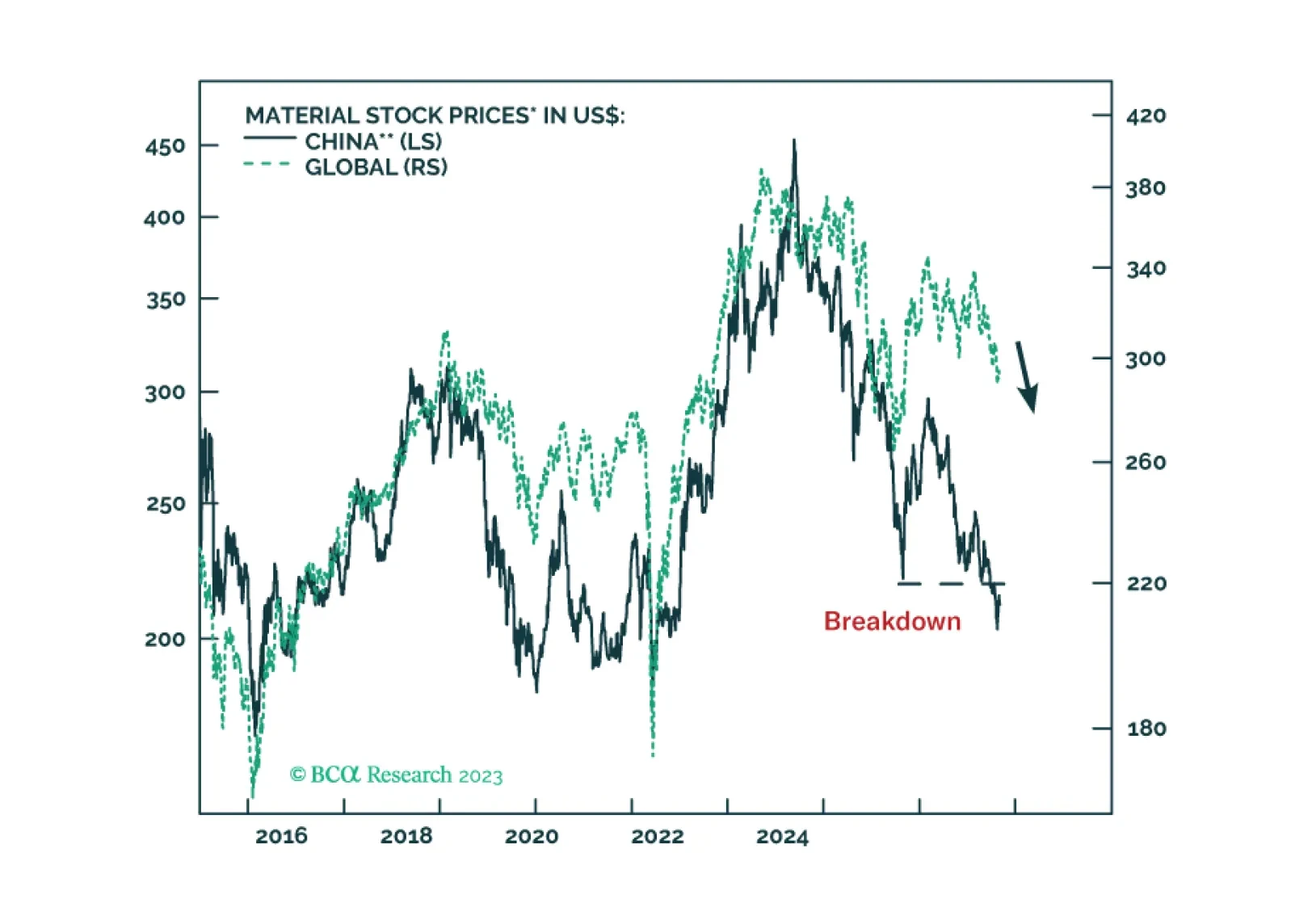

In financial systems, cracks typically begin on the periphery and then expand to the center. Hence, the ruptures on the fringes often act as an early warning. These fissures tend to widen and spread to the core, causing a breakdown…

