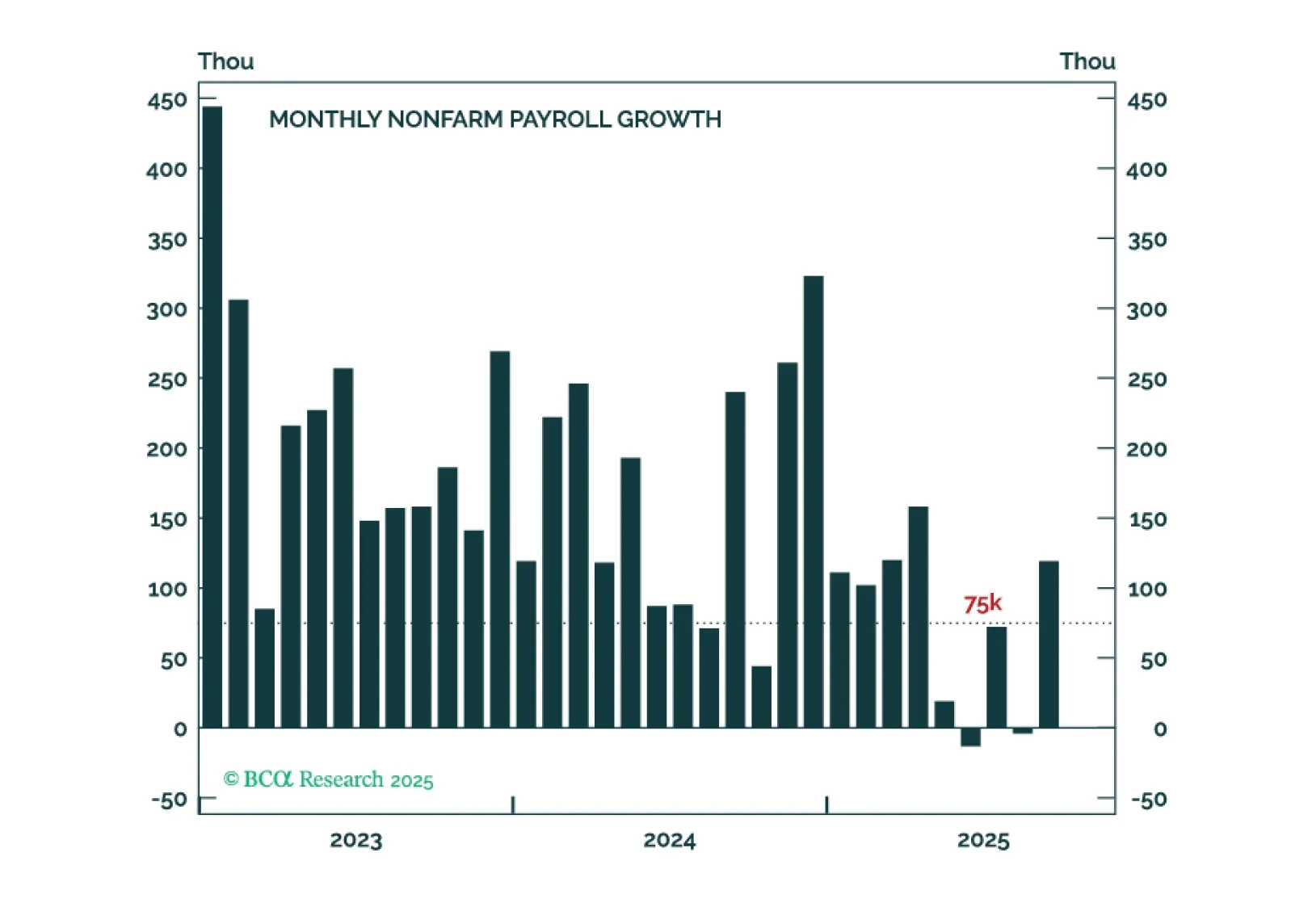

The September employment report probably won’t convince enough hawks to vote for a rate cut in December.

