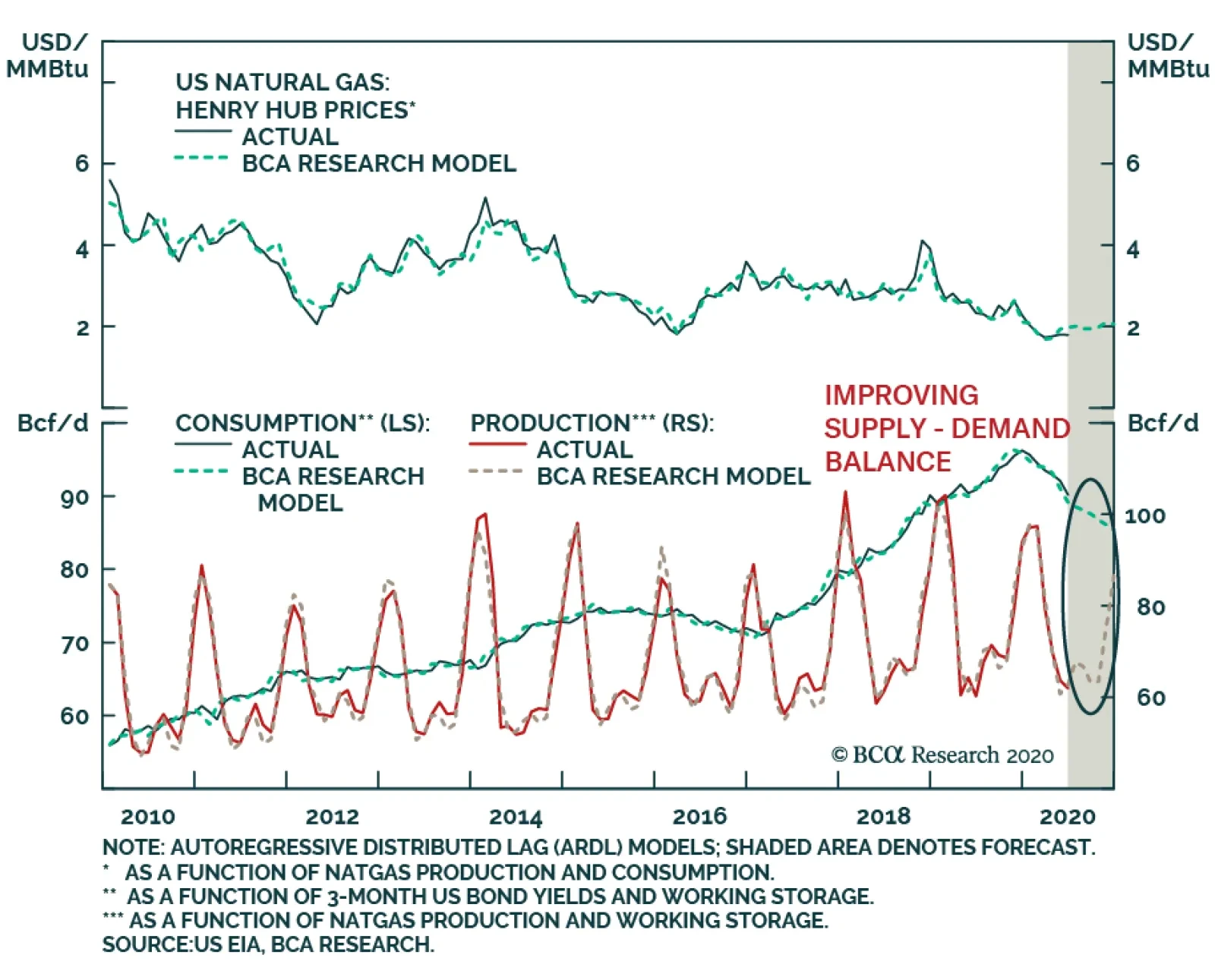

Highlights Continued upgrades to global economic growth – most recently by the IMF this week –will support higher natgas prices. In our estimation, gas for delivery at Henry Hub, LA, in the coming withdrawal season (…

According to BCA Research’s Commodity & Energy Strategy service, the odds that the US will succeed in halting completion of the final leg of the Russian Nord Stream 2 natural gas pipeline into Germany are higher than…