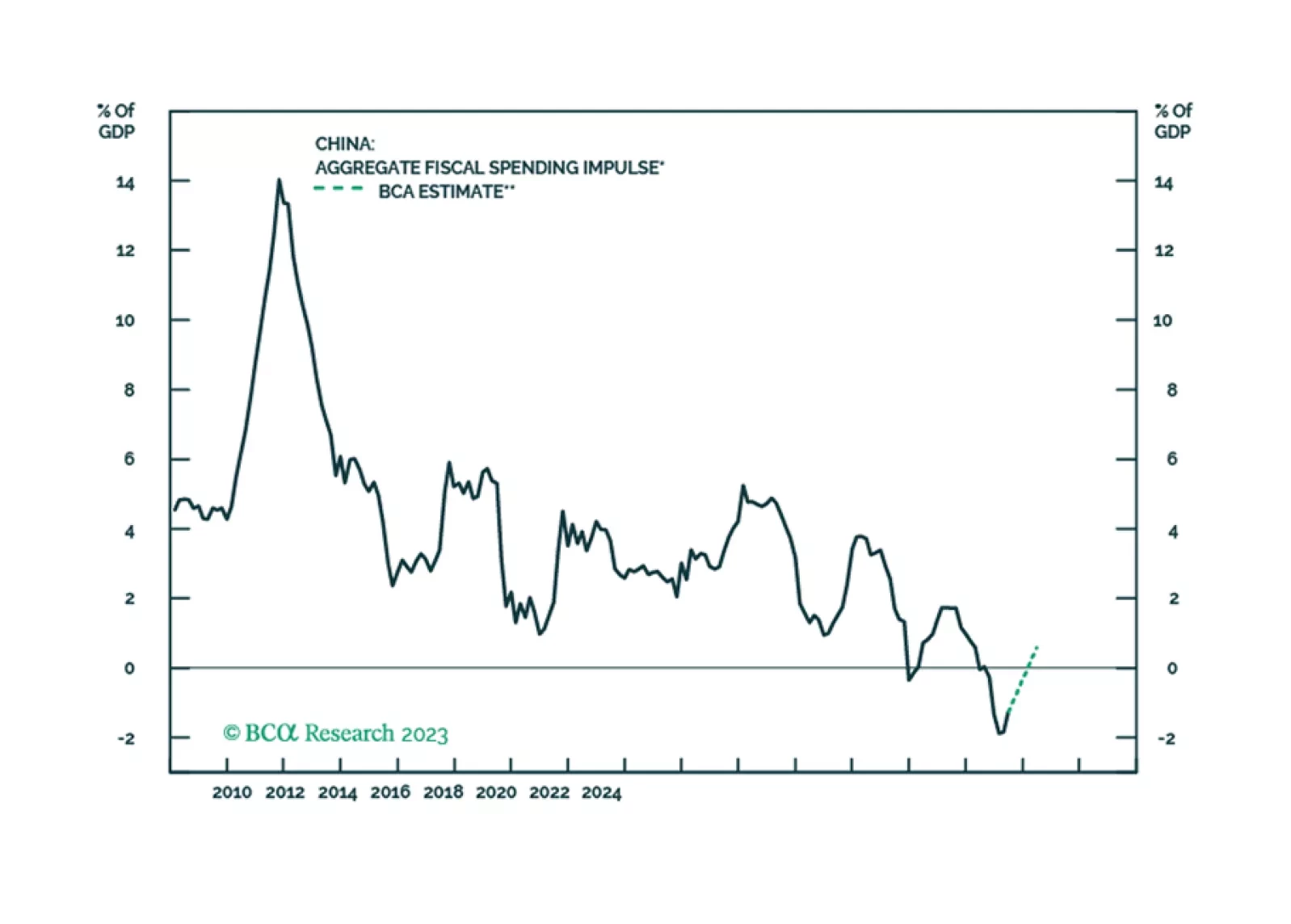

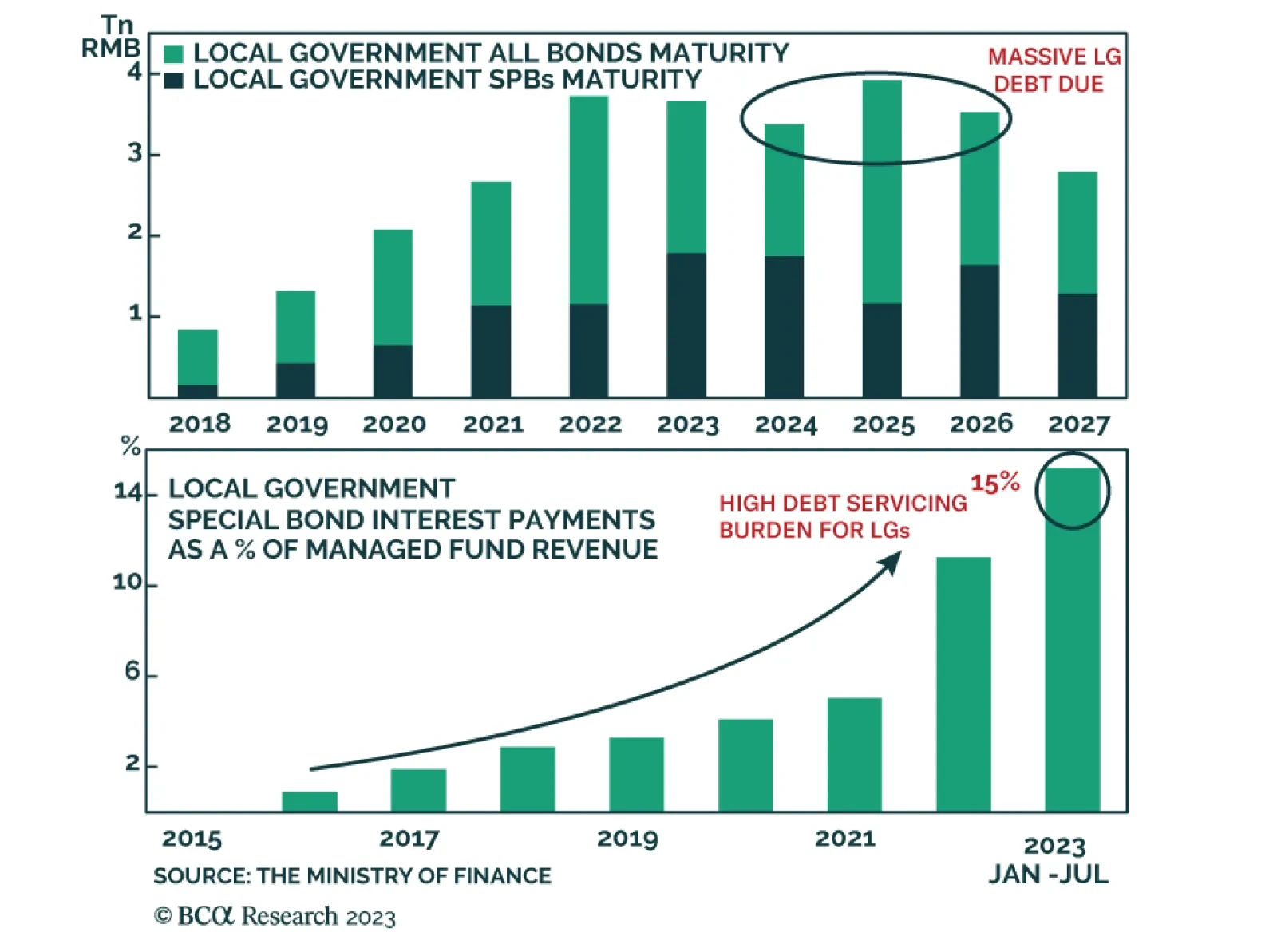

According to BCA Research’s China Investment Strategy service, China's recently introduced debt swap program will help prevent mushrooming defaults, but it will not lead to an acceleration in growth. In August, the…

