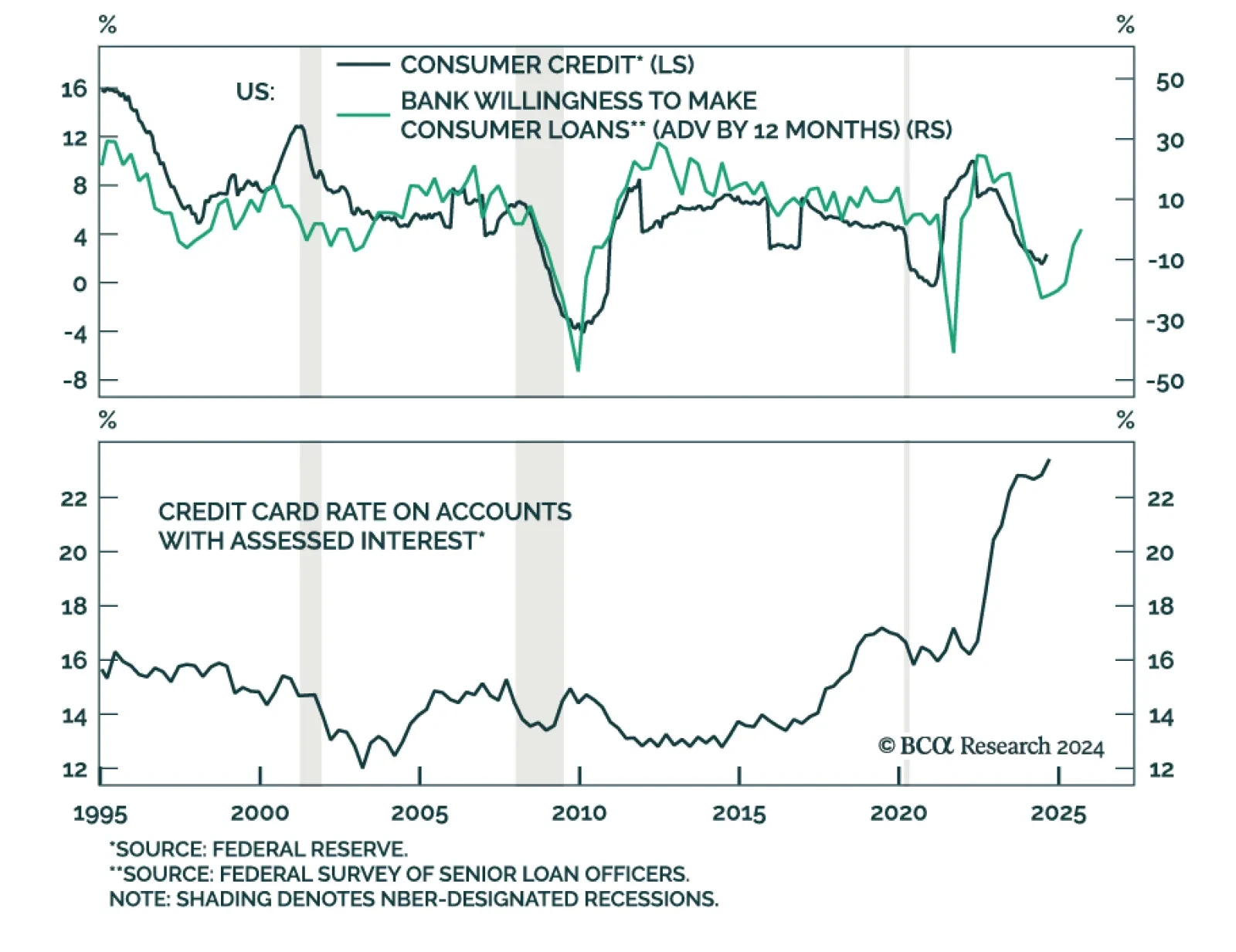

Consumer credit growth slowed in August, rising by USD 8.9 bn (to USD 5,097.6 bn outstanding) from USD 26.6 bn, disappointing expectations of a USD 12 bn monthly increase. Notably, revolving credit (which includes credit cards)…

The US election underscores three long-term trends of Generational Change, Peak Polarization, and Limited Big Government. Investors should expect more volatility around the election and should assess the results before adding more…

