Policy

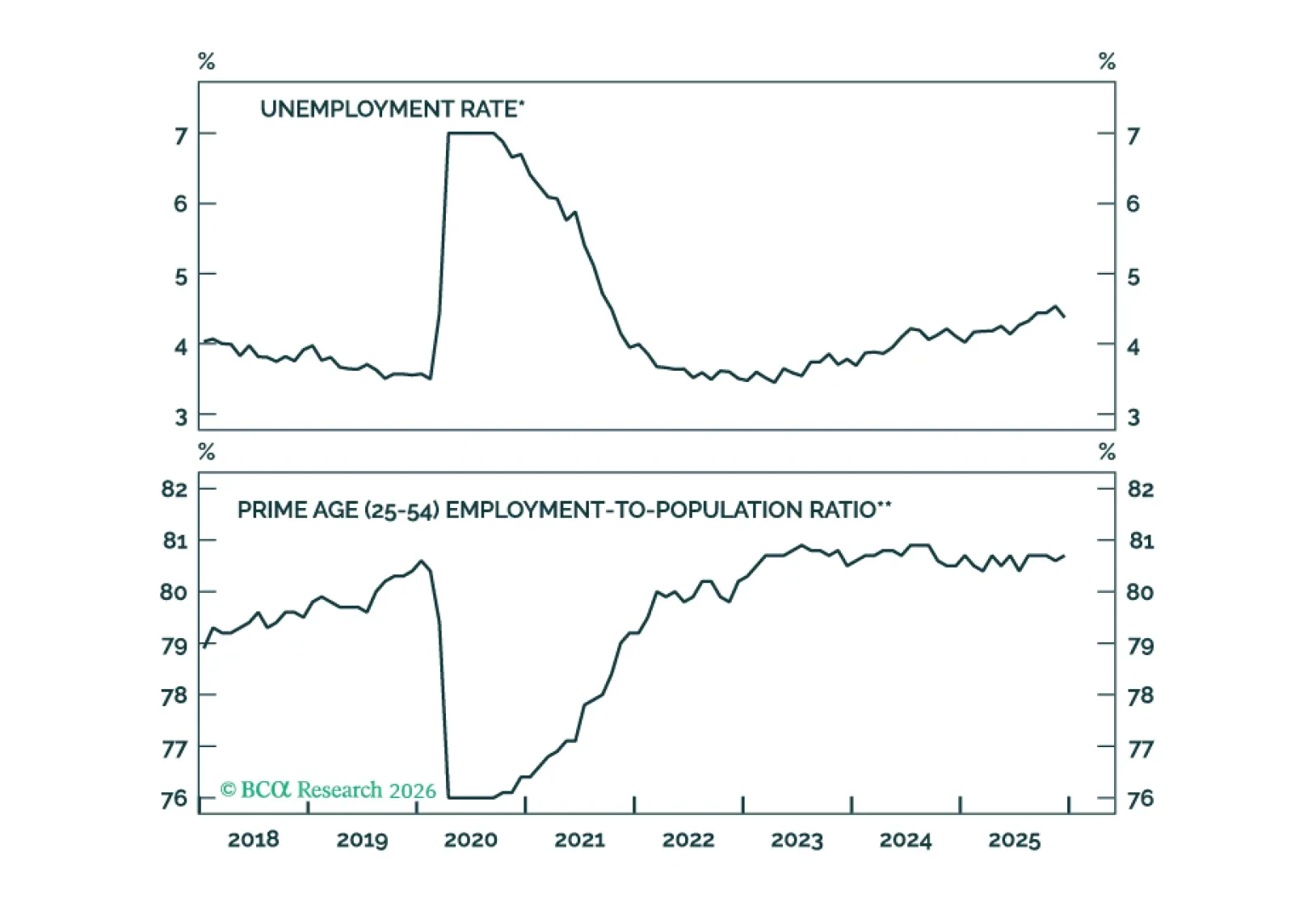

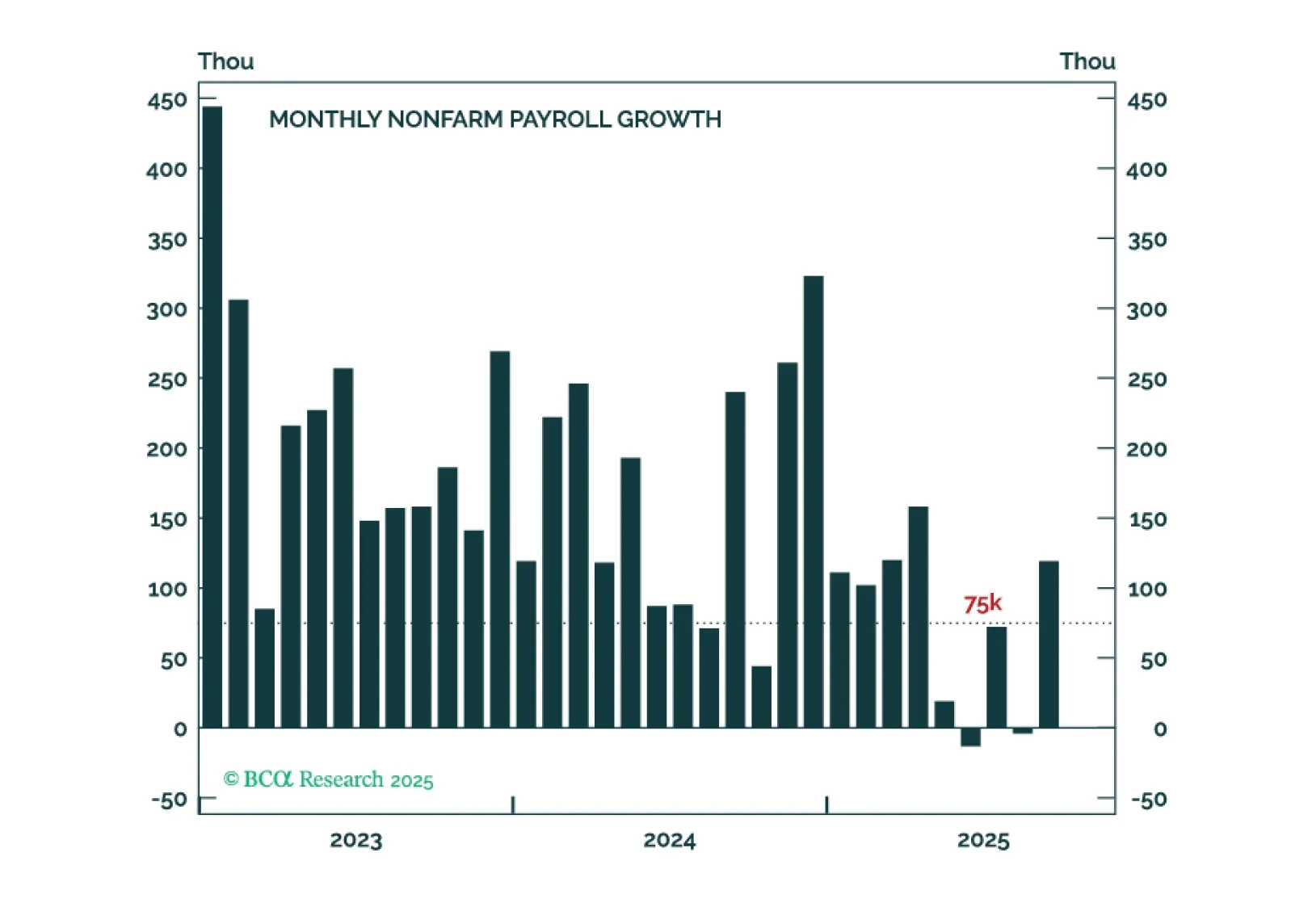

Measures of labor market utilization improved in December, ruling out a January cut and significantly reducing the odds of a March cut.

