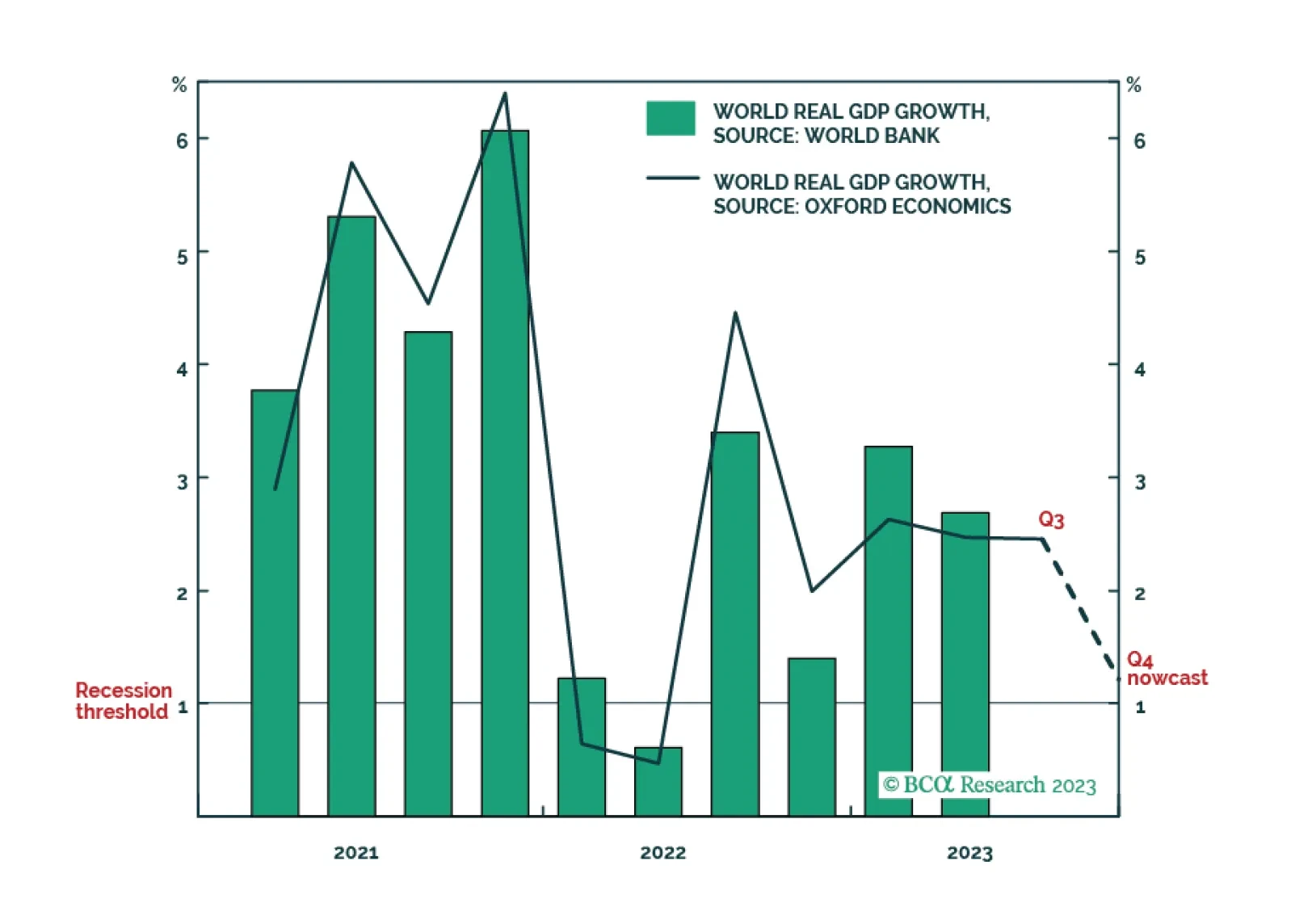

The latest ‘nowcast’ for world economic growth in the fourth quarter has plunged to just 1.2 percent, marking the cusp of another world recession. One important implication is that expectations for oil demand growth and industrial…