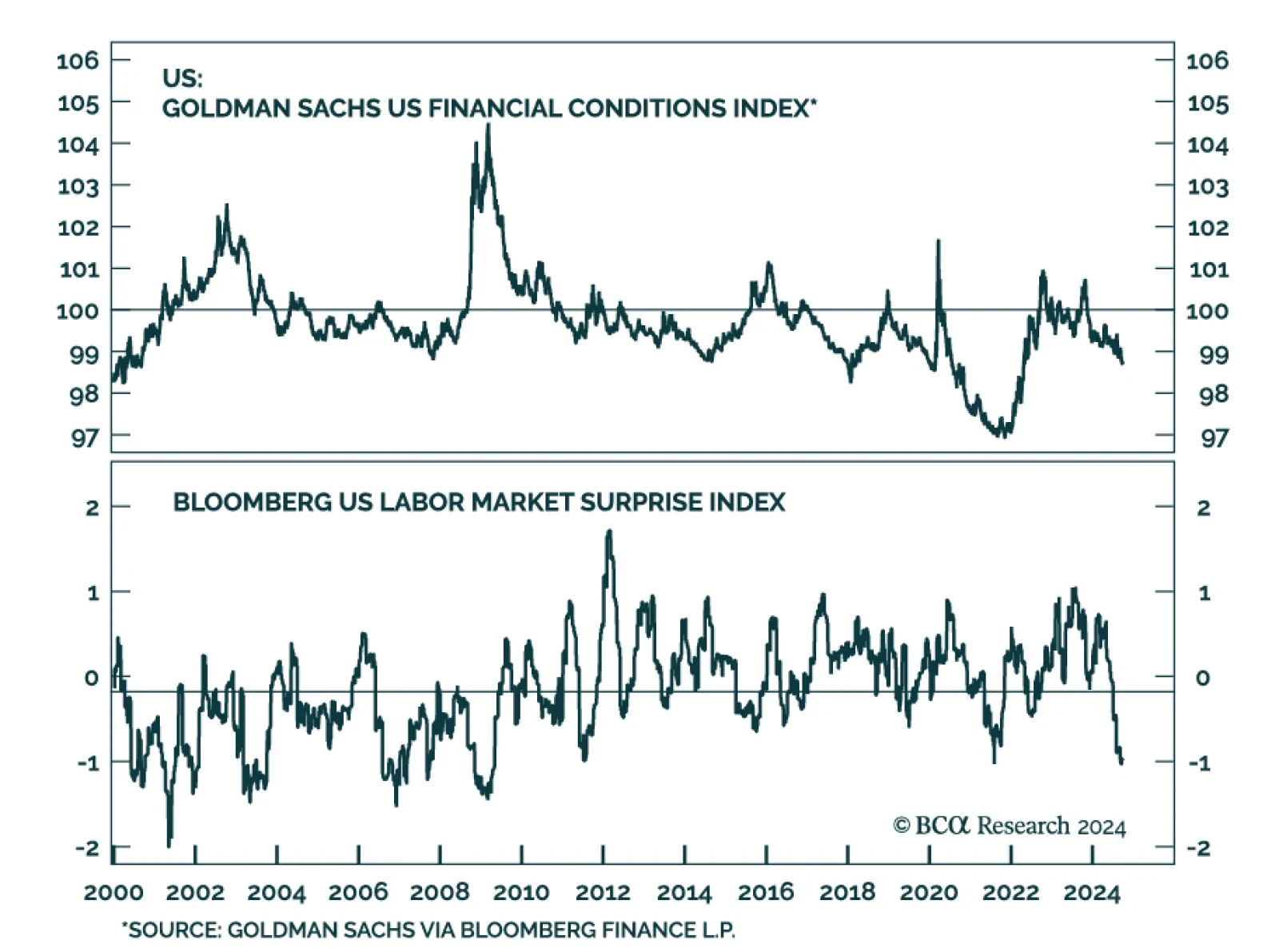

US financial conditions have become noticeably easier since August. The Fed has embarked on its easing cycle with a bang, sending equities higher and spreads lower, while the trade-weighted dollar gave back more than half of its…

