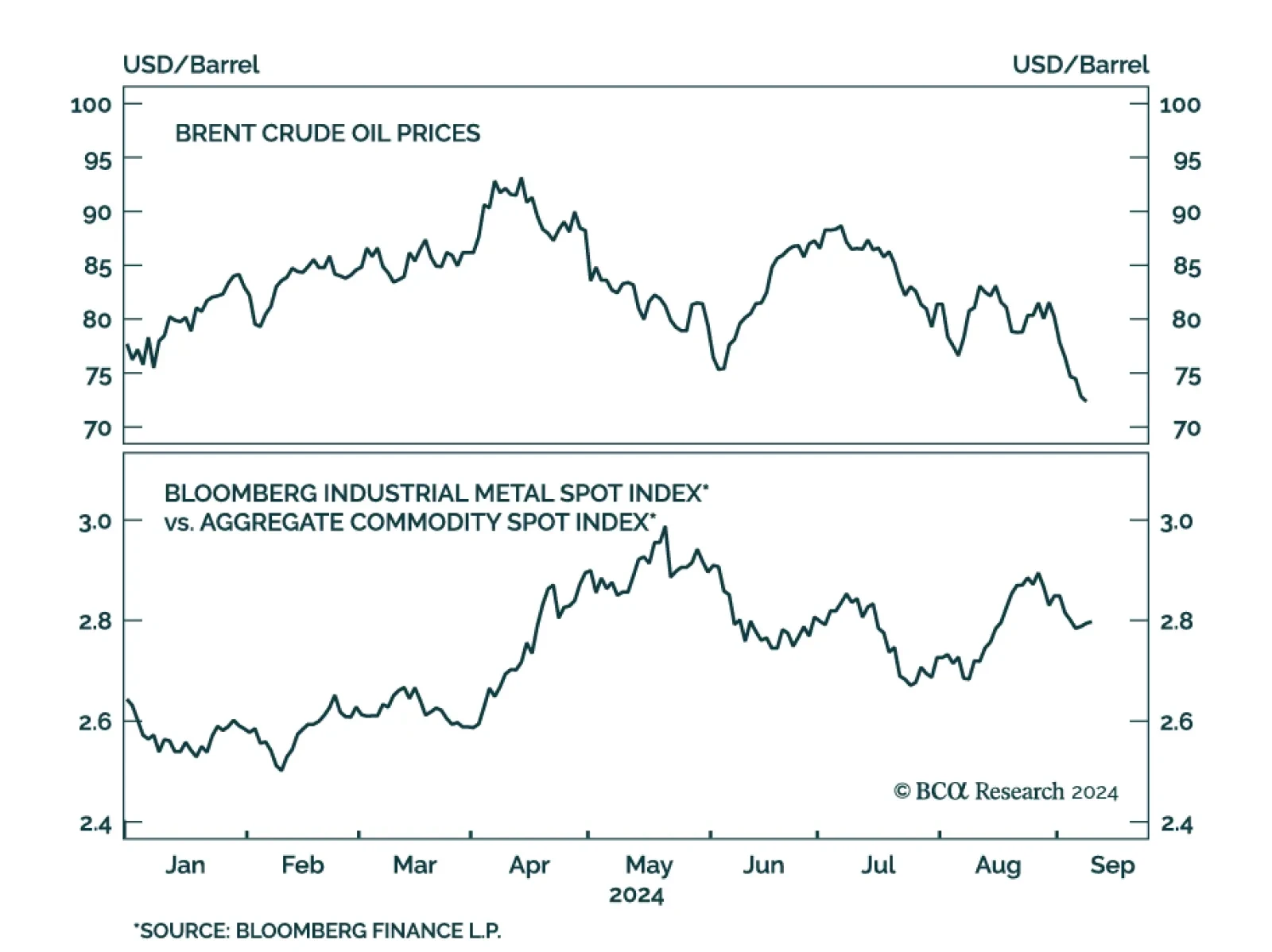

One commodity that has not reacted to the bullish demand-side news from the Politburo (see The Numbers) is crude oil. Brent shed over 2% on Thursday, in sharp contrast to Copper’s gains. Oil markets seem to be reacting…