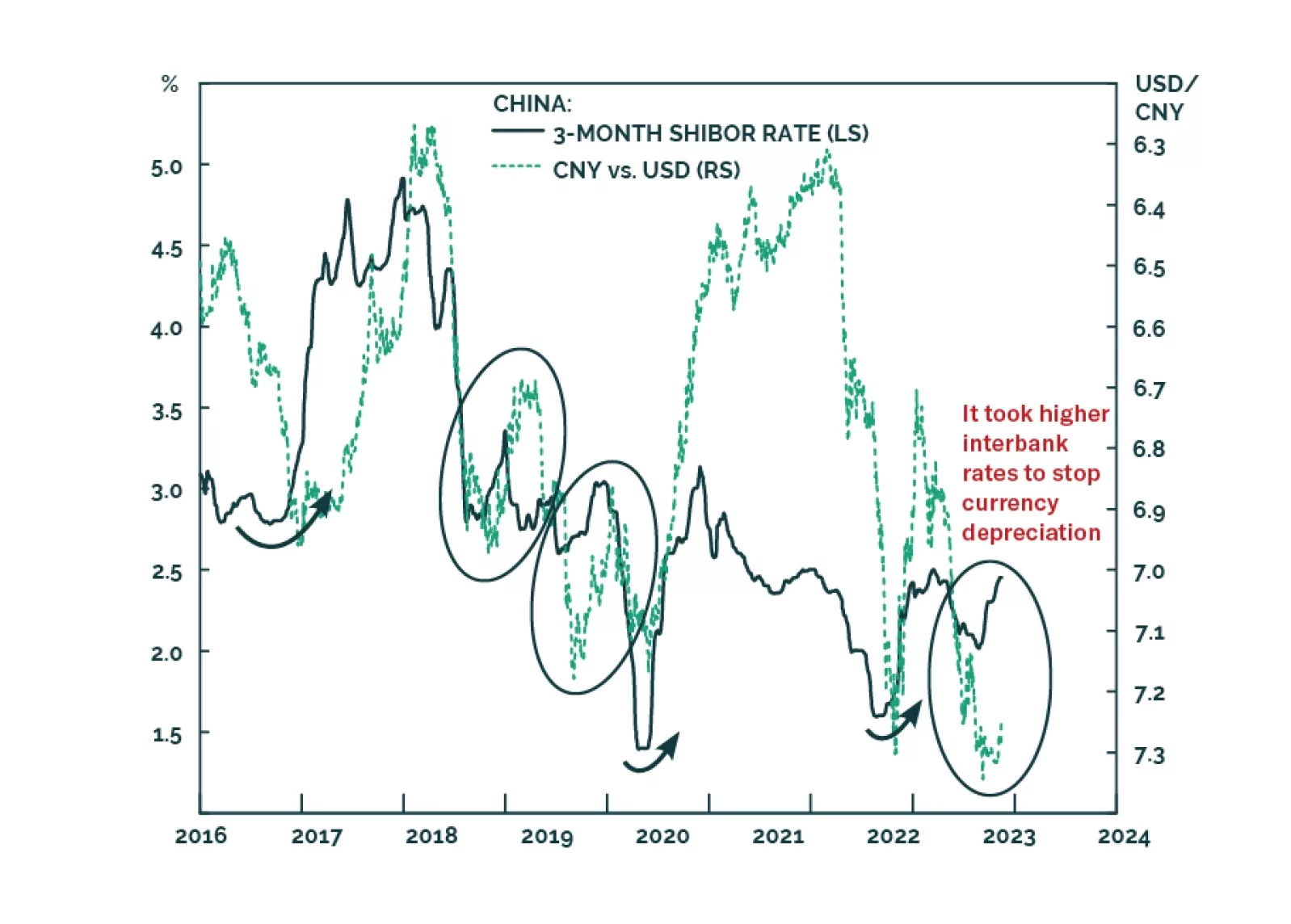

Many commentators have attributed the latest increase in Chinese interest rates to an improving economy, the large issuance of government bonds, the tax payments season, and other technical factors. Yet, these explanations are…

