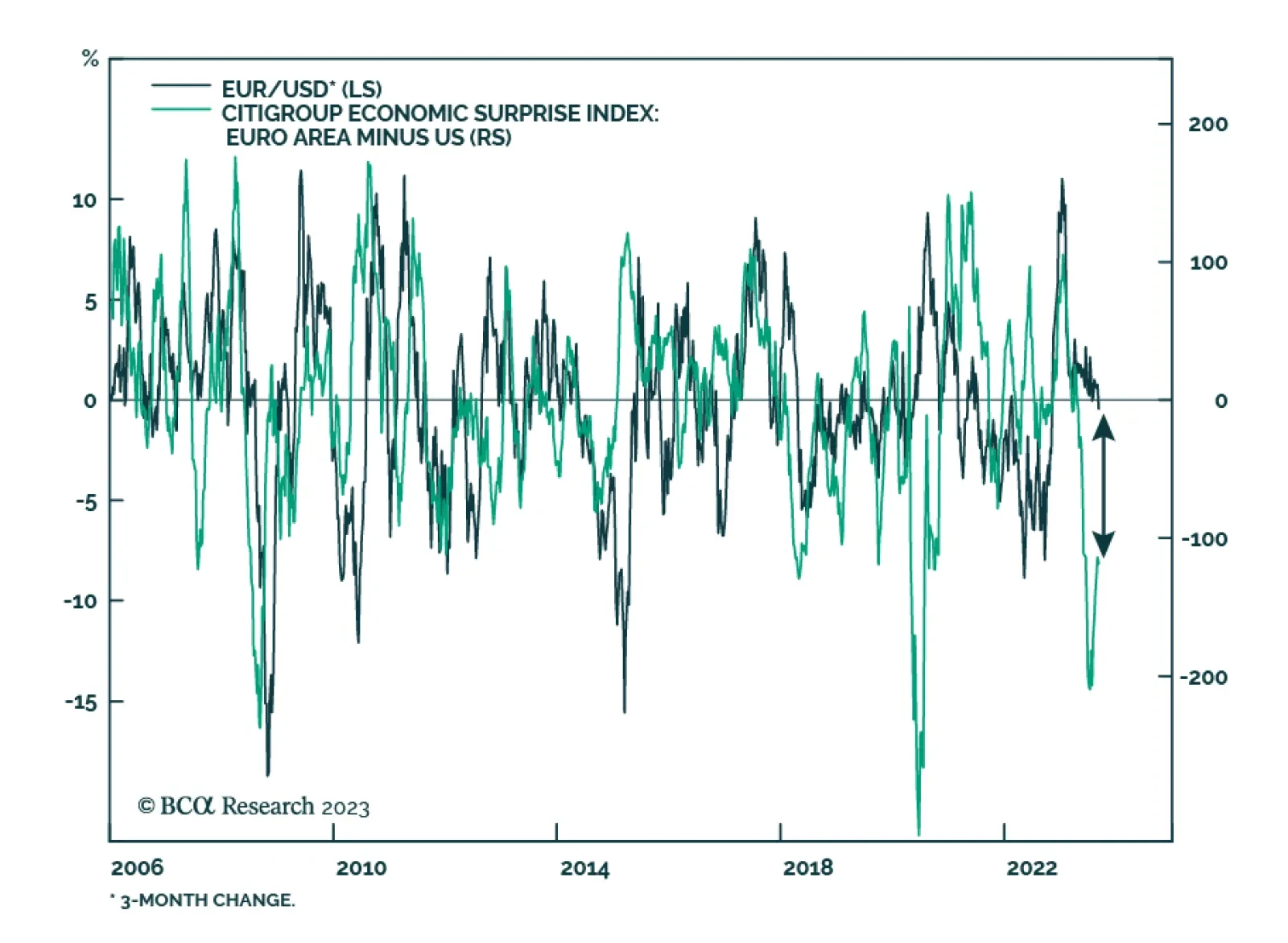

Recent Eurozone economic data indicate that restrictive monetary policy and the global manufacturing downturn are weighing down on the region’s economy. In particular, new orders at German factories plunged by 11.7% m/m…