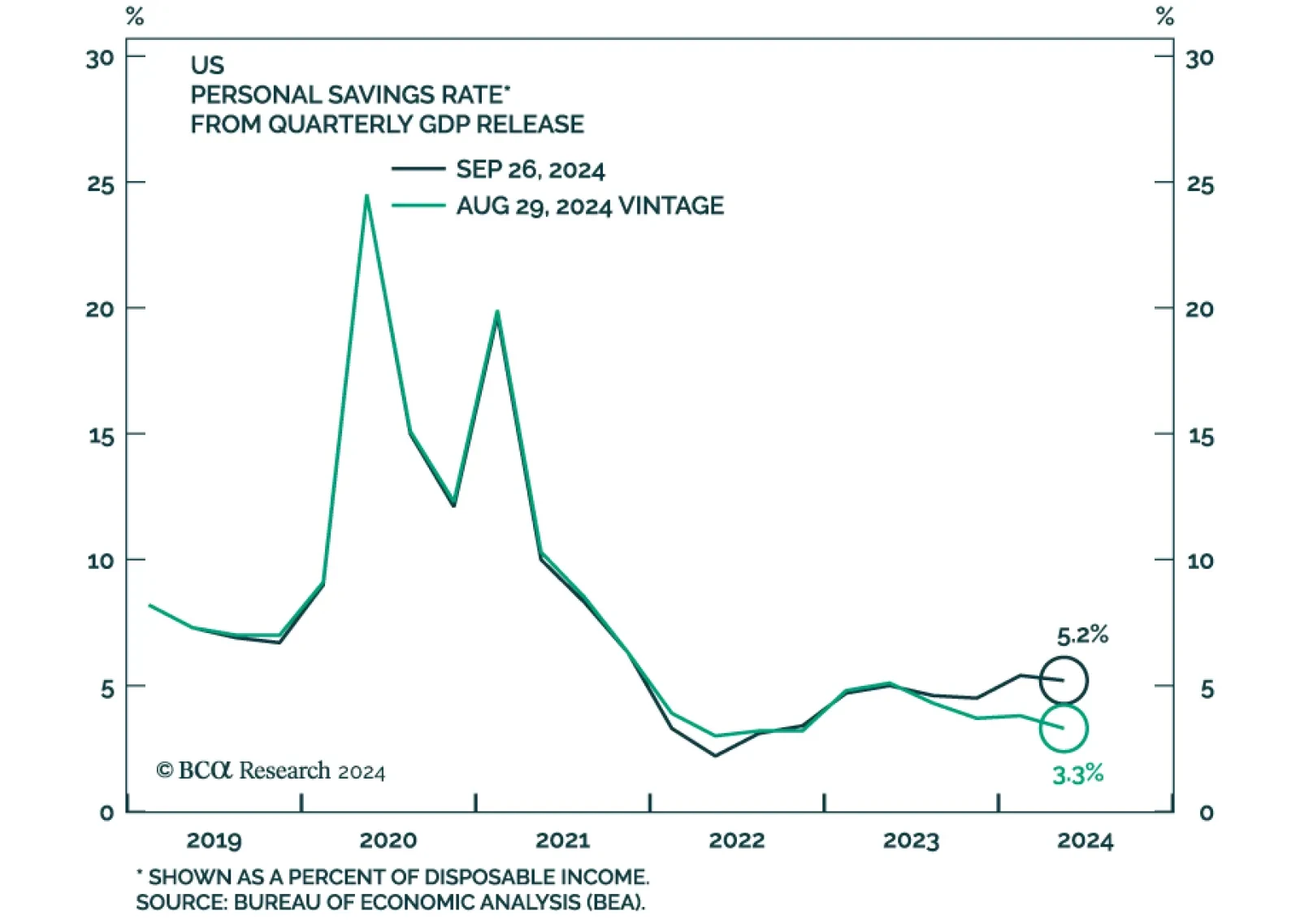

Annual BEA data revisions resulted in a significant upward revision in GDP growth since Q2 2020, led by stronger consumption growth and more robust real disposable income growth than previously believed. Revisions also show…

Markets are rallying on Fed rate cuts and China stimulus but there will also be October surprises ahead of the US election, which Trump could still win. Russia’s conflict with the West is escalating and the Middle East is…

