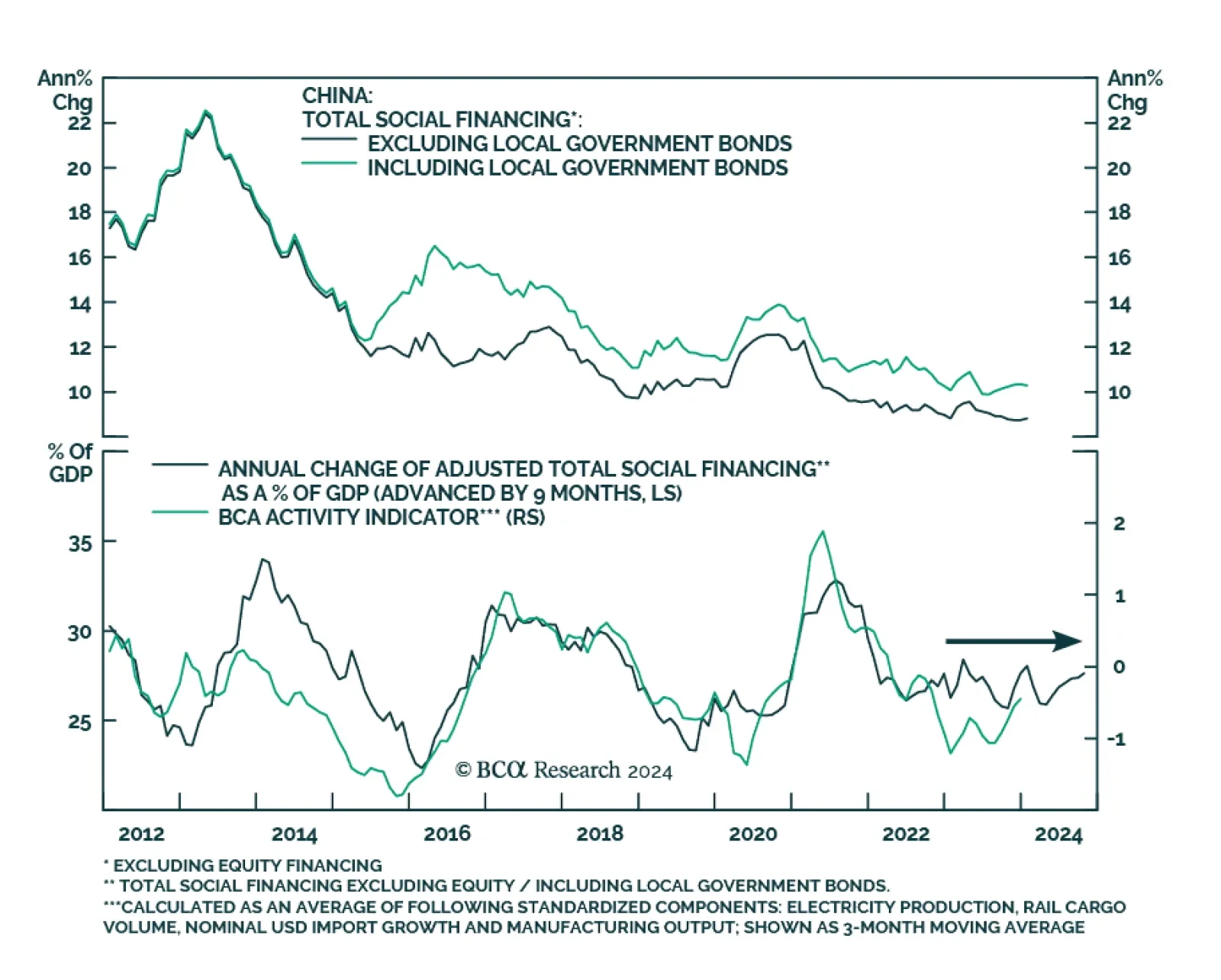

China’s credit data update for January delivered a mixed signal on Friday. The CNY 6.50 trillion increase in aggregate financing beat expectations of CNY 5.60 trillion and marked a significant acceleration from CNY 1.94…

