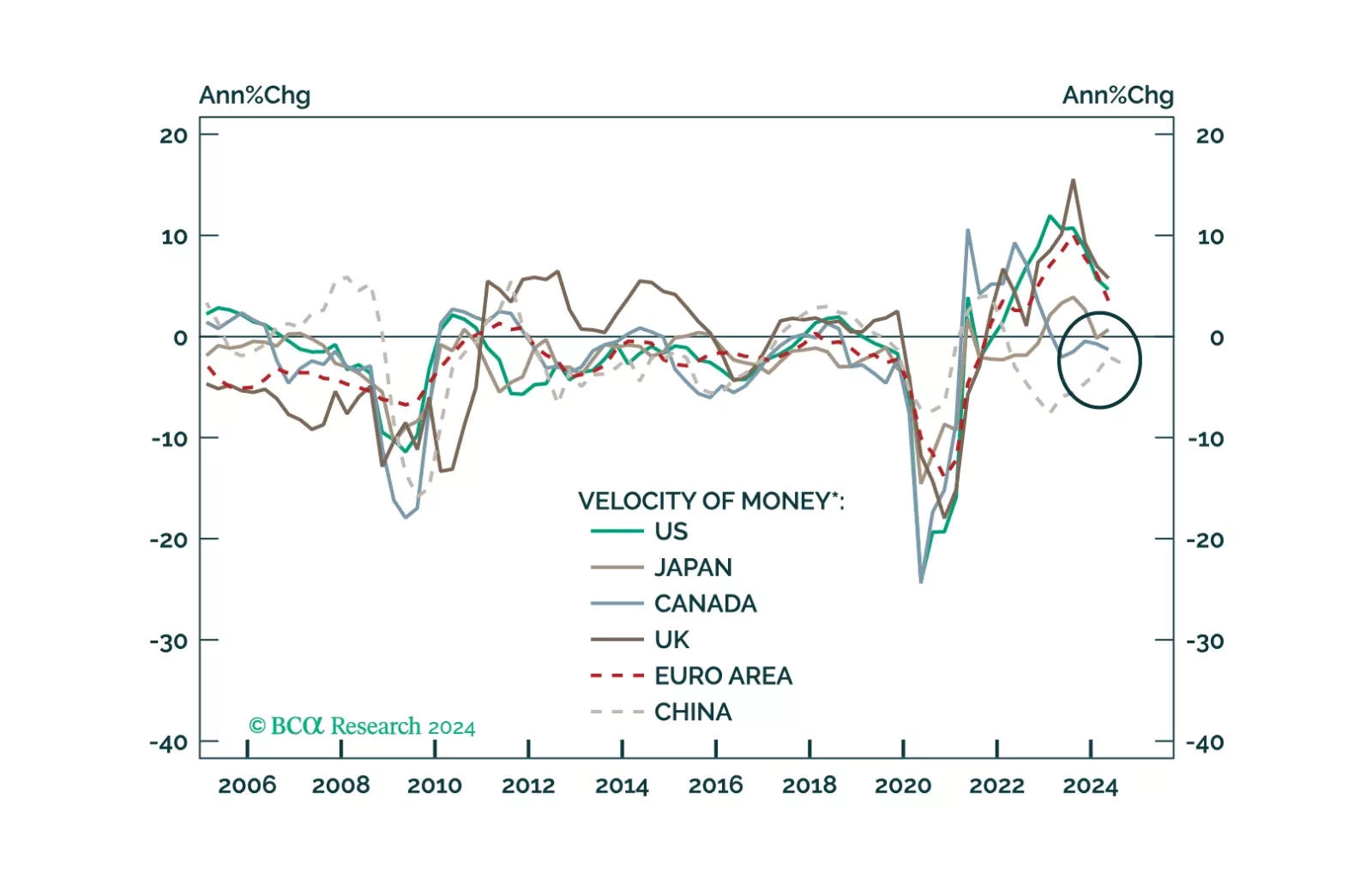

This Insight looks at the likely direction of bond yields and the dollar, from the lens of money velocity.

