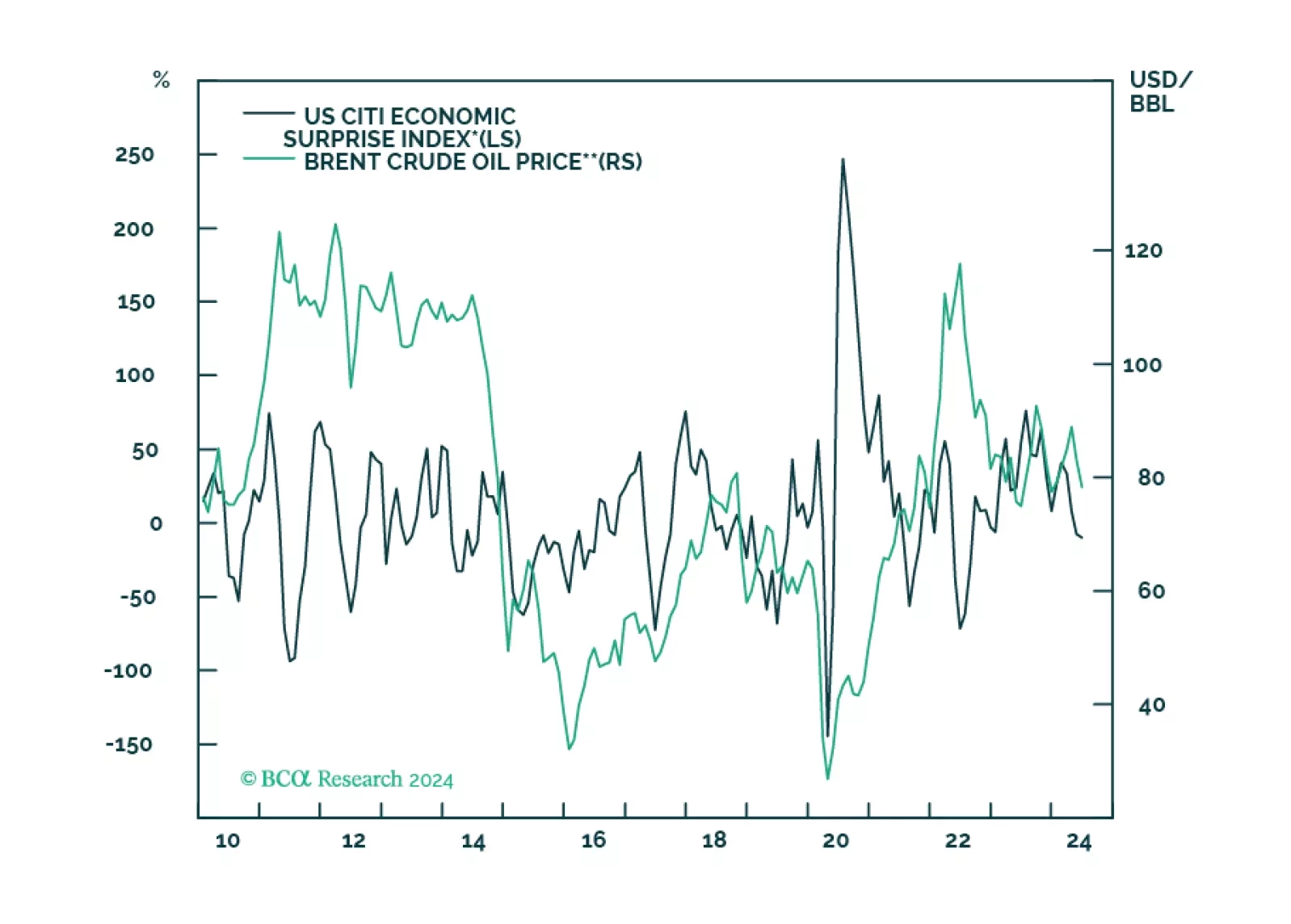

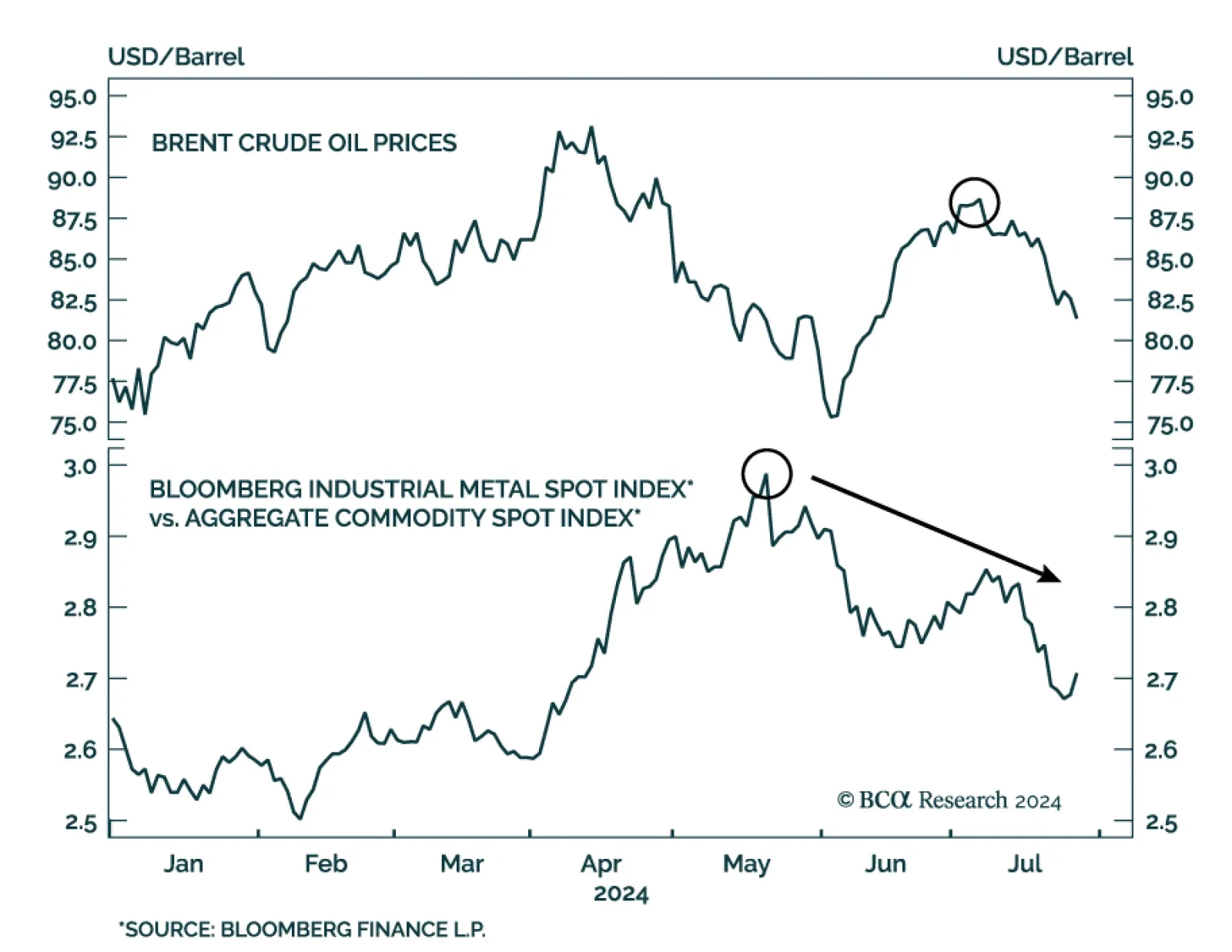

Brent prices have fallen 6% so far in July, reversing their June gains. Interestingly, these losses are occurring despite escalating Middle East tensions and quickening Chinese industrial profit growth in June (see The Numbers…