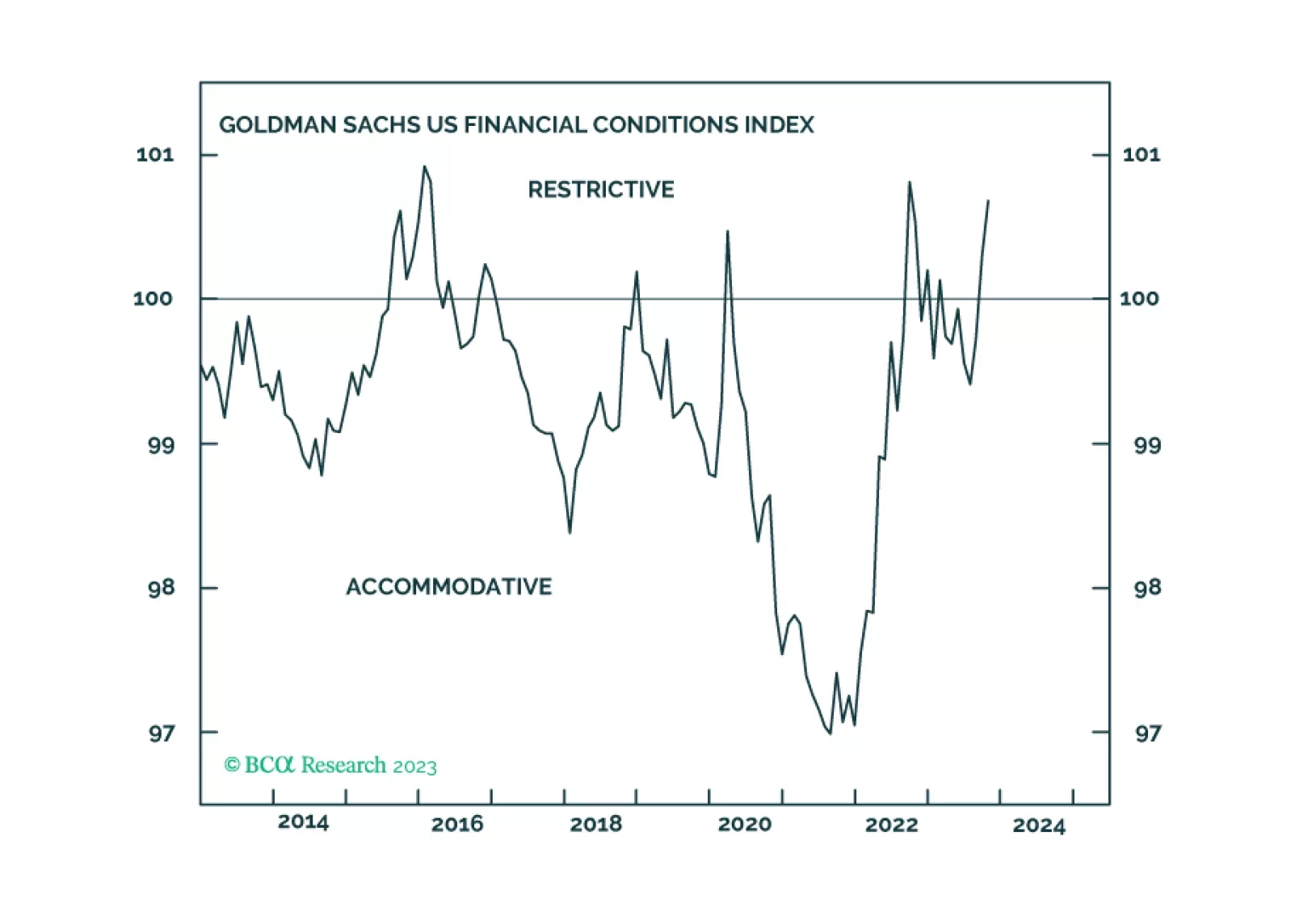

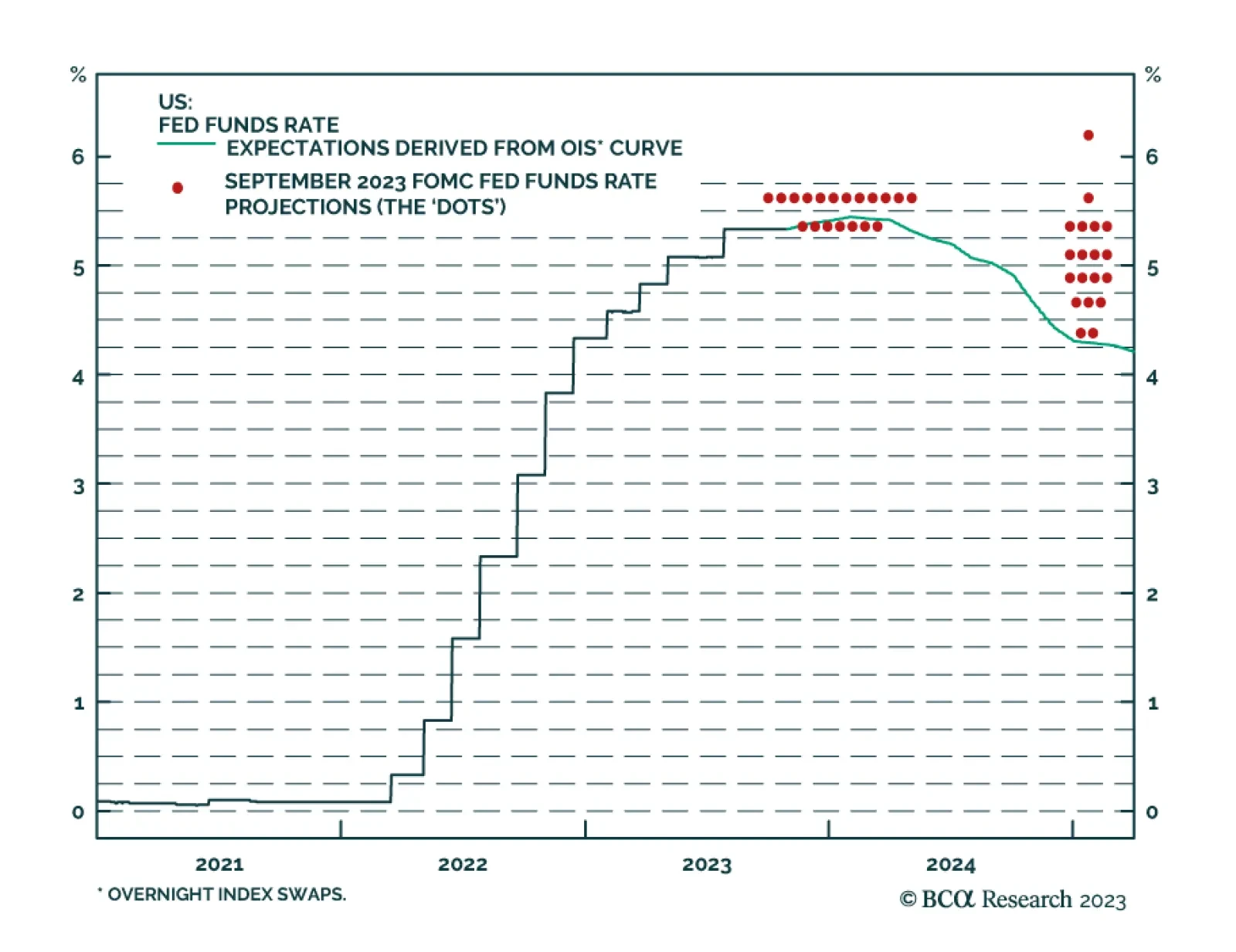

As expected, the Fed stood pat at its Wednesday meeting, maintaining the target for the fed funds rate at 5.25-5.50%. The minimal changes made to the Fed Statement were to emphasize the strong pace of economic activity in Q3, to…

Our reaction to today’s FOMC meeting and the Treasury’s Quarterly Refunding Announcement.

