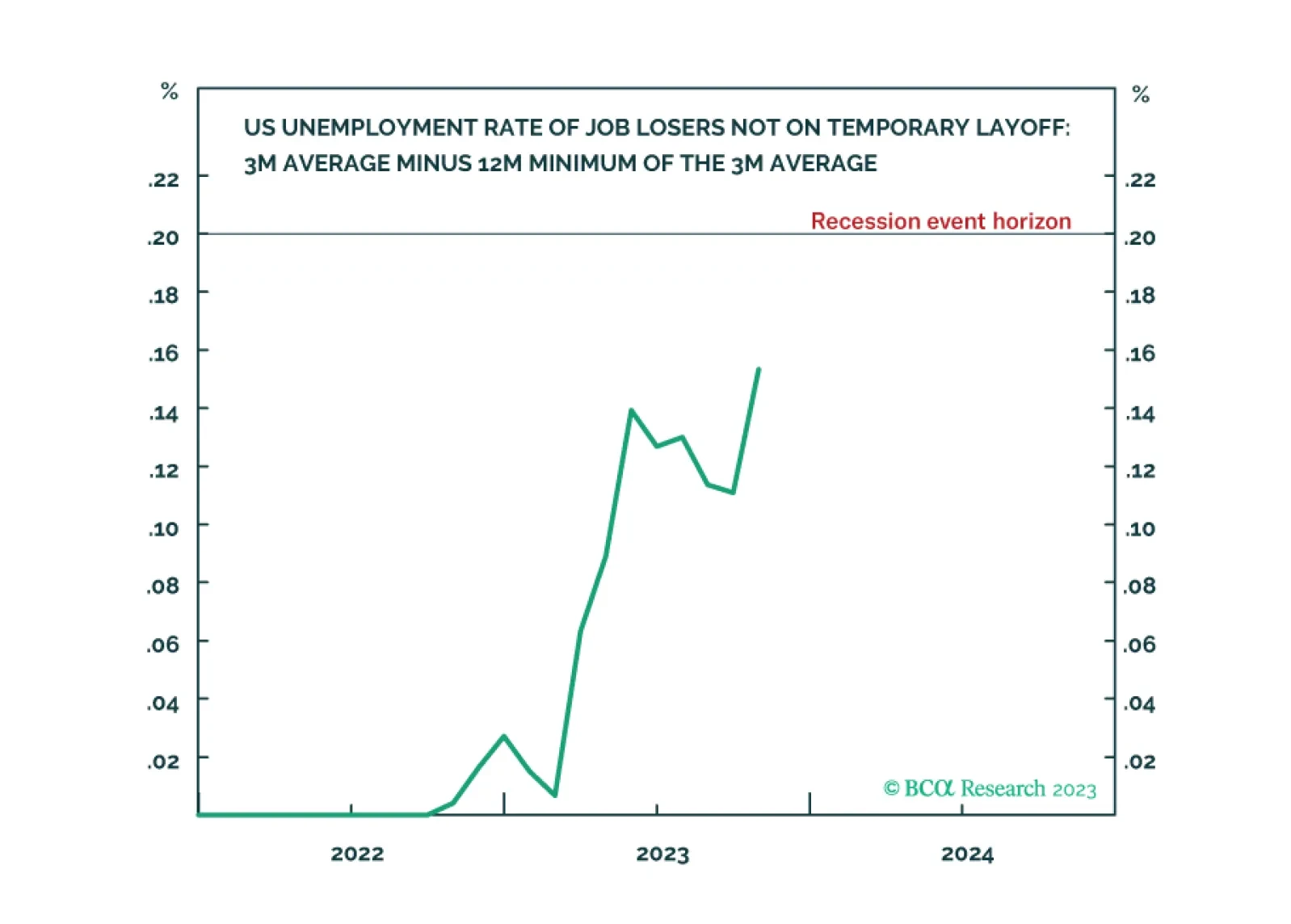

Following the October US jobs data, the ‘Joshi rule’ real-time US recession indicator increased from 0.11 to 0.15, meaning that it is fast approaching its event horizon of 0.20. We go through the investment implications. We also…

