Markets are rallying on Fed rate cuts and China stimulus but there will also be October surprises ahead of the US election, which Trump could still win. Russia’s conflict with the West is escalating and the Middle East is…

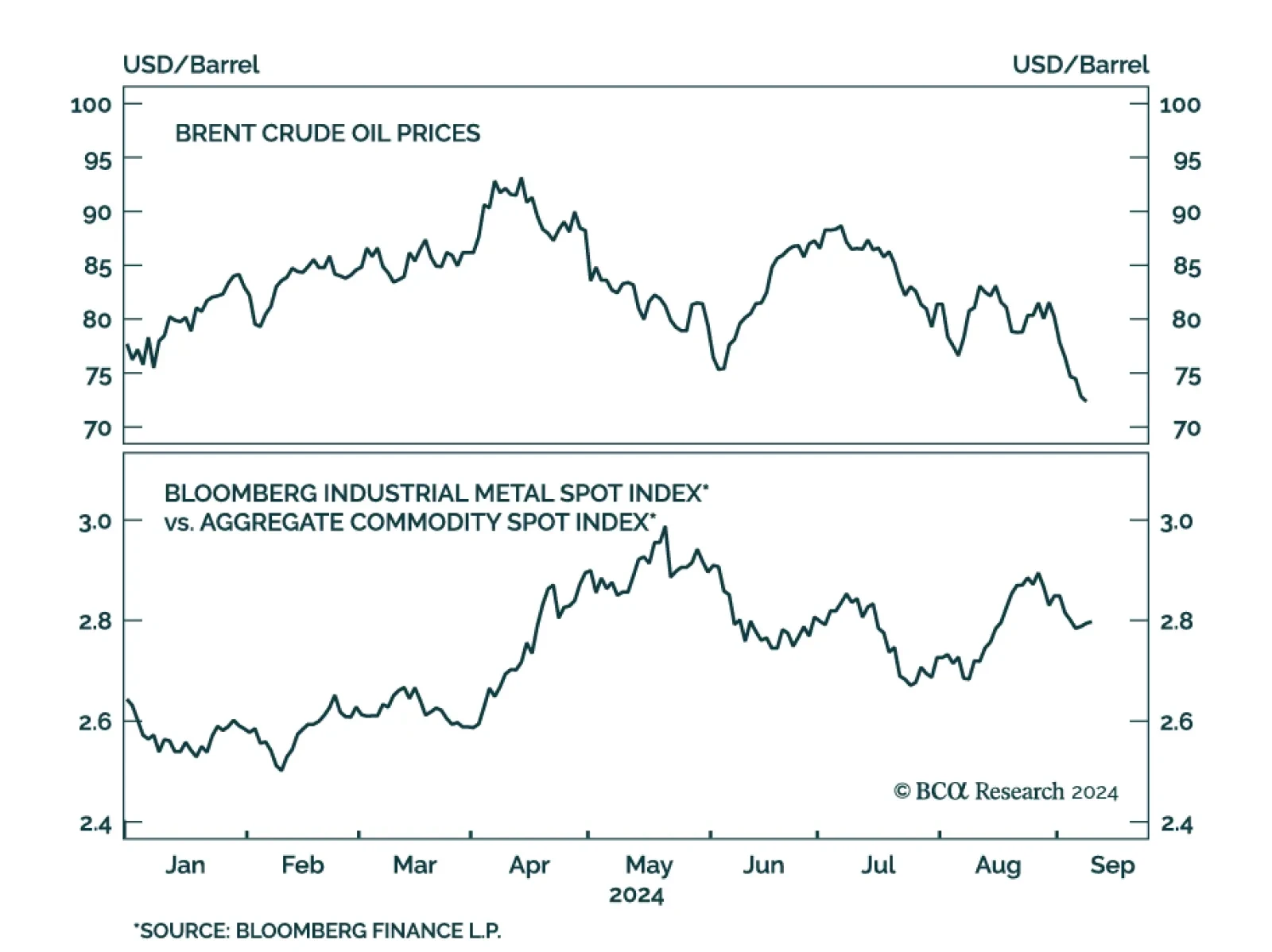

The decline in oil prices accelerated this month. Although Wednesday’s moves reversed Tuesday’s sharp daily declines, Brent and WTI have fallen 11% and 10% so far in September, and 30% and 33% from their April peaks…