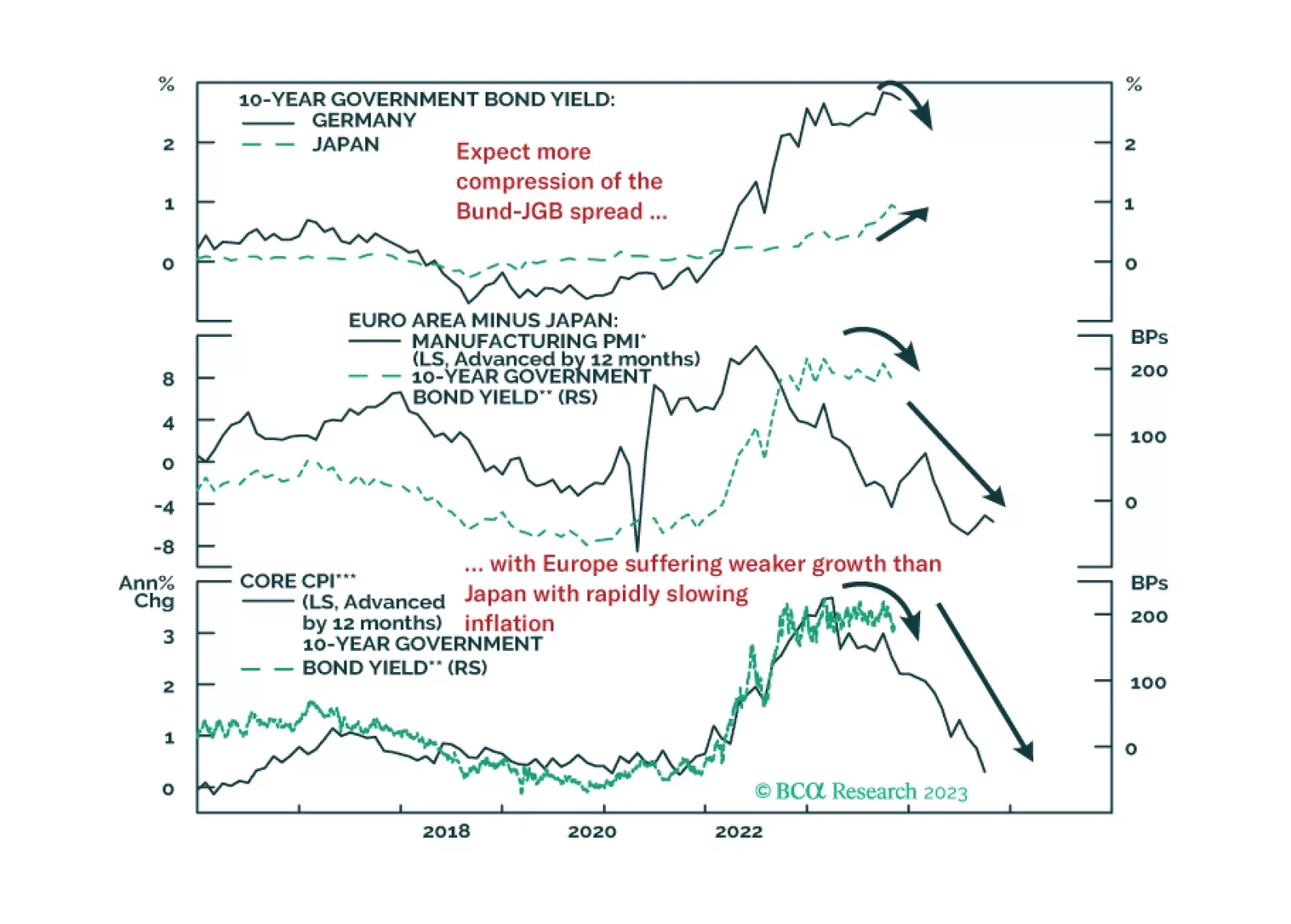

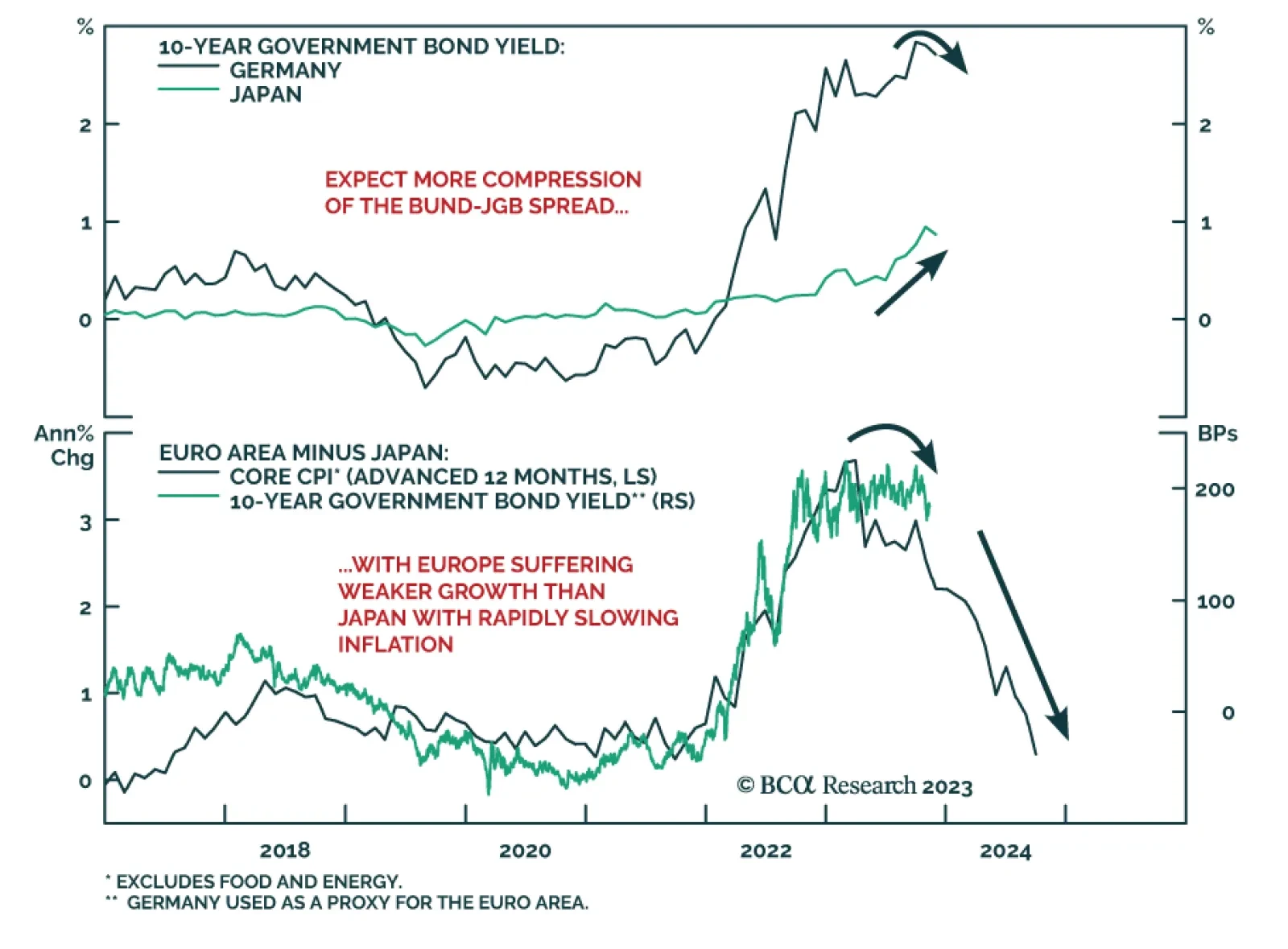

BCA Research’s Global Fixed Income Strategy service remains long 10-year German bunds vs short 10-year Japanese government bonds (JGBs) as a tactical trade. This trade mirrors the team's two highest conviction…

