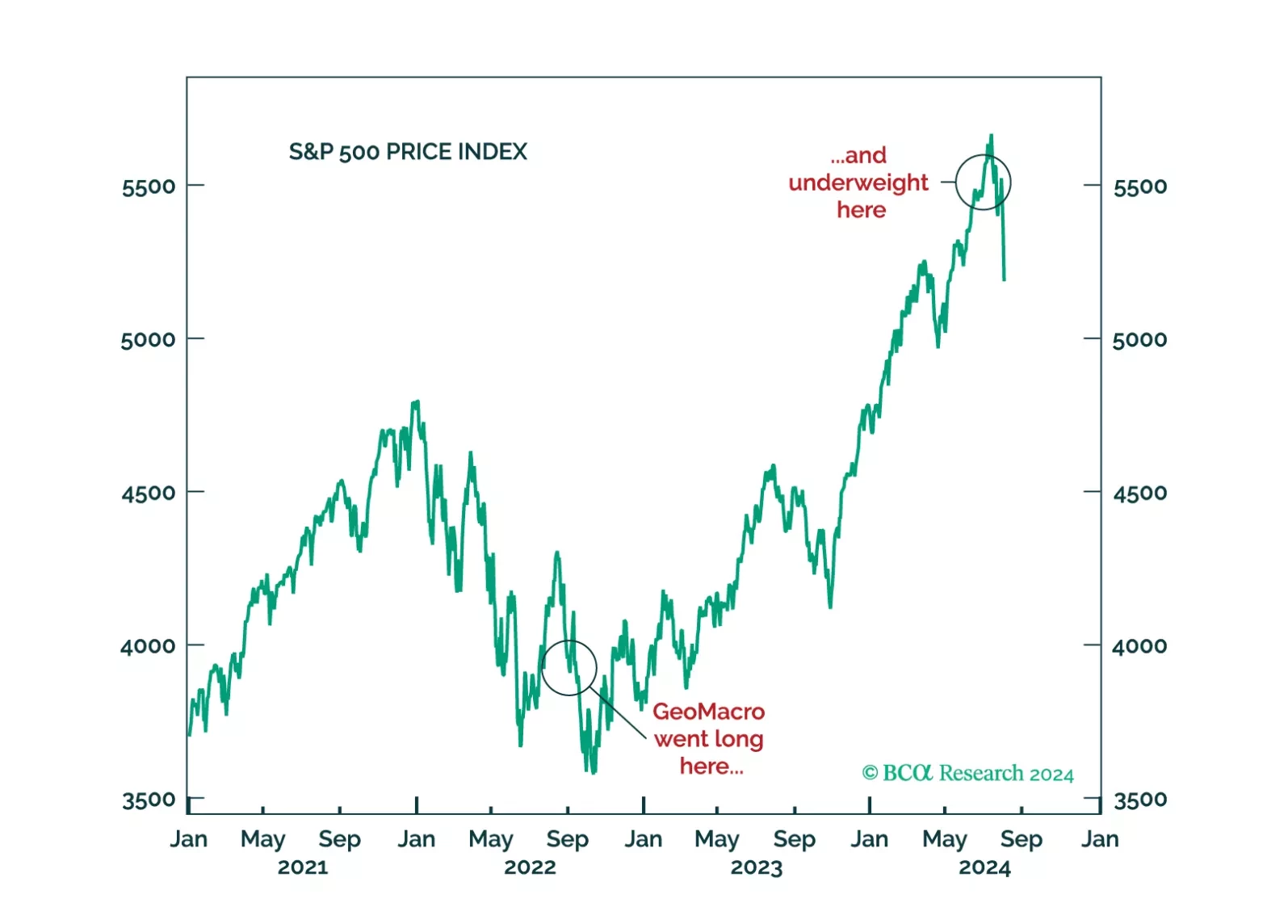

MacroQuant continues to recommend underweighting equities and overweighting bonds. This is consistent with the Global Investment Strategy Team's decision to downgrade global equities to underweight in late June.

