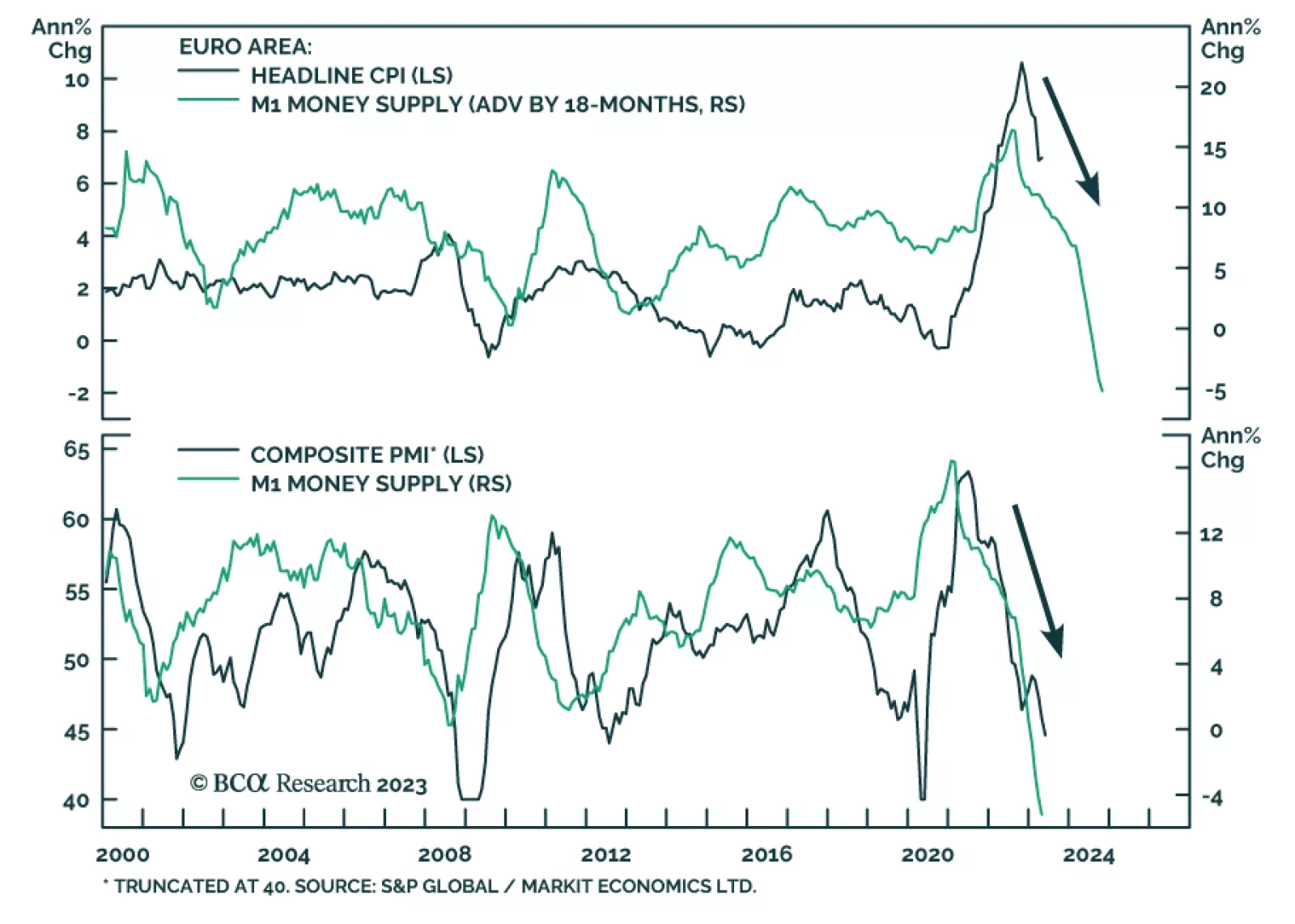

The latest Eurozone data releases show the impact of the ECB’s aggressive monetary tightening cycle. The contraction in M1 money supply – which includes currency in circulation and overnight deposits –…

Global growth will weaken in the coming months, yet monetary authorities worldwide will be reluctant to ease policy. This state of affairs foreshadows a clash between markets and policymakers in the months ahead. China’s recovery is…

Indian EPS growth is set for major disappointments vis-à-vis the lofty expectations. Weak domestic demand amid tight fiscal and monetary policy entails more downside in stock prices. Stay underweight.

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.

In this week’s report, we look at the current de-dollarization discussion within the context of the USD’s near-term cyclical outlook, and whether it warrants a bullish or bearish stance.

Eventually South Africa will do its macro rebalancing the least painful way: via adjustments in nominal variables such as prices and currency, rather than in real variables such as jobs and incomes. That entails a much weaker rand in…

In Section I, we discuss the implications of the banking crisis that emerged in March. We do not expect what happened in the US or Europe to morph into a full-blown meltdown of the financial system, but this month’s events will…

The Fed lifted rates 25 bps yesterday while also signaling that the tightening cycle is near its peak. We discuss the short-run and long-run implications for Treasury yields.

Have global equity markets reached a riot point? Is the Fed going on hold a sufficient condition for stocks to stage a cyclical rally? If not, what would be needed to produce such a rally? Does the Fed’s recent balance sheet…

This week’s report looks at the banking crisis within the context of shrinking dollar liquidity and implication for FX markets.