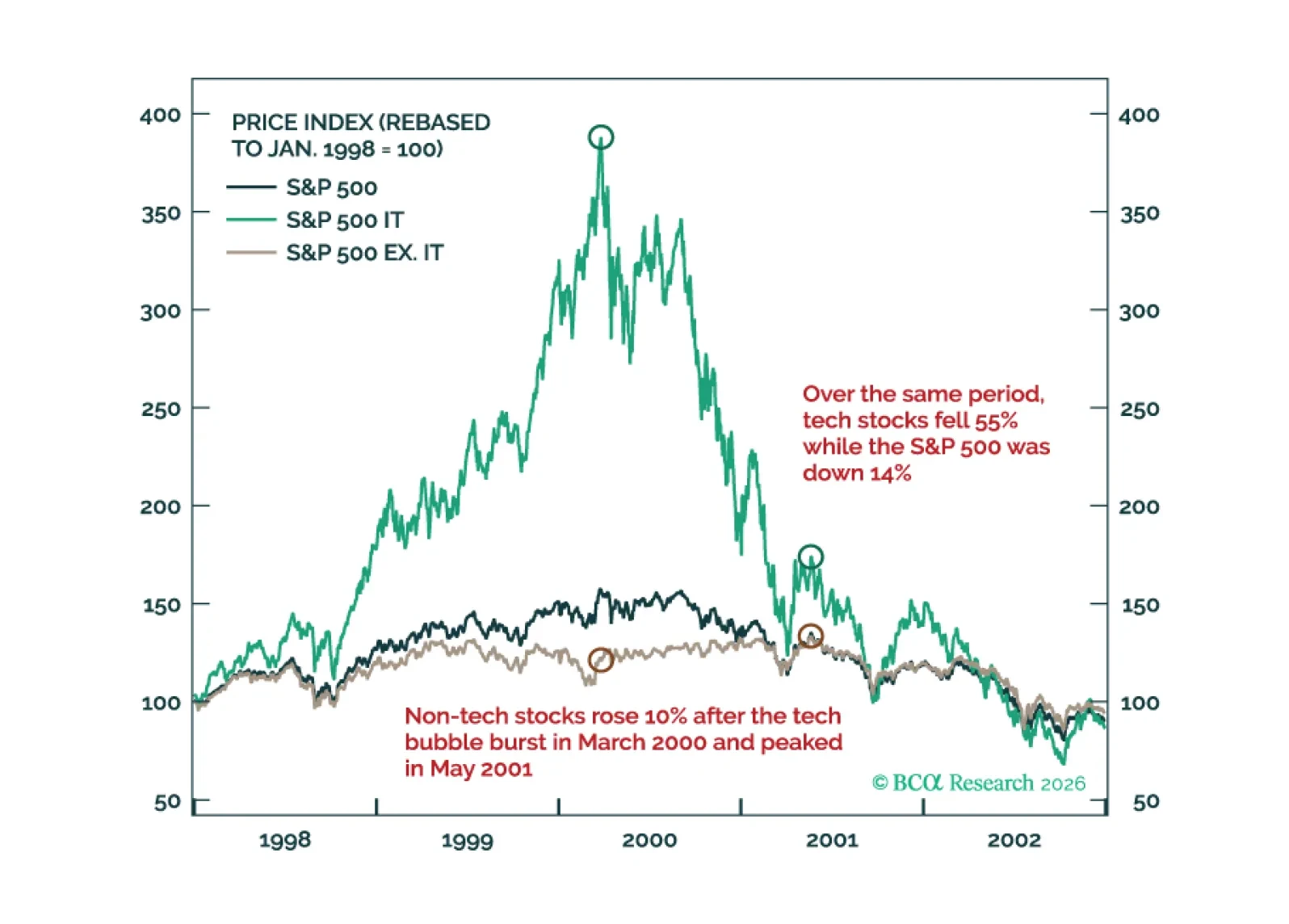

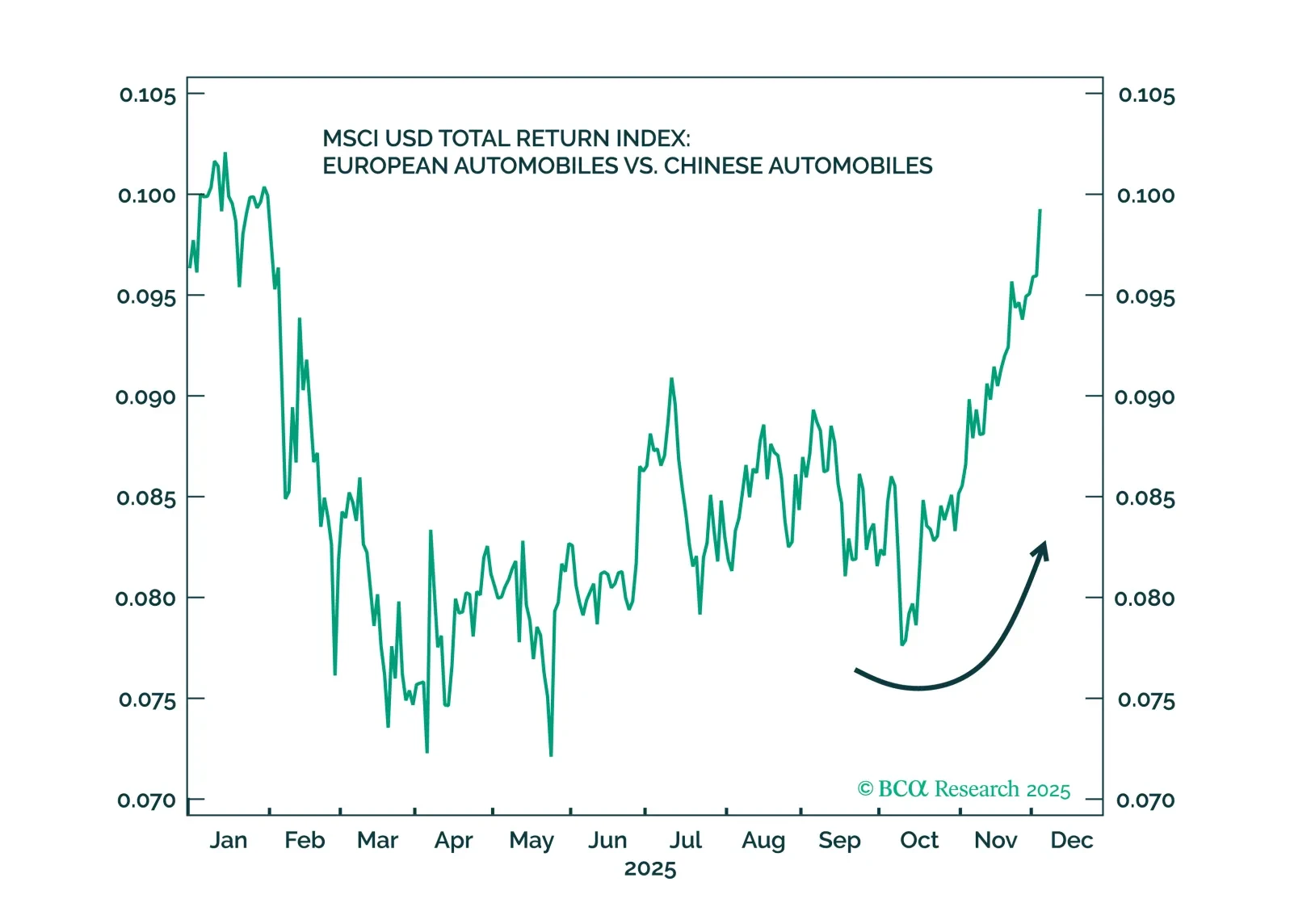

Much like the 2000 episode, we expect this year to unfold in two stages: A “Great Rotation” from tech stocks to non-tech names in the first half of 2026 followed by a broad-based selloff in stocks in the second half on the back of a weakening US economy.