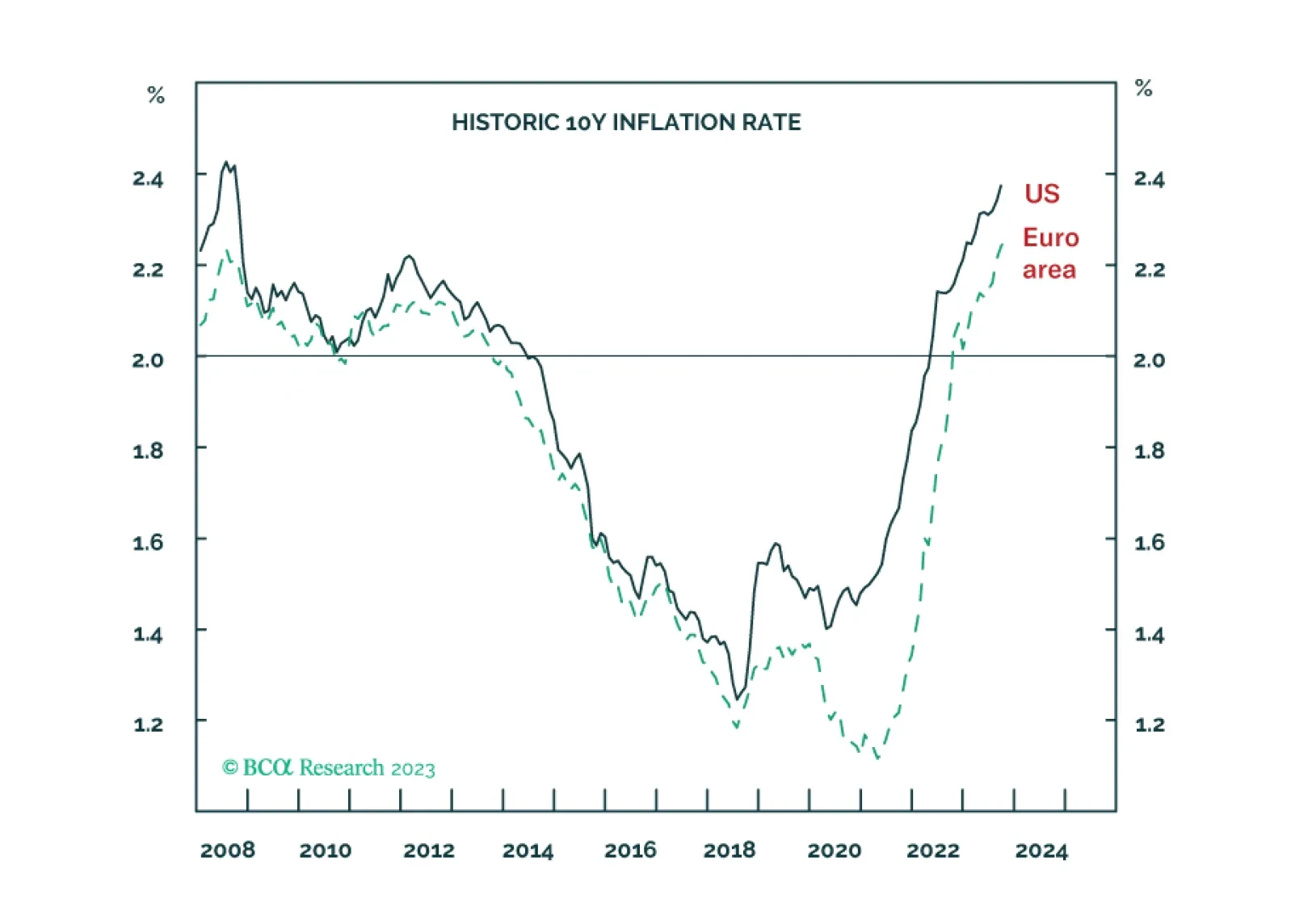

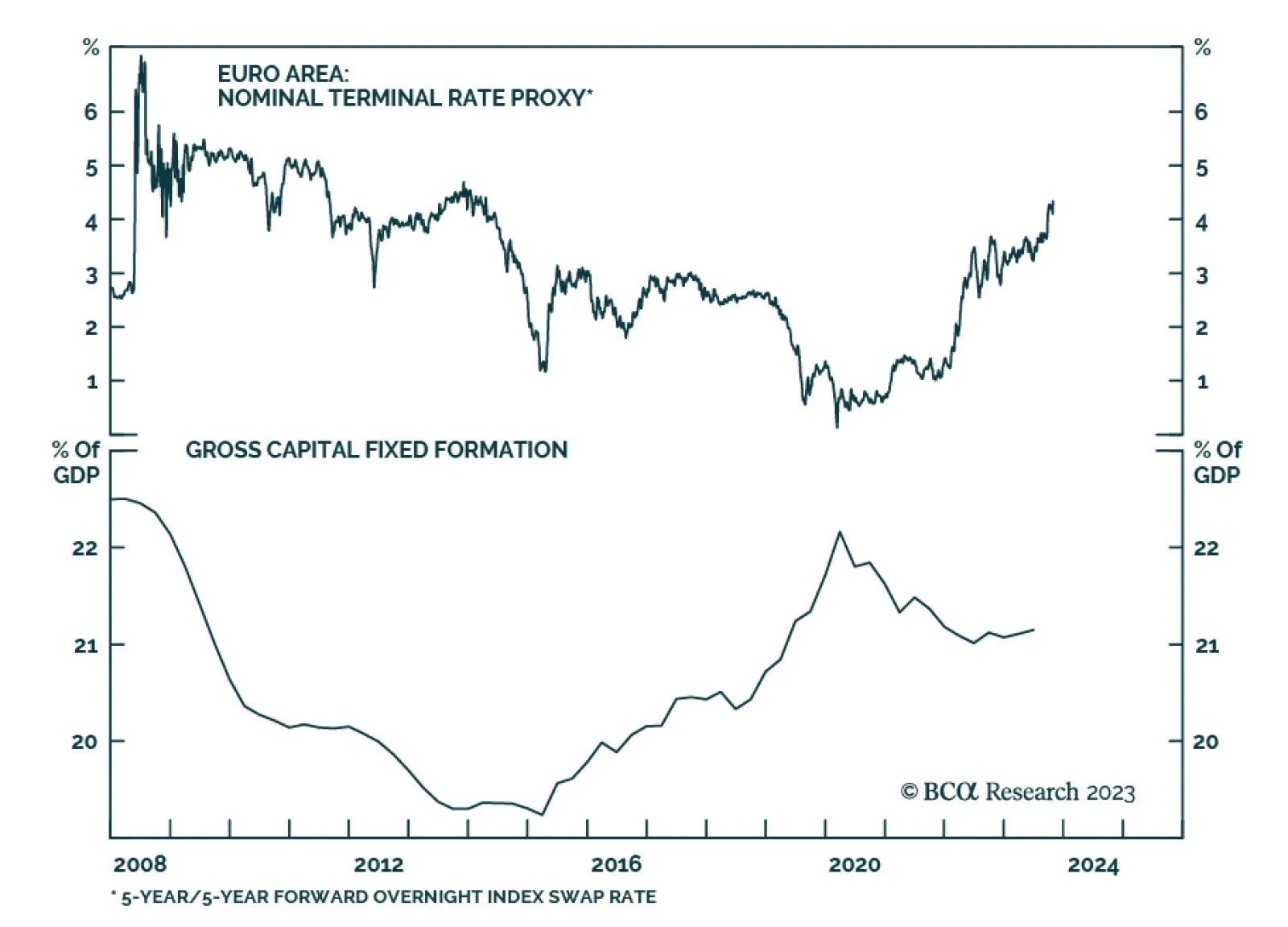

The fundamental component of long-term inflation expectations has climbed to its highest level since 2008 in both the US and the euro area. This means that both the Fed and the ECB will need to engineer inflation to undershoot 2…

We maintain our view that China’s economic growth in the coming months will remain lackluster. Beijing's recent measures to provide additional financing may help to bridge the gap in government spending in the rest of 2023 and into…

