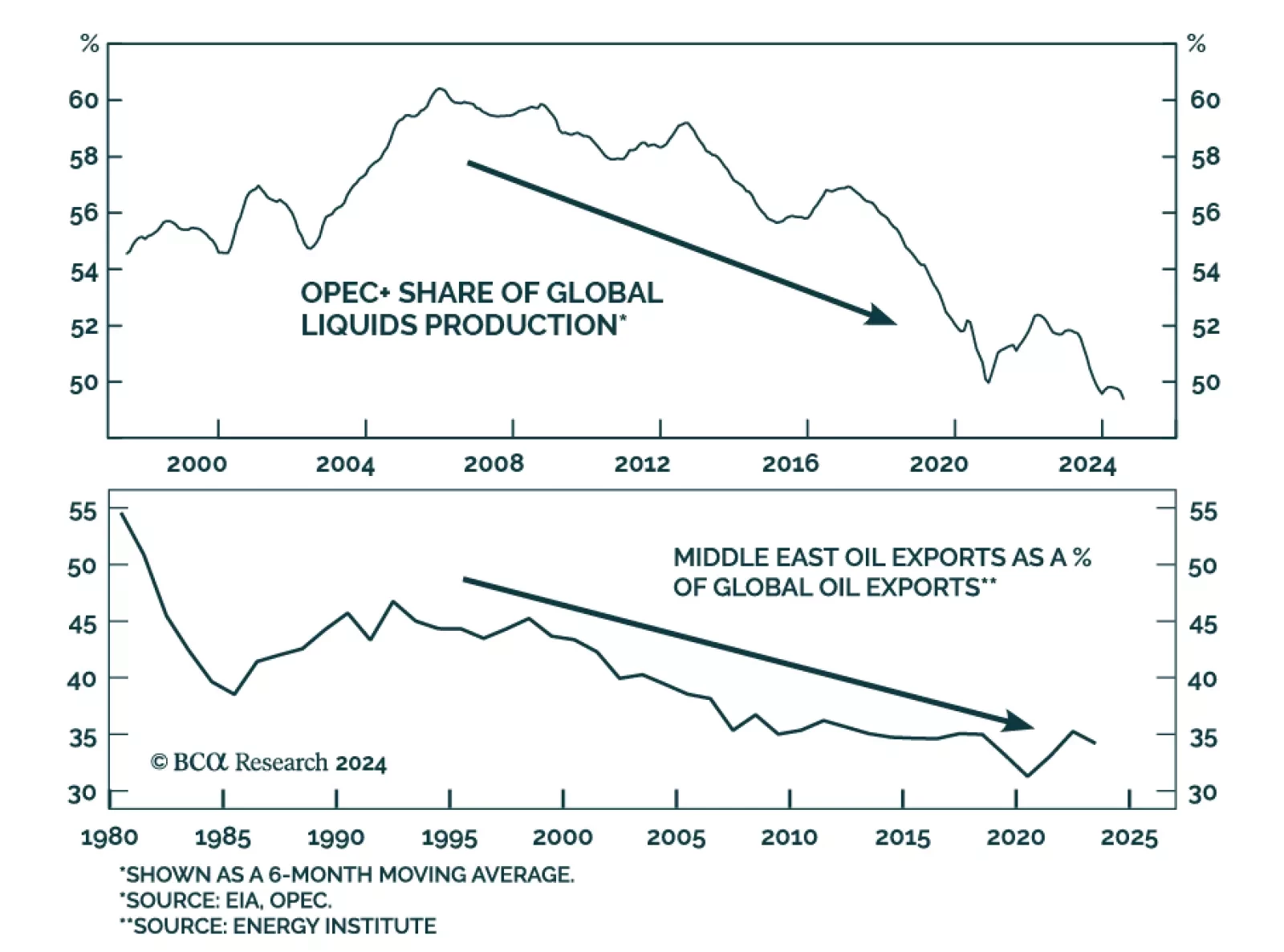

Our Commodity & Energy Strategy team evaluated the impact of president-elect Trump’s policies on commodity markets. Trump’s energy policies, while promoting increased domestic oil production, are unlikely to…

