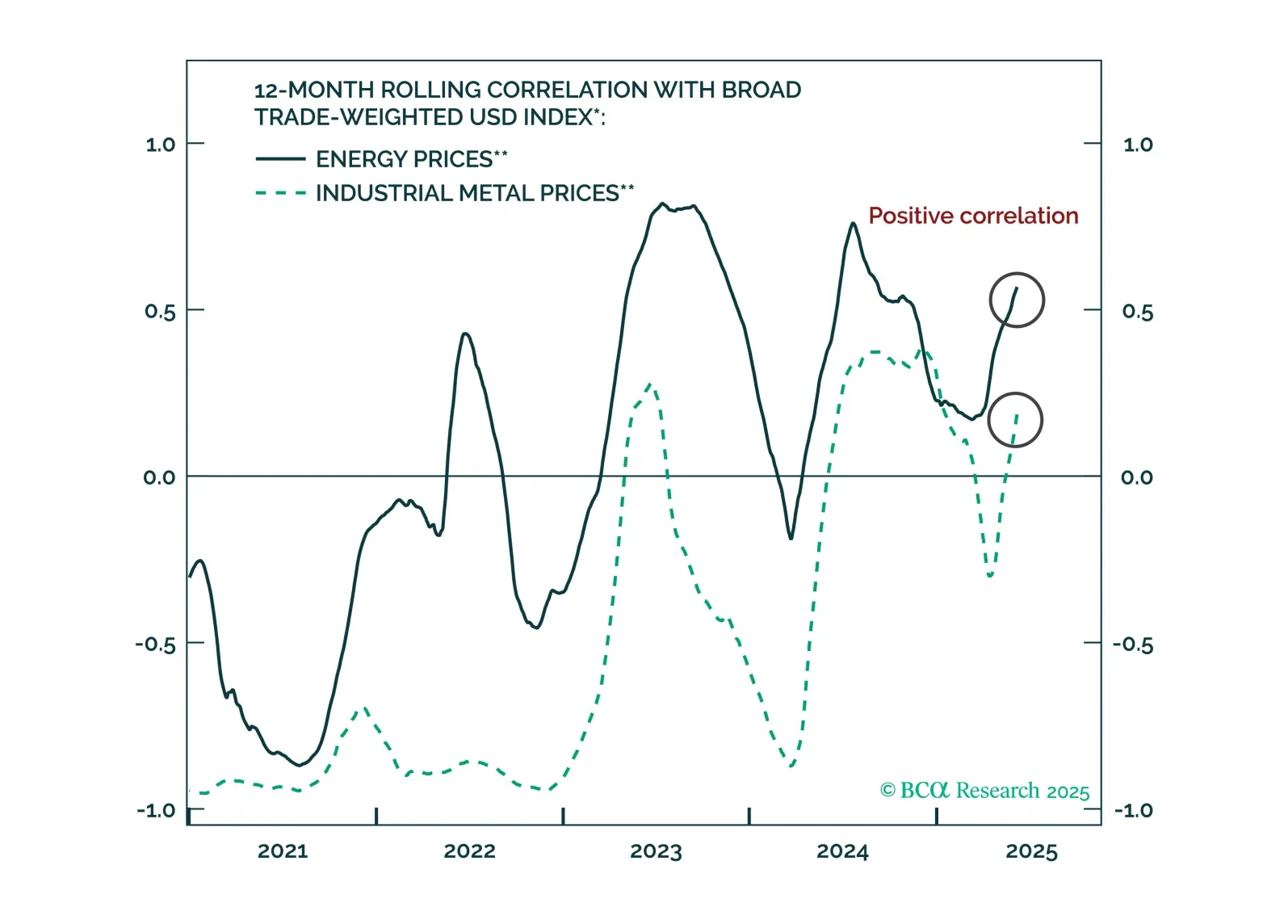

Investors often rely on past relationships to predict future outcomes. This strategy is at risk now that several commodity correlations have broken down. We explore the causes and sustainability of the new commodity relationships.

