The European economies are facing a major deflationary shock. We recommend that investors stay long a basket of Central European (CE3) domestic bonds. They should also upgrade CE3 bonds and stocks in their respective EM portfolios.

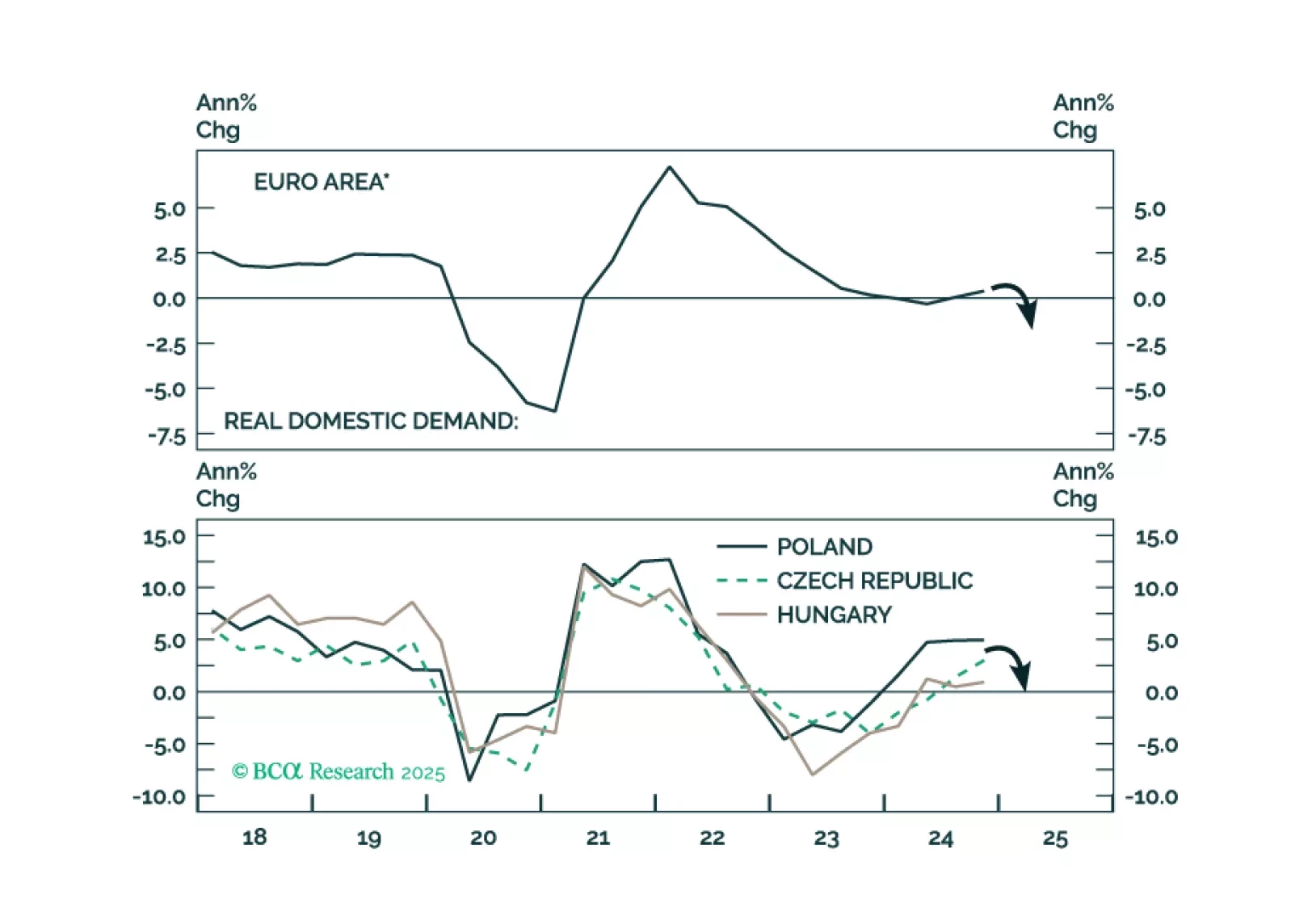

Domestic bond yields in the three major central European markets have recently inched up more than their German counterparts. This is despite economic growth staying quite weak in CE3. What should investors make of it (Chart 1)? Our…