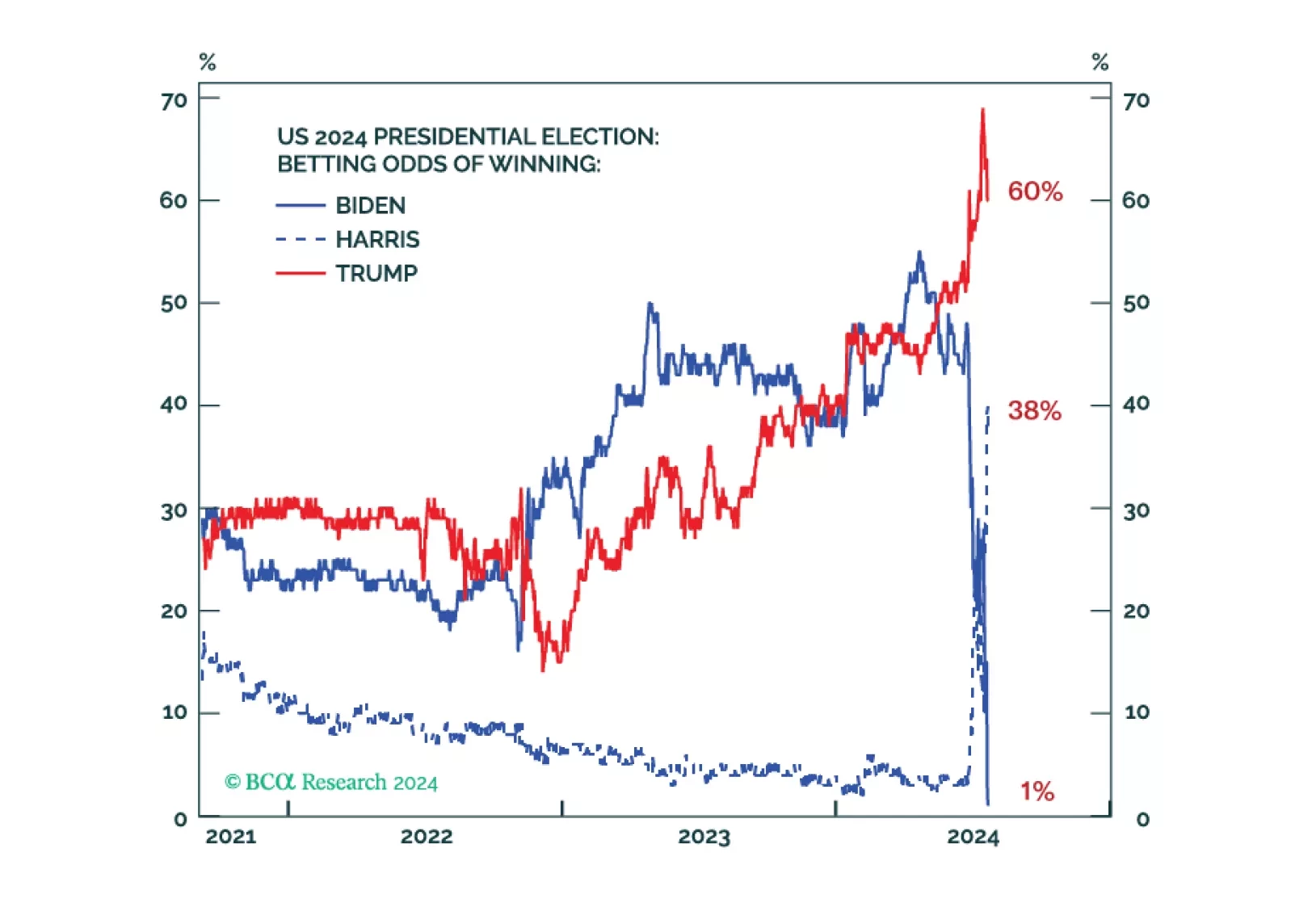

Investors should focus on growth concerns rather than the “Trump trade.” Bond yields will fall in the short run due to cyclically disinflationary economic slowdown, rather than rise in anticipation of a Republican full sweep and…

Investors should overweight US assets and de-risk their portfolios in anticipation of a major increase in policy uncertainty and geopolitical risk surrounding the US election and its global ramifications.

Concerns about the global economy have shifted from sticky inflation to faltering growth. Tight monetary policy is finally starting to bite. We suggest increasing portfolio defensiveness.