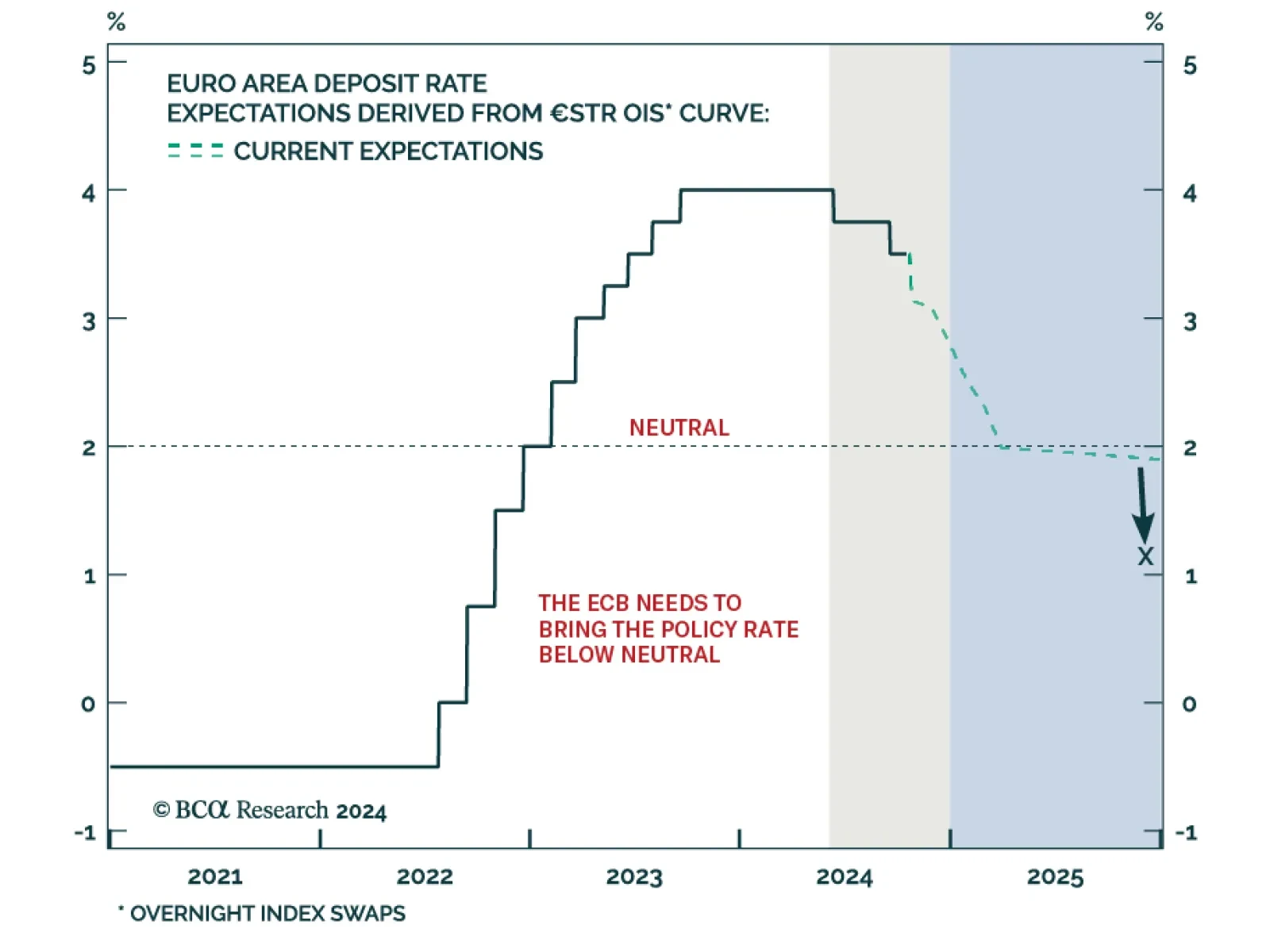

Yesterday, the ECB solidified its recent dovish tilt in response to weaker growth and decreasing inflationary pressures. It is now set to cut rates 25bps each meeting. How low will the ECB deposit rate ultimately go and what does…