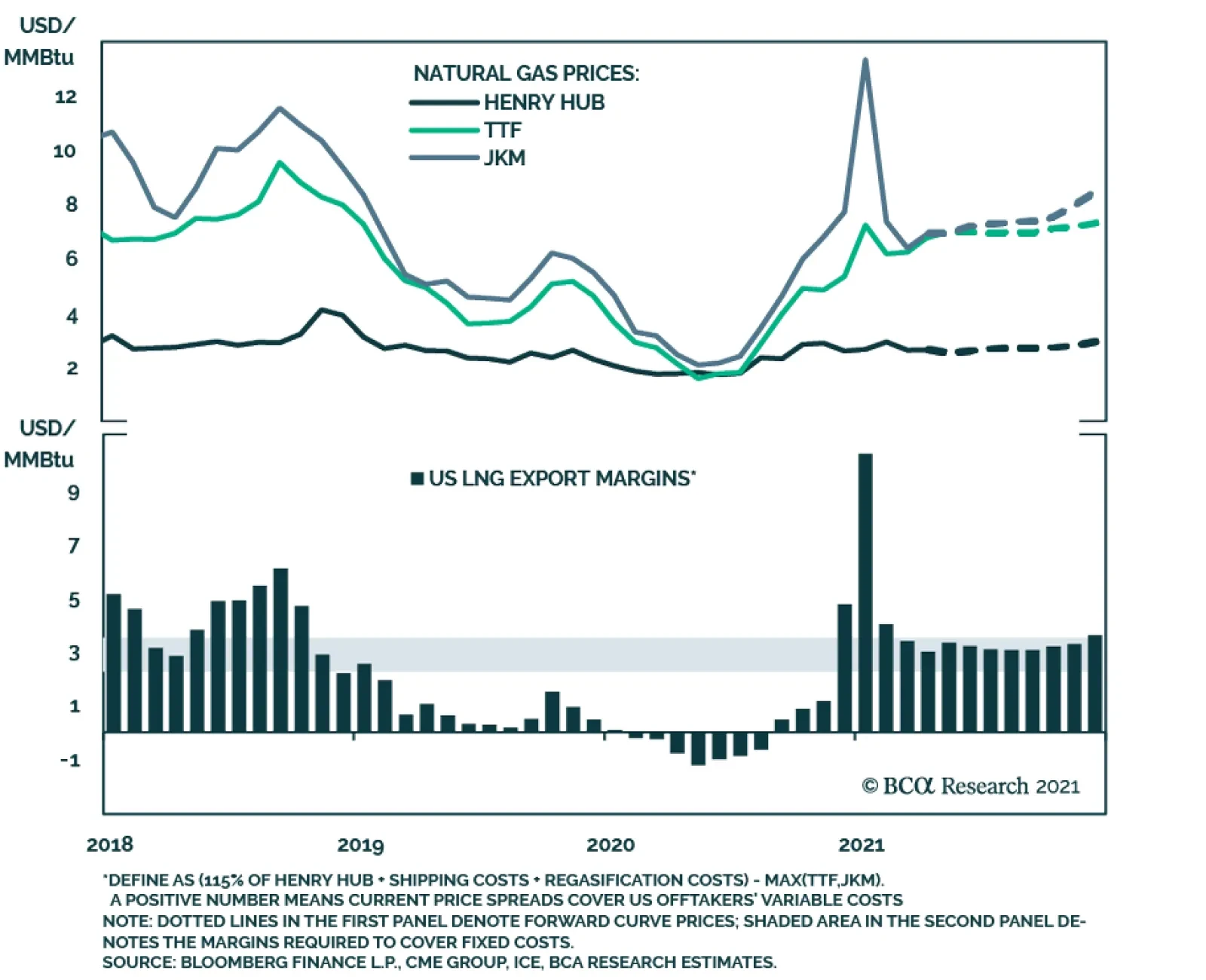

BCA Research's Commodity & Energy Strategy & Geopolitical Strategy services conclude that global natural gas markets have limited upside but suffer significant downside risk. The comeback of US Liquefied Natural…