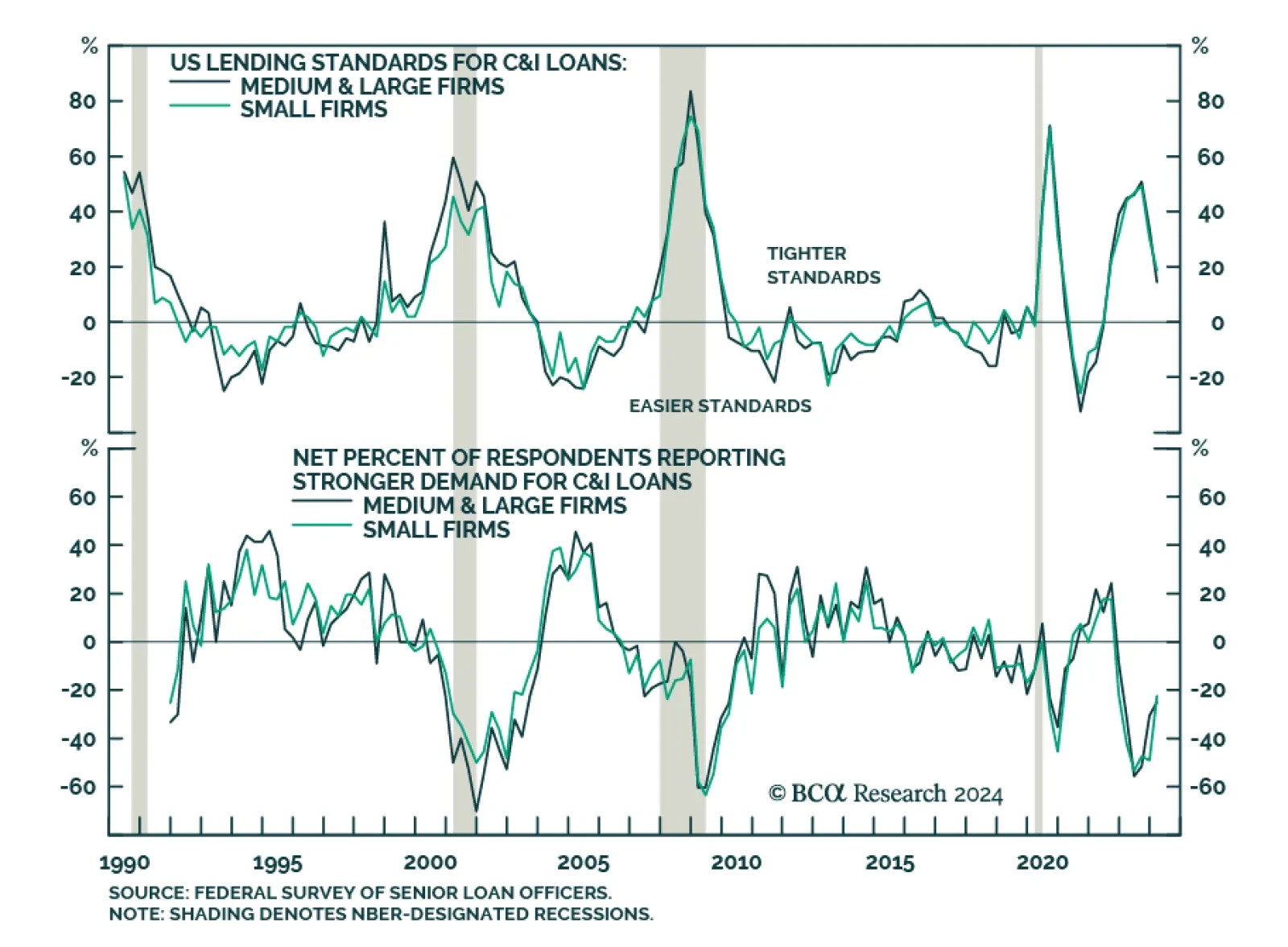

The US Federal Reserve Senior Loan Officer Opinion Survey (SLOOS) continues to show the impact of the Fed’s tightening cycle. Banks were still tightening lending standards for commercial and industrial (C&I),…