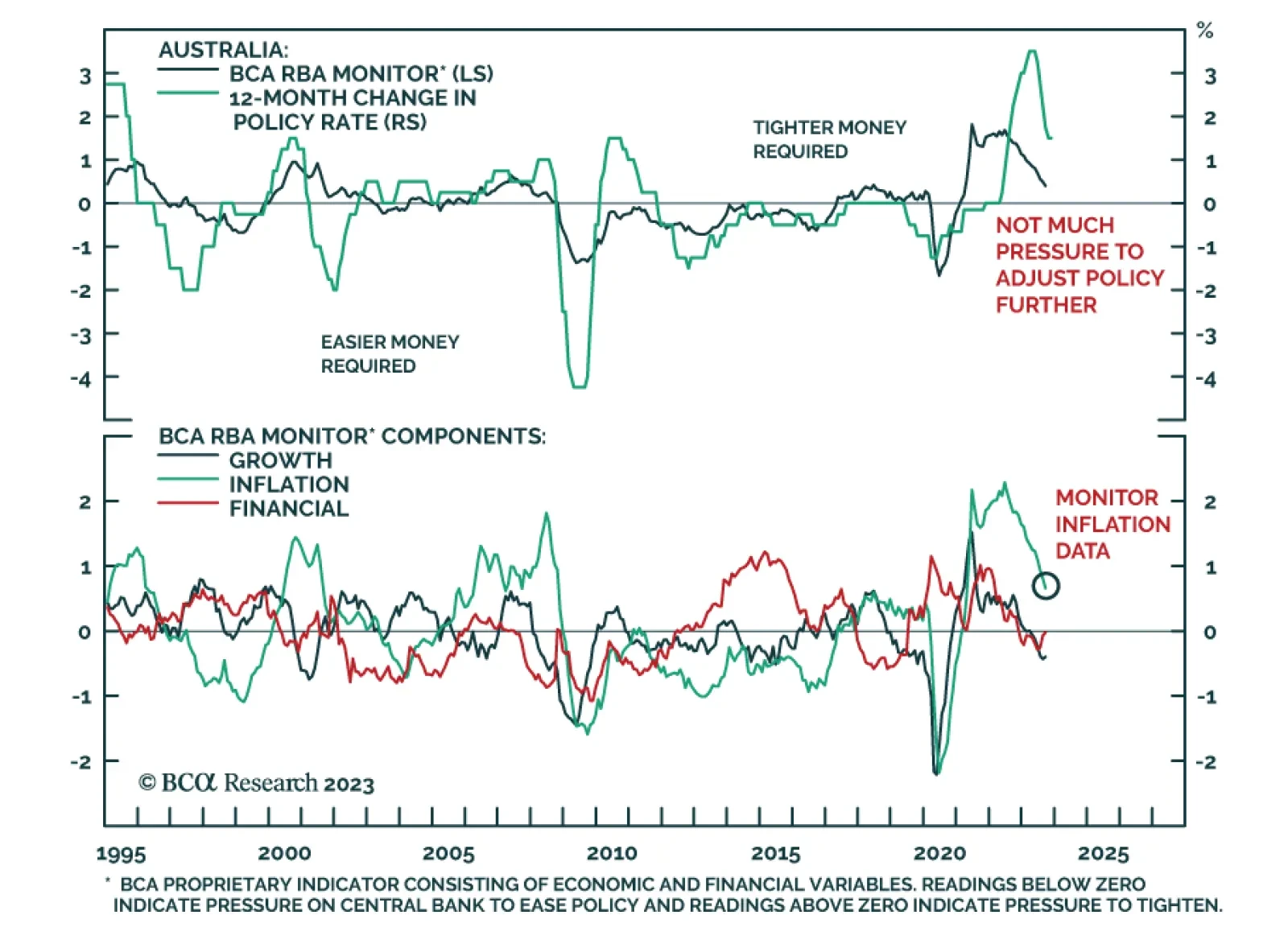

The Reserve Bank of Australia lifted the cash rate by 25 bps to a 12-year high of 4.35% on Tuesday, in line with consensus expectations. Governor Michele Bullock's post meeting statement underscored that although inflation is…

