Hamas’s attack on Israel raises the odds of a wider conflict in the Gulf, which would lead to higher oil prices. Given the response of oil prices Monday, markets appear to be relatively restrained in their assessment of a sharp…

Volatility will remain the key dynamic in oil markets in the aftermath of the surprise Hamas attacks against Israel on October 7. The risk of a major oil supply shock has gone up, but meanwhile supply constraints will remain at…

China’s reopening faltered and now it is applying moderate stimulus. OPEC 2.0’s production discipline is getting results, with oil prices climbing. The Fed will not be able to deliver dovish surprises in Q4 2023. Investors should…

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

Investors should underweight global equities and risk assets; overweight US stocks relative to global; and overweight defensive sectors versus cyclicals.

Falling inflation enables central banks to pause rate hikes, which is good news. But time goes on. Restrictive monetary policy, Chinese debt-deflation, energy supply shocks, US and global policy uncertainty, and extreme geopolitical…

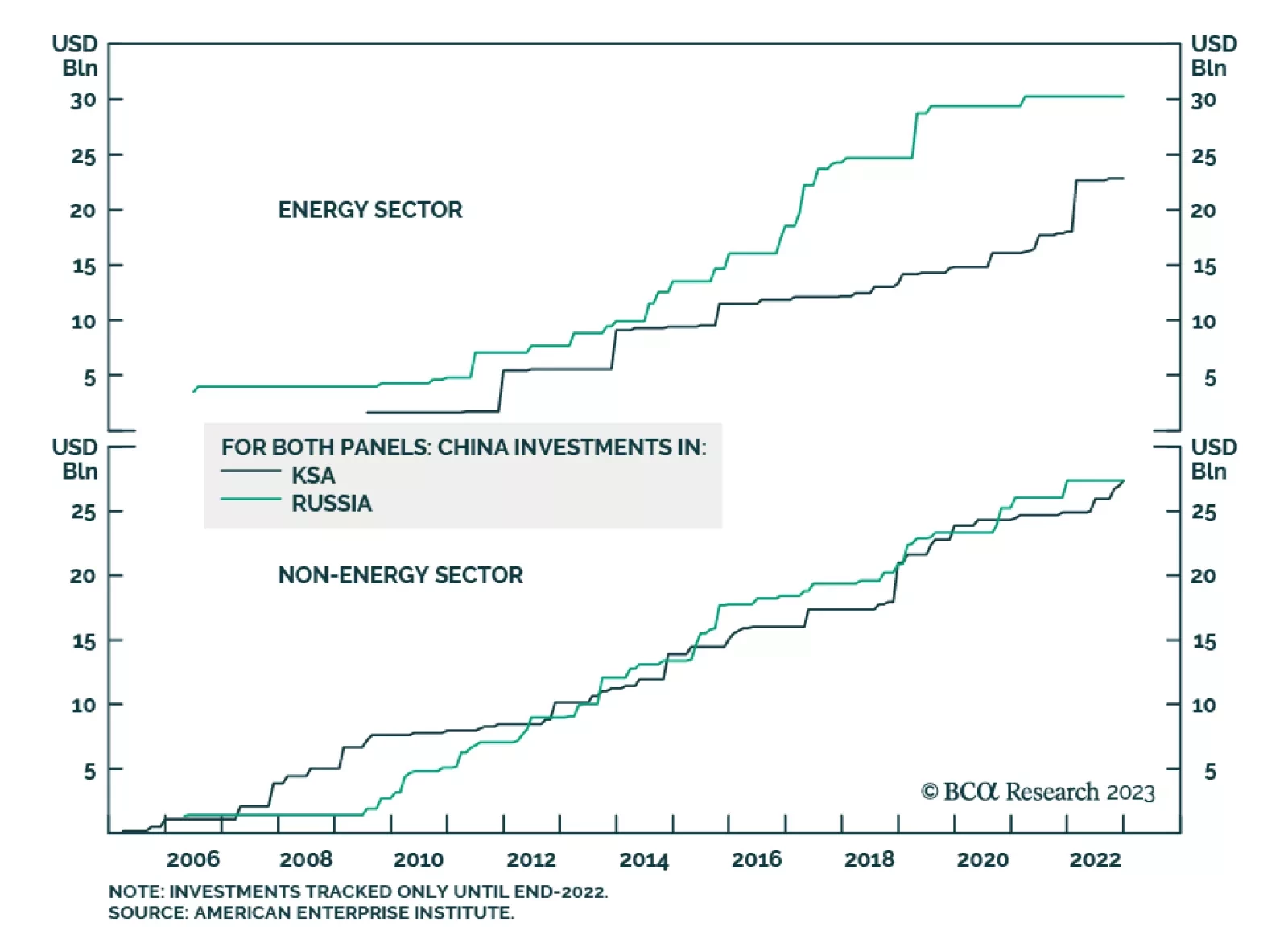

Gulf Cooperation Council (GCC) oil producers stand the most to gain following the failed coup against the administration of Russian President Vladimir Putin. The biggest beneficiaries will be the Kingdom of Saudi Arabia (KSA…

China’s economic and diplomatic interests in the GCC region will expand, as will its military presence. Whether or not this stabilizes the region is yet to be determined, particularly if tensions in the South China Sea and other…

The normalization of oil storage markets in the Northern Hemisphere; strong demand, aided by China stimulus this year; and continued production discipline supports our view Brent prices likely have bottomed, and will move higher from…