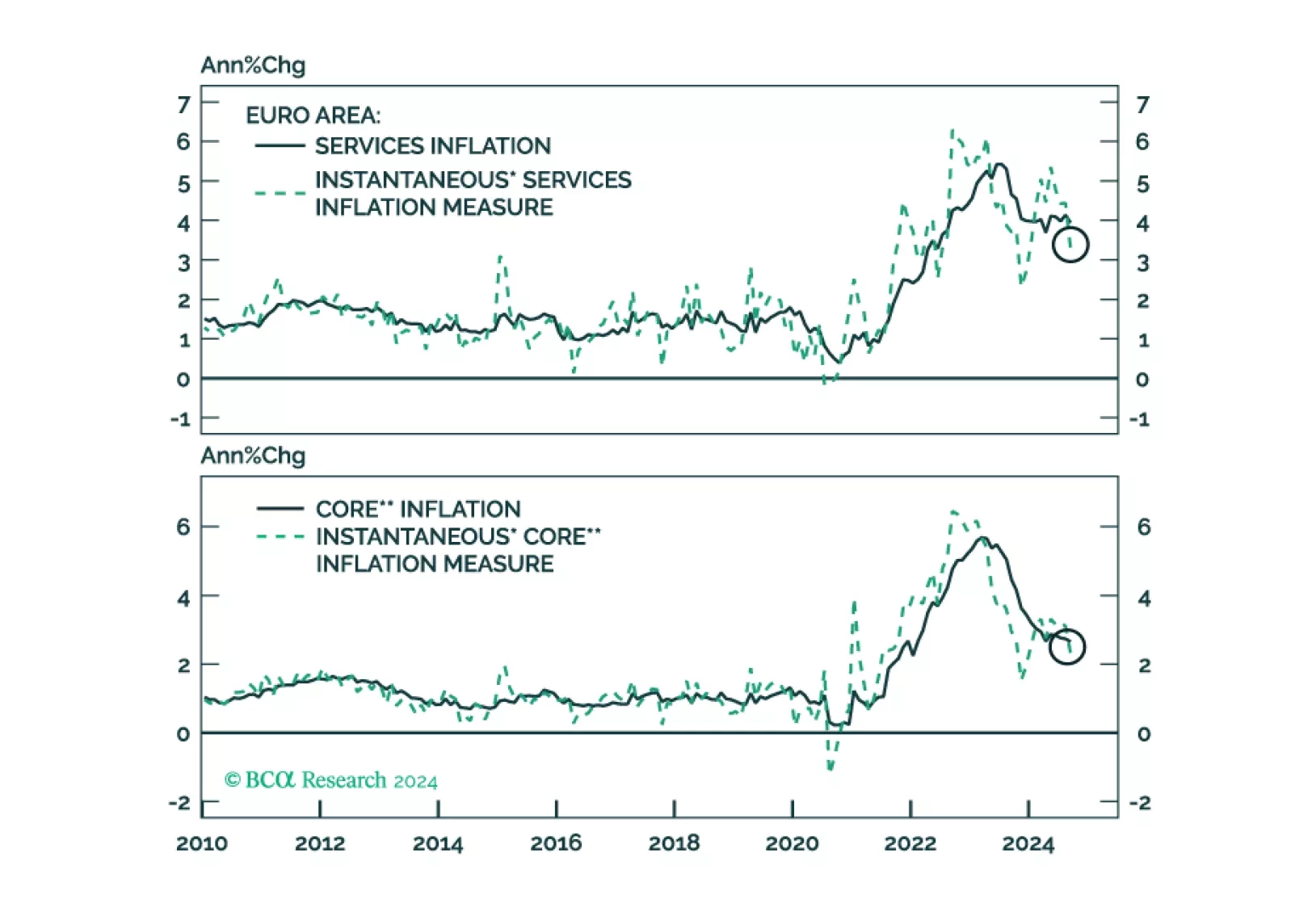

The ECB cut interest rates by 25 bps for the third time this year, lowering the deposit facility rate from 3.5% to 3.25%. While the ECB is avoiding explicitly committing to a path for policy, President Lagarde’s repeated…

