Last Friday, my colleague Dhaval Joshi and I held a webcast discussing investment strategies. The topics of discussion included global equity valuations, mega-cap stocks leadership and the outlook for EM stocks, fixed-income and…

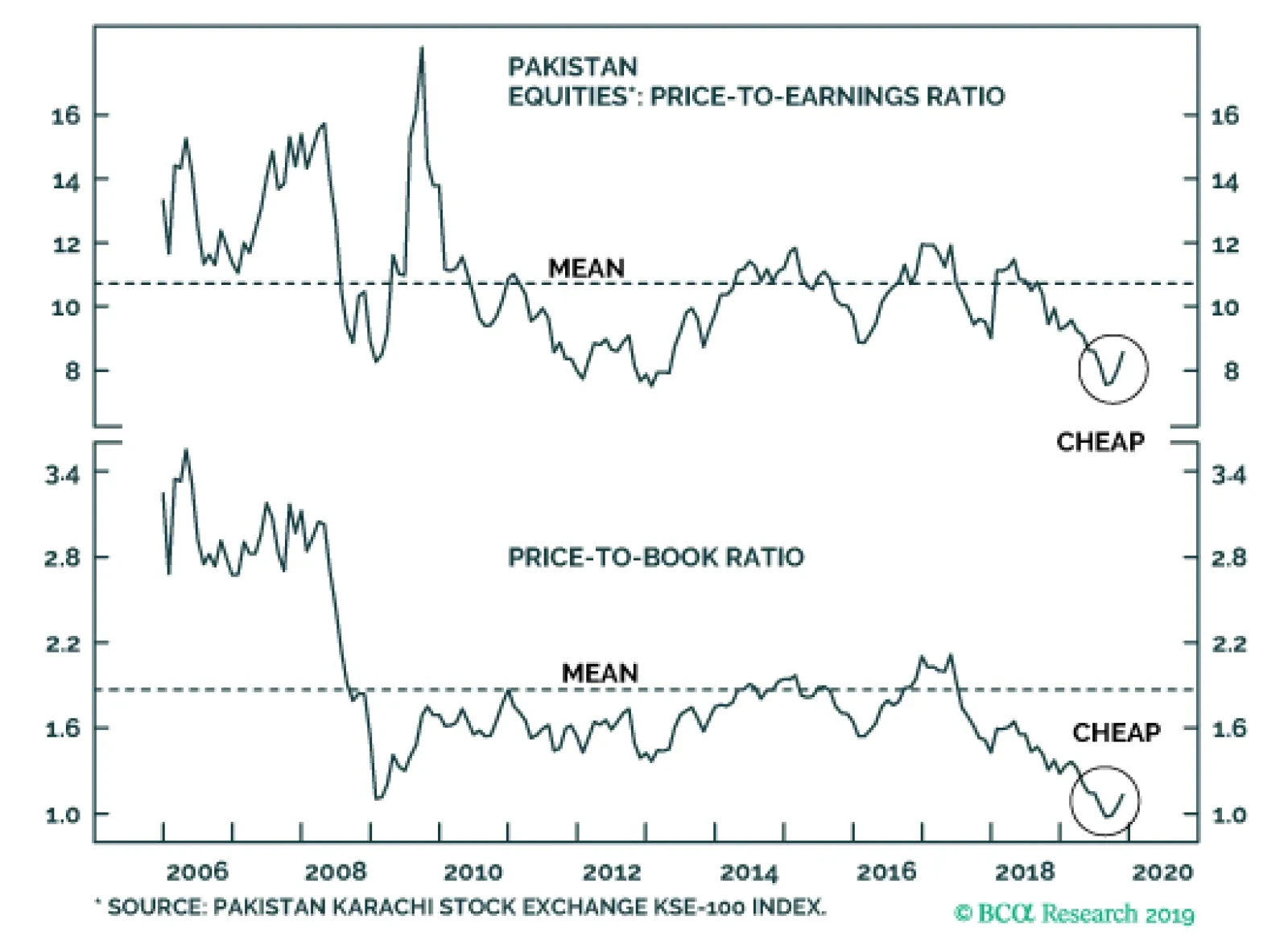

We are upgrading Pakistani equities to overweight within the emerging markets space. Both absolute and relative valuations of Pakistani stocks appear attractive and the economy is showing early signs of stabilization The…

Highlights We are upgrading Pakistani equities to overweight within an EM equity portfolio. Fixed-income investors should consider purchasing 5-year local currency government bonds. The balance-of-payments adjustment is probably over…

Highlights We are upgrading Pakistani equities to overweight within an EM equity portfolio. Fixed-income investors should consider purchasing 5-year local currency government bonds. The balance-of-payments adjustment is probably over…

Pakistan’s economy and stock market are currently going through painful but necessary adjustments. The country has been suffering from a severe balance-of-payment crisis. Its exchange rate has already depreciated by 30% versus the U…

Analysis on central Europe and Pakistan is published below. Highlights There are several reasons why Chinese authorities will likely allow the yuan to depreciate 6-8% from current levels in the coming months. RMB depreciation will…

Highlights So what? EM elections bring opportunities as well as risks. Why? Emerging market equities will benefit as long as China’s stimulus does not fizzle. Modi is on track to win India’s election –…