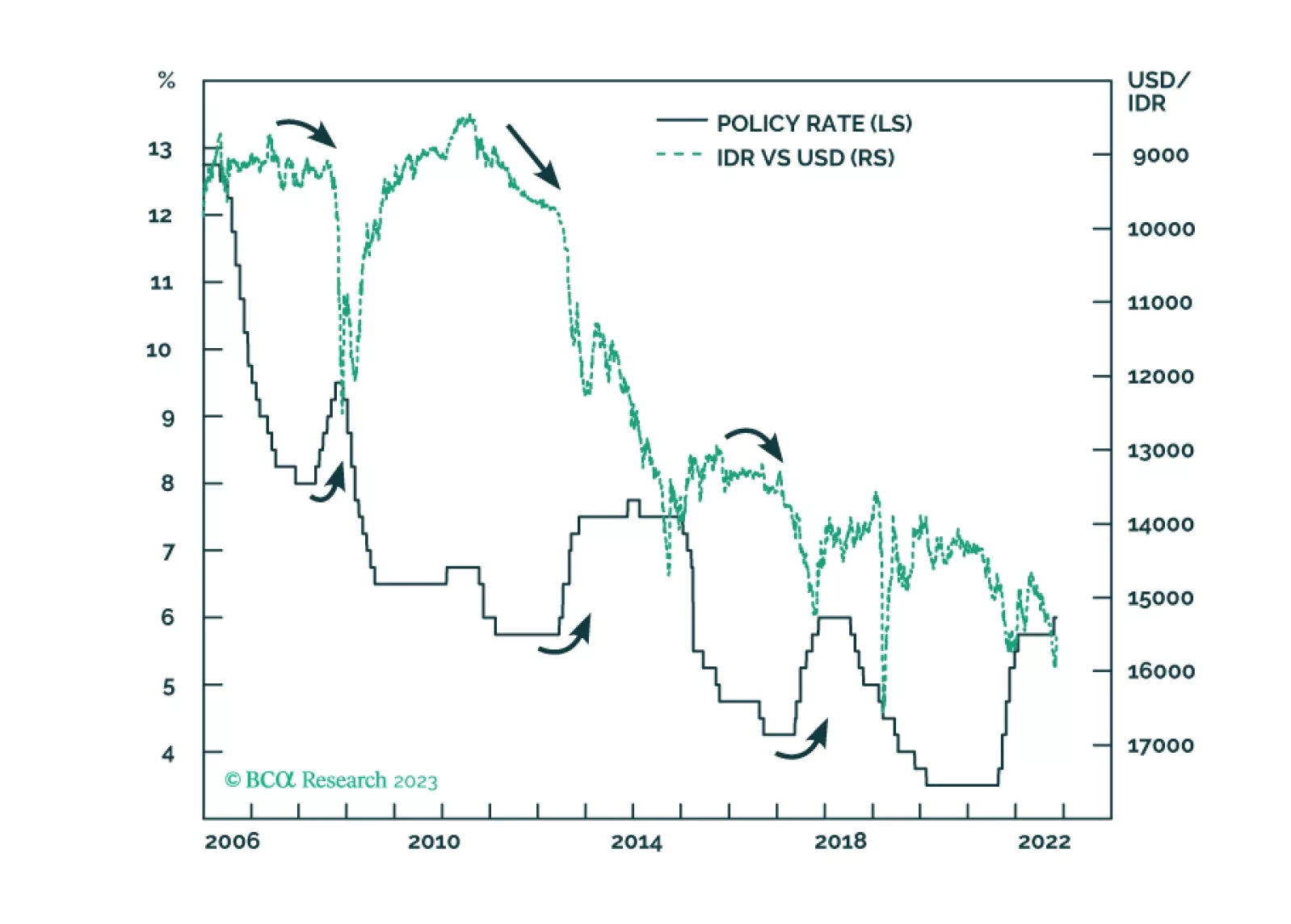

Despite very low inflation, Bank Indonesia raised its policy rates last month to support the currency. The strategy did not work before and will not work now. Stay short the rupiah.