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

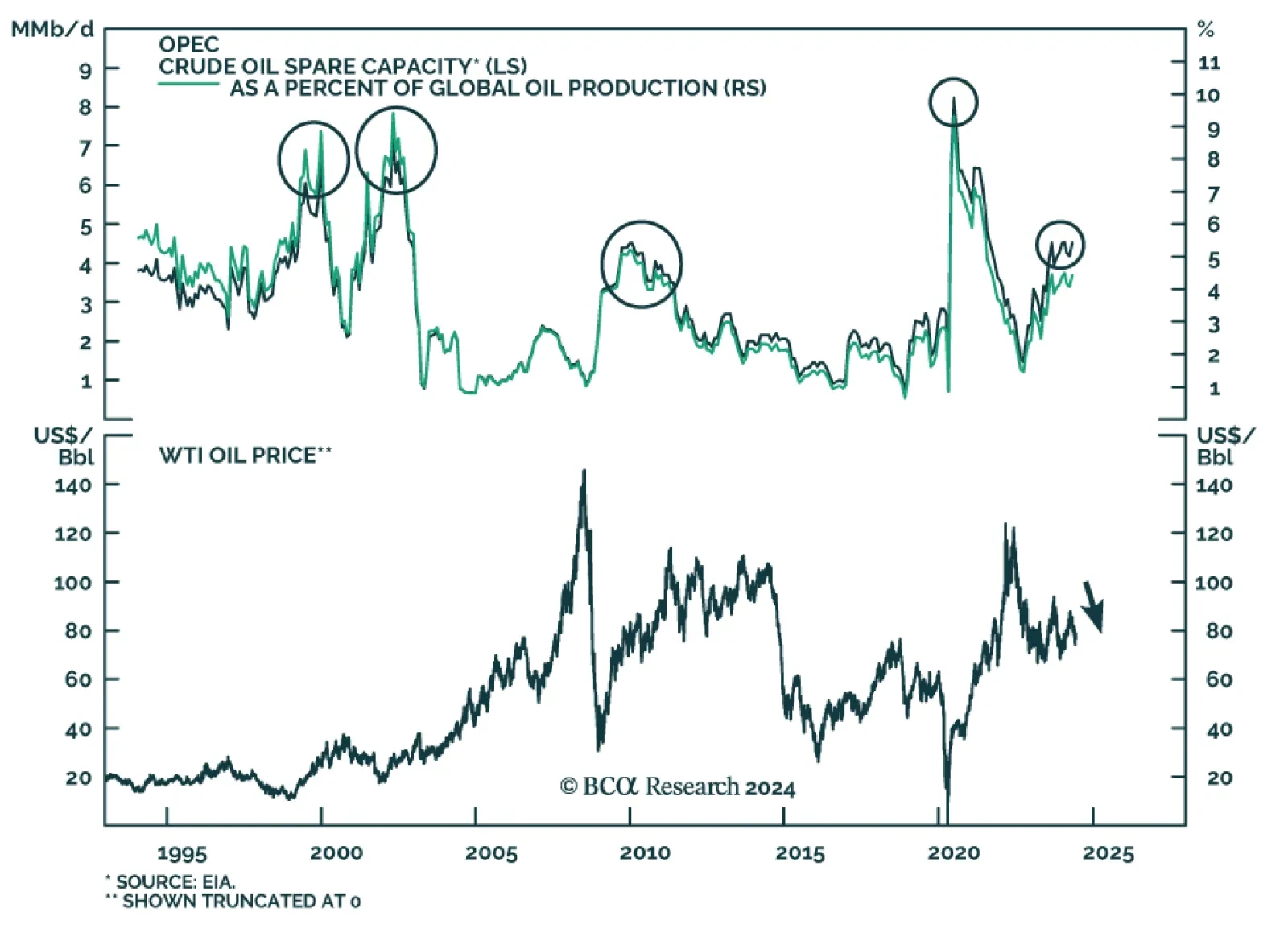

Earlier this year, WTI oil prices peaked on April 5th at $87.69 per barrel. They have since corrected by 12.7%. Should asset managers expect this decline to continue? Our Global Investment Strategy team believes oil prices…

We close our overweights to Energy and Aerospace & Defense. The macroeconomic backdrop is deteriorating for Energy. As for A&D, the good news is already priced in.