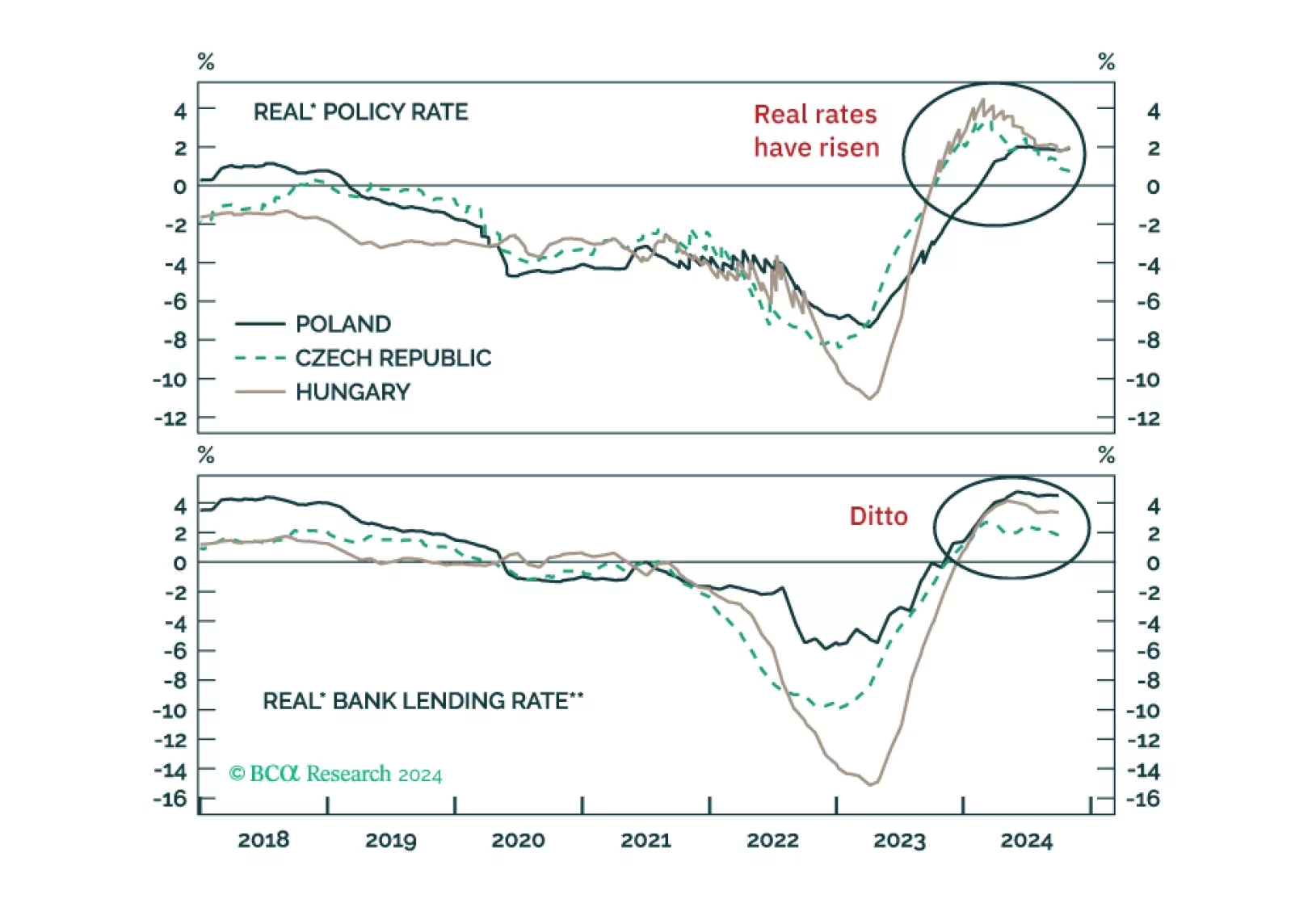

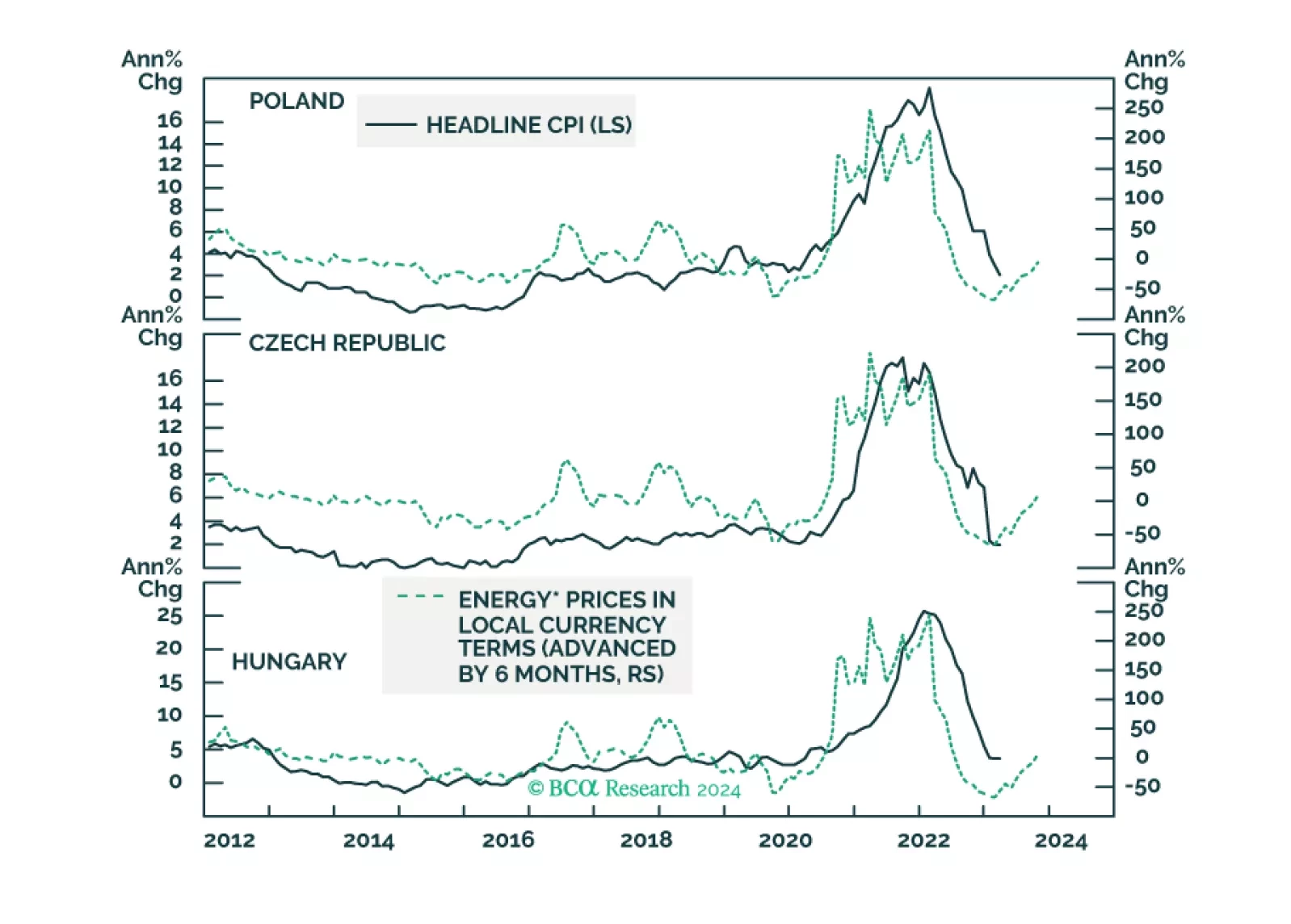

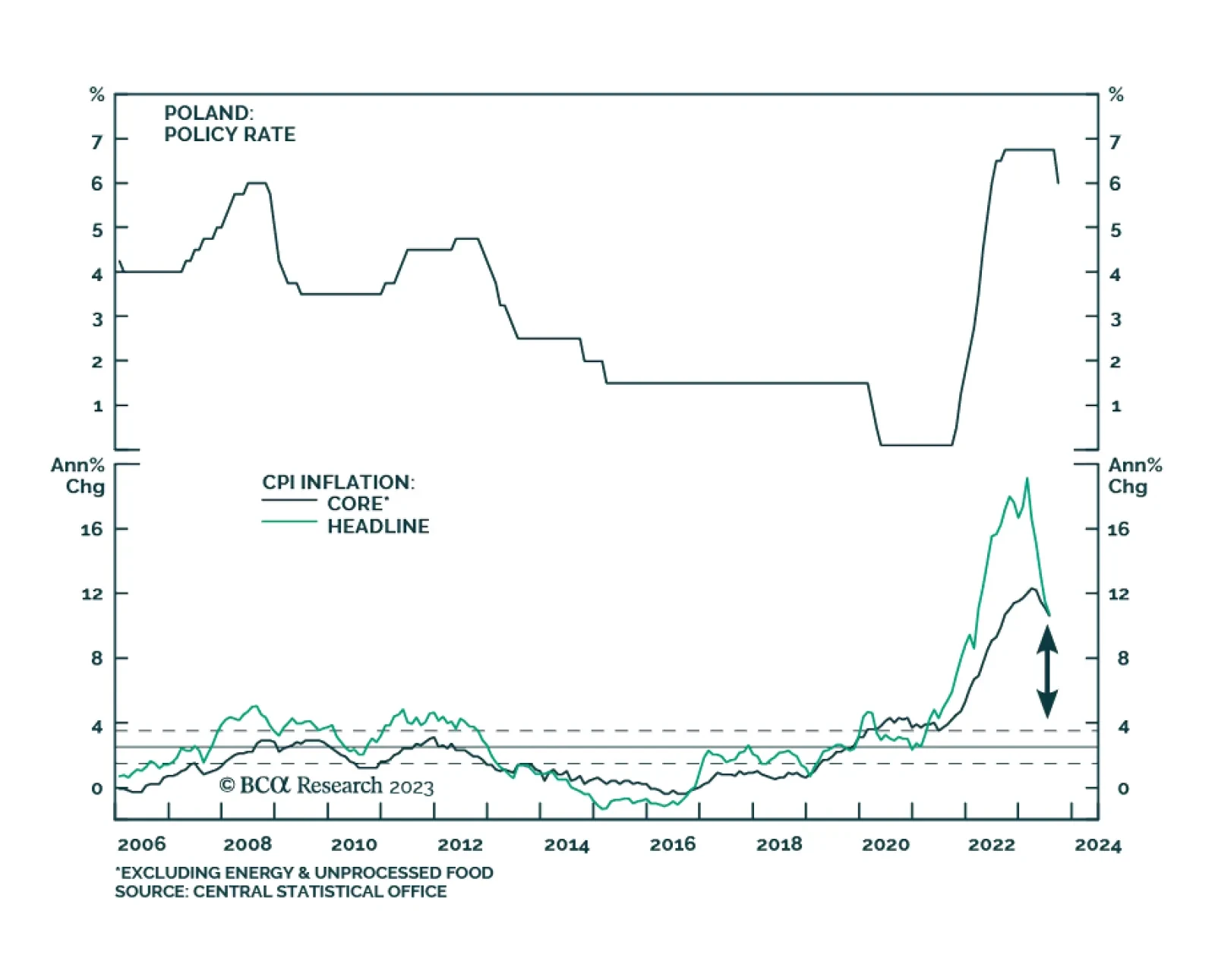

The disinflation process is over in Poland and Hungary. Only the Czech Republic will see its core inflation meet its central bank target this year. The reason is much tighter labor market dynamics in the first two. Investors should…