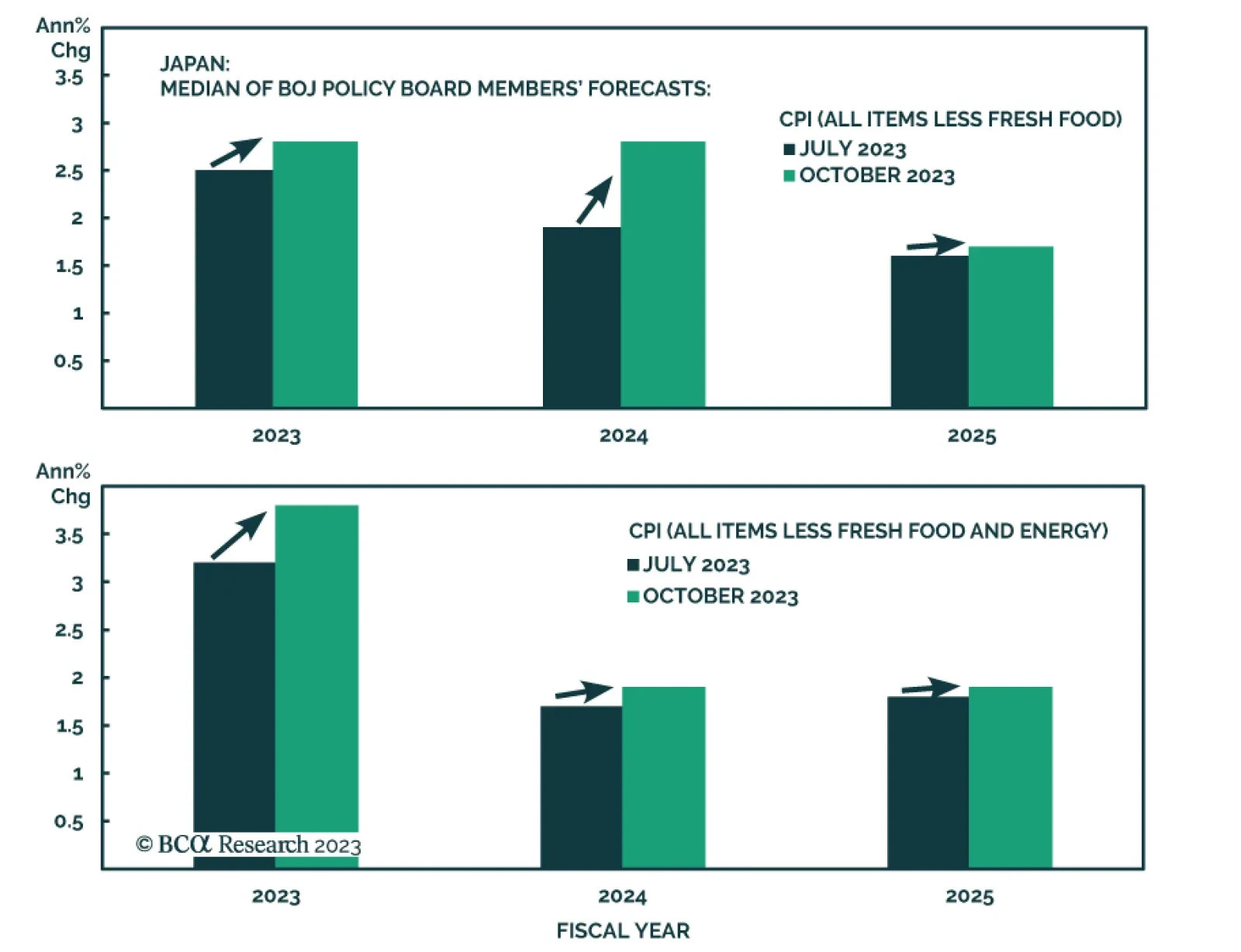

The Bank of Japan adjusted the language of its Monetary Policy Statement on Tuesday to indicate that it will allow greater flexibility it its yield curve control policy (YCC). It indicated that although the target level of 10-…

The European money market curve anticipates three rate cuts by October 2024. This pricing is appropriate considering the outlook for European growth next year. BCA’s Europe strategist expect a recession in the second half…