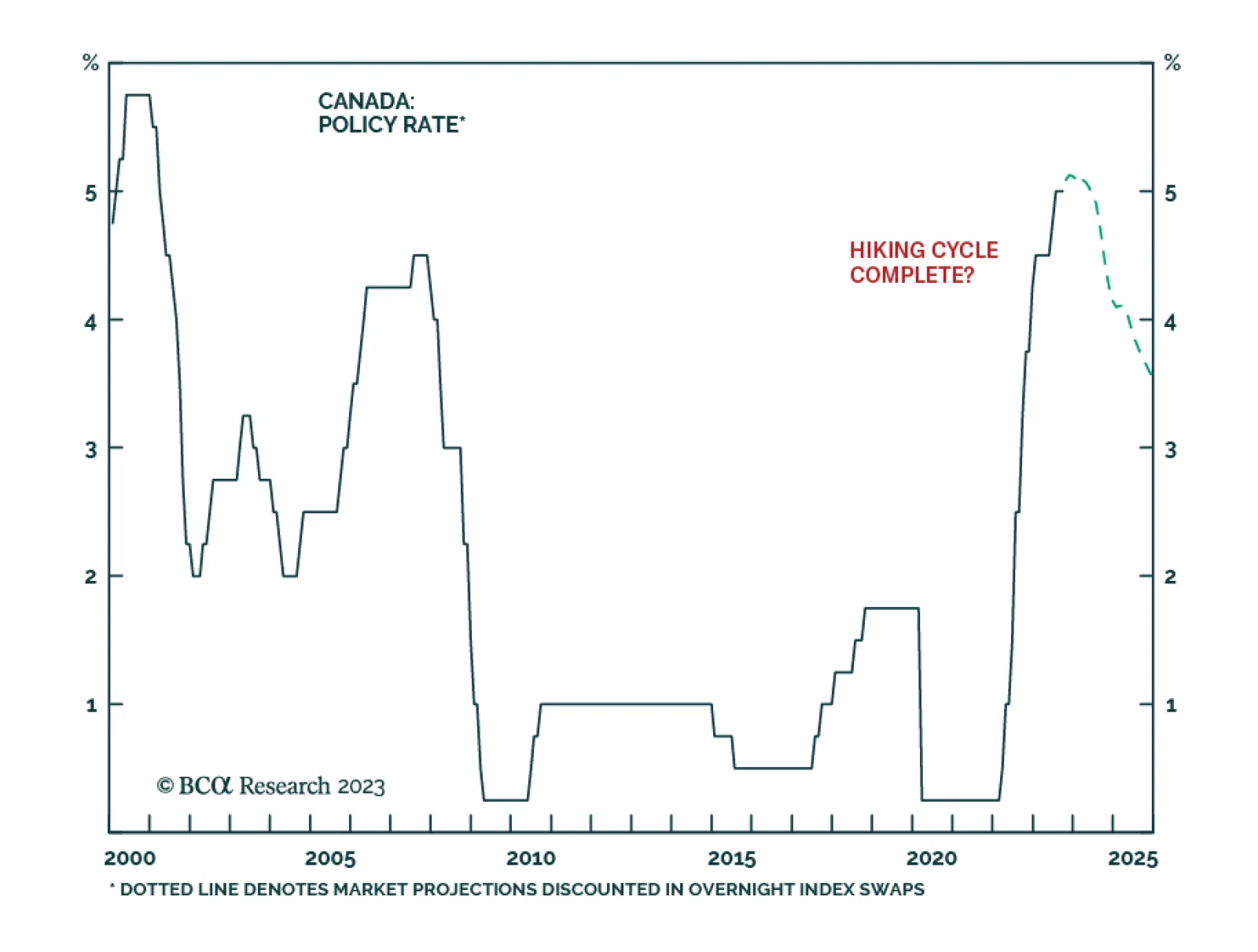

As expected, the Bank of Canada kept its policy rate unchanged at 5% on Wednesday. In particular, the central bank highlighted that domestic economic growth deteriorated. Indeed, last week’s GDP release showed the…