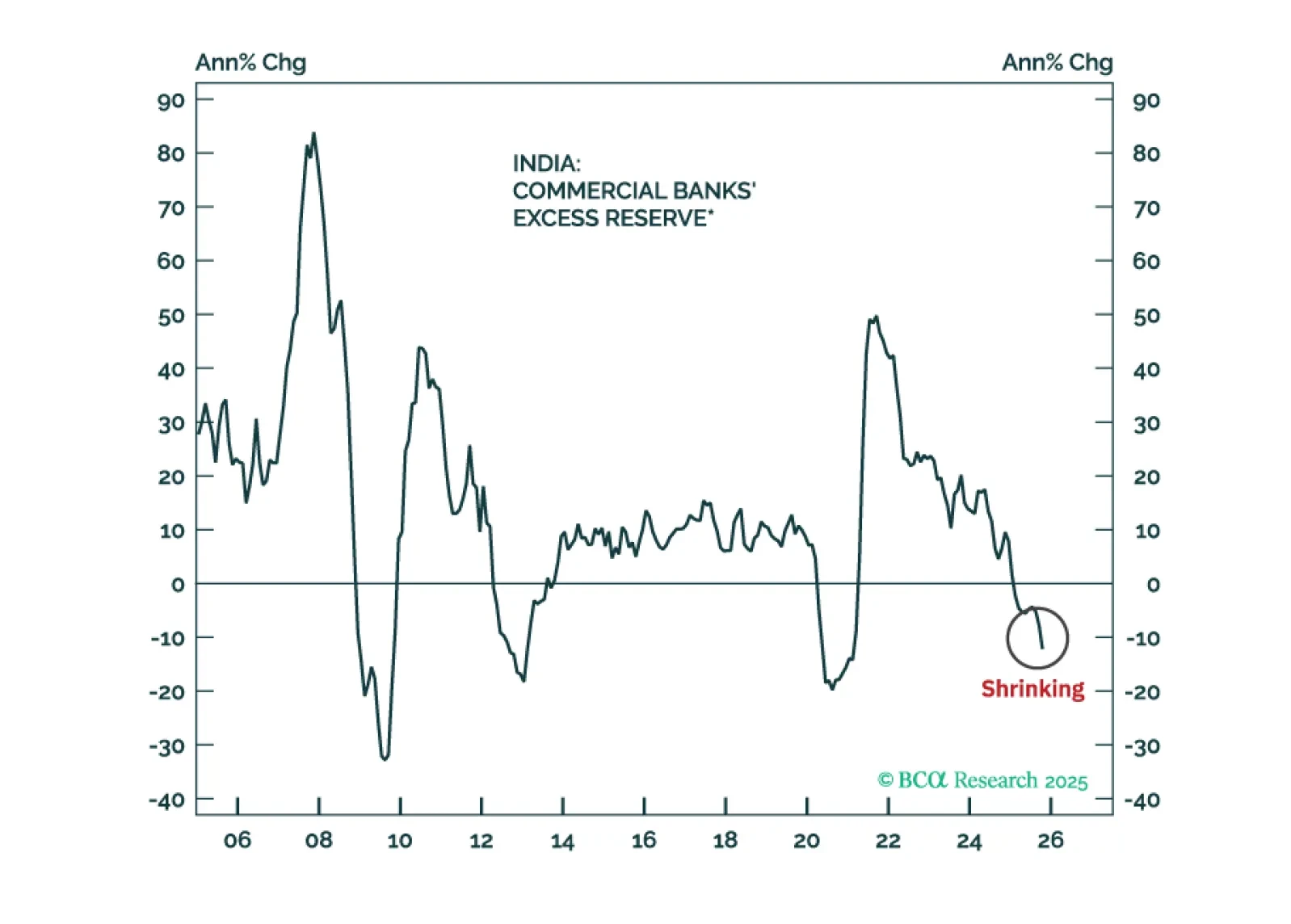

Indian stocks have further downside in absolute terms as profits disappoint. Their underperformance versus the EM equity benchmark, however, is late, which warrants a shift from underweight to neutral allocation.