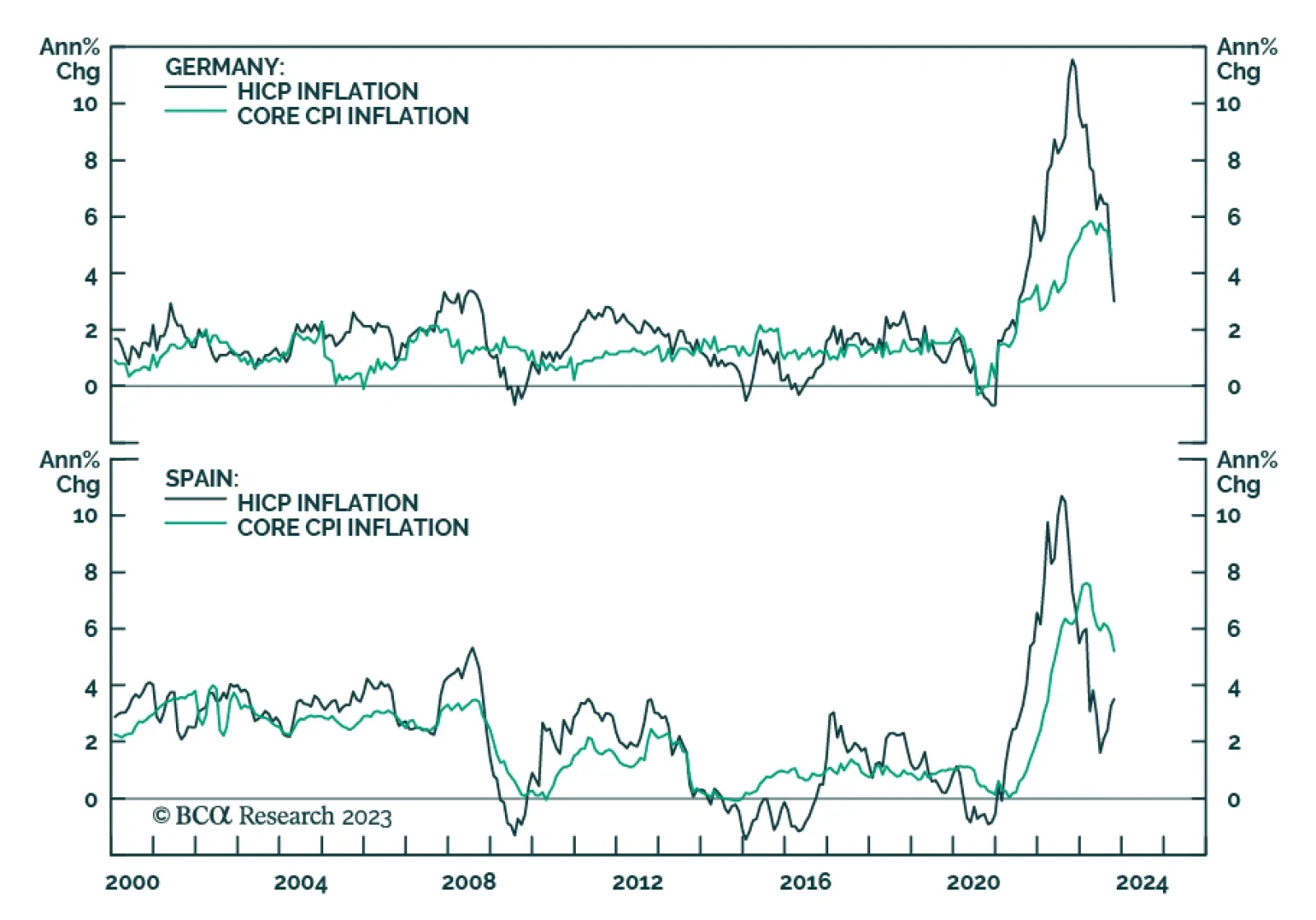

Eurozone economic data sent a positive signal on Monday. Preliminary CPI releases from Germany and Spain show price pressures continue to moderate. In Germany, the harmonized index declined by 0.2% m/m while the annual rate of…