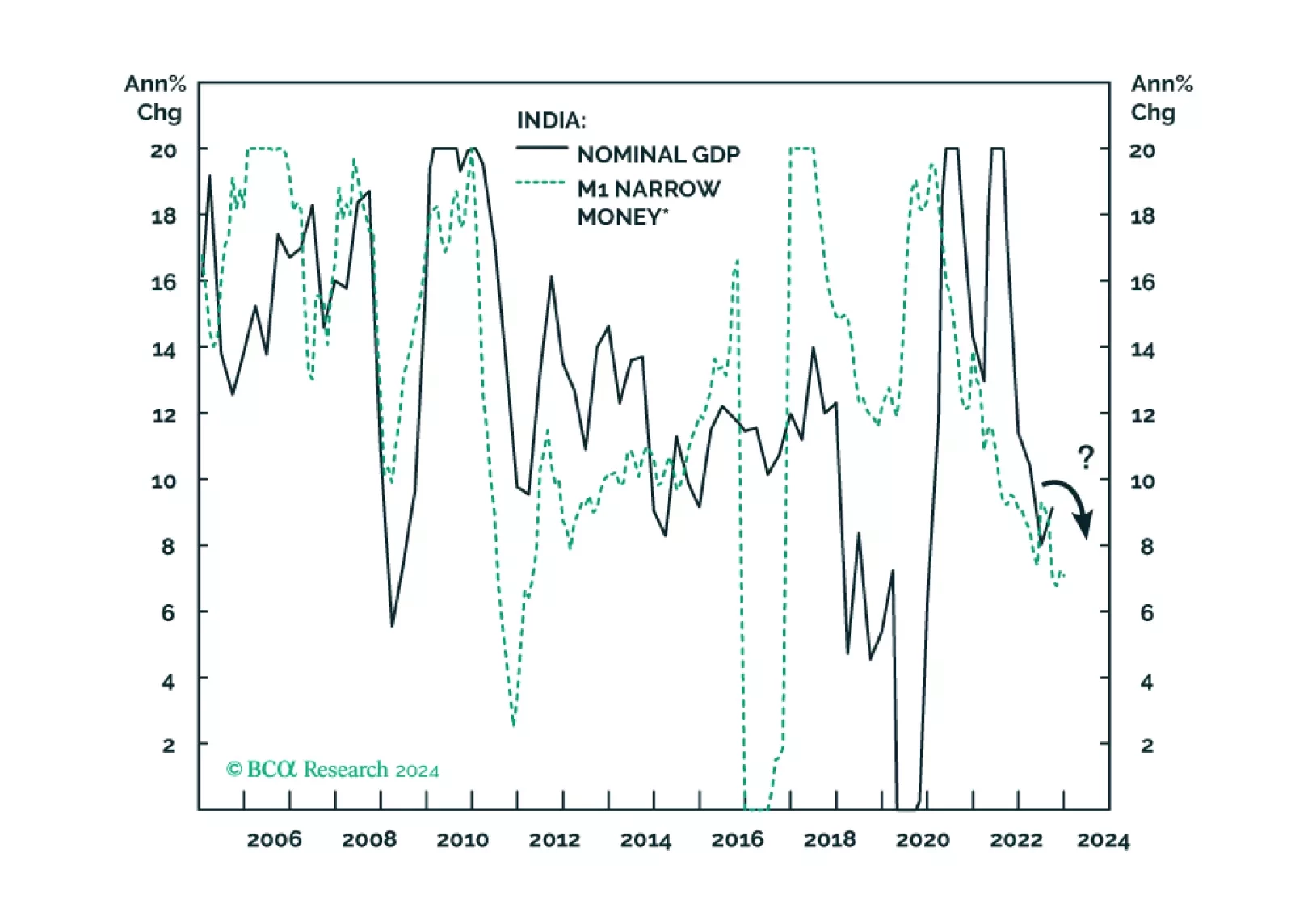

Decelerating nominal sales, a peaking credit cycle, and very high valuations - Indian stocks will not escape the carnage when risk assets globally begin to sell off.