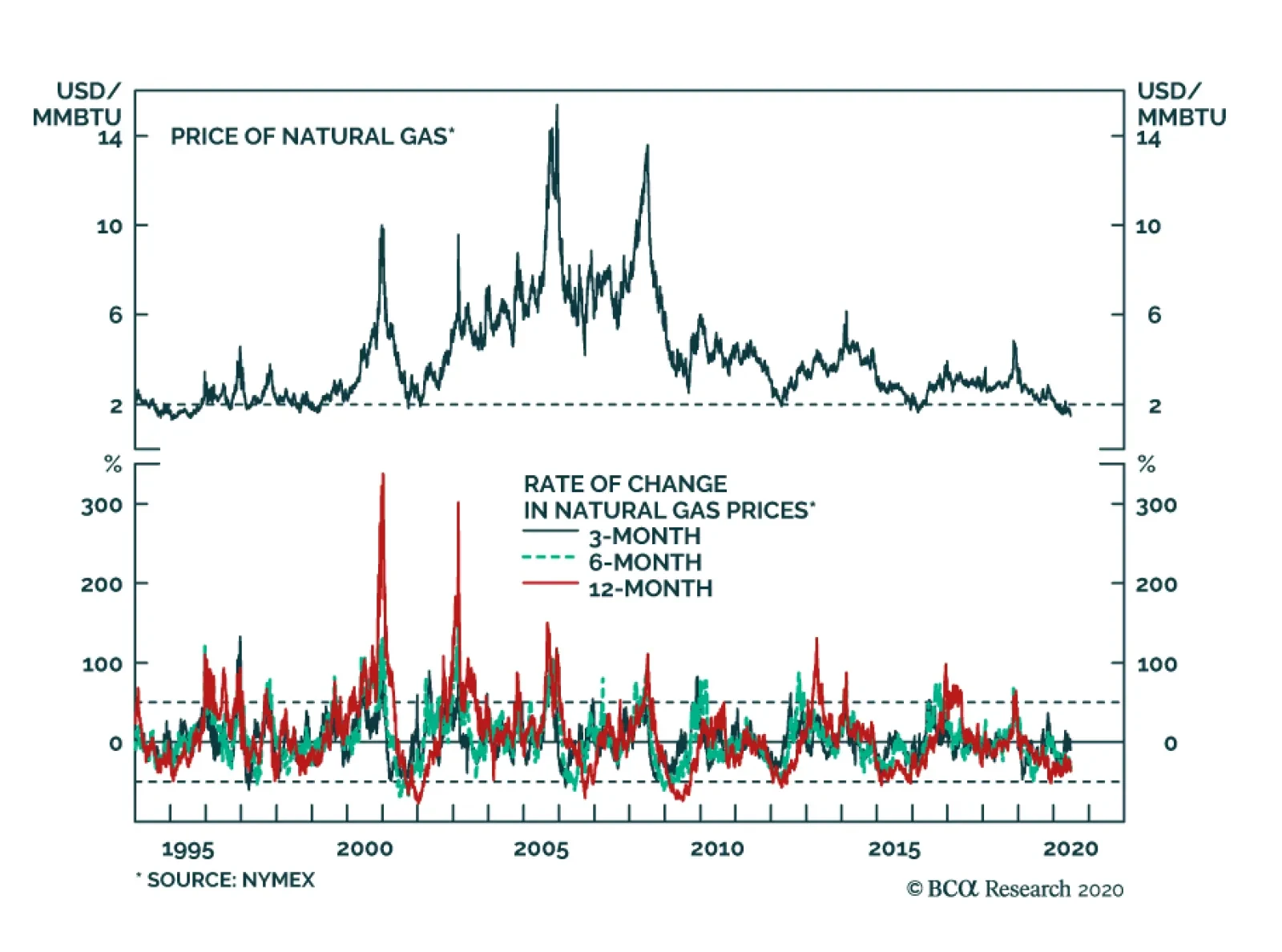

Natural gas loves volatility, but disciplined investors can still unearth pockets of tremendous value. For one, every time prices have fallen 50% on an annual basis, accumulating some futures has proved profitable, sometimes to the…