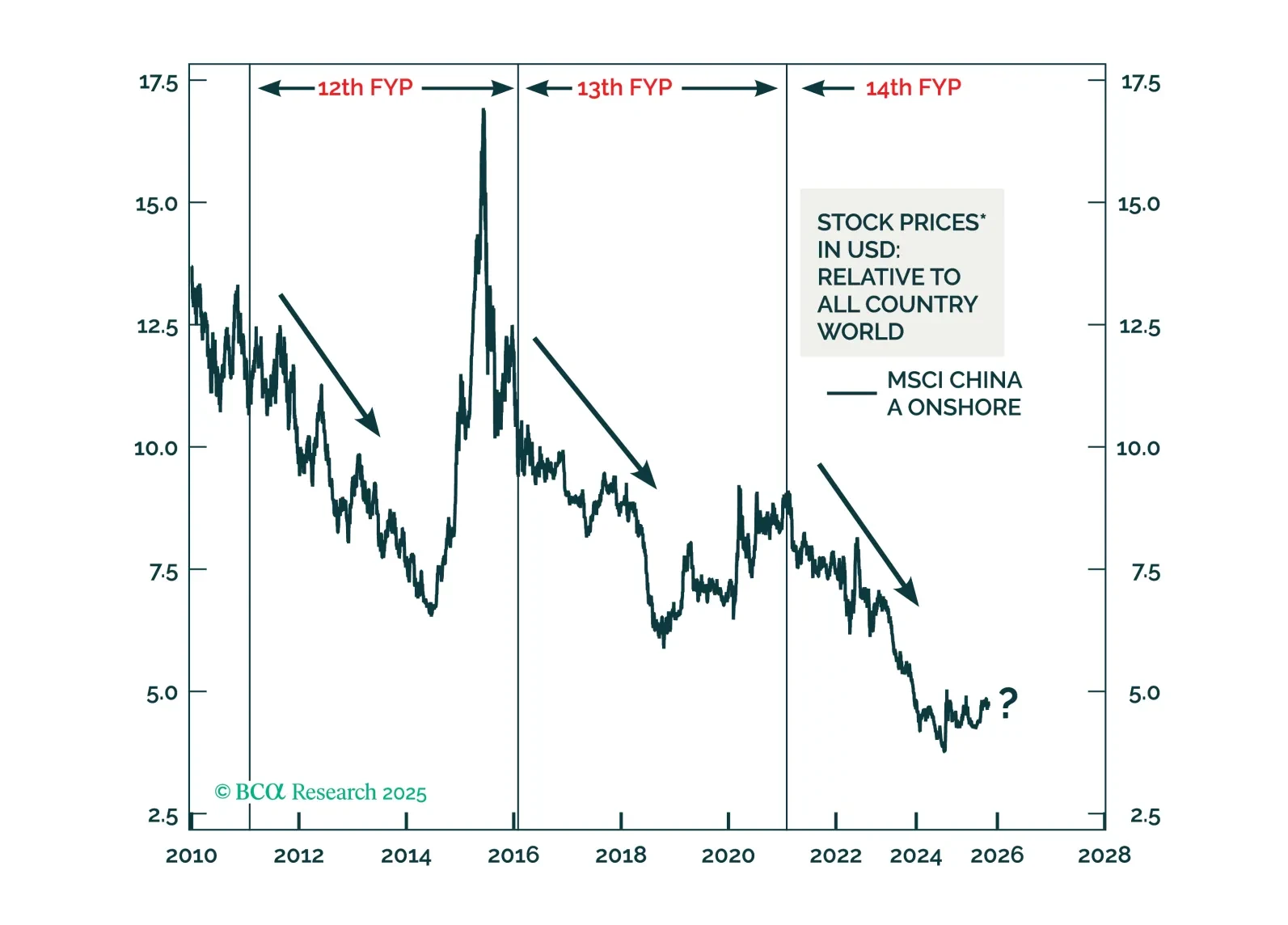

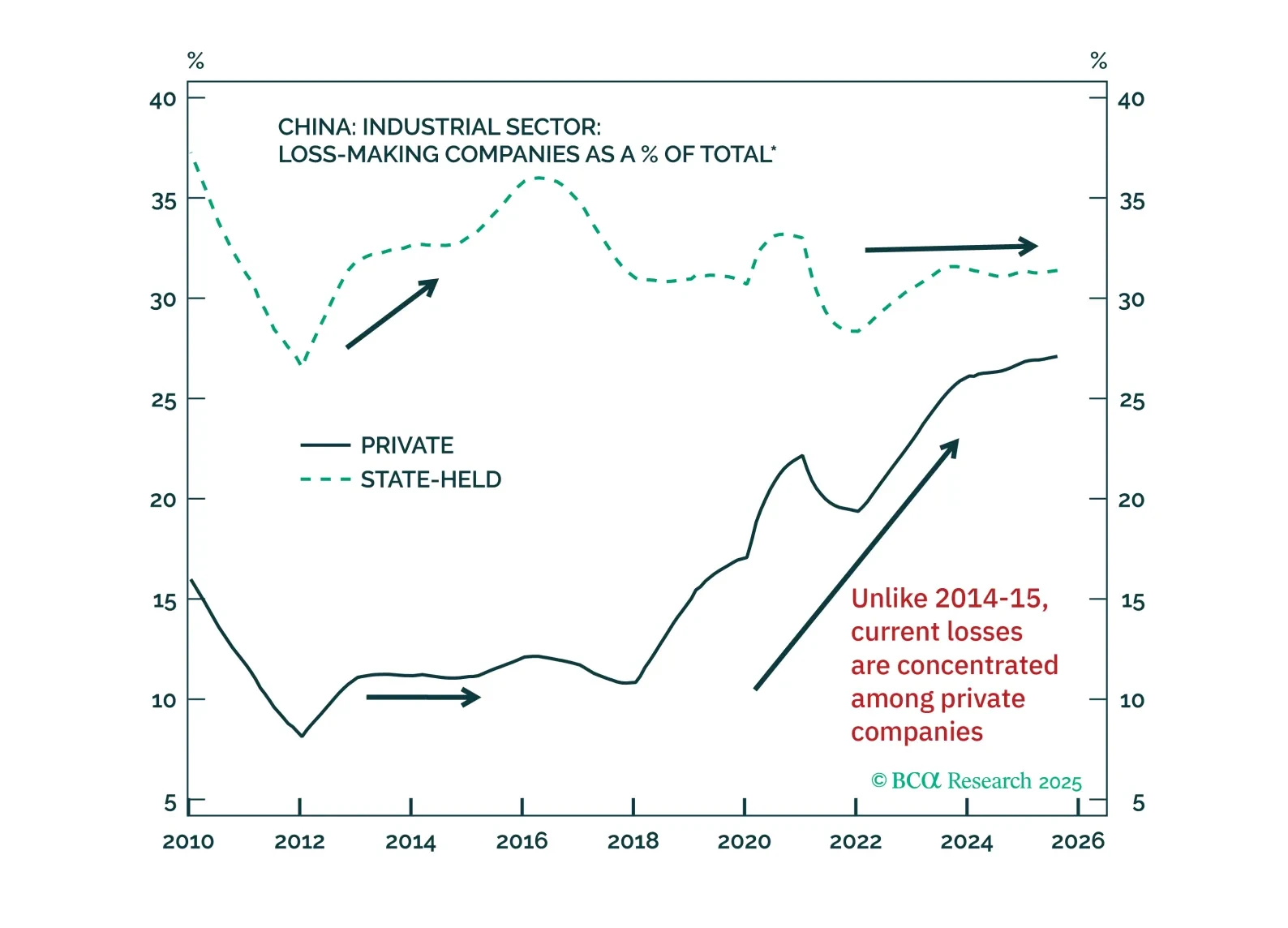

By tracing patterns across China’s past three Five-Year Plans, we reveal how policy cycles shape markets—and what investors should expect in the next five years.