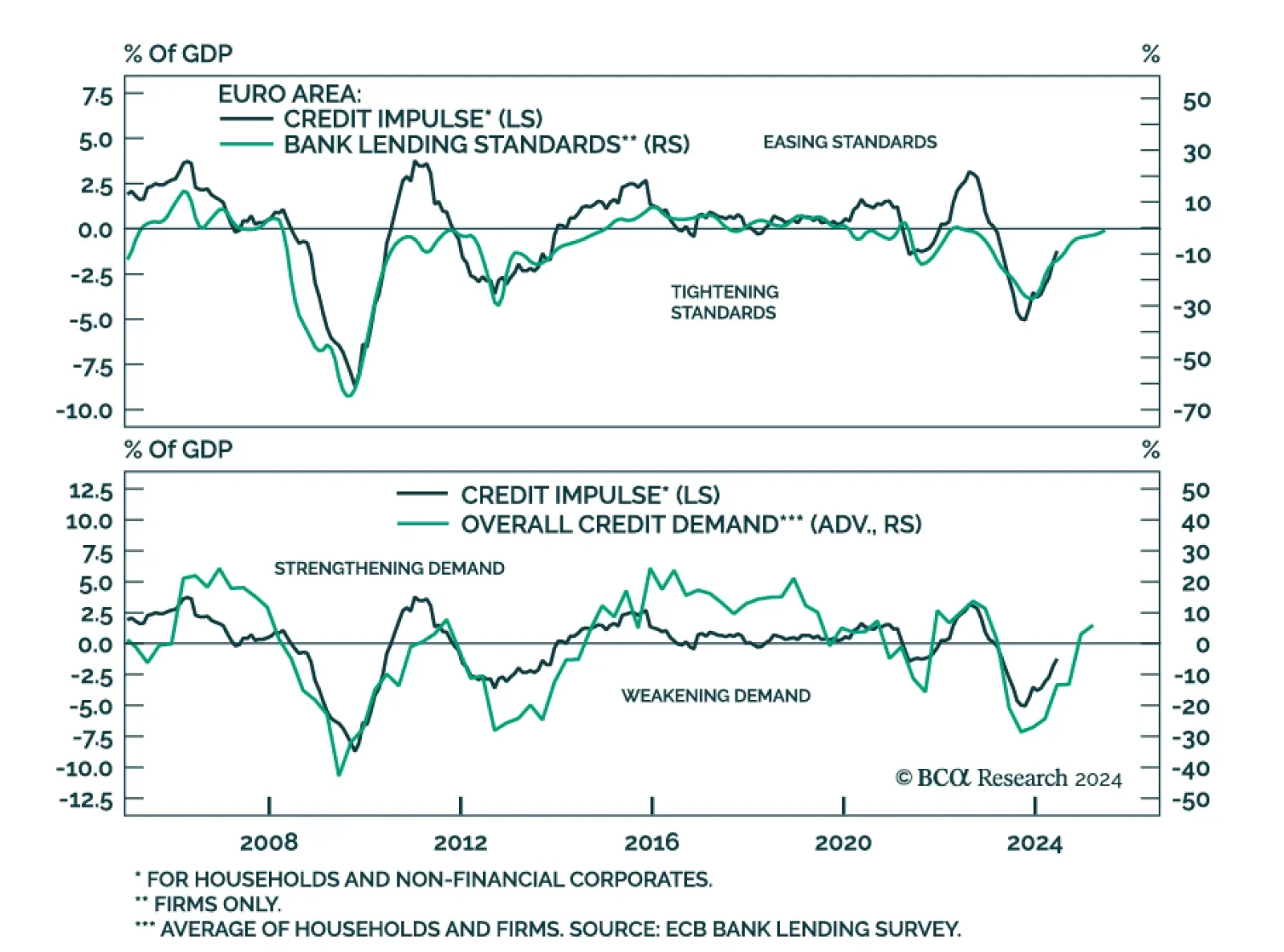

Banks reported an increase in loan demand from both firms and households in the European Central Bank’s Bank Lending Survey, marking the first rise since 2022. This demand increase occurred as lending standards for firms…