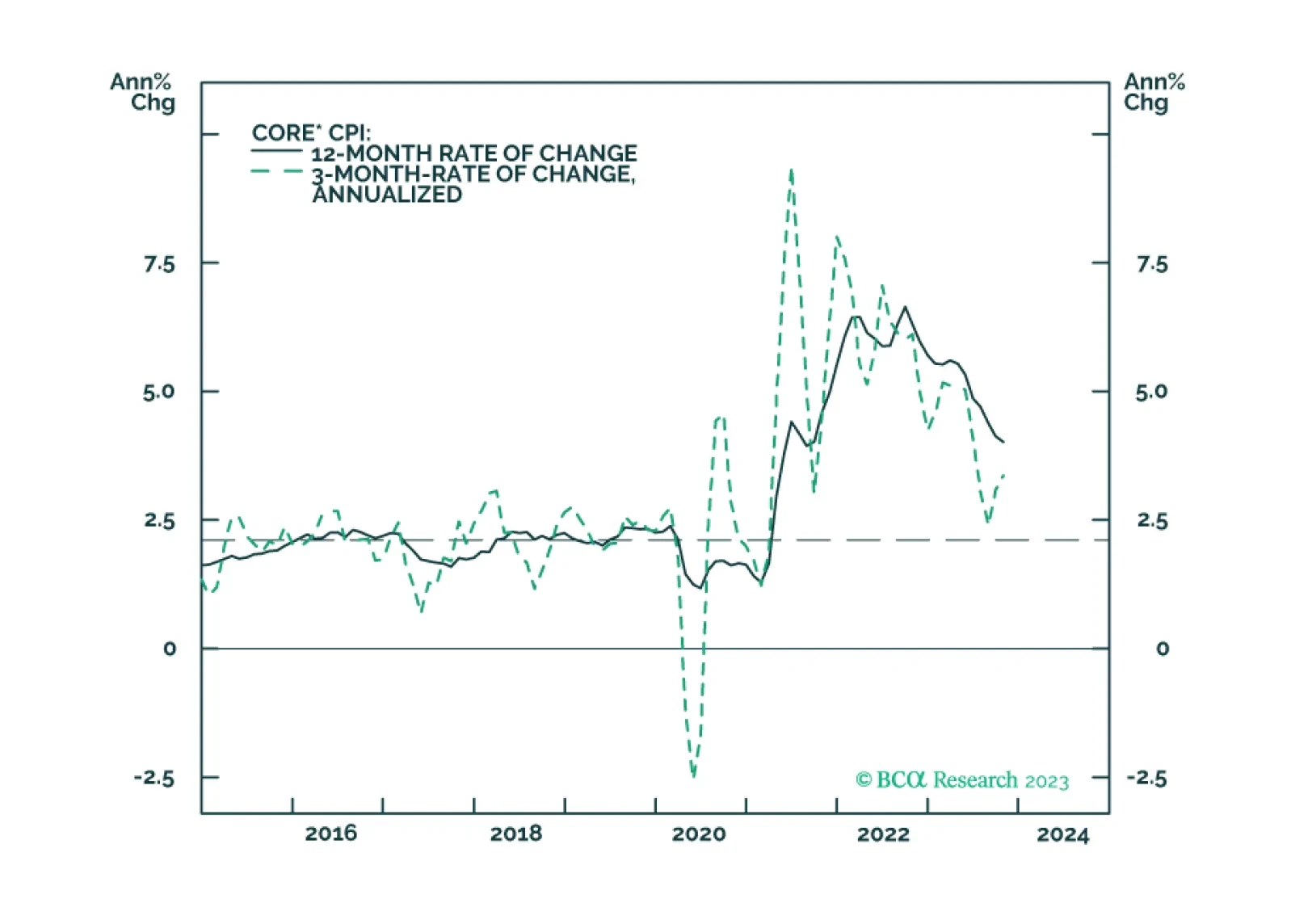

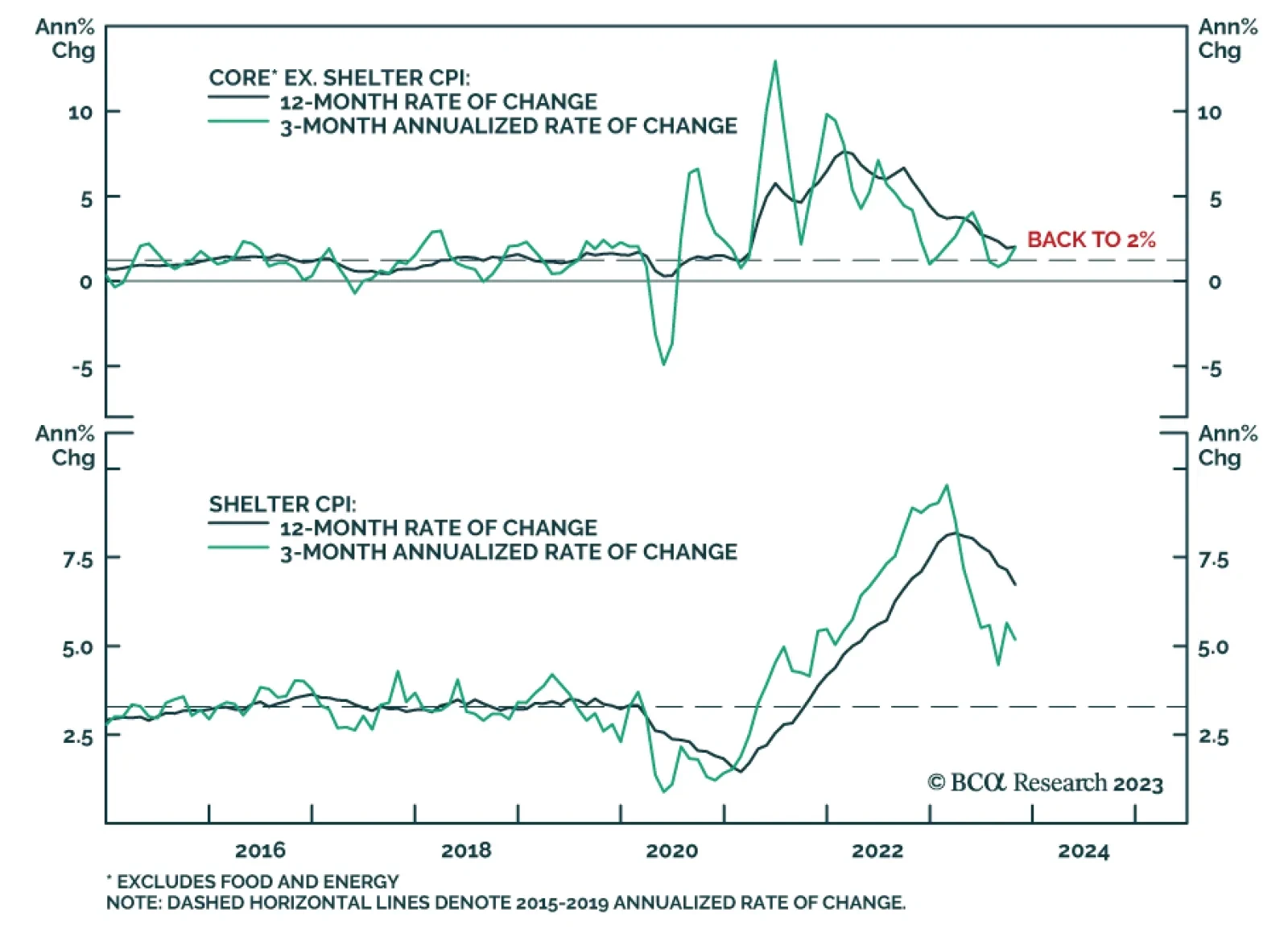

US Treasury yields fell sharply following yesterday’s soft October CPI report, and investors have now officially priced out all remaining rate hikes from the yield curve. In fact, the fed funds futures curve is priced for a…

Our thoughts on this morning’s CPI print and the bond market’s reaction.