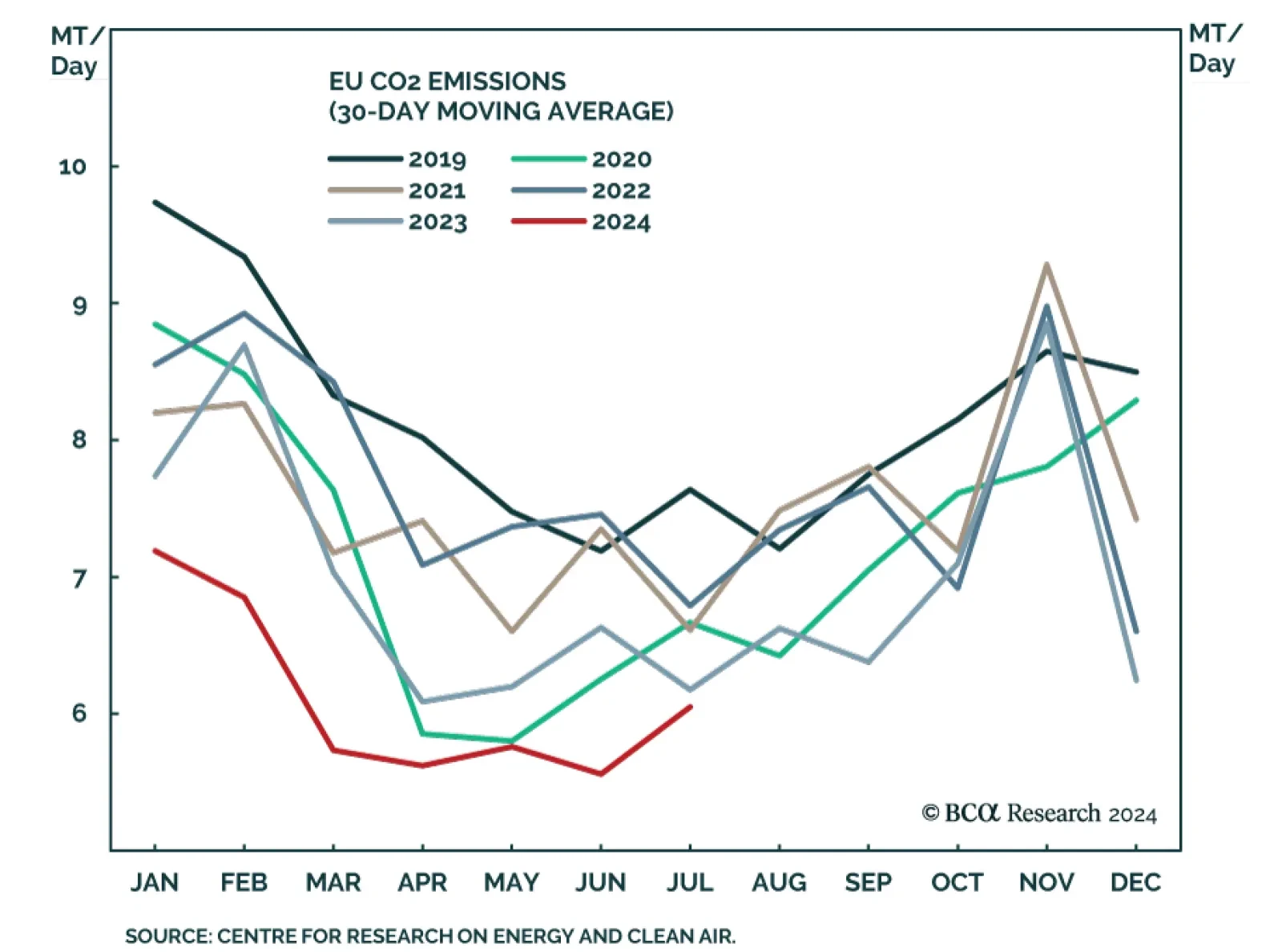

European regulatory carbon credits (EUAs) are becoming increasingly investable as an asset class. In a Special Report published last September, our Global Investment strategists agreed to the strategic bull case for EUAs, but…