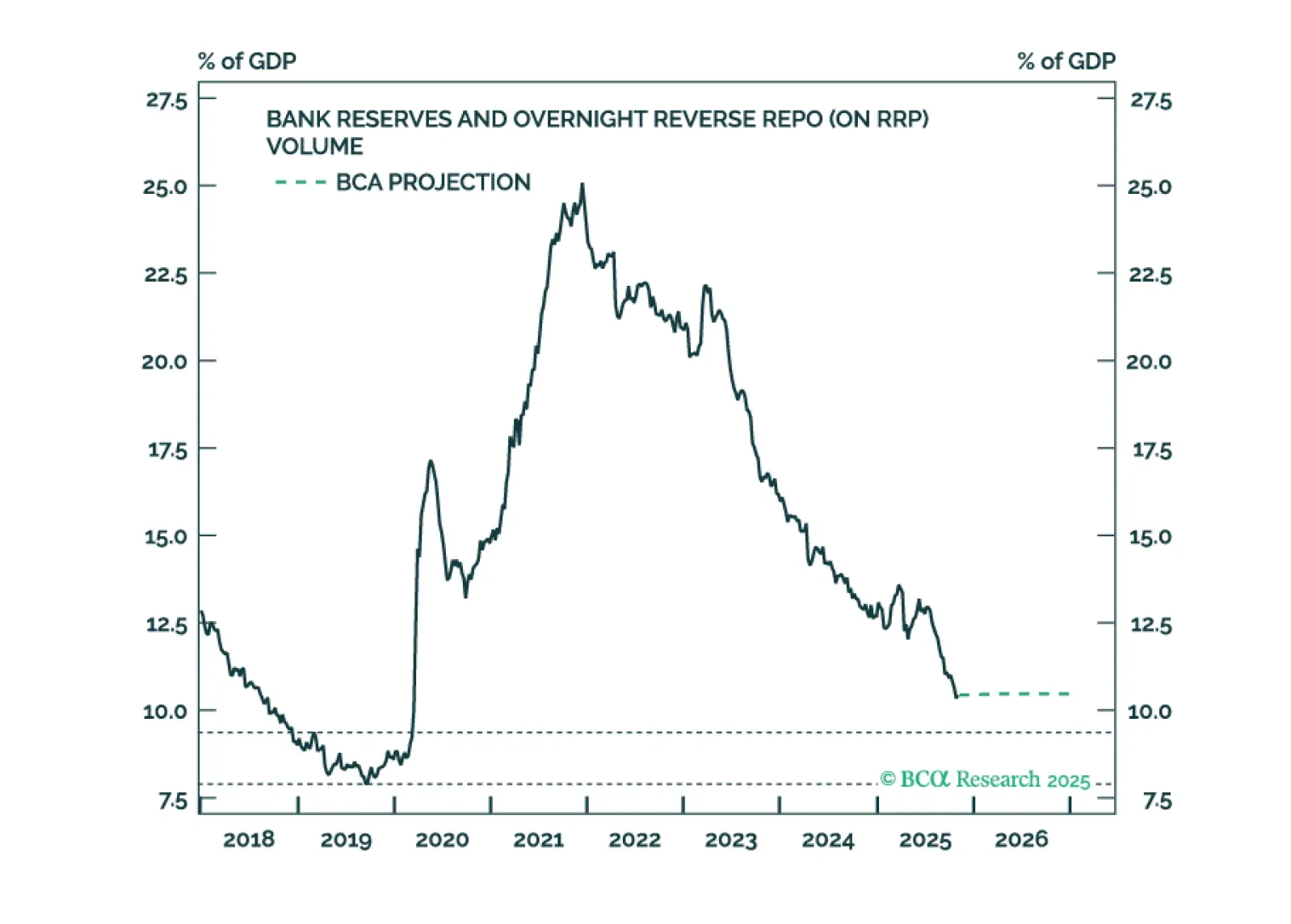

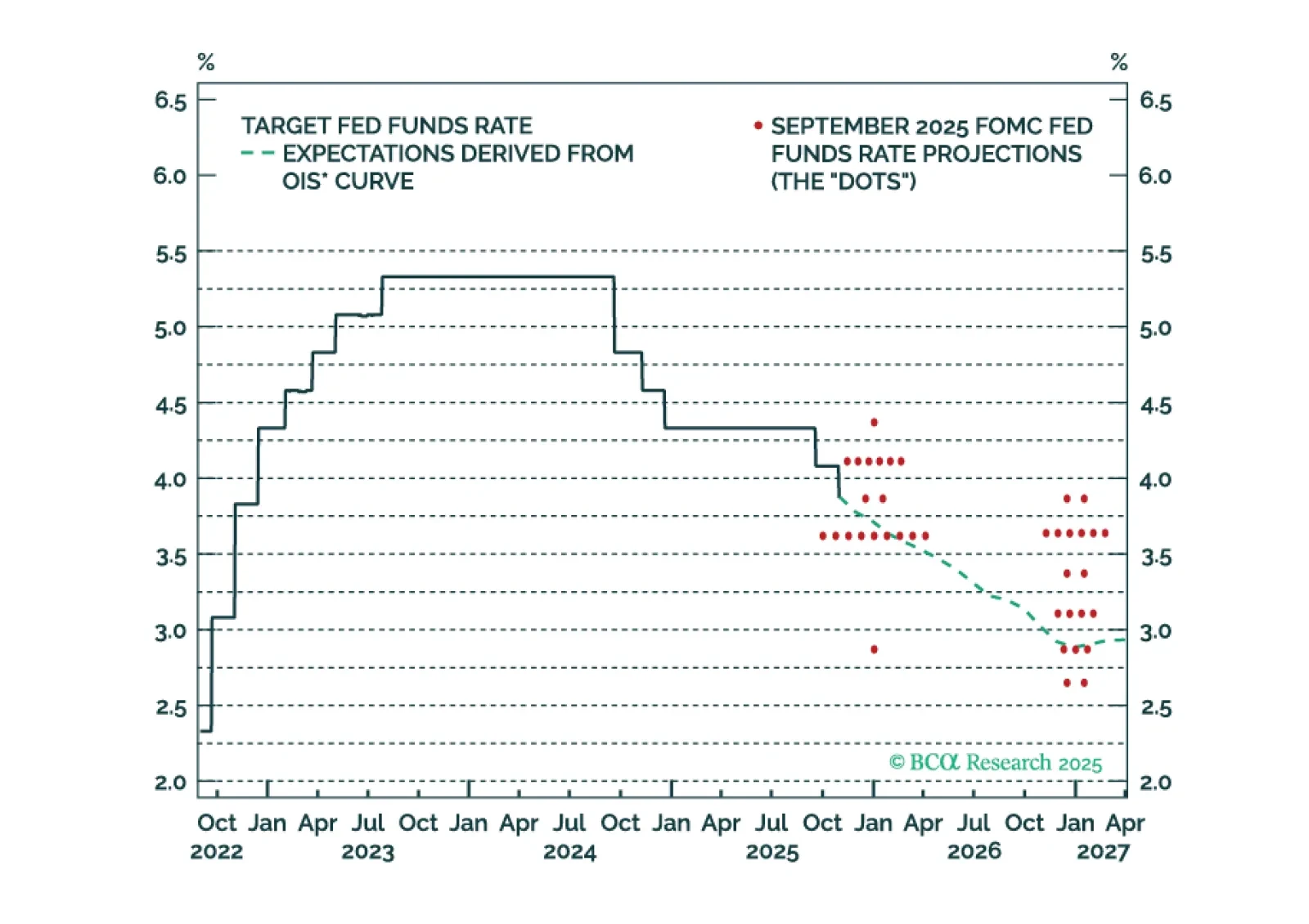

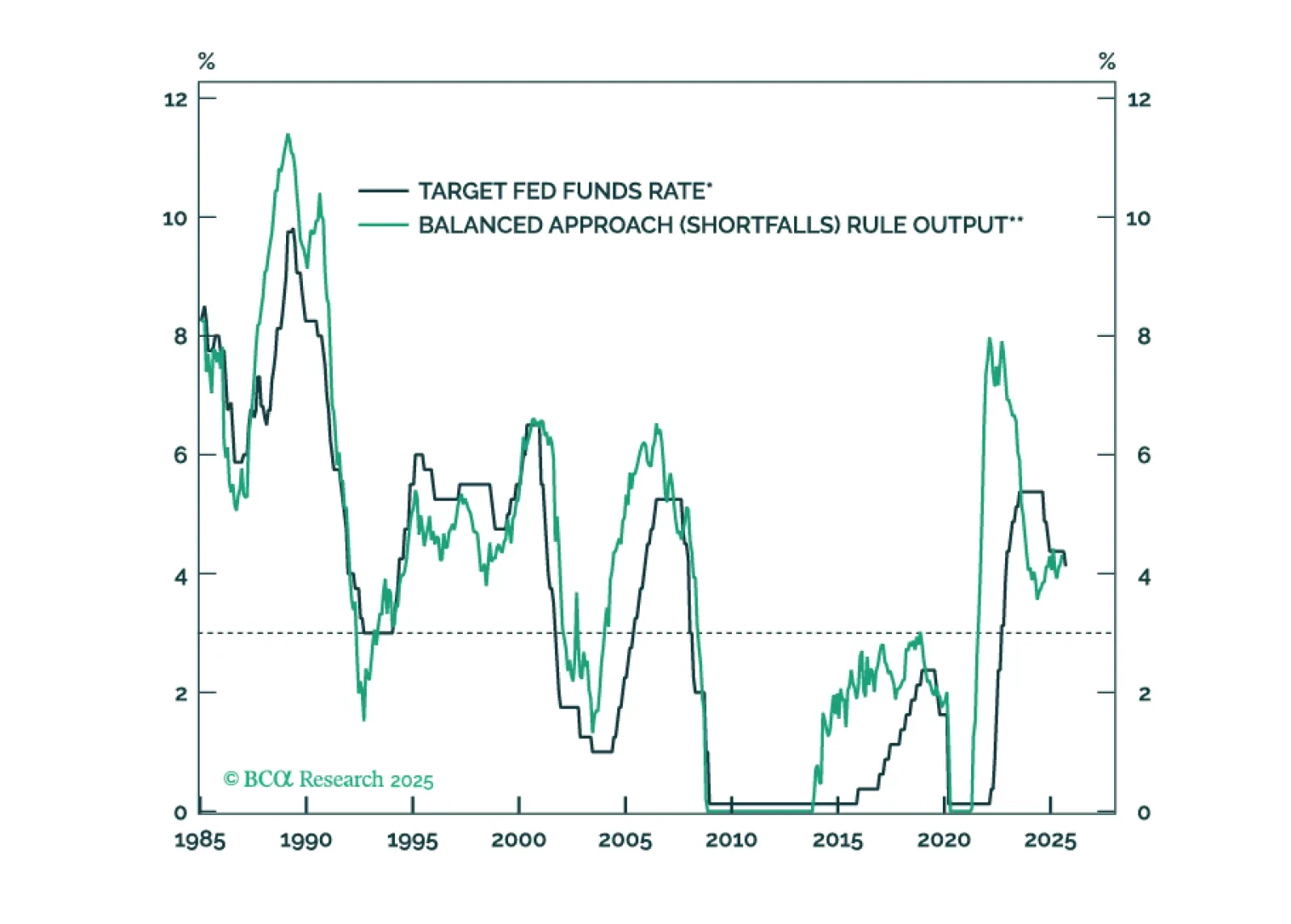

The Fed cut rates today, but a follow-up rate cut in December is uncertain. It will depend, in large part, on who wins a debate about the neutral rate of interest.