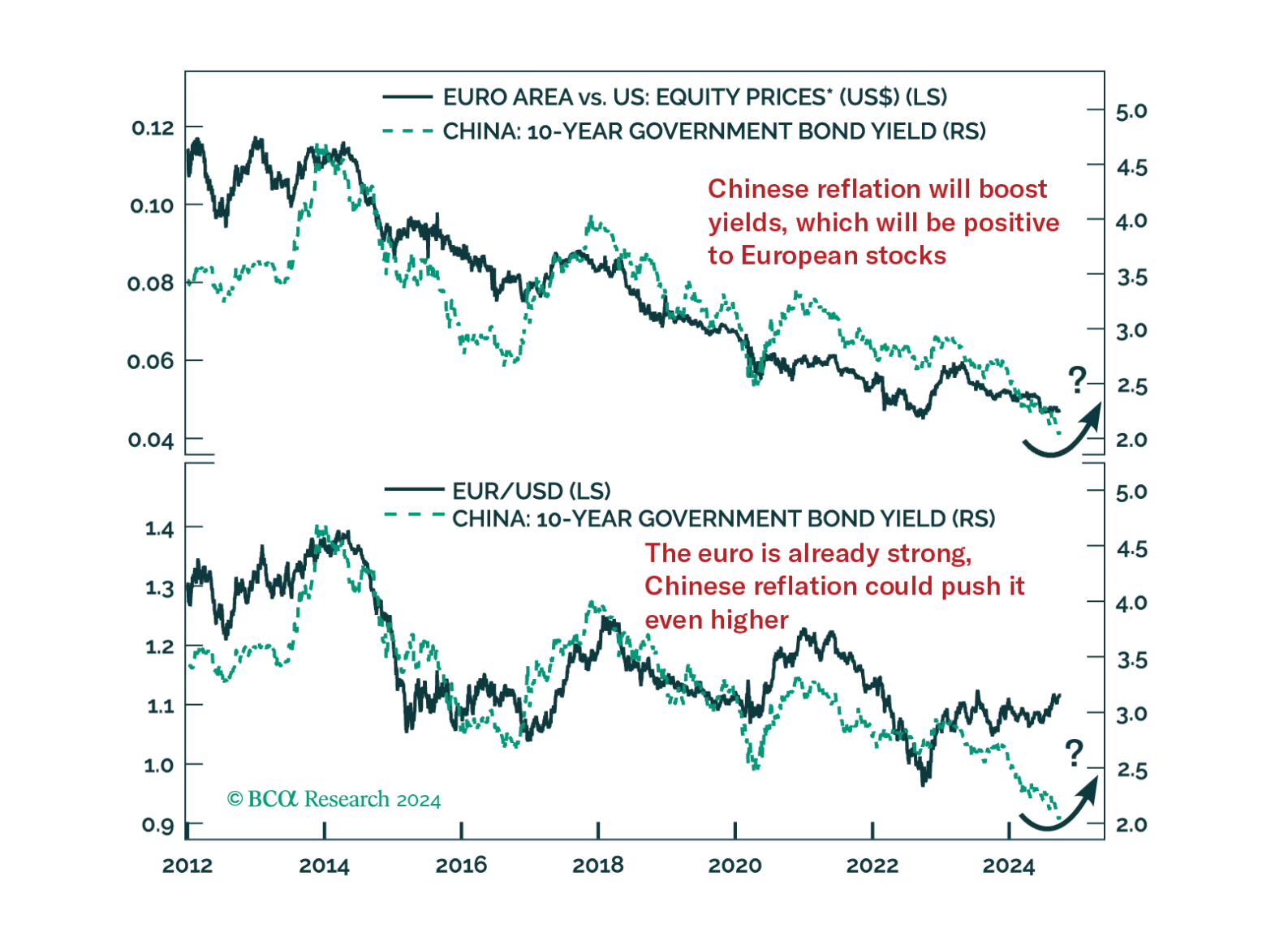

China’s Politburo announcement is likely to lead to a repricing of China’s growth in the near-term. Read how investors can hedge against this potent threat to our defensive investment stance.