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

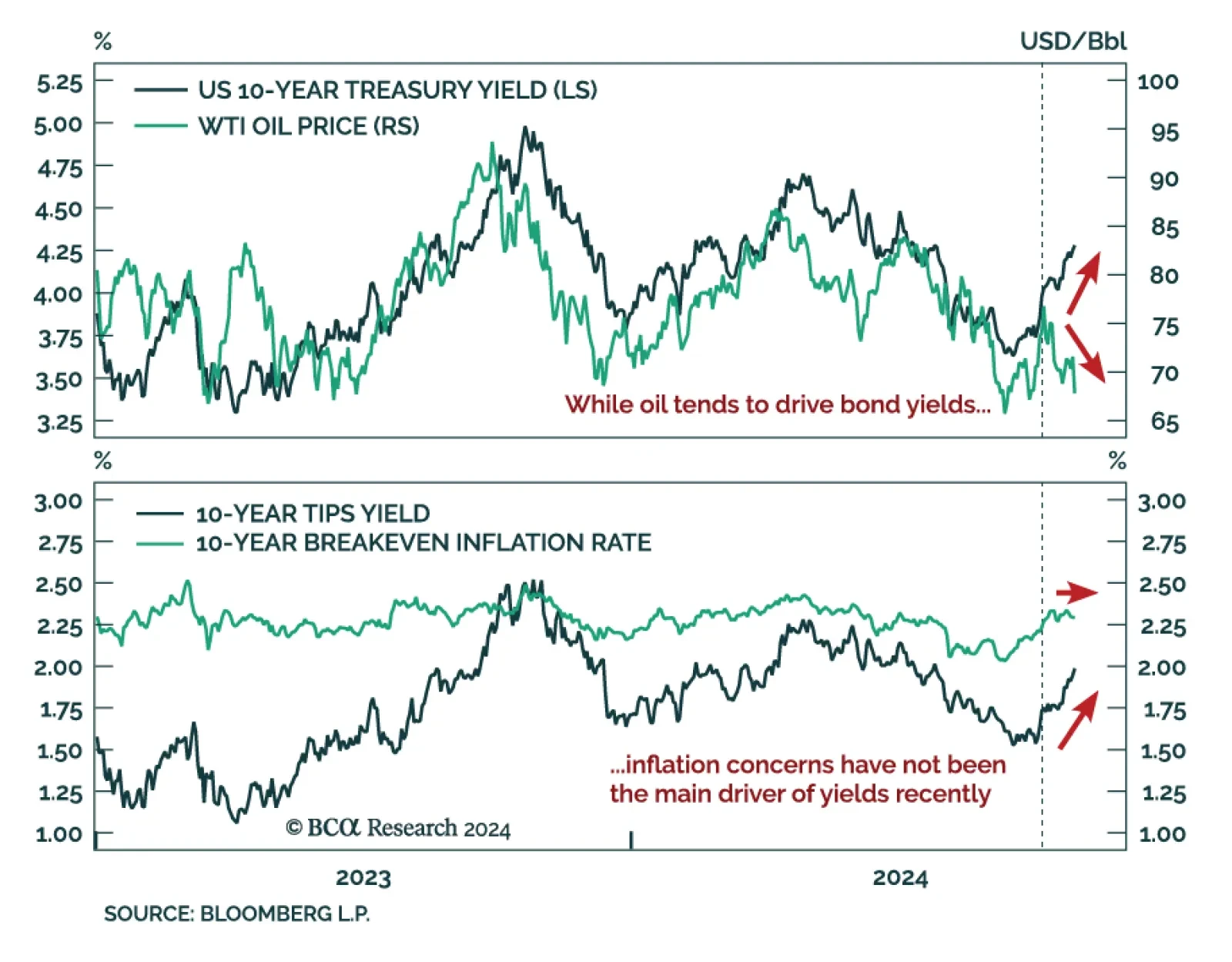

For the past two weeks, oil has sold off amid a global spike in yields. Oil prices and Treasury yields tend to be positively correlated, as oil prices are a fast-moving component of inflation, driving the inflation expectations…