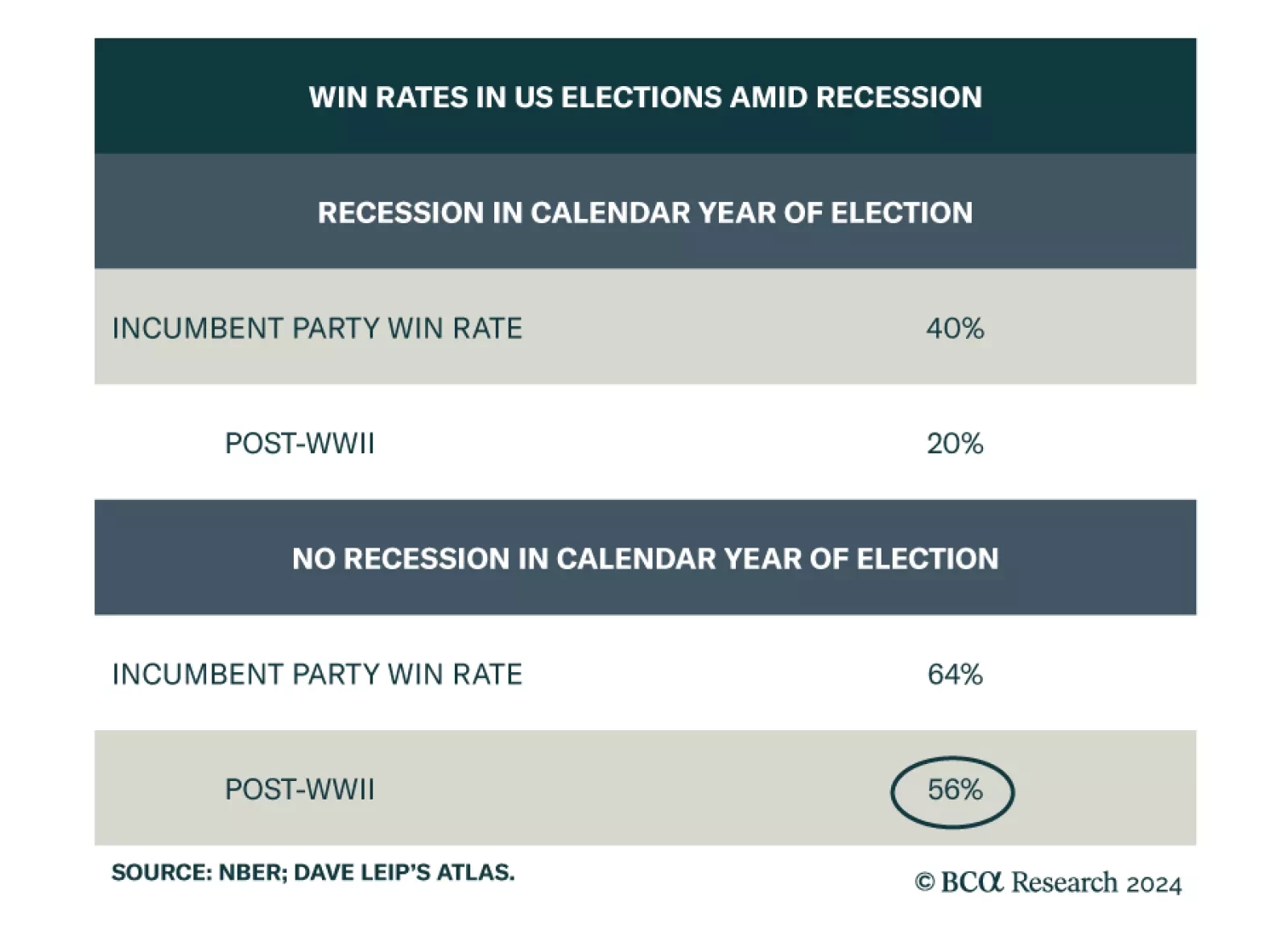

According to BCA Research’s Geopolitical Strategy service, seven surprises with non-negligible odds could tip the scale in favor of Republicans for the White House by November 5. One of them is a war between Israel and Iran…