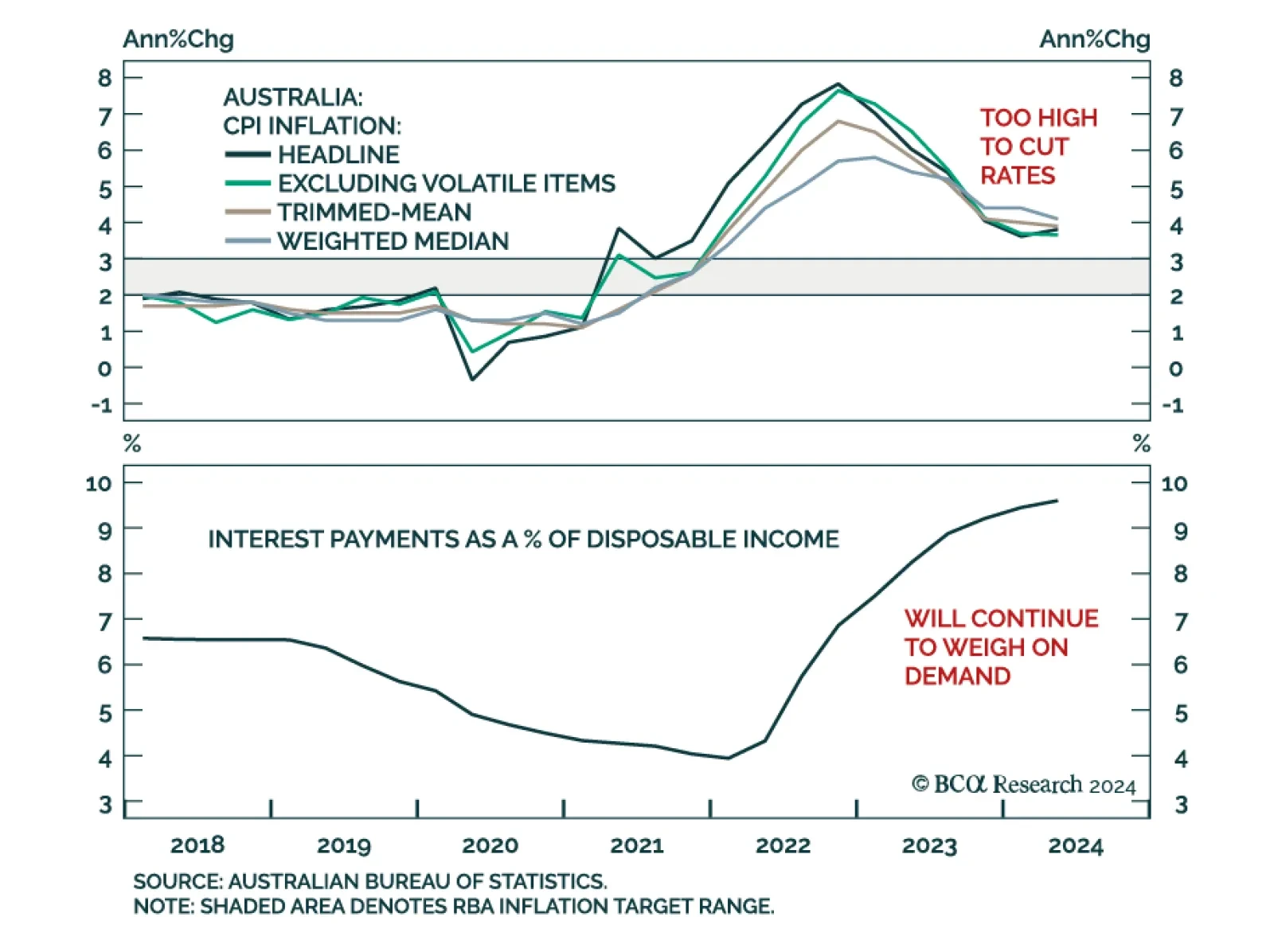

In a widely expected move, the Reserve Bank of Australia kept the cash rate unchanged at 4.35% in September. All measures of Australian CPI inflation remain well above the RBA target range. The Commonwealth Energy Bill Relief…