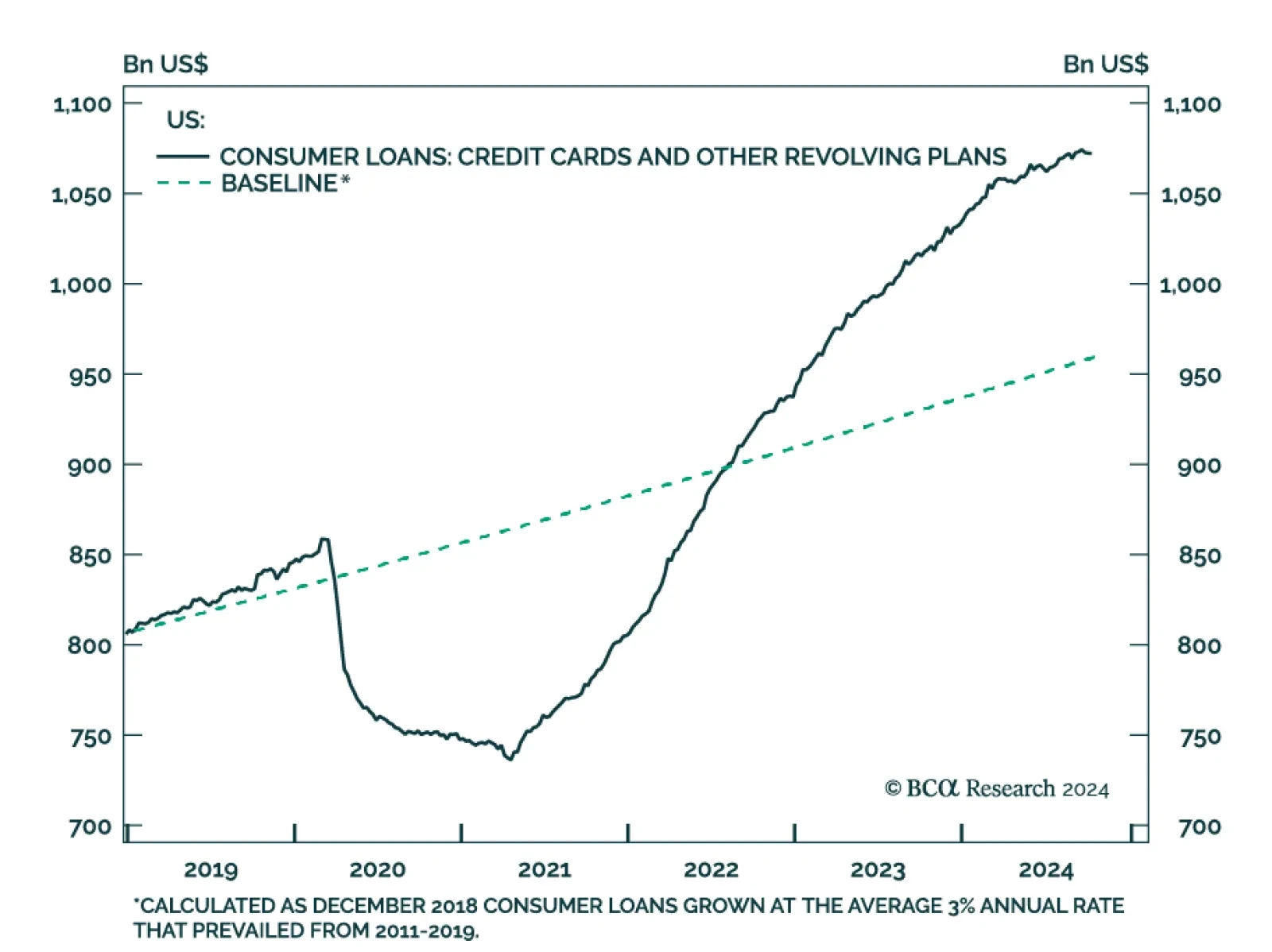

Third-quarter earnings season has started last week for banks, with most major banks reporting earnings above expectations so far. Our US Investment strategists routinely analyze the big banks' earnings calls to gauge…

