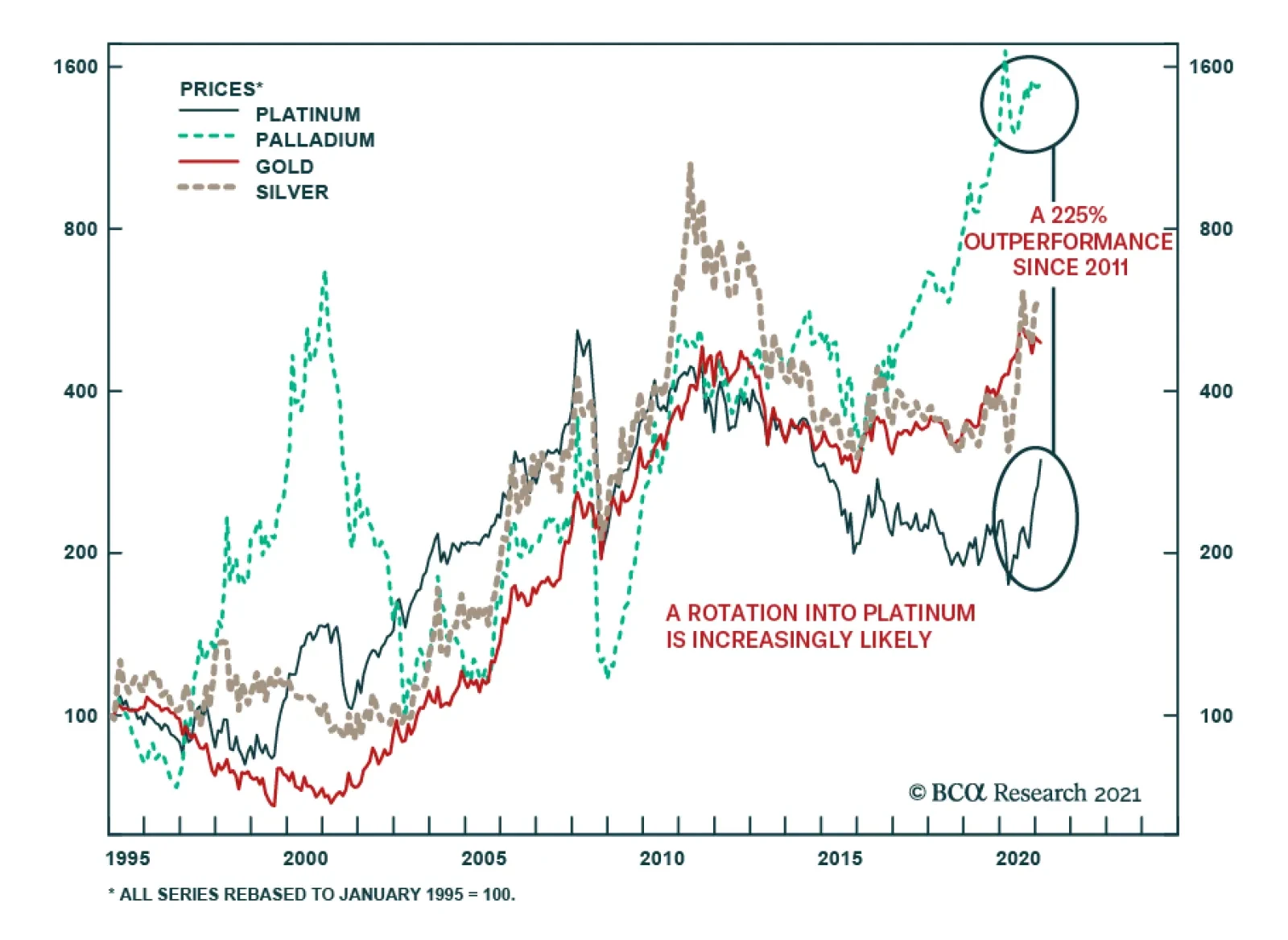

Precious metals have been a prime beneficiary of the reflation efforts of global central banks. Low real rates and a weak dollar are generally positive for the complex, albeit the reaction amongst each of these metals has not…