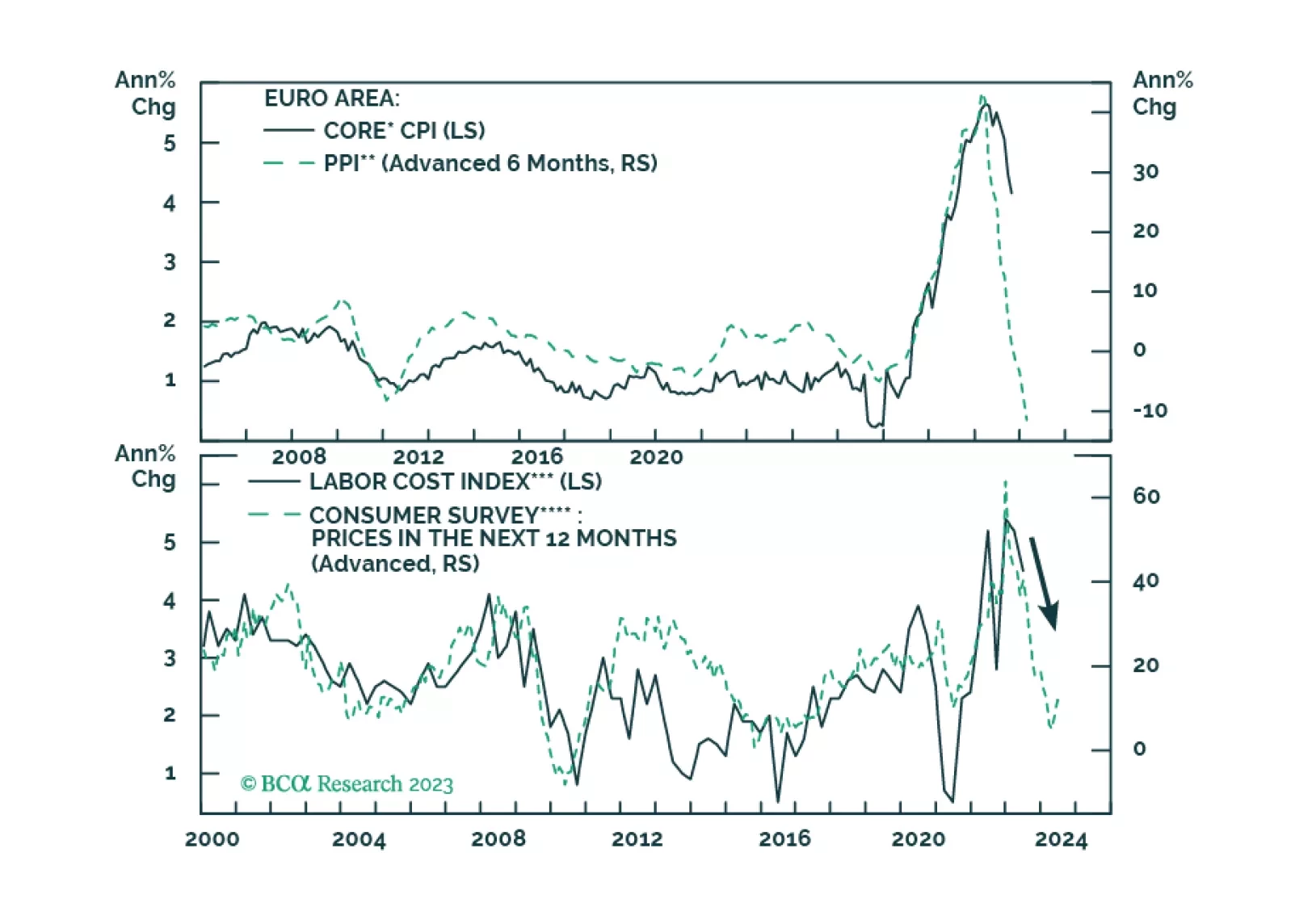

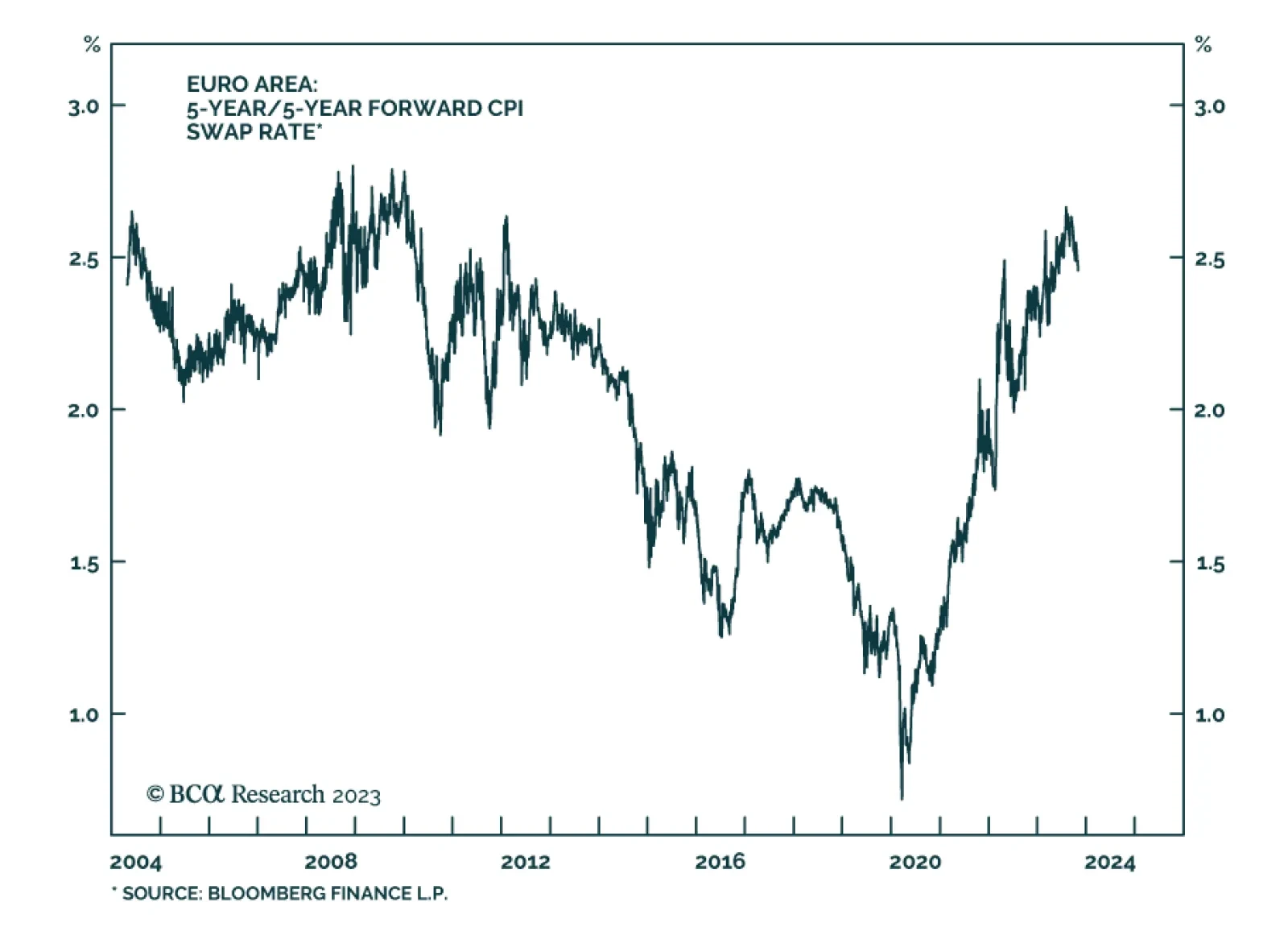

According to BCA Research’s European Investment Strategy service, German yields will fall toward 2% as market-based inflation expectations dip. For now, the deceleration in Eurozone core CPI can be attributed to the…

