The relative performance of Philippine equities against the EM benchmark is moving inversely to the direction of relative (Philippines minus EM) local bond yields (Chart I-1). When local Philippine bond yields drop versus those of other…

Highlights Analysis on the Chinese property market is available below. In the Philippines, domestic demand is set to accelerate at the hands of the government’s fiscal boost. The current account deficit will widen and the peso…

Analyses on the Philippines, Colombia and Argentina are available below. Highlights Global growth conditions, especially outside the U.S., remain bond friendly. Nevertheless, U.S. bonds are overbought and technical factors might…

Chart II-1Philippine Current Account Deficit Funded By Volatile Portfolio Flows Declining U.S. interest rates coupled with slumping oil prices have supported Philippine financial markets. However, the country’s…

Philippine stocks have outperformed the EM benchmark lately and have risen in absolute terms due to the sharp drop in U.S. rates (Chart II-1). Chart II-1Philippine Stocks Relative Performance Yet, investors have been ignoring…

Analysis on the Philippines and Argentina are below. Highlights Analysis on the Philippines starts on page 9 and Argentina on page 12. Relative return on capital for non-financial corporations points to continuous EM equity…

Highlights So what? EM elections bring opportunities as well as risks. Why? Emerging market equities will benefit as long as China’s stimulus does not fizzle. Modi is on track to win India’s election –…

The peso will plunge much further if the monetary authorities do not tighten aggressively. Alternatively, the central bank could defend the peso without hiking rates by selling foreign exchange reserves. Doing so, nevertheless…