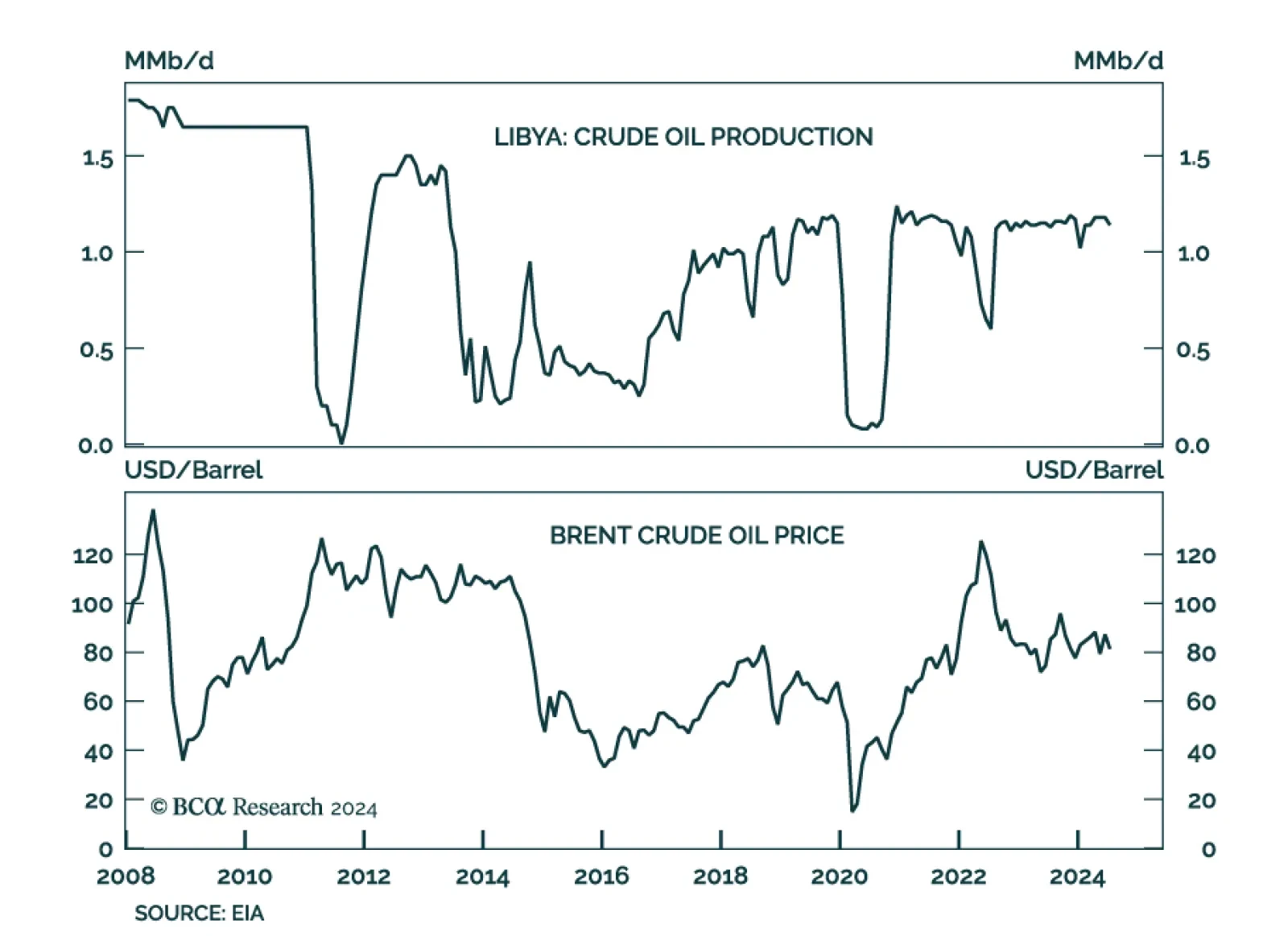

According to BCA Research’s Commodity & Energy Strategy service, oil markets are caught in a tug-of-war that has kept oil prices in a trading range since H2 2023. Bearish demand concerns are enforcing an upper limit on…

