In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

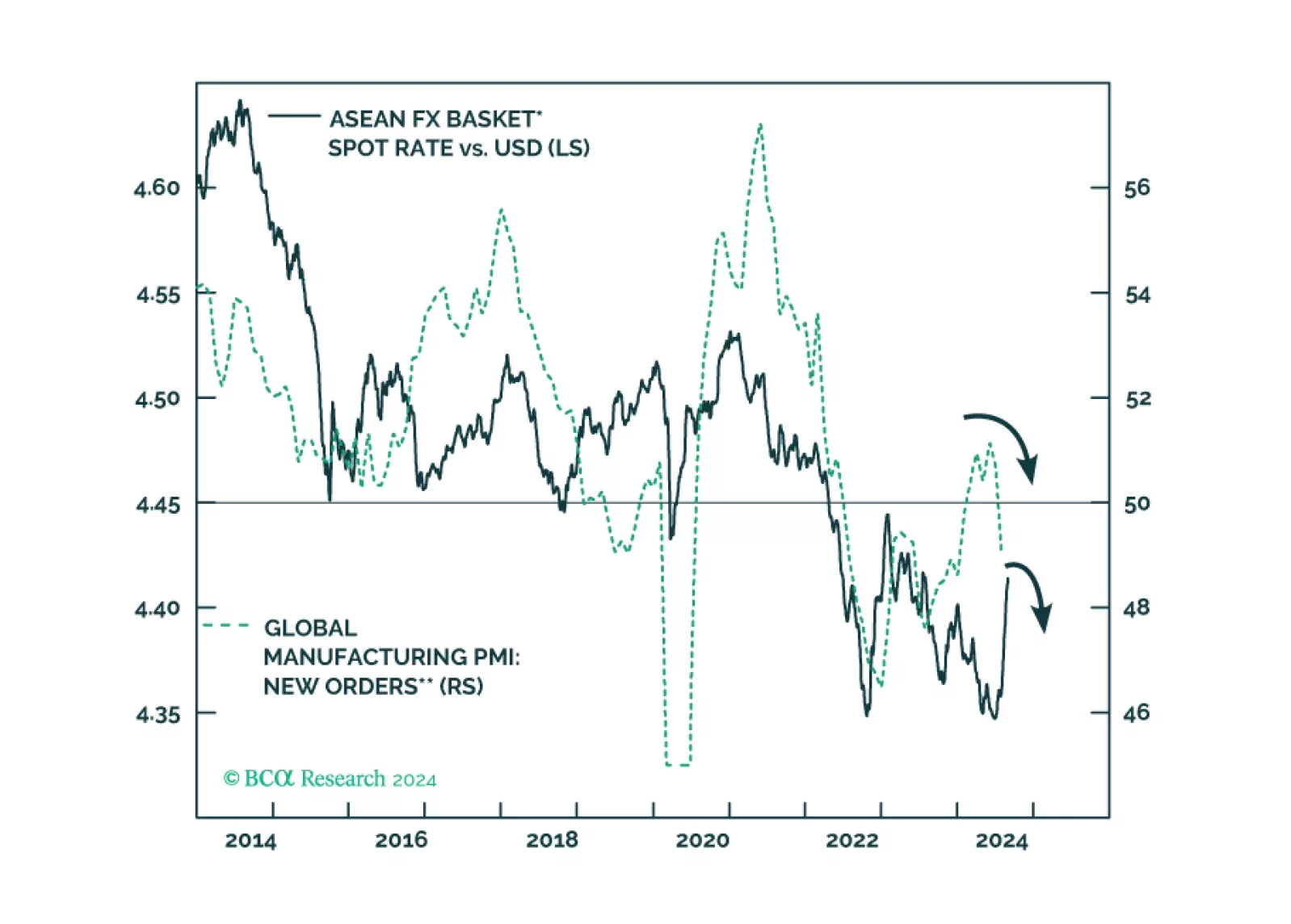

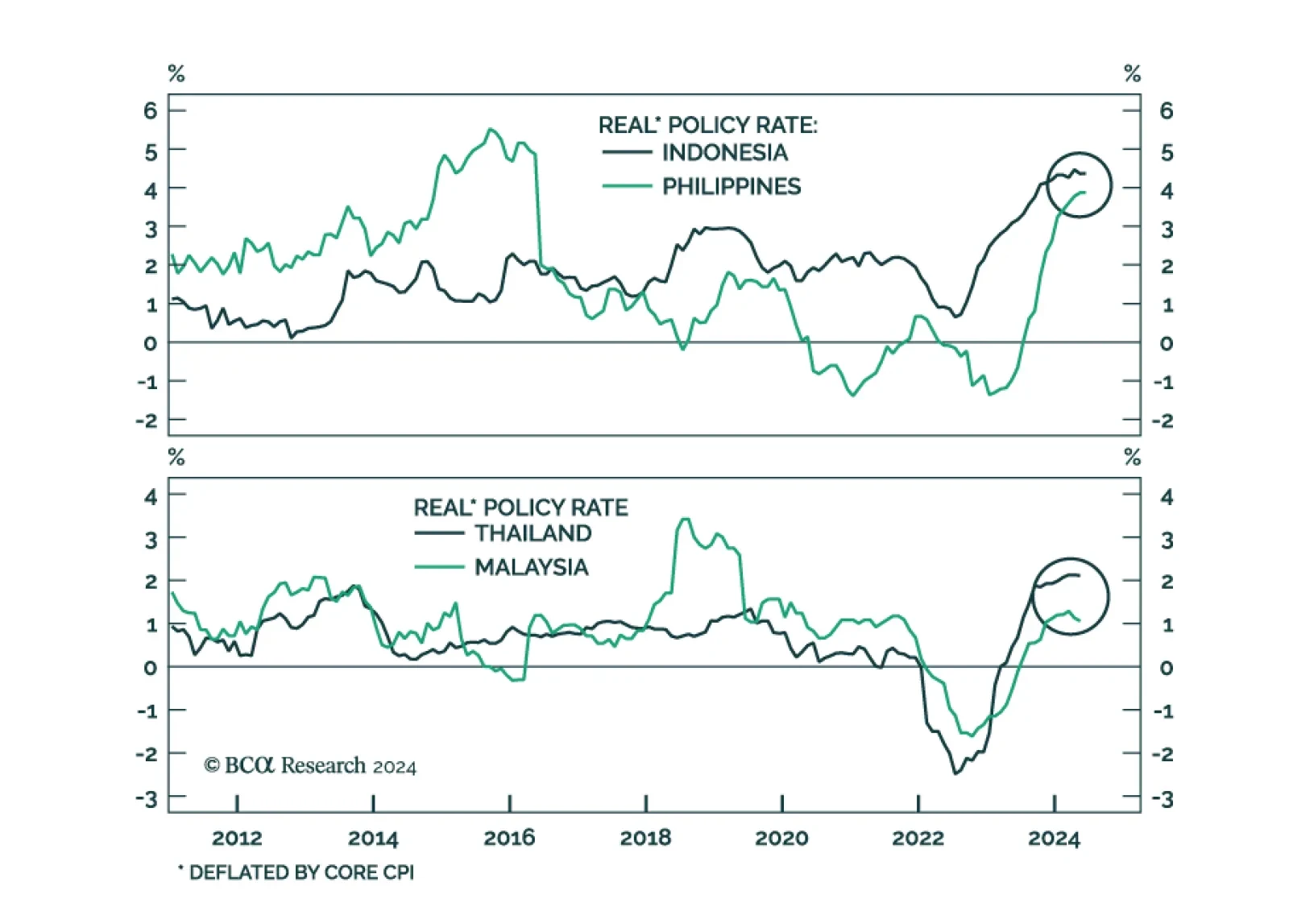

The ongoing rally in ASEAN currencies will fizzle sooner rather than later as they are not supported by fundamentals. The ringgit and the baht, however, will fare better than the peso and the rupiah during the coming global risk-off…

The four ASEAN stock markets (Indonesia, Malaysia, Thailand, and the Philippines) have fallen in absolute terms over the past year despite the powerful rally in the developed markets. They have also underperformed their EM…