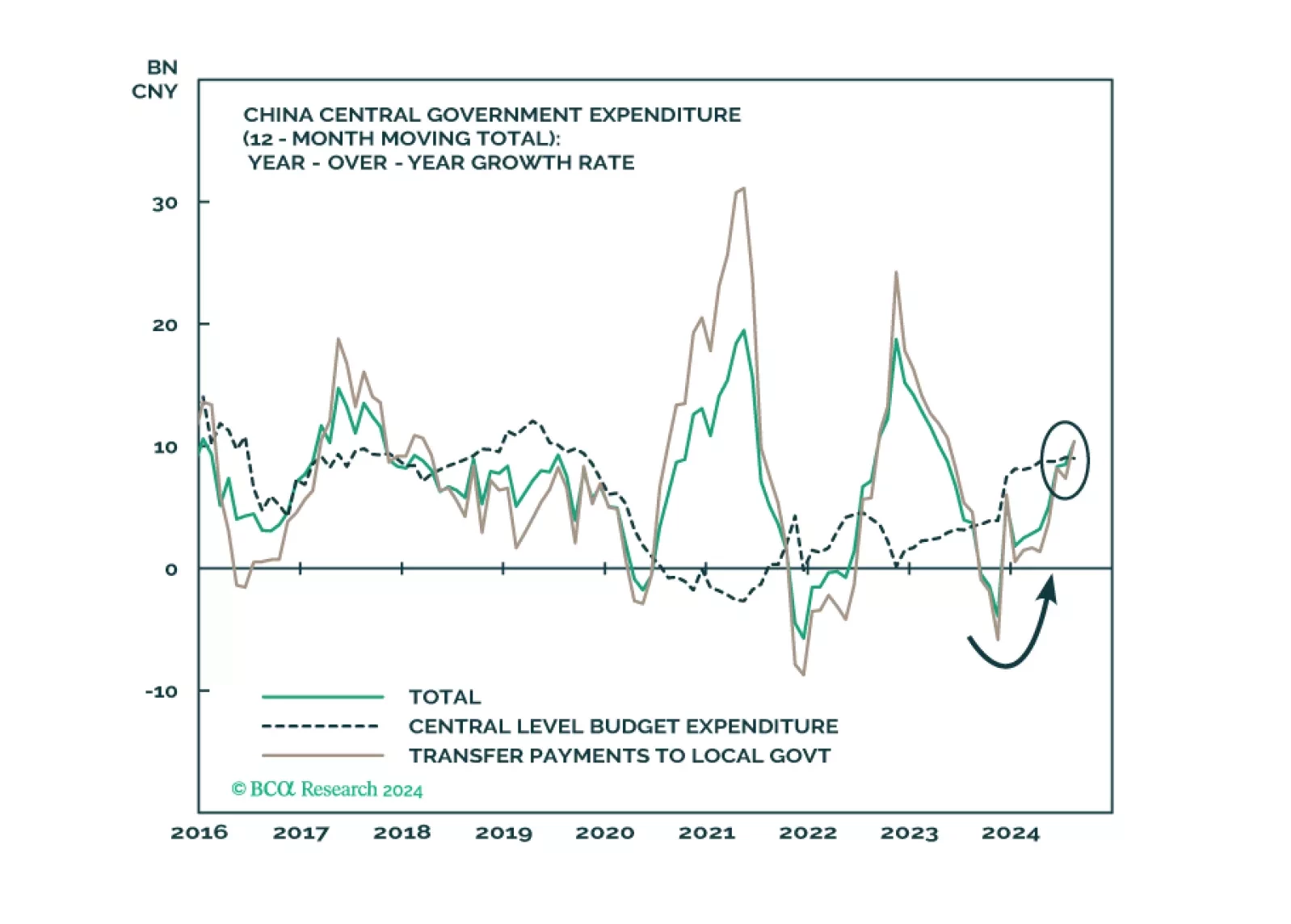

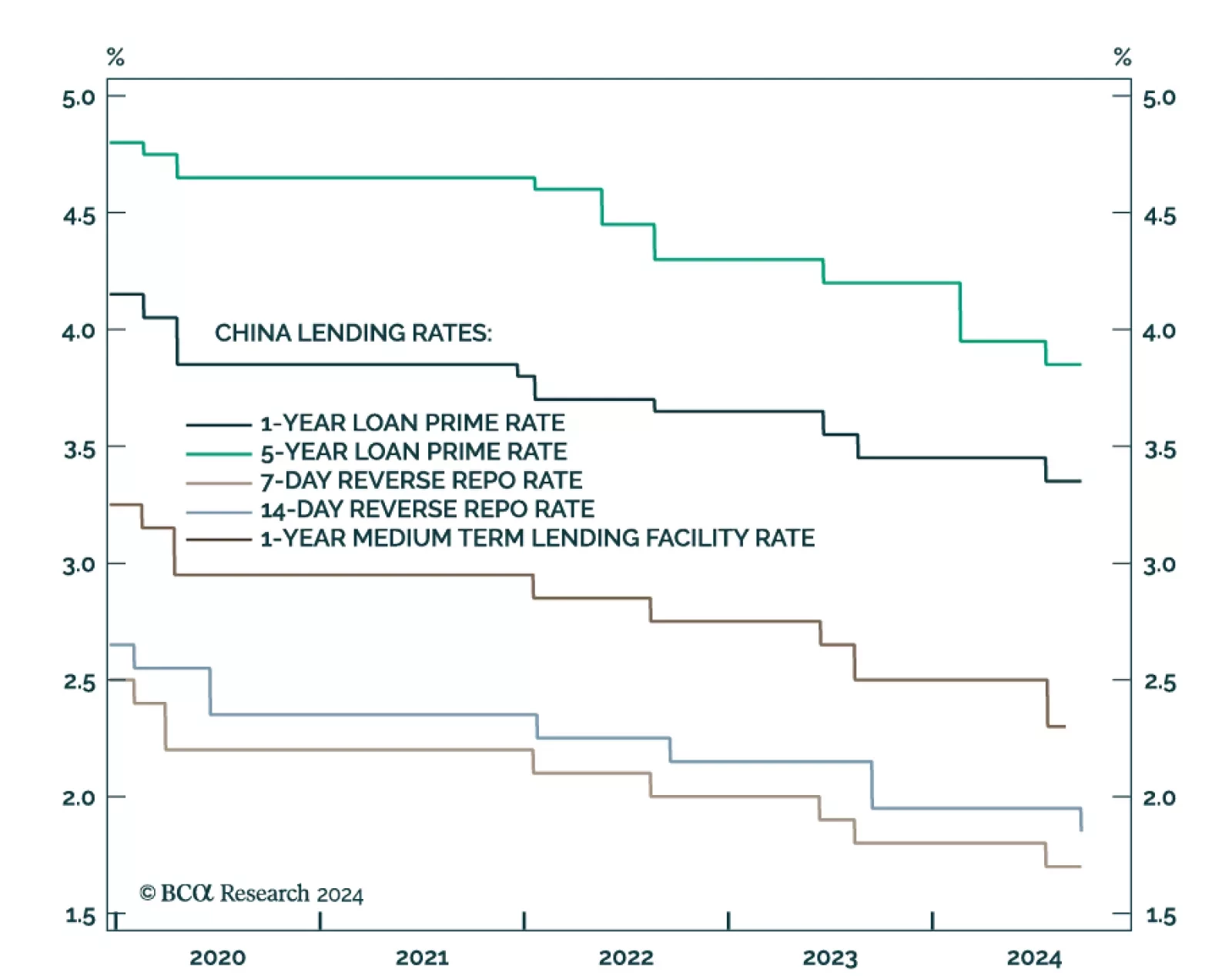

The PBoC lowered the 14-day reverse repo rate by 10 bps on Monday, a move that follows a string of easing measures in late July when the central bank lowered the 7-day reverse repo rate, several maturities of the loan prime rate…