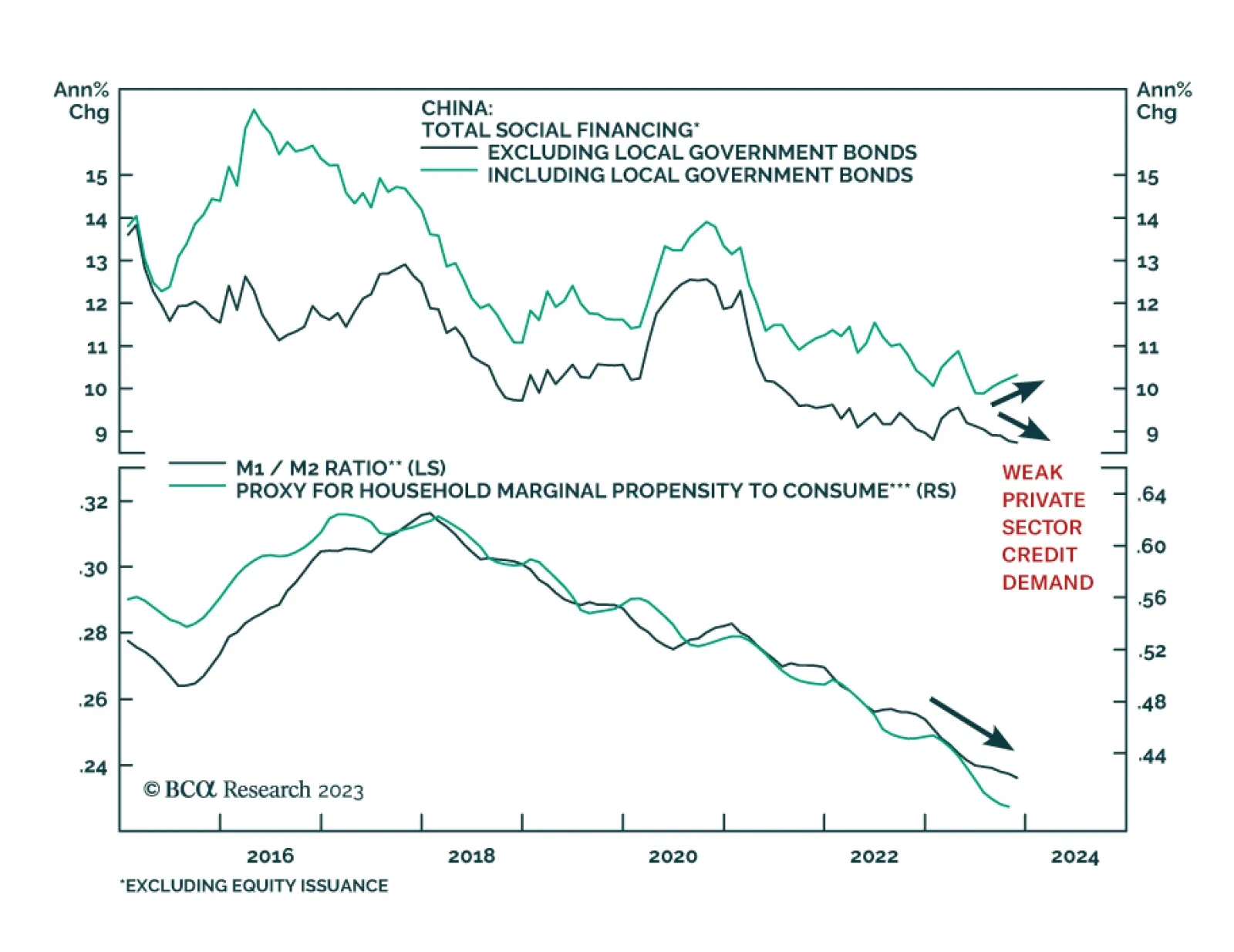

China’s credit expanded by less than expected in November. The CNY 2.45 trillion increase in aggregate financing fell short of anticipations of CNY 2.595 trillion following a CNY 1.845 trillion rise in October. Similarly,…