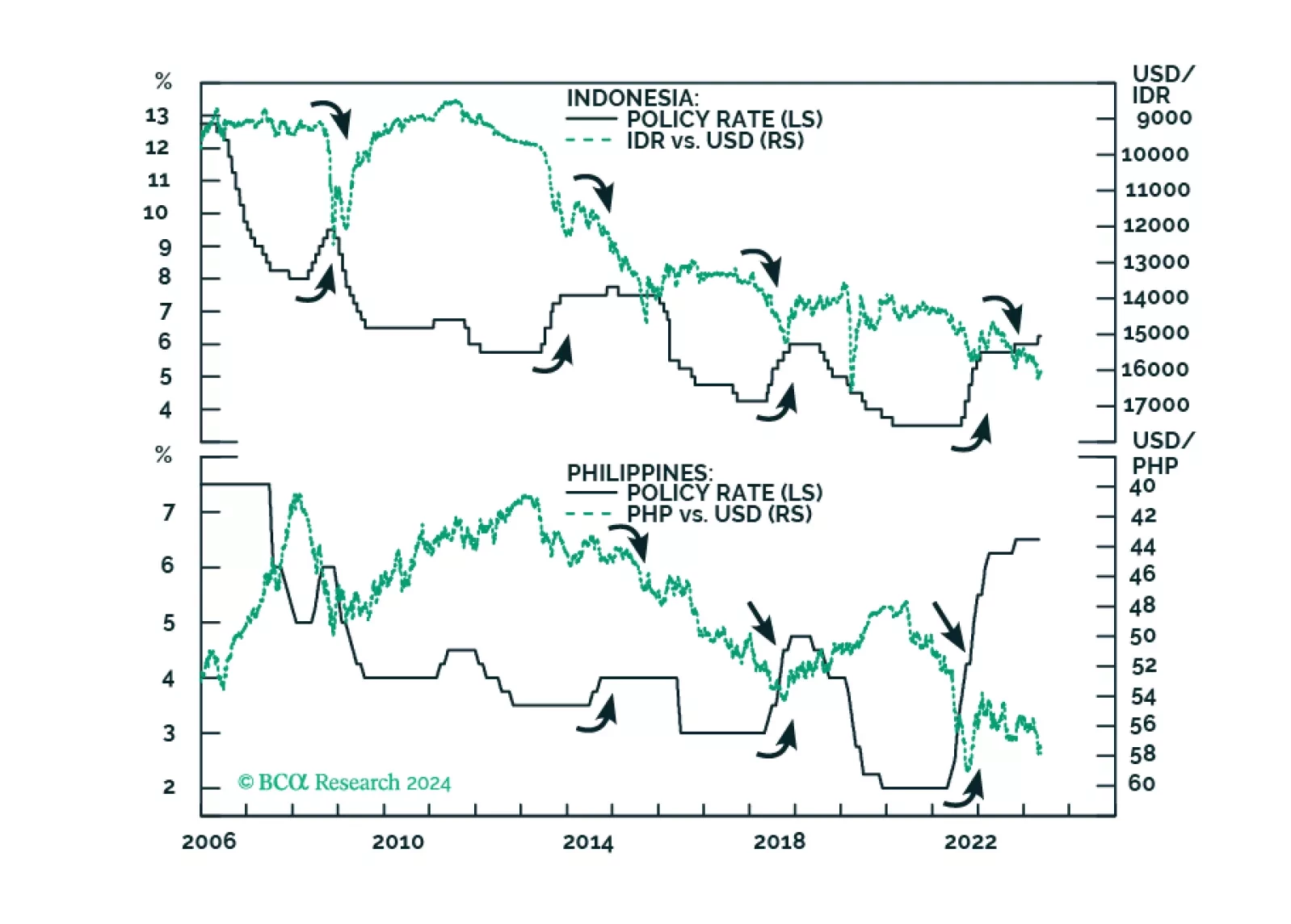

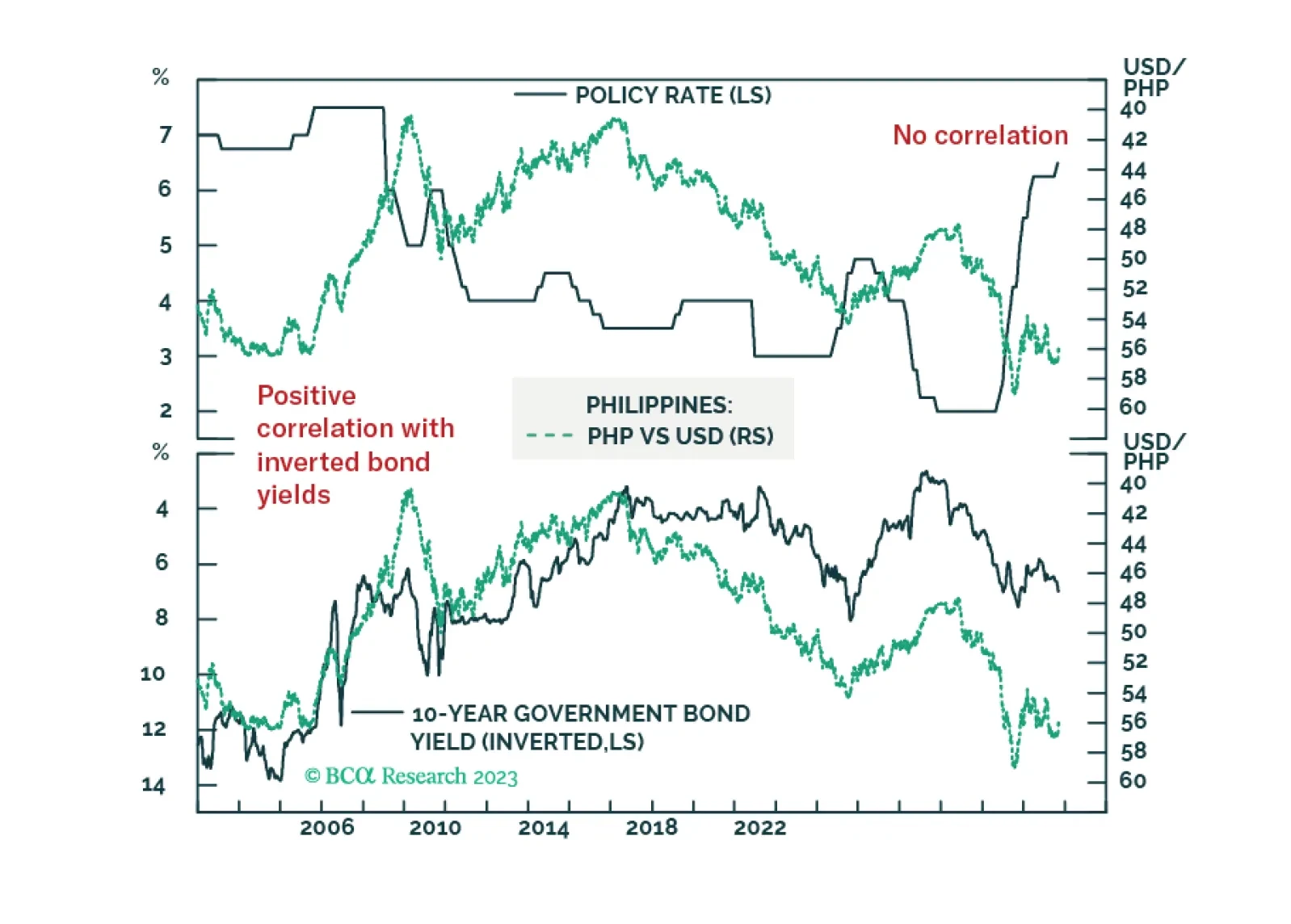

Since early 2023, the Philippine peso has depreciated by 8% versus the US dollar despite the country’s central bank pushing up real policy rates by 500 basis points. BCA’s Emerging Markets Strategy argues that raising…

ASEAN stocks and currencies will weaken further as these economies face multiple headwinds. Raising policy rates did not stop a sliding currency in the past, it is unlikely to do so now.