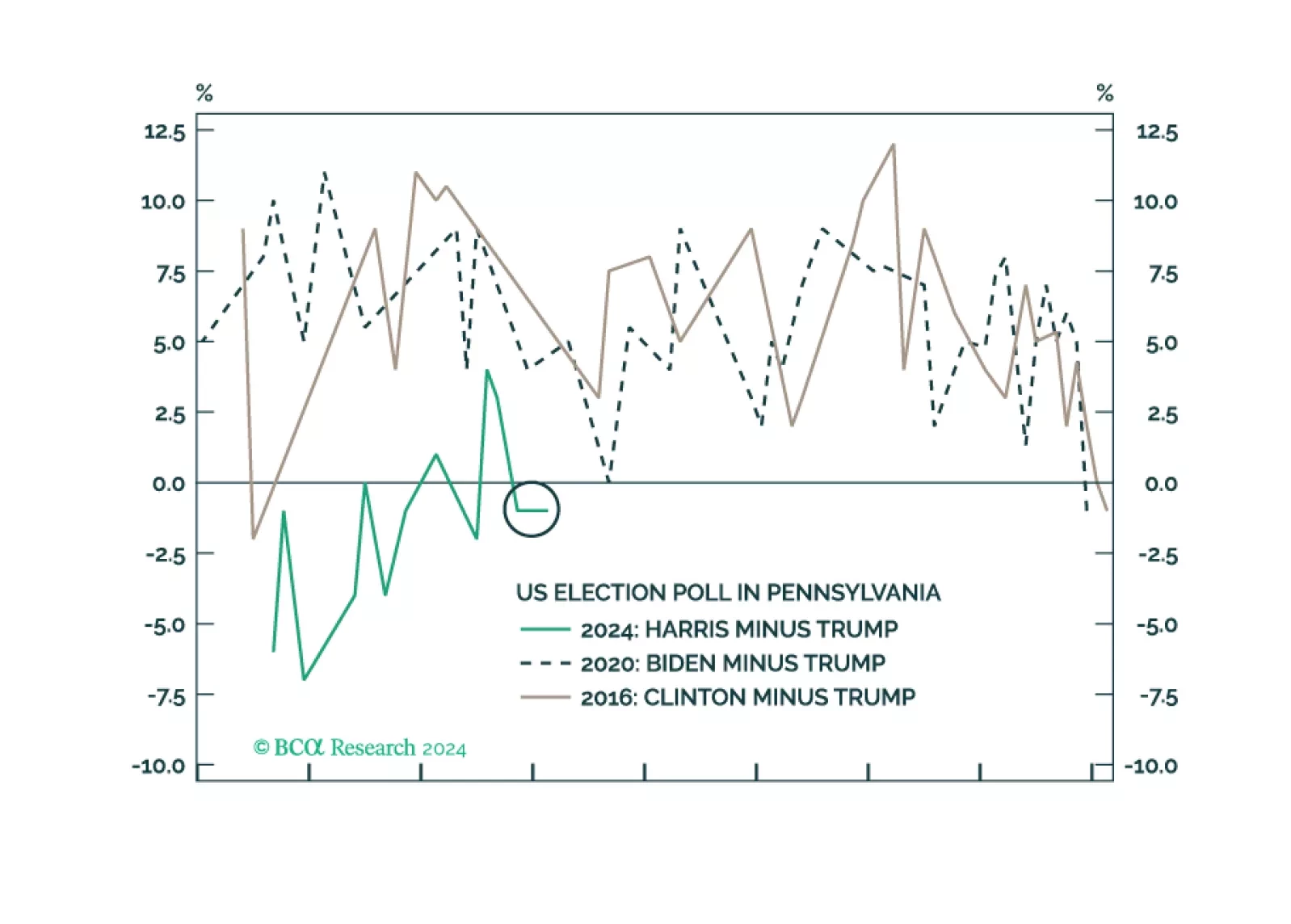

Investors should buy protection against further volatility. The shakeup in early August was a taste of things to come. The US election is a pivotal moment in modern history that will drive up uncertainty, while other countries take…

Investors should overweight US assets and de-risk their portfolios in anticipation of a major increase in policy uncertainty and geopolitical risk surrounding the US election and its global ramifications.