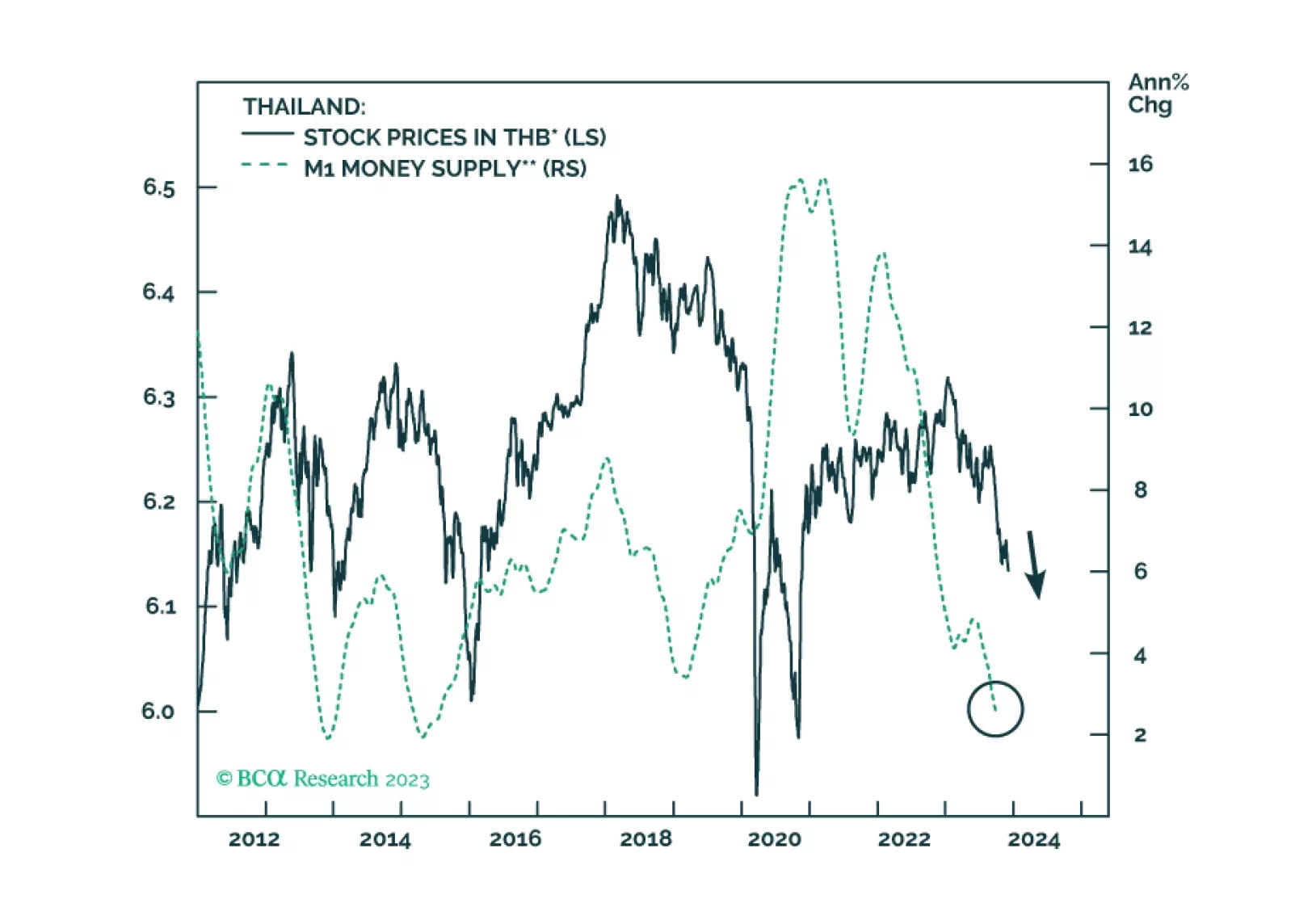

Meager credit growth and shrinking real wages will keep Thai inflation very low in the coming months. The currency will get support from an improving current account surplus. Fixed-income investors should upgrade Thailand from…

Today, we are sending you the BCA annual outlook for 2024. The report is an edited transcript of our recent conversation with Mr. X and his daughter, Ms. X, who are long-time BCA clients with whom we discuss the economic and…