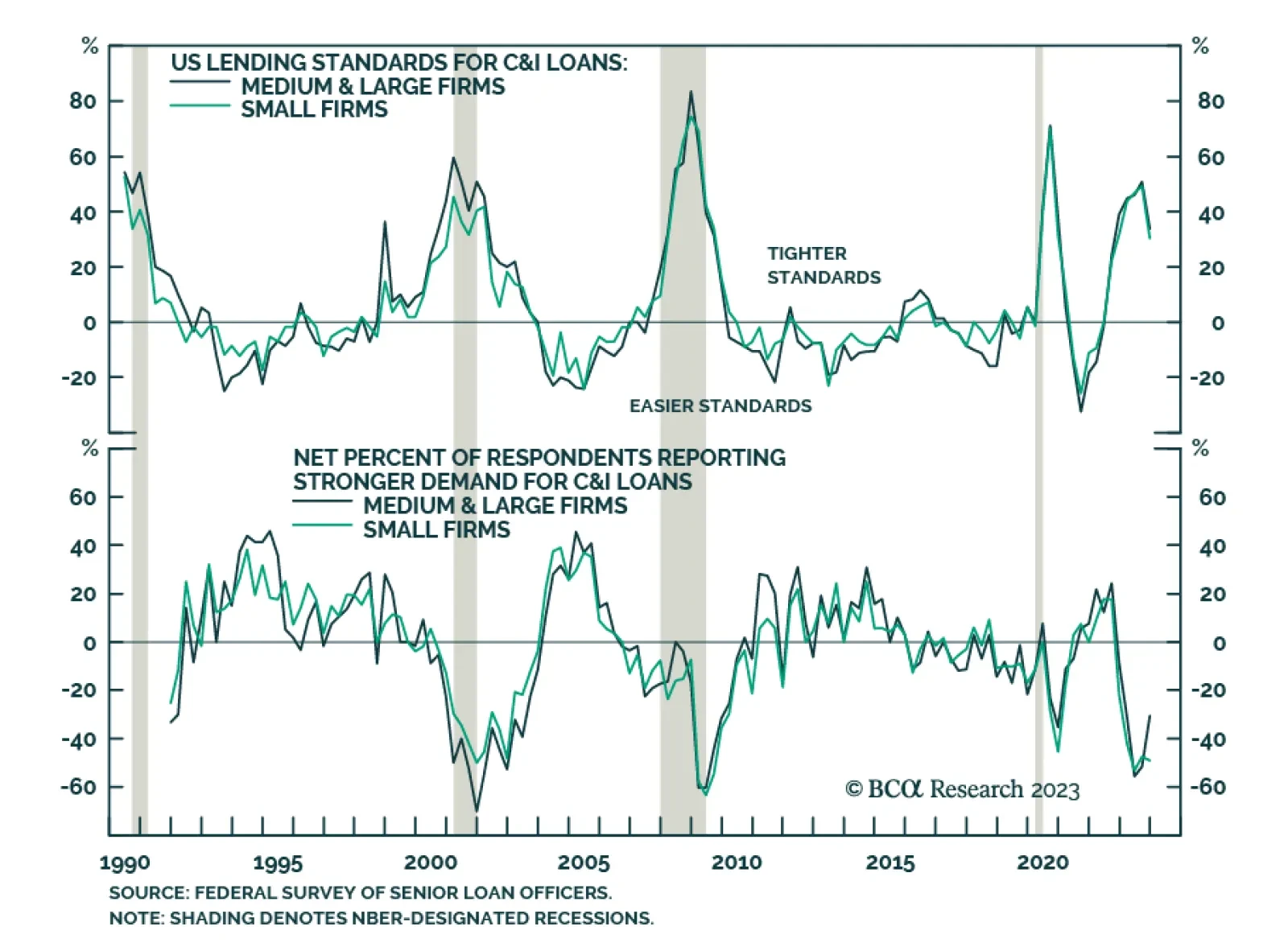

The US Federal Reserve Senior Loan Officer Opinion Survey (SLOOS) reveals that US banks continued to tighten lending standards for commercial and industrial (C&I), commercial real estate (CRE), residential real estate (RRE)…

Our Portfolio Allocation Summary for November 2023.