The recent rate hike by the Philippines central bank cannot control food inflation. Nor can it stem the currency slide.

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

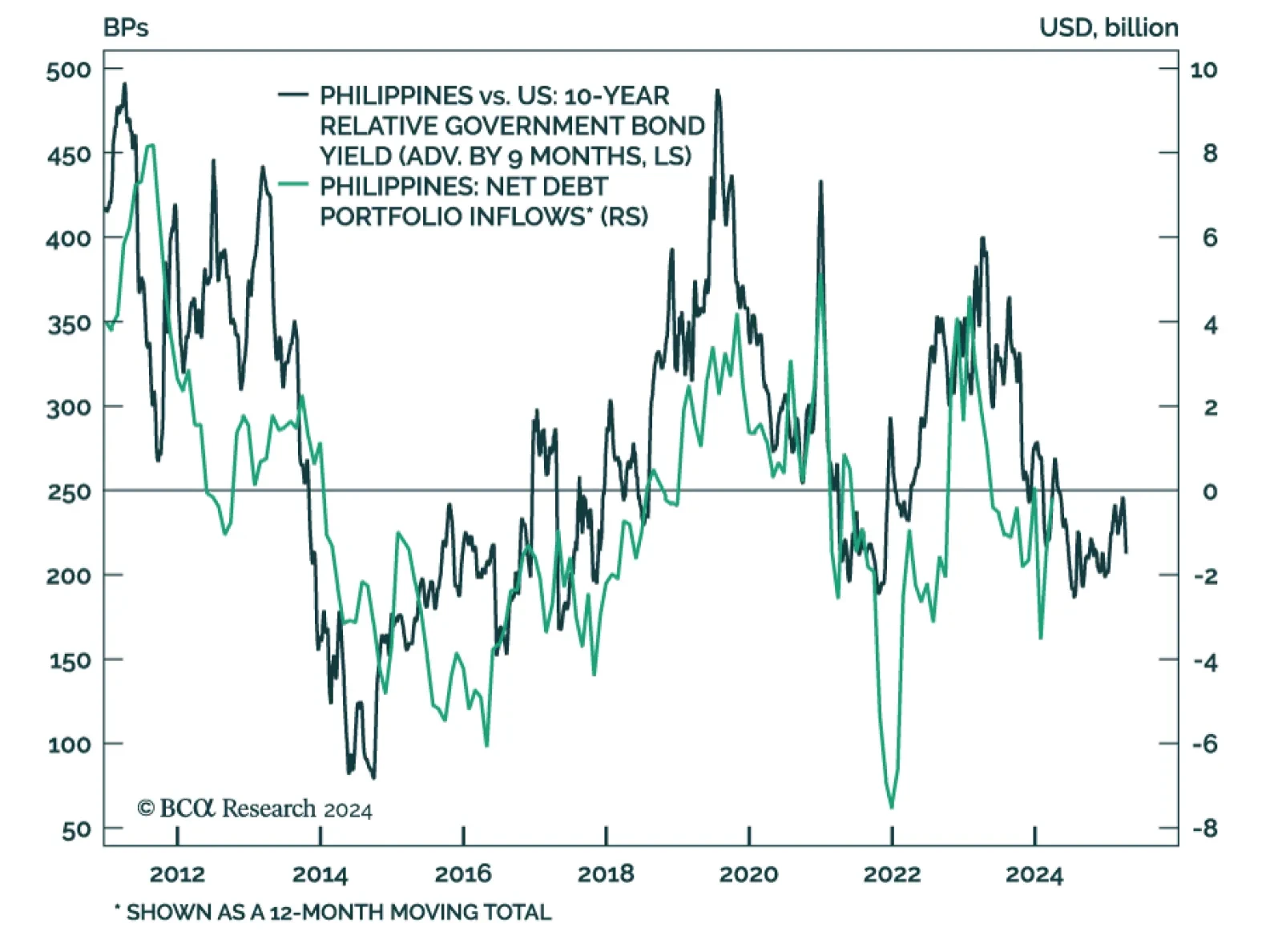

Foreign debt inflows into Philippines will be falling in coming months. Book profits on domestic bonds; and go short the peso.