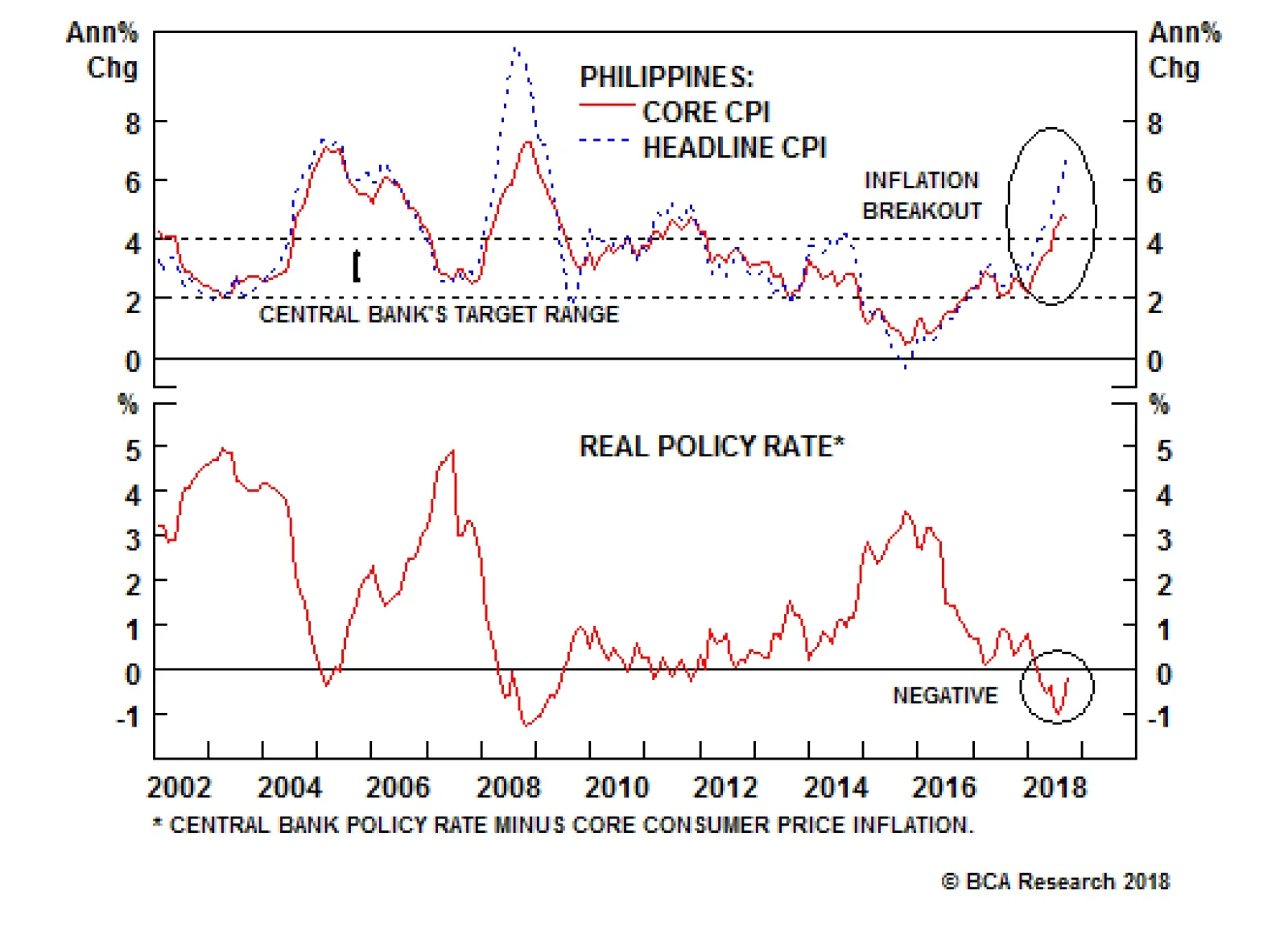

The Philippine economy continues to overheat. Both headline and core inflation measures are rising precipitously and have breached the central bank's upper target of 4% by a wide margin. Odds are that inflation will…

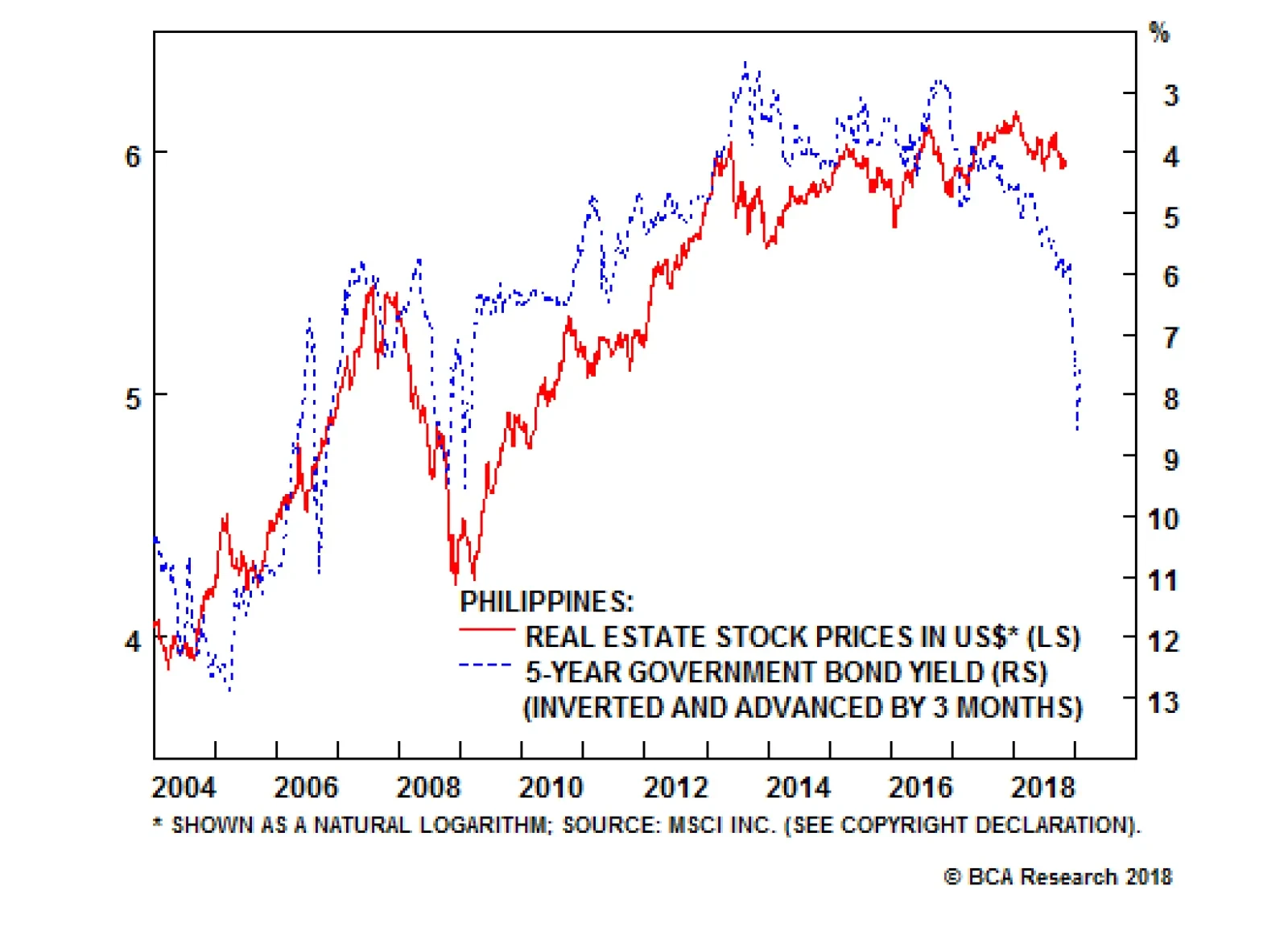

Highlights In the Philippines, inflation is breaking out while the central bank is well behind the curve. Financials markets remain at risk. As a play on surging interest rates: Go short Philippine property stocks. We appraise and…