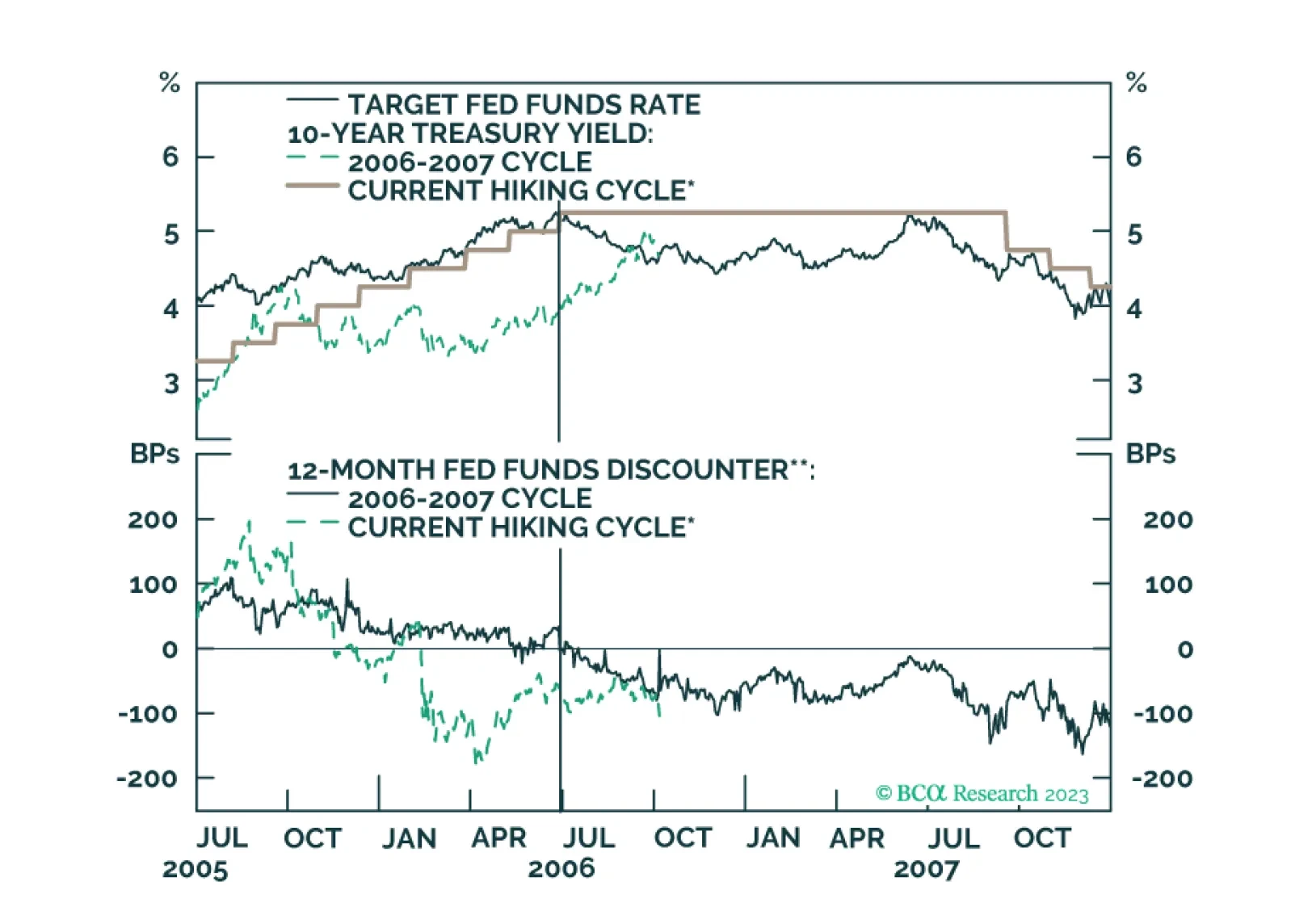

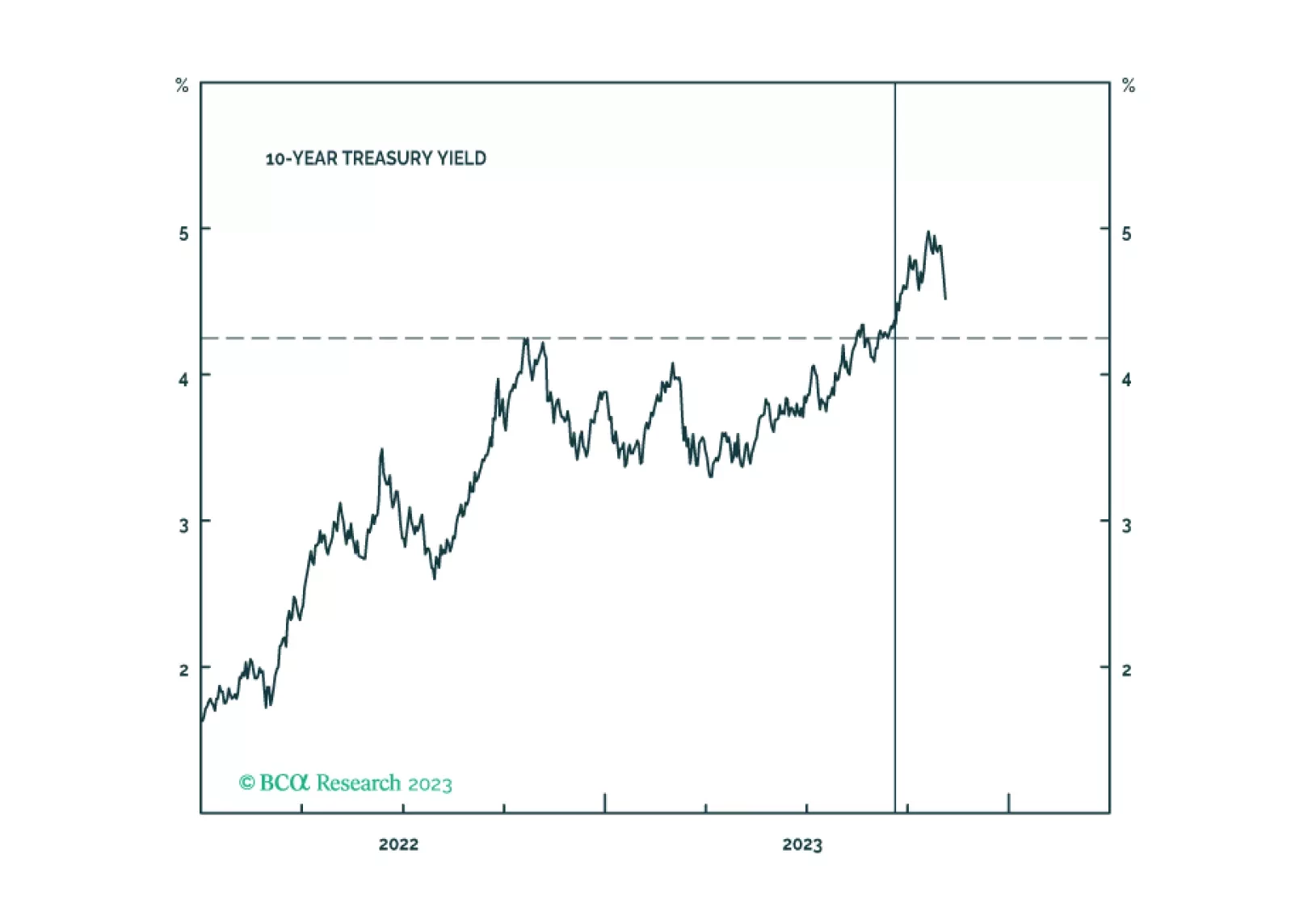

We consider several uncertainties in this week’s report, from the interest rate outlook to the source of the mountain of cash households have amassed since the pandemic began. We have not adjusted our tactical asset-allocation…

The Eurozone’s inflation will continue to slow over the coming months. While this trend will help Bund prices, will it boost the appeal of European equities?

