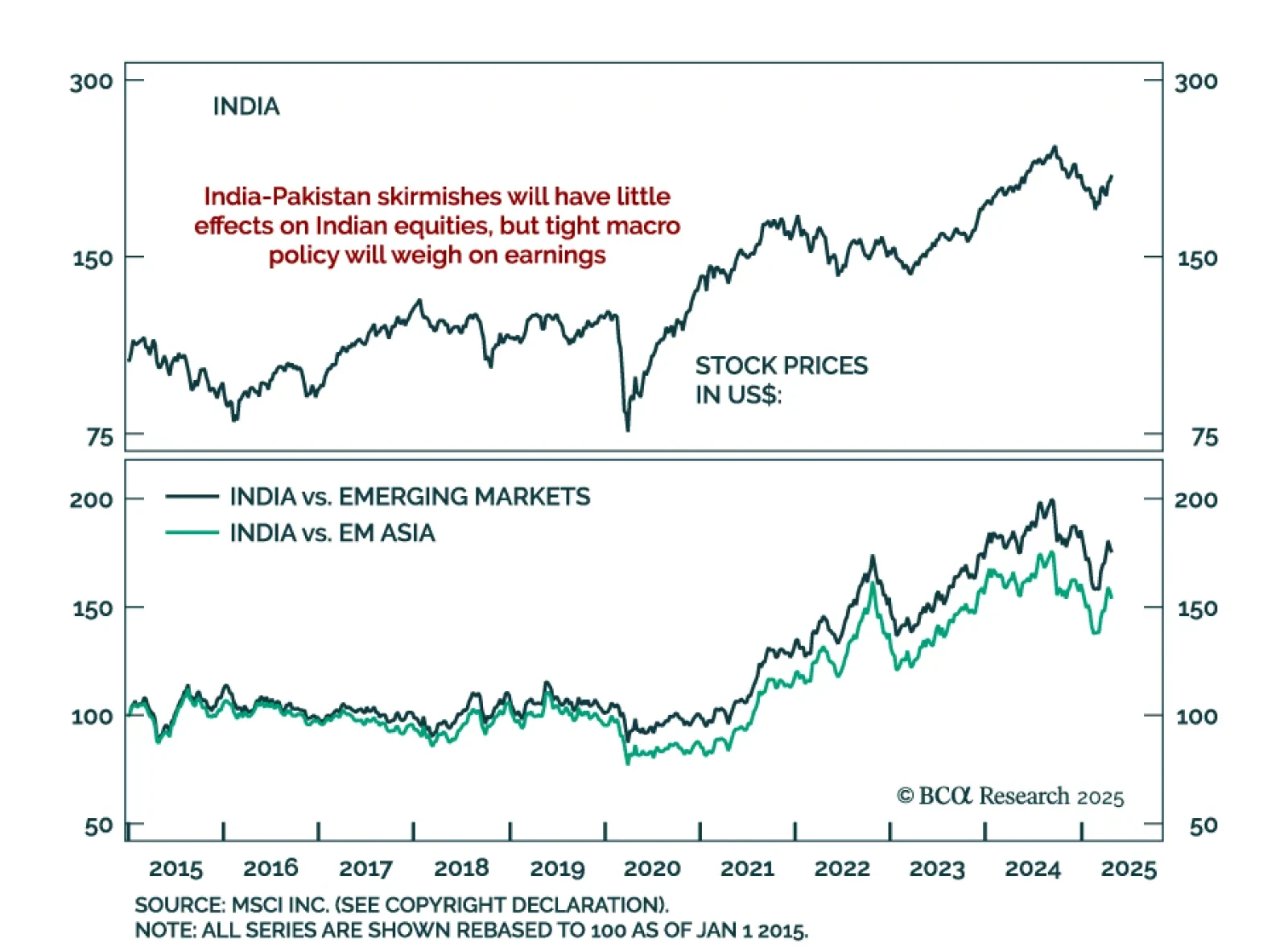

Indian equities remain resilient despite rising India-Pakistan tensions, but BCA’s EM strategists stay underweight India while favoring local-currency bonds. The latest flare-up follows Indian retaliation to last month’s terrorist…