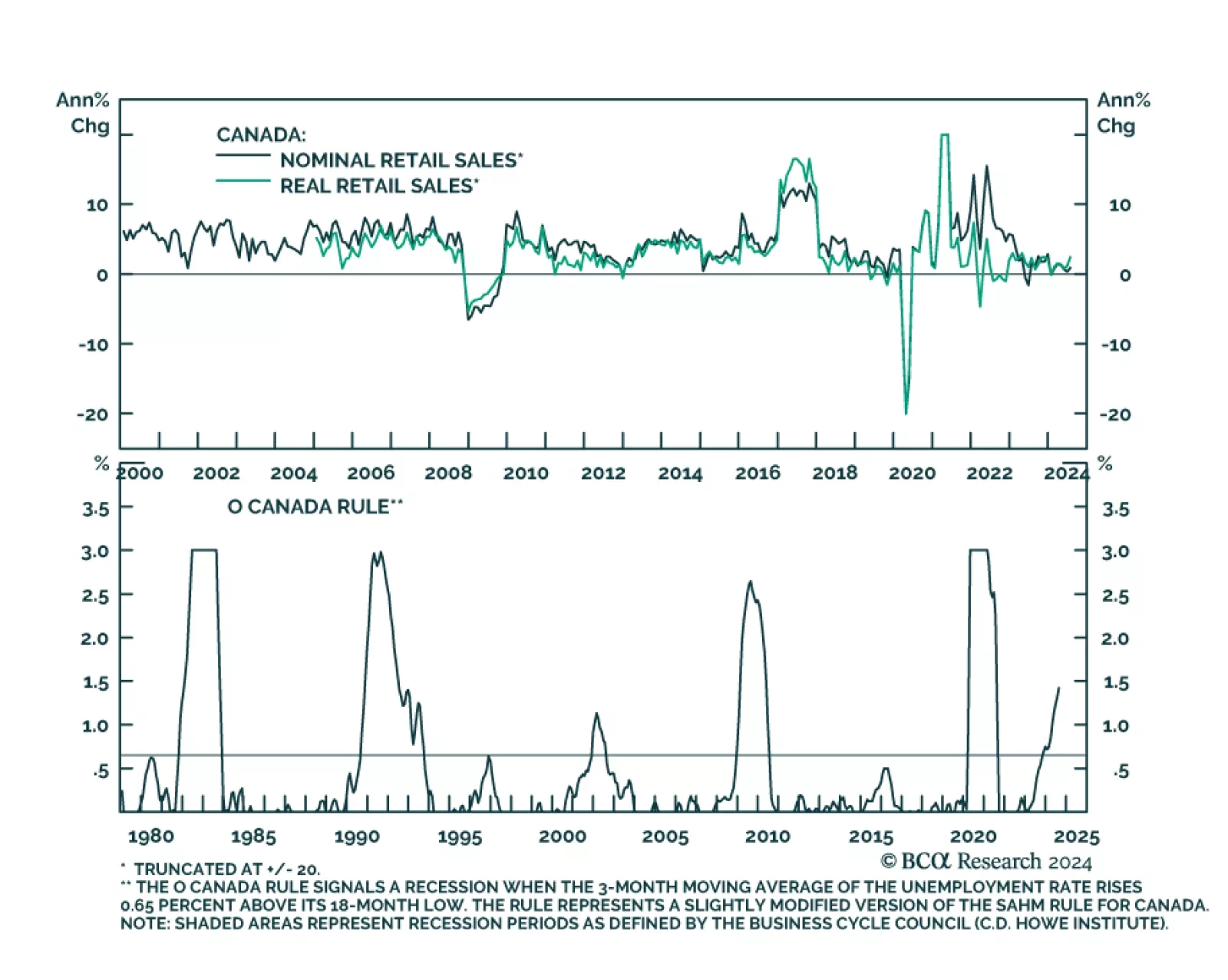

Canadian retail sales grew by a higher-than-expected 0.9% m/m in July from a 0.2% contraction in June. A 2.2% monthly rise in vehicle sales led an otherwise broad-based increase. Ex-auto retail sales also surprised positively,…