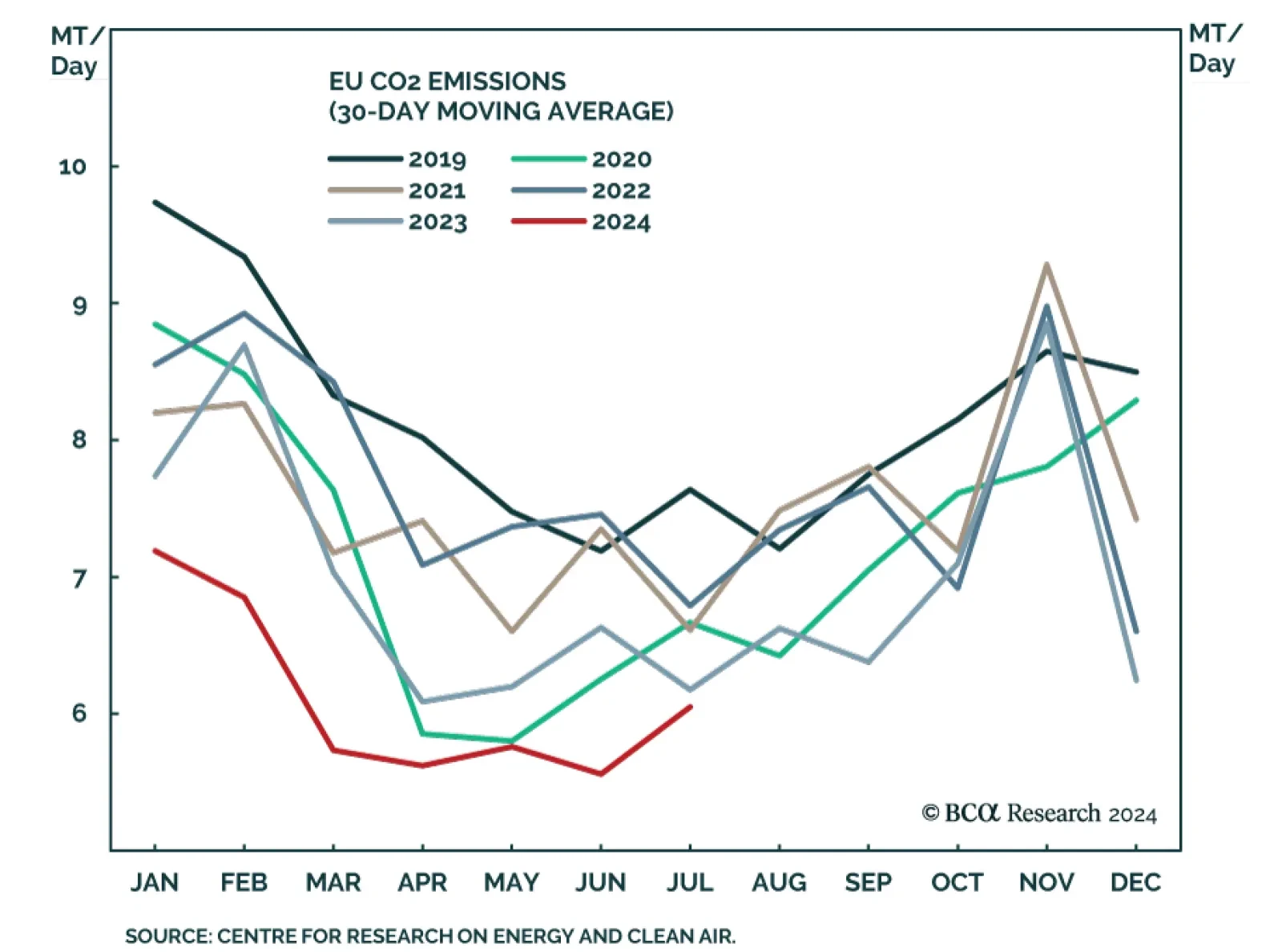

European regulatory carbon credits (EUAs) are becoming increasingly investable as an asset class. In a Special Report published last September, our Global Investment strategists agreed to the strategic bull case for EUAs, but…