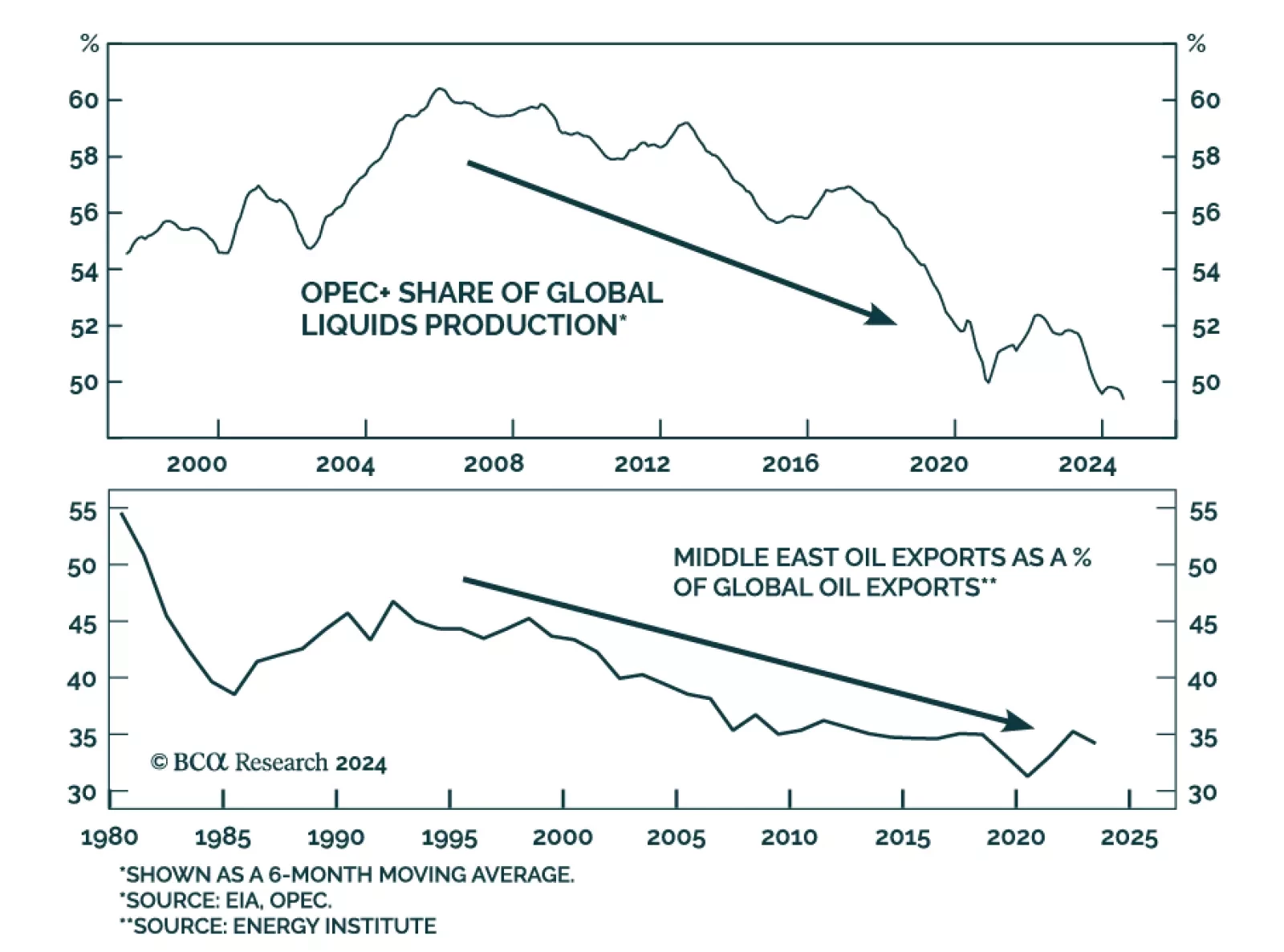

The decline in oil prices accelerated this month. Although Wednesday’s moves reversed Tuesday’s sharp daily declines, Brent and WTI have fallen 11% and 10% so far in September, and 30% and 33% from their April peaks…