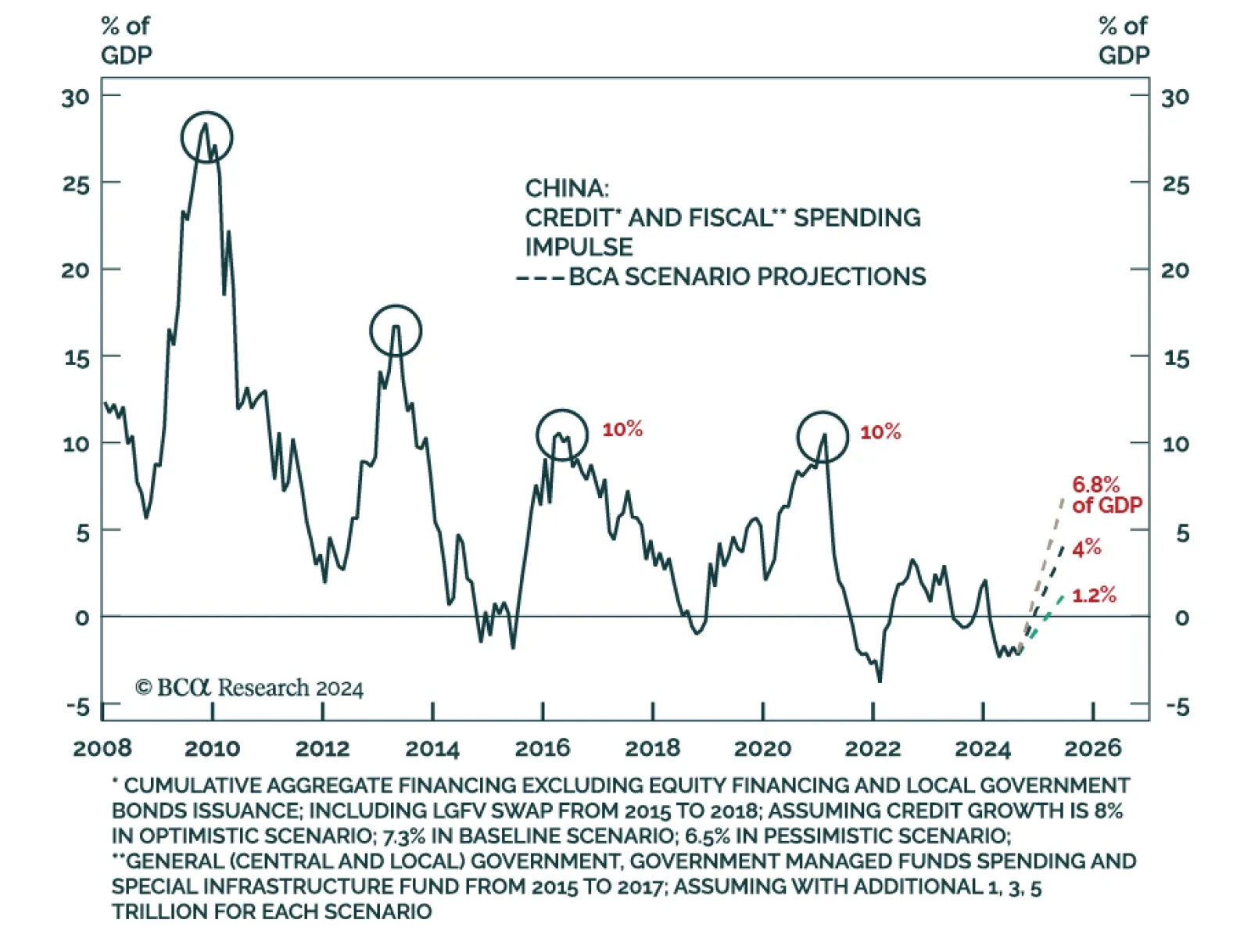

Our China and Emerging Market strategy teams analyzed this weekend press conference by the China’s Ministry of Finance (MoF), that provided additional details on the recently announced fiscal stimulus plan. Our…

To produce a moderate economic recovery, at least RMB 3 trillion in additional government expenditures is needed in H1 2025. Our bias is that Beijing is not yet ready to launch such a massive fiscal support measure. Hence, volatility…