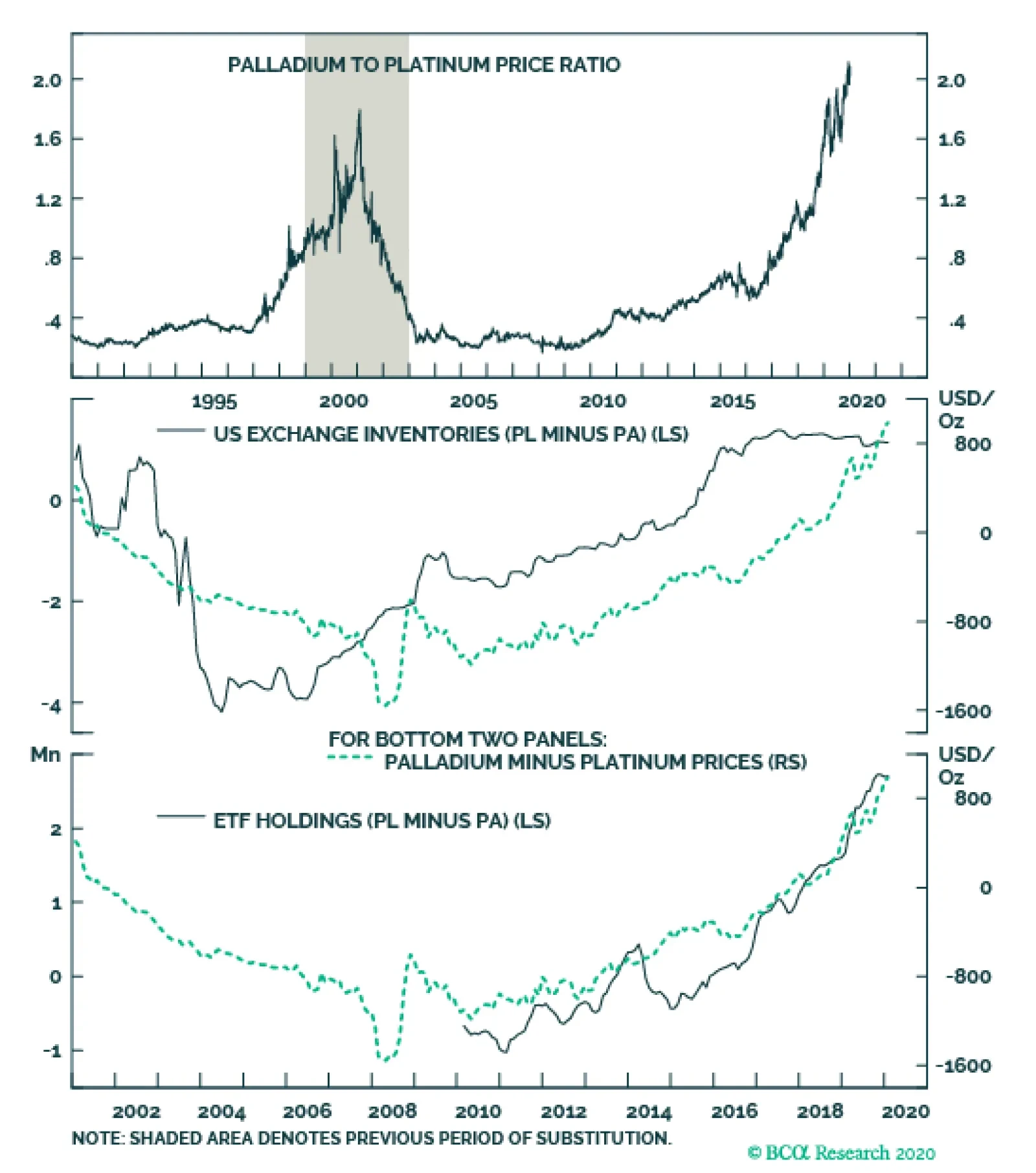

Highlights Supply constraints and unstoppable demand growth – the result of stricter regulations requiring higher loadings in autocatalysts to treat toxic pollution in automobile-engine emissions – will continue to push…