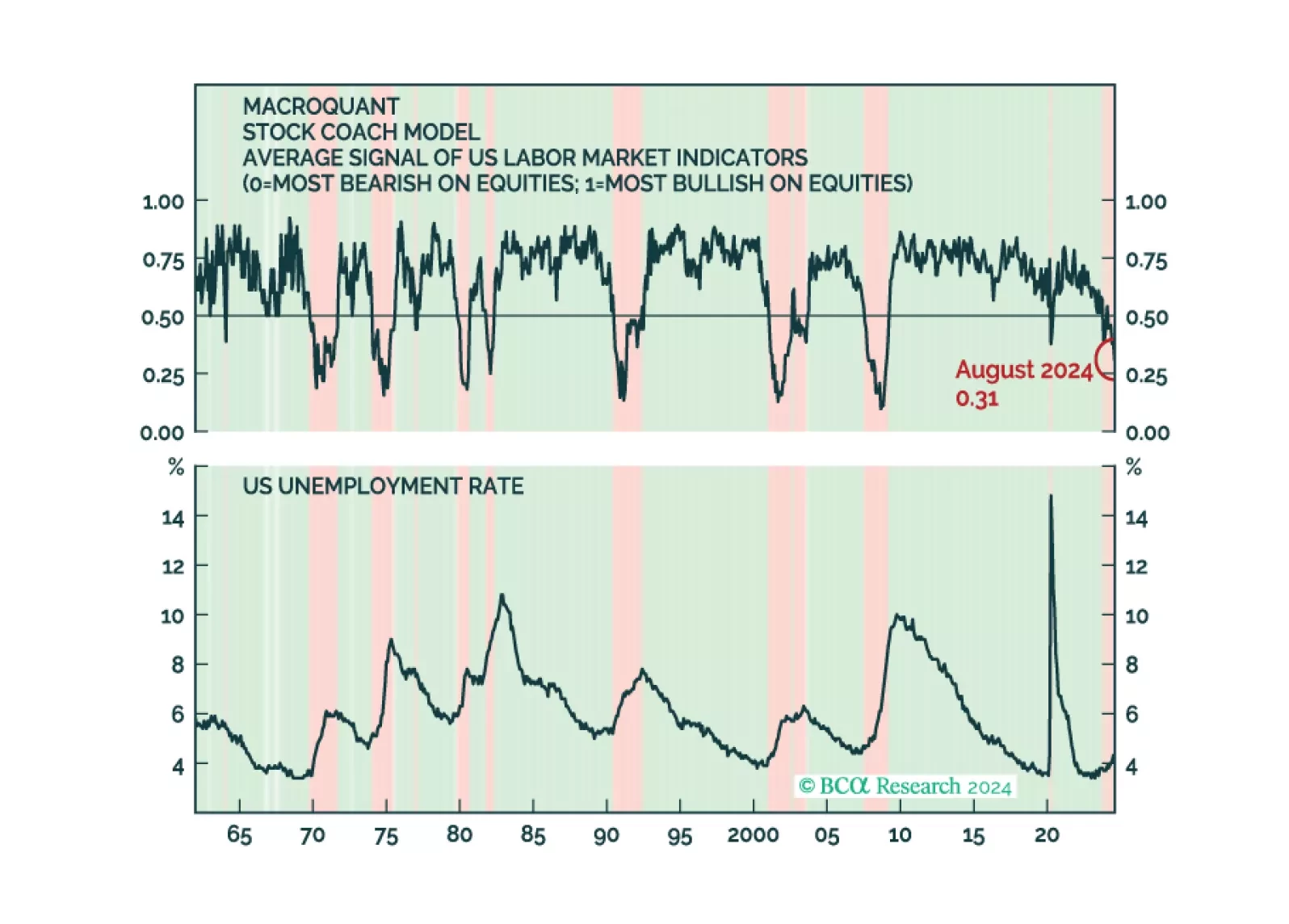

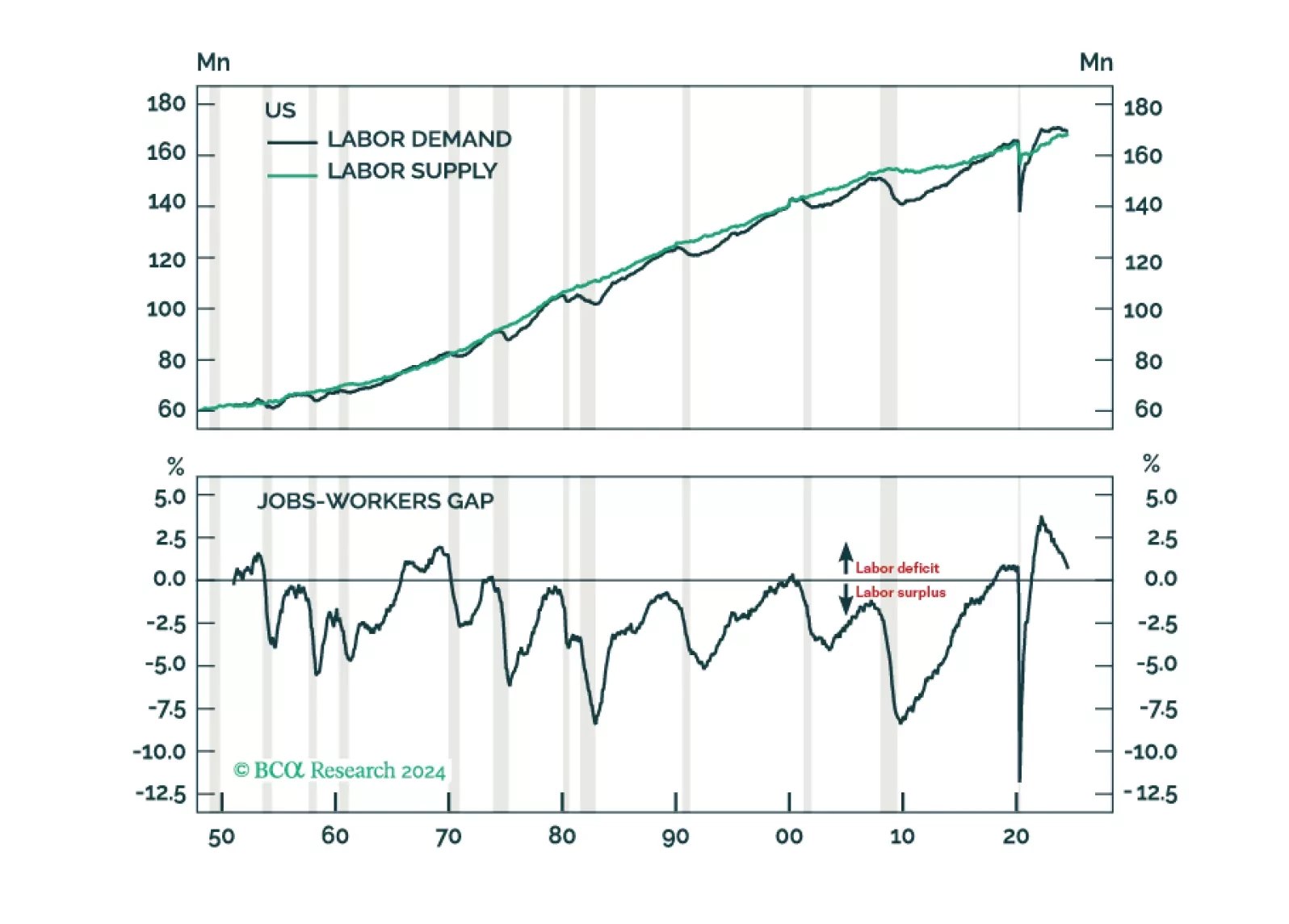

The great US labor market shortage is over. Labor demand will likely fall short of supply by the end of this year, causing unemployment to soar. Neither fiscal nor monetary policy will be able to prevent the coming recession.…