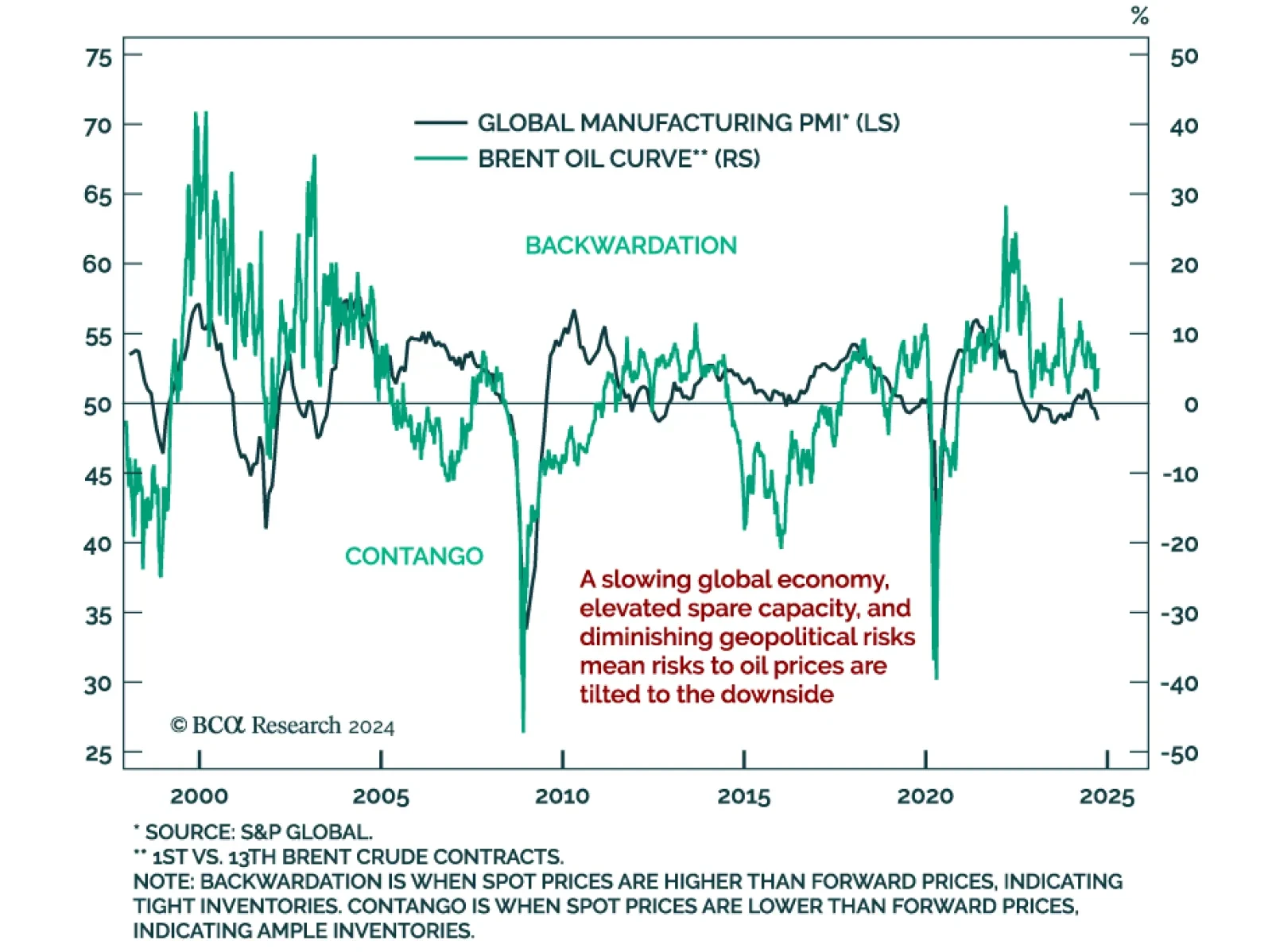

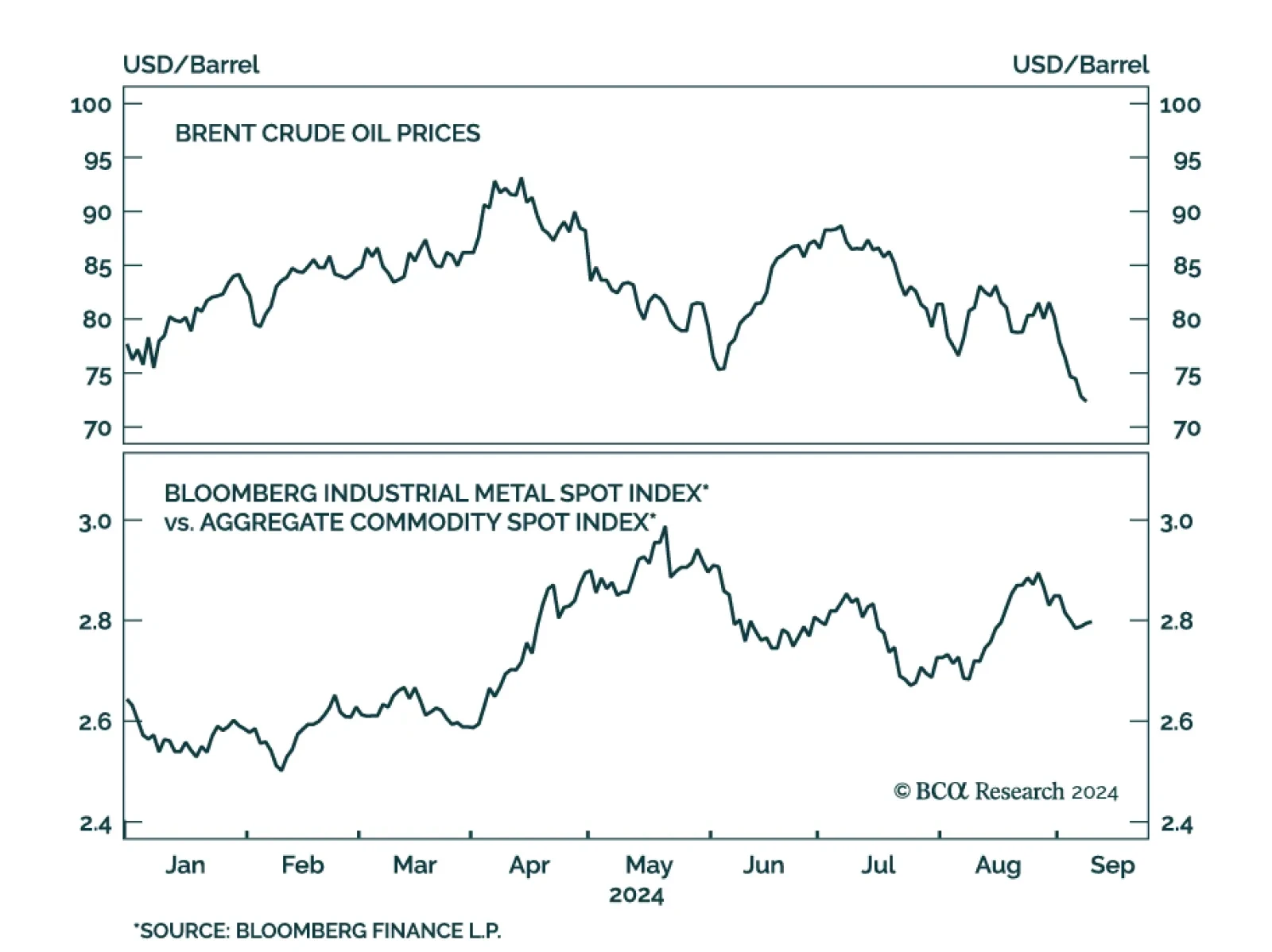

Crude prices have been trendless but volatile in 2024. Oil’s choppy price action illustrates the demand and supply tug-o-war in the market. Our bias is for crude prices to weaken on a six-to-nine months horizon. Good…