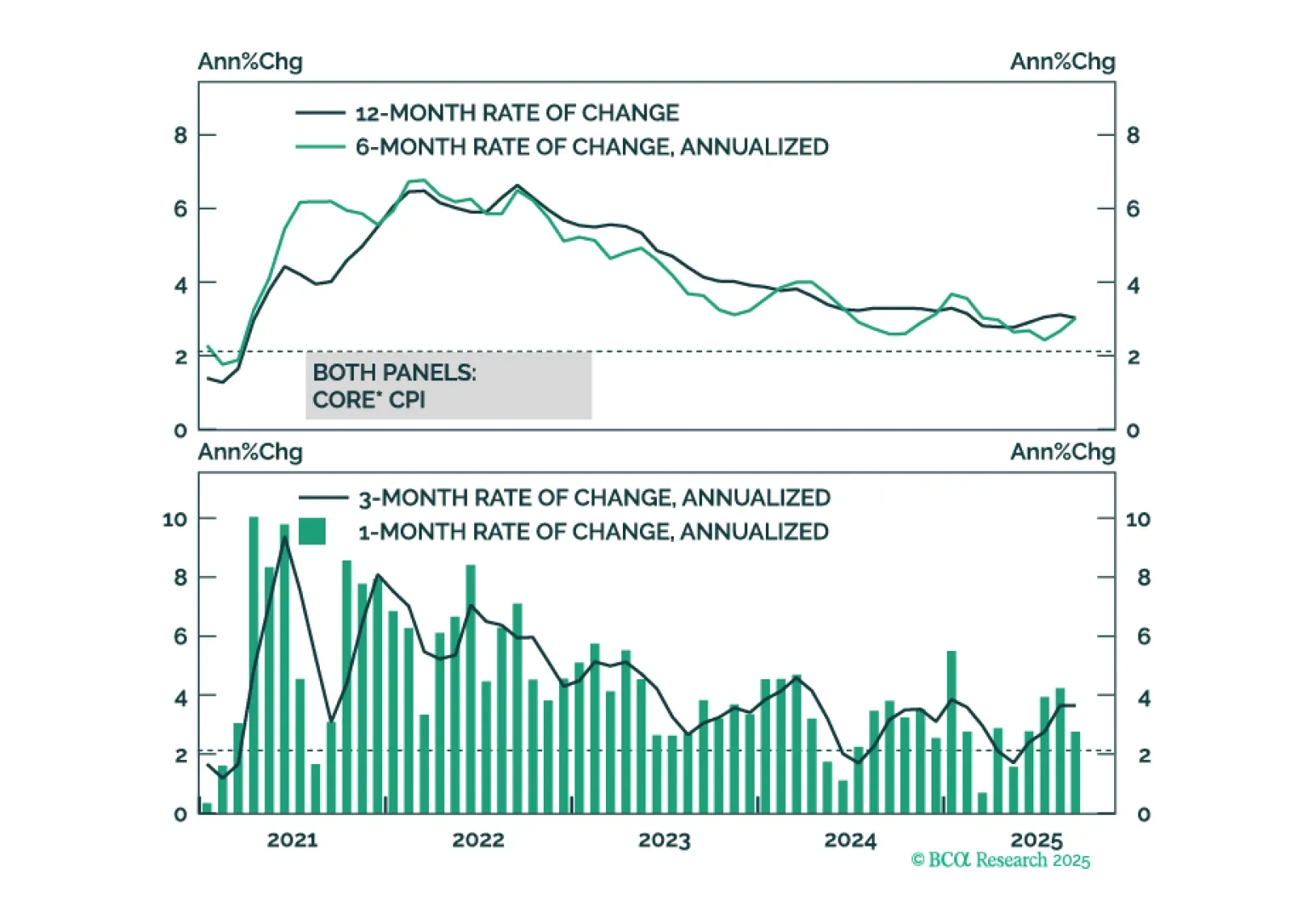

US inflation data continue to show no signs of price pressures beyond a near-term tariff effect.