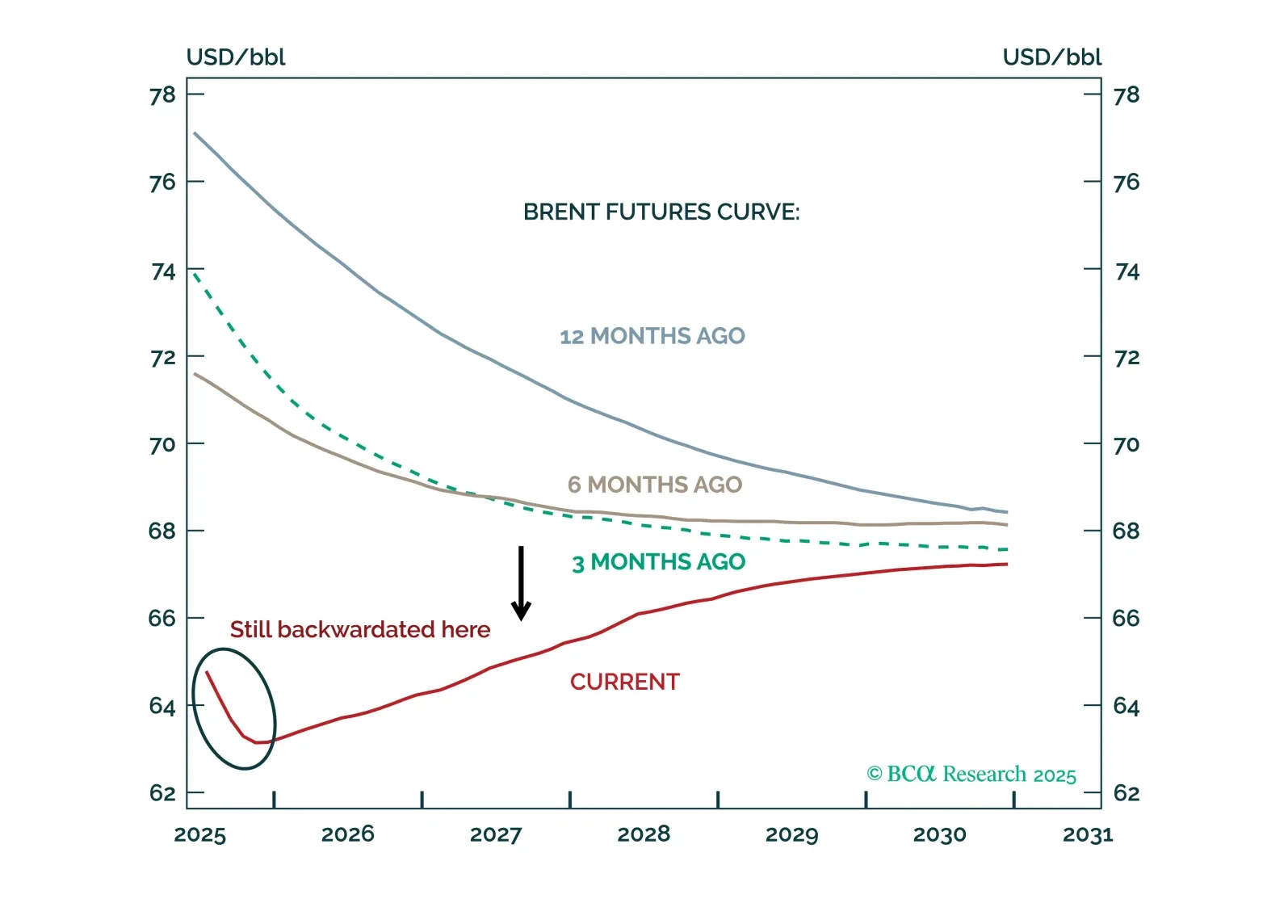

Oil, copper, and gold futures curves have recently experienced abnormal shifts and twists. Brent is no longer fully backwardated, copper curves on the LME and CME have diverged, and gold is in a steep contango. We examine the…