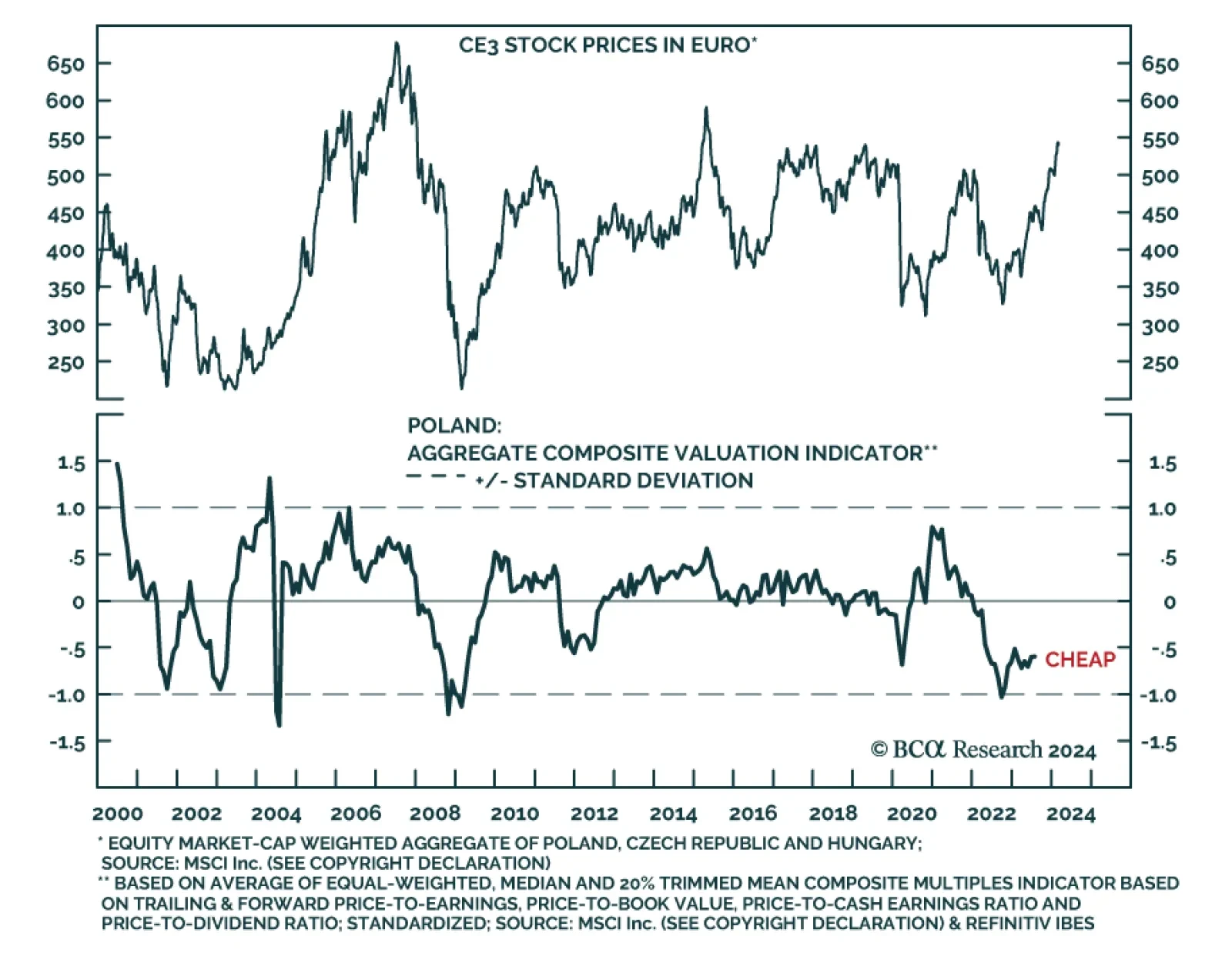

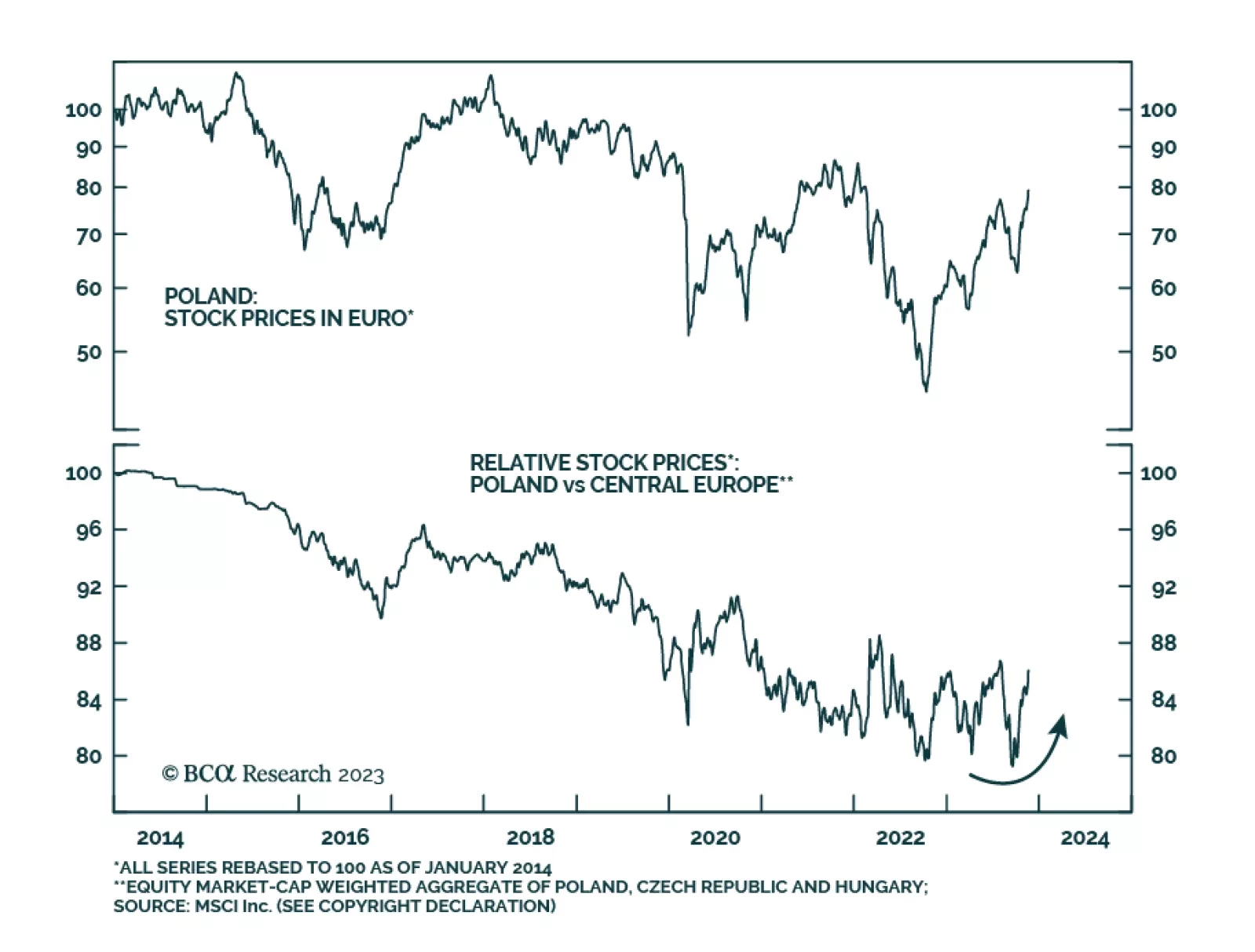

A market-cap weighted index of CE3 economies (Poland, Hungary and Czechia) returned a whopping 64% in common currency terms since its 2022 low. Polish and Hungarian equities led the rally, advancing by a respective 86% and 78% in…

In the recently held Polish general elections, the ruling Law & Justice Party (PiS) lost power. Chances are that a coalition led by the Civic Platform party will form a government next month. The new coalition ran on a pro…

Poland’s inflation will stay elevated. And yet, its return to the European mainstream has improved its financial market outlook. Accordingly, we are recommending new trades on Polish equity, fixed income, and currency.