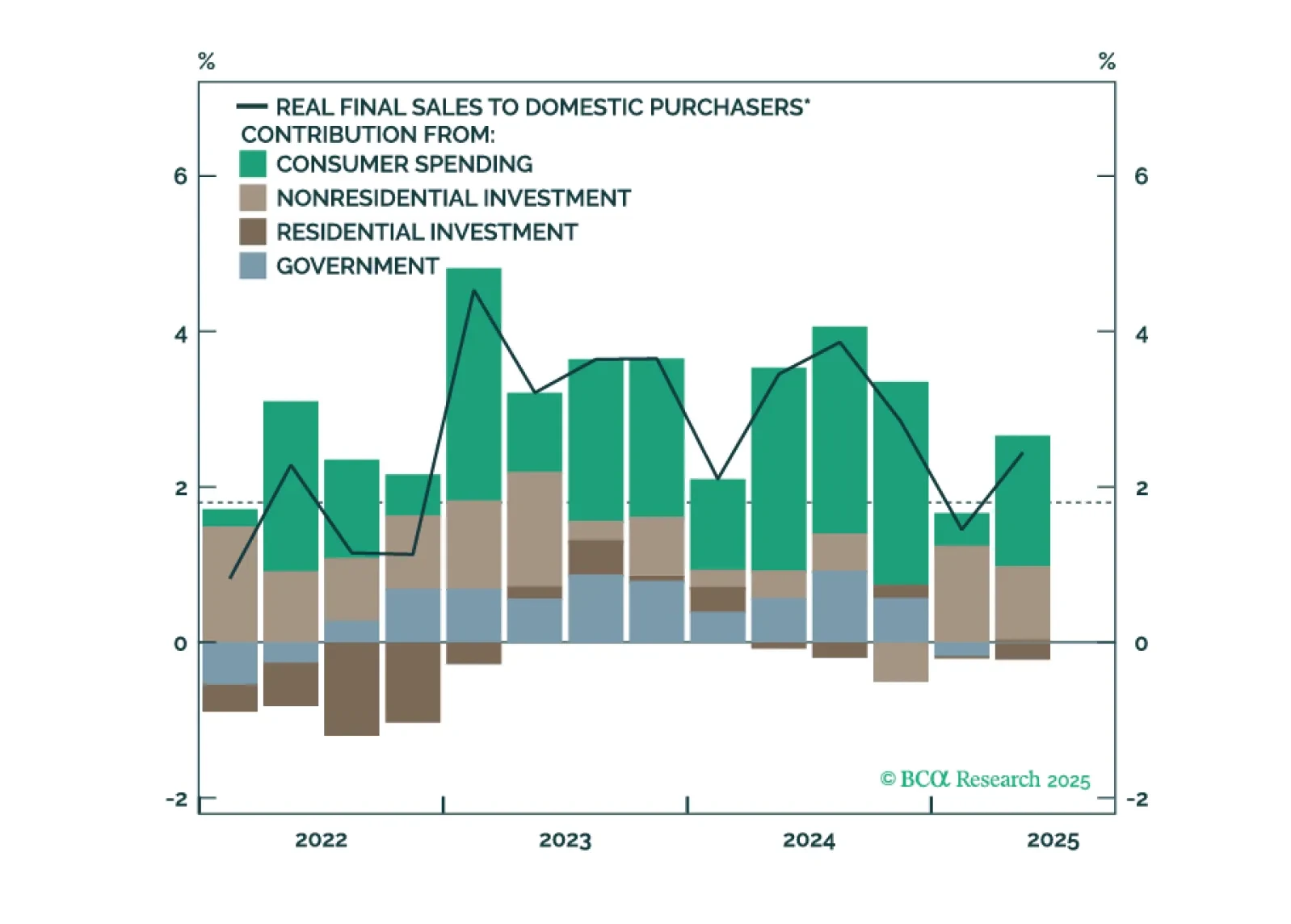

The Fed is poised to deliver a 25-basis-point rate cut this month, but a follow-up rate cut in December will depend on how the divergence between strong consumer spending and weak employment growth is resolved.