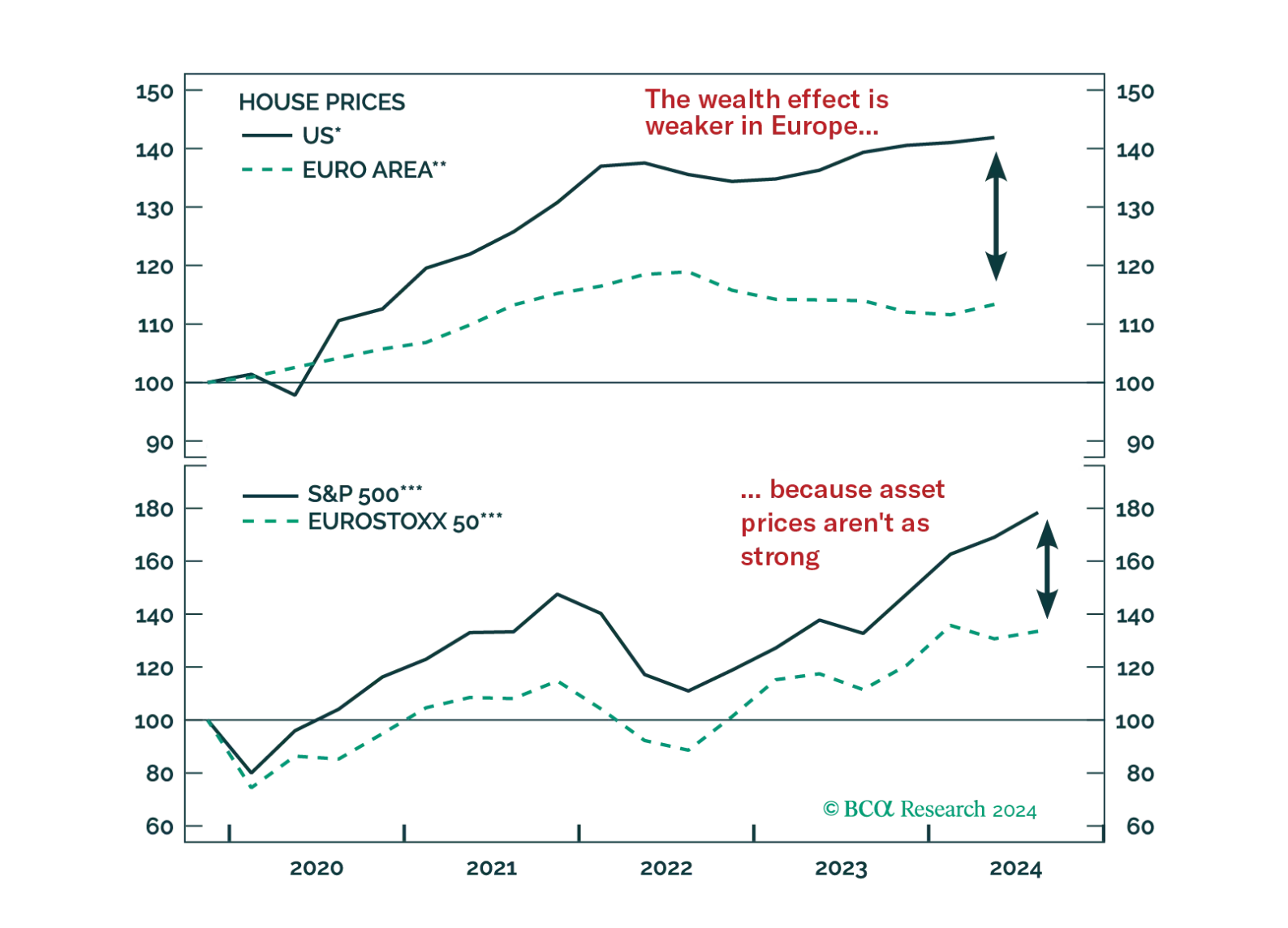

This week, we cover the main questions we fielded during our latest client trip in Europe. Among the many topics broached are Europe’s recession odds, the impact of China’s stimulus, and the outlook for European markets.