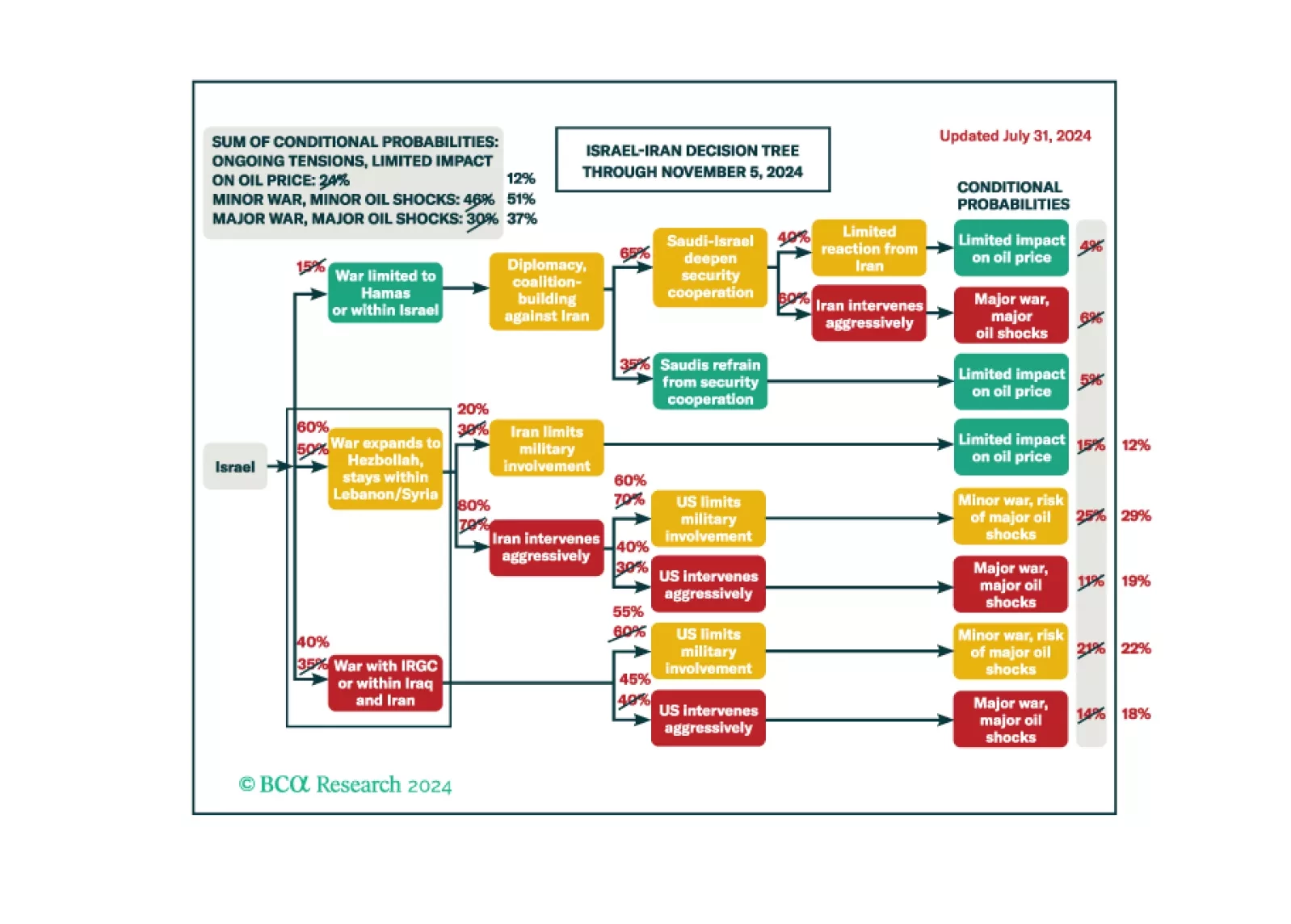

We maintain 37% odds of a major recessionary oil shock, 51% odds of minor shocks, and 12% odds of no shocks.

