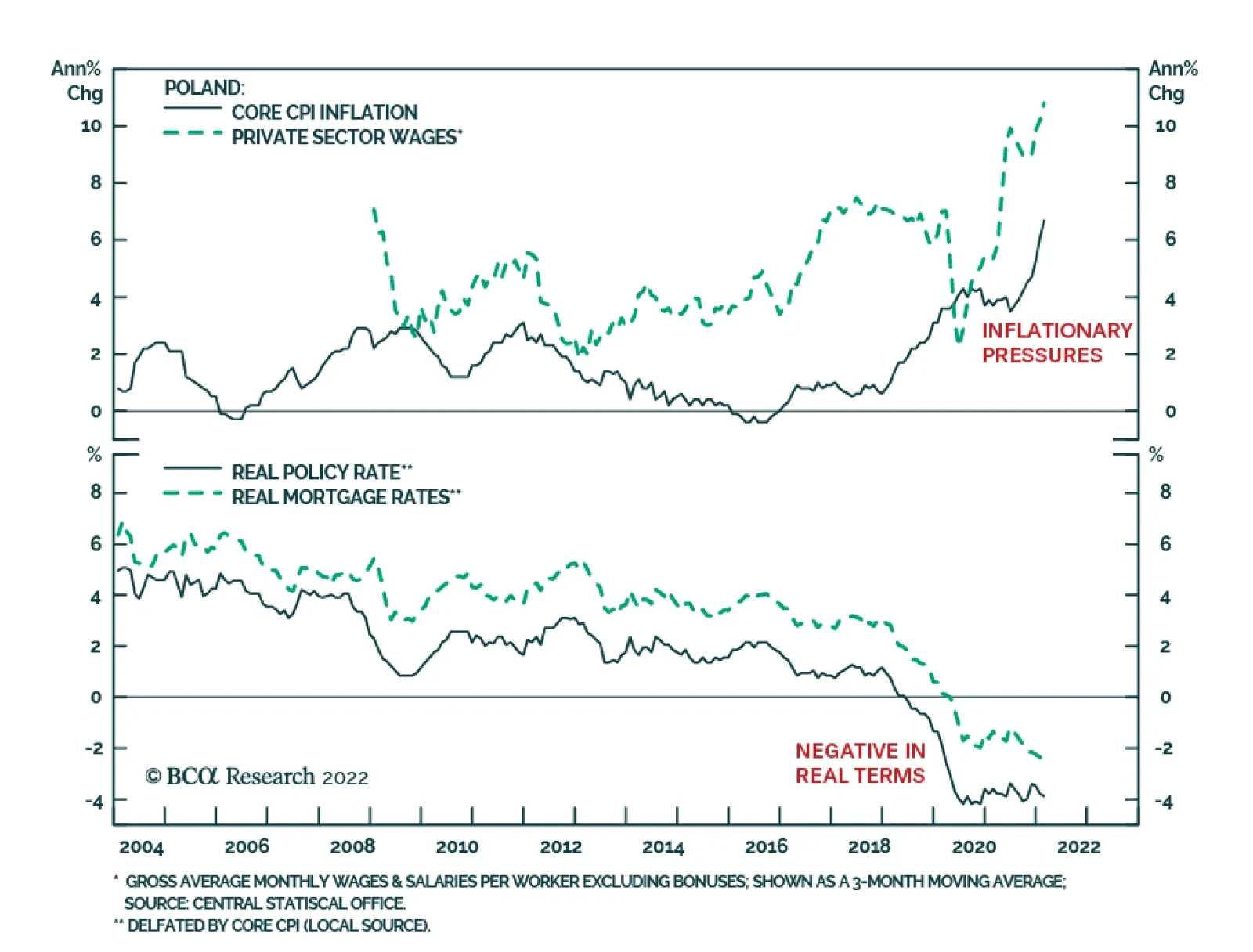

The Polish central bank (NBP) surprised markets yesterday with a 100bps rate hike to 4.5%, following a 75bps rate hike last month. The central bank rate hikes come after strong headline and core inflation prints in recent months…

Executive Summary Polish Central Bank Is Behind Inflation Curve; Czech One is Getting Ahead Curve Amid the current geopolitical crisis, Poland is more vulnerable than other Central European countries due to its extensive…

Please note that yesterday we published Special Report on Egypt recommending buying domestic bonds while hedging currency risk. Today we are enclosing analysis on Hungary, Poland and Colombia. I will present our latest thoughts on the…

Analysis on Mexico and Central Europe is available on pages 6 and 10, respectively. Highlights Deflationary pressures have been intensifying in Malaysia and the central bank will be forced to cut its policy rate. To play this theme,…

We published a Special Alert report titled Turkey: Book Profits On Shorts yesterday. The link is available on page 18. This report is Part 2 of an overview of the cyclical profiles of emerging market (EM) economies. This all-in-charts…

Highlights Stay tactically long the SEK. Our preferred expression is long SEK/GBP. Stay tactically short the NOK. Our preferred expression is long AUD/NOK. Take profits in the underweight to Poland... ...and open a tactical…

Highlights Trade 1: An unwinding of the Trump reflation trade... has worked exactly as expected. Take profits and switch into Trade 5. Trade 2: Short pound/euro at €1.18 and simultaneously buy call options at €1.30... is up…

Investors stand to benefit from Czech koruna revaluation versus the euro and also from positive carry, while waiting for the central bank to remove the exchange rate floor. Go long CZK / short euro. Economic fundamentals and policy…