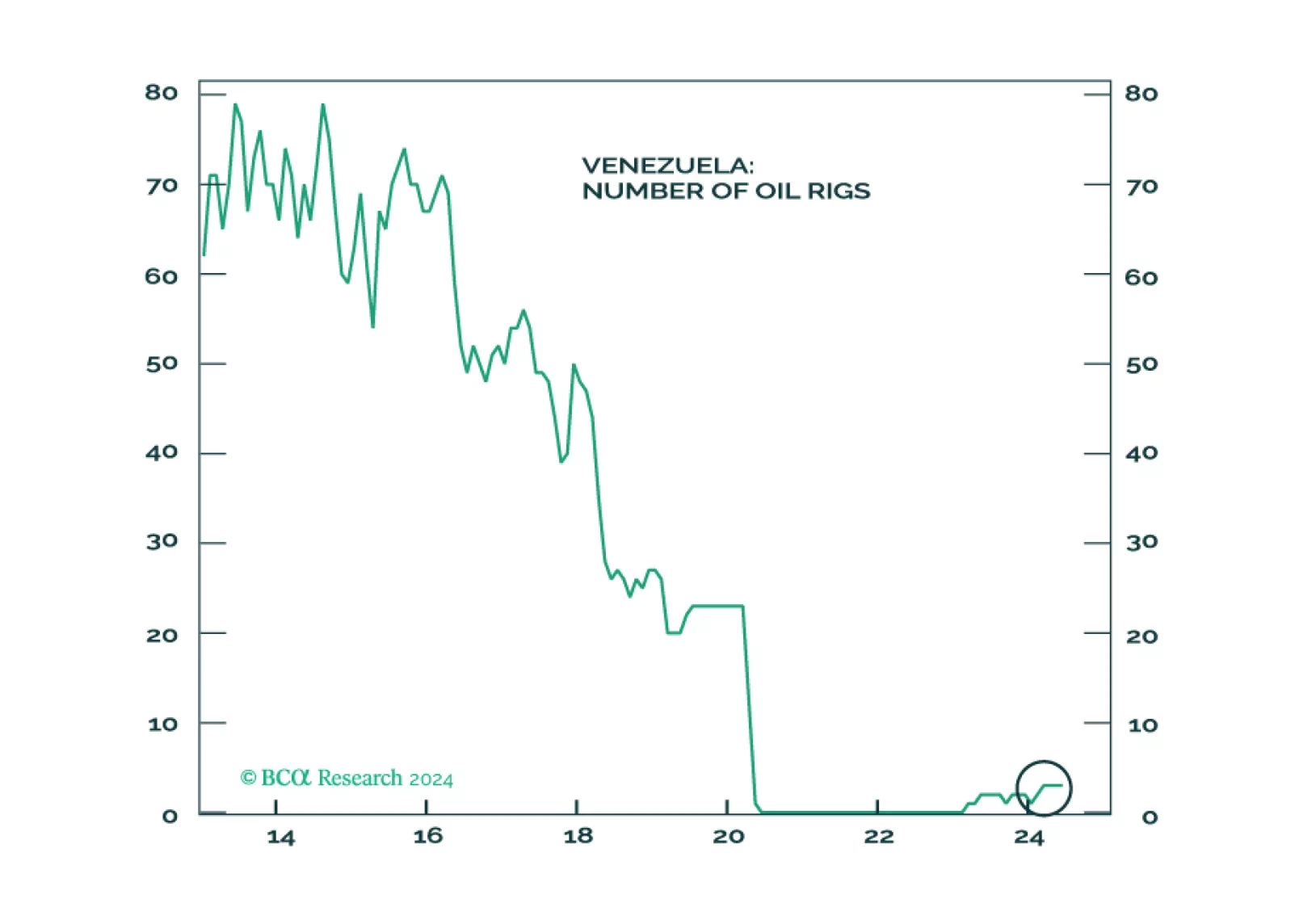

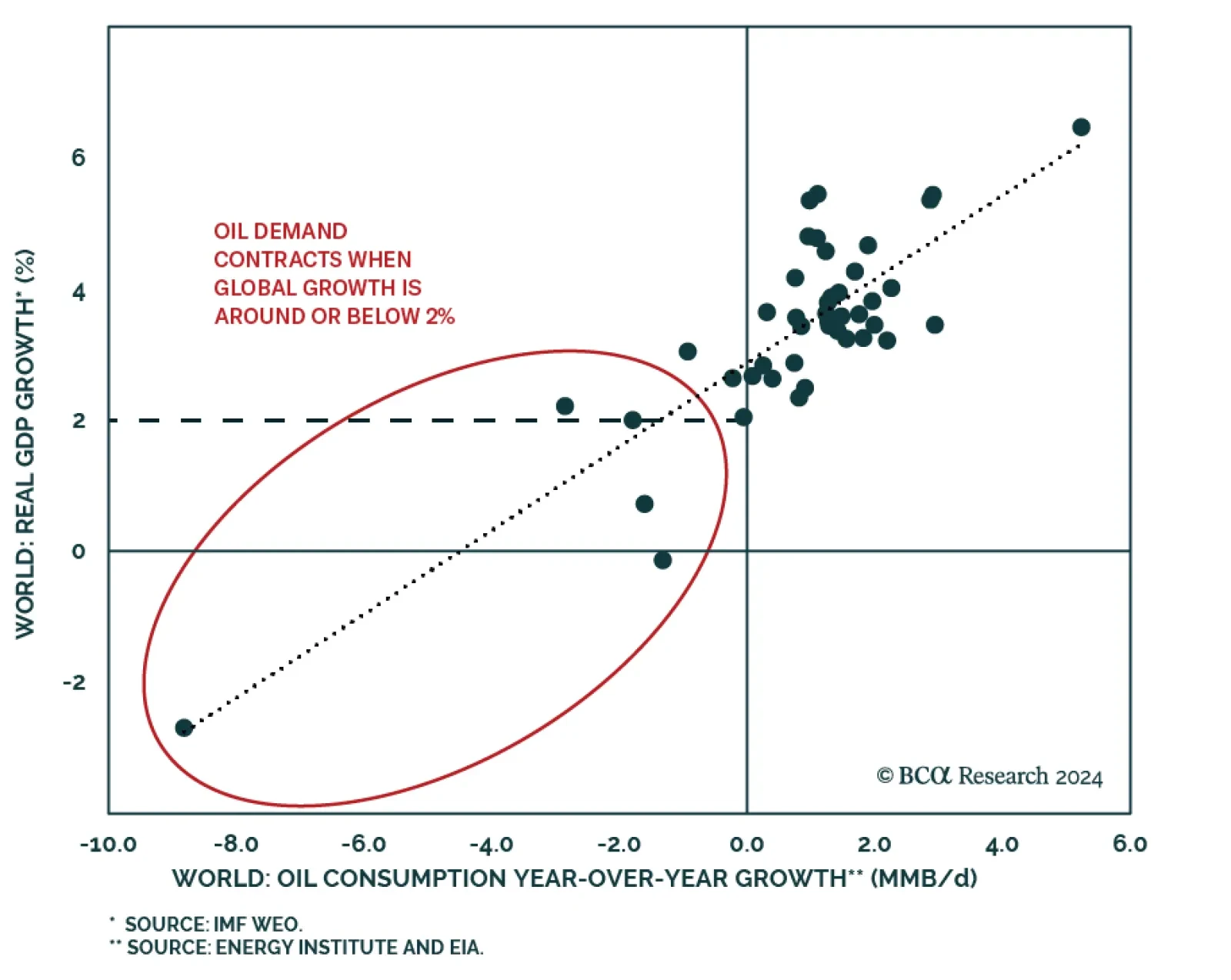

According to BCA Research’s Commodity & Energy Strategy service, the oil demand forecasts from the IEA, EIA, and OPEC are too optimistic. The IEA, EIA, and OPEC all anticipate oil demand growth to slow this year…