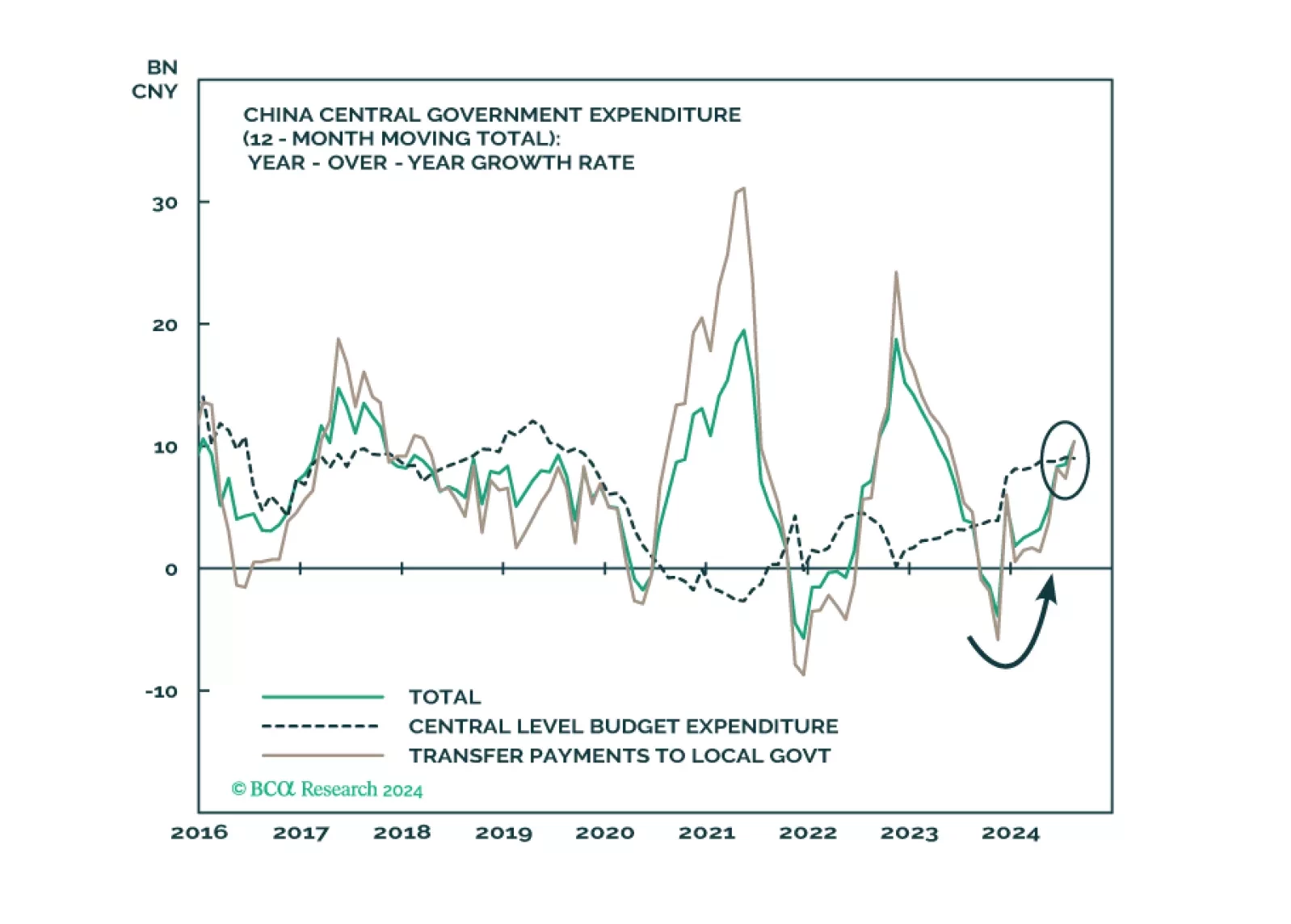

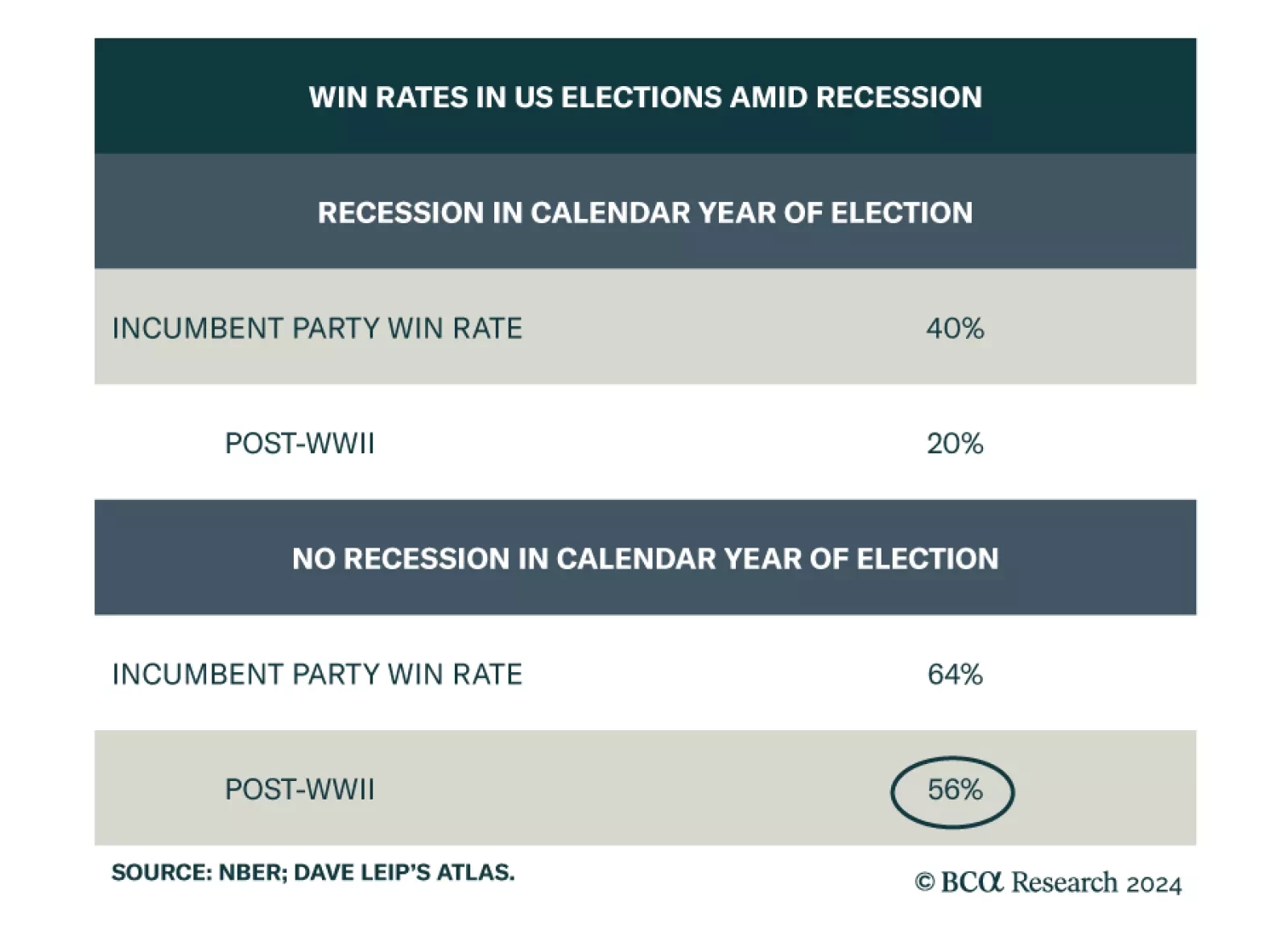

Markets are rallying on Fed rate cuts and China stimulus but there will also be October surprises ahead of the US election, which Trump could still win. Russia’s conflict with the West is escalating and the Middle East is…