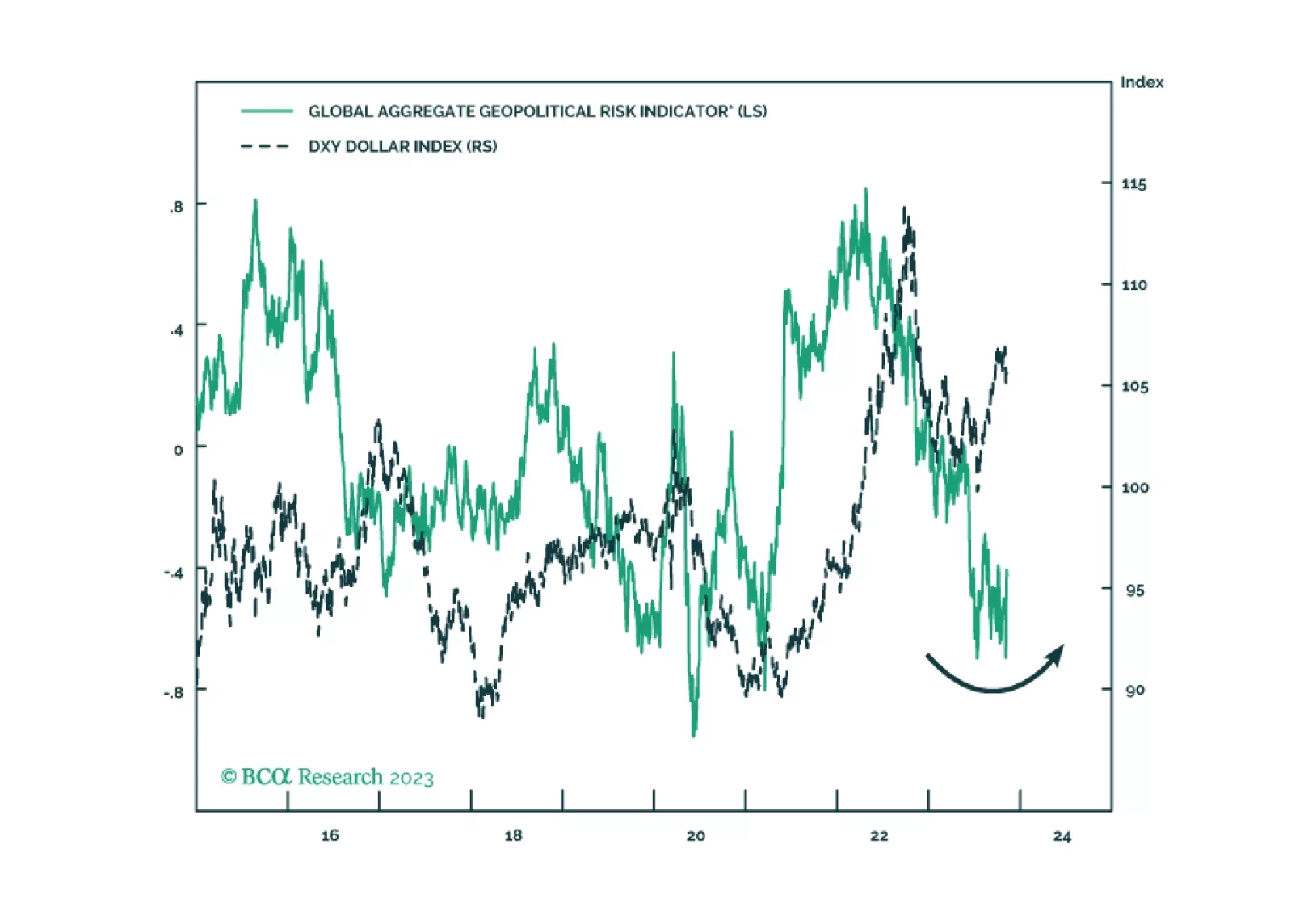

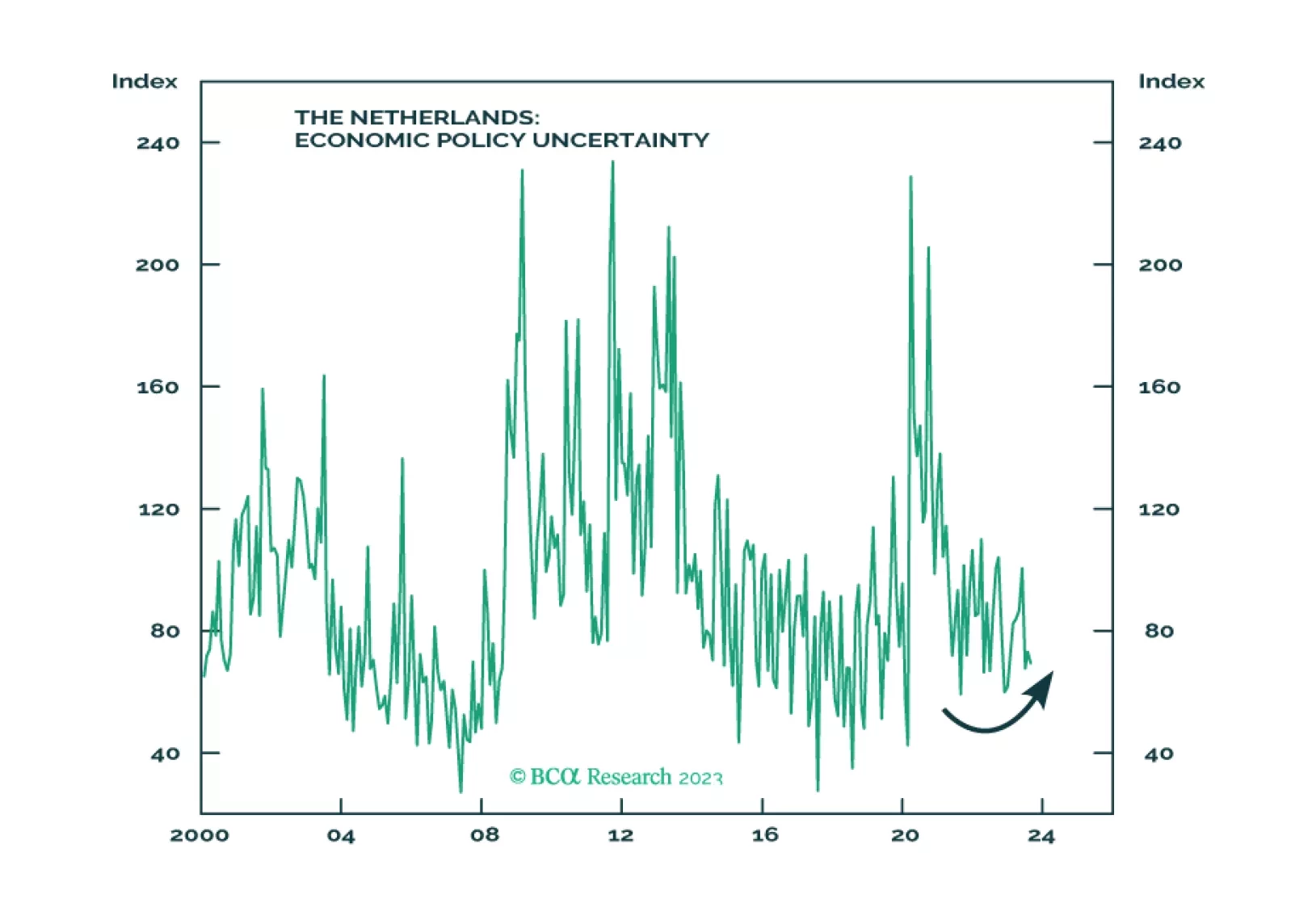

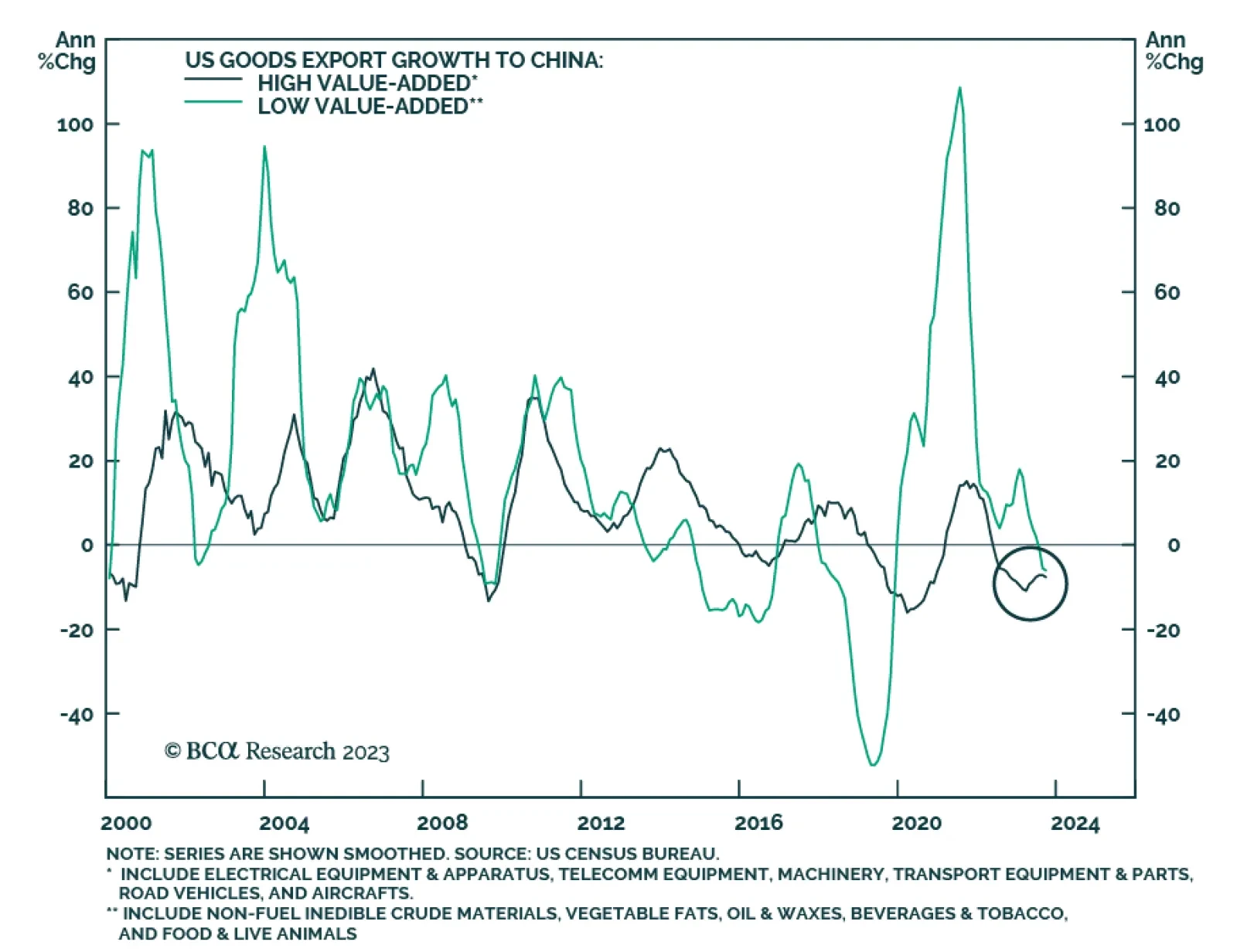

Amid a range of geopolitical narratives, what matters is that the US strategy of economic engagement with its rivals is failing, giving rise to a new strategy of containment that will reinforce the secular rise in geopolitical risk.…