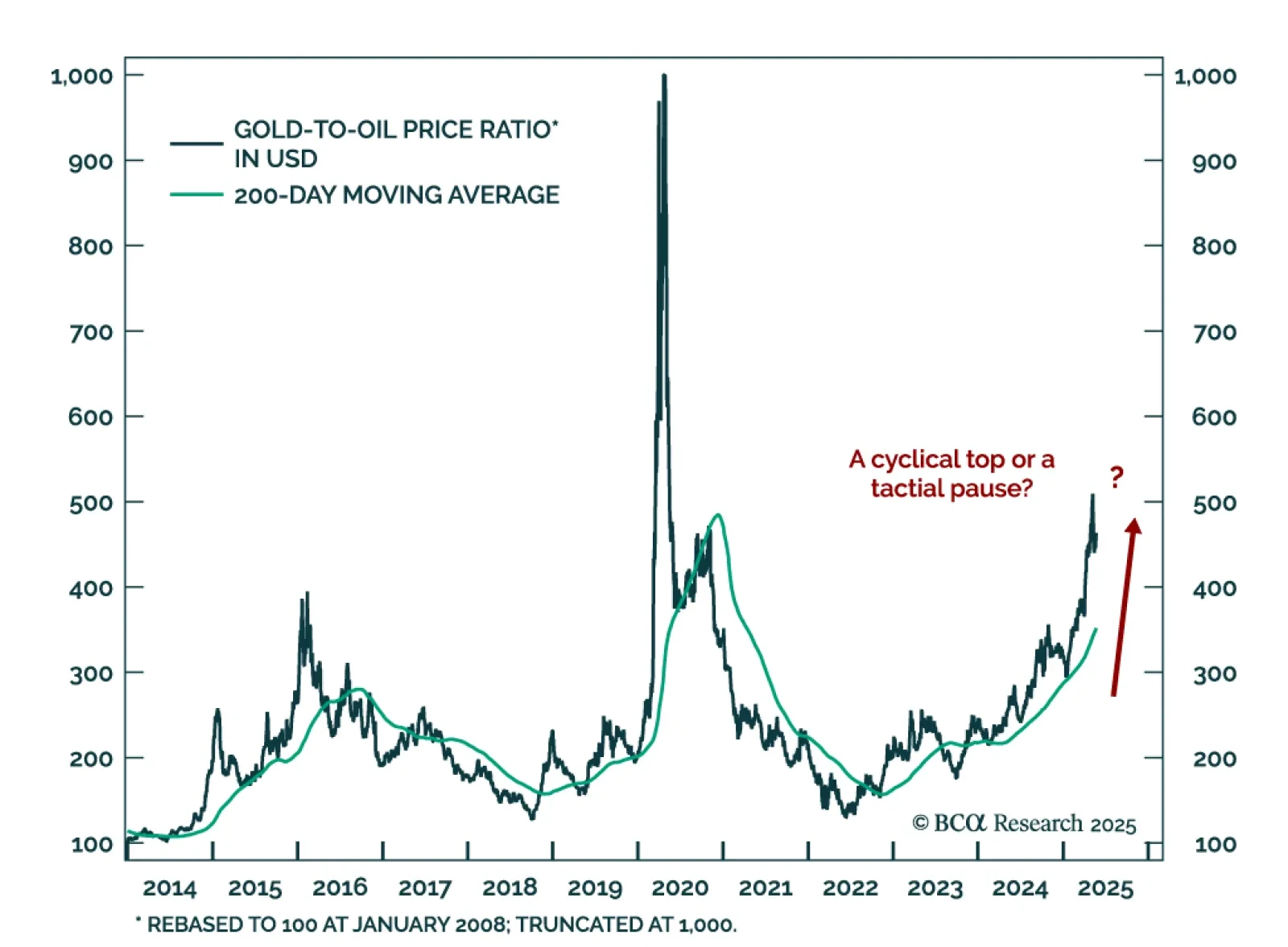

The gold-to-oil price ratio seems tactically overextended, but global macro drivers suggest it will rise further. The gold bull run is still relatively young and not yet stretched compared to rallies from the past 50…