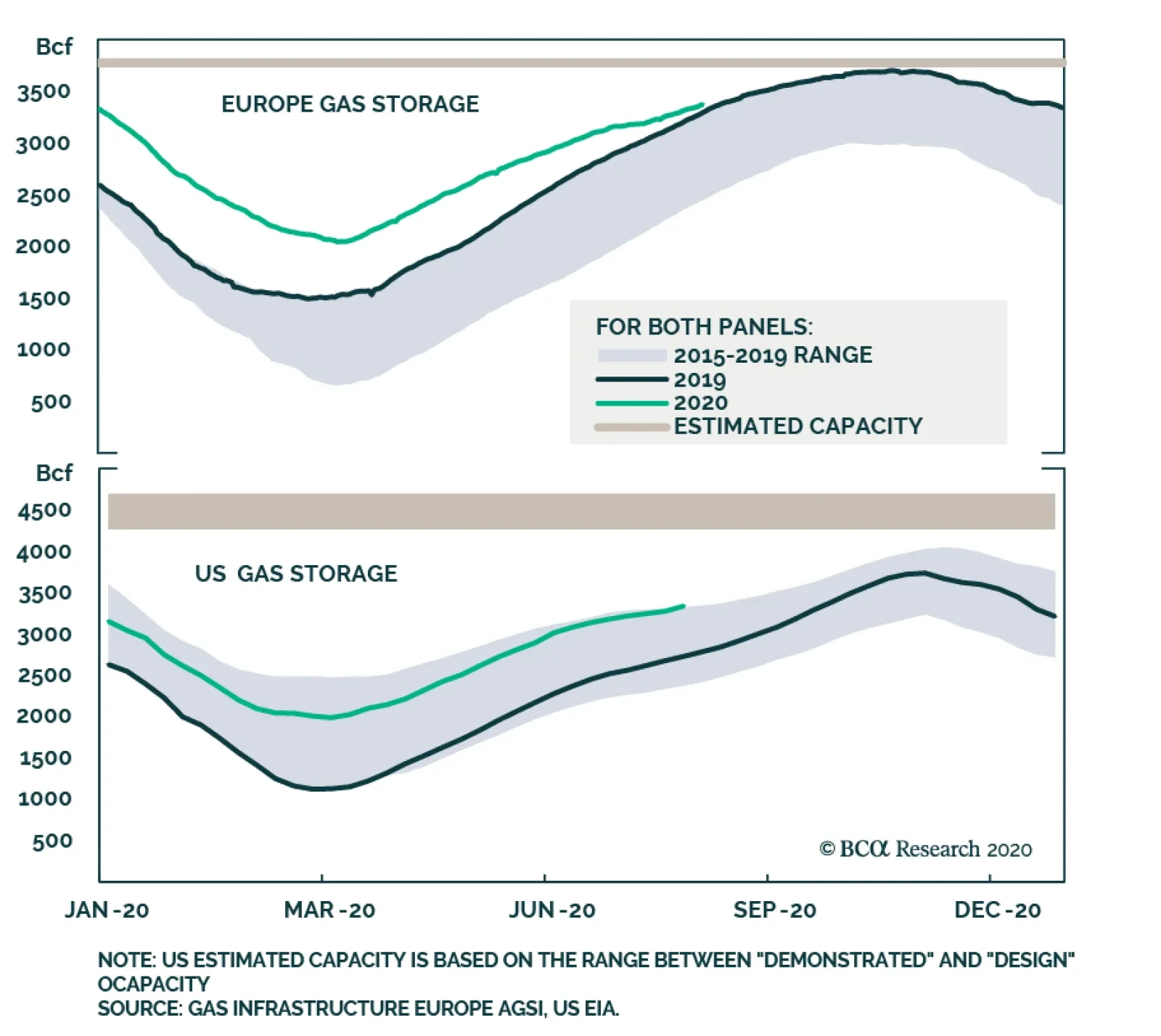

Highlights US dry gas production – the gas traded on futures exchanges and consumed by firms and households – is expected to fall ~ 2.5% this year to 89.7 bcf/d. Consumption will be down ~ 4% to 74.3 bcf/d. High…

BCA Research's Commodity & Energy Strategy service expects US natgas prices to recover slowly in 2H20 and pick up steam in 2021 as demand recovers and LNG export growth resumes. However, prices will not rally as much as…

Overweight S&P oil & gas exploration & production (E&P) stocks have closely tracked crude oil prices, but recently a wide gap has opened and we reckon that it will likely narrow via a catch up phase in the…