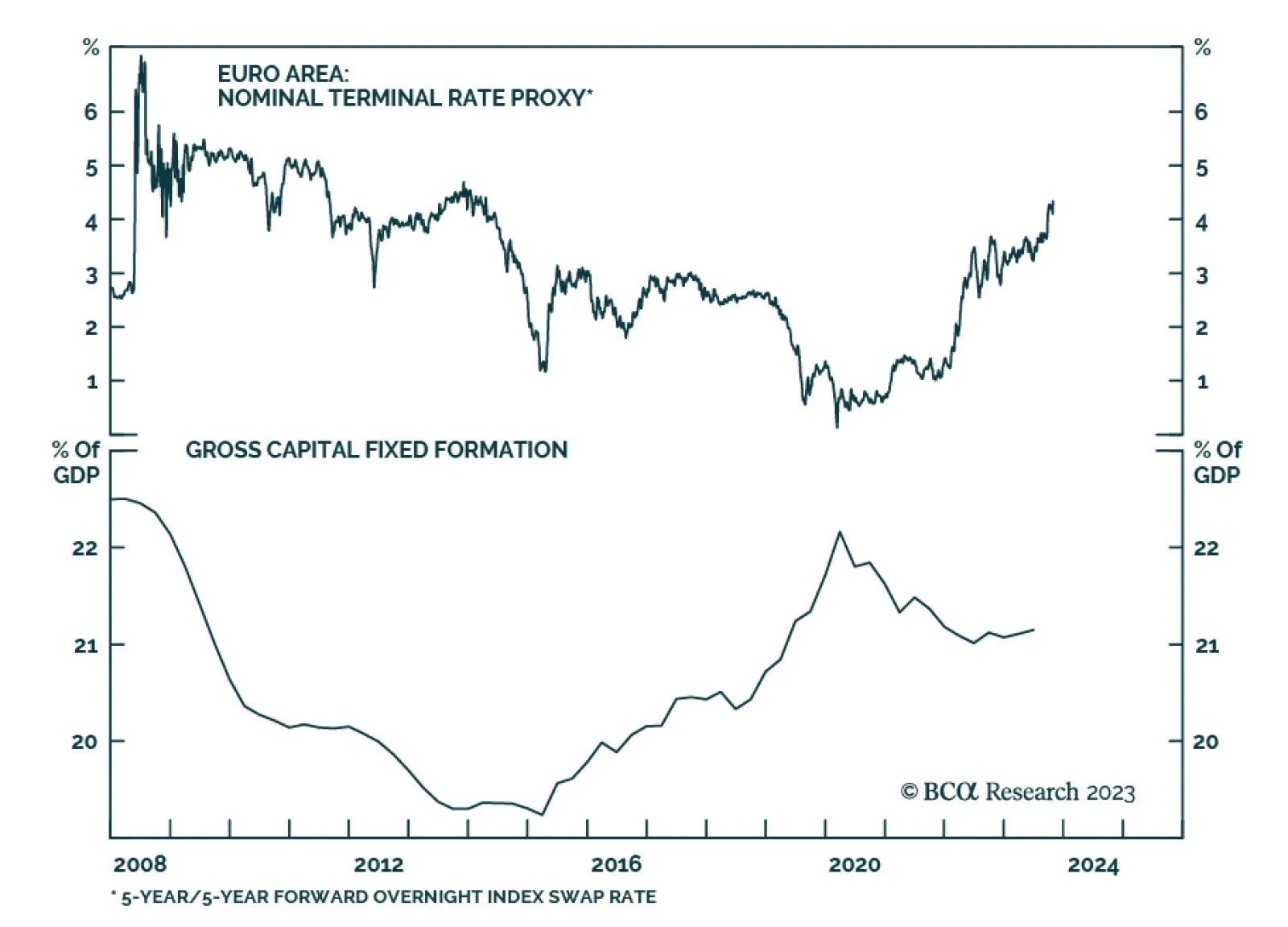

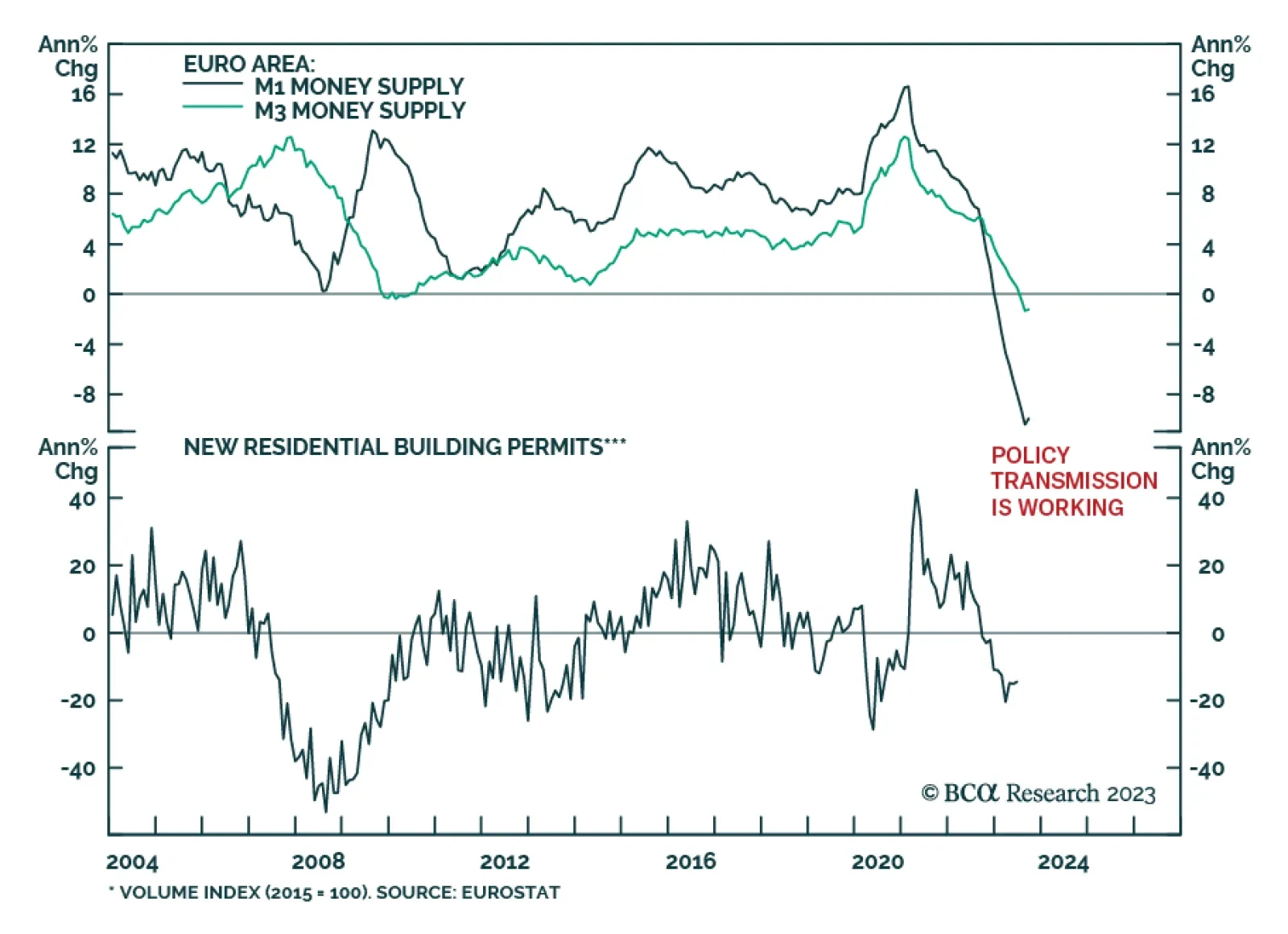

The European money market curve anticipates three rate cuts by October 2024. This pricing is appropriate considering the outlook for European growth next year. BCA’s Europe strategist expect a recession in the second half…