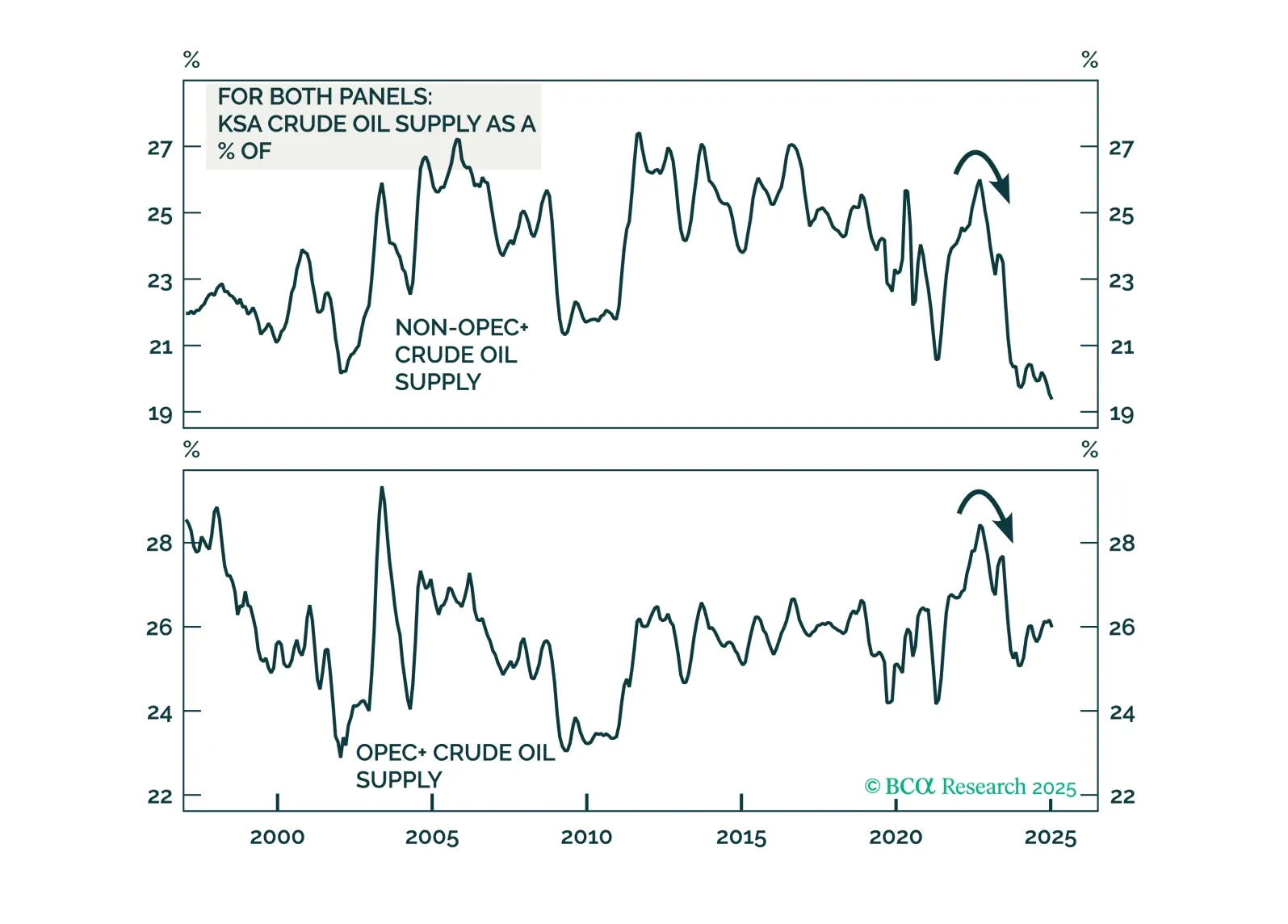

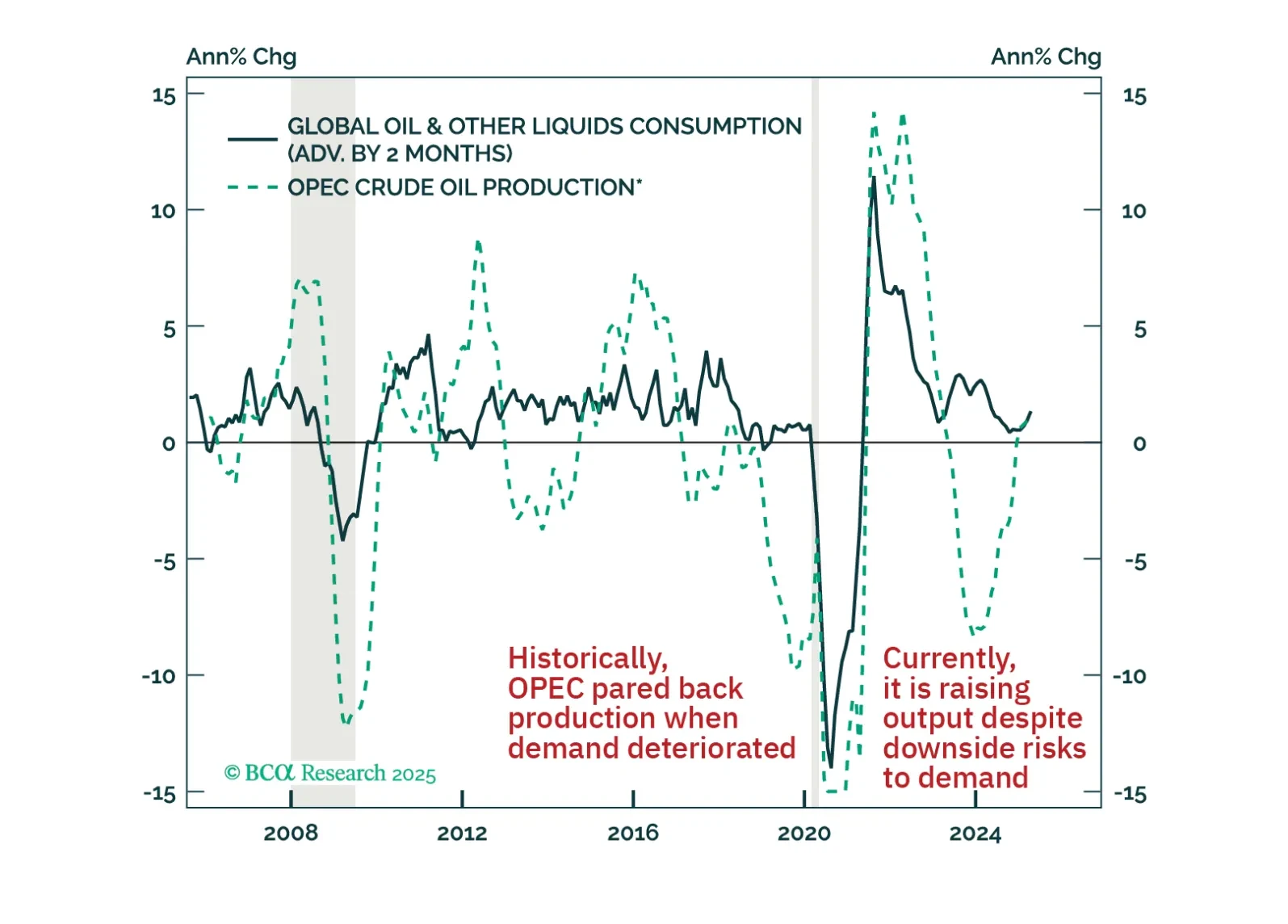

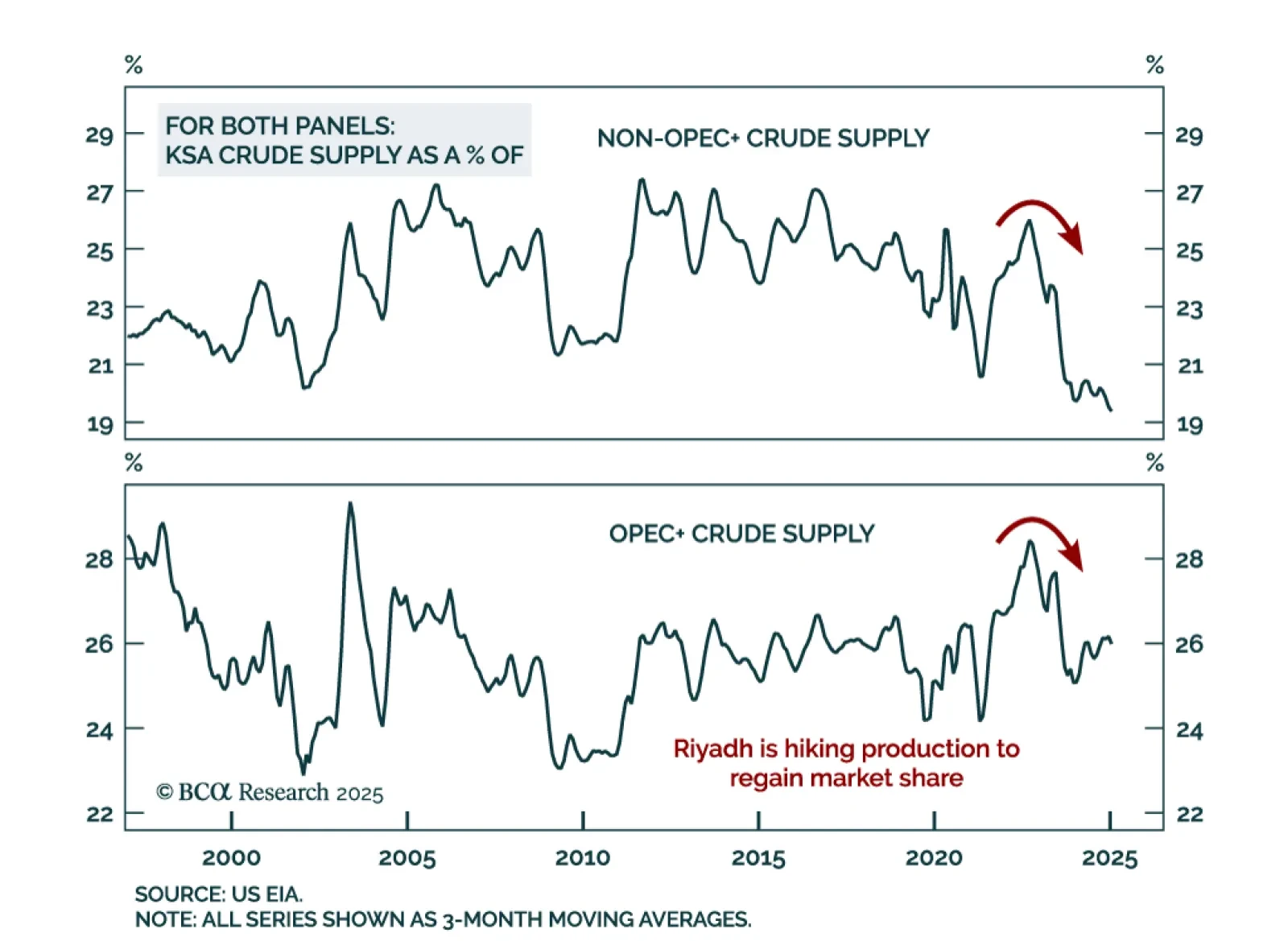

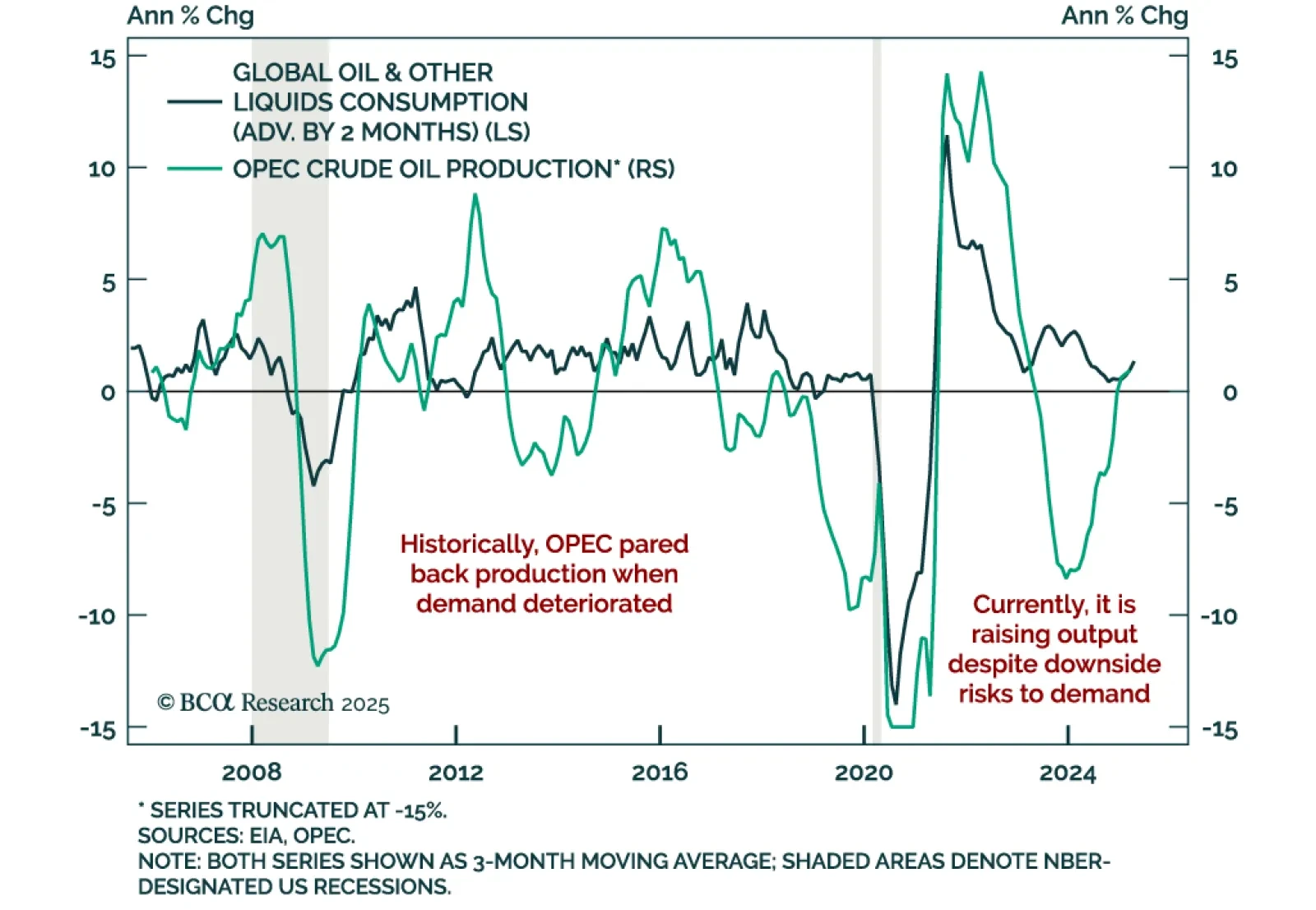

Our Commodities strategists believe Saudi Arabia is pursuing a controlled price war. Riyadh is intentionally pushing oil prices lower to regain market share and reset relations with the US. With OPEC+ production rising despite…

OPEC+ recently announced another outsized oil production hike, tripling its planned June output increase to 411k b/d for the second consecutive month. Our take on why KSA is boosting crude output at a time of heightened downside…

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

Our Commodity strategists stay short oil and long gold as global demand weakens and OPEC+ offers no support. Brent’s floor has likely fallen to $50, and bearish supply and demand forces continue to dominate the price outlook. …

Oil has borne the brunt of the year-to-date deterioration in cyclically sensitive financial assets. It is a key underperformer both within the commodity space and among global risk assets. This underperformance underscores that in…