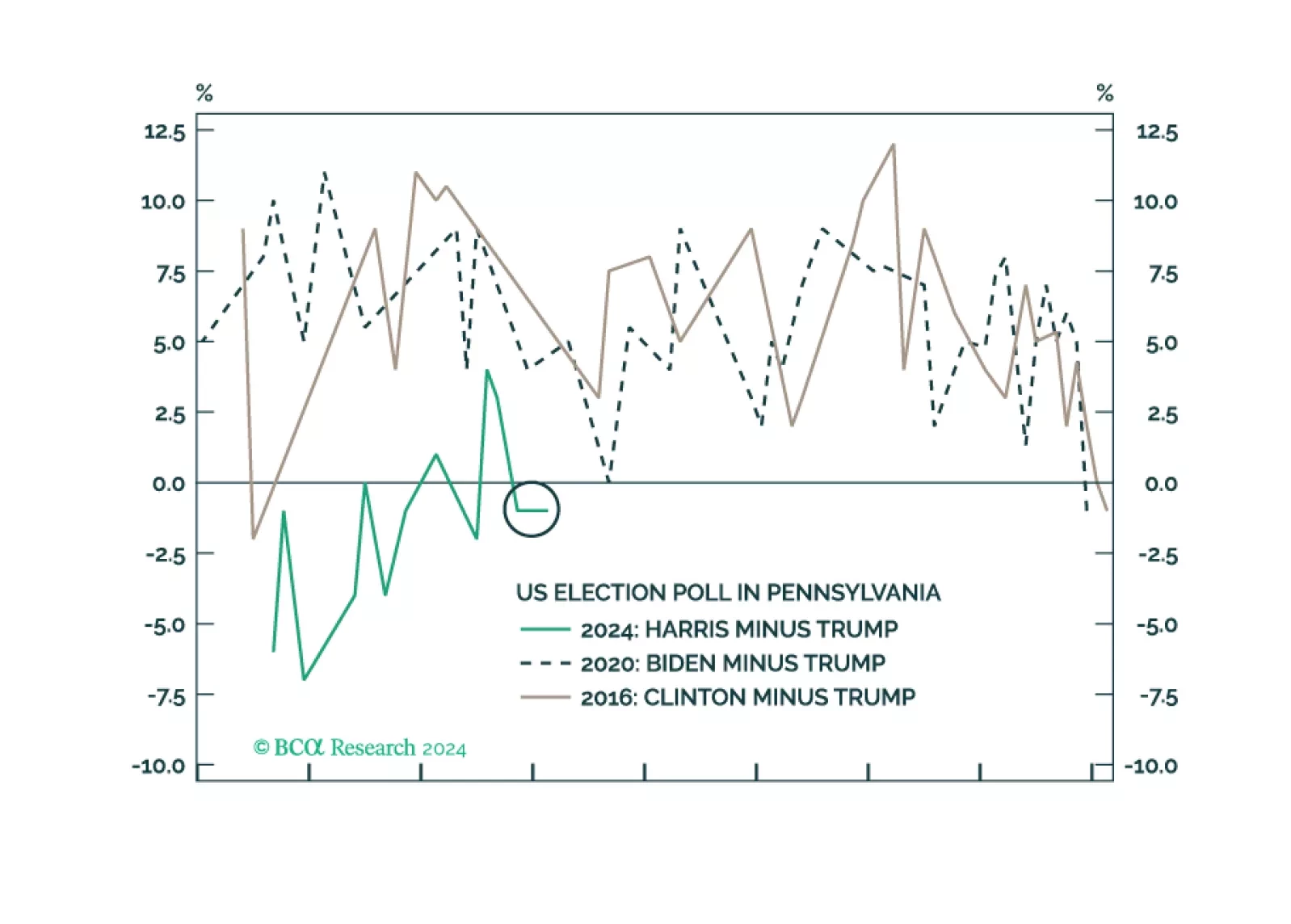

Investors should buy protection against further volatility. The shakeup in early August was a taste of things to come. The US election is a pivotal moment in modern history that will drive up uncertainty, while other countries take…