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

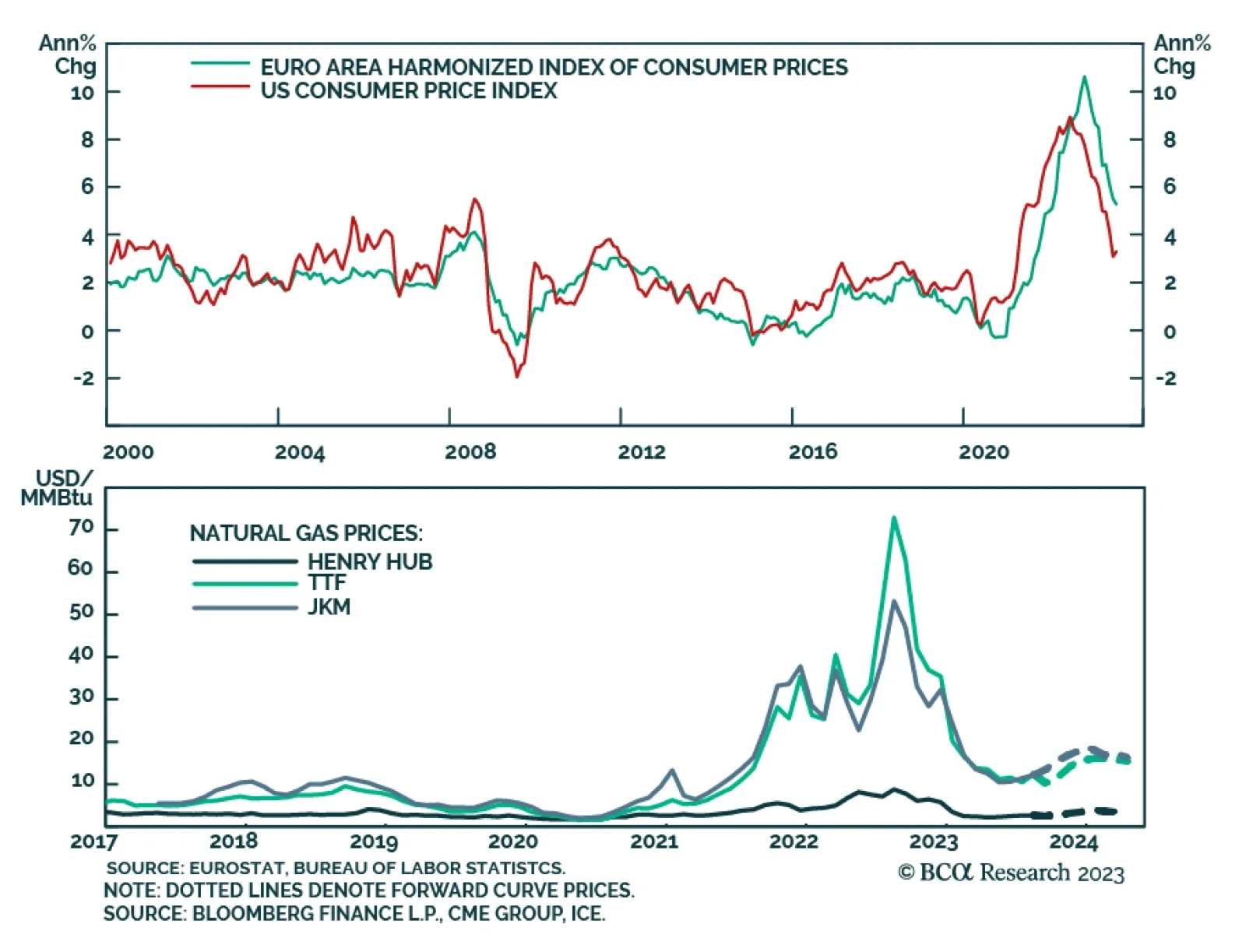

The broader rally that started in June is premised on a Goldilocks narrative that will prove to be a fairy tale. Either by stubborn inflation. Or, by higher unemployment that shows that the war on inflation is far from costless. Or,…