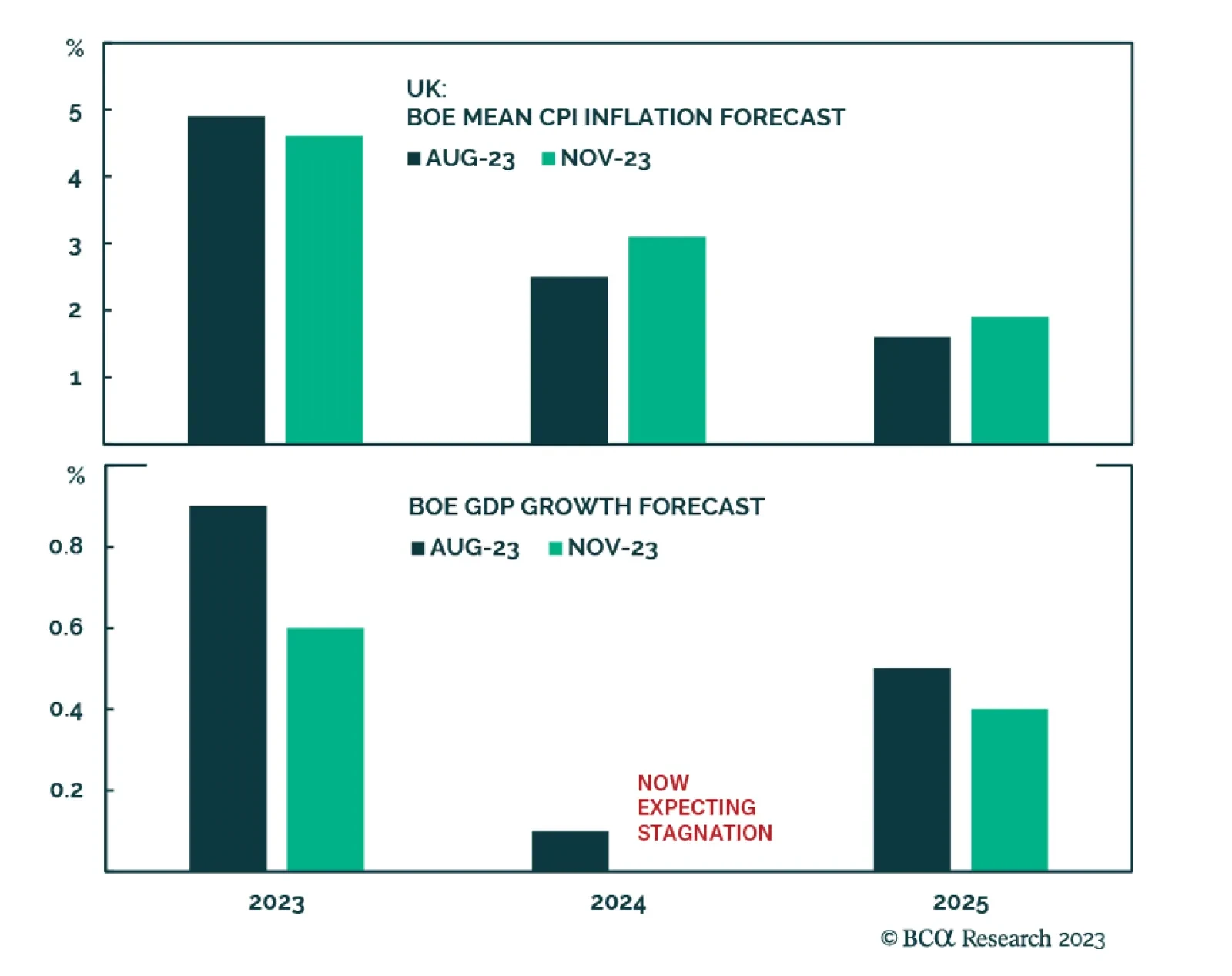

As expected, the Bank of England kept its bank rate unchanged at 5.25% at Thursday's MPC meeting with six members voting in favor of the decision and the remaining three preferring a 25bps rate increase. Governor Andrew…

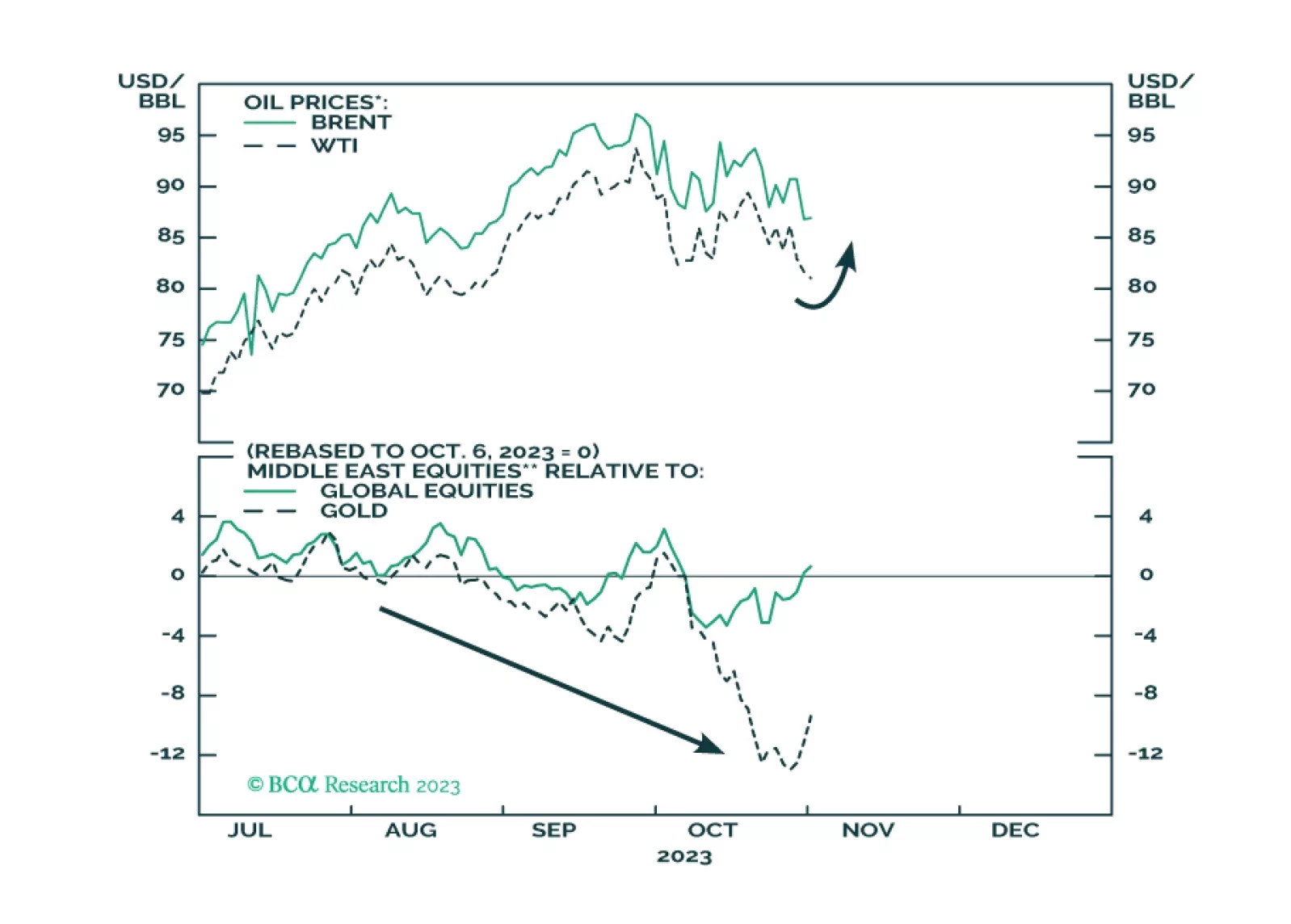

Investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the next zero-to-12 months.