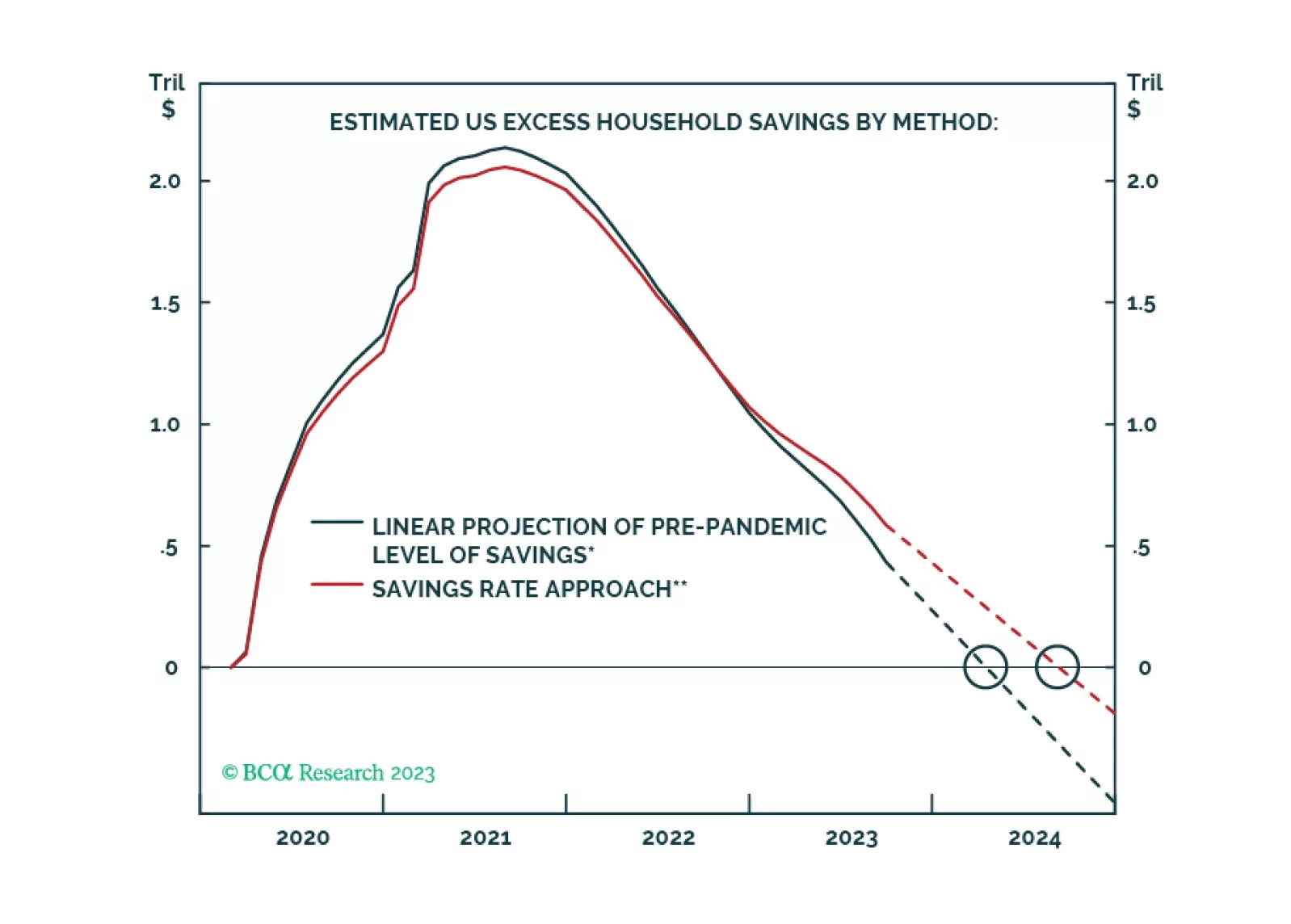

The Fed’s latest triennial Survey of Consumer Finances (SCF), spanning the period from 2019 to 2022, was released on October 18th. It augments the Distributional Financial Accounts' (DFA) depiction of the distribution…

As expected, the ECB kept policy on hold on Thursday. In a unanimous decision, it maintained the deposit rate at an all-time high of 4% following 10 consecutive increases. Ultimately, the tone of the communication was on the…