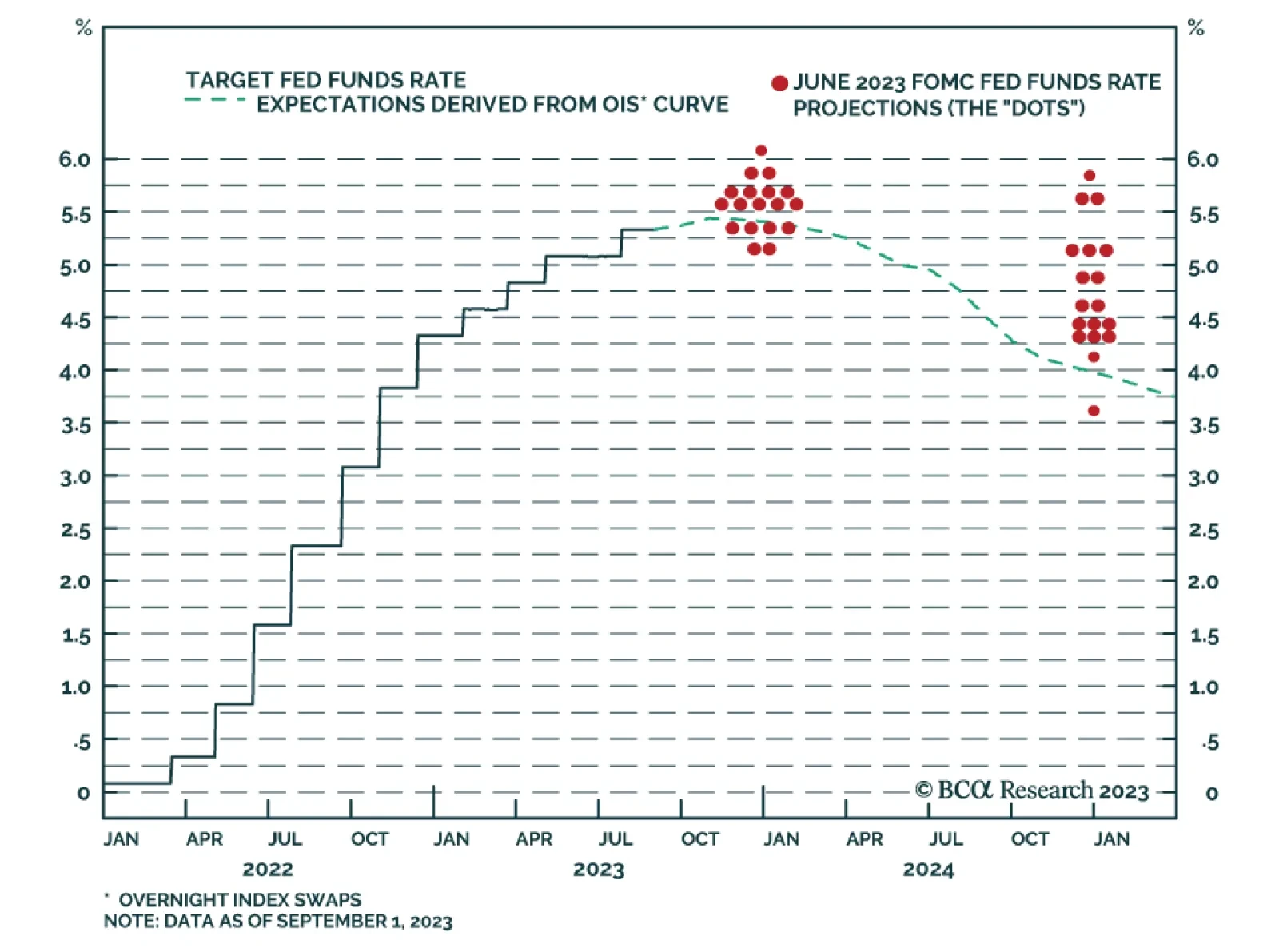

In a Tuesday morning television interview, Fed Governor Christopher Waller signaled that the Fed will not lift rates when it meets later this month. Specifically, Waller echoed language used by Chair Powell at the Jackson Hole…