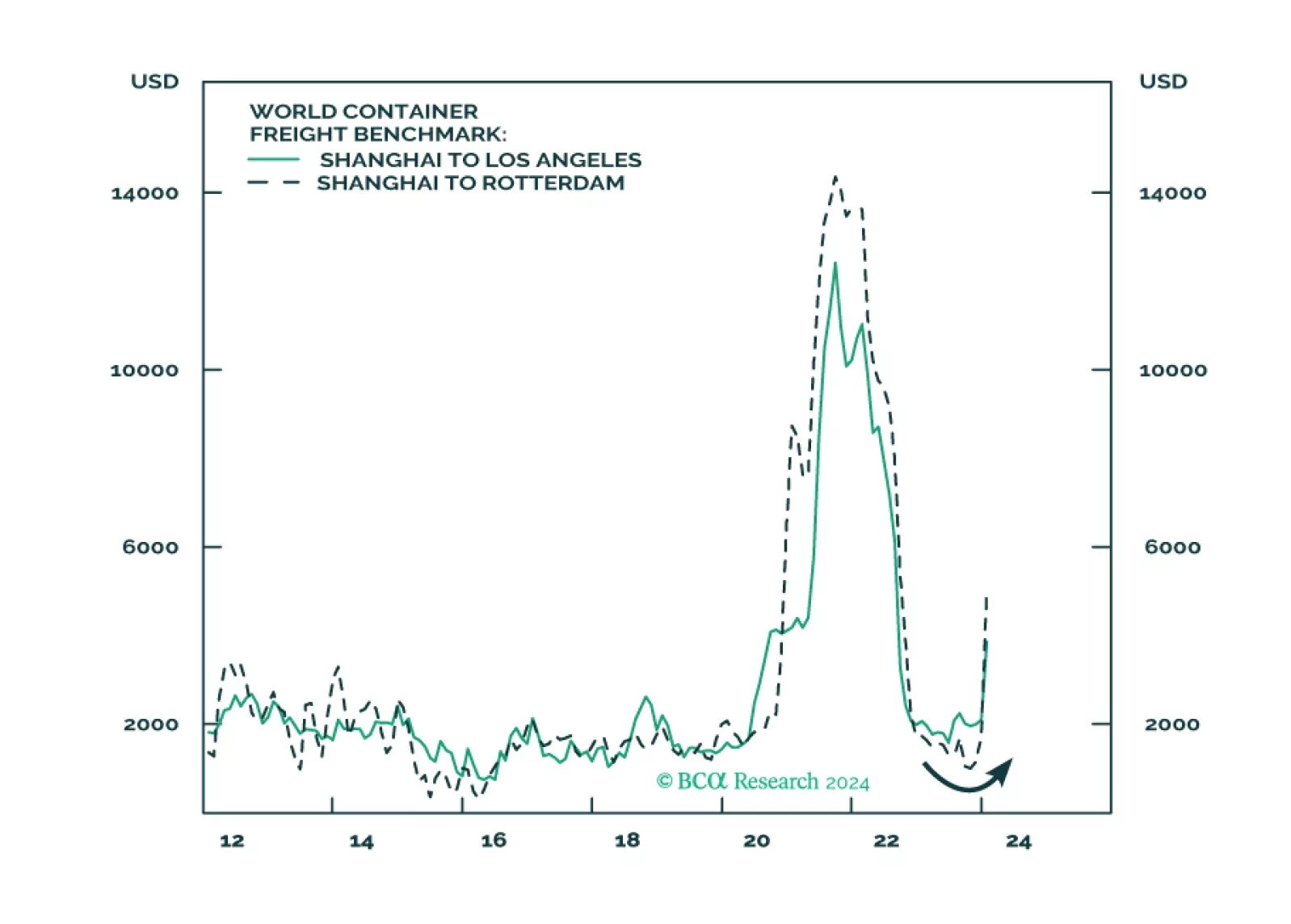

Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

Executive Summary EU Embargoes Russian Oil The EU imposed an embargo on 90% of Russian oil imports, which will provoke retaliation. Russia will squeeze Europe’s economy ahead of critical negotiations over the coming 6-…

Executive Summary Macron Still Favored, But Le Pen Cannot Be Ruled Out Macron is still favored to win the French election but Le Pen’s odds are 45%. Le Pen would halt France’s neoliberal structural reforms,…

Highlights Three distinct forces are likely to make South Asia’s geopolitical risks increasingly relevant to global investors. First, India’s tensions with China stem from China’s growing foreign policy assertiveness…

