Peru's financial assets have plummeted due to the election of left-wing president Pedro Castillo. Some investors may be tempted to bottom fish in these markets due to their lower valuations and oversold conditions. However…

This week I have been holding client calls and roundtables with clients located in the EMEA region. In next week’s report we will share our answers to the most common client questions. In the meantime, this week we are sending you a…

Highlights Over the short term – 1-2 years – the pick-up in re-infection rates in Asia and LatAm states with large-scale deployments of Sinopharm and Sinovac COVID-19 vaccines will re-focus attention on demand-side risks to…

The election of left-wing candidate Pedro Castillo in Peru is all but confirmed. While right-wing presidential candidate Keiko Fujimori is alleging signs of fraud and is demanding a recount of hundreds of thousands of votes, it is unlikely…

Highlights US labor-market disappointments notwithstanding, the global recovery being propelled by real GDP growth in the world's major economies is on track to be the strongest in 80 years. This growth will fuel commodity demand,…

Highlights Political and corporate climate activism will increase the cost of developing the resources required to produce and deliver energy going forward – e.g., oil and gas wells; pipelines; copper mines, and refineries. Over…

Highlights China's high-profile jawboning draws attention to tightness in metals markets, and raises the odds the State Reserve Board (SRB) will release some of its massive copper and aluminum stockpiles in the near future. Over…

Highlights Global oil markets will remain balanced this year with OPEC 2.0's production-management strategy geared toward maintaining the level of supply just below demand. This will keep inventories on a downward trajectory,…

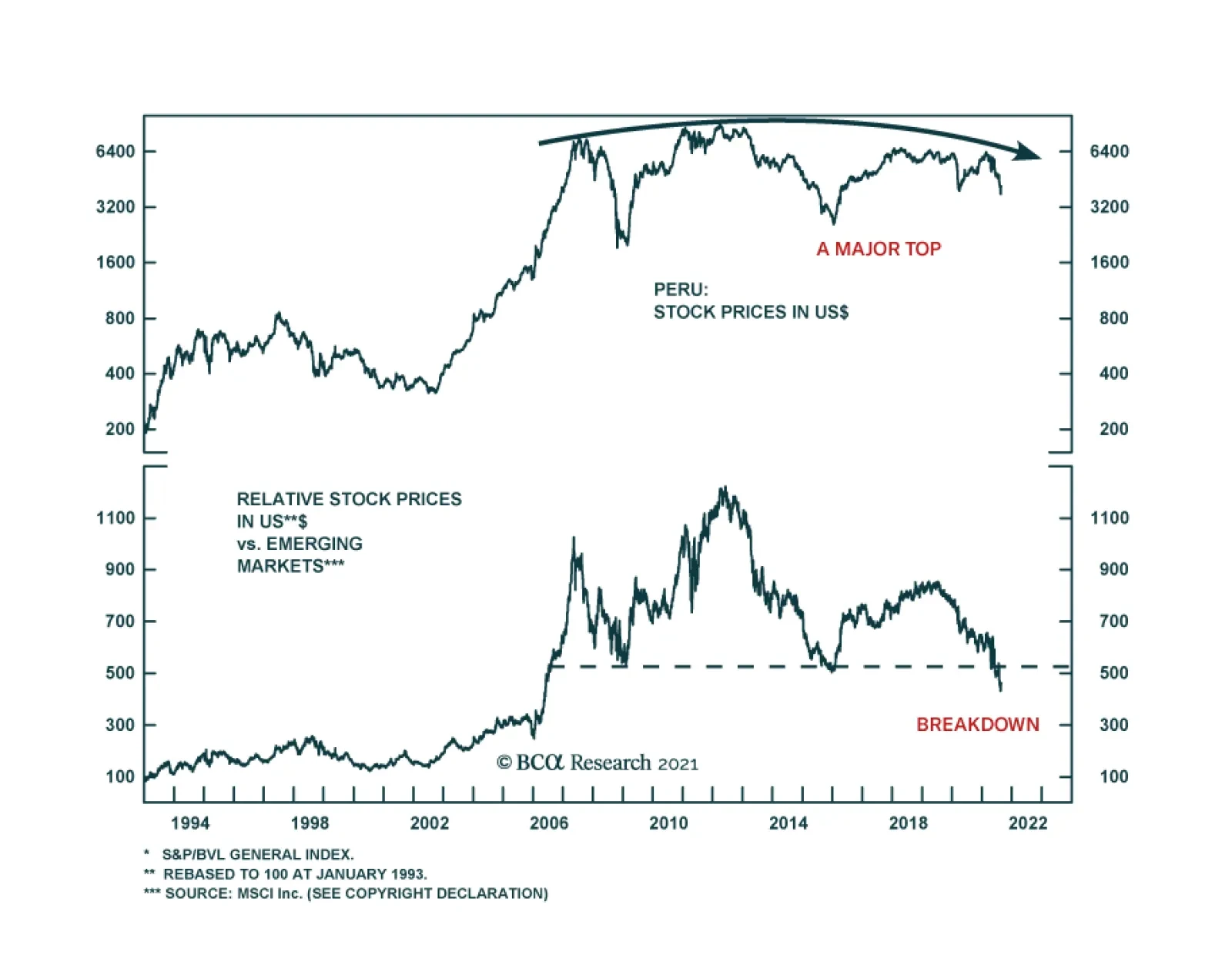

Chart 1Rising Metals Prices Have Failed To Boost Peruvian Equities Despite high precious and industrial metals prices, the Peruvian bourse has struggled in absolute terms and has also massively underperformed the EM equity…

Feature We closed our short position in EM equities last week but still maintain our short recommendation on EM currencies. Going forward we will be looking for signs of a durable bottom in risk assets. The clash between forthcoming…