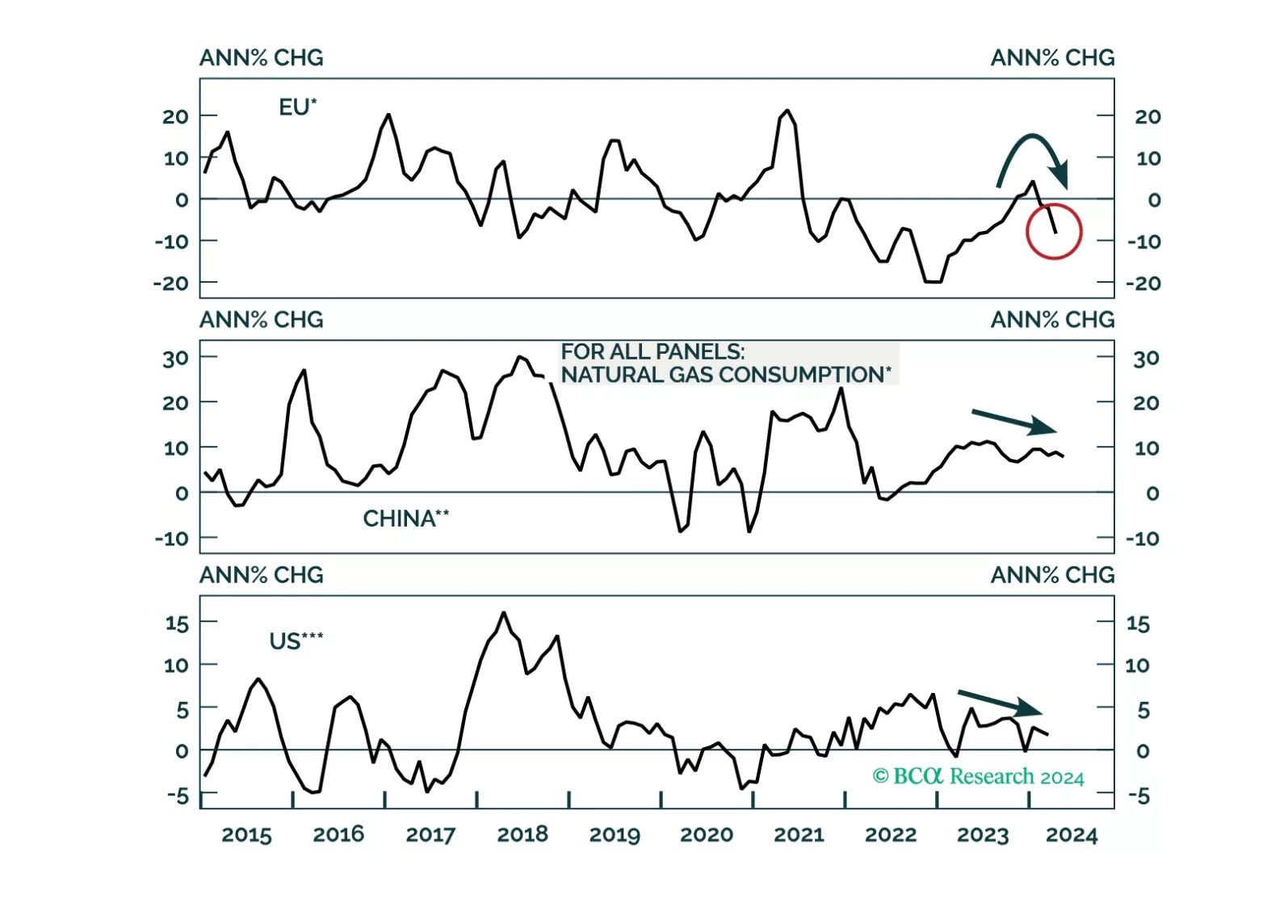

A global economic downturn will be a headwind for natgas prices over the cyclical horizon. Thereafter, LNG capacity additions will help keep the market in balance into the end of the decade. That said, Europe’s increased dependence…