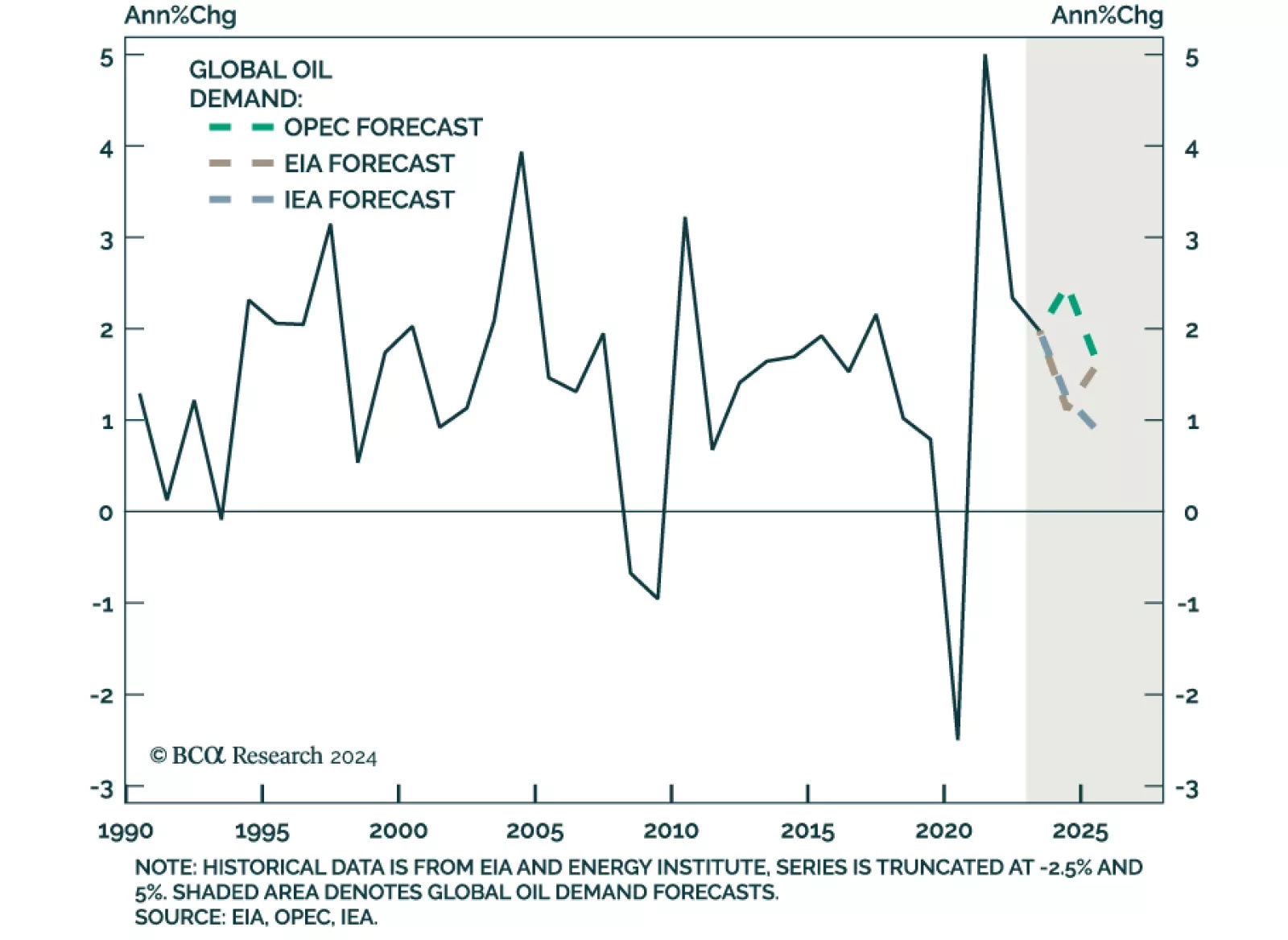

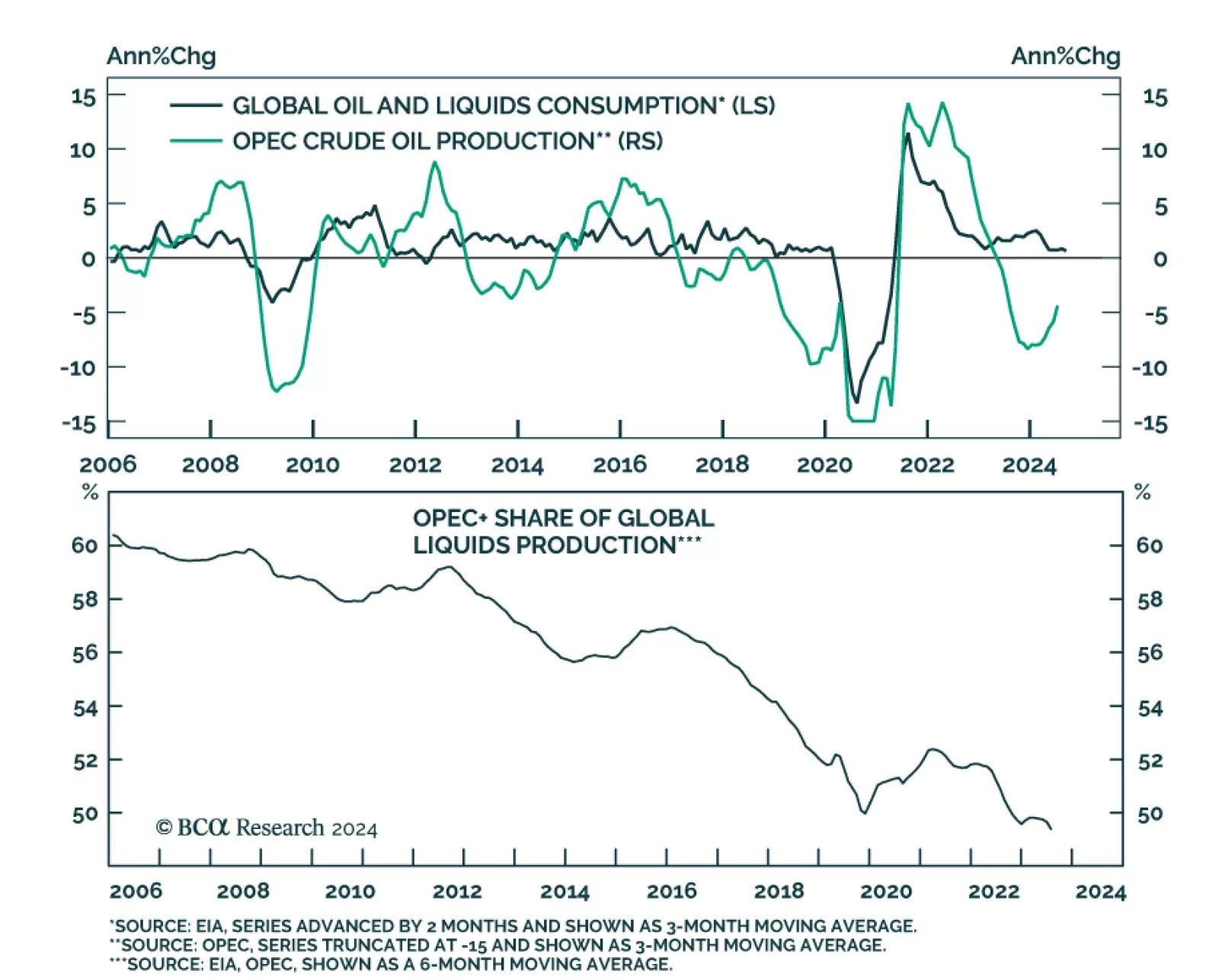

Back in May, our Commodity and Energy strategists argued that OPEC, EIA, and IEA oil demand forecasts were likely too optimistic. Indeed, while all three major oil price forecasters projected a moderation in demand this year,…

According to BCA Research’s Commodity and Energy Strategy service, soft oil demand growth raises the likelihood that OPEC+ will back down from its plan to begin unwinding some of its production cuts later this year. However…

The decision by GeoMacro team on July 2 to short USDJPY and underweight equities has proven to be prescient. We still do not like the market setup from here on out. A recession would, obviously, be negative for risk assets. But even…

