Peru’s economic resilience will help its markets outperform their EM peers. A global growth downturn will weigh on EM assets in absolute terms, but Peruvian markets offer attractive tradeable opportunities. The Andean…

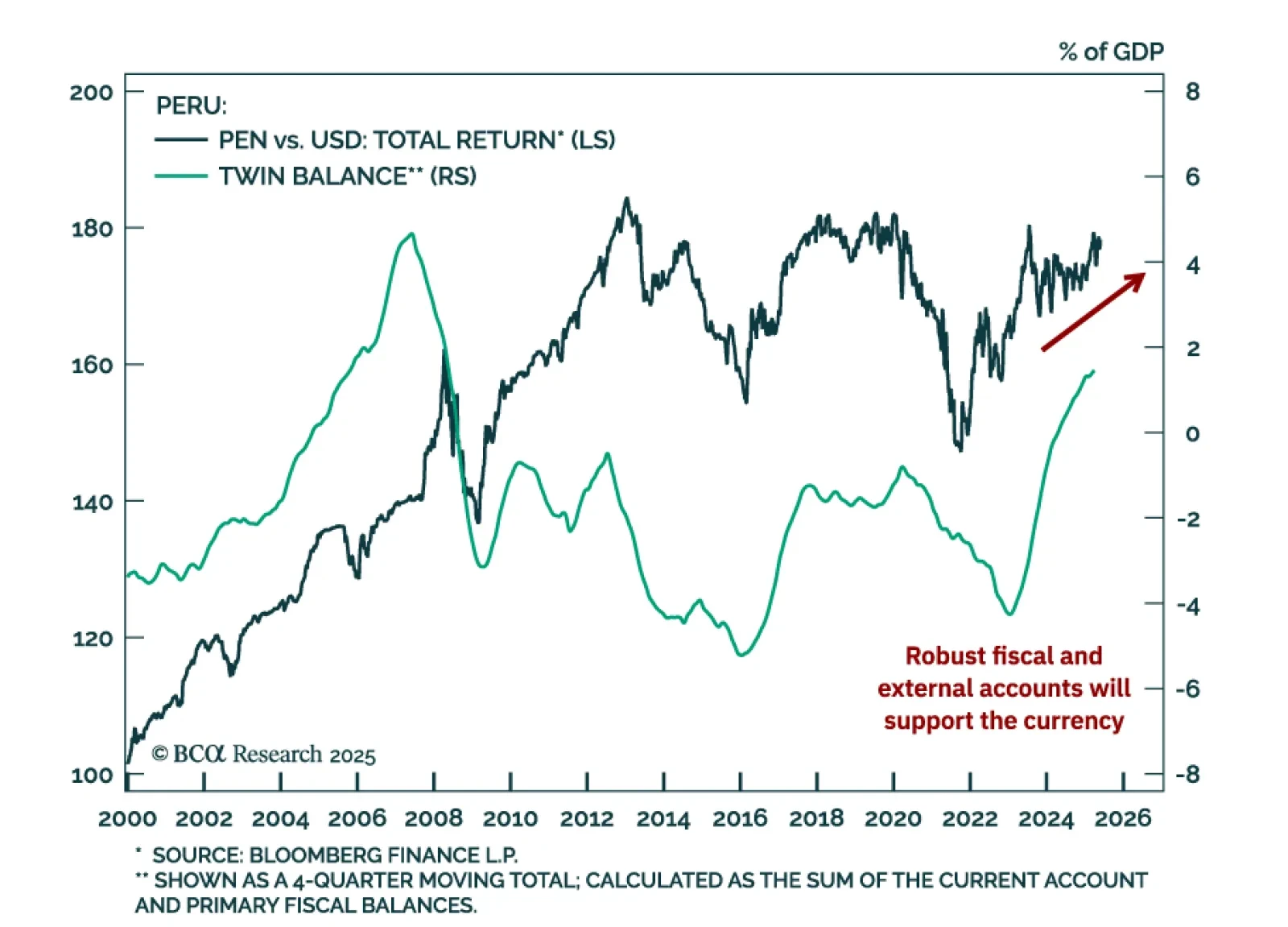

Peru’s economic resilience will help its markets outperform their EM peers. Domestic macro fundamentals are robust, and strong external accounts will lead to a stable-to-strengthening currency versus the US dollar. Overweight…