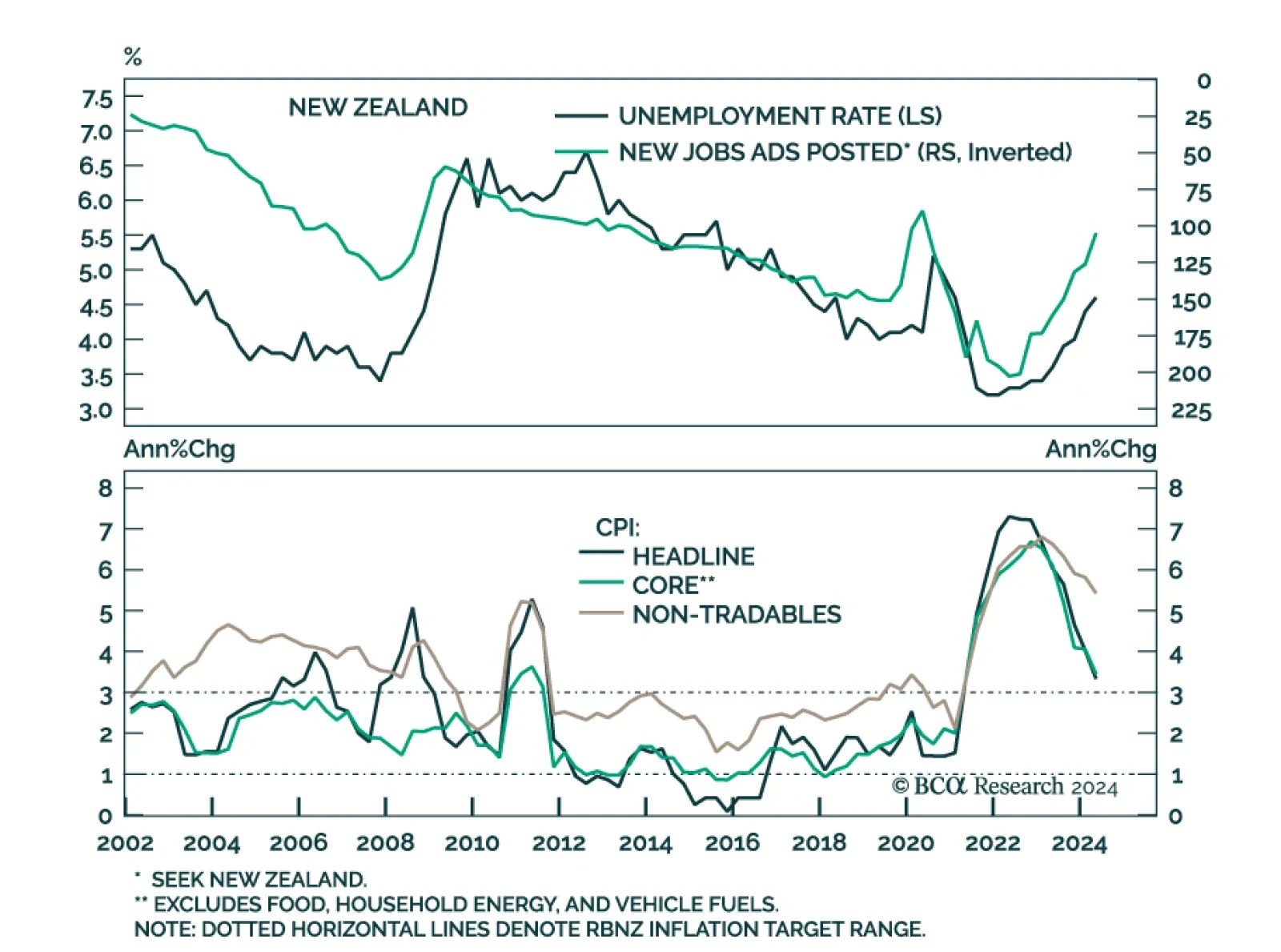

At its October meeting, the Reserve Bank Of New Zealand (RBNZ) cut the Official Cash Rate by 50 bps to 4.75%. The decision was not accompanied by an updated economic forecast or press conference and the latest forecast in August…