One commodity that has not reacted to the bullish demand-side news from the Politburo (see The Numbers) is crude oil. Brent shed over 2% on Thursday, in sharp contrast to Copper’s gains. Oil markets seem to be reacting…

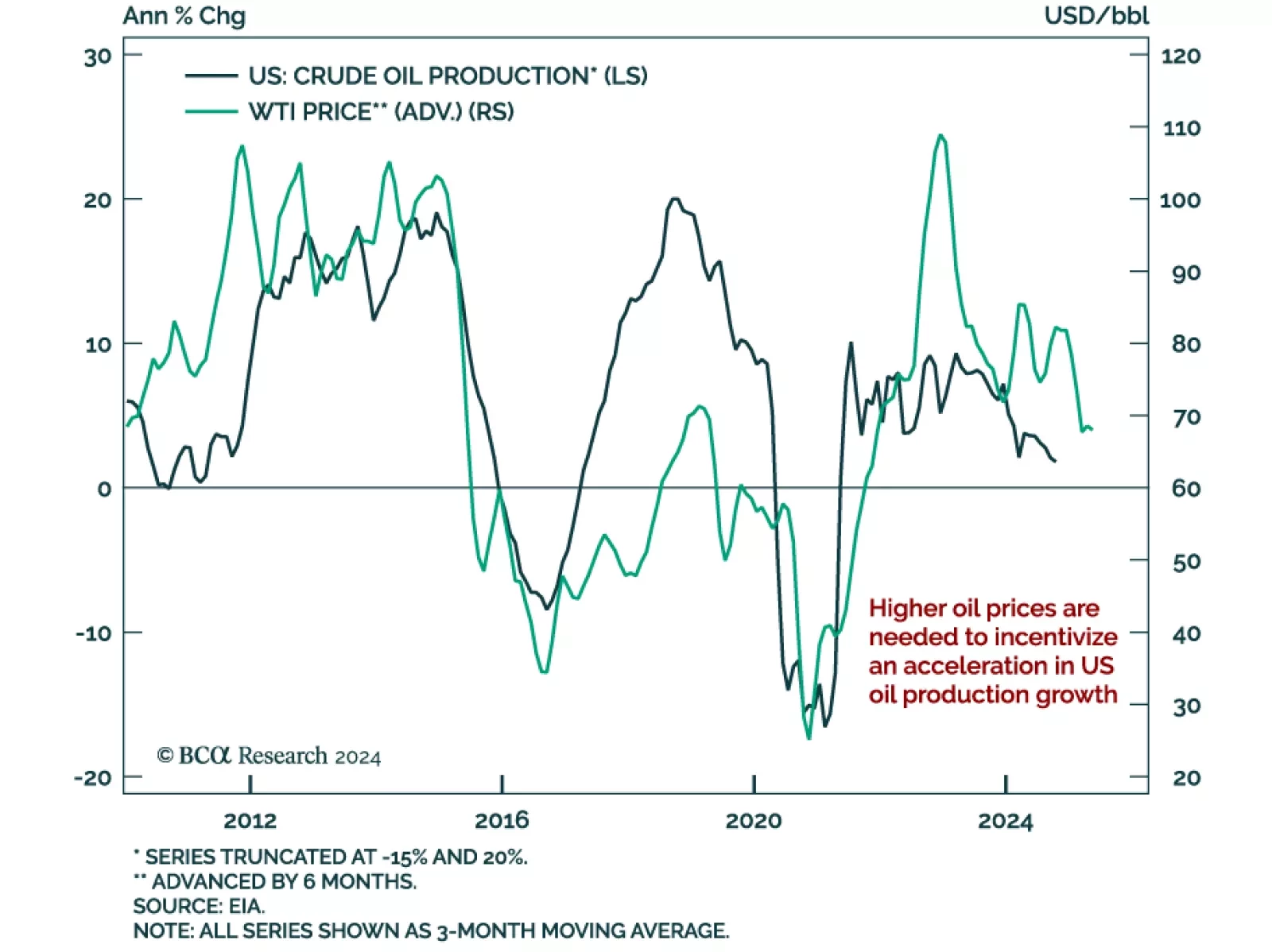

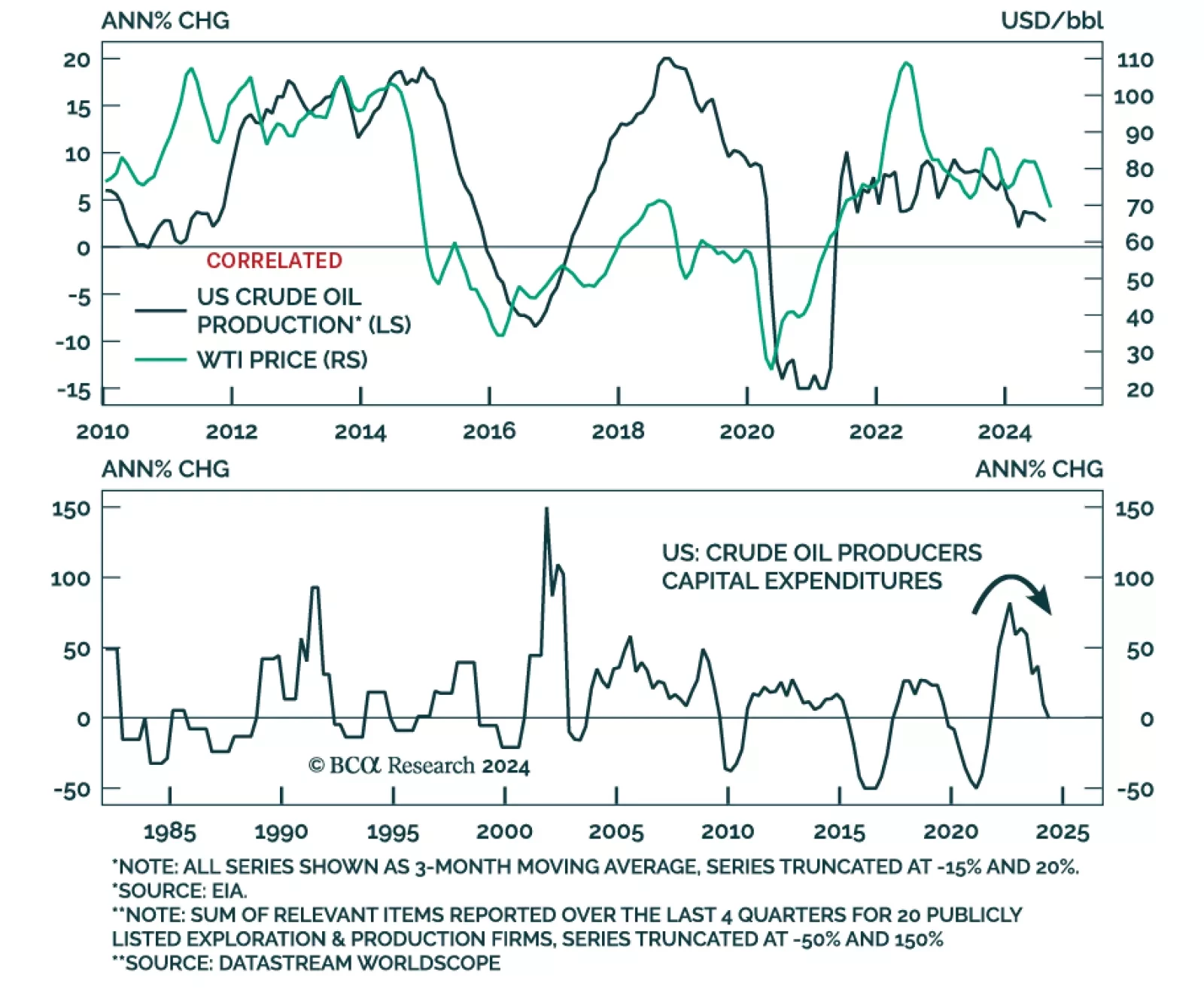

According to BCA Research’s Commodity and Energy strategy service, even though US crude output will continue rising, a meaningful growth acceleration is unlikely. US producers adjust their output in response to market…

According to BCA Research’s Geopolitical Strategy service, seven surprises with non-negligible odds could tip the scale in favor of Republicans for the White House by November 5. One of them is a war between Israel and Iran…

The decline in oil prices accelerated this month. Although Wednesday’s moves reversed Tuesday’s sharp daily declines, Brent and WTI have fallen 11% and 10% so far in September, and 30% and 33% from their April peaks…