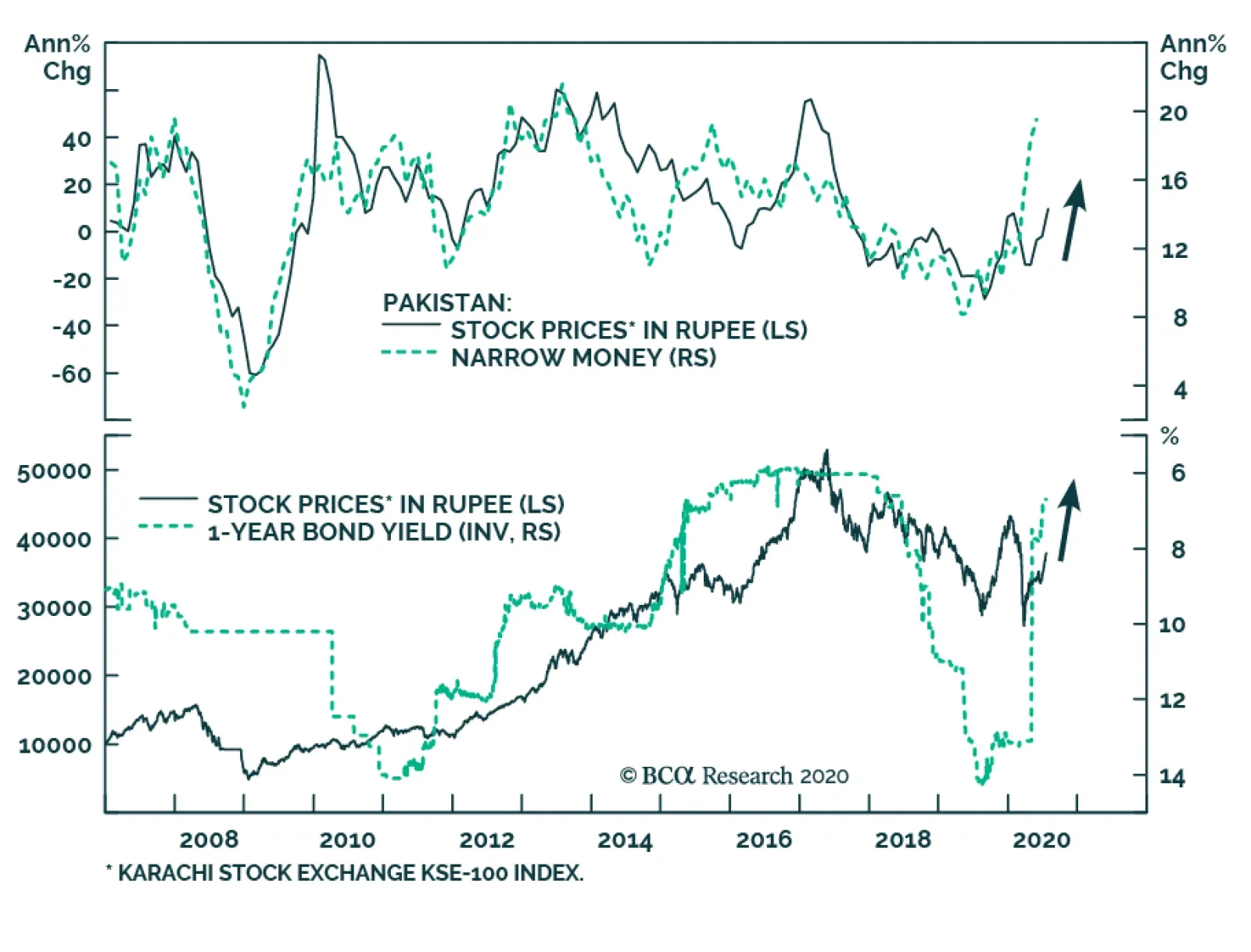

Highlights Massive fiscal deficits and high borrowing costs have led the government into a debt trap: interest payments alone cost the exchequer nearly half its revenues. Pursuing a tight fiscal and monetary policy now reduces the…

BCA Research's Emerging Markets Strategy service recommends buying Pakistani equities in absolute terms and overweighting this bourse within the emerging markets space. Pakistani stock prices in US dollar terms are…

Last Friday, my colleague Dhaval Joshi and I held a webcast discussing investment strategies. The topics of discussion included global equity valuations, mega-cap stocks leadership and the outlook for EM stocks, fixed-income and…