In this Insight, we review the performance and rationale for our current set of tactical fixed income trade recommendations. Our highest conviction positions also happen to be our most successful trades: positioning for a narrowing…

Investors should not get their hopes up about this week’s US-China summit. Chinese President Xi Jinping and US President Joe Biden will meet on the sidelines of the Asia Pacific Economic Cooperation (APEC) summit in San…

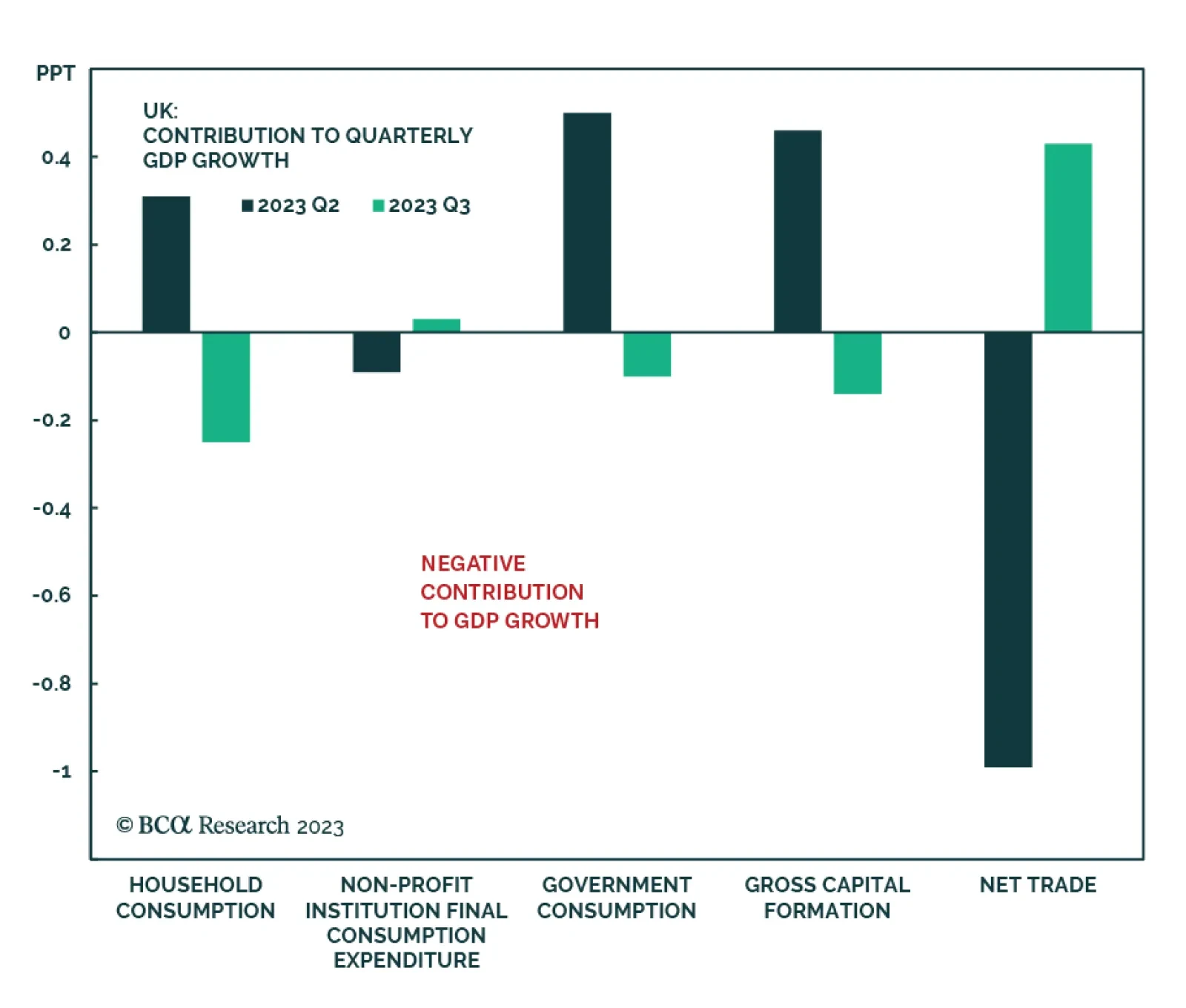

The UK economy stagnated in Q3 – a deterioration from the minor 0.2% q/q expansion in the prior quarter. Although the Q3 figure is slightly better than anticipations of a 0.1% q/q contraction, the details of the report are…