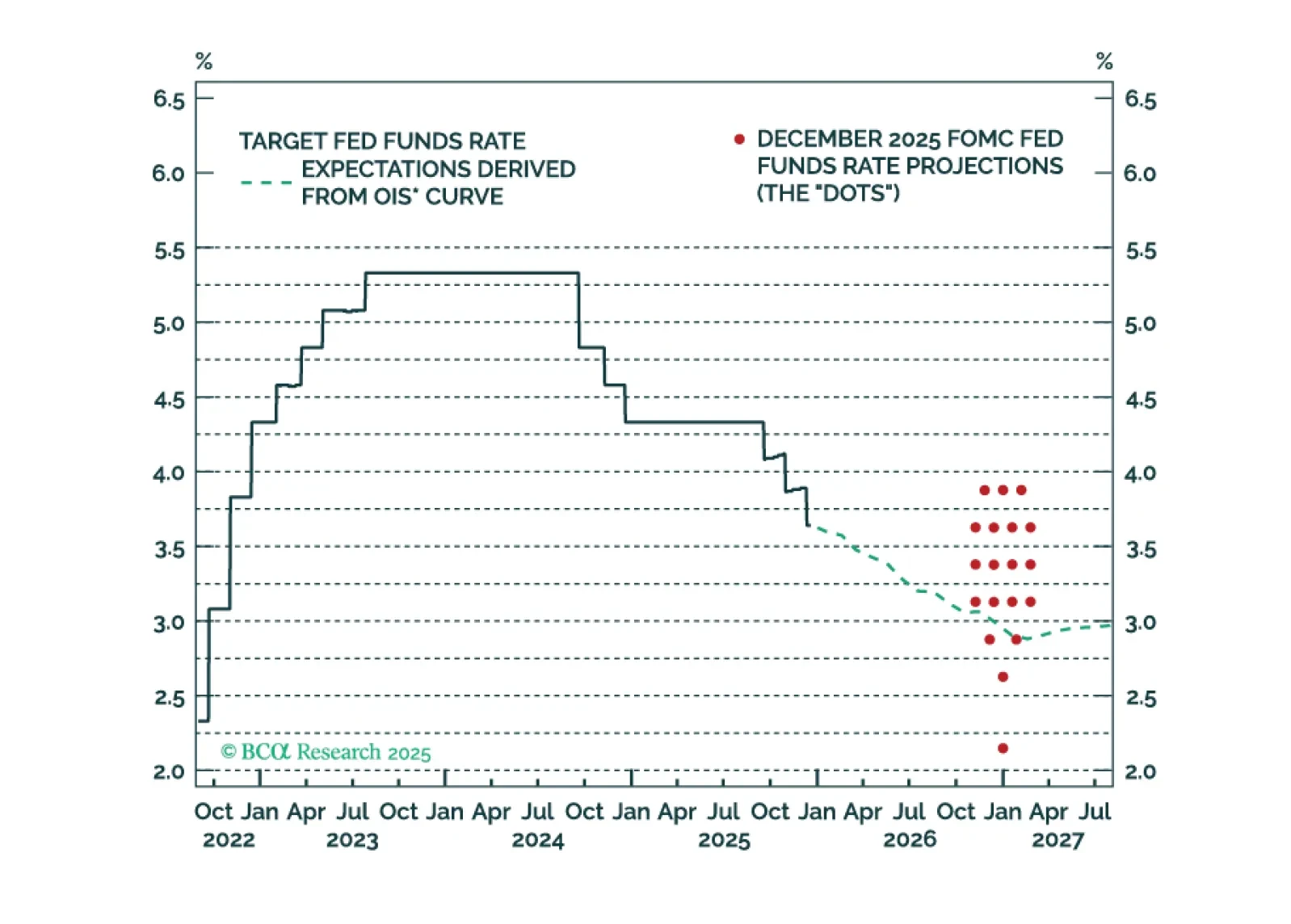

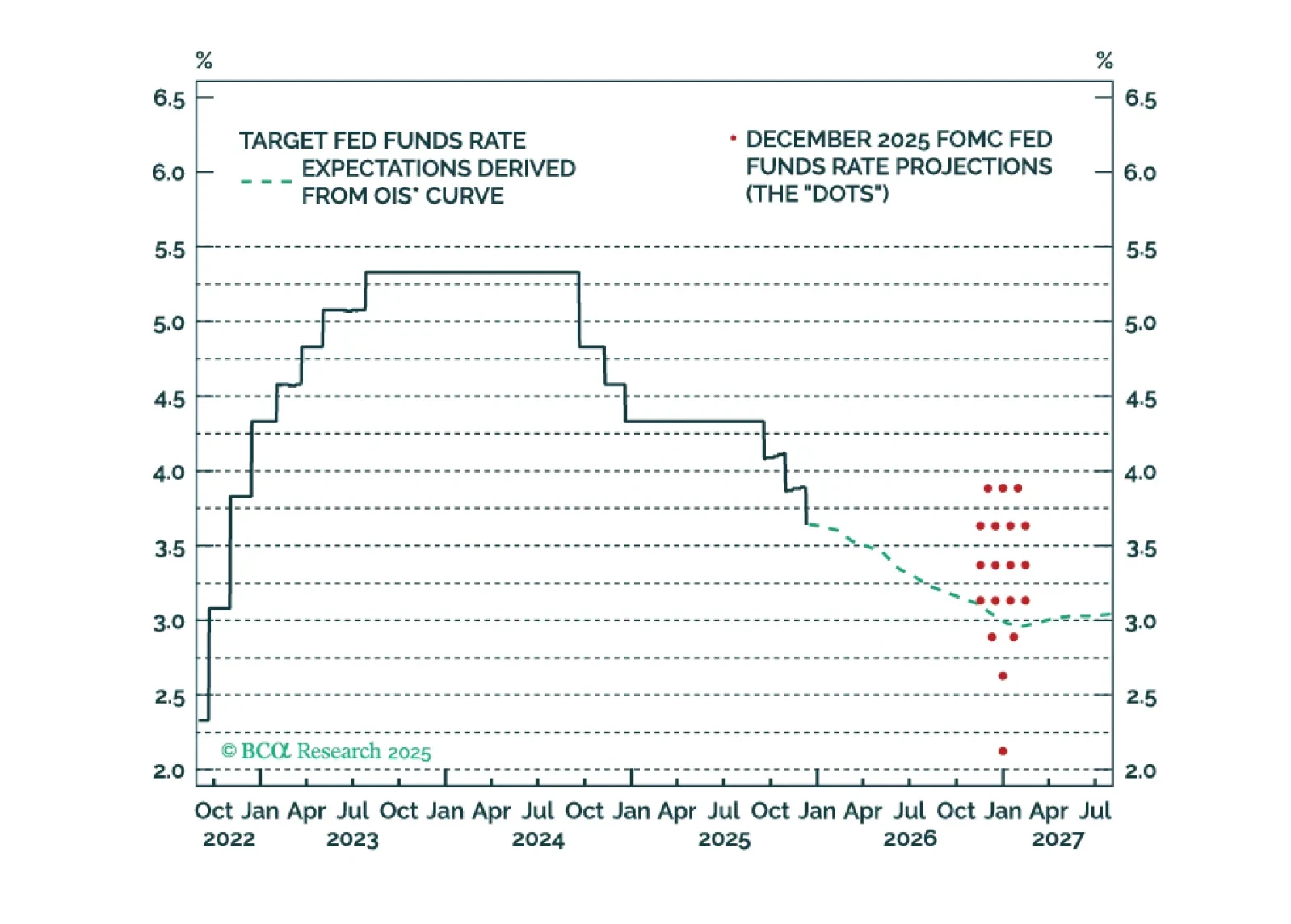

Our outlook for Fed policy in 2026.

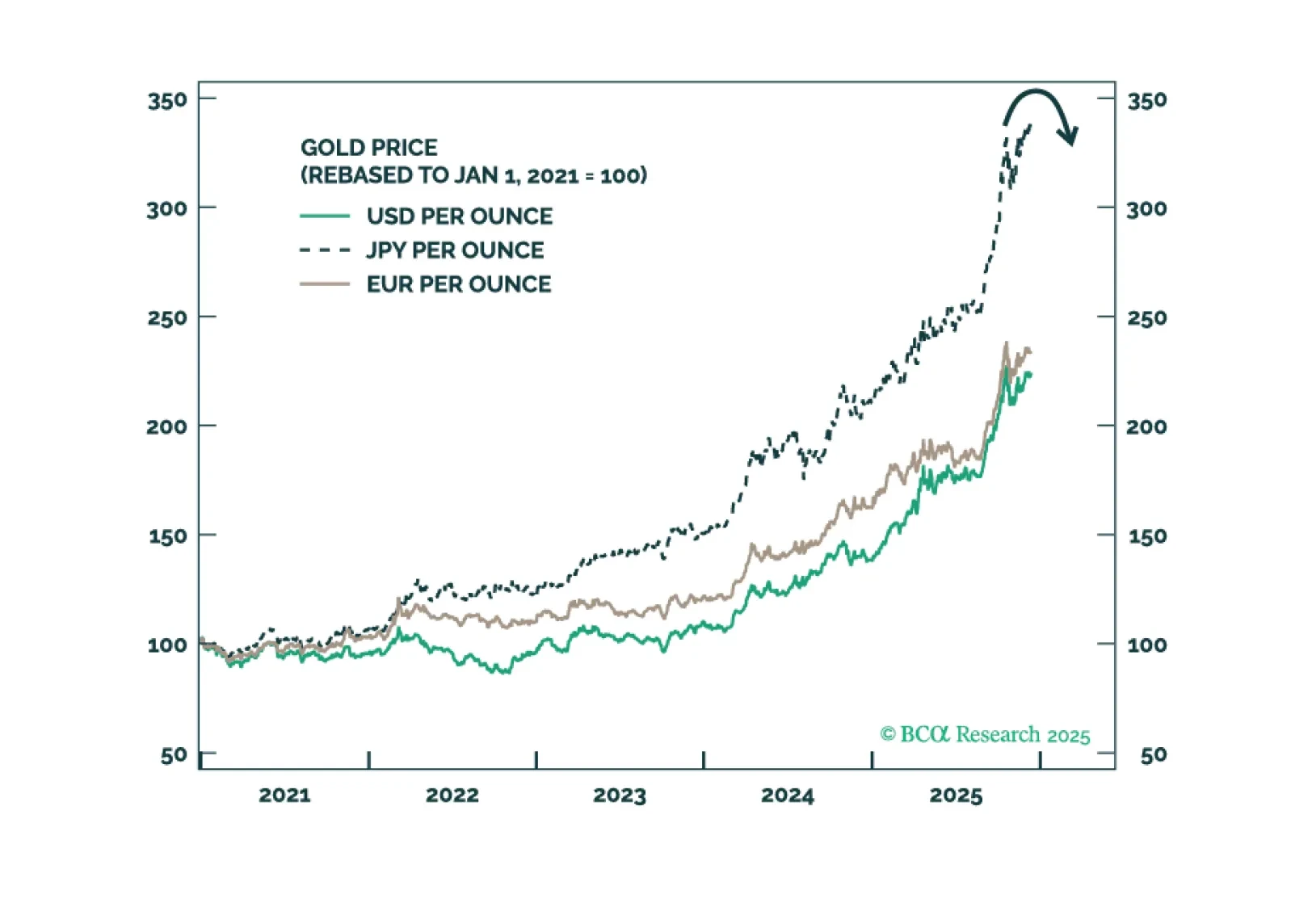

2026 will see geopolitical risk move sideways globally as the US pursues a ceasefire in the proxy war with Russia and a tariff truce with China ahead of midterm elections that will produce gridlock.