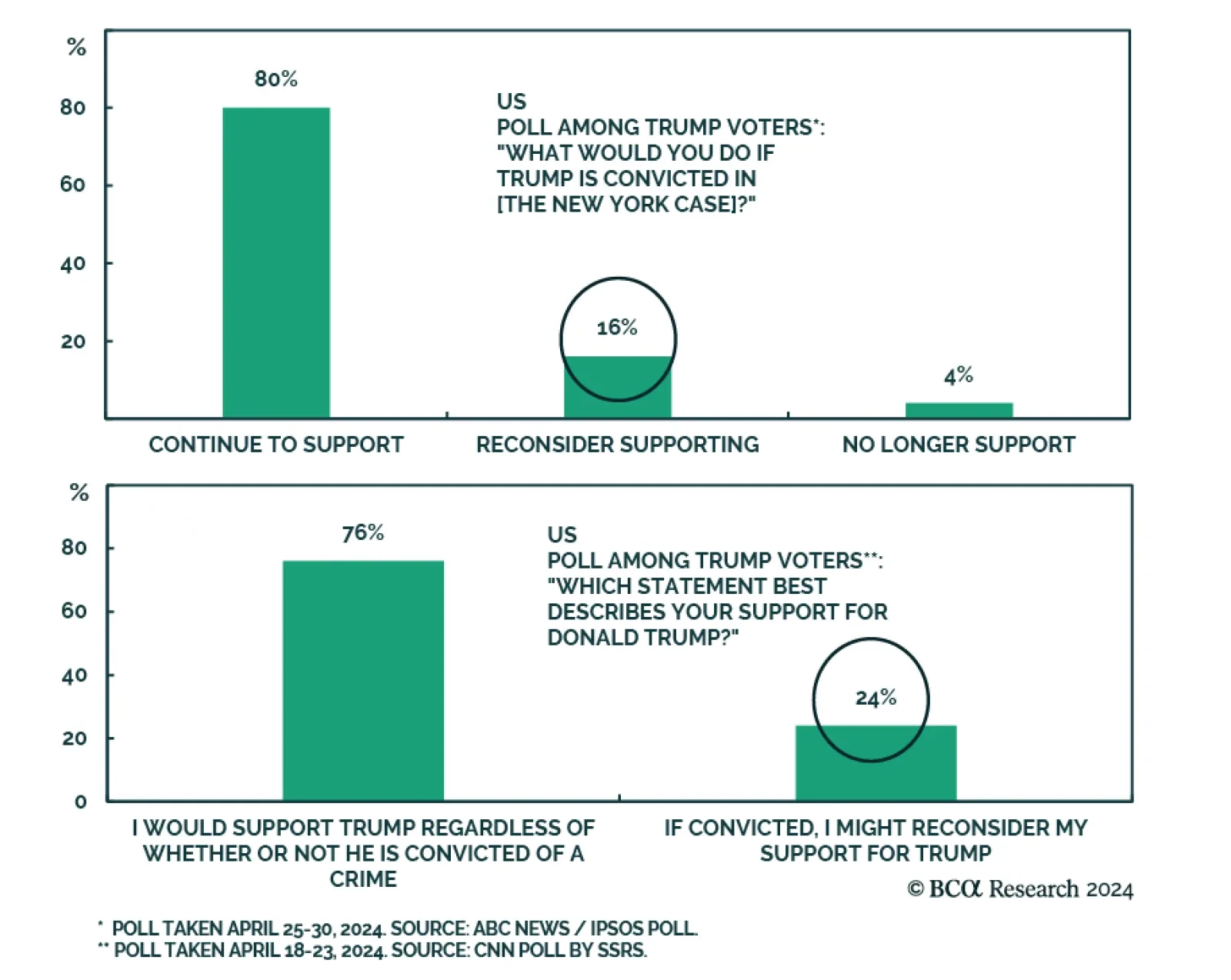

According to BCA Research’s US Political Strategy service, Trump’s conviction will not be a game changer in the upcoming Presidential election. President Trump was convicted of 34 felony charges by a 12-person jury…