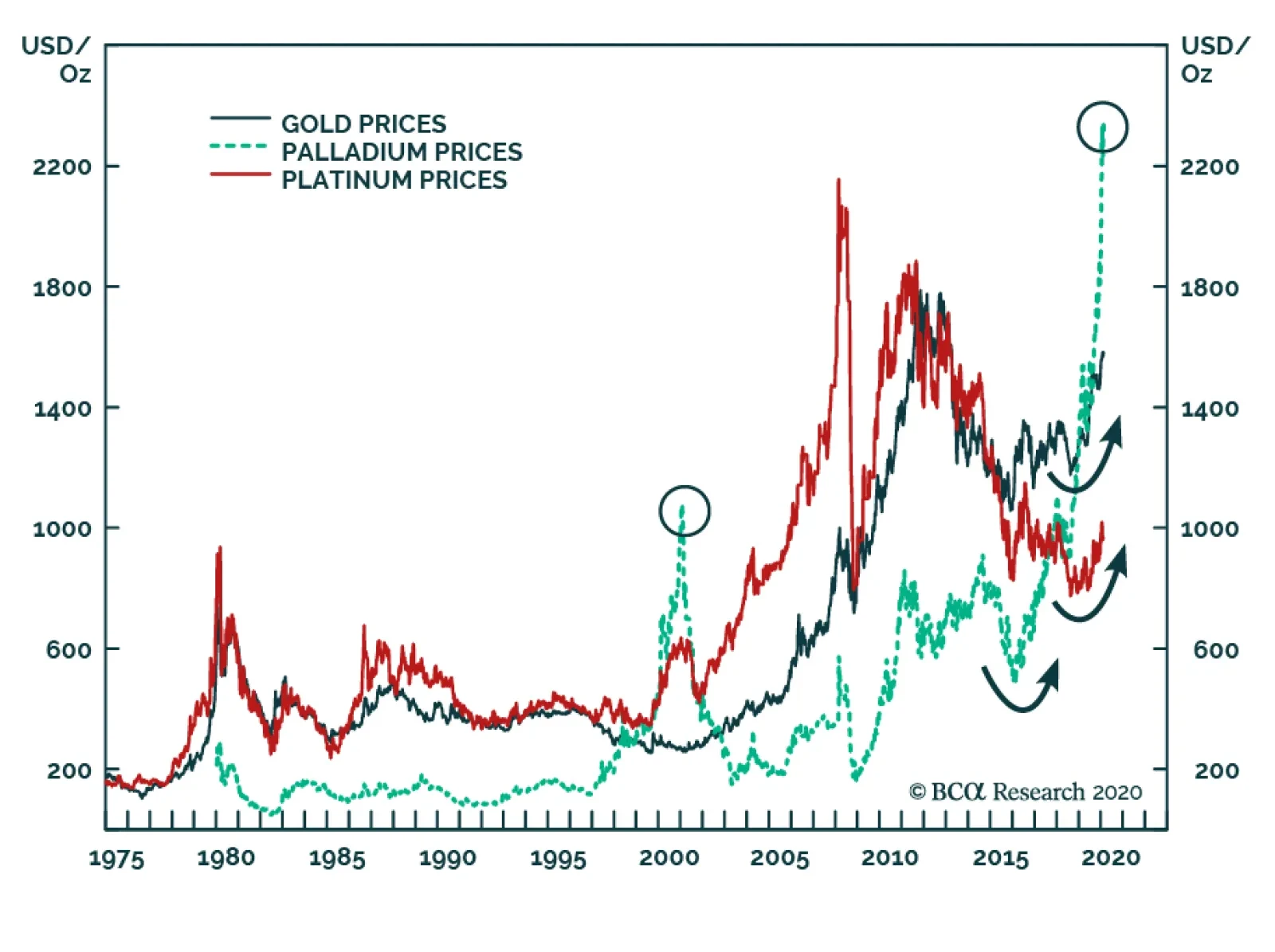

Palladium prices bottomed at $167/oz in the aftermath of the financial crisis and have since skyrocketed to $2458/oz, making it the most expensive precious metal in the PGM space. In annual terms, this constitutes a total return…

The platinum-to-palladium ratio is at a level that would incentivize substitution in the pollution-control technology in gasoline-powered engines, and supports higher platinum content in diesel catalyzers. Nonetheless, swapping…

Highlights OPEC 2.0 production discipline and the capital markets’ parsimony in re funding US shale-oil producers will restrain oil supply growth. Monetary and fiscal stimulus will revive EM demand. These fundamentals will push…

Highlights As the Fed proceeds with its policy tightening this year, higher real rates and a stronger USD will weigh on silver and platinum prices, and, to a lesser extent, palladium prices. Offsetting these downward pressures, silver,…

Highlights Expanding trade volumes - led by EM growth - will continue to support commodity demand, particularly for base metals. In the first four months of this year, EM import growth averaged 8.4% year-on-year (yoy), led by an…

Highlights EM tech stocks are overbought while banks are fundamentally vulnerable due to bad-loan overhang. EM stocks have never decoupled from the U.S. dollar and commodities prices. There has been no recovery in EM corporate…

Forget about the production-cooperation pact agreed between Russia and KSA over the weekend at the G20 meeting in China. With or without it, rebalancing of the oil market will force global inventories to draw beginning in 2016Q4 and…

Commodity speculation provides liquidity to hedgers, allows price discovery, and offers access to an asset class that typically produces returns that are not correlated with stock or bond returns.