The Fed is on hold for now, but its 2026 economic projections are far too optimistic. The Fed will ease more next year than it currently anticipates.

We got Trump's tariff shock and backtracking correct and predicted Israel's attack on Iran. But we missed the China rally — and there is still no Ukraine ceasefire.

Our Portfolio Allocation Summary for December 2025.

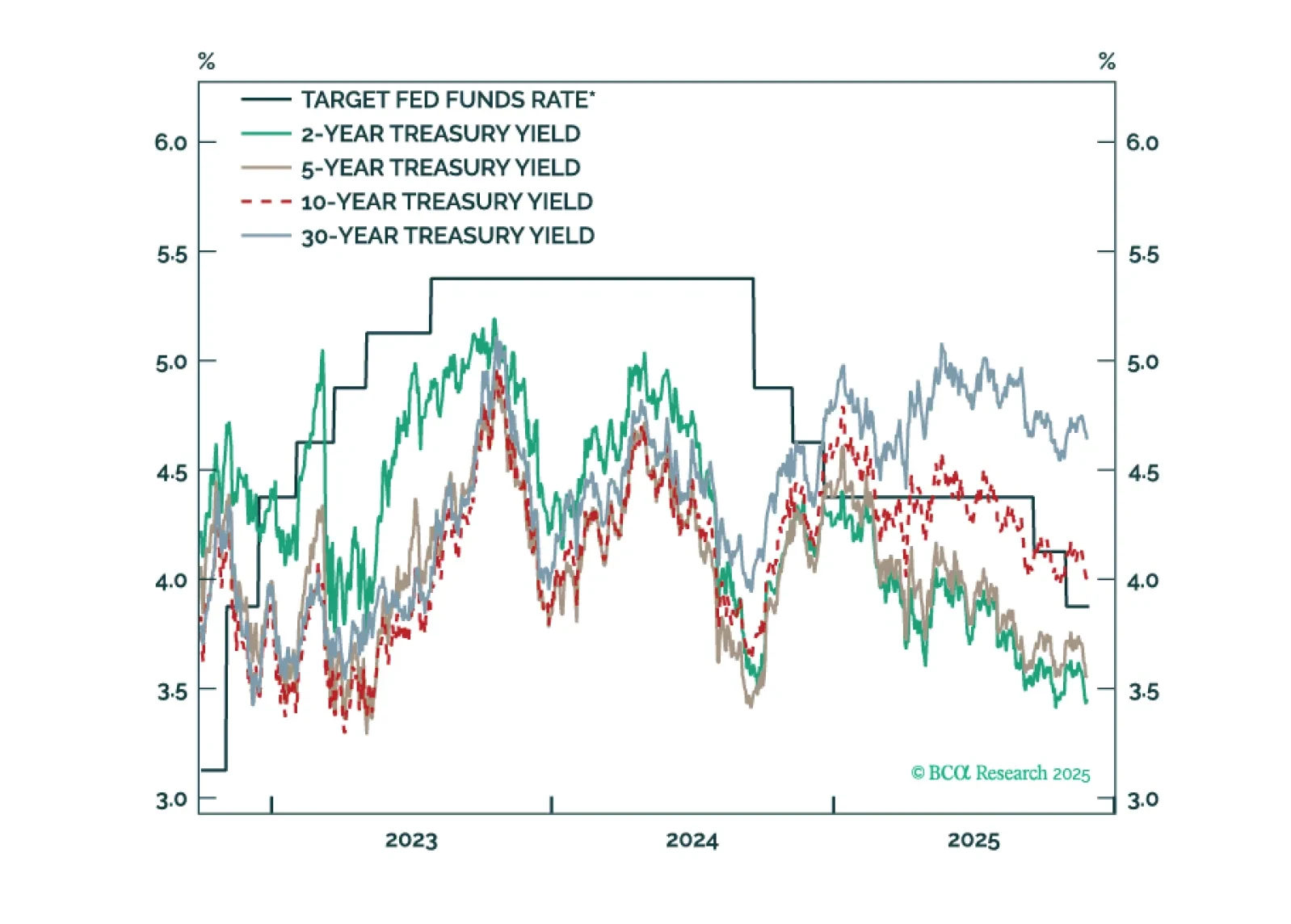

Our key US fixed income views for 2026.