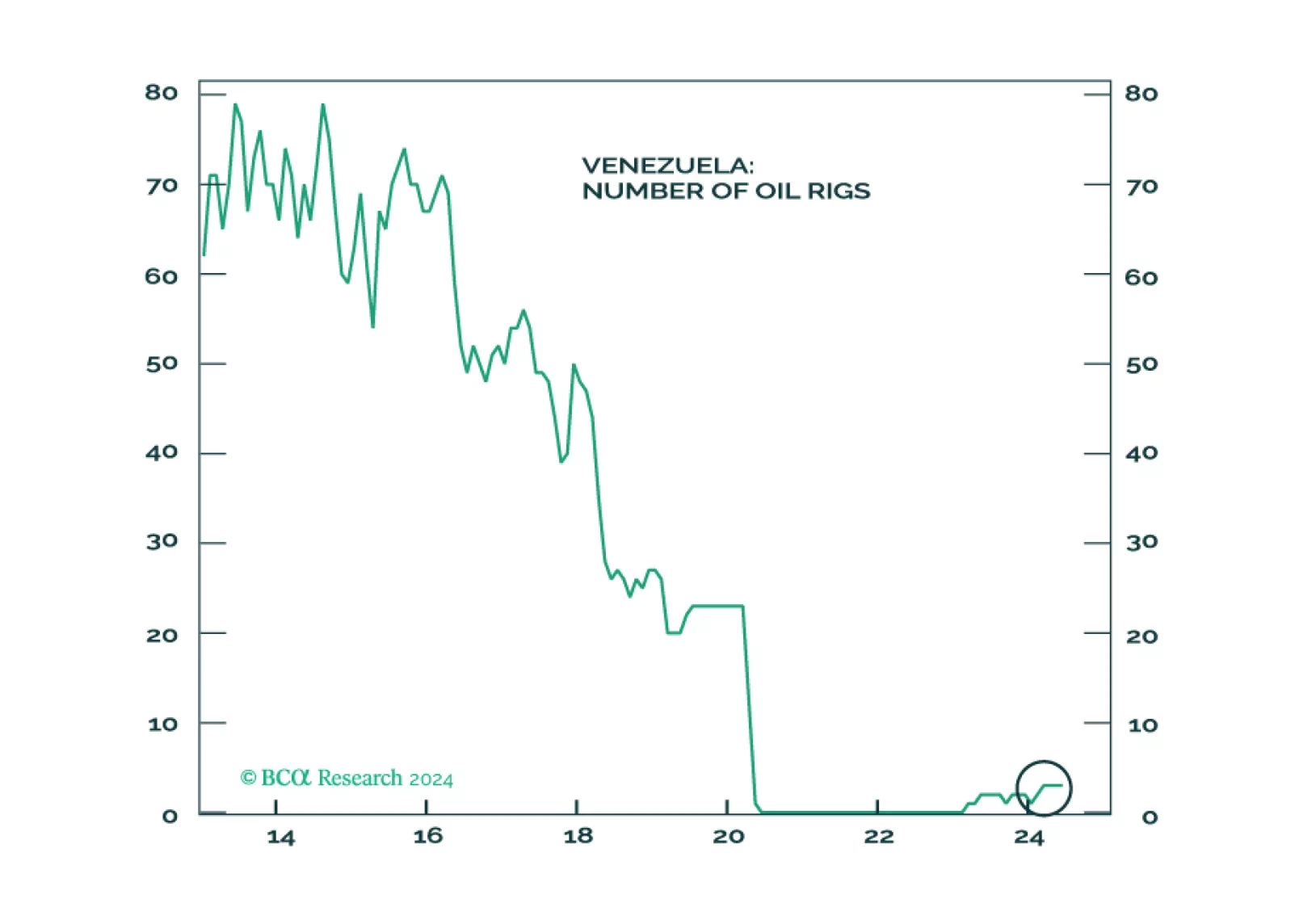

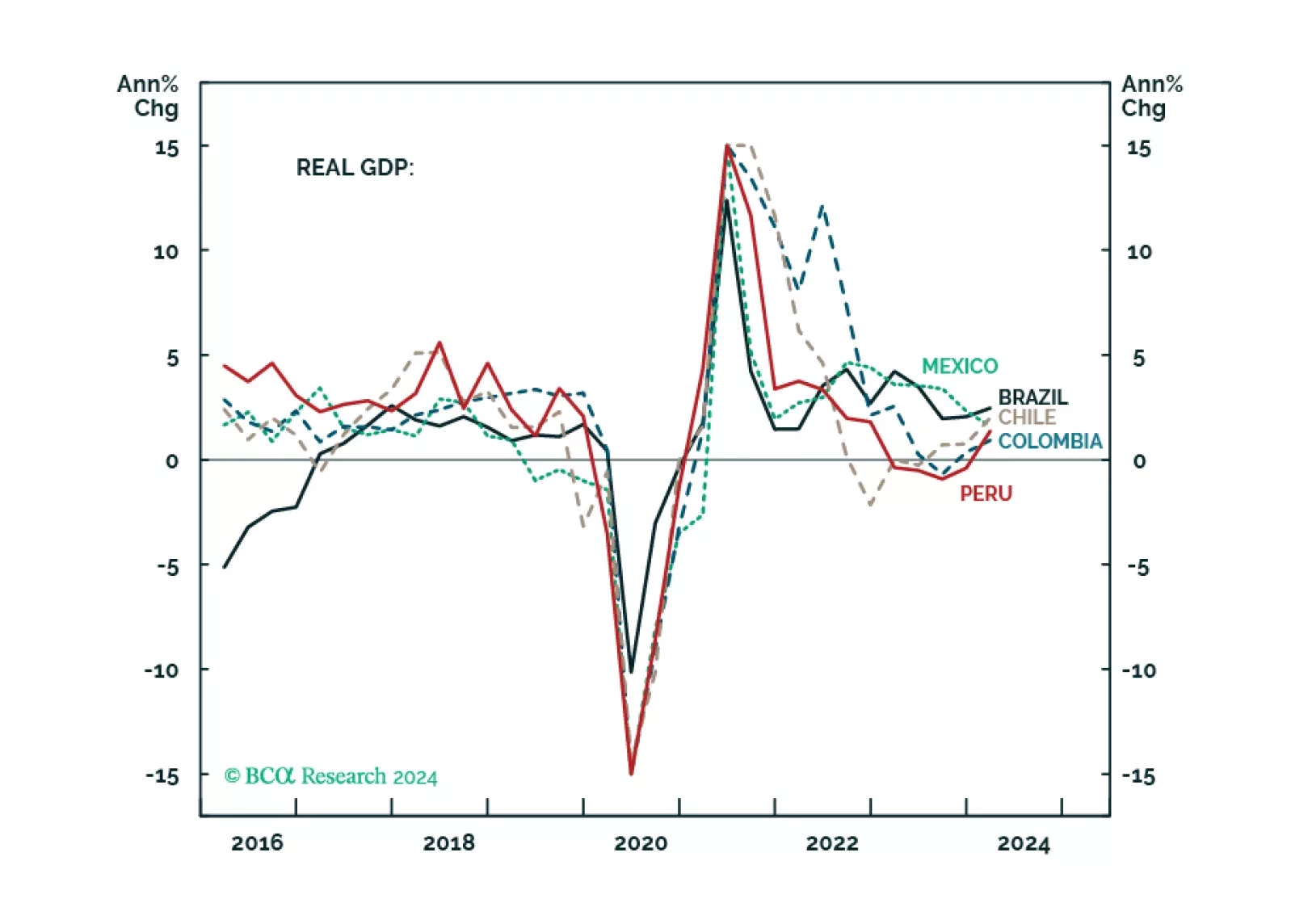

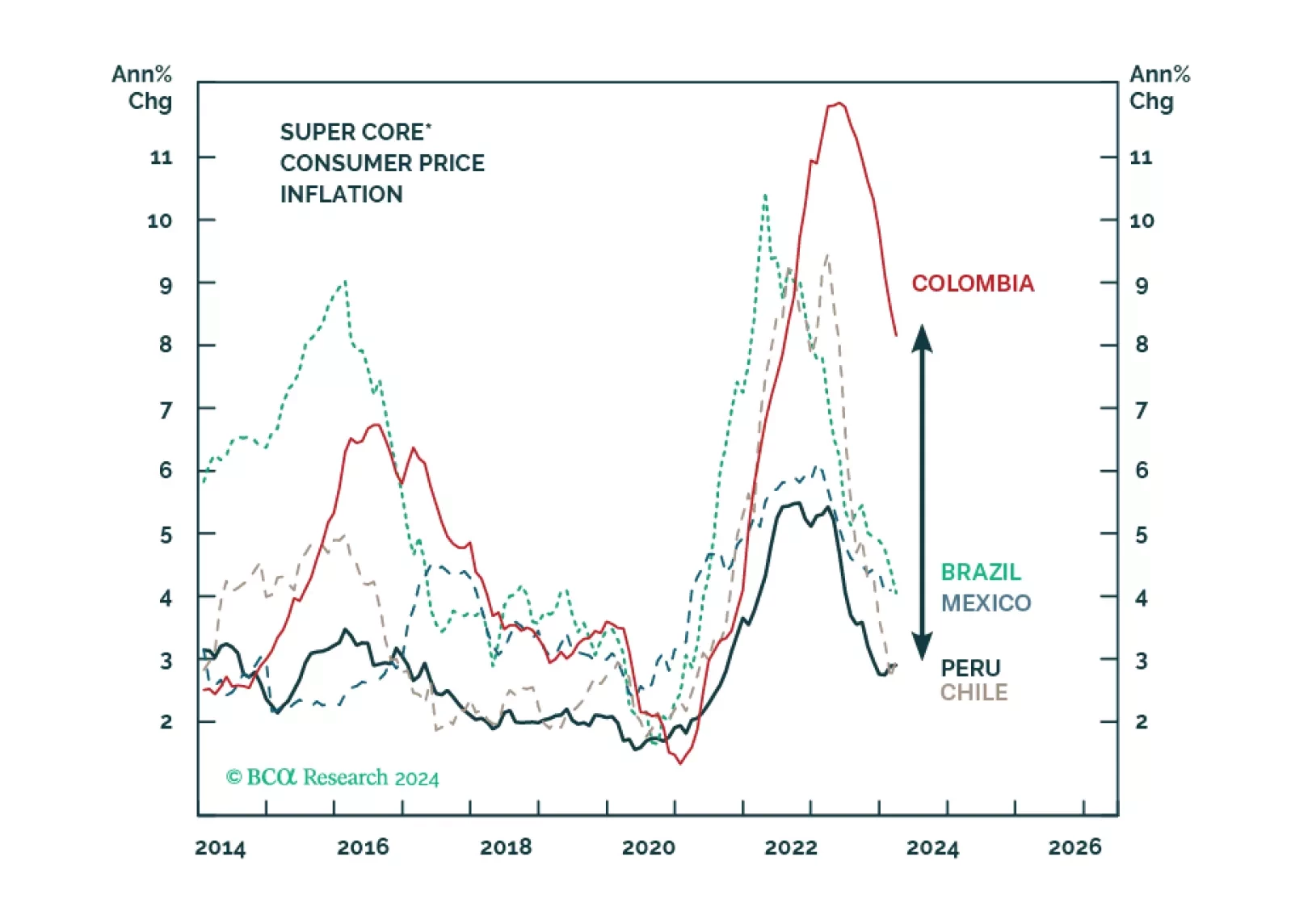

Non-trivial macro divergences have emerged between mainstream LATAM economies. This report compares and ranks Brazil, Mexico, Colombia, Chile, and Peru based on their business cycle outlook, macro policy stance, external accounts,…