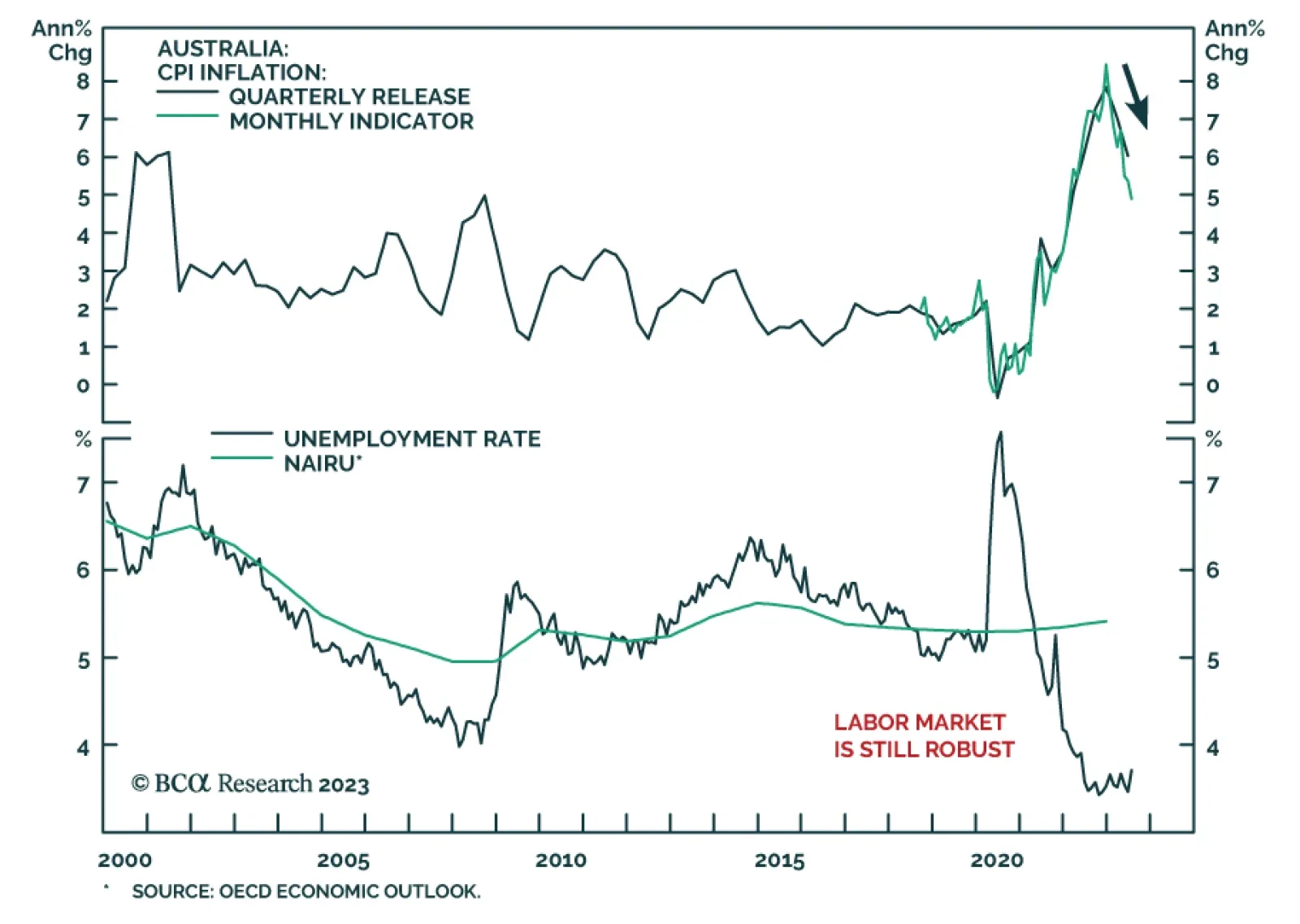

The AUD was the worst performing currency on Tuesday after the Reserve Bank of Australia kept its cash rate target unchanged at 4.1% for the third consecutive month. In particular, outgoing Governor Philip Lowe underscored that…

US bond investment takeaways from this week’s PCE and employment releases.

According to BCA Research’s Commodity & Energy Strategy service, current monetary policy settings at the Fed and ECB risk pushing commodity and energy prices lower. Lower prices and higher rates will suppress capex and…