The September employment report probably won’t convince enough hawks to vote for a rate cut in December.

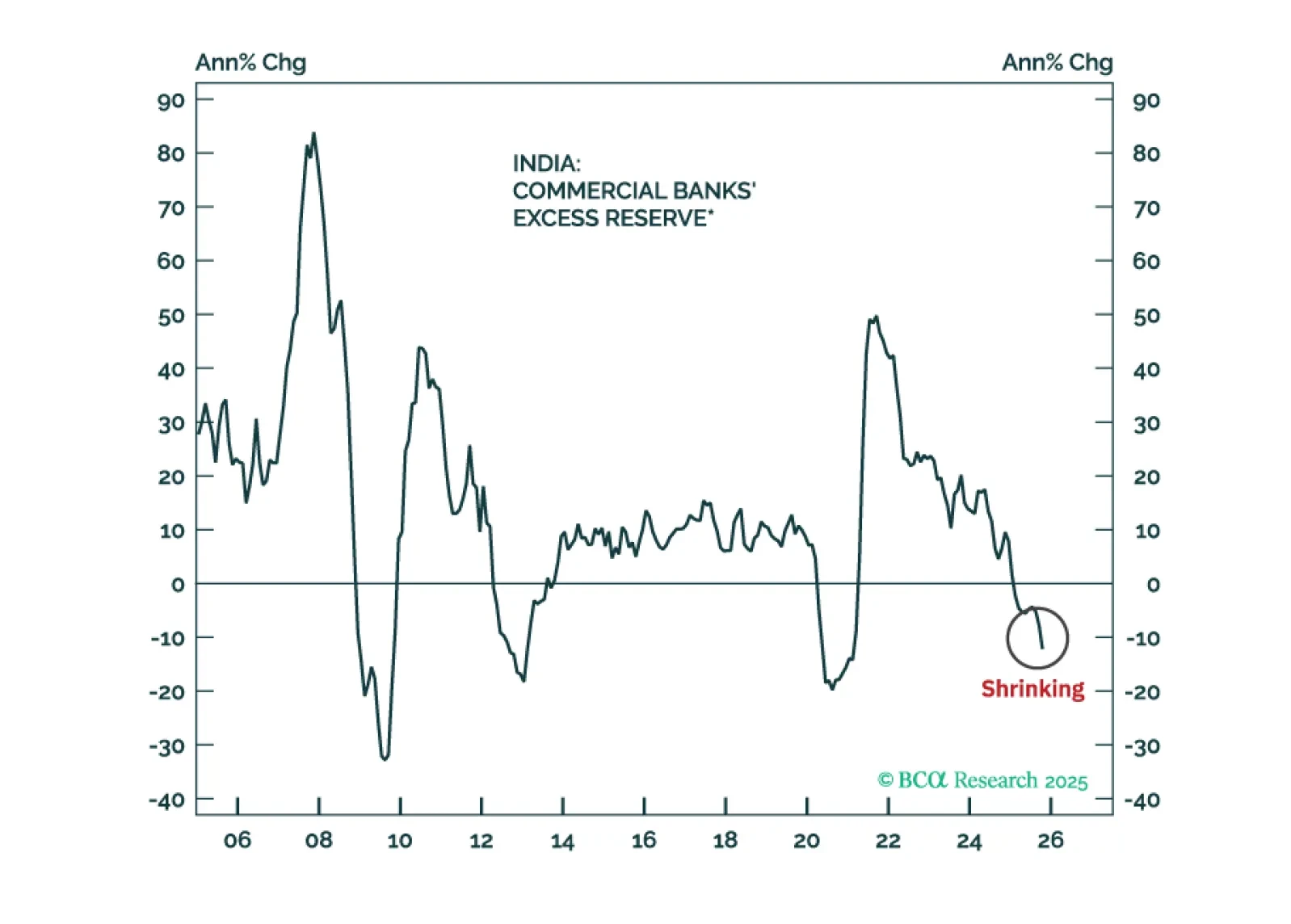

Indian stocks have further downside in absolute terms as profits disappoint. Their underperformance versus the EM equity benchmark, however, is late, which warrants a shift from underweight to neutral allocation.