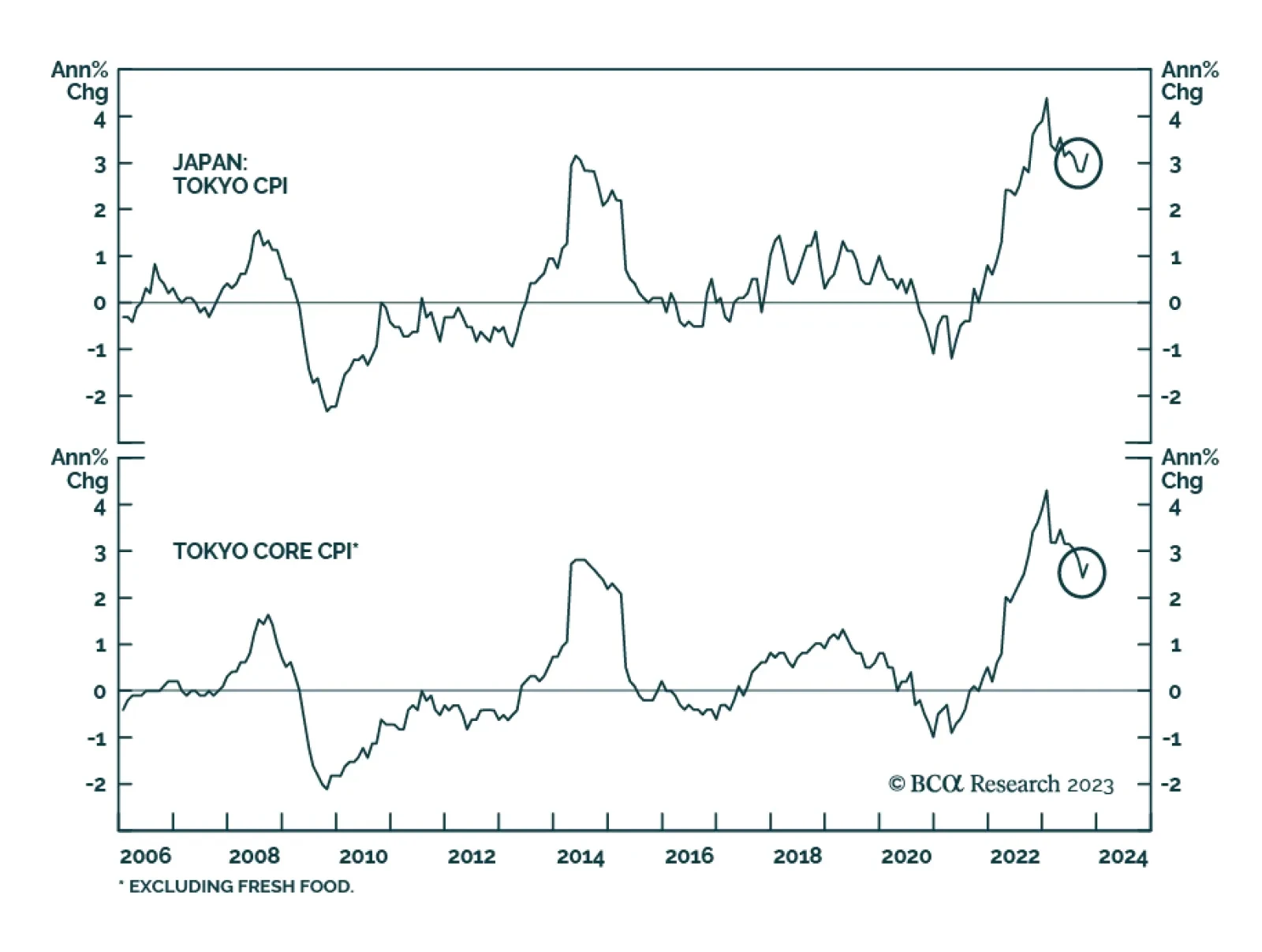

Friday's Tokyo CPI release suggests that inflationary pressures are picking back up again in Japan. Headline inflation accelerated to 3.3% y/y – surprising expectations it would remain unchanged at 2.8% y/y. The ex-…