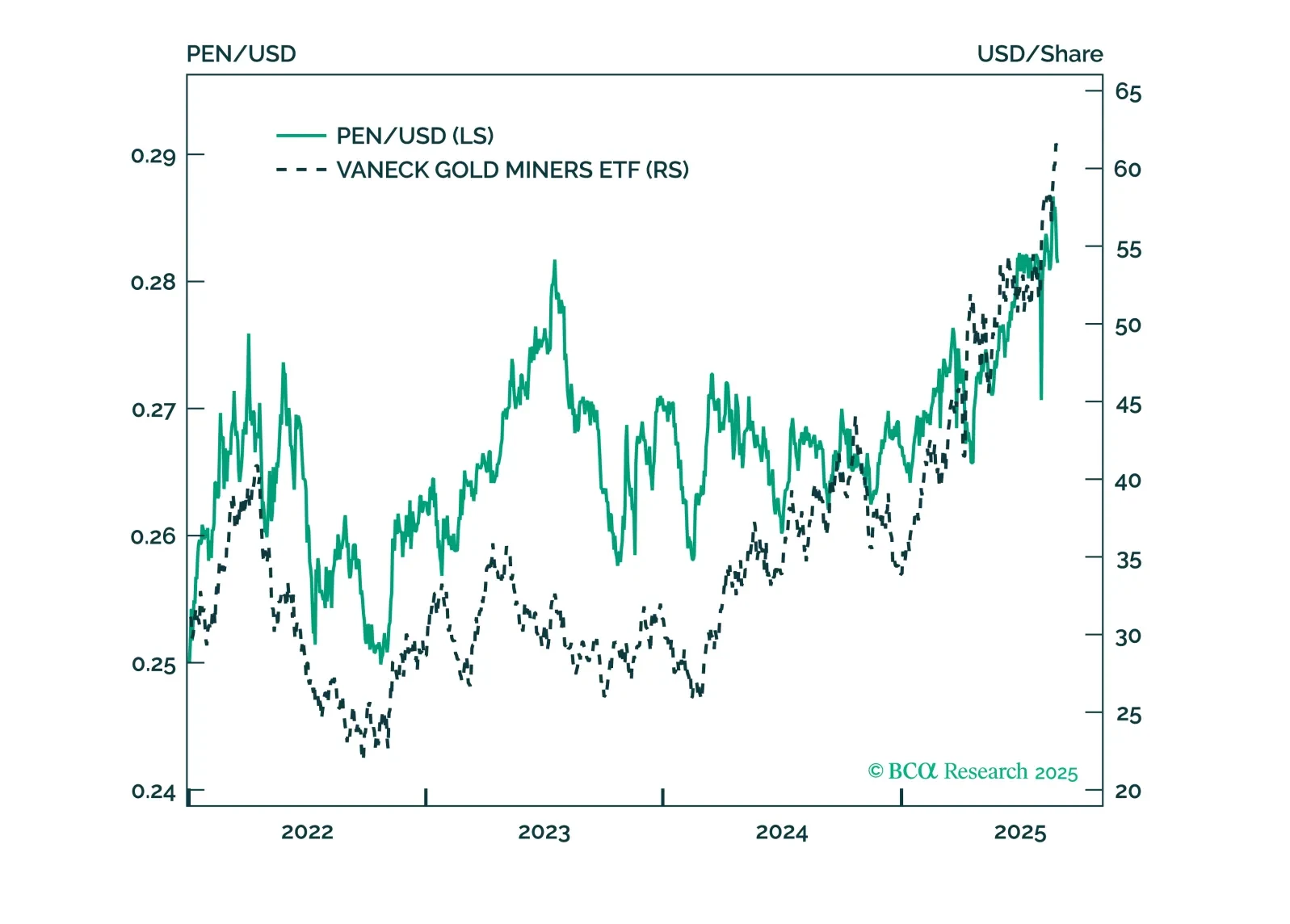

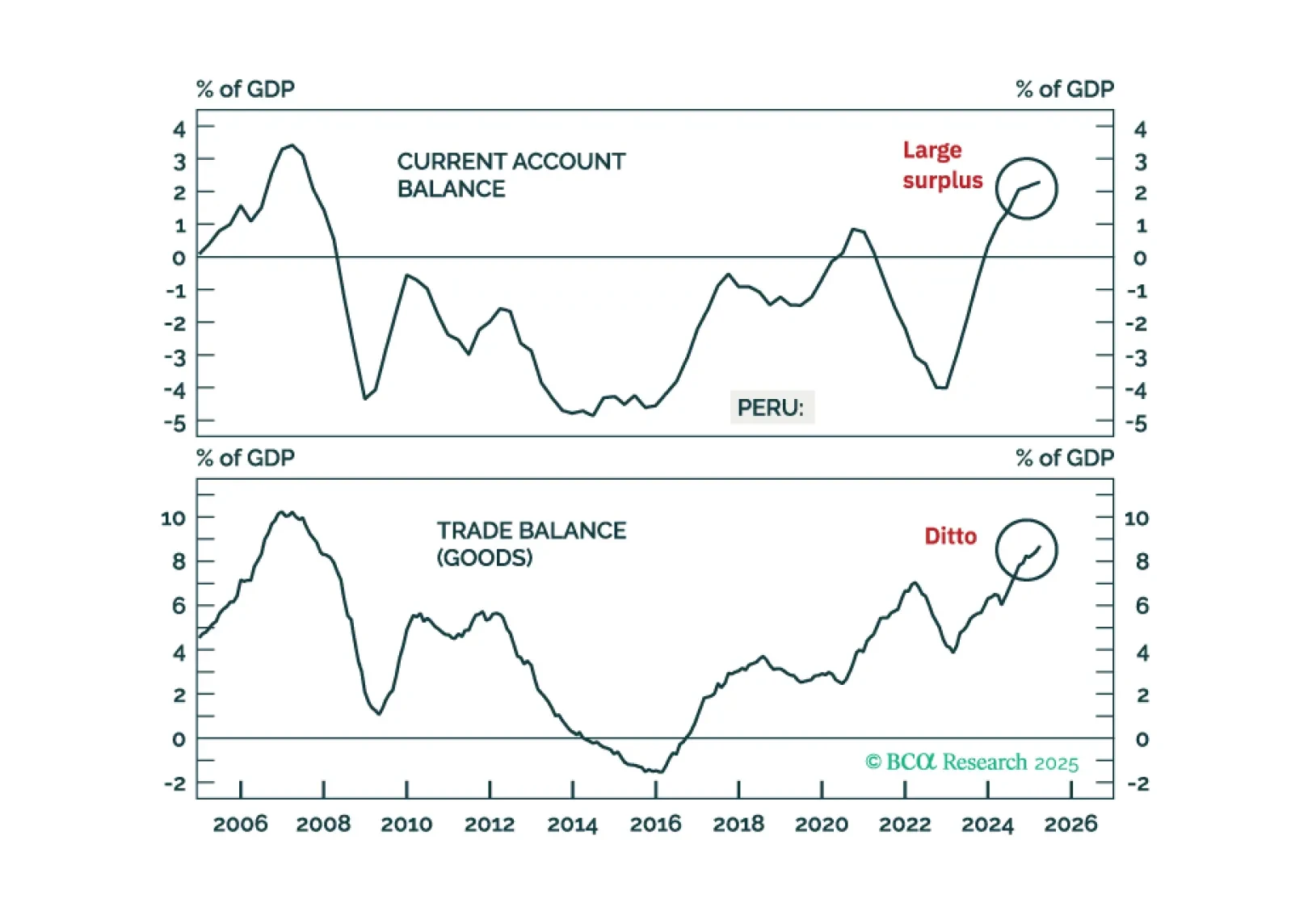

Peru is entering a benign macro environment: low and falling inflation amid a solid economic recovery. The country’s balance of payments position is robust, which will help the PEN depreciate by less than other EM currencies. The…

Peruvian financial markets will outperform their EM peers given the country’s clear macroeconomic and political visibility. Low and plummeting inflation, a decelerating economy and a lack of economic excesses will allow the central…

Peru is not suffering from economic or financial excesses: genuine inflation is subdued, fiscal and monetary policies are orthodox, and external accounts are healthy. While political instability has risen anew, markets will likely…

Dear Client, Next week, we will be sending you BCA Research’s Annual Outlook, featuring long-time BCA client Mr. X, who visits towards the end of each year to discuss the economic, financial and commodity market outlook for the…

Highlights Gold prices will continue to be challenged by conflicting information flows regarding US monetary policy; higher inflationary impulses from commodity prices and supply-chain bottlenecks; global economic policy uncertainty,…