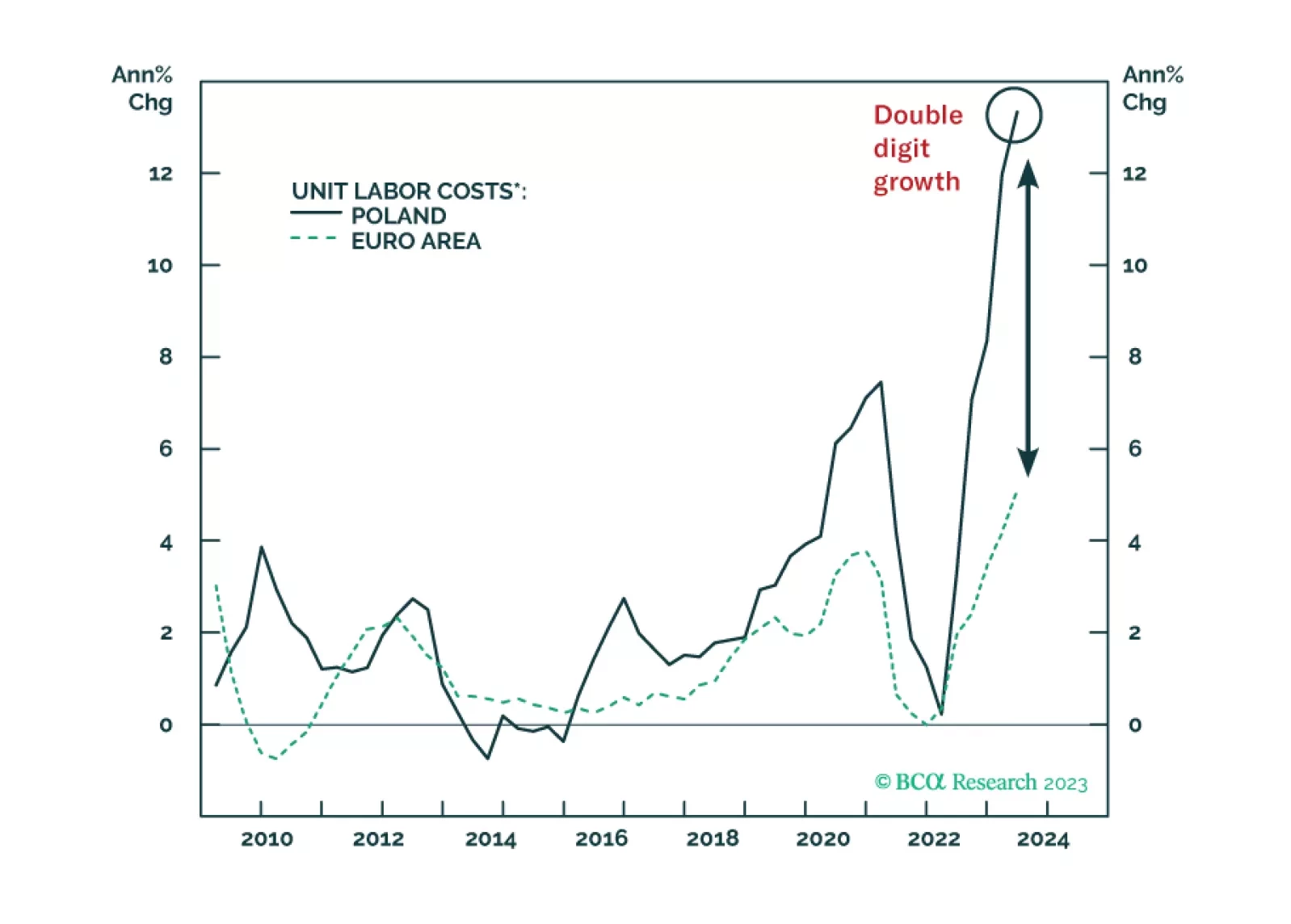

Real wages are set to rise in CE3 economies with implications for their asset markets and currencies. Of the three, Polish assets and the zloty are the most vulnerable.

The Polish central bank delivered a larger-than-anticipated 75 basis point rate cut on Wednesday – slashing the policy rate to 6%, versus expectations of 6.5%. The aggressive move marks the first rate cut following a 11-…

The growth and inflation profiles of the three central European countries are set to diverge. The outlook for Polish and Hungarian Bonds are not attractive anymore. Book profits on them. Instead, initiate a new trade: pay Polish /…

Executive Summary Poland: Wages Are Surging Hungary is exhibiting classic signs of an overheating economy –as rising inflation coincides with very strong domestic demand. Yet, authorities are still pursuing very…