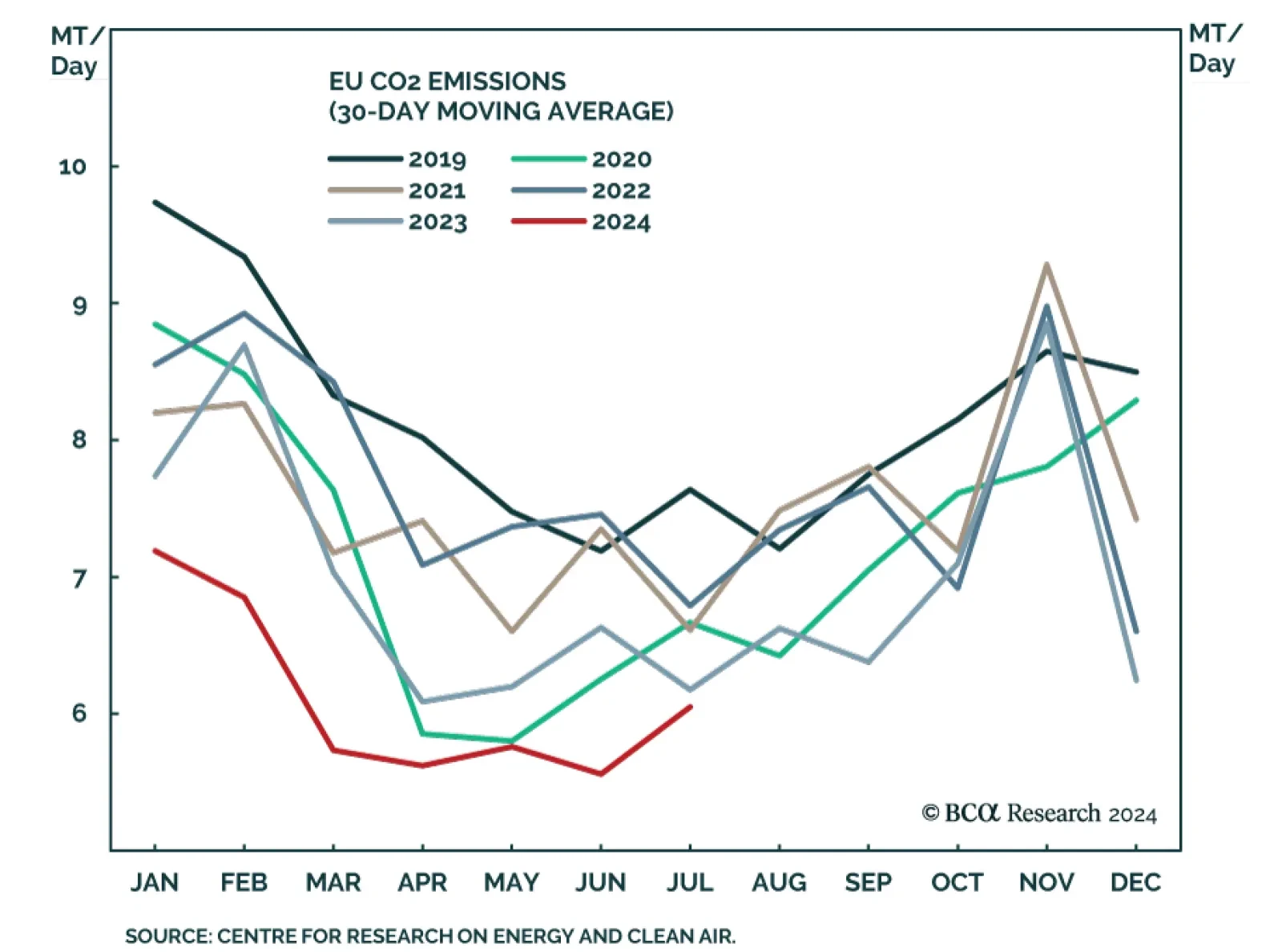

European regulatory carbon credits (EUAs) are becoming increasingly investable as an asset class. In a Special Report published last September, our Global Investment strategists agreed to the strategic bull case for EUAs, but…

Highlights US refiners will raise capacity-utilization rates as demand revives, which will keep crude oil inventories draining through 2H20. Early data indicate COVID-19-induced lockdowns pushed demand for gasoline, diesel, jet fuel…

Overweight US refiners enjoyed a solid run for the better part of 2019, but over the past three months have retraced roughly a third of those relative gains. Nevertheless, we remain overweight the S&P oil & gas…