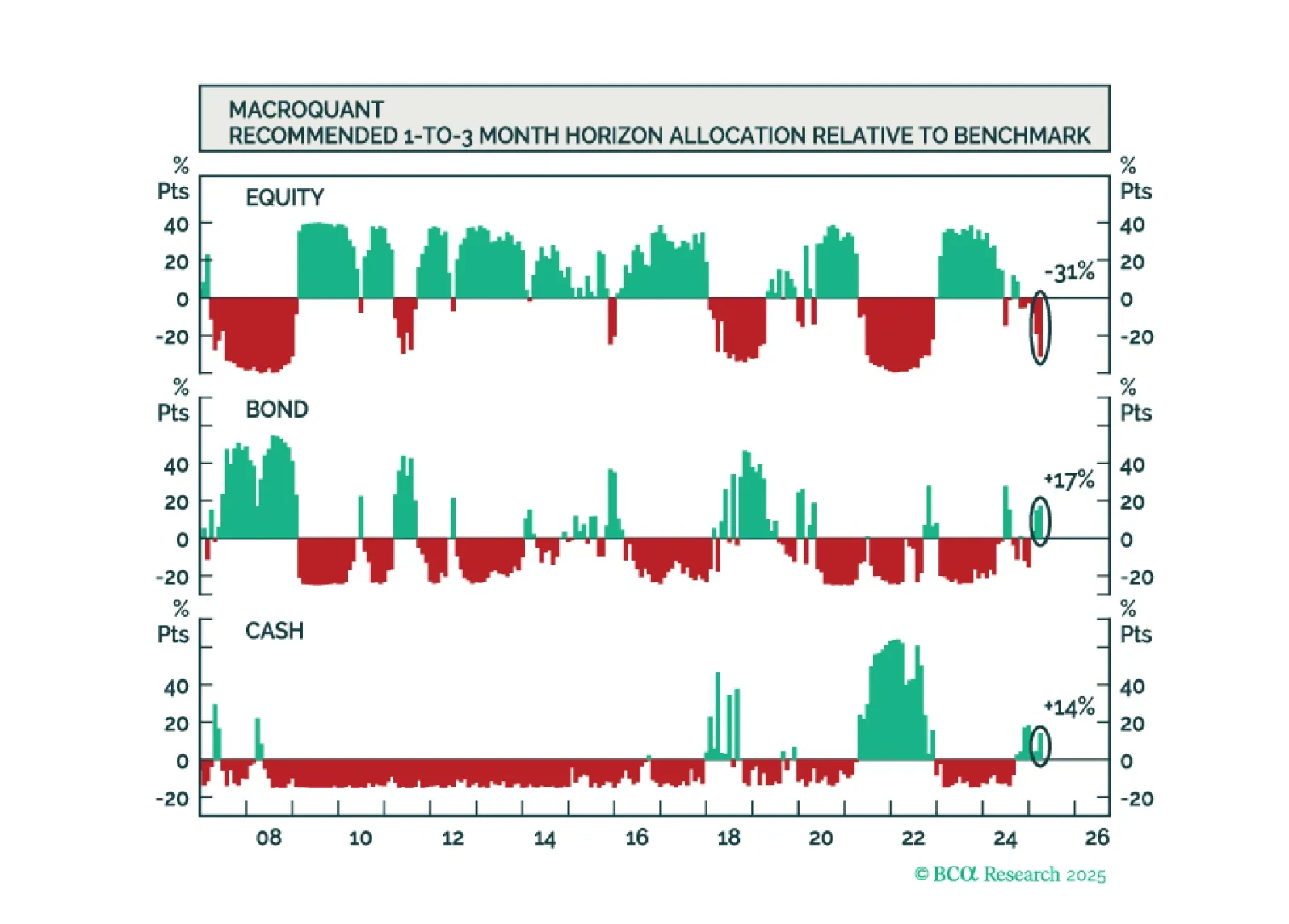

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.

MacroQuant sees the risks to US growth as being to the downside and the risks to inflation as being to the upside. Such a stagflationary brew justifies an underweight on stocks.