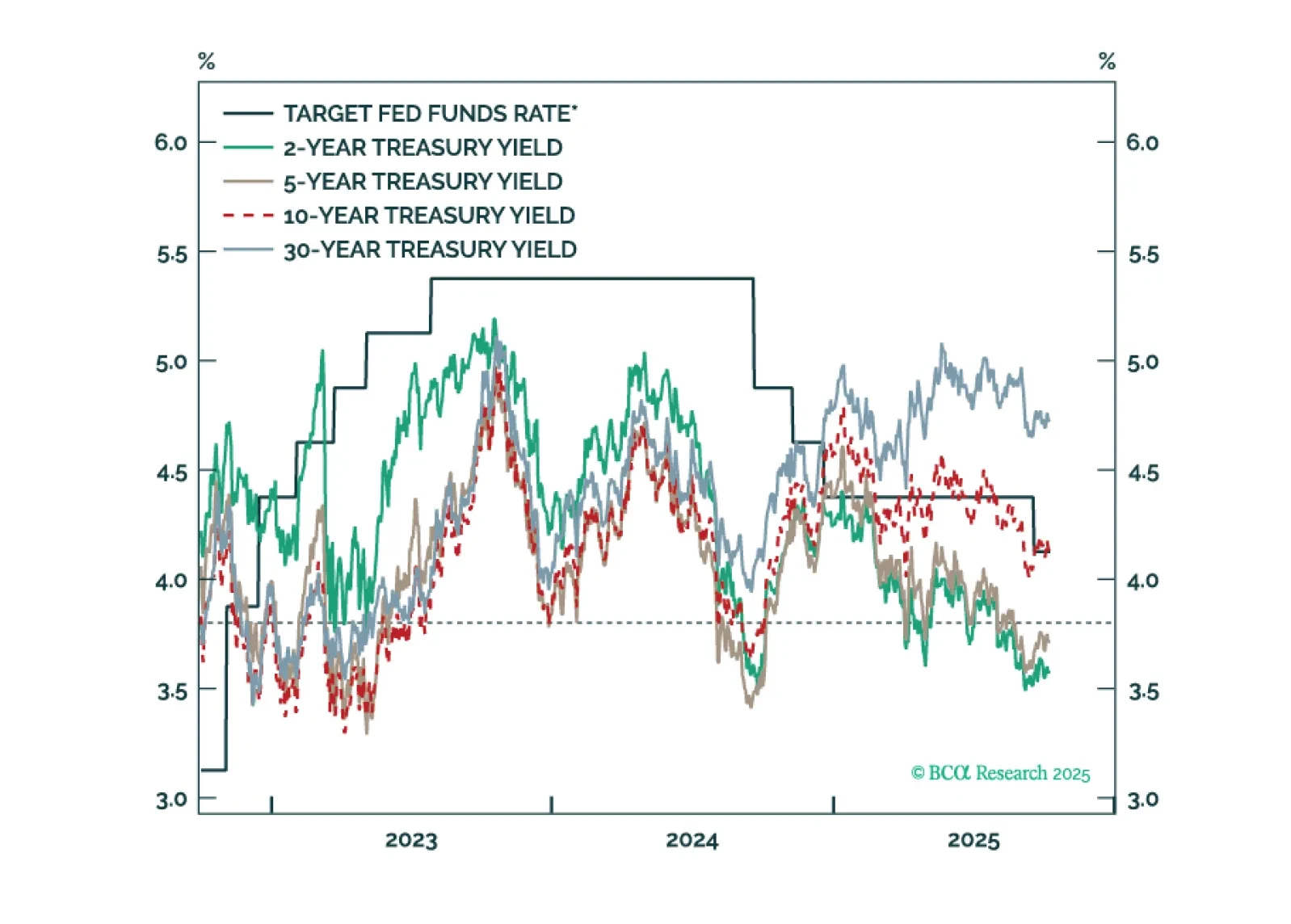

Treasury yields are generally following the pattern of past interest rate cycles, but with a larger term premium keeping the curve steeper than usual.