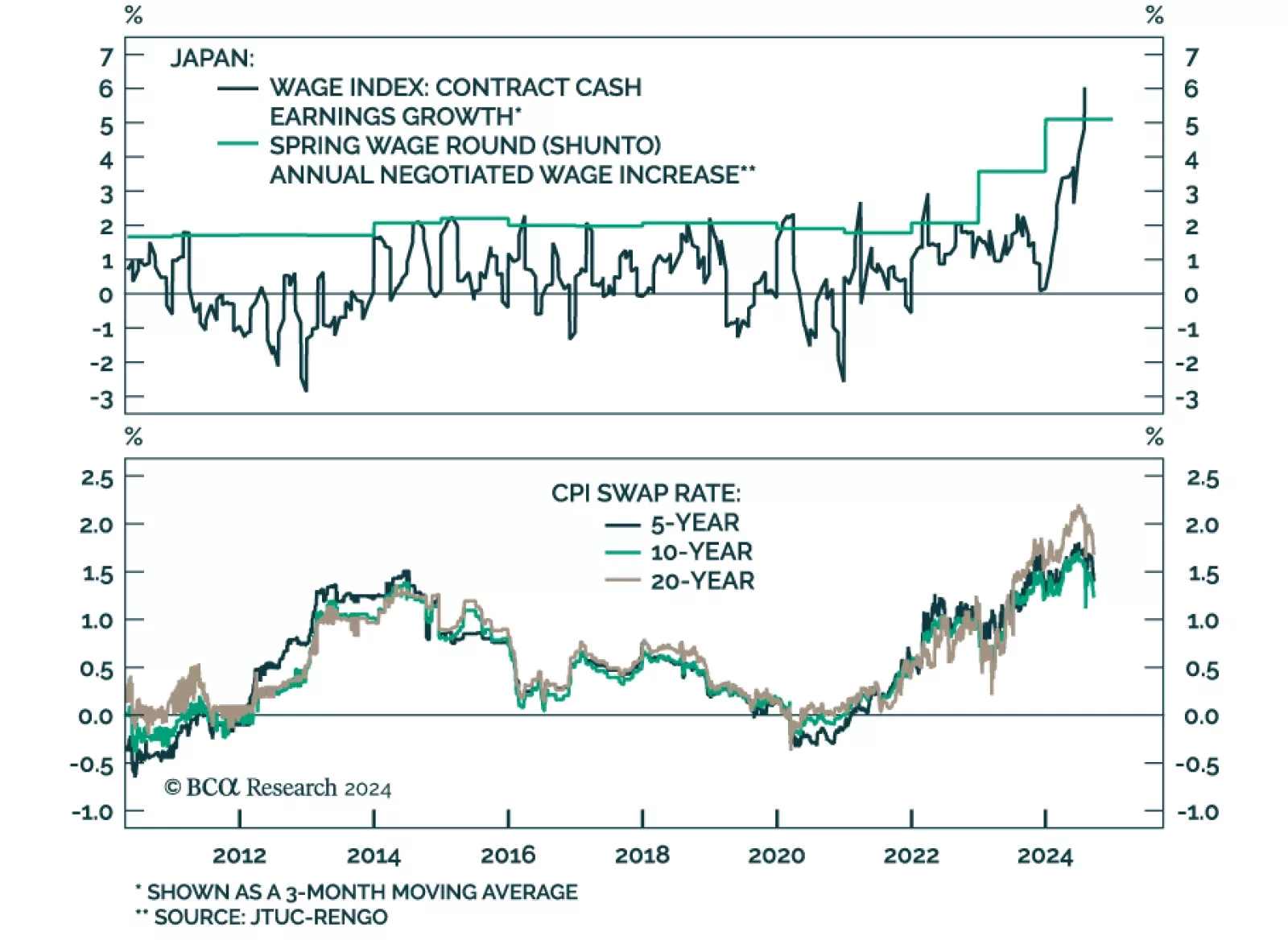

The Bank of Japan kept its policy rate unchanged at 0.25% in September and signaled it was in no rush to lift rates further. This move follows two hikes this year, one of them unanticipated. The signaling is consistent…