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

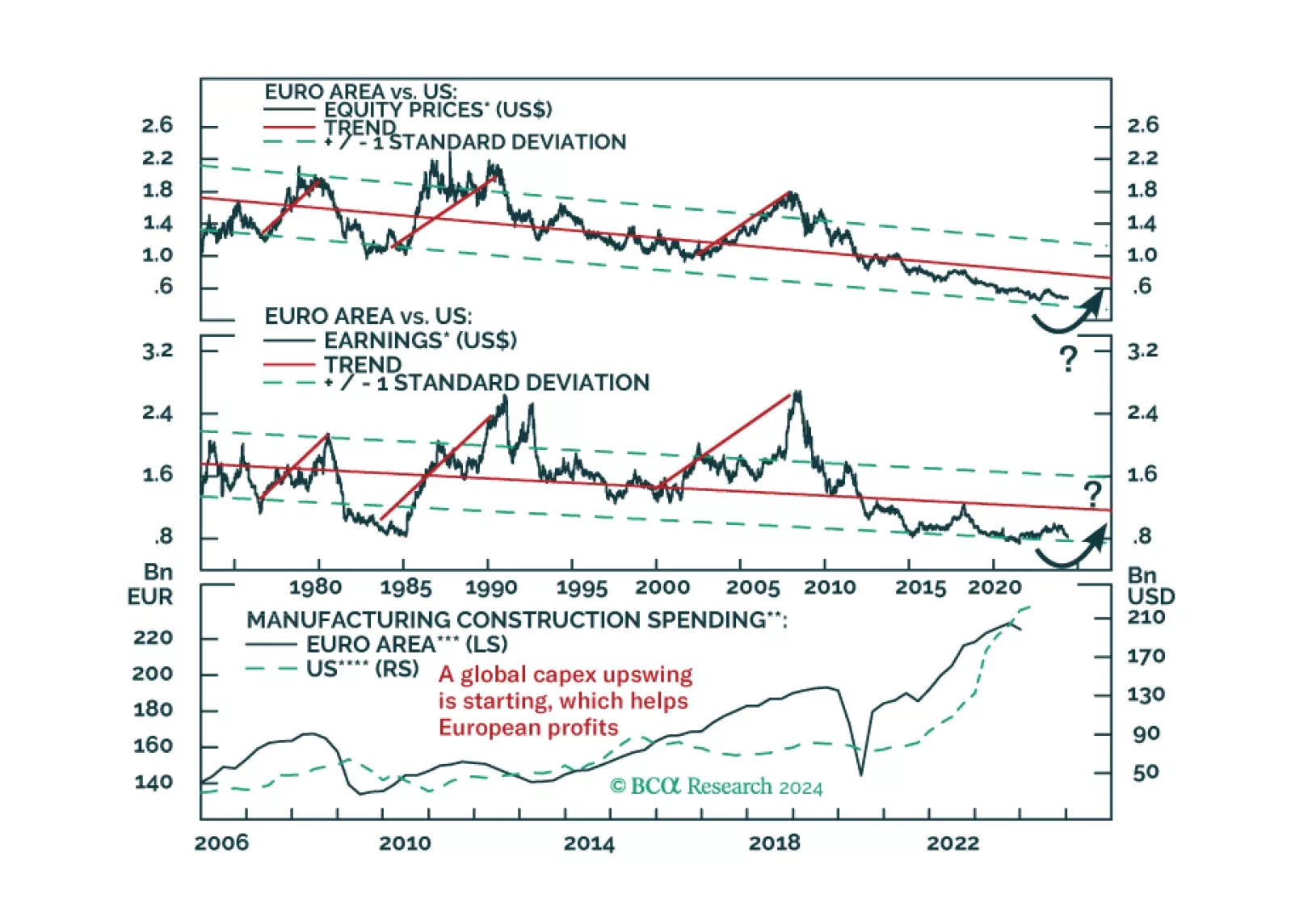

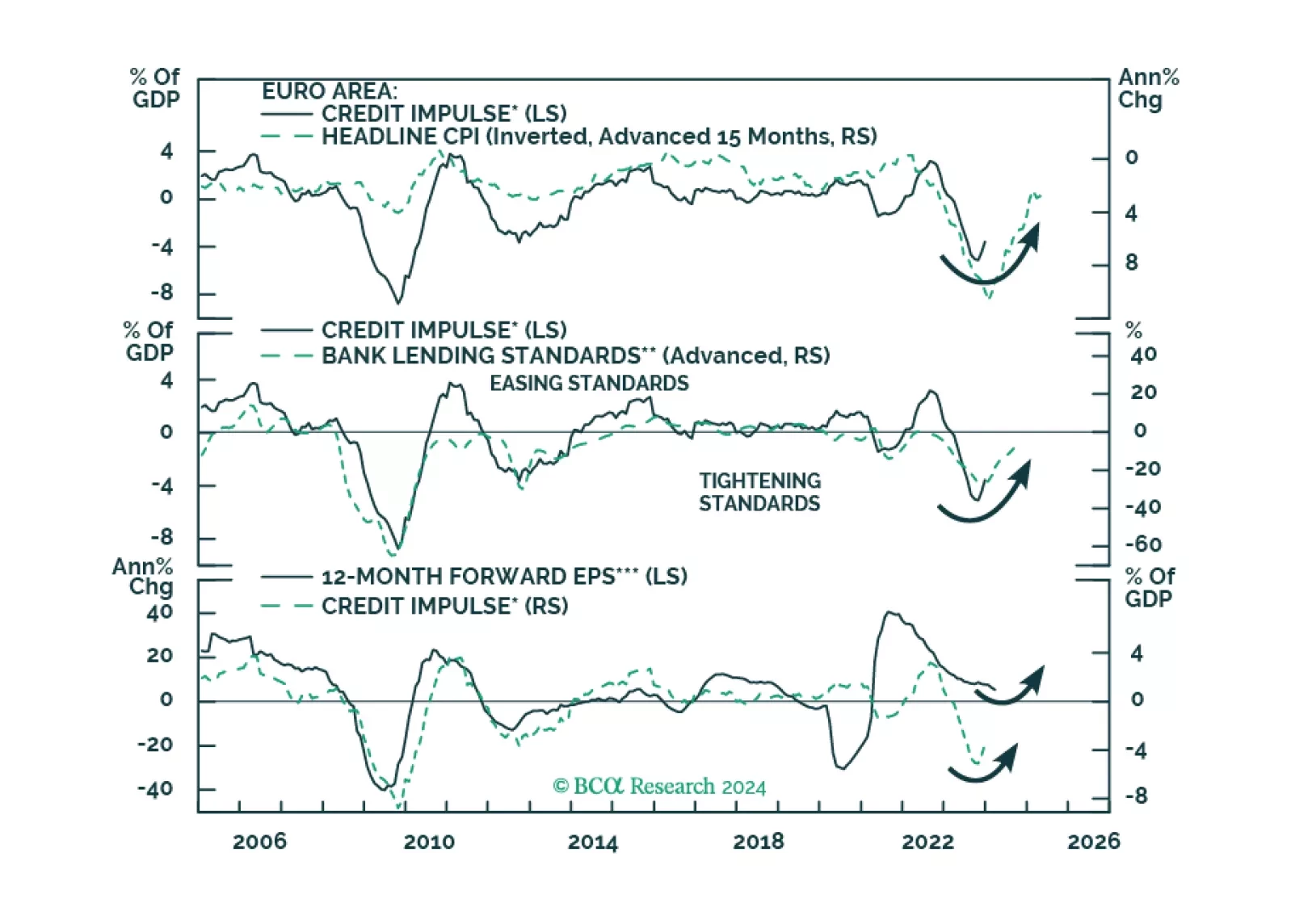

Europe credit flows are stabilizing, hence a major drag on the region’s growth will dissipate. What does this development imply for European equities?