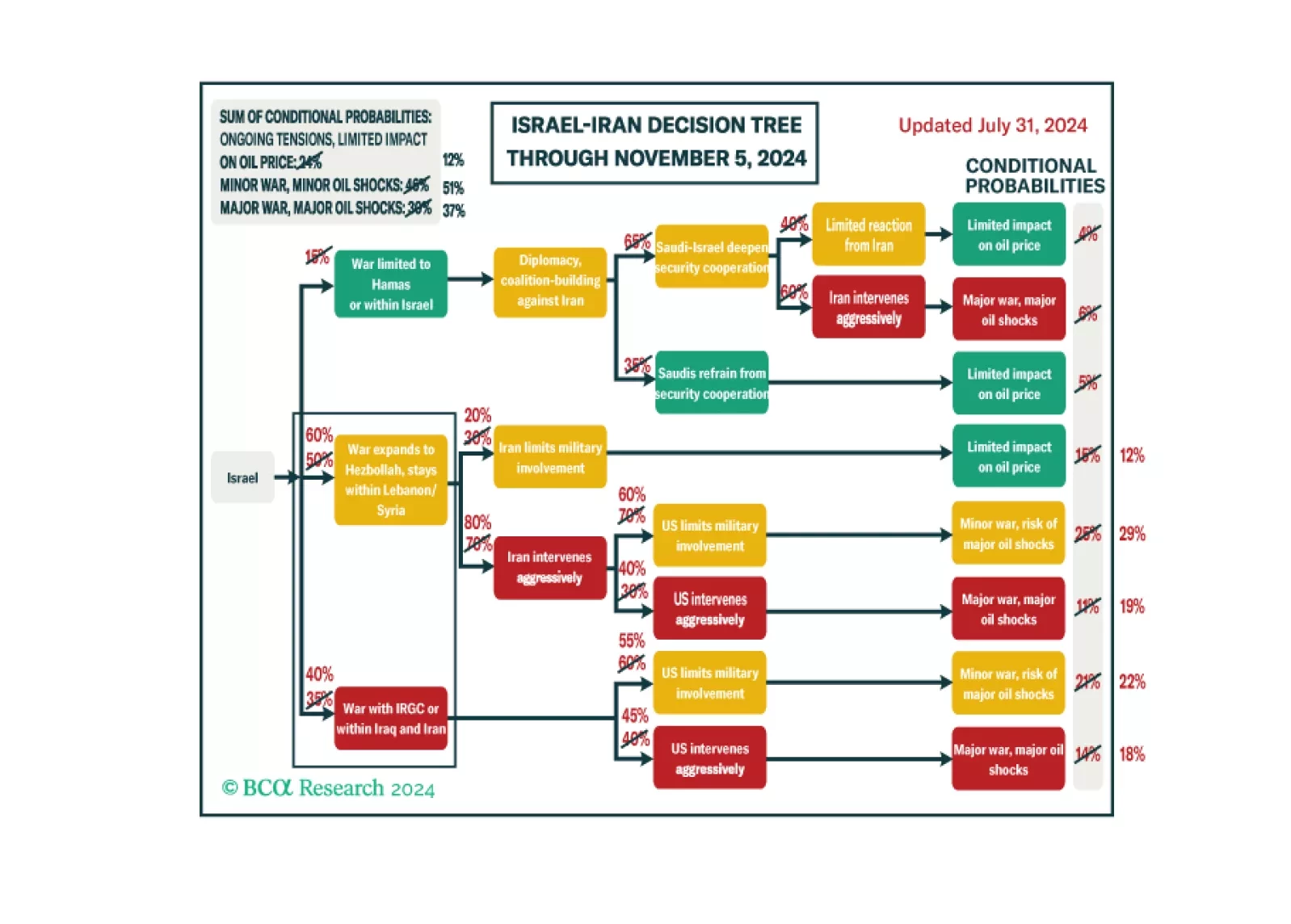

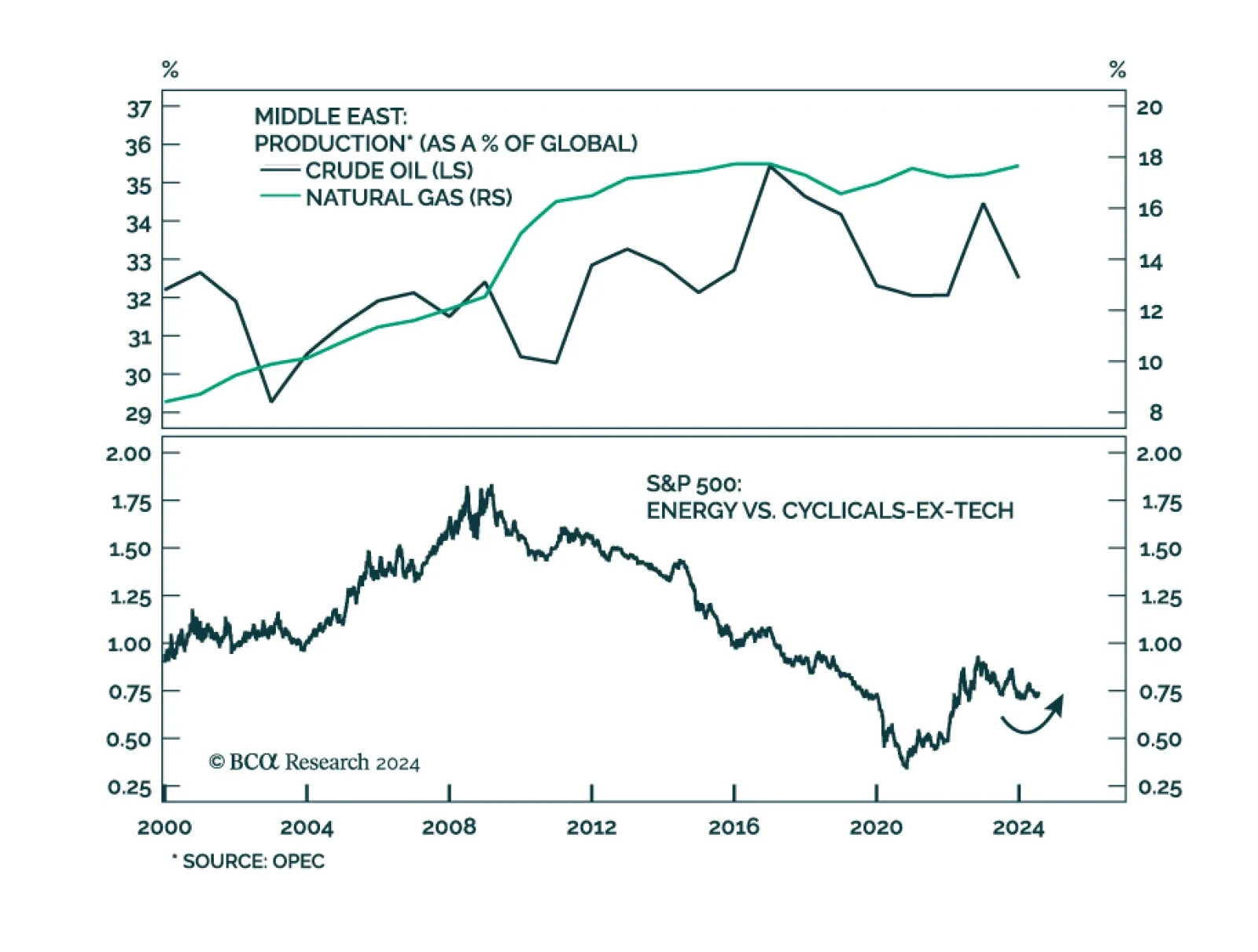

Following the recent escalation in the Middle East conflict, BCA Research’s Geopolitical Strategy service upgrades its subjective odds of a major oil supply shock to 37%. Volatility should spike again as investors…

The war in the Middle East is expanding, upgrading our subjective odds of a major oil supply shock to 37% and underscoring our 60% odds of Republican victory in November. Volatility should spike again as investors contemplate the…